When it comes to cryptocurrency exchanges, WhiteBIT and Bitget stand out as popular platforms with unique features. Many traders find themselves comparing these two options when deciding where to manage their digital assets.

Both exchanges offer different fee structures and supported cryptocurrencies that could impact your trading experience. WhiteBIT provides a BTC interest rate of 0.23% without compounding, while Bitget offers a higher 1.5% rate with compounding benefits. This difference can significantly affect your long-term investment strategy.

You’ll also find variations in their wallet technologies, with both platforms incorporating Web3 capabilities. The trading types, deposit methods, and overall user experience differ between these exchanges, making it important to understand their specific strengths before choosing where to trade your crypto.

WhiteBIT Vs Bitget: At A Glance Comparison

When choosing between WhiteBIT and Bitget, understanding their key differences can help you make the right decision for your crypto needs.

Both platforms offer cryptocurrency trading services but differ in several important ways. Let’s compare their main features:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Trading Fees | Competitive | Competitive |

| Supported Cryptocurrencies | Wide range | Wide range |

| Wallet Services | Web3 wallet | Web3 wallet |

| Interest Rates | Varies by crypto | BTC: 1.5% |

| Compounding | Available | Yes |

WhiteBIT and Bitget both provide Web3 wallet technologies, allowing you to interact with decentralized applications and manage your digital assets securely.

For Bitcoin investors, Bitget offers a 1.5% interest rate with compounding benefits. This means your earnings get reinvested automatically, potentially increasing your returns over time.

Both exchanges are ranked according to trust scores on comparison sites like CoinGecko, which evaluates platforms based on trading volume, available coins, and security features.

Your choice between these platforms may depend on specific needs like deposit methods, withdrawal fees, and the types of trading you want to do. Each platform has its strengths for different types of crypto users.

WhiteBIT Vs Bitget: Trading Markets, Products & Leverage Offered

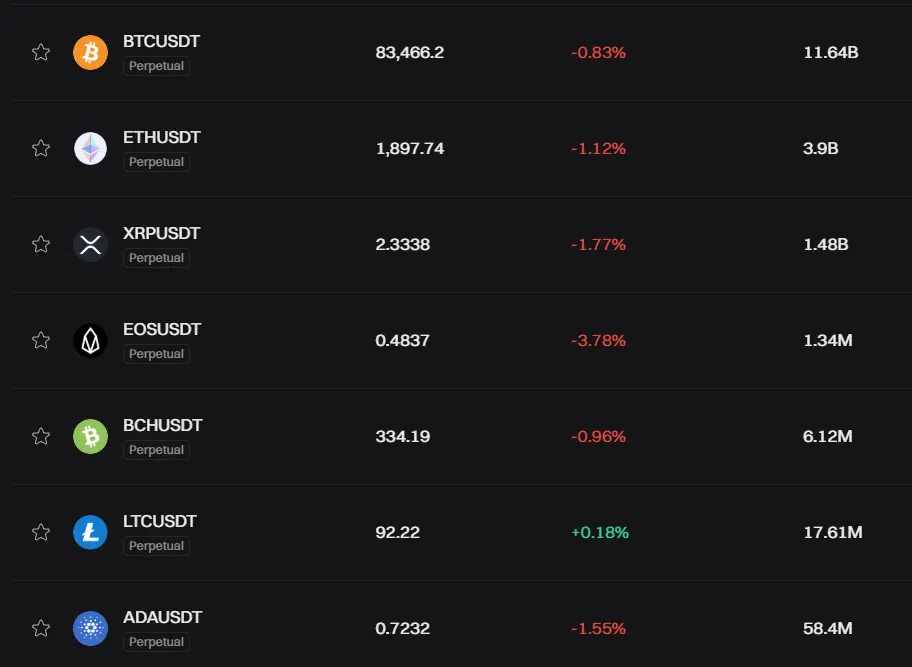

WhiteBIT and Bitget offer various trading options for crypto enthusiasts. Both platforms support spot trading, allowing you to buy and sell cryptocurrencies at current market prices.

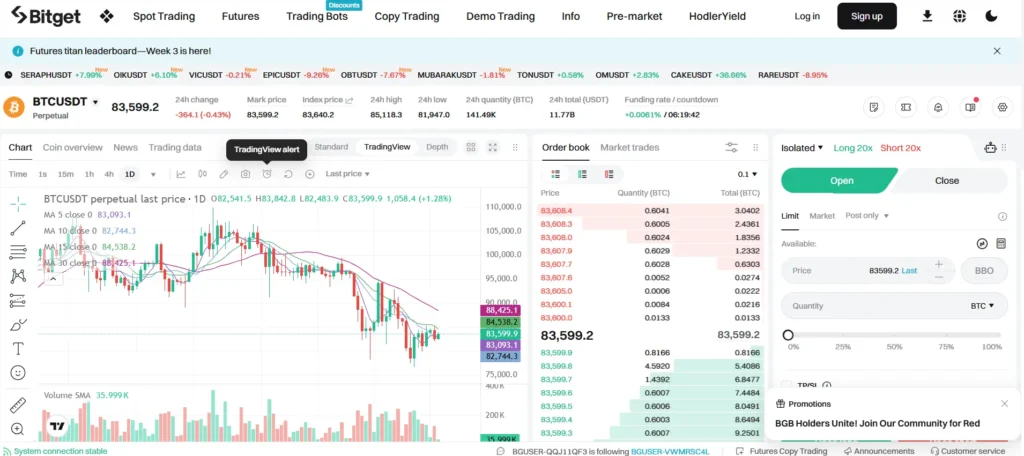

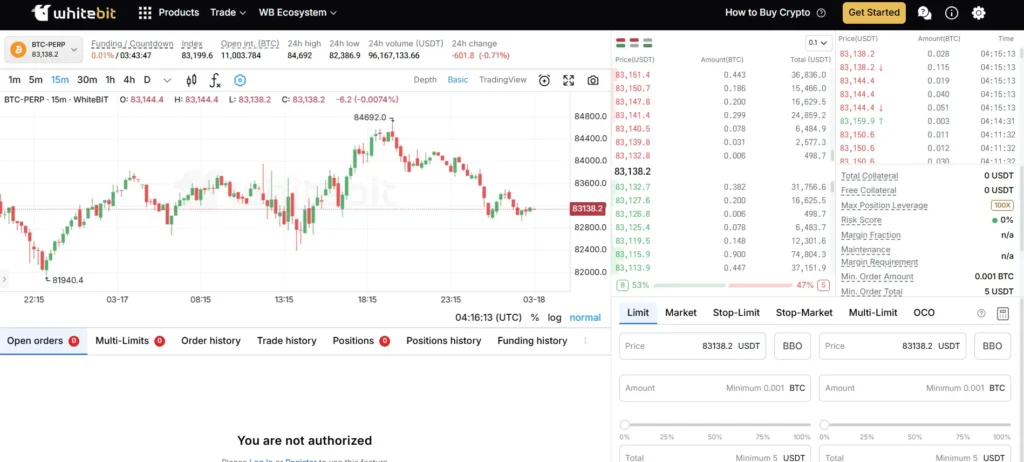

For futures trading, Bitget provides perpetual contracts with leverage up to 125x on select pairs. WhiteBIT also offers perpetual futures contracts, enabling you to trade with leverage in both bullish and bearish markets.

Trading Products Comparison:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Perpetuals | ✓ | ✓ |

| Maximum Leverage | Up to 100x | Up to 125x |

| Trading Pairs | 400+ | 500+ |

WhiteBIT has recently expanded its collateral offerings, adding 60 new assets to its platform. This expansion gives you more flexibility when trading derivatives.

Bitget Wallet integrates with Web3 technologies, providing access to decentralized applications alongside traditional trading. WhiteBIT Wallet also offers Web3 capabilities but focuses more on secure storage and trading functionality.

You’ll find a comprehensive suite of trading tools on both platforms, including advanced charting, order types, and risk management features. These tools help you analyze markets and execute trades more effectively.

The trading interfaces differ slightly in design, but both aim to accommodate beginners and experienced traders alike.

WhiteBIT Vs Bitget: Supported Cryptocurrencies

Both WhiteBIT and Bitget offer a wide range of cryptocurrencies for trading, but there are some differences in their selections.

WhiteBIT supports over 400 cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). The exchange also lists many smaller altcoins and tokens from emerging projects.

Bitget provides access to around 350+ cryptocurrencies. While this is slightly fewer than WhiteBIT, Bitget regularly adds new tokens to its platform, especially those gaining popularity in the DeFi and Web3 spaces.

Here’s a quick comparison of supported assets:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Total cryptocurrencies | 400+ | 350+ |

| Major coins (BTC, ETH, etc.) | Yes | Yes |

| Stablecoins | Yes | Yes |

| DeFi tokens | Extensive selection | Strong focus |

| Newly launched tokens | Regular additions | Quick to list trending tokens |

Both exchanges support staking for various cryptocurrencies, allowing you to earn passive income on your holdings. WhiteBIT offers staking for a slightly larger number of assets.

When choosing between these platforms, consider which specific cryptocurrencies you want to trade. If you’re interested in more obscure altcoins, WhiteBIT might have a slight edge with its larger selection.

For most traders focusing on mainstream cryptocurrencies, either platform will likely have all the assets you need for your trading activities.

WhiteBIT Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

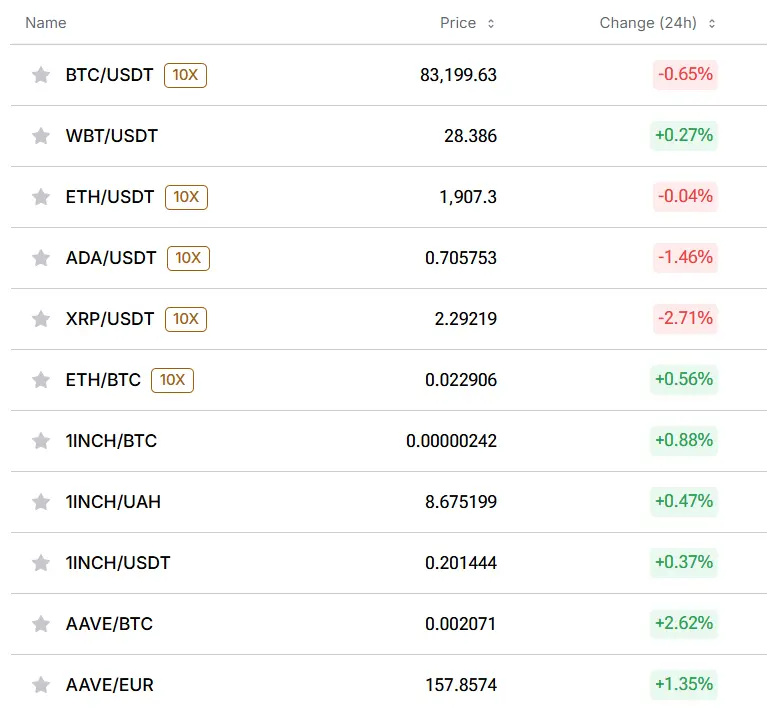

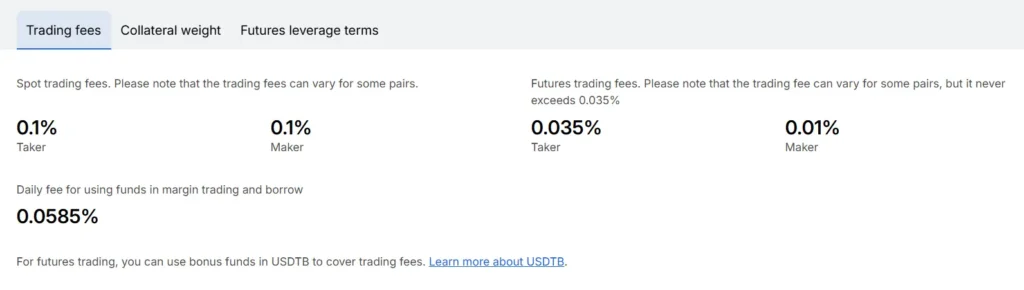

When comparing cryptocurrency exchanges, fees are a crucial factor to consider. Both WhiteBIT and Bitget have competitive fee structures, but there are some key differences.

WhiteBIT offers a standard trading fee of 0.1%. This is quite competitive in the crypto exchange market. The fee is straightforward with no complicated tiers for most traders.

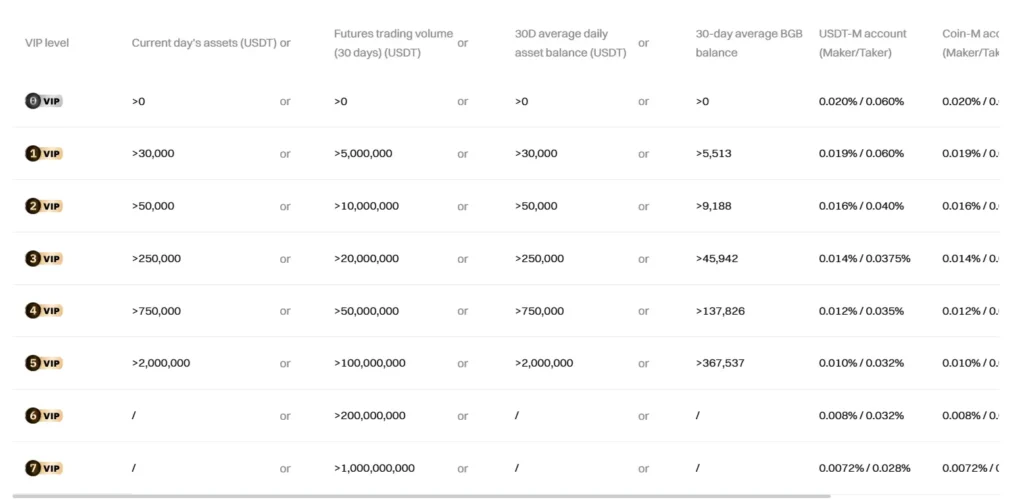

Bitget also maintains competitive rates, with a base trading fee of around 0.1%. They offer a tiered structure where fees can decrease based on your trading volume.

Trading Fee Comparison:

| Exchange | Standard Trading Fee | Discounts Available |

|---|---|---|

| WhiteBIT | 0.1% | Limited |

| Bitget | 0.1% | Yes, volume-based |

For deposits, both platforms typically offer free options for cryptocurrency transfers. However, fiat deposits may incur fees depending on your payment method.

Withdrawal fees vary by cryptocurrency on both platforms. These fees change based on network conditions and the specific digital asset you’re withdrawing.

Bitget offers compounding options which can be beneficial for users looking to maximize their crypto holdings over time.

Before choosing either platform, check their current fee schedule as these rates can change. Your trading volume and preferences should guide your decision between these two exchanges.

WhiteBIT Vs Bitget: Order Types

Both WhiteBIT and Bitget offer various order types to help you trade effectively. Understanding these options can improve your trading results.

Bitget provides standard order types including market orders, limit orders, and stop orders. Market orders execute immediately at the current price, while limit orders let you set a specific price for buying or selling.

WhiteBIT offers these basic orders too, but also features the Trailing Stop order. This advanced order type automatically adjusts your stop price as the market moves in your favor, helping maximize profits while limiting losses.

Bitget focuses on user-friendly trading with clear explanations of when to use different order types. Their platform guides you through selecting the right order based on your trading strategy.

Both exchanges support OCO (One-Cancels-Other) orders, allowing you to place two orders simultaneously with one automatically canceling when the other executes.

The main difference is that WhiteBIT tends to offer more advanced order types for experienced traders, while Bitget emphasizes accessibility for newer users.

Here’s a quick comparison:

| Order Type | Bitget | WhiteBIT |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop Loss | ✓ | ✓ |

| Trailing Stop | ✗ | ✓ |

| OCO | ✓ | ✓ |

Choosing between these platforms may depend on your trading experience and whether you need more advanced order types like trailing stops.

WhiteBIT Vs Bitget: KYC Requirements & KYC Limits

WhiteBIT has implemented mandatory KYC (Know Your Customer) for all users who signed up after September 21, 2022. If you created your account before this date, verification remains optional.

WhiteBIT operates under European Exchange and Custody licenses and strictly follows KYC and Anti-Money Laundering (AML) requirements. This focus on regulatory compliance adds an extra layer of security for your funds.

In contrast, Bitget offers a more flexible approach to verification. You can use Bitget without completing KYC procedures, making it attractive if you prefer privacy or quick account setup.

Bitget allows up to $800 in deposits without requiring identity verification. This no-KYC option means you can start trading almost immediately after registration.

Here’s a quick comparison of their KYC approaches:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| KYC Required | Yes (after Sept 2022) | No (for basic trading) |

| Deposit Limit Without KYC | Limited/None | Up to $800 |

| Regulatory Compliance | European licenses | Less stringent |

| Account Setup Speed | Slower (verification needed) | Faster (immediate trading) |

Your choice between these platforms may depend on how you value privacy versus security. WhiteBIT’s strict verification provides better security but takes more time to set up.

WhiteBIT Vs Bitget: Deposits & Withdrawal Options

Both WhiteBIT and Bitget offer various methods for depositing and withdrawing funds, though they differ in some key aspects.

Deposit Methods:

- Cryptocurrency: Both platforms support crypto deposits with no fees

- Fiat currencies: Both exchanges accept fiat, but available methods may vary by region

- Bank transfers: Available on both platforms, though processing times differ

WhiteBIT allows free crypto deposits while Bitget also offers this feature. For fiat deposits, both platforms have options but may charge small processing fees depending on your payment method.

Withdrawal Options:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Crypto withdrawal fees | Varies by asset | Varies by asset |

| Fiat withdrawal | Available | Available |

| Minimum withdrawal | Asset-dependent | Asset-dependent |

| Processing time | Generally fast | Generally fast |

WhiteBIT charges different fees for crypto withdrawals based on the specific cryptocurrency. Similarly, Bitget’s withdrawal fees vary by asset.

When withdrawing from either platform, you should verify the current fee structure as these can change. Both exchanges process most withdrawals quickly, though blockchain congestion may affect timing.

You can use the Bitget Wallet for managing your WhiteBIT Coin (WBT) if you wish to move assets between platforms. This feature allows you to swap and withdraw coins with relative ease.

WhiteBIT Vs Bitget: Trading & Platform Experience Comparison

WhiteBIT and Bitget offer different trading experiences that cater to various types of crypto traders. Both platforms support spot trading, but their interfaces and additional features set them apart.

Bitget provides a more intuitive interface that beginners find easier to navigate. You’ll notice its clean design with clearly marked sections for different trading options. The platform includes helpful tutorials and guides to help you get started.

WhiteBIT offers both standard and professional trading interfaces. This gives you flexibility to choose based on your experience level. Their professional trading view includes more advanced charting tools and indicators.

Trading Features Comparison:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Interface | Standard & Professional | User-friendly |

| Charting Tools | Advanced | Moderate |

| Mobile App | Yes | Yes (highly rated) |

| Demo Account | Yes | Yes |

| Order Types | Market, Limit, Stop | Market, Limit, Stop, OCO |

Bitget excels with its copy trading feature, allowing you to automatically mimic experienced traders’ strategies. This is particularly valuable if you’re new to crypto trading.

WhiteBIT’s platform includes more comprehensive analytics tools for those who prefer detailed market analysis. You can access in-depth market data and customizable charts.

Both platforms offer futures trading, but Bitget provides more leverage options. This can be beneficial if you’re looking for higher potential returns (with increased risk).

Response time is another factor to consider. Bitget generally offers faster execution speeds, which becomes important during volatile market conditions.

WhiteBIT Vs Bitget: Liquidation Mechanism

When trading with leverage on exchanges like WhiteBIT and Bitget, understanding their liquidation mechanisms is crucial for managing your risk.

Bitget uses Mark Price for liquidations rather than the last traded price. This helps protect traders from market manipulation and flash crashes that could trigger unnecessary liquidations.

WhiteBIT also employs a Mark Price system, but the calculation methodology may differ slightly from Bitget’s approach.

Both platforms have automatic liquidation processes that trigger when your margin ratio falls below maintenance requirements. This prevents losses from exceeding your collateral.

Key Differences:

| Feature | Bitget | WhiteBIT |

|---|---|---|

| Price Reference | Mark Price | Mark Price |

| Partial Liquidation | Available | Limited availability |

| Liquidation Warning | Yes | Yes |

| Liquidation Fund | Insurance fund protection | Insurance fund protection |

Bitget offers a more flexible partial liquidation system that may help you preserve some of your position during market volatility.

Both exchanges provide warning notifications when your position approaches liquidation thresholds. These alerts can give you time to add margin or reduce your position size.

The liquidation process on both platforms follows a standard procedure:

- Warning notification

- Opportunity to add margin

- Liquidation if margin requirements aren’t met

Understanding these mechanisms can help you trade more safely and avoid unexpected losses when using leverage on either platform.

WhiteBIT Vs Bitget: Insurance

When trading on crypto exchanges, insurance coverage is a crucial factor to consider. Both WhiteBIT and Bitget offer some form of insurance protection, but they differ in their approaches.

WhiteBIT maintains a dedicated insurance fund to protect user assets. They allocate a portion of their revenue to this fund, which can help cover losses in case of security breaches or technical issues.

Bitget also offers an insurance protection system. Their Protection Fund reportedly exceeds $300 million in assets, making it one of the larger insurance funds in the crypto exchange industry.

Both platforms use cold storage for the majority of user funds, which adds an extra layer of security beyond just insurance coverage.

Insurance Comparison:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Fund Size | Not publicly disclosed | $300+ million |

| Cold Storage | Yes | Yes |

| Coverage Type | Platform-level protection | Platform-level protection |

You should note that neither exchange offers individual account insurance like FDIC protection that traditional banks provide. The insurance funds are designed to cover large-scale incidents.

When choosing between these exchanges, consider the transparency around their insurance policies. Bitget is more forthcoming about their fund size, which might give you more confidence in their ability to cover potential losses.

Remember to review the most current insurance policies directly on each platform’s website, as coverage details may change over time.

WhiteBIT Vs Bitget: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a huge difference in your trading experience. Both WhiteBIT and Bitget offer support options, but there are some key differences.

WhiteBIT appears to have limited customer support options. According to search results, they don’t offer live chat support, which can be frustrating when you need immediate assistance.

Bitget, on the other hand, typically provides more comprehensive support channels including live chat, email support, and sometimes phone support depending on your region.

Response times also vary between the platforms. Users often report faster response times from Bitget compared to WhiteBIT, though this can fluctuate based on trading volume and time of day.

Neither platform seems to excel in educational resources. WhiteBIT specifically lacks learning portals or guides that could help new users navigate the platform more easily.

Both exchanges offer support in multiple languages, which is helpful for international users. However, the quality of non-English support may vary.

For urgent matters, Bitget generally provides more immediate assistance options. WhiteBIT users might need to rely more on community forums or social media for quick answers.

Consider how important responsive customer service is to you before choosing either platform. If you’re new to crypto trading, Bitget’s more accessible support might be the better option for your needs.

WhiteBIT Vs Bitget: Security Features

When choosing between WhiteBIT and Bitget, security should be one of your top priorities. Both exchanges offer strong security measures, but there are some key differences worth noting.

WhiteBIT stands out with its perfect security score according to recent reviews. The exchange ensures transparency through proof of funds and provides insurance for digital assets, giving you added protection.

Bitget also prioritizes security but takes a different approach. They focus on Web3 technologies to enhance their wallet security features, making it suitable for users interested in decentralized applications.

Key Security Features Comparison:

| Feature | WhiteBIT | Bitget |

|---|---|---|

| Insurance | ✓ | Limited |

| Proof of Funds | ✓ | Not specified |

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Regulatory Compliance | Strong | Moderate |

WhiteBIT emphasizes compliance with laws and regulations as part of its security strategy. This regulatory focus may provide you with more confidence when trading larger amounts.

Bitget’s wallet integrates more deeply with Web3 functionality, which might appeal to you if you’re looking for seamless interaction with decentralized platforms.

Both exchanges offer basic security features like two-factor authentication and cold storage for digital assets. However, WhiteBIT’s additional insurance coverage gives it an edge for security-conscious traders.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT stands out as one of the safest cryptocurrency exchanges available today. It has achieved Level 3 certification under the Cryptocurrency Security Standard (CCSS), making it the first exchange to reach this top-tier security status.

The platform has earned an AAA security rating and is consistently ranked among the top 3 safest trading platforms. This high level of security is something WhiteBIT takes great pride in.

WhiteBIT prioritizes compliance with regulatory standards by following both Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This helps ensure that your trading activities remain within legal boundaries.

For your peace of mind, WhiteBIT offers secure storage solutions for your digital assets. The exchange also provides insurance coverage for these assets, adding an extra layer of protection for your investments.

Transparency is another key feature of WhiteBIT’s approach to security. The exchange offers proof of funds, allowing you to verify that your assets are properly maintained.

When comparing WhiteBIT to other platforms like Bitget, both emphasize security as a core value. However, WhiteBIT’s specific certifications and perfect security score help it stand out in the crowded exchange marketplace.

You can feel confident using WhiteBIT as a secure gateway for your cryptocurrency trading and investment activities.

Is Bitget A Safe & Legal To Use?

Bitget is generally considered safe and legal to use. It is a fully licensed cryptocurrency exchange that has completed regulatory processes to ensure security and compliance.

According to recent information, Bitget has not experienced any major security breaches or significant losses of user funds. This track record helps establish its reputation as a secure platform.

Some users have expressed concerns, but these appear to be isolated cases rather than widespread issues.

The exchange offers various security features to protect your assets. These security measures are important when comparing it to other exchanges like WhiteBIT, which recently became the first exchange to secure Level 3 certification under the Cryptocurrency Security Standard (CCSS).

Bitget is recognized as one of the top cryptocurrency exchanges that combines affordability with safety. It provides a range of trading features and tools, including margin trading options.

If you’re concerned about security, it’s worth noting that Bitget has been operating since at least 2018, giving it several years of experience in the cryptocurrency exchange market.

For maximum protection, always enable all available security features, use strong passwords, and consider using hardware wallets for long-term storage of significant crypto assets.

Frequently Asked Questions

Many crypto traders have specific questions about WhiteBIT and Bitget before choosing a platform. These questions address key aspects like fees, security, and available features that directly affect trading experience.

What are the main differences in trading fees between WhiteBIT and Bitget?

WhiteBIT and Bitget have different fee structures. WhiteBIT typically charges trading fees ranging from 0.10% to 0.25% depending on your trading volume and account level.

Bitget offers slightly lower fees, starting at around 0.08% for makers and 0.10% for takers. Both platforms provide fee discounts for users who hold their native tokens.

Volume-based discounts are available on both exchanges, with fees decreasing as your monthly trading volume increases.

Can users from the United States access all the features on WhiteBIT?

Users from the United States face significant restrictions on WhiteBIT. The platform doesn’t fully support U.S. residents due to regulatory constraints.

Bitget has historically been more accessible to U.S. users, though some features may still be limited. Always check the current terms of service as regulations change frequently.

You should verify the latest country restrictions before registering with either platform if you’re a U.S. resident.

What security measures does WhiteBIT implement to protect user assets?

WhiteBIT employs multi-signature cold storage for most user funds, keeping 96% of assets in offline wallets. The platform uses two-factor authentication (2FA) and anti-phishing protection.

Regular security audits are conducted by third-party firms to identify vulnerabilities. WhiteBIT also maintains an insurance fund to protect users in case of security breaches.

The exchange offers IP address monitoring and withdrawal confirmation emails as additional security layers.

What variety of cryptocurrencies are available for trading on Bitget compared to WhiteBIT?

Bitget supports over 500 cryptocurrencies and more than 800 trading pairs. Their selection includes major coins and a wide range of altcoins and tokens.

WhiteBIT offers approximately 350 cryptocurrencies for trading. Both platforms regularly add new tokens, but Bitget generally maintains a larger selection.

You’ll find all major cryptocurrencies like Bitcoin, Ethereum, and Solana on both platforms, but for less common tokens, Bitget typically provides more options.

How do the customer support services of Bitget and WhiteBIT compare?

Bitget offers 24/7 customer support through live chat, email, and ticket systems. Response times are generally within 1-2 hours for most inquiries.

WhiteBIT provides multilingual support through similar channels but has received mixed reviews about response speed. Both platforms maintain comprehensive help centers with guides and FAQs.

You can reach both platforms on social media channels, though direct support requests are better handled through official support channels.

What are the margin trading options available on Bitget versus those on WhiteBIT?

Bitget offers leverage of up to 125x on certain trading pairs, making it popular among margin traders. The platform supports both isolated and cross margin modes.

WhiteBIT provides more conservative leverage options, typically up to 20x depending on the trading pair. Both platforms require identity verification and risk assessments before accessing margin trading.

You’ll find more advanced margin trading tools on Bitget, including adjustable leverage and risk management features.

Bitget Vs WhiteBIT Conclusion: Why Not Use Both?

Both Bitget and WhiteBIT offer strong features for crypto traders in 2025. Each platform has its own strengths that might benefit you in different situations.

Bitget stands out with its user-friendly interface and robust security measures. It provides excellent tools for both beginners and experienced traders who want a reliable trading experience.

WhiteBIT offers advanced trading tools and a comprehensive futures trading platform. Its technology makes it particularly attractive if you’re interested in exploring Web3 capabilities.

Why choose just one?

Using both platforms allows you to:

- Take advantage of different fee structures

- Access more trading pairs

- Reduce risk through platform diversification

- Test different trading interfaces

Consider this approach:

- Use Bitget for everyday trading and simple transactions

- Turn to WhiteBIT for advanced futures trading

- Compare both platforms’ security features for your particular needs

Remember that all blockchain technology carries some risk. Both platforms use smart contracts that, while innovative, aren’t immune to potential bugs or exploits.

Your trading style and goals should guide which platform you use more frequently. Many traders find value in maintaining accounts on multiple exchanges to capitalize on different opportunities.