Crypto options trading opens up a new world of possibilities in the digital asset market. You can profit from cryptocurrency price movements without owning actual coins, making it an attractive choice for traders seeking flexibility.

Crypto options trading lets you buy contracts that give you the right, but not the obligation, to purchase or sell cryptocurrencies at a predetermined price within a specific timeframe. These contracts can serve as powerful tools for generating income, hedging your existing positions, or speculating on market movements.

You can start crypto options trading through established exchanges that offer these financial instruments. The key to success lies in selecting the right strategy, such as covered calls or protective puts, based on your risk tolerance and market outlook. Professional traders have long used these tools, and now retail investors are discovering their potential in the cryptocurrency markets.

What Is Crypto Options Trading

Crypto options trading gives you the right – but not the obligation – to buy or sell a cryptocurrency at a predetermined price within a specific timeframe. This flexible derivative instrument allows you to speculate on price movements without owning the underlying digital asset.

Unlike futures contracts that require execution, options provide more strategic choices. You can choose whether to exercise the contract based on market conditions, limiting your potential losses to the premium paid.

The market for crypto options has grown significantly as traders seek sophisticated tools for risk management and profit generation. Trading volumes on major exchanges have surged as both institutional and retail participants embrace these instruments.

Crypto options function similarly to traditional stock options but operate 24/7 and typically offer higher volatility. Your potential returns can be amplified through leverage, though this also increases risk exposure.

Key characteristics of crypto options:

- Contract Size: Standardized amount of cryptocurrency

- Strike Price: Predetermined buying/selling price

- Expiration Date: When the contract ends

- Premium: Cost to purchase the option

Digital asset options provide unique advantages for portfolio management. You can use them to hedge existing positions, generate income through premium collection, or capitalize on market volatility.

Trading these instruments requires understanding complex factors like implied volatility, time decay, and price movements of the underlying cryptocurrency. The premium you pay or receive reflects these market dynamics. To know more, check this guide on how do crypto options work.

Why Are Options In Crypto Becoming Popular

Crypto options trading has gained significant traction as digital asset markets mature. You can now access these financial instruments through more platforms than ever before.

The extreme volatility in cryptocurrency markets makes options particularly attractive for risk management. You can use options to protect your positions against sudden price swings while maintaining potential upside.

Major financial institutions like Fidelity are introducing crypto options products, bringing increased legitimacy and accessibility to the market. This institutional adoption helps create deeper liquidity pools for traders.

Options give you flexible strategies for capitalizing on market movements. Whether prices go up, down, or sideways, you can design positions to profit from various scenarios.

Key Benefits of Crypto Options:

- Risk hedging capabilities

- Leverage opportunities

- Portfolio diversification

- Lower capital requirements

- Strategic trading flexibility

The growing crypto derivatives ecosystem provides you with professional-grade tools previously only available in traditional markets. Trading volumes continue to expand as more sophisticated investors enter the space.

You can now access options through regulated exchanges with robust security measures and compliance standards. This infrastructure development makes options trading more appealing to both retail and institutional participants.

Understanding Options: Key Concepts

Options give traders the right, but not the obligation, to buy or sell cryptocurrencies at predetermined prices. These financial instruments provide flexibility and defined risk while enabling strategic trading approaches.

Call Options Vs. Put Options

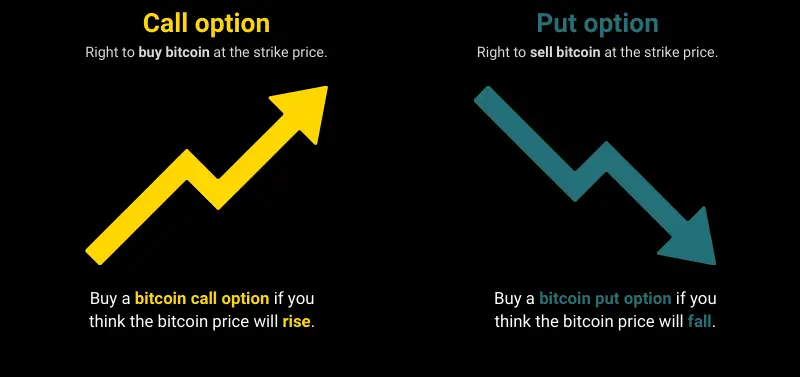

A call option gives you the right to buy cryptocurrency at a set price, called the strike price. When you purchase a call option, you’re betting the crypto’s price will rise above the strike price before expiration.

Put options grant you the right to sell cryptocurrency at the strike price. These contracts become profitable when prices fall below the strike price.

Both types require payment of a premium – the upfront cost of purchasing the option contract. Your maximum loss is limited to this premium.

What Are Bitcoin Options

Bitcoin options function as contracts that give you specific rights over BTC. Each contract represents a standardized amount of Bitcoin, typically 1 BTC on most exchanges.

These derivatives track Bitcoin’s price movements while offering leveraged exposure. You can open positions with less capital than needed for spot trading.

The premium you pay varies based on market conditions and contract specifications. Major exchanges like Deribit and CME offer regulated Bitcoin options trading.

Option Pricing And Implied Volatility

The premium of an option depends on several components:

- Intrinsic value: The difference between strike price and current price

- Time value: The remaining time until expiration

- Implied volatility: Market’s forecast of price fluctuations

Higher implied volatility leads to higher premiums. Crypto markets often experience significant volatility, making options relatively expensive.

Strike price proximity to current market price strongly influences premiums. At-the-money options typically have the highest time value.

European Vs. American Options

European-style options only allow exercise on the expiration date. This restriction makes them simpler to price and trade.

American-style options provide more flexibility, allowing exercise at any point before expiration. Most crypto options follow European style.

Exercise timing affects option values. Early exercise rights in American options can make them more expensive than equivalent European options.

Most cryptocurrency exchanges offer European-style options to maintain consistent pricing models and reduce complexity.

Types Of Crypto Options

Cryptocurrency options trading provides different instruments to match various trading strategies and risk appetites. Each type serves specific purposes in portfolio management and speculation.

Vanilla Options

Call options give you the right to buy cryptocurrency at a predetermined price before expiration. Put options provide the right to sell at a set price.

American-style options let you exercise the contract any time before expiration. European-style options only allow exercise on the expiration date.

Bitcoin and Ethereum dominate vanilla options trading due to their market size and liquidity. Most exchanges offer BTC and ETH options with various strike prices and expiration dates.

Exotic Options

Barrier options activate or terminate when the asset reaches a specific price level. These cost less than vanilla options but carry more complex risks.

Binary options pay a fixed amount if certain conditions are met at expiration. The payout is all-or-nothing based on the price reaching specific targets.

Look-back options allow you to benefit from the highest or lowest price during the contract period. These provide unique opportunities but trade at a premium.

Other Underlying Assets

Altcoin options exist for cryptocurrencies like Solana, Cardano, and BNB. Trading volume remains significantly lower than Bitcoin options.

Limited liquidity in altcoin options can lead to wider spreads and more difficulty entering or exiting positions.

Consider the higher volatility and market risks when trading options on smaller cryptocurrencies. Proper position sizing becomes even more critical with these instruments.

Read more: How to trade Crypto Options in India

Benefits Of Crypto Options Trading

Crypto options trading provides powerful tools for managing market exposure while creating opportunities for enhanced returns and portfolio optimization.

Risk Management

You can limit potential losses by purchasing put options as insurance against price drops in your crypto holdings. The maximum loss is capped at the premium paid, protecting your portfolio from severe market downturns.

Put options let you hedge existing positions without selling your crypto assets. This strategy maintains your long-term investment while safeguarding against short-term volatility.

You can also use call options to lock in future purchase prices, securing favorable entry points even if the market moves higher.

Leverage

Options contracts give you exposure to larger positions using less capital compared to spot trading. A single options contract controls multiple units of cryptocurrency.

You can amplify potential returns by paying only the premium instead of the full asset price. This capital efficiency allows for strategic position sizing.

The leverage inherent in options trading means smaller price movements can generate significant profits when your market view is correct.

Strategic Flexibility

You can profit from multiple market scenarios using various options strategies. Bull call spreads work in upward trends, while iron condors generate income in sideways markets.

Options let you capitalize on changes in volatility, not just price direction. Straddles and strangles allow you to profit when markets become more volatile.

Time decay strategies like covered calls generate regular income from your existing crypto holdings.

Speculation and Diversification

Options enable you to take positions on price movements without owning cryptocurrency directly. This reduces custody risks and simplifies position management.

You can access sophisticated trading strategies previously limited to traditional markets. Calendar spreads and butterflies add new dimensions to your trading toolkit.

Your crypto portfolio gains additional uncorrelated return streams through options strategies that work independently of market direction.

What Are Bitcoin Options?

Bitcoin options are financial derivatives that give you the right – but not the obligation – to buy or sell Bitcoin at a set price on a specific future date. These contracts use BTC as the underlying asset.

When trading Bitcoin options, you can choose between two types: call options and put options. A call option lets you buy Bitcoin at the strike price, while a put option allows you to sell at the strike price.

Each Bitcoin options contract includes key components:

- Strike price: The predetermined price to buy/sell

- Expiration date: When the contract ends

- Premium: The upfront cost you pay for the option

Trading Bitcoin options provides flexibility in your crypto investment strategy. You can use them to speculate on price movements or protect your existing positions against market volatility.

The potential profit from options trading depends on the price movement of Bitcoin relative to your strike price. Your maximum loss is limited to the premium paid for the contract.

You’ll need to select a reputable cryptocurrency exchange that offers options trading to get started. Look for platforms with strong security measures and clear trading interfaces.

What Is Bitcoin Options Expiry?

Bitcoin options expiry marks the specific date and time when your Bitcoin options contracts reach their end point. At expiry, you must make a decision about your open positions.

Your options contracts give you the right – but not the obligation – to buy or sell Bitcoin at a predetermined price before the expiration date. When that date arrives, the contracts settle.

Two key outcomes happen at expiry:

- In-the-money options can be exercised for a profit

- Out-of-the-money options expire worthless

Price volatility often increases around major expiry dates as traders adjust their positions. This creates both risks and opportunities in the market.

Many exchanges offer monthly and quarterly expiry dates. You’ll need to closely monitor these dates if you’re actively trading Bitcoin options.

Important considerations for expiry:

- Track expiration dates carefully

- Plan your exit strategy in advance

- Consider rolling over profitable positions

- Be prepared for increased market movement

Trading volume typically rises leading up to expiry as traders close or roll their positions. Your awareness of these market dynamics can help inform your trading decisions.

What Time Bitcoin Options Expire?

Bitcoin options typically expire on Fridays at 08:00 UTC on most major cryptocurrency exchanges. Your trading platform will display the specific expiration time for each contract.

Monthly options are the most common, expiring on the last Friday of each month. Some exchanges also offer weekly options that expire every Friday, giving you more frequent trading opportunities.

When an option reaches its expiration time, you have two choices if you hold the contract:

- Exercise the option if it’s profitable (in-the-money)

- Let it expire worthless if it’s unprofitable (out-of-the-money)

The hours leading up to expiration can see increased market volatility, especially when there’s high open interest. This creates both risks and opportunities for traders.

Key expiration times to watch:

- Monthly options: Last Friday of each month, 08:00 UTC

- Weekly options: Every Friday, 08:00 UTC

- Quarterly options: Last Friday of March, June, September, December

You’ll want to monitor your positions closely as expiration approaches. The value of options tends to decay more rapidly in the final days before expiry.

What Time Do Crypto Options Expire?

Crypto options typically expire at specific times set by each cryptocurrency exchange. Most Bitcoin and Ethereum options expire at 8:00 AM UTC on their scheduled expiration dates.

Trading activity often increases in the hours leading up to expiration as traders close or exercise their positions. You’ll notice higher market volatility during these periods.

Major exchanges like Deribit offer options with daily, weekly, quarterly, and yearly expiration cycles. Weekly options usually expire every Friday, while monthly options expire on the last Friday of each month.

Before expiration, you have three choices: exercise the option, close your position by selling it, or let it expire. If your option is “in the money,” most exchanges will automatically exercise it at expiration.

Key expiration times to remember:

- Daily options: 8:00 AM UTC

- Weekly options: Friday, 8:00 AM UTC

- Monthly options: Last Friday, 8:00 AM UTC

Set reminders for your option expiration dates to avoid missing critical deadlines. Your options become worthless after the expiration time passes.

What Does Bitcoin Options Expiring Mean?

Bitcoin options expiry marks the exact date and time when your options contracts reach their end point. At this moment, you must decide whether to exercise your contract rights or let them expire.

When you hold Bitcoin options, you have the right – but not the obligation – to buy (call) or sell (put) BTC at a specific price before the expiry date. This predetermined price is called the strike price.

The expiry process affects options differently based on their value position:

- In-the-money options get exercised or settled

- Out-of-the-money options become worthless

- At-the-money options require careful consideration

Market impact can vary during expiry periods. Your Bitcoin options may contribute to price movements as traders adjust their positions and large contracts settle simultaneously.

Several major exchanges handle Bitcoin options expiry:

- Deribit: Largest BTC options exchange

- CME: Regulated U.S. exchange

- Binance: Growing options platform

You’ll notice expiry dates often align with the last Friday of each month. Some contracts also expire weekly or quarterly, giving you flexibility in choosing timeframes that match your trading strategy.

Trading volume typically increases near expiry as positions get closed or rolled over to new contracts. Your awareness of these patterns can help inform trading decisions.

Frequently Asked Questions

Getting started with crypto options requires understanding specific platforms, strategies, and risk management techniques. Key decisions include choosing regulated exchanges and mastering basic options concepts.

How can beginners get started with crypto options trading?

Start by selecting a reputable cryptocurrency options exchange with strong security measures and educational resources. Create an account and complete the verification process.

Learn the fundamental concepts of options trading through the exchange’s tutorials and practice with a demo account before risking real money.

Begin with small position sizes and simple strategies like basic call or put options. Focus on one cryptocurrency pair until you develop consistent trading practices.

Can you trade options for cryptocurrencies on platforms like Coinbase?

Coinbase does not currently offer direct cryptocurrency options trading. You’ll need to use specialized crypto derivatives exchanges like Deribit or FTX.

These platforms provide dedicated options trading interfaces with tools for analyzing market data and executing trades.

What is an example of a trade involving bitcoin call options?

You buy a Bitcoin call option with a $50,000 strike price, expiring in 30 days, for a premium of $2,000. If Bitcoin’s price rises above $52,000, you profit from the difference.

The maximum loss is limited to your $2,000 premium, while potential profits increase as Bitcoin’s price rises above the break-even point of $52,000.

This trade lets you control a larger Bitcoin position without buying the actual cryptocurrency.

Conclusion

Trading crypto options provides you with advanced tools to engage with cryptocurrency markets without directly holding the assets. These derivatives let you speculate on price movements while limiting potential losses to your initial premium.

You’ll find multiple strategies available, from basic calls and puts to complex spread combinations. Each approach offers distinct ways to manage risk and potentially generate returns based on your market outlook.

Risk management remains crucial when trading crypto options. Setting clear position sizes, using stop-loss orders, and maintaining adequate collateral helps protect your capital in this volatile market.

Your success depends on developing strong analytical skills and staying informed about market conditions. Start with small positions while you learn the mechanics of options trading, and gradually increase your exposure as you gain experience.

Remember that crypto options combine two complex elements – derivatives trading and cryptocurrency markets. Take time to master the fundamentals before attempting advanced strategies.

Trading platforms offer practice accounts where you can test strategies without risking real money. This hands-on experience proves invaluable for building practical trading skills.

Key points to remember:

- Always verify platform security and regulatory compliance

- Monitor position sizes and leverage carefully

- Keep detailed records of trades and outcomes

- Continue expanding your options trading knowledge

Explore these crypto option trading exchanges: