Options expiry in cryptocurrency markets creates action and movement that affects traders and investors.

When crypto options expire, traders must decide to exercise their contracts or let them end. This means they might buy or sell large amounts of crypto at specific prices.

During options expiration, the crypto market often sees big price swings as traders adjust their positions and close out their bets.

The price of cryptocurrencies like Bitcoin tends to move toward key price levels where many options contracts are set to expire.

This happens because traders work to protect their positions or take profits.

Your trading strategy needs careful planning around options expiry dates.

These events can create good entry and exit points for trades, but they also bring extra risk.

The market impact depends on the total value of expiring options and whether most traders are betting on prices going up or down.

Understanding Crypto Options

Crypto options give traders ways to profit from cryptocurrency price movements without owning the actual assets. These financial contracts offer both protection against market risks and opportunities for strategic trading.

Definition of Crypto Options

A crypto option is a contract that gives you the right, but not the obligation, to buy or sell cryptocurrency at a set price before a specific date.

The price you agree to is called the strike price, and the end date is the expiration date.

When you buy an option, you pay a premium upfront. This premium is your maximum possible loss if the option expires worthless.

Types of Crypto Options

Call Options: These let you buy crypto at the strike price. You might buy calls if you think prices will go up.

Put Options: These let you sell crypto at the strike price. You might buy puts if you think prices will drop.

Both types come in American and European styles:

- American options can be exercised any time before expiry

- European options can only be exercised at expiry

Key Terminology

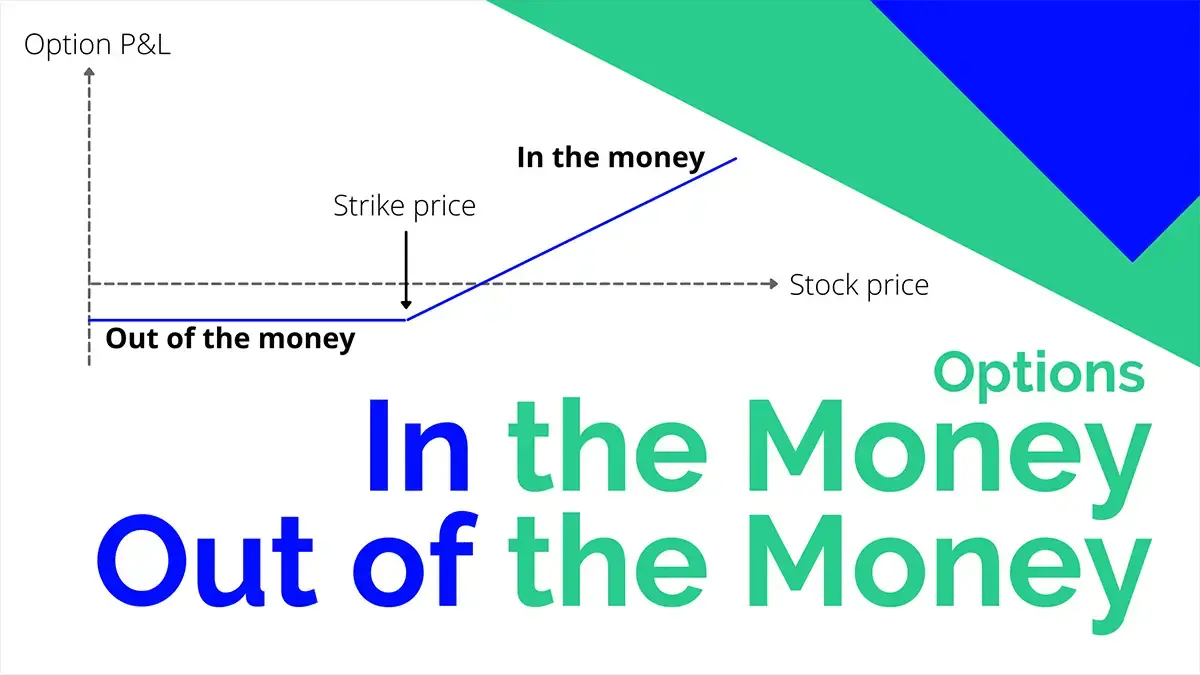

Strike Price: The price at which you can buy or sell the cryptocurrency.

Premium: The cost you pay to buy an option contract.

Expiration Date: The last day you can exercise your option.

In-the-money (ITM): When an option has real value because the market price is better than the strike price.

Out-of-the-money (OTM): When an option has no real value because the market price is worse than the strike price.

Expiration of Crypto Options

Crypto options expire at specific dates and times, which triggers settlement between traders. These contracts require traders to make decisions about exercising their rights before expiry.

Meaning of Expiry in Crypto Options

When a crypto option expires, you must decide whether to exercise your right to buy or sell the underlying cryptocurrency. The option’s value becomes fixed at the expiration time and price.

In-the-money options convert to their respective futures contracts at expiry. Out-of-the-money options expire worthless.

Your choices at expiry depend on your position:

- Buyers: Exercise profitable options or let unprofitable ones expire

- Sellers: Prepare to fulfill obligations if assigned

Expiration Date and Time

Crypto options typically expire monthly on predetermined dates.

Most platforms set expiration times at 8:00 UTC on the last Friday of each month.

New contracts become available as old ones expire. Trading platforms list contracts six months into the future.

You’ll need to track these key expiry details:

- Settlement price at expiry

- Time left until expiration

- Exercise deadlines

- Contract rollover dates

The expiry process follows strict schedules to ensure fair settlement for all traders involved.

Crypto Options Settlement

Options contracts must be settled when they expire. The two main ways to settle crypto options are through cash payments or by delivering the actual cryptocurrency.

Cash Settlement

With cash settlement, you receive money equal to the difference between the strike price and market price at expiry. No actual crypto changes hands. This is common for bitcoin options on exchanges like Deribit.

The cash amount is calculated automatically at expiration.

If you hold a call option and the market price is above the strike price, you get paid the difference. For put options, you profit when the market price falls below the strike.

Physical Settlement

Physical settlement means you receive or deliver the actual cryptocurrency when options expire in-the-money. The contract transfers ownership of the underlying crypto asset.

Your crypto wallet must have enough funds to fulfill physical delivery.

Some exchanges require pre-funding before expiration. The delivery process happens automatically through smart contracts on the exchange.

Note: Not all exchanges support physical settlement. Make sure to check the settlement type before trading.

Physical settlement gives you direct access to the cryptocurrency but requires more capital than cash settlement.

Exercising Crypto Options

When crypto options reach their expiry date, you’ll need to decide whether to exercise your right to buy or sell the underlying cryptocurrency futures contract at the strike price.

In-The-Money Options

An option is “in-the-money” when exercising it gives you an immediate profit.

For call options, this means the market price is higher than your strike price. For put options, it’s when the market price is lower than your strike price.

Most trading platforms will automatically exercise these profitable options at expiry.

Your broker will deliver the underlying crypto futures contract to your account when you exercise an in-the-money option. You can then choose to hold or trade the futures position.

Out-of-The-Money Options

Out-of-the-money options have no value at expiration because exercising them would result in a loss. These options simply expire worthless.

For call options, this happens when the market price is below your strike price. For put options, it’s when the market price is above your strike price.

You don’t need to take any action with out-of-the-money options. They’ll disappear from your account at expiry, and you’ll lose the premium you paid.

At-The-Money Options

At-the-money options have a strike price very close to the current market price of the cryptocurrency. These options typically have little to no intrinsic value at expiry.

You’ll need to carefully evaluate whether exercising makes financial sense after accounting for fees and transaction costs.

Most traders let at-the-money options expire rather than exercise them, since the potential profit is minimal or non-existent.

Implications for Option Holders

The final outcome of your crypto options depends on whether they expire in-the-money (ITM) or out-of-the-money (OTM). Your actions in the days before expiration can greatly impact your trading results.

Rights and Obligations

When you hold crypto options, you have specific rights but no obligations to exercise.

For call options, you get the right to buy the underlying crypto futures at the strike price. For puts, you get the right to sell.

Your ITM options will typically exercise automatically at expiration. The crypto exchange will convert them into corresponding futures positions.

OTM options become worthless at expiration. You’ll lose your initial premium payment but have no further obligations.

Managing Expiring Positions

You must decide whether to close, exercise, or let your options expire.

Consider closing ITM positions before expiration to capture remaining value.

Monitor position delta and time decay as expiration approaches. Price movements in the underlying crypto can quickly change your option’s value.

Set calendar reminders for important expiration dates. Many traders close positions a few days early to avoid expiration day risks.

Consider rolling positions forward if you want to maintain similar exposure.

This involves closing current options and opening new ones with later expiration dates.

Post-Expiration Scenarios

When crypto options reach their expiration date, two main outcomes can occur based on whether the options are in-the-money or out-of-the-money. The resulting actions directly impact your trading positions and potential profits or losses.

Automatic Exercise and Assignment

In-the-money options typically get exercised automatically at expiration.

For call options, this means you’ll buy the underlying cryptocurrency at the strike price. For put options, you’ll sell at the strike price.

The assignment process happens through your broker or exchange platform. They handle the transfer of assets and settlement of positions according to the contract terms.

Your account must have enough funds to cover the exercise cost.

If you lack sufficient funds, your broker might close the position before expiration to prevent assignment.

Expiration Without Exercise

Out-of-the-money options expire worthless. You lose the premium paid for the option, but face no other obligations.

Your trading platform will remove expired options from your account automatically. No action is needed on your part.

Many traders close profitable positions before expiration to lock in gains and avoid exercise fees. This strategy can help manage risks and costs more effectively.

Financial Impact of Expiry

The expiration of cryptocurrency options creates direct financial consequences for traders through profit/loss outcomes and changes to their investment portfolios. Market prices at expiry determine whether options finish in or out of the money.

Profit and Loss Calculations

Your maximum potential loss from buying options is limited to the premium paid. If your option expires worthless, you lose the entire premium amount.

For in-the-money options at expiry, your profit equals the difference between the strike price and market price, minus the premium paid.

The Put/Call ratio of 1.08 shows balanced positioning between bullish and bearish traders in the current market.

Settlement happens automatically – in-the-money options convert to futures contracts that settle to cash value.

Effect on Portfolio Value

Your portfolio value can change significantly around options expiry dates due to price volatility in the underlying crypto assets.

You must track expiring positions closely since automatic settlement could impact your margin requirements and overall account balance.

Large expiries of $14 billion or more can create broader market effects that influence prices of related crypto holdings in your portfolio.

Consider rolling positions forward before expiry to maintain desired exposure levels and avoid unwanted settlements.

Expired out-of-the-money options remove those positions from your portfolio entirely, potentially changing your risk profile.

Risk Management Strategies

Trading crypto options needs smart risk management to protect your investments. A clear plan helps you handle market swings and avoid big losses.

Hedging Against Expiry Risks

Keep a close eye on your options’ time value as they get closer to expiry. You can protect yourself by taking opposite positions in the spot market.

Use stop-loss orders to limit potential losses. Set these at key price levels based on your risk tolerance.

Consider using multiple expiry dates for your options. This spreads out your risk across different time periods instead of having all positions expire at once.

Match your position sizes to your account. Never risk more than 1-2% of your trading capital on a single options trade.

Rolling Over Options

Rolling over means closing your current option and opening a new one with a later expiry date. This gives your trade more time to work out.

Choose the new expiry date carefully. Look at market trends and pick dates that align with your trading strategy.

You might need to pay extra premium when rolling options. Make sure the cost makes sense for your expected returns.

Check if rolling maintains your original trading thesis. Sometimes it’s better to take a small loss than risk more capital on a failing strategy.

Market Dynamics at Expiry

When crypto options expire, prices often show notable movement as traders adjust their positions and market makers rebalance their holdings. These movements create opportunities and risks in the cryptocurrency market.

Impact on Cryptocurrency Market

Major options expiry dates affect both spot and derivatives markets. Your trading strategy needs to account for potential price swings during these times.

Large options expirations can trigger price movements in either direction. A significant number of expired contracts means traders must decide whether to close positions or roll them into new ones.

Market makers who sold options need to adjust their hedges after expiry. This leads to increased trading activity in the spot market as they buy or sell the underlying crypto assets.

Options Expiry and Volatility

Price volatility typically increases near options expiration dates. You’ll notice larger price swings as traders and market makers react to expiring positions.

The size of the expiring options matters. $14 billion in Bitcoin options expiring at once creates more market impact than smaller expiration events.

Trading volume often spikes in the hours before and after major expiry events. This increased activity can lead to sudden price changes as large orders hit the market.

Key price levels around popular strike prices tend to act as magnets during expiry. The market may gravitate toward these levels as traders exercise their options.

Regulatory and Legal Considerations

Crypto options trading must follow specific regulations set by financial authorities to protect investors and maintain market stability.

Different jurisdictions have unique rules about contract settlement and trading practices.

Expiry and Compliance

You need to understand your local regulations before trading crypto options.

The SEC and CFTC in the United States require all crypto derivatives trading to happen on registered exchanges. These platforms must follow strict reporting and monitoring rules.

Trading platforms will verify your identity and location before letting you trade. Many regions restrict certain types of crypto options or ban them completely.

Regular audits ensure exchanges handle expirations correctly. Platforms must keep detailed records of all trades and settlements.

Legal Implications of Settlement Methods

Your settlement rights and obligations depend on the contract terms and platform rules.

Cash settlement requires proper documentation and tax reporting.

Physical delivery of crypto assets must follow specific legal protocols. The exchange needs to verify ownership and transfer rights.

Smart contracts used for settlements must meet regulatory standards. These automated systems need built-in compliance checks.

You’re responsible for reporting all gains or losses from expired options to tax authorities. Keep detailed records of all your trades and settlements.

Strategies for Upcoming Expiry Periods

Successful crypto options trading requires careful preparation and monitoring before contracts expire. The right approach combines analysis of current market conditions with strategic planning for future positions.

Analyzing Market Sentiment

Track options open interest and trading volume in the days leading up to expiration. These metrics reveal where other traders expect prices to move.

Key indicators to monitor:

- Price action in spot markets

- Options pricing changes

- Put/call ratios

- Trading volume spikes

Set price alerts for significant support and resistance levels. This helps you react quickly if the market moves sharply near expiry.

Create a checklist of actions to take 48-72 hours before expiration. Include reviewing your position sizes and calculating potential profits or losses at different price points.

Planning for Future Contracts

Look at contracts with later expiration dates to find new trading opportunities. Compare premiums across different expiry months to spot favorable entry points.

Steps for rolling positions:

- Check liquidity in longer-dated contracts

- Calculate roll costs and fees

- Identify optimal strike prices

Consider splitting your position across multiple expiration dates. This reduces the impact of a single expiry event on your portfolio.

Keep track of upcoming contract listings and expiration schedules. Many exchanges add new contracts on a regular monthly cycle, giving you time to research and plan ahead.

Frequently Asked Questions

Options expiry affects crypto markets in many ways, from settlement procedures to price impacts. Trading volumes often spike near expiration dates as traders adjust their positions.

What is the process for settlement of expired crypto options?

When crypto options expire in-the-money, they are settled according to the contract terms. Cash-settled options pay out the difference in cash value. Physical settlement requires actual delivery of the cryptocurrency.

Automatic exercise happens for in-the-money options at expiry. Out-of-the-money options expire worthless.

Do Bitcoin options expire at the same time across all platforms?

Different exchanges set their own expiration times and dates. Major platforms like Deribit expire at 8:00 UTC, while CME options expire at different times. You need to check the specific expiration schedule for your chosen trading platform.

What does ‘max pain’ mean in the context of Bitcoin options expiry?

Max pain is the price point where options buyers lose the most money at expiry. It represents the strike price where the combined value of all outstanding puts and calls is lowest. This price often acts as a magnet near expiration as options sellers benefit most at this level.

How does the expiration of Bitcoin options affect market volatility?

Price swings often increase near major expiration dates. Large traders adjust or close positions, creating extra market activity. The days before expiration can see heightened volatility as positions get rolled over to later dates.

Can you explain the difference between cash-settled and physically-settled crypto options?

Cash-settled options pay out profits in money based on the price difference at expiry. No actual crypto changes hands. Physical settlement requires the actual delivery of cryptocurrency when exercised. The buyer receives the crypto while the seller delivers it.

What are the key dates one should be aware of for Bitcoin options expirations?

Monthly options expire on the last Friday of each month. Weekly options expire every Friday. Quarterly expirations in March, June, September, and December tend to have the highest trading volumes. Major exchange-specific dates vary, so check your platform’s expiration calendar.