Choosing the right cryptocurrency exchange can be challenging with so many options available. Uphold and KuCoin are two popular platforms that offer different experiences for crypto traders and investors. Uphold is generally more user-friendly with a higher ease-of-use score of 9.0 compared to KuCoin’s 7.3, making it better suited for beginners.

While KuCoin offers faster transactions and may appeal to more experienced traders, it has a steeper learning curve. Uphold connects more seamlessly with bank accounts, allowing you to purchase XRP and other cryptocurrencies more directly. Your decision between these exchanges should consider your experience level, trading needs, and how quickly you need to move in and out of positions.

When comparing these platforms, you’ll want to look at their fees, security features, and available cryptocurrencies. Uphold stands out for its comprehensive service offerings and educational resources, while KuCoin might offer advantages for those comfortable with more complex trading interfaces.

Uphold vs KuCoin: At A Glance Comparison

KuCoin and Uphold offer different experiences for crypto traders. Understanding their key differences will help you choose the right platform for your needs.

Ease of Use

- Uphold: Scores 9.0 for user-friendliness, making it excellent for beginners

- KuCoin: Scores 7.3, slightly more complex interface

Transaction Speed

- KuCoin: Faster for getting in and out of positions

- Uphold: Direct linking to savings accounts for quick XRP purchases

Focus Areas

- KuCoin emphasizes user experience

- Uphold prioritizes functionality

Interface Complexity

- KuCoin: More complicated to navigate but offers advanced features

- Uphold: More accessible for new users with a straightforward design

Purchase Methods

- Uphold: Links directly to savings accounts for faster purchases

- KuCoin: Requires more steps but offers more trading pairs

The right choice depends on your trading goals and experience level. If you’re new to crypto trading, Uphold’s accessibility might better serve your needs. If you want advanced trading options, KuCoin provides more tools despite its steeper learning curve.

Your preferences for specific cryptocurrencies and payment methods should also influence your decision, as both platforms offer different selections.

Uphold vs KuCoin: Trading Markets, Products & Leverage Offered

Uphold and KuCoin offer different trading options to meet various investor needs. Your choice between these platforms may depend on what you want to trade and how.

KuCoin provides more advanced trading options with impressive leverage capabilities. You can access up to 125x leverage in the futures market and 5x leverage for margin trading. This makes KuCoin attractive if you’re interested in high-risk, high-reward trading strategies.

Uphold focuses on accessibility and simplicity while still offering a comprehensive range of assets. The platform makes it easy to trade between cryptocurrencies, fiat currencies, and even some precious metals and stocks, all in one place.

Trading Products Comparison:

| Feature | Uphold | KuCoin |

|---|---|---|

| Cryptocurrencies | Wide selection | Extensive (including many altcoins) |

| Fiat currencies | Multiple options | Limited |

| Stocks/ETFs | Limited selection | Not available |

| Precious metals | Available | Not available |

| Futures trading | Not available | Available |

| Margin trading | Limited | Available (up to 5x) |

| Leverage options | Basic | Advanced (up to 125x) |

KuCoin tends to be more complex but offers greater flexibility for experienced traders. You’ll find more trading pairs and advanced order types on KuCoin.

Uphold simplifies the trading experience. If you’re new to crypto or prefer straightforward transactions, Uphold’s interface makes buying, selling, and converting assets more intuitive.

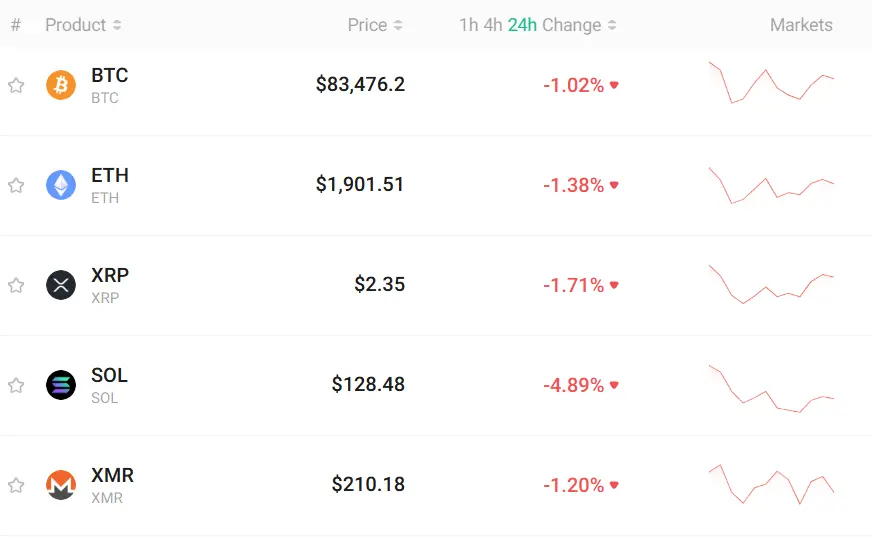

Uphold vs KuCoin: Supported Cryptocurrencies

Uphold and KuCoin offer different ranges of cryptocurrencies for trading, which may influence your choice between the platforms.

Uphold supports over 200 cryptocurrencies, including major coins like Bitcoin, Ethereum, XRP, and Litecoin. You can also trade various stablecoins like USDT and USDC on the platform.

KuCoin provides access to a much larger selection with over 700 cryptocurrencies. This makes KuCoin particularly attractive if you’re interested in trading newer or less common altcoins.

Here’s a comparison of their cryptocurrency offerings:

| Feature | Uphold | KuCoin |

|---|---|---|

| Total cryptocurrencies | ~200+ | ~700+ |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Stablecoins | ✓ | ✓ |

| Altcoins selection | Moderate | Extensive |

| New/emerging tokens | Limited | Abundant |

KuCoin stands out for early access to new tokens and trading pairs. You’ll find many cryptocurrencies on KuCoin before they reach other exchanges.

Uphold focuses on a more curated selection but adds value by allowing you to trade between cryptocurrencies and traditional assets like stocks and precious metals on a single platform.

Your choice depends on your trading needs. If you want a wide variety of altcoins, KuCoin is preferable. For a more streamlined selection with traditional asset integration, Uphold might better suit your requirements.

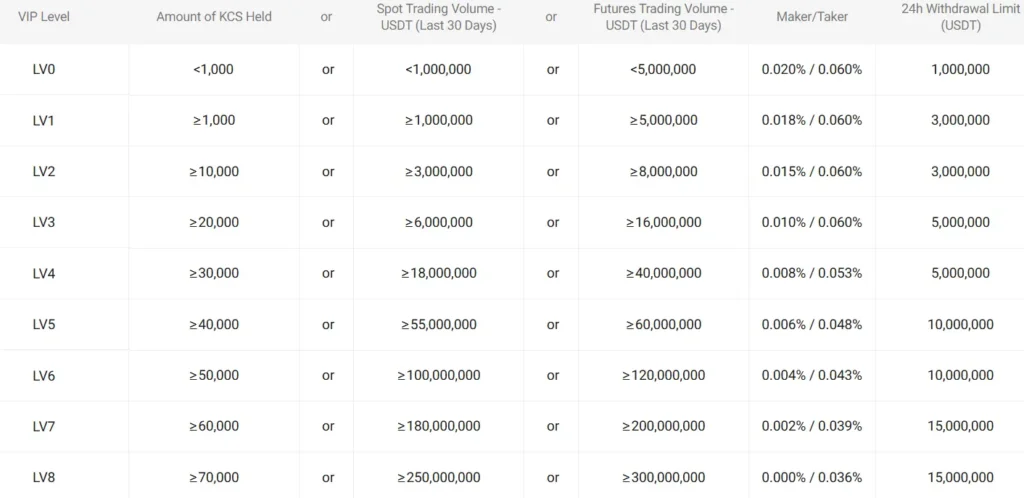

Uphold vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Uphold and KuCoin, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Special Features |

|---|---|---|---|

| Uphold | 0.85-1.8% | 0.85-1.8% | Volume discounts available |

| KuCoin | 0.1% | 0.1% | KCS token holders get fee discounts |

KuCoin offers significantly lower standard trading fees compared to Uphold. This makes KuCoin more attractive for frequent traders who want to minimize costs.

Deposit Fees

Uphold allows free deposits via bank transfers and debit cards in many regions. However, credit card deposits typically incur a 3.99% fee.

KuCoin generally doesn’t charge for crypto deposits, making it convenient for transferring existing crypto holdings.

Withdrawal Fees

Uphold offers free withdrawals to external wallets for most cryptocurrencies, which is a notable advantage.

KuCoin’s withdrawal fees vary by cryptocurrency. For example, BTC withdrawals cost around 0.0005 BTC, while ETH withdrawals are approximately 0.004 ETH.

Network Fees

Both exchanges pass network fees to users during withdrawals. These fees fluctuate based on network congestion.

Remember that fee structures can change, so you should verify the current rates on each platform before making your decision.

Uphold vs KuCoin: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Uphold and KuCoin offer different order options that cater to various trading needs.

Uphold keeps things simple with a limited selection of order types. You can place basic market orders that execute immediately at the current market price. This straightforward approach makes Uphold more accessible for beginners.

KuCoin provides a more extensive range of order options for advanced traders. You can use:

- Market orders: Execute immediately at current prices

- Limit orders: Set specific buy/sell prices

- Stop orders: Trigger at predetermined price points

- Stop-limit orders: Combine stop triggers with limit prices

- OCO (One Cancels Other): Place two orders where filling one cancels the other

KuCoin also offers margin trading with specialized order types. This allows you to leverage your position for potentially higher returns, though with increased risk.

The difference in order variety reflects each platform’s target audience. Uphold focuses on simplicity for newcomers and casual traders. KuCoin caters to more experienced traders who need advanced tools.

Your trading style should guide your choice between these platforms. If you prefer straightforward buying and selling, Uphold might be sufficient. For more complex trading strategies, KuCoin’s diverse order types provide greater flexibility.

Uphold vs KuCoin: KYC Requirements & KYC Limits

KYC (Know Your Customer) requirements differ significantly between Uphold and KuCoin, affecting how quickly you can start trading and what limits you’ll face.

Uphold KYC Policy:

- Requires full verification for all users before trading

- Verification includes ID document, selfie, and personal information

- Process typically completed within 24 hours

- All features unavailable until KYC is complete

Uphold’s strict KYC approach means you can’t use the platform anonymously, but it provides better regulatory compliance in many regions.

KuCoin KYC Policy:

- Basic trading available without KYC verification

- Limited daily withdrawal of 1-5 BTC (varies by time period) for unverified accounts

- Higher limits require ID verification and proof of address

- Three verification tiers with progressively higher limits

KuCoin offers more flexibility for users who prefer privacy or want to start trading immediately.

Which is Better for You?

If regulatory compliance and security are your priorities, Uphold’s mandatory verification might be preferable. You’ll face fewer potential issues with withdrawals later.

If you value privacy or need immediate access to trading, KuCoin’s tiered approach gives you more options. Just remember that higher withdrawal limits will eventually require verification.

Your choice should depend on your trading volume needs and comfort level with providing personal information.

Uphold vs KuCoin: Deposits & Withdrawal Options

When choosing between Uphold and KuCoin, deposit and withdrawal options are key factors to consider.

Uphold offers more traditional banking options. You can link directly to your savings account for quick purchases. This makes it easier for beginners to get started.

Uphold supports bank transfers, credit/debit cards, and digital wallets. Their fee structure is transparent, typically charging only network fees for withdrawals.

KuCoin focuses more on crypto-to-crypto transactions. While it may have fewer traditional banking options, many users find it faster for moving in and out of positions.

KuCoin can be a bit more complex to use for beginners. However, experienced traders often prefer its advanced options for deposits and withdrawals.

Both platforms support major cryptocurrencies, but their supported coins differ. Check if your preferred crypto is available before choosing.

For withdrawal speed, KuCoin is noted to be faster in processing. This can be important if you need quick access to your funds.

Deposit methods comparison:

| Method | Uphold | KuCoin |

|---|---|---|

| Bank transfer | ✓ | Limited |

| Credit/debit card | ✓ | ✓ |

| Crypto deposit | ✓ | ✓ |

| Direct savings link | ✓ | ✗ |

Your choice should depend on how you plan to fund your account and how quickly you need to move your assets.

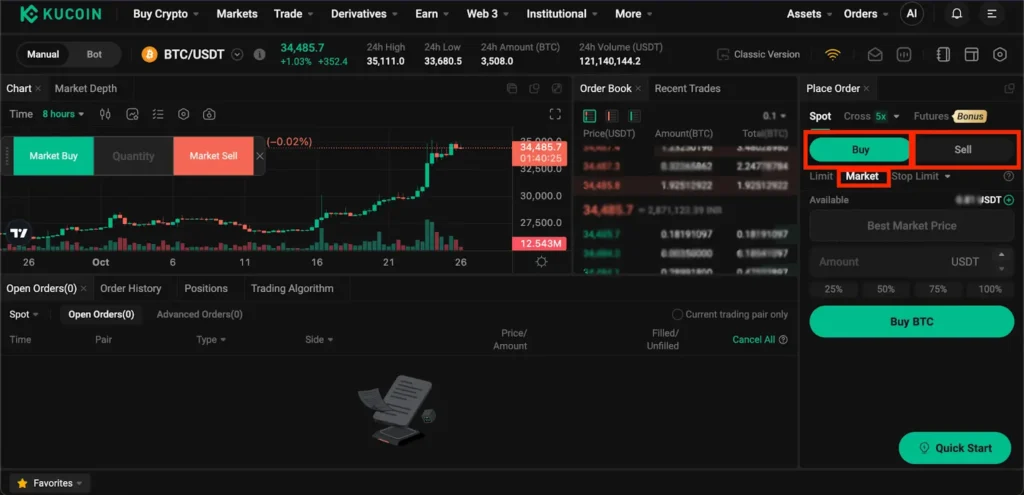

Uphold vs KuCoin: Trading & Platform Experience Comparison

When choosing between Uphold and KuCoin, the trading experience and platform usability significantly impact your decision.

Ease of Use

Uphold scores higher in user-friendliness with a 9.0 rating compared to KuCoin’s 7.3. This makes Uphold more accessible if you’re new to cryptocurrency trading.

KuCoin offers a more technical interface with advanced trading features that experienced traders might prefer. However, new users often find its layout overwhelming.

Trading Features

| Feature | Uphold | KuCoin |

|---|---|---|

| User Interface | Simple, intuitive | Complex, feature-rich |

| Mobile Experience | Streamlined | Comprehensive but busy |

| Trading Tools | Basic, accessible | Advanced, technical |

| Asset Selection | Good variety | Extensive selection |

Uphold prioritizes a straightforward trading experience. You can easily convert between cryptocurrencies, fiat currencies, and even precious metals on one platform.

KuCoin provides more sophisticated trading options, including futures, margin trading, and lending services. You’ll find a wider range of trading pairs and altcoins here.

The platform you choose should match your trading style. If you value simplicity and ease of navigation, Uphold might be your better option.

For more advanced trading features and access to a broader range of cryptocurrencies, KuCoin offers more depth despite its steeper learning curve.

Uphold vs KuCoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for your risk management strategy. Both Uphold and KuCoin have systems to protect themselves when your positions approach dangerous loss levels.

KuCoin offers a tiered liquidation system for futures trading. Your position enters a liquidation risk zone when your margin ratio falls below 100%. If it drops below the maintenance margin requirement (typically 80%), partial liquidation begins.

For complete liquidation on KuCoin, your margin ratio must fall below 30%. The platform sends notifications at different risk levels, giving you time to add funds or reduce your position size.

Uphold takes a more conservative approach to liquidation. The platform has fewer margin trading options compared to KuCoin, which means fewer opportunities for liquidation events.

Liquidation Comparison:

| Feature | KuCoin | Uphold |

|---|---|---|

| Warning notifications | Multiple tiers | Limited |

| Partial liquidation | Yes | Limited |

| Liquidation threshold | Below 30% margin ratio | Varies by asset |

| Fee structure | Insurance fund contribution | Simpler structure |

KuCoin provides more advanced traders with greater flexibility but requires closer attention to margin levels. Uphold’s simpler structure may benefit beginners but offers fewer options for advanced trading strategies.

You should consider your trading style when choosing between these platforms. Active traders who use leverage frequently might prefer KuCoin’s more developed liquidation system with multiple safeguards.

Uphold vs KuCoin: Insurance

When comparing cryptocurrency exchanges, insurance protection is a crucial factor to consider for your assets’ safety. Both Uphold and KuCoin offer different approaches to insurance coverage.

Uphold provides more robust insurance protection. They maintain insurance coverage for digital assets held in their hot wallets. This means your funds stored online have some protection against potential security breaches.

Additionally, Uphold offers FDIC insurance for USD deposits up to $250,000 per customer. This gives you an extra layer of security for your fiat currency holdings on the platform.

KuCoin takes a different approach with their Safeguard Fund. This is an internal insurance fund designed to compensate users in case of security incidents. In 2020, KuCoin experienced a major hack and successfully reimbursed affected users.

However, KuCoin doesn’t offer FDIC insurance for fiat deposits like Uphold does. This is an important distinction if you plan to keep significant amounts of US dollars on the platform.

Insurance Comparison:

| Feature | Uphold | KuCoin |

|---|---|---|

| Digital Asset Insurance | Yes (hot wallets) | Via Safeguard Fund |

| FDIC Insurance | Yes (up to $250K) | No |

| History of Reimbursing Users | Good track record | Successfully handled 2020 hack |

You should consider these insurance differences when choosing between these platforms, especially if asset protection is a top priority for your crypto activities.

Uphold vs KuCoin: Customer Support

Customer support is a critical factor when choosing a cryptocurrency exchange. Both Uphold and KuCoin offer various support options, but with notable differences.

Uphold provides 24/7 customer support through email and a comprehensive help center. Their response times typically range from a few hours to one business day. You can also access their chatbot for immediate assistance with basic questions.

KuCoin also offers round-the-clock support with more communication channels including email, live chat, and an active presence on social media platforms. Their support team generally responds within 24 hours, though response times may vary during high volume periods.

Knowledge Base Comparison:

- Uphold: Well-organized FAQ section, video tutorials, and detailed guides

- KuCoin: Extensive help center, trading guides, and a community forum

Many users find KuCoin’s community forum particularly helpful for troubleshooting common issues. You can often find solutions from other users before needing to contact official support.

Language support is another important consideration. Uphold offers support in more languages, making it more accessible if English isn’t your primary language. KuCoin primarily focuses on English support with some resources available in other languages.

Both platforms have generally positive customer support ratings, though some users report occasional delays during market volatility or high-traffic periods. You should consider which support channels matter most to your trading style when making your decision.

Uphold vs KuCoin: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both Uphold and KuCoin offer different security measures to protect your investments.

KuCoin uses advanced encryption algorithms to secure data transmission and storage. The platform also implements two-factor authentication (2FA), adding an extra layer of protection for your account.

Uphold emphasizes user accessibility while maintaining strong security protocols. Their security system includes multi-signature wallets and regular security audits to identify potential vulnerabilities.

KuCoin Security Features:

- Advanced encryption

- Two-factor authentication (2FA)

- Anti-phishing security measures

- Cold storage for majority of assets

Uphold Security Features:

- Multi-signature wallets

- Regular security audits

- 2FA verification

- Biometric authentication options

KuCoin has experienced security breaches in the past but has strengthened its security framework since then. The platform now stores most user funds in cold wallets, which are disconnected from the internet.

Uphold maintains a strong focus on regulatory compliance, which indirectly enhances security. Their transparent approach includes clear policies about how they manage and protect your assets.

When comparing the two, consider your specific needs. If you value advanced technical security features, KuCoin may be your preference. If you prioritize user-friendly security combined with regulatory compliance, Uphold might be more suitable.

Is Uphold a Safe & Legal To Use?

Uphold is considered a safe and legal platform for cryptocurrency trading and other financial activities. Based on current information as of March 2025, Uphold operates as a compliant exchange in multiple jurisdictions.

Security is a priority for Uphold, implementing industry-standard protections to safeguard your assets. The platform uses encryption technology and offers two-factor authentication to protect your account from unauthorized access.

Uphold is regulated and follows compliance standards in the countries where it operates. This legal standing helps protect you as a user and ensures the platform follows proper financial regulations.

According to recent reviews, Uphold has built a reputation for security in the cryptocurrency exchange market. The platform stores the majority of user funds in offline cold storage, which adds an extra layer of protection against potential cyberattacks.

When using Uphold, you can take additional steps to enhance your security:

- Enable two-factor authentication

- Use strong, unique passwords

- Be cautious of phishing attempts

- Regularly monitor your account activity

The platform also provides educational resources to help you understand cryptocurrency security best practices, which can be valuable especially if you’re new to digital assets.

Is KuCoin a Safe & Legal To Use?

KuCoin’s safety and legality present a mixed picture for potential users. While the exchange offers high-security standards and a wide range of digital assets, it has faced significant challenges.

In 2020, KuCoin experienced a large-scale hack. Following this security breach, the platform strengthened its security measures to better protect user assets.

However, KuCoin’s legal status has become more complicated recently. In 2024, the exchange was served with a Department of Justice (DOJ) indictment for allegedly violating US regulations.

For US-based users, this legal situation creates uncertainty about using the platform. The regulatory challenges might affect your ability to access funds or trade certain assets.

When comparing KuCoin to alternatives like Uphold, you’ll find different safety profiles. Uphold tends to have more straightforward compliance with regulations in various jurisdictions.

Key safety considerations for KuCoin:

- Enhanced security after the 2020 hack

- Current legal challenges with US authorities

- Uncertain regulatory compliance status

- Potential access restrictions in some regions

Before choosing KuCoin, you should research the current legal status in your country and consider how regulatory issues might affect your crypto assets. Alternative exchanges might offer more stability if legal compliance is your priority.

Frequently Asked Questions

Investors considering cryptocurrency exchanges often need specific information to make informed decisions. These common questions address key differences between Uphold and KuCoin for various trading needs.

What are the main differences in fees between Uphold and KuCoin?

Uphold typically charges slightly higher fees than KuCoin for standard transactions. KuCoin employs a tiered fee structure that rewards high-volume traders with lower fees, starting at 0.1% and decreasing based on trading volume.

Uphold uses a spread-based pricing model, which includes their fee in the quoted price. This can make Uphold seem more expensive at first glance, but their all-inclusive pricing is simpler to understand for beginners.

KuCoin also offers fee discounts when using their native KCS token, which can significantly reduce costs for frequent traders.

How do Uphold and KuCoin differ in terms of supported cryptocurrencies?

KuCoin offers a much wider selection of cryptocurrencies, supporting over 700 different coins and tokens. This makes it ideal if you’re looking to trade newer or less common altcoins.

Uphold supports fewer cryptocurrencies, focusing on mainstream options like Bitcoin, Ethereum, and XRP. However, Uphold also allows trading of precious metals and selected stocks, offering more diversity of asset types.

The limited selection on Uphold makes it less suitable for traders seeking exposure to emerging cryptocurrency projects, but more than adequate for most common investment needs.

Can you compare the user experience of trading on Uphold versus KuCoin?

Uphold scores significantly higher in user experience with a 9.0 rating compared to KuCoin’s 7.3, according to G2 user feedback. Uphold’s interface is designed with simplicity in mind, making it more accessible for beginners.

KuCoin offers more advanced trading features and options, which creates a steeper learning curve. The platform includes spot trading, margin trading, futures, and more complex order types.

Uphold links directly to savings accounts, making purchases faster and more straightforward. KuCoin provides more trading tools but requires more time to learn and navigate effectively.

What security measures do Uphold and KuCoin employ for their users?

Both exchanges implement industry-standard security measures like two-factor authentication and encryption. KuCoin maintains the majority of user funds in cold storage to protect against online threats.

Uphold offers additional security through its regulatory compliance in multiple countries and provides insurance on digital assets. They also conduct regular security audits.

KuCoin experienced a major hack in 2020 but compensated affected users fully. Since then, they’ve strengthened their security protocols significantly with advanced risk control systems.

Which platform, Uphold or KuCoin, offers better customer support?

Uphold generally receives better reviews for customer support responsiveness. They offer email support, help center resources, and faster response times for account-related issues.

KuCoin provides 24/7 support through multiple channels including live chat and email. However, during high-volume periods, response times can be significantly longer.

The language support is more extensive on KuCoin, which serves a global audience in multiple languages, while Uphold’s support is primarily English-focused.

What advantages does KuCoin offer over Uphold for seasoned traders?

KuCoin provides advanced trading features that experienced traders value, including futures trading, margin trading with up to 10x leverage, and trading bots for automated strategies.

The exchange offers a wider range of order types, including stop-limit orders and OCO (One-Cancels-the-Other) orders, giving traders more control over their positions.

KuCoin’s higher liquidity for altcoins means less price slippage when executing large trades. Their staking and lending platforms also provide additional ways to earn passive income from crypto holdings.

KuCoin vs Uphold Conclusion: Why Not Use Both?

After comparing KuCoin and Uphold, you might wonder which platform to choose. The answer could be: use both for different purposes.

KuCoin offers a wider selection of cryptocurrencies and enhanced security features. It’s faster for trading in and out of positions, though its interface is slightly more complex for beginners.

Uphold boasts a higher overall score (9.4 compared to KuCoin’s lower rating) and provides better customer support. Users rate Uphold’s support at 8.2, significantly higher than KuCoin’s 5.6.

For purchasing XRP specifically, some users find Uphold more convenient as it links directly to savings accounts, making purchases streamlined.

Best uses for each platform:

| Platform | Best For |

|---|---|

| KuCoin | Advanced trading, wide crypto selection, security-focused users |

| Uphold | Beginners, customer support, quick XRP purchases |

You can leverage KuCoin’s extensive offerings for diversified crypto investments while using Uphold for simpler transactions and better support when needed.

Both exchanges have their strengths for Canadian users and others worldwide. Your specific needs should guide which platform you use for particular transactions.

Remember that splitting your assets between multiple reputable exchanges can also be a sound security strategy, reducing your risk exposure.