Choosing the right cryptocurrency exchange is essential when you want to start trading digital assets. In today’s comparison, we’ll look at two popular platforms: Uphold and Kraken. Kraken generally offers better trading features and higher evaluation scores than Uphold, though Uphold charges a flat 0.65% fee while Kraken uses a tiered fee structure based on trading volume.

For US-based XRP traders, Uphold stands out as the better option since it still supports XRP trading despite SEC litigation. Uphold also offers a simpler fee structure with no commissions beyond the spread, no bank deposit fees, and no withdrawal fees. Kraken, meanwhile, caters to more experienced traders with its advanced trading features and may be preferable if you plan to trade large volumes.

Uphold Vs Kraken: At A Glance Comparison

Both Uphold and Kraken are popular cryptocurrency exchanges, but they serve different types of users. Here’s how they compare on key features:

| Feature | Uphold | Kraken |

|---|---|---|

| Founded | 2014 | 2011 |

| Available Assets | 200+ cryptocurrencies, stocks, metals | 185+ cryptocurrencies |

| Trading Fees | Spread-based pricing | Maker-taker fee model (0.16% to 0.26%) |

| Security | Industry-standard security | Advanced security with proof of reserves |

| User Interface | Beginner-friendly | More technical, suited for traders |

| Unique Feature | Direct trading across asset classes | Advanced trading tools and order types |

Uphold stands out with its “anything-to-anything” trading model. You can directly trade between different asset types without converting to USD first.

Kraken offers more advanced trading features that appeal to experienced traders. Their platform includes detailed charts, multiple order types, and margin trading options.

When it comes to fees, the structures differ significantly. Uphold builds fees into their spreads, while Kraken uses a traditional maker-taker model that rewards high-volume traders.

Security is strong on both platforms, but Kraken has built a reputation as one of the most secure exchanges in the industry. They’ve never experienced a major security breach.

Your choice between these platforms should depend on your trading needs and experience level. Uphold works well for beginners and those wanting diverse asset classes, while Kraken suits more experienced crypto traders.

Uphold Vs Kraken: Trading Markets, Products & Leverage Offered

Kraken and Uphold offer different trading options to meet your crypto needs. Both platforms support popular cryptocurrencies like Bitcoin and Ethereum, but differ in their offerings.

Kraken provides more extensive cryptocurrency choices with over 200 trading pairs. You can access futures trading and margin trading with up to 5x leverage on Kraken, making it attractive if you want to amplify your trading potential.

Uphold stands out by letting you trade between cryptocurrencies, fiat currencies, precious metals, and even U.S. stocks. This versatility allows you to diversify your portfolio without switching platforms.

Here’s a quick comparison of what each platform offers:

| Feature | Kraken | Uphold |

|---|---|---|

| Cryptocurrencies | 200+ trading pairs | 130+ cryptocurrencies |

| Fiat Currencies | Several major currencies | 27+ national currencies |

| Other Assets | Futures, NFTs | Precious metals, U.S. stocks |

| Leverage Trading | Up to 5x (higher for eligible traders) | Not available |

| Staking Options | Yes | Limited |

Kraken caters more to experienced traders looking for advanced trading options like futures and leverage. Its platform includes sophisticated charting tools and order types.

Uphold focuses on simplicity and asset diversity. You can easily move between different asset classes, making it useful for beginners or those wanting a one-stop shop for various investments.

Uphold Vs Kraken: Supported Cryptocurrencies

When choosing between Uphold and Kraken, the variety of cryptocurrencies available plays a crucial role in your decision.

Kraken offers over 200 cryptocurrencies for trading, including popular options like Bitcoin, Ethereum, and Solana. They regularly add new tokens to their platform as the crypto market evolves.

Uphold supports approximately 130+ cryptocurrencies, which is fewer than Kraken but still covers most major coins. Notably, Uphold is one of the few exchanges that still supports XRP in the United States, making it a preferred choice for XRP traders.

Here’s a quick comparison of supported cryptocurrencies:

| Feature | Kraken | Uphold |

|---|---|---|

| Total cryptocurrencies | 200+ | 130+ |

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| XRP in the US | ✗ | ✓ |

| Altcoins | Extensive selection | Good selection |

| Stablecoins | Multiple options | Multiple options |

Kraken tends to add new, promising cryptocurrencies faster than Uphold. This gives you more opportunities to invest in emerging tokens.

If you’re primarily interested in mainstream cryptocurrencies, both platforms will likely meet your needs. However, if you’re looking for more obscure altcoins or specifically need to trade XRP in the US, this could influence your choice between the two exchanges.

Uphold Vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Uphold and Kraken, fees are a crucial factor to consider before choosing a platform for your crypto needs.

Uphold’s Fee Structure:

- Trading Fee: 0.65% flat fee for all transactions

- Deposit Fee: No charge for bank deposits

- Withdrawal Fee: None

Uphold keeps things simple with its straightforward pricing model. You’ll pay the same percentage regardless of how much you trade, which can be helpful for beginners who don’t want to track complicated fee tiers.

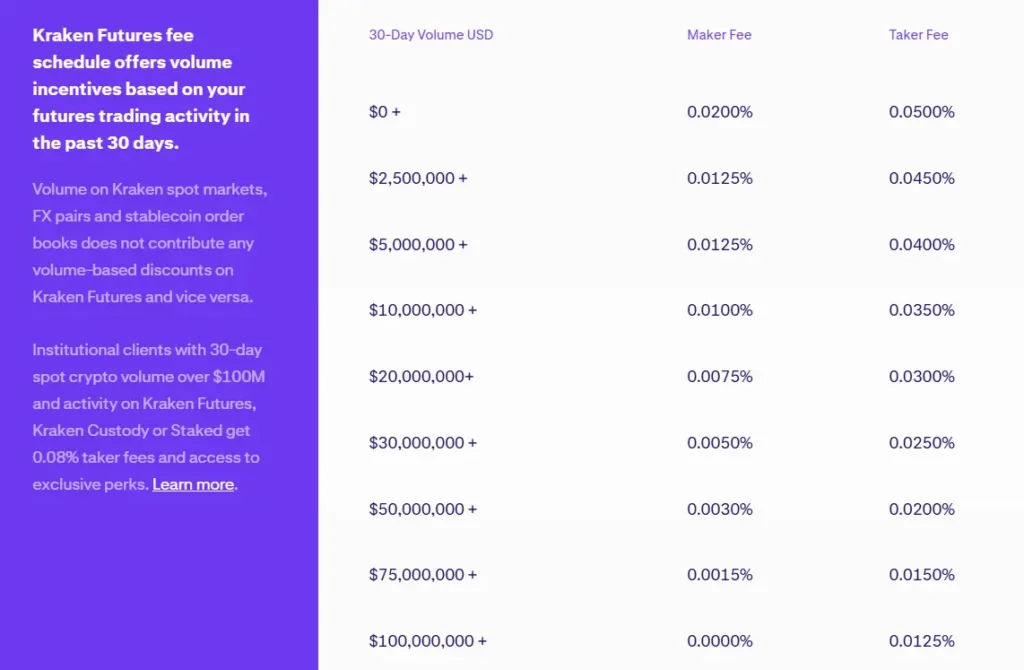

Kraken’s Fee Structure:

- Trading Fee: Tiered system based on your 30-day trading volume

- Maker Fees: Start at 0.16% for regular users

- Taker Fees: Start at 0.26% for regular users

- Fees decrease as your trading volume increases

Kraken’s tiered approach rewards active traders. If you trade in large volumes, you’ll benefit from progressively lower fees.

For deposits, Kraken may charge small fees depending on your payment method. Wire transfers typically incur fees, while ACH transfers might be free.

Withdrawal fees on Kraken vary by cryptocurrency. Each coin has its specific withdrawal fee based on network costs.

If you’re an occasional trader, Uphold’s flat-rate system might be easier to understand. However, if you plan to trade frequently or in large amounts, Kraken’s volume-based discounts could save you money in the long run.

Uphold Vs Kraken: Order Types

When trading cryptocurrencies, the types of orders you can place significantly impact your trading strategy. Kraken offers a more comprehensive range of order types for serious traders.

Kraken provides standard market orders, limit orders, and stop-loss orders. It also offers more advanced options like stop-limit orders, take-profit orders, and conditional close orders. These advanced features give you more control over your trading positions.

Uphold, in contrast, has a simpler approach to trading. It primarily offers market orders for direct asset exchanges. This straightforward system makes Uphold easier to use for beginners.

If you’re an active trader who needs precise control over entry and exit points, Kraken’s diverse order types will likely better suit your needs. The platform caters to both beginners and experienced traders who want to implement more sophisticated trading strategies.

Uphold’s simplified order system works well if you prefer direct exchanges without complex conditions. Its interface focuses on making trading accessible rather than providing numerous order options.

Keep in mind that your trading style should determine which platform’s order types will work best for you. Frequent traders may benefit from Kraken’s versatility, while occasional traders might prefer Uphold’s simplicity.

Uphold Vs Kraken: KYC Requirements & KYC Limits

Both Uphold and Kraken require users to complete Know Your Customer (KYC) verification to comply with financial regulations. These procedures help prevent fraud and illegal activities.

Uphold KYC Requirements:

- KYC verification is mandatory during registration

- Users must provide personal information, government ID, and sometimes a selfie

- The process is integrated into the initial account setup

Kraken KYC Requirements:

- Offers tiered verification levels

- Basic accounts require name, date of birth, and address

- Higher tiers require government ID and proof of residence

- More documentation needed for higher trading limits

Verification Timeframes:

| Exchange | Basic Verification | Full Verification |

|---|---|---|

| Uphold | 1-2 days | 2-5 days |

| Kraken | 1-3 days | 4-7 days |

Kraken’s tiered approach gives you flexibility based on your trading needs. You can start with basic verification and upgrade when needed.

Uphold’s all-at-once approach gets you fully verified faster, but you must complete the entire process before trading.

For US customers specifically looking to trade XRP, Uphold’s KYC process might be worth completing since it’s one of the few platforms still supporting XRP trading in the United States.

Both platforms follow strict Anti-Money Laundering (AML) regulations, but verification times can vary depending on submission quality and verification queue length.

Uphold Vs Kraken: Deposits & Withdrawal Options

When choosing between Uphold and Kraken, understanding their deposit and withdrawal options is crucial for your crypto experience.

Payment Methods

Uphold offers more flexibility with payment options. You can fund your account through bank transfers, credit/debit cards, and other cryptocurrencies.

Kraken primarily supports bank transfers and cryptocurrency deposits, making it slightly more limited for beginners who prefer card payments.

Withdrawal Fees

The fee structure between these platforms shows significant differences:

| Platform | Withdrawal Fees |

|---|---|

| Uphold | Up to 1.75% |

| Kraken | Up to $60 |

Kraken’s fixed fee structure can be expensive for smaller withdrawals but more economical for larger ones.

Deposit Fees

Uphold charges no bank deposit fees, which is a plus for users who prefer traditional banking methods.

Kraken may charge fees depending on your deposit method, though they offer free deposits for certain cryptocurrencies.

Processing Time

Both platforms process cryptocurrency transactions quickly, but bank transfers may take 1-5 business days depending on your location and banking institution.

For U.S. users specifically interested in XRP, Uphold remains the better option between the two due to availability following SEC regulatory concerns.

Before making your final decision, consider which assets you plan to trade and how you’ll typically fund your account, as these factors might influence which platform better suits your needs.

Uphold Vs Kraken: Trading & Platform Experience Comparison

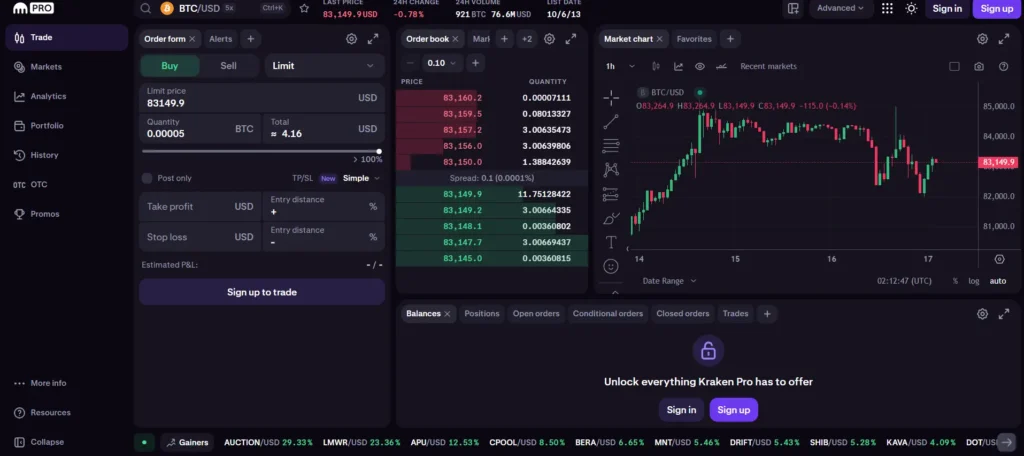

Kraken provides a more advanced trading experience with detailed charts and multiple order types. You’ll find features like margin trading and futures contracts that appeal to experienced traders.

Uphold offers a simpler interface focused on ease of use. You can trade directly between different asset classes—cryptocurrencies, stocks, precious metals, and fiat currencies—without converting to USD first.

Trading Fees Comparison:

| Platform | Maker Fee | Taker Fee | Special Features |

|---|---|---|---|

| Kraken | 0.16% | 0.26% | Volume discounts |

| Uphold | Varies | Varies | No deposit fees |

Kraken’s platform includes both basic and advanced (Kraken Pro) interfaces. The Pro version gives you access to more detailed market data and advanced charting tools.

Uphold’s unique “anything-to-anything” trading model lets you move between assets in a single step. This makes portfolio diversification simpler for beginners.

For US-based XRP traders, Uphold is the better choice since Kraken suspended XRP trading after SEC litigation.

Kraken offers more technical tools and indicators for market analysis. You’ll appreciate these features if you’re interested in technical trading strategies.

Both platforms provide mobile apps, but users generally find Kraken’s app more robust for active trading. Uphold’s app focuses on simplicity and quick transactions.

Uphold Vs Kraken: Liquidation Mechanism

When trading on margin, it’s important to understand how exchanges handle liquidations. Both Uphold and Kraken have different approaches to this process.

Kraken uses a tiered liquidation system that gives traders more flexibility. If your position approaches the liquidation price, Kraken first issues warnings through email and platform notifications.

You’ll have time to add more funds or reduce your position size before full liquidation occurs. Kraken’s system typically liquidates positions gradually rather than all at once.

Uphold takes a more straightforward approach to liquidations. Their system has fewer warning mechanisms in place and may liquidate positions more quickly when they fall below maintenance margin requirements.

Margin Call Comparison:

| Feature | Kraken | Uphold |

|---|---|---|

| Warning System | Multiple notifications | Limited warnings |

| Liquidation Speed | Gradual | Faster |

| Partial Liquidation | Available | Limited options |

| Margin Call Threshold | Customizable | Fixed |

Kraken offers more advanced liquidation controls for experienced traders. You can set custom stop-loss orders to prevent full liquidation and maintain more control over your positions.

Remember that both exchanges will liquidate your positions if they fall below required margin levels. The main difference is in how much warning you receive and how much control you maintain during the process.

For new traders, Kraken’s more gradual approach may provide a better learning experience with less risk of sudden complete liquidations.

Uphold Vs Kraken: Insurance

When choosing a crypto exchange, insurance is a critical factor to consider for your asset protection. Both Uphold and Kraken offer some form of insurance, but with notable differences.

Kraken provides insurance through its custody solution, where digital assets are kept in cold storage. They maintain crime insurance that covers digital assets held in their custody against theft and other cybercrime incidents.

For assets on the main Kraken exchange platform, they employ security measures rather than direct insurance. Most funds (95%+) are kept in cold storage that’s air-gapped from the internet.

Uphold, on the other hand, offers a different approach. They provide insurance for digital assets through a partnership with Marsh and other insurance providers. This coverage specifically protects against certain forms of theft and security breaches.

Uphold also maintains a reserve that often exceeds 100% of all customer assets. This provides an additional layer of protection for your funds beyond insurance.

Insurance Comparison:

| Feature | Kraken | Uphold |

|---|---|---|

| Insurance Type | Crime insurance for custody solution | Digital asset insurance through partnerships |

| Cold Storage | 95%+ of funds | Yes, with multiple layers of security |

| Additional Protection | Security measures | Reserve fund exceeding 100% of customer assets |

Neither platform insures against market fluctuations or losses from trading decisions you make. Remember that FDIC insurance (for bank accounts) does not typically apply to cryptocurrency holdings on these platforms.

Uphold Vs Kraken: Customer Support

When choosing between crypto exchanges, customer support can make a big difference in your experience. Both Uphold and Kraken offer support options, but they differ in quality and accessibility.

Kraken provides 24/7 customer support through live chat and email. They’re known for having knowledgeable staff who can handle technical questions about trading and account issues.

Uphold offers support through tickets and email, with response times typically ranging from a few hours to a day. Some users report longer wait times during busy periods.

According to search results, reviewers feel that Uphold has better ongoing product support. This suggests that while Kraken might have more immediate availability, Uphold may provide more satisfactory resolution to problems.

Both platforms offer help centers with FAQs and guides to solve common issues. These resources can help you find answers without contacting support directly.

Response times can vary based on your issue’s complexity and current demand. Technical problems usually take longer to resolve than simple account questions.

For U.S. users specifically dealing with XRP, Uphold’s support may be more helpful since they continue to support XRP trading, while Kraken suspended it due to SEC litigation.

Neither platform offers phone support, which some users find limiting when dealing with urgent account issues.

Uphold Vs Kraken: Security Features

When choosing between Uphold and Kraken, security should be a top priority for your crypto investments. Both exchanges implement strong security measures, but there are notable differences.

Kraken offers robust security features including two-factor authentication (2FA), global settings lock, and email verification for withdrawals. They also maintain most user funds in cold storage, which provides better protection against online threats.

Uphold similarly provides 2FA but adds biometric authentication options on mobile devices. They also use cold storage for the majority of assets and offer email confirmations for transactions.

Both platforms employ encryption for data protection. Kraken has earned a strong reputation for security with no major breaches in its operating history.

Regulatory compliance is another security aspect to consider. Kraken follows strict regulations across multiple jurisdictions and conducts regular security audits. Uphold also maintains regulatory compliance but operates in fewer regions.

Account recovery options differ between the platforms. Kraken has a more formal process that often requires significant verification, while Uphold offers slightly more accessible account recovery methods.

Key security features comparison:

| Feature | Kraken | Uphold |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Biometric authentication | Limited | Extensive |

| Cold storage | Most funds | Most funds |

| Security history | No major breaches | Good track record |

| Account recovery | Strict process | More accessible |

Is Uphold Safe & Legal To Use?

Uphold is generally considered a safe platform for trading cryptocurrency. According to recent information, it maintains registration with the Financial Conduct Authority (FCA) in the UK, which provides a layer of regulatory oversight.

The platform employs strong security measures including encryption protocols to protect your data and transactions. One standout security feature is Uphold’s real-time proof of reserves, allowing you to verify that your assets are actually there.

As for legality, Uphold operates as a legitimate exchange in multiple countries. In the United States, it remains one of the few platforms where you can still trade XRP after the SEC litigation that affected many other exchanges.

When comparing safety features between Uphold and Kraken, both prioritize security, but they implement different approaches:

| Security Feature | Uphold | Kraken |

|---|---|---|

| Regulatory Compliance | FCA registered | Multiple global registrations |

| Fund Verification | Real-time proof of reserves | Regular proof-of-reserve audits |

| Account Protection | Encryption protocols | Two-factor authentication, global settings lock |

While no platform is 100% risk-free, Uphold takes significant measures to protect your funds and personal information. Their transparency about reserves is particularly reassuring for users concerned about exchange solvency.

Before choosing Uphold, verify it operates legally in your specific location, as cryptocurrency regulations vary widely by country and change frequently.

Is Kraken Safe & Legal To Use?

Kraken is considered one of the more secure cryptocurrency exchanges available today. It uses robust security measures like two-factor authentication and cold storage for most digital assets.

In terms of legality, Kraken operates as a fully registered business in the United States and other countries. It holds licenses in multiple jurisdictions and complies with relevant regulations.

The exchange follows strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. You’ll need to verify your identity before trading on the platform, which adds an extra layer of security.

Kraken has built a strong reputation since its founding in 2011. Its longevity in the volatile crypto market speaks to its stability as a business.

Key Security Features:

- Cold storage for 95% of assets

- 24/7 surveillance

- Encrypted personal information

- Global Settings Lock for account changes

While no exchange is completely immune to risks, Kraken has maintained a relatively clean security record compared to many competitors. It has experienced fewer major hacks or breaches than other exchanges.

For U.S. residents, Kraken is legal to use in most states, though some services may be restricted based on your location. Always check the current regulations in your area before signing up.

Frequently Asked Questions

Choosing between Uphold and Kraken depends on your specific needs as a crypto trader or investor. These platforms differ in several key areas that might impact your decision.

What are the main differences in fees between Uphold and Kraken?

Uphold uses a simpler fee structure, charging a flat fee of 0.65% per transaction regardless of your trading volume. This predictable pricing can be helpful for occasional traders.

Kraken employs a tiered fee structure based on your trading volume. As you trade more, your fees decrease, which can benefit active traders.

Uphold also charges a spread fee of approximately 1-2% on transactions, which may be higher for less popular cryptocurrencies. This is in contrast to Kraken’s more transparent fee schedule.

How does the user experience compare between Kraken and Uphold platforms?

Uphold is designed with beginners in mind, offering a straightforward interface that’s easy to navigate. It includes a native Dollar Cost Averaging (DCA) tool that simplifies regular investing.

Kraken provides a more advanced trading platform with detailed charts, order books, and advanced trading options. This can be overwhelming for newcomers but valuable for experienced traders.

Uphold allows quick deposits via bank cards, making it convenient for new users to start trading quickly. Kraken offers more deposit methods but may have a steeper learning curve.

In terms of security, how do Uphold and Kraken differ?

Both exchanges prioritize security, but their approaches differ. Kraken has built a strong reputation for security with no major hacks in its operating history.

Kraken stores most user funds in cold storage, away from internet-connected systems. They also offer additional security features like two-factor authentication and email confirmations.

Uphold also implements security measures but hasn’t been operating as long as Kraken. They offer similar basic security features but may not have the same track record of security excellence.

What are the customer support options available on Uphold versus Kraken?

Uphold provides customer support through email tickets and a knowledge base with articles addressing common issues. Response times can vary depending on current demand.

Kraken offers more comprehensive support options, including live chat, phone support for account security issues, and an extensive help center. They typically receive higher ratings for customer service.

Both platforms have active community forums where users can find answers to common questions, though Kraken’s community tends to be larger and more established.

How do the available cryptocurrencies on Kraken compare with those on Uphold?

Kraken supports a wide range of cryptocurrencies, including major coins and many altcoins. Their selection caters to traders looking for both established and emerging digital assets.

Uphold offers fewer cryptocurrencies overall but includes popular options that most casual investors seek. Their focus is on providing access to the most widely-used coins.

Both platforms regularly add new cryptocurrencies, but Kraken typically has a more extensive selection that appeals to diverse trading interests.

What are the advantages of using Kraken over other exchanges like Uphold and Coinbase?

Kraken offers lower trading fees for high-volume traders compared to both Uphold and Coinbase. This can result in significant savings for active traders.

The platform provides more advanced trading features including margin trading, futures, and staking options that aren’t available on Uphold.

Kraken’s security record is excellent, with no major security breaches throughout its operating history. This reliability has helped establish its reputation as a trusted exchange in the cryptocurrency community.

Kraken Vs Uphold Conclusion: Why Not Use Both?

When choosing between Kraken and Uphold, you don’t necessarily need to pick just one. Each platform offers unique benefits that might suit different parts of your crypto journey.

Kraken stands out with its advanced trading features and tiered fee structure. If you’re looking to actively trade cryptocurrencies, Kraken’s platform may give you more tools and potentially lower fees as your trading volume increases.

Uphold, on the other hand, offers a simpler buying process with a flat 0.65% fee on all transactions. For beginners or those who just want to purchase and hold crypto with minimal fuss, Uphold’s straightforward approach is appealing.

Key differences at a glance:

| Feature | Kraken | Uphold |

|---|---|---|

| Fee Structure | Tiered based on volume | Flat 0.65% |

| User Experience | More complex, trader-focused | Simpler, beginner-friendly |

| Best For | Active trading | Easy purchasing |

You might consider using Uphold for simple purchases and holdings while utilizing Kraken when you’re ready to engage in more active trading.

Many crypto enthusiasts maintain accounts on multiple exchanges to take advantage of different features, promotions, and coin offerings.

The best strategy might be to start with the platform that matches your current needs, then expand to the other as your crypto experience and requirements grow.