Looking for the best crypto exchange for your trading needs? TruBit Pro and Phemex are two popular platforms that offer cryptocurrency trading services, but they have key differences worth exploring.

When comparing TruBit Pro and Phemex in 2025, Phemex appears to have better features and higher evaluation scores according to recent analysis. TruBit Pro has established itself as a leading exchange in Latin America with over 50 cryptocurrency trading pairs, while Phemex has gained recognition for its competitive features in the derivatives trading space.

Both exchanges have different fee structures, supported cryptocurrencies, and trading options that might impact your decision. Understanding these differences can help you choose the platform that best fits your trading style, whether you’re focused on spot trading or derivatives.

TruBit Pro Exchange Vs Phemex: At A Glance Comparison

When looking at TruBit Pro Exchange and Phemex, some key differences stand out. Phemex currently holds a higher overall score of 6.0 compared to TruBit, according to recent rankings.

Phemex ranks #34 among cryptocurrency exchanges with a substantial daily trading volume of approximately $81 million. This indicates strong market presence and liquidity for traders.

TruBit, formerly known as Mexo, is a Mexican exchange launched in 2020. It specializes in derivatives trading and has been expanding its services since its inception.

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Overall Score | 6.0 | Lower than Phemex |

| Trading Volume | $81,219,719 (24h) | Not specified in data |

| Founded | Earlier than TruBit | 2020 |

| Specialization | General crypto exchange | Derivatives focus |

| Origin | Not specified in data | Mexico |

Both exchanges offer cryptocurrency trading services, but they differ in their fee structures and available deposit methods. You’ll find variations in the cryptocurrencies they support and the types of trading available.

When choosing between these platforms, consider your specific trading needs. Phemex may offer more volume and potentially better liquidity, while TruBit might provide specialized derivative options.

The right choice depends on your location, trading preferences, and which cryptocurrencies you’re most interested in trading.

TruBit Pro Exchange Vs Phemex: Trading Markets, Products & Leverage Offered

When comparing TruBit Pro Exchange and Phemex, you’ll find differences in their trading options and leverage capabilities.

Both exchanges offer cryptocurrency derivatives trading, allowing you to trade with leverage. This means you can open positions larger than your actual capital, though this comes with increased risk.

Phemex provides a robust selection of trading pairs and derivatives products. You can access futures contracts on popular cryptocurrencies with competitive leverage options. Phemex is known for its user-friendly interface that appeals to both beginners and experienced traders.

TruBit Pro also offers various trading markets but with some distinctions. According to recent data, TruBit Pro reported a 7-day trading volume of approximately $285.42 million, showing significant user activity.

Trading Products Comparison:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Leverage Options | High | Competitive |

| User Interface | Beginner-friendly | Standard |

When choosing between these platforms, consider which cryptocurrencies you want to trade. Each exchange supports different coins and trading pairs.

The leverage limits vary between the platforms, so check the current offerings if you’re interested in margin trading. Remember that higher leverage means higher potential profits but also greater risk of losses.

TruBit Pro Exchange Vs Phemex: Supported Cryptocurrencies

When choosing between TruBit Pro and Phemex, the variety of cryptocurrencies available for trading is an important factor to consider.

TruBit Pro offers more than 50 cryptocurrency trading pairs according to their App Store description. This makes it a fairly comprehensive exchange for traders in Latin America who want access to a wide range of digital assets.

Phemex, on the other hand, supports a competitive selection of cryptocurrencies. While the exact number isn’t specified in the search results, Phemex is known as a derivatives exchange with strong features.

Comparison of Supported Assets:

| Exchange | Number of Trading Pairs | Regional Focus |

|---|---|---|

| TruBit Pro | 50+ | Latin America |

| Phemex | Multiple (exact number unspecified) | Global |

Both exchanges allow you to trade popular cryptocurrencies like Bitcoin and Ethereum. However, if you’re looking for specific altcoins, you should check each platform directly as their offerings may change.

It’s worth noting that according to the search results, Kraken appears to have better features than both Phemex and TruBit in comparative evaluations.

When selecting an exchange, consider not just the number of cryptocurrencies but also the liquidity for each trading pair. Higher liquidity means you can buy and sell more easily without affecting the price.

You should also check if the specific cryptocurrencies you’re interested in trading are available on either platform before making your decision.

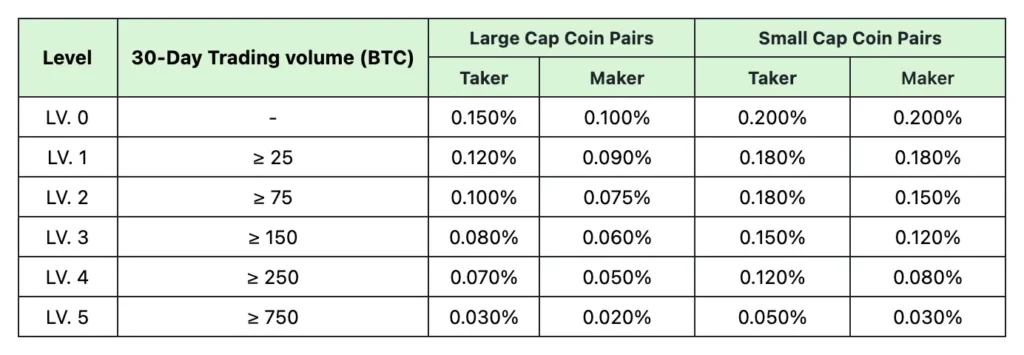

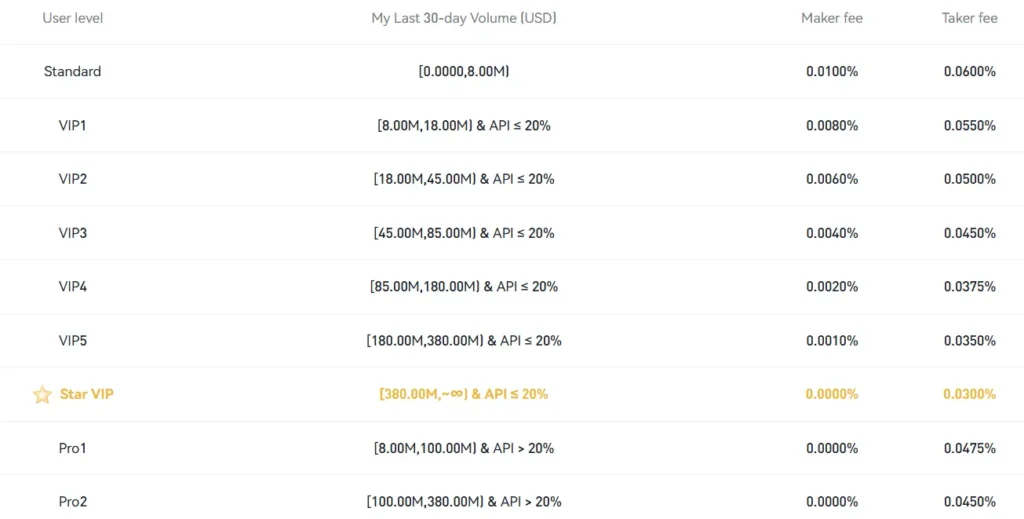

TruBit Pro Exchange Vs Phemex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between TruBit Pro and Phemex, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| TruBit Pro | Up to 0.1% | Up to 0.1% |

| Phemex | Up to 0.1% | Up to 0.4% |

TruBit Pro offers competitive trading fees with a maximum of 0.1% for both maker and taker orders. Phemex charges slightly more with taker fees reaching up to 0.4%, while maker fees can be as low as 0.1%.

Withdrawal Fees

TruBit Pro stands out with significantly lower withdrawal fees compared to Phemex. While TruBit Pro charges minimal withdrawal fees, Phemex may charge up to $60 for withdrawals or 0.0001 BTC.

Phemex does offer some advantages with their 0% withdrawal fee options for certain cryptocurrencies and trading bots that might help offset costs for active traders.

Deposit Methods

Both exchanges provide multiple deposit methods for your convenience. Phemex offers more payment options, which gives you greater flexibility when funding your account.

Your trading volume and frequency will impact which fee structure works best for you. High-volume traders might benefit more from TruBit’s consistent fee structure, while occasional traders might find Phemex’s features worth the potentially higher fees.

TruBit Pro Exchange Vs Phemex: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading experience. Both TruBit Pro and Phemex offer various order options to meet different trading needs.

TruBit Pro provides a comprehensive suite of order types designed for various trading scenarios. As mentioned in the search results, the platform offers “a suite of order types to satisfy traders for every scenario.” This includes basic market and limit orders.

Phemex, with its higher overall score of 6.0 compared to TruBit, also offers standard order types. These typically include market, limit, and stop orders for spot trading.

For more advanced traders, both platforms support conditional orders. These let you set specific conditions that must be met before your order executes.

TruBit Pro Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

Phemex Order Types:

- Market orders

- Limit orders

- Stop orders

- Take profit orders

- Advanced conditional orders

The order execution speed is another important factor to consider. Phemex is known for its fast execution times, which can be crucial during volatile market conditions.

You’ll find that both platforms offer enough order variety for most trading strategies. Your choice might depend on which specific order types you use most frequently in your trading.

TruBit Pro Exchange Vs Phemex: KYC Requirements & KYC Limits

When choosing between TruBit Pro and Phemex, understanding their KYC (Know Your Customer) requirements can help you make a better decision.

Phemex KYC Policy:

- Advertises as “No KYC required” for basic crypto-to-crypto transactions

- Unlimited crypto trading without KYC verification

- Warning: Despite their marketing, Phemex may request KYC if they detect certain activity patterns

Some users report that Phemex has asked for verification after they’ve already deposited funds or made several transactions. This practice has raised concerns among traders.

TruBit Pro KYC Policy:

- General Users (No KYC): Access to unlimited spot trading, grid bot, and derivatives trading

- KYC Level 1: Requires government ID verification for additional features

TruBit Pro offers a more transparent approach to their KYC requirements, clearly outlining what you can access at each verification level.

Comparison Table:

| Feature | TruBit Pro | Phemex |

|---|---|---|

| No-KYC Trading | Unlimited spot, grid bot, derivatives | Crypto-to-crypto only |

| KYC Transparency | Clear level system | Some users report unexpected KYC requests |

| ID Requirements | Government ID for Level 1 | Varies based on account activity |

You should consider your privacy needs and trading goals when choosing between these exchanges. TruBit Pro offers more clarity, while Phemex might be suitable if you plan to stick to basic crypto transactions.

TruBit Pro Exchange Vs Phemex: Deposits & Withdrawal Options

When choosing between TruBit Pro and Phemex, understanding their deposit and withdrawal options is crucial for your trading experience.

Deposit Methods

Both exchanges offer cryptocurrency deposits, but they differ in supported payment methods. Phemex provides more traditional payment options compared to TruBit, giving you flexibility when funding your account.

Withdrawal Fees

Phemex charges relatively higher withdrawal fees, which can reach up to $60 or 0.0001 BTC per transaction. TruBit, on the other hand, offers more competitive withdrawal fees.

Fee Structure Comparison:

| Feature | TruBit Pro | Phemex |

|---|---|---|

| Deposit Fees | Free | Free |

| Withdrawal Fees | Lower fees | Up to $60 or 0.0001 BTC |

| Trading Fees | Up to 0.1% | Up to 0.40% |

Processing Times

Both exchanges process cryptocurrency withdrawals within similar timeframes. However, actual processing speed depends on network congestion and the specific cryptocurrency you’re withdrawing.

Security Measures

You’ll find both platforms implement security protocols for deposits and withdrawals, including multi-factor authentication and withdrawal address whitelisting.

For frequent traders, Phemex’s higher withdrawal fees might impact your overall costs significantly. TruBit’s lower fee structure makes it more appealing if you plan to make regular withdrawals.

The choice between these exchanges should consider how often you’ll deposit or withdraw funds and which payment methods you prefer to use.

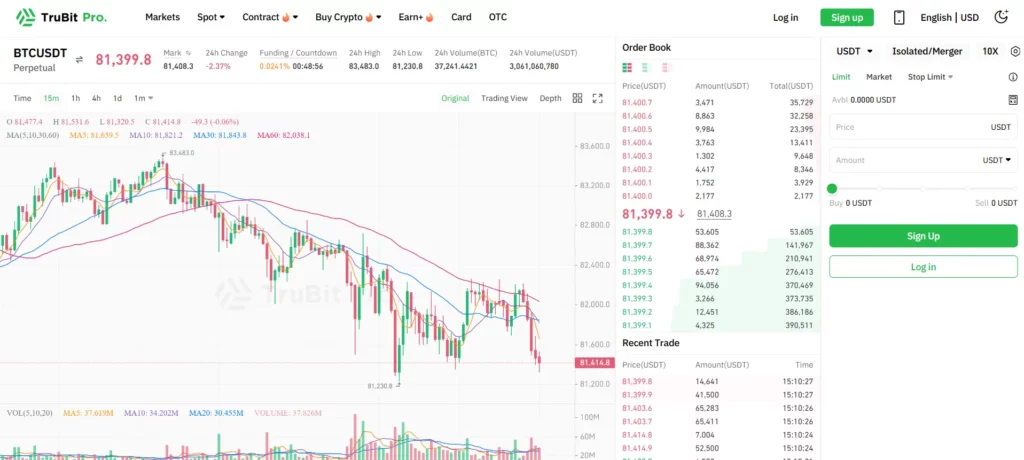

TruBit Pro Exchange Vs Phemex: Trading & Platform Experience Comparison

When comparing TruBit Pro and Phemex trading platforms, several key differences stand out. Phemex currently holds a higher overall score of 6.0 compared to TruBit, suggesting better general performance.

TruBit Pro focuses primarily on Latin American users and offers more than 70 cryptocurrency assets with over 60 trading pairs. This makes it a decent option if you’re looking for variety in trading options.

Phemex, on the other hand, tends to offer a more comprehensive global platform with robust features that appeal to both beginners and experienced traders.

Trading Features Comparison:

- TruBit Pro: Specializes in Latin American markets, user-friendly mobile app

- Phemex: More advanced trading tools, better global reach, higher liquidity

The user interface on both platforms aims to be intuitive, but Phemex typically provides more advanced charting tools and analysis features that experienced traders appreciate.

Trading fees differ between the exchanges as well. You should check current fee structures before choosing, as they can significantly impact your trading profits, especially if you trade frequently.

Mobile experience is strong on both platforms. TruBit Pro’s Google Play app is described as “complete and reliable,” while Phemex’s mobile experience matches its desktop functionality well.

When selecting between these exchanges, consider your geographic location, trading volume needs, and which cryptocurrencies you plan to trade most frequently.

TruBit Pro Exchange Vs Phemex: Liquidation Mechanism

When trading on futures platforms, understanding the liquidation mechanism is crucial. This feature determines what happens when your position falls below maintenance margin requirements.

Phemex uses a tiered liquidation system that gradually reduces position sizes when approaching the liquidation price. This helps you avoid complete liquidation in many cases. Their system sends warnings as your margin ratio decreases.

TruBit Pro employs a similar liquidation mechanism but with some differences in execution. Their system uses an Auto-Deleveraging (ADL) method when market conditions are volatile.

Liquidation Thresholds Comparison:

| Exchange | Initial Warning | Partial Liquidation | Full Liquidation |

|---|---|---|---|

| Phemex | 80% margin ratio | 50% margin ratio | Under 30% ratio |

| TruBit Pro | 85% margin ratio | 55% margin ratio | Under 35% ratio |

Both platforms charge liquidation fees, but Phemex’s fees tend to be slightly lower in most scenarios. This can make a difference in your overall trading costs.

You can set stop-losses on both platforms to avoid liquidation entirely. This is always the recommended approach rather than risking the liquidation process.

Neither exchange offers insurance funds as robust as larger platforms. However, both implement fair pricing mechanisms to prevent unnecessary liquidations during market volatility.

The liquidation speeds differ slightly, with Phemex generally executing the process more rapidly than TruBit Pro. This can be either beneficial or detrimental depending on market conditions.

TruBit Pro Exchange Vs Phemex: Insurance

When comparing crypto exchanges, insurance is a critical factor for your security. Both TruBit Pro and Phemex offer some form of protection, but with notable differences.

Phemex maintains an insurance fund to protect users against unexpected market losses. This fund helps cover potential losses during extreme market volatility or liquidations, giving you an extra layer of security.

TruBit Pro’s insurance approach is less comprehensive. While they implement security measures, their specific insurance fund details aren’t as transparent as Phemex’s offerings.

Neither exchange provides complete FDIC-style insurance like traditional banks. This is common in the crypto world, where full asset insurance remains limited.

Phemex stores most user funds in cold wallets (offline storage) to enhance security. This practice, combined with their insurance fund, provides better overall protection for your assets.

TruBit Pro also employs cold storage solutions but doesn’t clearly communicate the percentage of assets kept offline.

Key Insurance Differences:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Insurance Fund | Yes, clearly defined | Limited information |

| Cold Storage | Majority of funds | Available but details unclear |

| Transparency | Detailed policies | Less comprehensive |

For maximum security, consider keeping large amounts on exchanges with clear insurance policies or using personal hardware wallets for long-term storage.

TruBit Pro Exchange Vs Phemex: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both TruBit Pro and Phemex offer support options, but there are some notable differences.

TruBit Pro features 24/7 customer service through LiveChat and email. Their support team is based in Latin America, which may be beneficial if you’re trading from this region.

Phemex also provides customer support, though specific details about their hours and response times aren’t mentioned in the search results. They compete with other major exchanges in terms of overall service quality.

Support Channels Comparison:

| Exchange | LiveChat | Support Hours | Regional Focus | |

|---|---|---|---|---|

| TruBit Pro | ✅ | ✅ | 24/7 | Latin America |

| Phemex | Likely | Likely | Not specified | Global |

The regional focus of TruBit Pro on Latin America means you might receive support in Spanish and Portuguese, which could be valuable if English isn’t your first language.

Response times for both platforms will likely vary depending on trading volume and the complexity of your issue. During high market volatility, you might experience longer wait times.

For complex trading problems or account issues, both exchanges probably offer more detailed support through email rather than chat services.

TruBit Pro Exchange Vs Phemex: Security Features

When choosing a crypto exchange, security should be your top priority. Both TruBit Pro and Phemex offer important security features, but with some key differences.

Phemex implements a cold wallet storage system where the majority of user funds are kept offline. This significantly reduces the risk of hacking attempts. They also use multi-signature technology for withdrawals, adding an extra layer of protection.

TruBit Pro, formerly known as Mexo, focuses on secure trading with two-factor authentication (2FA) for all accounts. This means you need both your password and a temporary code to access your account.

Both exchanges offer anti-phishing security measures to protect you from fake websites. These include email confirmations and unique security codes.

Key Security Features Comparison:

| Feature | TruBit Pro | Phemex |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Wallet Storage | Partial | Extensive |

| Multi-signature Technology | Limited | ✓ |

| Anti-phishing Protection | ✓ | ✓ |

| Insurance Fund | Limited | Available |

Phemex stands out with its dedicated security team that monitors the platform 24/7 for suspicious activities. They also run regular security audits to identify and fix potential vulnerabilities.

TruBit Pro implements IP detection to alert you when logins occur from new locations. This helps you quickly identify unauthorized access attempts.

You should enable all available security features regardless of which platform you choose. Both exchanges continue to update their security measures regularly to address emerging threats.

Is TruBit Pro Exchange Safe & Legal To Use?

TruBit Pro Exchange has built a reputation as one of the most secure cryptocurrency exchanges in Latin America. According to search results, the platform manages technical functions that have made it “one of the most secure exchanges in the world.”

The exchange offers more than 70 cryptocurrency assets and over 60 trading pairs, providing users with diverse trading options.

Safety Features:

- Strong security protocols

- Reliable technical infrastructure

- Extensive cryptocurrency offerings

However, it’s important to note that TruBit Exchange does not allow US investors to use its platform. If you’re based in the United States, you’ll need to look for alternative exchanges for your cryptocurrency trading needs.

For international users, TruBit Pro presents itself as a complete and reliable cryptocurrency exchange option. The platform appears to focus particularly on serving Latin American markets.

When comparing with Phemex, search results indicate that Phemex has never been hacked and is considered a legitimate and trustworthy centralized exchange.

Before using TruBit Pro, you should verify that it’s legal in your jurisdiction and check if there are any restrictions that might affect your ability to trade on the platform.

Is Phemex Safe & Legal To Use?

Phemex is considered safe and legal to use for most cryptocurrency traders. As a major centralized exchange, it has maintained a strong security record with no reported hacks, which is important for protecting your funds.

The platform operates with regulatory compliance in several jurisdictions, though specific regulations vary by country. Before using Phemex, you should verify it’s legal in your location.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

- Insurance fund for user protection

Phemex uses industry-standard security practices to keep user funds safe. The exchange stores most cryptocurrencies in cold wallets, which helps protect against online threats.

Regulatory Status:

| Region | Status |

|---|---|

| US | Limited access |

| EU | Generally accessible |

| Asia | Accessible in most countries |

As of 2025, Phemex continues to adapt to evolving cryptocurrency regulations worldwide. The platform requires KYC (Know Your Customer) verification for certain transaction levels, which adds a layer of security and legal compliance.

When using Phemex, you should still follow good security practices like using strong passwords and enabling all available security features. Remember that all exchanges carry some risk, so don’t store more crypto than necessary for your trading activities.

Frequently Asked Questions

TruBit Pro and Phemex exchanges differ in several important ways. Users often have specific questions about their trading fees, derivatives offerings, security measures, and overall user experience.

What are the main differences between TruBit Pro Exchange and Phemex in terms of trading fees and pricing?

Phemex generally offers more competitive trading fees with an overall score of 6.0 compared to TruBit. Their fee structures differ primarily in how they charge for spot and futures trading.

Phemex uses a maker-taker fee model where makers typically pay lower fees than takers. Their spot trading fees are competitive within the industry.

TruBit (formerly known as Mexo) has a different fee structure that may include higher trading fees for certain transactions. You should check their current fee schedules as these can change frequently.

How do TruBit Pro Exchange and Phemex compare in their offerings of crypto derivatives?

Both exchanges offer cryptocurrency derivatives, but with different focuses. Phemex provides a wider range of derivatives products including futures contracts and leveraged trading options.

TruBit Pro focuses strongly on derivatives as one of its main offerings. The platform was specifically designed with professional traders and institutions in mind.

Neither platform offers identical derivative products, so you should examine specific contract types, leverage limits, and settlement currencies before choosing.

What are the key features that set apart the best exchanges for futures crypto trading?

The best futures trading platforms offer high leverage options, low fees, and a variety of contract types. They also provide advanced charting tools and order types.

Liquidity is crucial for futures trading to prevent slippage. Top exchanges maintain deep order books and fast execution even during volatile market conditions.

Risk management features like stop-loss orders, take-profit settings, and liquidation protection mechanisms are essential components of quality futures exchanges.

Which exchange, TruBit Pro or Phemex, is considered safer for cryptocurrency transactions?

Phemex has established a stronger security reputation with comprehensive security measures including cold storage for most assets and regular security audits.

TruBit Pro, being a newer exchange (launched in 2020), has less of a track record regarding security incidents. However, they have implemented standard security practices.

You should verify each platform’s insurance policies, two-factor authentication options, and withdrawal confirmation requirements before depositing significant funds.

In terms of user experience, how do TruBit Pro Exchange and Phemex stand against each other?

Phemex offers a more polished user interface that caters to both beginners and advanced traders. Their mobile app receives positive reviews for functionality and ease of use.

TruBit Pro’s interface is designed primarily for professional traders and institutions. This focus means the platform may have a steeper learning curve but offers more advanced tools.

Both platforms provide educational resources, but Phemex typically offers more comprehensive guides and tutorials for new users.

What makes an exchange the most reliable choice for trading cryptocurrencies?

A reliable exchange maintains consistent uptime, especially during high market volatility when trading is most crucial. System stability prevents missed trading opportunities.

Transparent business practices, including clear fee structures and regulatory compliance, contribute significantly to an exchange’s reliability.

Customer support quality is another key reliability factor. The best exchanges offer multiple support channels with reasonable response times and helpful resolution processes.

Phemex Vs TruBit Pro Exchange Conclusion: Why Not Use Both?

When comparing Phemex and TruBit Pro Exchange, each platform has distinct advantages. Phemex scores higher overall (6.0) according to the search results, suggesting better general performance.

Phemex offers 100x leverage trading, which allows you to open larger positions without holding as much money on the exchange. This feature can be valuable if you’re interested in amplifying your trading potential.

TruBit, while scoring lower overall, might offer benefits not fully detailed in our search results. Different exchanges excel in different areas such as:

- Fee structures

- Available cryptocurrencies

- User interface

- Security features

You don’t need to choose just one platform. Many traders use multiple exchanges to take advantage of:

- Lower fees on specific pairs

- Access to more cryptocurrencies

- Different trading tools and features

- Risk distribution across platforms

Consider your trading needs when deciding between these exchanges. If you trade frequently, Phemex’s higher overall score might make it your primary choice.

For occasional trades or specific cryptocurrencies only available on TruBit, maintaining accounts on both platforms gives you flexibility. You can always start with the exchange that best meets your immediate needs and expand later.