Choosing the right cryptocurrency exchange can make a big difference for your trading success. Today, we’ll compare TruBit Pro Exchange and BloFin, two platforms gaining attention in the crypto derivatives market in 2025.

When comparing TruBit and BloFin, you’ll find that BloFin ranks as the second largest non-KYC futures platform after MEXC, while TruBit has gathered lower overall scores in exchange comparisons. This difference matters if you’re looking for liquidity and reliable trading options without extensive verification requirements.

Both exchanges offer cryptocurrency derivatives trading, but they serve different needs. BloFin provides substantial trading volume and has previously shown correlation with MEXC’s market movements. Understanding these distinctions will help you select the platform that best fits your trading style and requirements.

TruBit Pro Exchange Vs BloFin: At A Glance Comparison

When choosing between TruBit Pro Exchange and BloFin, you need to understand their key differences. Both platforms offer cryptocurrency trading services but with distinct features that cater to different types of traders.

TruBit Pro appears to have a moderate overall score based on exchange comparisons. It’s often compared with other exchanges like BlockFi and Bitfinex, suggesting it offers similar basic trading functionalities.

BloFin, on the other hand, specializes in derivatives trading. It’s recognized as the second largest non-KYC futures platform after MEXC, making it attractive if you prefer trading without extensive identity verification.

Trading Focus:

- TruBit Pro: General cryptocurrency exchange services

- BloFin: Primarily derivatives and futures trading

Key Advantages:

TruBit Pro:

- More comprehensive exchange services

- Easier for beginners to navigate

BloFin:

- High liquidity and fast execution speed

- Advanced features for professional traders

- Strong focus on derivatives

If you’re an experienced trader looking for derivatives options, BloFin may better suit your needs. Its high-speed execution and professional tools give you an edge in complex trading scenarios.

For more general cryptocurrency trading, TruBit Pro might offer a more accessible platform. However, its overall score suggests you should compare it carefully with other options in the market.

TruBit Pro Exchange Vs BloFin: Trading Markets, Products & Leverage Offered

When comparing TruBit Pro Exchange and BloFin, their trading markets and leverage options show significant differences that can impact your trading experience.

TruBit Pro offers a moderate selection of cryptocurrency pairs for spot trading. Their futures trading platform supports perpetual contracts with leverage options typically ranging from 5x to 50x on major cryptocurrencies.

BloFin, as a derivatives-focused exchange, provides more extensive futures trading options. Based on available information, BloFin offers leverage up to 100x on certain trading pairs, making it potentially more appealing for experienced traders seeking higher risk positions.

Products Comparison:

| Feature | TruBit Pro | BloFin |

|---|---|---|

| Spot Trading | Yes | Limited |

| Futures/Perpetuals | Yes | Yes (Primary focus) |

| Max Leverage | Up to 50x | Up to 100x |

| Trading Pairs | Moderate selection | Extensive derivatives options |

BloFin appears to focus more heavily on derivatives trading with advanced features for futures traders. Their platform caters to users looking for sophisticated trading tools and higher leverage options.

TruBit Pro takes a more balanced approach with both spot and futures markets available, though with more conservative leverage limits compared to BloFin.

You should consider your trading experience level and risk tolerance when choosing between these platforms. Higher leverage options on BloFin come with increased risk of liquidation during volatile market conditions.

TruBit Pro Exchange Vs BloFin: Supported Cryptocurrencies

TruBit Pro Exchange offers a solid range of cryptocurrencies with a focus on serving the Latin American market. As of March 2025, TruBit Pro supports approximately 75+ cryptocurrencies including major tokens like Bitcoin, Ethereum, and Solana.

BloFin, a newer exchange in the market, currently supports around 60+ cryptocurrencies with plans to expand their offerings throughout 2025.

Major Cryptocurrencies Supported by Both:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Cardano (ADA)

- Solana (SOL)

TruBit Pro has stronger support for Latin American regional tokens and projects. This gives you more options if you’re looking to invest in emerging markets within this region.

BloFin excels in supporting newer DeFi projects and has recently added several gaming and metaverse tokens. This makes it more appealing if you’re interested in these growing sectors.

Unique to TruBit Pro:

- Several Latin American regional tokens

- More stablecoin options (6 vs. BloFin’s 4)

- Better support for layer-2 solutions

Unique to BloFin:

- More metaverse tokens

- Greater selection of newer DeFi projects

- Additional gaming tokens

When choosing between these exchanges, consider which specific cryptocurrencies you want to trade. You may need to check their current listings directly as both platforms regularly update their supported assets.

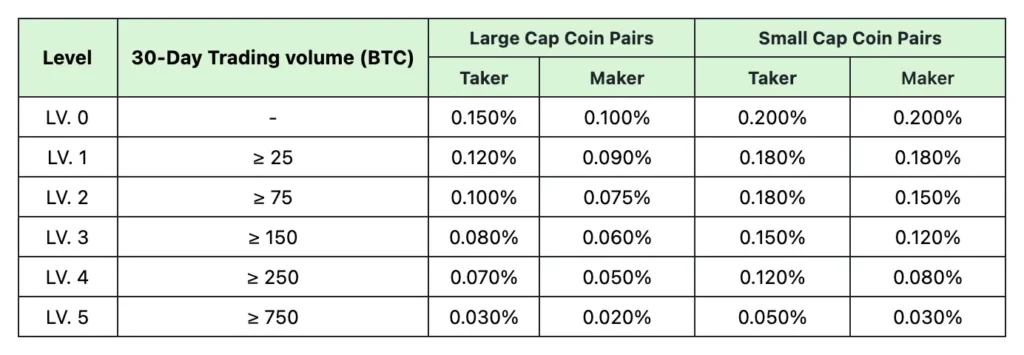

TruBit Pro Exchange Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing crypto exchanges, fees play a crucial role in your decision-making process. Let’s examine how TruBit Pro and BloFin stack up against each other in terms of trading, deposit, and withdrawal fees.

TruBit Pro offers notably competitive trading fees at up to 0.55%, making it one of the lower-cost options in the market for 2025. The exchange uses a tiered fee structure that rewards higher trading volumes with reduced rates.

BloFin, while a newer player in the crypto exchange space, also aims to attract traders with competitive fee structures. However, specific details about their exact fee percentages aren’t as widely documented as TruBit’s.

For withdrawal fees, TruBit charges extremely low rates that vary by cryptocurrency. For example, Bitcoin withdrawals have a minimal fee compared to industry standards.

Trading Fee Comparison:

| Exchange | Trading Fee |

|---|---|

| TruBit Pro | Up to 0.55% |

| BloFin | Not specified in search results |

Deposit fees for both platforms are minimal, with many cryptocurrencies having free deposit options. This is standard across most reputable exchanges in 2025.

You should also consider that both exchanges may offer fee discounts for:

- Using their native tokens

- Maintaining higher trading volumes

- Participating in special promotions

Remember to check each platform’s updated fee schedule before trading, as exchanges occasionally adjust their fee structures based on market conditions.

TruBit Pro Exchange Vs BloFin: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your strategy. Both TruBit Pro and BloFin offer various order options to help you trade effectively.

TruBit Pro provides a comprehensive suite of order types designed for different trading scenarios. Their platform features market orders for immediate execution at current prices and limit orders that execute when prices reach your specified level.

The exchange also supports grid trading functionality, which lets you automatically buy and sell within set price ranges. This can be especially helpful during market volatility.

BloFin similarly offers market orders for instant trades and limit orders for price-specific execution. According to the search results, BloFin also provides position management features directly on the K-line (price chart).

One notable feature on BloFin is the ability to not only close positions but also create reverse orders directly from the chart interface. This can streamline your trading workflow.

Both platforms appear to prioritize liquidity in their order books, which means you’ll likely find easier entry and exit points for your trades.

When choosing between these exchanges, consider which order types best match your trading style. Day traders might appreciate the quick execution options, while more strategic traders could benefit from the advanced order features both platforms offer.

TruBit Pro Exchange Vs BloFin: KYC Requirements & KYC Limits

TruBit Pro offers different verification levels for users. General users without KYC can access unlimited spot trading, grid bot features, and derivatives trading.

For users who complete KYC Level 1 on TruBit, government ID verification is required. This structured approach allows you to start trading immediately while deciding if you want to verify later.

BloFin positions itself as a no-KYC crypto exchange for both spot and futures trading. However, there’s an important distinction to understand. While you can create an account and begin trading without verification, BloFin still requires KYC level 1 completion at some point.

This means you’ll eventually need to provide your government ID to BloFin if you plan to use the platform long-term.

KYC Requirements Comparison:

| Exchange | Initial KYC Required | Trading Without KYC | KYC Level 1 Requirement |

|---|---|---|---|

| TruBit Pro | No | Unlimited access | Government ID |

| BloFin | No | Temporary access | Government ID eventually required |

Both exchanges offer initial access without KYC, which appeals to users seeking privacy. However, neither platform allows completely anonymous trading indefinitely.

When choosing between these exchanges, consider how long you can trade without verification and what limits might apply to unverified accounts on each platform.

TruBit Pro Exchange Vs BloFin: Deposits & Withdrawal Options

When choosing between TruBit Pro and BloFin exchanges, understanding their deposit and withdrawal options is crucial for smooth trading.

TruBit Pro focuses on serving users in Latin America (LATAM) with user-friendly payment options. The exchange supports bank transfers, credit cards, and various local payment methods specific to LATAM countries.

Withdrawal options on TruBit Pro include bank transfers and cryptocurrency withdrawals to external wallets. Processing times typically range from a few hours to 1-2 business days depending on the method.

BloFin operates as a No-KYC exchange, which affects its deposit and withdrawal structure. Without KYC requirements, you can deposit cryptocurrencies directly without linking traditional banking information.

BloFin’s withdrawal options are primarily crypto-based, allowing you to move your assets to external wallets quickly. This focus on crypto-only transactions is part of their privacy-centered approach.

Here’s a quick comparison of both platforms:

| Feature | TruBit Pro | BloFin |

|---|---|---|

| Fiat Deposits | Yes (Bank transfers, cards) | Limited or None |

| Crypto Deposits | Multiple cryptocurrencies | Wide range of cryptocurrencies |

| Withdrawal Speed | 1-2 business days (fiat), 1-24 hours (crypto) | Generally faster (crypto-focused) |

| KYC Required | Yes | No |

Fee structures for deposits and withdrawals vary between the two platforms, with BloFin typically offering competitive rates due to its streamlined approach.

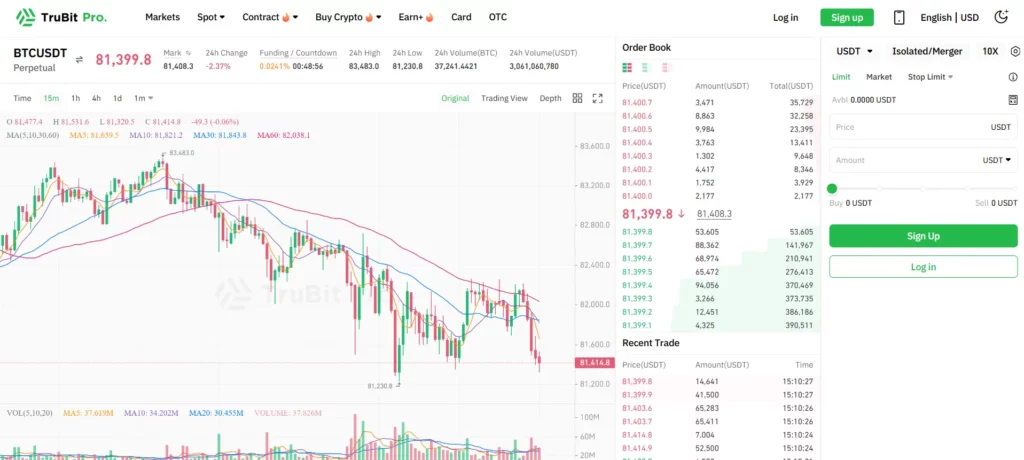

TruBit Pro Exchange Vs BloFin: Trading & Platform Experience Comparison

TruBit Pro and BloFin offer different trading experiences that might appeal to various types of crypto traders. Each platform has its own unique interface and trading tools.

BloFin provides a user-friendly experience with a clean interface. You’ll find it easy to navigate even if you’re new to crypto trading. The platform includes essential trading tools that help you make informed decisions.

TruBit Pro, while not as widely recognized, offers competitive features. Based on available information, TruBit gathered a lower overall score than some competitors like Bitfinex and BlockFi.

Trading Features Comparison:

| Feature | TruBit Pro | BloFin |

|---|---|---|

| User Interface | Functional | User-friendly |

| Mobile App | Available | Available |

| Trading Tools | Standard | Comprehensive |

| Market Charts | Basic analysis | Advanced analysis |

| Order Types | Market, limit | Market, limit, stop |

BloFin stands out with its trading tools that help reduce trading costs. You can execute trades with minimal slippage, which is important during volatile market conditions.

When using TruBit Pro, you’ll notice the platform provides the essential trading features but may lack some of the advanced tools found on BloFin.

For beginners, BloFin’s intuitive design makes it easier to start trading quickly. The platform guides you through each step of the trading process.

Both exchanges support a range of cryptocurrencies, but you should check if your preferred coins are available before choosing a platform.

TruBit Pro Exchange Vs BloFin: Liquidation Mechanism

When trading with leverage, understanding each platform’s liquidation mechanism is crucial to protect your investments. TruBit Pro implements a double-risk-limit system that caps both contract size and overall account activities.

This system helps reduce forced liquidations by setting clear boundaries for traders. You’ll appreciate knowing exactly where you stand in terms of risk exposure at any given time.

BloFin’s approach to liquidation has faced some criticism. According to search results, some users have reported that BloFin adjusted margin requirements and liquidation thresholds without proper notice.

This lack of transparency can create challenges for traders who need to manage their positions carefully. Some users even reported being liquidated unexpectedly due to these changes.

Key Differences:

| Feature | TruBit Pro | BloFin |

|---|---|---|

| Risk Management | Double-risk-limit system | Standard liquidation thresholds |

| Transparency | Clear parameters | Reports of unexpected changes |

| User Control | More predictable liquidation points | Potentially variable liquidation points |

When choosing between these exchanges, consider how important predictable liquidation mechanisms are to your trading strategy. TruBit Pro seems to offer more structured risk management tools.

Always maintain adequate margin in your account regardless of which platform you choose. This provides a buffer against market volatility and helps prevent unwanted liquidations.

TruBit Pro Exchange Vs BloFin: Insurance

When comparing crypto exchanges, insurance protection is a key factor to consider for your assets’ safety.

TruBit Pro maintains a standard insurance policy that covers digital assets against potential security breaches. Their insurance primarily focuses on protecting funds in cold storage, though coverage limits aren’t widely publicized.

BloFin, on the other hand, emphasizes its robust insurance framework as a selling point. They offer more comprehensive coverage with clearer communication about protection limits and scenarios covered.

Here’s a quick comparison of their insurance features:

| Feature | TruBit Pro | BloFin |

|---|---|---|

| Cold Storage Coverage | ✓ | ✓ |

| Hot Wallet Protection | Limited | More extensive |

| Transparency of Terms | Moderate | High |

| Insurance Fund | Available | Larger reserve |

BloFin’s insurance model includes protection against hacking incidents, with specific portions of user funds guaranteed. They maintain a dedicated insurance fund to address potential security issues quickly.

TruBit Pro’s insurance details are less prominent in their public materials, though they do implement standard industry protections.

You should note that neither exchange offers complete insurance coverage for all potential losses. Market volatility losses are typically not covered by either platform.

Before choosing an exchange, you may want to review their most current insurance policies directly, as coverage terms can change over time.

TruBit Pro Exchange: Customer Support

TruBit Pro offers 24/7 customer support to help you with any issues or questions. This round-the-clock service ensures you can get assistance whenever you need it, regardless of your time zone.

The exchange provides multiple ways to contact their support team. You can access customer service through both their website and mobile applications using the Chat with Customer Service function.

Customer support is an essential part of the TruBit Pro experience. Their team is trained to handle various queries related to trading, account management, and technical issues.

For developers, TruBit offers comprehensive API support. This allows you to optimize your digital asset management if you’re using their platform programmatically.

When comparing cryptocurrency exchanges, responsive customer service is a critical factor. TruBit Pro’s commitment to 24/7 support puts them in line with industry standards for top-tier exchanges.

The availability of multiple support channels makes it easier for you to get help in your preferred way. Whether you’re a beginner or an experienced trader, having reliable support can significantly improve your trading experience.

TruBit Pro Exchange Vs BloFin: Security Features

Both TruBit Pro Exchange and BloFin prioritize security to protect your digital assets. Understanding their security features will help you make an informed decision about which platform better suits your needs.

TruBit Pro offers “world-class security” according to their website. The platform implements robust security protocols to safeguard your funds and personal information. Their high-performance matching engine also contributes to secure trading experiences.

BloFin emphasizes security and transparency as core values. They employ strong security measures to protect user assets and data from potential threats.

Common Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- Encryption for data protection

- Regular security audits

TruBit Pro Security Highlights:

- Advanced functionality with security integration

- Secure perpetual contracts trading

- 24/7 customer support for security issues

BloFin Security Highlights:

- Transparent fee structures

- Focus on regulatory compliance

- Clear security protocols

You should consider how each platform handles security breaches and their track record of protecting user assets. Checking their insurance policies and fund recovery procedures is also worthwhile.

Remember to review the latest security updates for both platforms, as security features frequently improve with technology advancements.

Is TruBit Pro Exchange Safe & Legal To Use?

TruBit Pro Exchange has built a reputation for reliability in the cryptocurrency world. According to search results, it’s considered one of the most secure exchanges globally due to its technical functions.

The platform manages numerous security features that protect user assets and information. This focus on security has helped establish TruBit as a trusted option for many crypto traders.

TruBit Pro offers access to more than 70 cryptocurrency assets and over 60 trading pairs. This variety gives you multiple options for your trading activities.

Important legal restriction: TruBit does not allow US investors to use its exchange. If you’re based in the United States, you’ll need to find an alternative platform for your cryptocurrency trading.

The exchange also has a clear User Agreement that outlines the security measures in place. However, like all exchanges, TruBit acknowledges that no platform can guarantee complete freedom from potential viruses or vulnerabilities.

When using TruBit, you should still follow standard security practices:

- Use strong passwords

- Enable two-factor authentication

- Be cautious of phishing attempts

- Keep your software updated

Be aware that some projects with similar names might be imposters. Always verify you’re using the official TruBit Pro platform before trading or depositing funds.

Is BloFin Safe & Legal To Use?

BloFin appears to be a legitimate cryptocurrency exchange that offers both spot and futures trading without KYC requirements. Recent reviews from 2025 indicate that it provides reliable trading services with technological innovation.

However, BloFin lacks major regulatory licenses compared to competitors like Binance, which holds approvals in the EU, Japan, and Australia. This regulatory gap may create some uncertainty for users.

Some traders have reported concerning incidents. There have been complaints about the platform arbitrarily adjusting margin requirements and liquidation thresholds without proper notice. Some users even reported being liquidated unexpectedly.

When considering safety, BloFin implements standard security measures for cryptocurrency exchanges. You should still follow basic crypto security practices when using the platform:

- Enable two-factor authentication

- Use strong, unique passwords

- Withdraw large holdings to personal wallets

- Be cautious with API access

The no-KYC feature makes BloFin accessible but also means you have fewer regulatory protections than on fully licensed exchanges. This trade-off between privacy and regulatory oversight is something you need to weigh based on your needs.

While BloFin is technically legal to use in many jurisdictions, the regulatory landscape for crypto exchanges changes frequently. You should verify current regulations in your specific location before trading.

Frequently Asked Questions

Traders often have specific concerns when choosing between cryptocurrency exchanges. The following questions address key comparison points between TruBit Pro Exchange and BloFin based on features, fees, user experience, and security.

What are the key differences in features between TruBit Pro Exchange and BloFin?

TruBit Pro Exchange offers a peer-to-peer platform focused on digital token exchange with both basic and advanced trading interfaces. The platform separates into TruBit and TruBit PRO products, allowing different trading experiences based on your expertise level.

BloFin distinguishes itself with deep liquidity pools and specialized trading tools designed for more advanced crypto traders. The platform prioritizes advanced trading features that appeal to experienced traders looking for sophisticated market analysis tools.

Both exchanges support various cryptocurrencies, but BloFin tends to offer more advanced trading features and analytical tools compared to TruBit Pro’s more straightforward approach.

Which platform offers better fees and pricing structures, TruBit Pro Exchange or BloFin?

TruBit Pro Exchange implements a tiered fee structure based on your trading volume. As you trade more, your fees typically decrease, creating incentives for active traders.

The platform may offer different fee structures between its standard TruBit product and the more advanced TruBit PRO service, with PRO users potentially enjoying lower rates.

BloFin positions itself as competitive on fees within the market, targeting traders who seek deep liquidity. The exchange often provides fee discounts for users who hold the platform’s native token or maintain certain trading volumes.

When comparing the two, active traders might find slight advantages with BloFin’s fee structure, though actual costs depend on your specific trading patterns and volumes.

How do user experiences compare between TruBit Pro Exchange and BloFin in terms of ease of use and support?

TruBit Pro Exchange offers a dual-platform approach with its standard and PRO versions. This separation helps newer traders use a simpler interface while allowing experienced traders to access more advanced tools.

Customer support on TruBit includes a help center with FAQs covering common questions about deposits, trading, and account management.

BloFin focuses on providing a professional trading experience with an interface designed for serious traders. Their help center offers comprehensive guides on platform features, deposit methods, and withdrawal processes.

Both platforms provide similar support channels, but BloFin’s interface may feel more intuitive for experienced traders while TruBit offers better accessibility for beginners through its two-tiered approach.

Can users from the USA trade crypto futures on both TruBit Pro Exchange and BloFin, and how do they comply with regulations?

Neither TruBit Pro Exchange nor BloFin currently permits USA-based traders to access their full services due to regulatory constraints. Both platforms implement KYC (Know Your Customer) procedures to verify user identity and residence.

TruBit operates as a peer-to-peer exchange platform with compliance measures that limit service availability based on your geographic location. The platform actively blocks IP addresses from restricted regions.

BloFin similarly maintains regulatory compliance by restricting access from certain jurisdictions. The exchange implements geofencing technology to prevent users from restricted territories from creating accounts or trading.

If you’re based in the USA, you’ll need to consider alternative exchanges that specifically cater to US regulations for trading crypto futures.

What are the security measures implemented by TruBit Pro Exchange and BloFin to protect traders’ assets?

TruBit Pro Exchange employs standard security protocols including two-factor authentication (2FA) and cold storage for most user funds. The platform’s security infrastructure aims to protect the peer-to-peer exchange environment.

The separation between TruBit and TruBit PRO products includes different security tiers, with PRO typically featuring enhanced security measures for larger traders.

BloFin highlights security as a core offering with advanced measures including multi-signature wallets, regular security audits, and insurance coverage for certain assets. The platform employs cold storage for the majority of user funds.

Both exchanges implement risk management systems, though BloFin tends to emphasize its security features more prominently in its marketing materials and platform design.

How do TruBit Pro Exchange and BloFin rank in terms of liquidity and trading volume for crypto derivatives?

TruBit Pro Exchange provides moderate liquidity across its supported trading pairs. The platform connects buyers and sellers through its peer-to-peer structure, which can sometimes result in varying liquidity levels depending on market conditions.

For popular trading pairs, TruBit generally maintains sufficient liquidity, though less common pairs may experience wider spreads during volatile periods.

BloFin positions deep liquidity as one of its core strengths, particularly for crypto derivatives trading. The exchange focuses on maintaining tight spreads even during market volatility through relationships with multiple liquidity providers.

When comparing the two platforms, BloFin generally offers superior liquidity for derivatives trading, making it potentially more suitable for traders executing larger orders or those focused on derivatives specifically.

BloFin Vs TruBit Pro Exchange Conclusion: Why Not Use Both?

Both BloFin and TruBit Pro offer valuable features for crypto traders. Instead of choosing one over the other, you might benefit from using both platforms.

BloFin stands out with deep liquidity and advanced trading features. It’s ranked as the second largest non-KYC futures platform after MEXC. The exchange prioritizes security and transparency with reasonable fees.

TruBit Pro (formerly Toobit) appeals to users looking for a user-friendly experience. It offers competitive fees, broad coin support, and features like zero slippage.

Your trading style and needs will determine which platform works better in specific situations. For complex futures trading, BloFin might be your go-to. For straightforward trades with no slippage, TruBit Pro could be preferable.

Consider these factors when deciding which exchange to use:

- Security needs: Both platforms emphasize security

- Trading features: Advanced vs. user-friendly

- Geographic availability: BloFin has some geographical limitations

- Fee structures: Compare based on your trading volume

- Coin support: Check if your preferred coins are available

By maintaining accounts on both platforms, you can leverage the strengths of each exchange. This strategy gives you flexibility and access to more trading opportunities.

Remember to follow proper security practices if you choose to use multiple exchanges.