Cryptocurrency traders often compare PrimeXBT and BitMEX when looking for trading platforms with leverage options. These two exchanges have gained popularity among day traders and swing traders who want to maximize their potential returns.

PrimeXBT currently has a higher overall score of 6.0 compared to BitMEX, making it a preferred choice for many traders in 2025. While both platforms are legitimate, they differ in several key aspects that might influence your decision.

One notable difference is the leverage offering. Both platforms provide up to 100x leverage, but BitMEX limits this maximum leverage to Bitcoin trading pairs only. PrimeXBT, on the other hand, offers 100x leverage across all of its supported cryptocurrency pairs, giving you more flexibility in your trading strategies.

PrimeXBT Vs BitMEX: At A Glance Comparison

When choosing between PrimeXBT and BitMEX for crypto trading, several key differences stand out. Based on recent comparisons as of 2025, PrimeXBT holds a higher overall score of 6.0 compared to BitMEX.

Trading Fees:

- PrimeXBT: 0.05% trading fee

- BitMEX: 0.075% trading fee

PrimeXBT offers a slightly more competitive fee structure, which can make a difference if you trade frequently.

Platform Stability & Performance:

| Feature | PrimeXBT | BitMEX |

|---|---|---|

| UI Experience | More modern interface | Traditional layout |

| Stability | Better performance during high volatility | May experience lag during critical moments |

| Security | Strong security features | Strong security features |

PrimeXBT appears to handle high-traffic trading periods with less lag, which is crucial when executing time-sensitive trades.

Both platforms specialize in crypto derivatives trading, but PrimeXBT offers a wider variety of markets beyond just cryptocurrencies.

You’ll find that PrimeXBT’s user interface is generally considered more intuitive for beginners, while BitMEX might appeal to traders who prefer a more traditional trading platform layout.

For new traders, PrimeXBT’s platform stability and cleaner interface might be more welcoming. Experienced traders might appreciate either platform depending on their specific trading strategies.

The choice between these platforms ultimately depends on your trading style, fee sensitivity, and which user experience you find more comfortable.

PrimeXBT Vs BitMEX: Trading Markets, Products & Leverage Offered

PrimeXBT and BitMEX offer different trading markets and products that cater to various trader needs. Both platforms provide crypto trading with high leverage options, but they differ in what they offer beyond Bitcoin.

BitMEX focuses primarily on cryptocurrency derivatives. It’s known for its Bitcoin perpetual contracts and futures. BitMEX attracts traders looking specifically for crypto trading options with up to 100x leverage on Bitcoin.

PrimeXBT provides a wider range of assets beyond just cryptocurrencies. You can trade crypto, forex, commodities, and stock indices all on one platform. PrimeXBT offers 100x leverage across all its crypto assets, not just Bitcoin.

When comparing trading instruments:

| Platform | Cryptocurrencies | Other Markets | Max Leverage |

|---|---|---|---|

| BitMEX | Bitcoin and select altcoins | Limited | 100x (Bitcoin) |

| PrimeXBT | Multiple cryptocurrencies | Forex, CFDs, bonds | 100x (all crypto) |

For those looking to diversify beyond crypto, PrimeXBT’s additional markets like forex and CFDs offer more trading opportunities. You can manage different asset classes from one account.

BitMEX might be more suitable if you focus exclusively on Bitcoin trading and prefer a platform specialized in crypto derivatives.

Your trading style will determine which platform serves you better. Day traders and swing traders use both platforms, but your specific needs regarding market diversity will guide your choice.

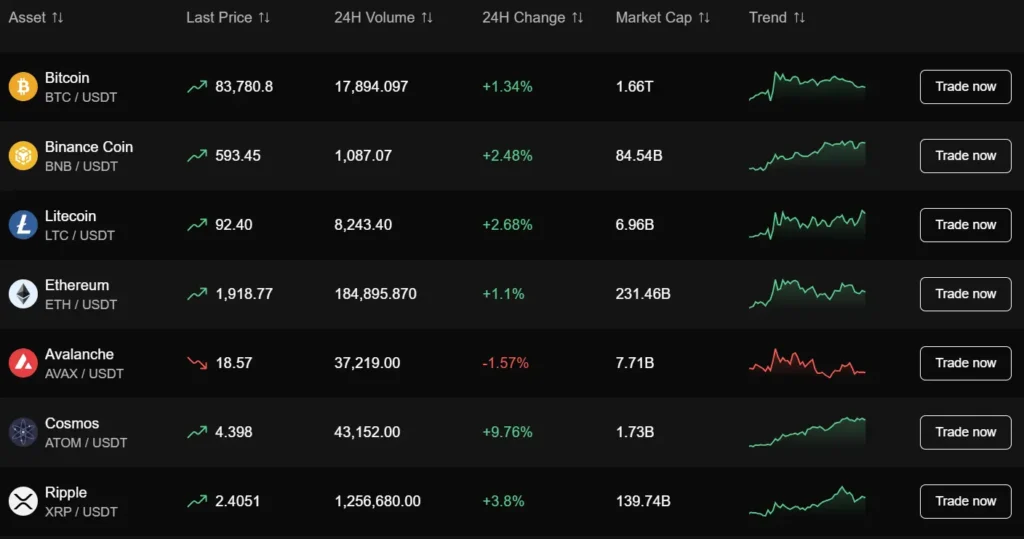

PrimeXBT Vs BitMEX: Supported Cryptocurrencies

When choosing between PrimeXBT and BitMEX, the variety of cryptocurrencies available for trading is an important factor to consider.

BitMEX primarily focuses on Bitcoin trading pairs. While they offer some altcoin futures contracts, their selection is relatively limited compared to other exchanges. Their main offerings include Bitcoin, Ethereum, Litecoin, and a few other major cryptocurrencies.

PrimeXBT supports a broader range of cryptocurrencies. You can trade Bitcoin, Ethereum, Litecoin, Ripple (XRP), and EOS among others. This wider selection gives you more diversification options for your trading portfolio.

Both platforms offer leveraged trading on their supported cryptocurrencies, allowing you to amplify potential returns (and risks).

Here’s a quick comparison:

| Platform | Bitcoin | Ethereum | Litecoin | XRP | EOS | Others |

|---|---|---|---|---|---|---|

| BitMEX | ✓ | ✓ | ✓ | ✗ | ✗ | Limited |

| PrimeXBT | ✓ | ✓ | ✓ | ✓ | ✓ | Several |

If you’re mainly interested in Bitcoin trading, either platform will serve your needs. However, if you want to trade a wider variety of cryptocurrencies, PrimeXBT offers more options.

PrimeXBT also provides access to traditional assets like forex, commodities, and stock indices, which BitMEX doesn’t offer.

Remember to check each platform’s current offerings as available cryptocurrencies may change over time.

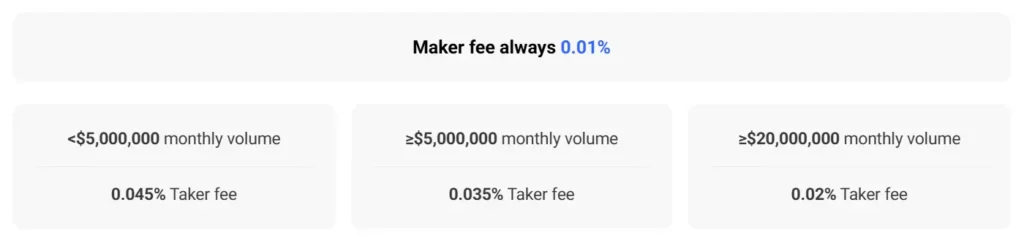

PrimeXBT Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between PrimeXBT and BitMEX, understanding their fee structures is crucial for your trading decisions. Both platforms have different approaches to trading and withdrawal fees.

Trading Fees:

- PrimeXBT: Up to 0.05% for most cryptocurrencies

- BitMEX: Up to 0.05% per trade

PrimeXBT’s trading fees vary slightly depending on the market and asset class. BitMEX offers competitive rates that match PrimeXBT for standard trades.

Withdrawal Fees:

- PrimeXBT: Fixed amount (up to $60)

- BitMEX: Fixed amount

Both platforms use a fixed fee structure for withdrawals rather than percentage-based fees. PrimeXBT’s withdrawal fees can reach up to $60, which might be higher than some competitors.

Deposit Methods:

Both exchanges have different supported deposit methods. This can affect your choice depending on which payment options you prefer to use.

When trading frequently, even small differences in fees can significantly impact your profits over time. You should calculate potential costs based on your expected trading volume.

Fee structures may change over time, so it’s worth checking the official websites for the most current information before making your decision.

PrimeXBT Vs BitMEX: Order Types

When trading on cryptocurrency platforms, order types can make a big difference in your strategy. Both PrimeXBT and BitMEX offer several order options to help you manage trades effectively.

PrimeXBT provides traders with a robust selection of order types. You can use market orders, limit orders, and stop orders for basic trading needs. The platform also supports OCO (One Cancels Other) orders, which let you set up two conditional orders where executing one automatically cancels the other.

BitMEX offers similar basic order types including market, limit, and stop orders. They also provide more specialized options like trailing stops, which automatically adjust your stop price as the market moves in your favor.

Common Order Types on Both Platforms:

- Market orders (execute immediately at current price)

- Limit orders (execute only at specified price or better)

- Stop orders (trigger at a certain price point)

PrimeXBT Special Features:

- OCO (One Cancels Other) orders

- Advanced charting tools integrated with order placement

BitMEX Special Features:

- Trailing stop orders

- Post-only limit orders (ensures you’re always the maker, not taker)

Both platforms allow for reduced fees when you use certain order types. BitMEX gives discounts for post-only orders, while PrimeXBT may offer better rates for limit orders.

Your trading style will determine which platform’s order types serve you better. Day traders might prefer BitMEX’s trailing stops, while swing traders could find value in PrimeXBT’s OCO functionality.

PrimeXBT Vs BitMEX: KYC Requirements & KYC Limits

When choosing between PrimeXBT and BitMEX, their KYC (Know Your Customer) policies represent a significant difference in user experience.

PrimeXBT KYC Policy:

- No mandatory KYC for small accounts

- KYC only required for larger trading volumes

- Optional verification available for users who prefer it

- Focus on user privacy and security

This approach makes PrimeXBT attractive if you value privacy or want to start trading quickly without paperwork.

BitMEX KYC Policy:

- Mandatory KYC verification for all users

- Complete identity verification required before trading

- Stricter compliance with international regulations

- Multi-signature withdrawal security features

BitMEX has tightened its KYC requirements in recent years to meet regulatory standards across different markets.

Withdrawal Limits:

| Platform | Non-Verified Users | Verified Users |

|---|---|---|

| PrimeXBT | Higher limits available | Full access |

| BitMEX | Limited (previously 0.06 BTC) | Full access |

If immediate trading access is important to you, PrimeXBT’s no-KYC-upfront policy might be preferable. However, BitMEX’s mandatory verification creates a more regulated environment.

Both platforms offer strong security measures, though they take different approaches to balancing privacy and regulatory compliance.

Your choice should depend on your comfort with sharing personal information and how quickly you need to begin trading.

PrimeXBT Vs BitMEX: Deposits & Withdrawal Options

Both PrimeXBT and BitMEX offer cryptocurrency-based deposit and withdrawal systems, but they differ in important ways that might affect your trading experience.

PrimeXBT only supports cryptocurrency deposits and withdrawals. You cannot use fiat currencies (like USD or EUR) directly on the platform. This means you’ll need to already own crypto to start trading on PrimeXBT.

BitMEX similarly focuses on cryptocurrency transactions without direct fiat support. Both platforms maintain this crypto-only approach to simplify their operations and regulatory compliance.

When it comes to fees, there are notable differences. PrimeXBT’s withdrawal fees can reach up to $60, which is on the higher end for crypto exchanges. BitMEX uses a fixed fee structure for withdrawals rather than a percentage-based system.

For trading fees, PrimeXBT charges up to 0.40%, while BitMEX’s fees go up to 0.05%. This significant difference could impact your profitability, especially if you engage in frequent trading.

Both platforms process withdrawals relatively quickly, but actual times depend on network congestion. Remember that all crypto transactions must be confirmed on their respective blockchains.

Deposit/Withdrawal Comparison:

| Feature | PrimeXBT | BitMEX |

|---|---|---|

| Supported currencies | Cryptocurrencies only | Cryptocurrencies only |

| Fiat support | None | None |

| Withdrawal fees | Up to $60 | Fixed amount |

| Processing time | Blockchain-dependent | Blockchain-dependent |

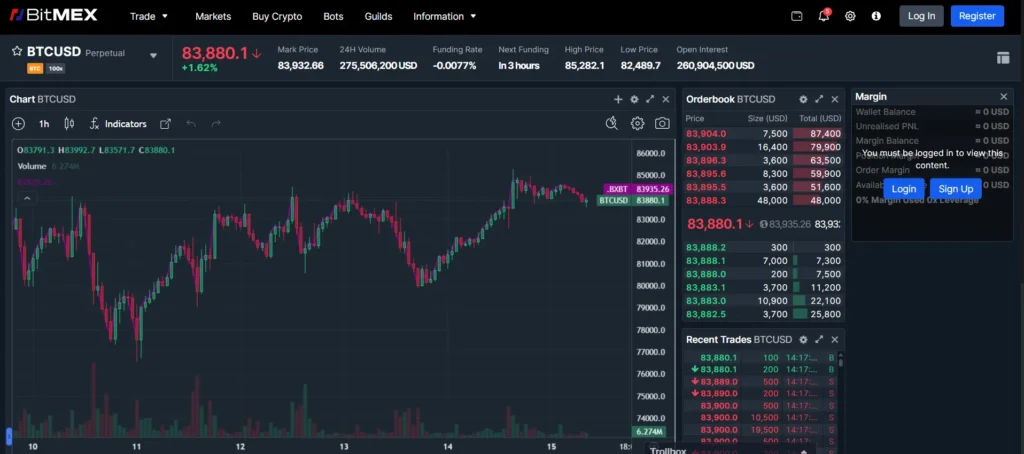

PrimeXBT Vs BitMEX: Trading & Platform Experience Comparison

PrimeXBT offers a customizable interface that many traders find intuitive and user-friendly. You can arrange charts and trading tools to match your personal preferences, making your trading workflow more efficient.

BitMEX provides a more technical trading experience that experienced traders often appreciate. Its platform has been a staple in the crypto trading space for years, though some new users find it less accessible.

User Interface Comparison:

- PrimeXBT: Modern, customizable dashboard with drag-and-drop functionality

- BitMEX: Technical, data-heavy interface focused on advanced traders

When it comes to trading options, both platforms support leveraged trading. PrimeXBT allows you to trade various assets beyond cryptocurrencies, including commodities, indices, and forex pairs. BitMEX focuses primarily on crypto derivatives.

The charting tools on PrimeXBT are robust and include multiple time frames and indicators. You can perform detailed technical analysis without leaving the platform. BitMEX also offers solid charting capabilities but with less customization.

Mobile trading experiences differ between the platforms. PrimeXBT has invested in making their mobile experience comparable to desktop, while BitMEX’s mobile solution provides core functionality but lacks some advanced features.

Execution speed is critical for traders. Both platforms offer reasonable execution times, but during high volatility, you might experience slight differences in performance.

PrimeXBT Vs BitMEX: Liquidation Mechanism

When trading on leverage platforms, understanding liquidation mechanisms is crucial for your risk management. Both PrimeXBT and BitMEX have systems in place to protect themselves when your position faces significant losses.

BitMEX uses an index price-based liquidation system. This means your position will only be liquidated when the actual index price moves beyond your liquidation price, not just because of temporary market spikes. This approach offers some protection against market manipulation.

However, according to search results, some traders have reported instances where BitMEX liquidated profitable positions when one of their two tracking indexes experienced issues. This can happen despite spike protection mechanisms being in place.

PrimeXBT, on the other hand, offers a more straightforward liquidation process that some traders find easier to understand. Both platforms will begin liquidating positions when your margin falls below maintenance requirements.

Key differences to consider:

- BitMEX uses a more complex index-based liquidation

- PrimeXBT’s system may be more user-friendly for beginners

- Both platforms can force-liquidate positions to prevent negative balances

- The actual liquidation price depends on your leverage level and position size

Your choice between these platforms should factor in how comfortable you are with their liquidation methods. Higher leverage means tighter liquidation thresholds on both platforms.

PrimeXBT Vs BitMEX: Insurance

When trading on cryptocurrency platforms, insurance protection is a crucial factor to consider for your funds’ safety.

BitMEX currently does not offer any notable deposit insurance protection for users. This lack of insurance coverage means your funds might be at risk in case of a security breach or platform failure.

PrimeXBT, while competing favorably with BitMEX in other aspects, also has limitations regarding insurance coverage. Neither platform provides comprehensive insurance protection that covers all user deposits.

This insurance gap is important to note when considering where to trade. You should take additional security measures regardless of which platform you choose.

Some steps you can take to protect your investments include:

- Using strong passwords and two-factor authentication

- Withdrawing large amounts to secure wallets when not actively trading

- Keeping a minimal balance on the platforms

- Regularly monitoring your accounts for suspicious activity

The lack of deposit insurance on both platforms reflects a common challenge in the cryptocurrency trading industry, where comprehensive protection remains limited compared to traditional financial institutions.

When making your decision between these platforms, weigh this insurance limitation against other features like trading options, fees, and user experience.

PrimeXBT Vs BitMEX: Customer Support

When trading cryptocurrencies, good customer support can make a big difference. PrimeXBT and BitMEX both offer support for their users, but they take different approaches.

PrimeXBT provides customer support primarily through email. Based on comparison results, PrimeXBT has earned top honors in crypto support comparisons when matched against other platforms including BitMEX.

BitMEX offers customer support as well, but appears to be slower with limited help. One review described their support as “slow but helpful,” indicating you might get the assistance you need, but it could take longer than expected.

Support Quality Comparison:

- PrimeXBT: Rated as “The Best” in support comparisons

- BitMEX: Described as “Slow with Limited Help”

When choosing between these platforms, consider how important quick support responses are to your trading needs. If you’re new to trading or anticipate needing assistance, PrimeXBT’s higher-rated support might be more suitable.

Both platforms offer resources to help you navigate their services, but their responsiveness and overall quality differ significantly. PrimeXBT seems to prioritize customer satisfaction and security, making users feel their funds are safe.

Your trading experience can be significantly improved by a platform with responsive and helpful support, especially during volatile market conditions when immediate assistance might be necessary.

PrimeXBT Vs BitMEX: Security Features

When choosing a crypto trading platform, security should be your top priority. Both PrimeXBT and BitMEX offer strong security measures to protect your assets.

PrimeXBT implements several security features including two-factor authentication (2FA) and encryption technology. The platform stores the majority of user funds in cold storage, keeping them offline and away from potential hackers.

BitMEX also utilizes 2FA and encryption protocols to secure user accounts. Like PrimeXBT, BitMEX employs cold storage solutions for safekeeping user assets, minimizing the risk of online threats.

Both platforms have security systems that monitor for suspicious activities. This helps detect and prevent unauthorized access attempts to your account.

Key Security Features Comparison:

| Feature | PrimeXBT | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Encryption | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Security Monitoring | ✓ | ✓ |

You should always enable all available security features on either platform. This includes setting up 2FA and using strong, unique passwords.

Neither platform has experienced major security breaches in recent years, which speaks to their commitment to security. However, you should still practice caution with the amount you deposit and trade.

Remember that your security habits matter too. Always access these platforms through secure networks and keep your devices free from malware.

Is PrimeXBT Safe & Legal To Use?

PrimeXBT operates as a legitimate cryptocurrency trading platform with robust security measures in place. The platform employs extensive cyber-security implementations to protect customer funds and personal information.

When considering legal status, PrimeXBT is available in many countries, but not all. You should verify if it’s permitted in your region before signing up.

Unlike some competitors, PrimeXBT doesn’t require KYC (Know Your Customer) verification for basic trading. This offers privacy but may raise regulatory concerns in some jurisdictions.

The platform uses cold storage for most user funds, which significantly reduces the risk of hacking. Multi-signature technology adds an extra layer of protection for your assets.

Security Features:

- Cold storage for majority of funds

- Multi-signature wallets

- Two-factor authentication (2FA)

- Dedicated security team

PrimeXBT is registered in the Seychelles, which affects its regulatory status in various countries. This offshore registration provides certain operational freedoms but may limit protection in case of disputes.

Trading on PrimeXBT involves significant risk due to its leverage options of up to 100x. You should be aware that leveraged trading can lead to substantial losses.

Before using the platform, review all relevant legal documentation to understand the terms of service and your rights as a user.

Is BitMEX Safe & Legal To Use?

BitMEX has established itself as a well-known cryptocurrency derivatives exchange. When it comes to safety, BitMEX provides robust security features to protect user funds and information.

However, it’s important to note that BitMEX currently lacks notable regulatory licenses. They also don’t offer deposit insurance for users, which is something to consider when evaluating platform safety.

Most users find BitMEX reliable for trading purposes. As one user mentioned, “BitMEX is fine, it’s an exchange so trust it as far as you need for your trades but don’t accumulate on it more than what you need.”

Security Features:

- Two-factor authentication

- Cold storage for majority of funds

- Email notifications for account activities

The legal status of BitMEX varies by location. The platform has faced regulatory challenges in some countries, particularly the United States.

Regulatory Considerations:

| Region | Status |

|---|---|

| United States | Restricted |

| Most European countries | Accessible |

| Asia | Varies by country |

You should check if BitMEX is legally available in your country before creating an account. Their terms of service outline restricted regions.

For optimal security, consider using strong passwords, enabling all security features, and only keeping trading funds on the platform.

Frequently Asked Questions

Traders often need specific details about exchange platforms before making their choice. These answers address the most common comparisons between PrimeXBT and BitMEX.

What are the key differences in leverage options between PrimeXBT and BitMEX?

PrimeXBT offers higher leverage than BitMEX for most trading pairs. You can access up to 100x leverage on cryptocurrency pairs on PrimeXBT, while BitMEX typically caps at 100x for Bitcoin but lower for other cryptocurrencies.

For traditional assets like forex and commodities, PrimeXBT provides up to 1000x leverage, a feature entirely absent from BitMEX which focuses exclusively on crypto derivatives.

BitMEX uses a more conservative auto-deleveraging system during volatile markets, which sometimes reduces your effective leverage to protect positions.

How do the trading fees on PrimeXBT compare to those on BitMEX?

BitMEX typically charges 0.075% as a taker fee and offers a -0.025% maker rebate for adding liquidity to the order book. PrimeXBT’s fee structure is slightly higher with 0.095% for takers.

Both platforms implement fee discounts based on trading volume, but BitMEX’s VIP program kicks in at lower thresholds, making it more accessible for medium-volume traders.

PrimeXBT charges overnight financing fees for positions held open, which can accumulate for long-term trades. BitMEX uses a funding rate mechanism that can either cost or reward you depending on market conditions.

What variety of assets can be traded on PrimeXBT versus BitMEX?

PrimeXBT offers a diverse range of assets beyond cryptocurrencies, including forex pairs, commodities like gold and oil, and stock indices. This makes it a more comprehensive platform for diversified trading.

BitMEX focuses exclusively on cryptocurrency derivatives, primarily Bitcoin futures and perpetual contracts. While its crypto selection is robust, it doesn’t extend beyond the digital asset space.

You can access about 30+ cryptocurrencies on PrimeXBT compared to BitMEX’s more limited selection of around 15 major cryptocurrencies.

Are there any notable differences in security measures between PrimeXBT and BitMEX?

Both platforms utilize cold storage for the majority of user funds. BitMEX stores 100% of user deposits in cold wallets, while PrimeXBT maintains approximately 95% in cold storage.

BitMEX implements mandatory two-factor authentication (2FA) for all accounts, whereas PrimeXBT makes it optional but strongly recommended. This gives BitMEX a slight edge in baseline security protocols.

PrimeXBT offers IP address whitelisting as an additional security feature not prominently available on BitMEX. Both platforms use SSL encryption and offer email notifications for account activities.

How do user interface and trading experience on PrimeXBT differ from that on BitMEX?

PrimeXBT features a more modern, intuitive interface designed for both beginners and experienced traders. The platform includes a customizable dashboard where you can arrange charts and trading panels.

BitMEX has a more technical interface that can seem overwhelming to newcomers but provides extensive data and tools appreciated by professional traders.

You’ll find more robust charting tools on PrimeXBT with over 50 indicators, while BitMEX offers a more streamlined set of technical analysis features. Both platforms support TradingView chart integration.

What customer support services does PrimeXBT offer in contrast to BitMEX?

PrimeXBT provides 24/7 live chat support along with email ticket systems. You can typically receive responses within 1-2 hours for urgent issues.

BitMEX relies primarily on email support, which can take 6-24 hours for responses depending on query complexity. Their knowledge base is extensive but direct support options are more limited.

Both platforms maintain active community forums and social media presence, but PrimeXBT offers more multilingual support options covering over 10 languages compared to BitMEX’s primary focus on English support.

BitMEX Vs PrimeXBT Conclusion: Why Not Use Both?

Both BitMEX and PrimeXBT offer strong platforms for trading crypto derivatives, but they each have unique advantages that might suit different trading needs.

PrimeXBT stands out with its lower trading fees at 0.05% compared to BitMEX’s 0.075%. This difference can add up significantly if you’re an active trader.

The platforms differ in their market variety as well. Using both platforms gives you access to a wider range of trading options and features that might not be available on just one platform.

Security is robust on both exchanges, though their approaches to regulation differ. This might influence your decision depending on your risk tolerance and regulatory preferences.

Key Differences:

- Fees: PrimeXBT (0.05%) vs BitMEX (0.075%)

- Interface: Each platform has a different user experience

- Available markets: Different selection of trading pairs

- Features: Unique tools and capabilities on each platform

You can leverage the strengths of both platforms for different trading strategies. Use PrimeXBT when lower fees are priority, and switch to BitMEX when you need its specific features.

Many experienced traders maintain accounts on multiple exchanges to capitalize on the best aspects of each platform and to diversify their trading options.