Choosing the right cryptocurrency exchange is important for your trading needs. Poloniex and BitMEX are two popular platforms that offer different features for crypto traders in 2025.

When comparing Poloniex and BitMEX, you’ll find that Poloniex has a higher overall score of 6.0, while BitMEX is considered more expensive but offers better support and requirement fulfillment. These exchanges differ in their fee structures, available cryptocurrencies, and trading tools that might impact your trading experience.

You’ll want to consider factors like trading volume, security features, and user interface when making your choice. Both platforms have unique strengths – Poloniex may appeal to those looking for better value, while BitMEX might be better for traders who prioritize customer support and specific feature requirements.

Poloniex Vs BitMEX: At A Glance Comparison

When choosing between Poloniex and BitMEX, you need to understand their key differences. Based on recent data, Poloniex scores higher overall with a 6.0 rating compared to BitMEX.

Trading Options

| Feature | Poloniex | BitMEX |

|---|---|---|

| Cryptocurrency Range | Wider selection | More limited |

| Leverage Trading | Available | Advanced with higher options |

| Trading Volume | $545,100,901 (24h) | Varies |

Poloniex ranks #18 among cryptocurrency exchanges and offers a broader range of cryptocurrencies for trading. This makes it appealing if you want more variety in your trading portfolio.

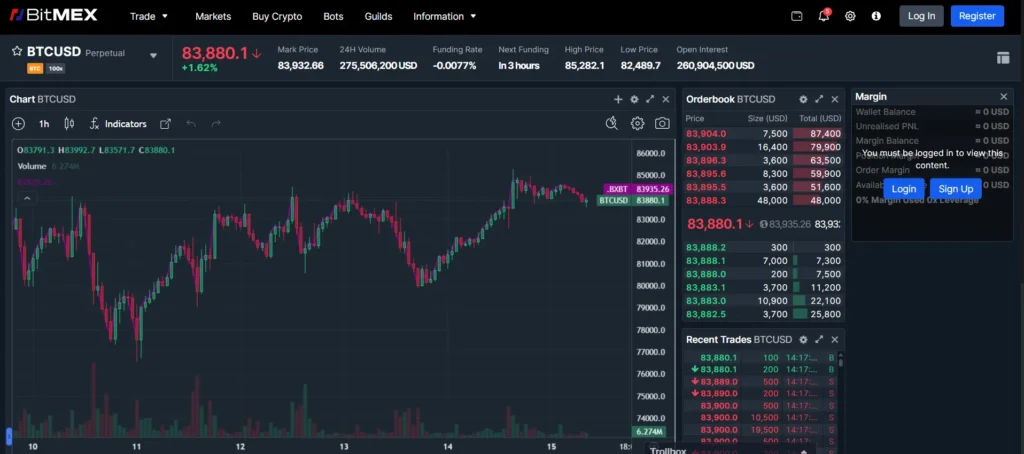

BitMEX specializes in advanced trading tools and higher leverage options. You might prefer BitMEX if you’re an experienced trader looking for sophisticated trading instruments.

User Experience

Both platforms have different strengths that appeal to different types of traders. Poloniex might be more suitable for traders who value cryptocurrency diversity and a solid overall experience.

BitMEX tends to attract traders focused on leverage trading and advanced tools. The platform is designed for those who want more technical options in their trading strategy.

Your choice between these exchanges should depend on your specific trading needs, experience level, and the features that matter most to your trading style.

Poloniex Vs BitMEX: Trading Markets, Products & Leverage Offered

Poloniex and BitMEX offer different trading options for cryptocurrency investors. Each platform has unique features that might suit your specific trading needs.

Poloniex supports over 350 digital currencies, giving you access to a wide range of altcoins. This makes it a good choice if you want to diversify your cryptocurrency portfolio beyond the major coins.

BitMEX, on the other hand, focuses more on advanced trading tools and fewer cryptocurrencies. It’s known for its Bitcoin-focused trading products.

Leverage Trading:

- BitMEX: Offers high leverage trading options up to 100x on some contracts

- Poloniex: Provides more modest leverage options, typically lower than BitMEX

When it comes to trading products, BitMEX specializes in derivatives and futures contracts. This platform is designed for experienced traders who understand complex trading instruments.

Poloniex provides spot trading along with margin trading features. Its interface tends to be more approachable for newer traders while still offering advanced options.

Trading Markets Comparison:

| Feature | Poloniex | BitMEX |

|---|---|---|

| Number of cryptocurrencies | 350+ | Fewer, Bitcoin-focused |

| Market types | Spot and margin | Derivatives and futures |

| Target audience | Both new and experienced traders | Advanced traders |

Your trading style will determine which platform serves you better. Choose Poloniex for coin variety or BitMEX for advanced leverage options.

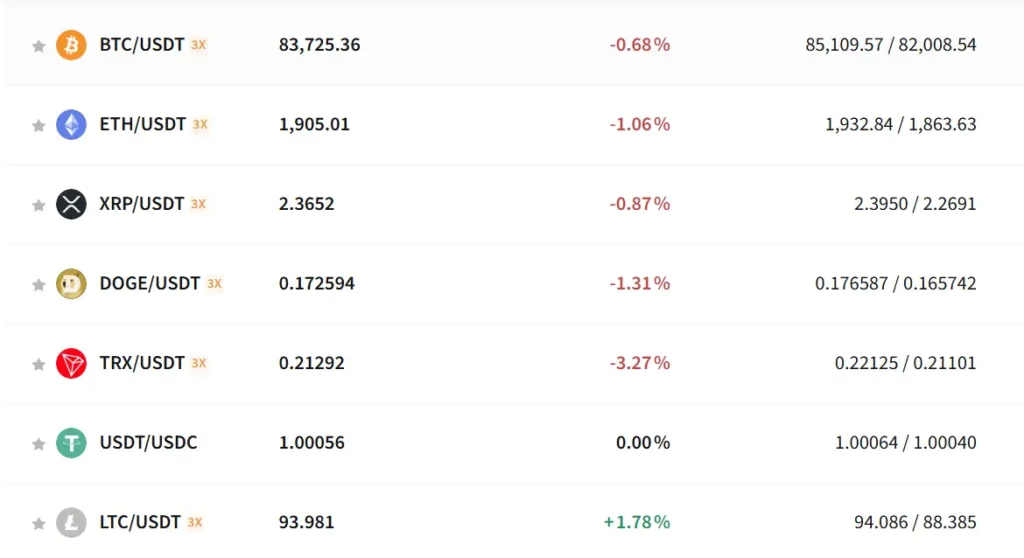

Poloniex Vs BitMEX: Supported Cryptocurrencies

Poloniex and BitMEX offer different selections of cryptocurrencies for trading. Understanding these differences helps you choose the platform that best suits your trading needs.

Poloniex supports a wider range of cryptocurrencies compared to BitMEX. You can trade over 100 different cryptocurrencies on Poloniex, including major coins and many altcoins.

BitMEX focuses primarily on Bitcoin and a limited selection of top altcoins. The platform specializes in cryptocurrency derivatives rather than spot trading of numerous tokens.

Here’s a comparison of their supported cryptocurrencies:

| Exchange | Bitcoin | Ethereum | Altcoins | Total Cryptocurrencies |

|---|---|---|---|---|

| Poloniex | ✓ | ✓ | 100+ | 100+ |

| BitMEX | ✓ | ✓ | Limited | Under 20 |

On Poloniex, you can trade popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin. You’ll also find many smaller cap coins not available on other platforms.

BitMEX offers trading primarily through perpetual contracts and futures. Their focus is on Bitcoin (XBT) contracts, with some additional options for Ethereum, Litecoin, and a few other major cryptocurrencies.

If you’re looking to diversify your crypto portfolio with many different coins, Poloniex provides more options. For traders focused on Bitcoin derivatives and leverage trading, BitMEX offers specialized tools with fewer cryptocurrencies.

Trading pairs also differ between the platforms. Poloniex offers many BTC, ETH, and USDT trading pairs, while BitMEX primarily uses Bitcoin as the settlement currency.

Poloniex Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Poloniex and BitMEX, fees play a crucial role in your trading decisions. Based on current information, Poloniex offers more competitive trading fees with rates up to 0.145%.

BitMEX’s fee structure is slightly different, with rates that vary based on the type of contract and your trading volume. Both platforms use a maker-taker fee model.

Trading Fees Comparison:

| Platform | Maker Fees | Taker Fees |

|---|---|---|

| Poloniex | Up to 0.145% | Up to 0.145% |

| BitMEX | Varies by contract | Varies by contract |

For deposits, both exchanges generally don’t charge fees for cryptocurrency deposits. This is standard across most crypto exchanges.

Withdrawal Fees:

- BitMEX: No bitcoin withdrawal fees, with immediate withdrawals up to 2 XBT from their Advance Withdrawal fund

- Poloniex: Varies by cryptocurrency

Your trading volume can affect the fees you pay on both platforms. Higher volume traders often receive discounts on their trading fees.

Remember that fee structures may change over time. It’s always best to check the official websites for the most current rates before making your decision.

Both platforms offer competitive fee structures compared to other exchanges in the market, but Poloniex appears to have the edge with lower percentage rates for standard trading.

Poloniex Vs BitMEX: Order Types

When trading on cryptocurrency exchanges, order types are crucial tools for executing your trading strategy. Both Poloniex and BitMEX offer various order types to meet different trading needs.

Poloniex Order Types:

- Market Orders: Buy or sell instantly at the current market price

- Limit Orders: Set a specific price for your buy or sell order

- Stop-Limit Orders: Create orders that activate when the market hits a trigger price

- Post-Only Orders: Ensure your order is placed as a maker, not a taker

BitMEX Order Types:

- Market Orders: Execute immediately at the best available price

- Limit Orders: Set your desired price for execution

- Stop Orders: Both stop-market and stop-limit variations available

- Take Profit Orders: Automatically close positions when profit targets are reached

- Trailing Stop Orders: Follow the market price at a set distance

BitMEX is known for its advanced trading features, offering more sophisticated order types like trailing stops that adjust automatically as the market moves. This is particularly useful for futures trading.

Poloniex provides standard order types that are sufficient for most spot trading needs. Their interface is generally considered more straightforward for beginners.

Your trading style will determine which platform’s order types serve you better. If you need advanced order execution options, BitMEX might be more suitable. For simpler spot trading, Poloniex’s offerings are typically adequate.

Poloniex Vs BitMEX: KYC Requirements & KYC Limits

When choosing between Poloniex and BitMEX, understanding their KYC (Know Your Customer) requirements is important for your trading experience.

BitMEX KYC Requirements:

- Previously allowed anonymous trading with just an email

- Now implements KYC processes due to regulatory pressure

- Required verification includes ID documents and personal information

BitMEX faced regulatory issues in the past related to their lack of Anti-Money Laundering programs, which led to stricter compliance measures.

Poloniex KYC Requirements:

- According to recent information, Poloniex allows trading without KYC verification

- This creates a more accessible platform for users valuing privacy

- Trading limits may apply for non-verified accounts

Trading Limits Comparison:

| Exchange | Non-KYC Limits | KYC Verified Limits |

|---|---|---|

| Poloniex | Basic trading allowed | Higher withdrawal limits |

| BitMEX | Not available | Full platform access |

For traders concerned about privacy, Poloniex might offer an advantage with its KYC-free option. However, if you’re planning to trade large volumes, completing verification on either platform would be beneficial.

Remember that cryptocurrency regulations change frequently. You should check the current requirements on both platforms before making your decision.

Poloniex Vs BitMEX: Deposits & Withdrawal Options

When you’re choosing between Poloniex and BitMEX, deposit and withdrawal options are important factors to consider.

Poloniex offers cryptocurrency deposits only, with no fiat currency support. You can deposit various cryptocurrencies into your Poloniex account depending on what trading pairs you want to access.

BitMEX similarly does not accept fiat deposits. You can only fund your BitMEX account with Bitcoin, which limits your options compared to some exchanges.

For withdrawals, Poloniex charges a fixed fee of 0.0001 BTC for Bitcoin withdrawals. This fee structure is straightforward but may not be the most economical for smaller transactions.

BitMEX withdrawal fees are not clearly specified in the search results, but the platform is known for its Bitcoin-focused operations.

When it comes to withdrawal limits, Poloniex has implemented some restrictions that users find annoying. These limitations might affect your trading strategy if you need to move large amounts quickly.

Fee Comparison:

| Exchange | Withdrawal Fees | Trading Fees |

|---|---|---|

| Poloniex | 0.0001 BTC (fixed) | Up to 0.2% |

| BitMEX | Not specified | Up to 0.075% |

Both platforms have cryptocurrency-only ecosystems, but BitMEX’s Bitcoin-only deposit system is more restrictive than Poloniex’s support for multiple cryptocurrencies.

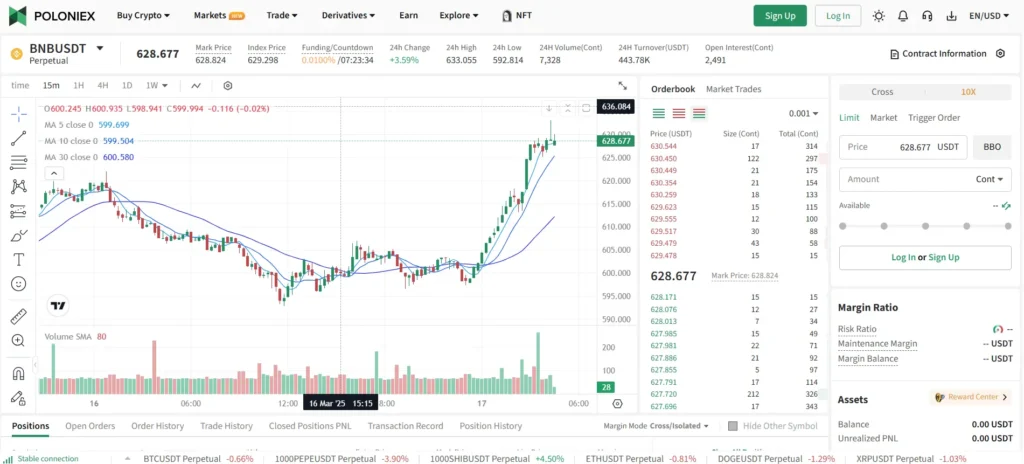

Poloniex Vs BitMEX: Trading & Platform Experience Comparison

When choosing between Poloniex and BitMEX, the trading experience differs significantly between these platforms.

User Interface

- Poloniex offers a more intuitive interface suitable for beginners

- BitMEX provides a data-rich dashboard that appeals to advanced traders

- Both platforms are available on web browsers, but mobile experiences vary

Trading Options

BitMEX is known for high-leverage trading, allowing you to amplify your positions up to 100x on certain pairs. Poloniex offers more modest leverage but compensates with a wider selection of altcoins for diversifying your portfolio.

Advanced Features

| Feature | BitMEX | Poloniex |

|---|---|---|

| Charting Tools | Advanced | Basic |

| Order Types | More varieties | Standard |

| API Access | Comprehensive | Limited |

BitMEX excels in providing sophisticated trading tools and analysis options. You’ll find more customizable charts and technical indicators compared to Poloniex.

Trading volume tends to be higher on BitMEX for major cryptocurrencies, which can mean better liquidity for your larger trades.

Platform Stability

Both exchanges have experienced downtime during peak market volatility. BitMEX has implemented more robust systems in recent updates to address these issues.

If you’re new to crypto trading, Poloniex’s straightforward approach may be less intimidating. Experienced traders often prefer BitMEX for its advanced trading capabilities and analytical tools.

Poloniex Vs BitMEX: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding liquidation mechanisms is crucial. Liquidation happens when your position can’t meet the minimum margin requirements.

BitMEX uses an index price-based liquidation system. This provides better protection against market manipulation. Your position on BitMEX will only be liquidated if the actual index price moves against your position, not just temporary market fluctuations.

BitMEX employs an Auto-Deleveraging (ADL) mechanism for liquidation. This system helps maintain market stability during extreme volatility.

Poloniex, based in Seychelles, handles liquidations differently. Their system monitors your margin ratio continuously. When your collateral falls below required levels, the platform automatically closes your positions.

Both exchanges aim to protect users and themselves from excessive losses, but their approaches differ in implementation.

Key Differences at a Glance:

| Feature | BitMEX | Poloniex |

|---|---|---|

| Liquidation Trigger | Index price movements | Margin ratio thresholds |

| Protection Mechanism | Auto-Deleveraging (ADL) | Automatic position closing |

| Market Manipulation Protection | Higher (uses index price) | Standard |

You should carefully consider these liquidation mechanisms when deciding which platform better suits your trading style. Risk-averse traders might prefer BitMEX’s index-based approach, while others may find Poloniex’s system more straightforward.

Poloniex Vs BitMEX: Insurance

When trading on cryptocurrency exchanges, insurance coverage is a crucial factor to consider. This protection can safeguard your assets in case of security breaches or platform failures.

BitMEX maintains an insurance fund that has grown substantially over the years. This fund helps protect traders from auto-deleveraging during volatile market conditions. The insurance fund acts as a buffer when liquidated positions can’t be closed at market prices.

Poloniex also offers an insurance fund, though it’s generally considered smaller than BitMEX’s. Their fund works similarly by providing protection against losses during extreme market volatility.

Neither exchange offers complete protection for all user funds stored on their platforms. Both exchanges primarily use their insurance funds to maintain orderly markets rather than to compensate users for all types of losses.

It’s worth noting that neither BitMEX nor Poloniex provides FDIC-like insurance that you might find with traditional financial institutions. This means you should practice caution with the amount you keep on either platform.

For maximum security, consider using hardware wallets for long-term storage of your cryptocurrency. Only keep the amounts you actively trade on these exchanges.

The specific details of each exchange’s insurance policies may change over time, so you should check their current terms before making a decision based on insurance alone.

Poloniex Vs BitMEX: Customer Support

When choosing a cryptocurrency exchange, customer support quality can make a big difference in your trading experience. Both Poloniex and BitMEX offer support options, but they differ in quality and response times.

According to user reviews, BitMEX has earned a higher rating for its customer support compared to Poloniex. Many users specifically praise BitMEX’s live chat feature, which provides quicker resolution to issues.

For ongoing product support, reviewers consistently prefer BitMEX over Poloniex. This suggests you might experience fewer frustrations when needing help with BitMEX’s platform.

Poloniex’s support system has faced criticism in the past for slower response times. Some users report waiting several days for ticket responses, which can be problematic during urgent trading situations.

Both exchanges offer the following support channels:

| Support Channel | Poloniex | BitMEX |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | Limited | ✓ |

| Knowledge Base | ✓ | ✓ |

| FAQ Section | ✓ | ✓ |

BitMEX also seems to have an edge when it comes to feature updates and roadmap communications. This transparency helps you better understand platform changes and upcoming improvements.

If customer support is a priority for your trading needs, BitMEX appears to be the stronger option based on current user feedback.

Poloniex Vs BitMEX: Security Features

When choosing between Poloniex and BitMEX, security should be a top priority for your crypto assets. Both exchanges offer security measures, but with notable differences.

Poloniex Security Features:

- Two-factor authentication (2FA)

- Email confirmations for withdrawals

- Cold storage for majority of funds

- IP address monitoring

Poloniex has faced some security challenges in the past. The exchange experienced a hack in 2014 that resulted in a loss of funds. Since then, they’ve improved their security protocols.

BitMEX Security Features:

- Multi-signature wallets

- Two-factor authentication (2FA)

- Cold storage for user funds

- Mandatory ID verification

- Advanced DDoS protection

BitMEX has maintained a relatively strong security record. Their multi-signature wallet system adds an extra layer of protection for your assets.

Both exchanges require KYC (Know Your Customer) verification, though BitMEX’s process is typically more stringent. This helps protect against unauthorized account access.

For withdrawal security, BitMEX implements a more robust verification process. You’ll need to confirm withdrawals through multiple methods.

Neither platform offers insurance for user funds in case of a security breach. This is an important consideration for your risk assessment.

For maximum security on either platform, you should enable all available security features and consider using a hardware wallet for long-term storage.

Is Poloniex Safe & Legal To Use?

Poloniex is a legitimate cryptocurrency exchange that operates within legal frameworks. However, you should be aware of its history and certain risks.

The exchange has experienced two security breaches in the past. Despite these incidents, Poloniex has improved its security measures and now stores most user funds in offline cold storage to protect them from hacks.

The SEC (Securities and Exchange Commission) has taken regulatory action against Poloniex. According to search results, the SEC found that Poloniex operated without registering as a national securities exchange and without a valid exemption.

When it comes to safety, Poloniex implements standard security features that many crypto exchanges use:

- Two-factor authentication (2FA)

- Cold storage for most crypto assets

- IP address monitoring

- Email confirmations for withdrawals

You should consider using a hardware wallet for long-term storage of your cryptocurrencies instead of keeping large amounts on any exchange, including Poloniex.

Before using Poloniex, check if it’s available in your country. Regulatory status varies by region, and some countries have restrictions on cryptocurrency trading platforms.

Always use strong, unique passwords and enable all security features available to protect your funds when trading on Poloniex or any cryptocurrency exchange.

Is BitMEX Safe & Legal To Use?

BitMEX operates in a complex regulatory landscape that varies by country. The platform has faced scrutiny from regulators in recent years, particularly in the United States.

In 2020, the U.S. Commodity Futures Trading Commission (CFTC) charged BitMEX with operating an unregistered trading platform and violating Anti-Money Laundering regulations. This led to settlements and changes in their compliance practices.

Current Legal Status:

- Legal in many international jurisdictions

- Restricted or unavailable in the US, UK, and some other countries

- Requires KYC (Know Your Customer) verification for all users

BitMEX has improved its security measures over time. The platform uses multi-signature wallets and cold storage for most funds, reducing the risk of hacks.

Security Features:

- Two-factor authentication (2FA)

- Address whitelisting

- Email notifications for account activities

- Insurance fund to protect against losses

When using BitMEX, you should consider both the regulatory status in your country and your personal risk tolerance. The platform is generally considered technically secure but has had compliance issues.

For many traders outside restricted regions, BitMEX remains a legitimate option for cryptocurrency derivatives trading. However, you should always use strong security practices like unique passwords and 2FA on any exchange.

Frequently Asked Questions

Trading cryptocurrencies involves understanding the specific features and limitations of each exchange. Here are answers to common questions that traders ask when comparing Poloniex and BitMEX for their crypto trading needs.

What are the primary differences in futures trading fees between Poloniex and BitMEX?

BitMEX typically charges a taker fee of 0.075% and offers a maker rebate of 0.025% for most contracts. This fee structure rewards liquidity providers.

Poloniex has a different fee structure with spot trading fees starting at 0.155% for takers and 0.055% for makers. Their futures trading fees are competitive but generally higher than BitMEX for beginners.

Both exchanges offer fee discounts based on trading volume, with higher-volume traders receiving more favorable rates.

Which exchange offers the best platform for futures trading based on user reviews, Poloniex or BitMEX?

BitMEX is often praised by experienced traders for its advanced trading interface and powerful tools specifically designed for futures trading. Its platform offers sophisticated charting tools and order types.

Poloniex receives positive feedback for its wider range of altcoins and more user-friendly interface. However, many professional traders prefer BitMEX for futures trading due to its leverage options and specialized futures-focused design.

User reviews suggest BitMEX has an edge for serious futures traders, while Poloniex may be more accessible for beginners and those looking to trade multiple altcoins.

How do the security features of Poloniex compare with those of BitMEX?

Both exchanges implement strong security measures, including two-factor authentication and cold storage for most funds. BitMEX uses a multi-signature wallet system that requires multiple approvals for withdrawals.

Poloniex offers similar security features with added advanced API key permissions. Both exchanges have experienced security issues in the past, with Poloniex having faced a hack in 2014.

BitMEX has never reported a successful hack of its platform, giving it a slight edge in security history. However, both exchanges have significantly improved their security protocols in recent years.

Can you provide a comparison of the customer support services offered by Poloniex and BitMEX?

BitMEX provides customer support primarily through email and a comprehensive knowledge base. Response times can vary from a few hours to days depending on request volume and complexity.

Poloniex offers more support channels including email, ticket system, and social media support. They also maintain an extensive FAQ section and provide regular updates on platform status.

User feedback suggests Poloniex has improved its customer service in recent years, while BitMEX customer support sometimes receives criticism for slower response times during high-volume trading periods.

What are the available alternatives to Poloniex for cryptocurrency trading?

Binance is a top alternative to Poloniex, offering a vast selection of cryptocurrencies and lower trading fees. It also provides futures trading with high leverage options.

Kraken stands out for its strong security record and regulatory compliance. It offers a good balance of altcoins and major cryptocurrencies with reasonable fees.

Coinbase is ideal for beginners with its user-friendly interface, though it has higher fees. Kucoin and FTX are also popular alternatives with competitive features and wide coin selections.

Which platform between Poloniex and BitMEX is preferred for trading small market cap cryptocurrencies?

Poloniex has a clear advantage for trading small market cap cryptocurrencies. The exchange lists hundreds of altcoins, including many smaller projects not available on other major platforms.

BitMEX focuses primarily on futures contracts for major cryptocurrencies like Bitcoin and Ethereum. It does not offer the diversity of small cap tokens that Poloniex provides.

If you’re interested in discovering and trading emerging cryptocurrencies with smaller market capitalizations, Poloniex offers substantially more options than BitMEX.

BitMEX Vs Poloniex Conclusion: Why Not Use Both?

Both BitMEX and Poloniex offer unique advantages that might benefit your cryptocurrency trading strategy. BitMEX stands out with its high leverage trading options and advanced tools for experienced traders, while Poloniex provides access to a wider variety of altcoins.

You don’t necessarily have to choose between them. Many traders maintain accounts on multiple exchanges to take advantage of different features and opportunities.

Key considerations for using both platforms:

| Feature | BitMEX | Poloniex |

|---|---|---|

| Leverage trading | Higher leverage options | More limited |

| Coin variety | Fewer coins supported | Wider range of altcoins |

| User interface | Advanced trading tools | More straightforward |

| Overall score | Lower (based on reviews) | Higher (6.0/10) |

If you’re interested in margin trading with high leverage, BitMEX might be your go-to platform. For diversifying your cryptocurrency portfolio with various altcoins, Poloniex offers better options.

Using both exchanges allows you to leverage the strengths of each platform. You can conduct high-leverage trades on BitMEX while exploring a broader range of altcoin investments on Poloniex.

Before committing to either exchange, make sure to review their current fee structures and security measures. Both platforms have evolved since their inception, and staying updated on their offerings helps you make informed decisions.