Choosing the right cryptocurrency exchange is crucial for your trading success. Phemex and WhiteBIT are two popular platforms that offer various services for crypto enthusiasts in 2025. Both exchanges provide full trading services but differ in their fee structures, supported cryptocurrencies, and special features that might impact your trading experience.

When comparing these platforms, you’ll notice WhiteBIT offers attractive interest rates for most coins if you commit to a 360-day lockup period. The exchange also supports a wide variety of cryptocurrencies. Phemex, on the other hand, has its own set of advantages that we’ll explore throughout this article.

This comparison will help you understand the key differences between Phemex and WhiteBIT, including their trading types, user ratings, deposit methods, and overall costs. By the end of this article, you’ll have a clearer picture of which exchange better suits your crypto trading needs.

Phemex Vs WhiteBIT: At A Glance Comparison

When choosing between Phemex and WhiteBIT in 2025, several key differences stand out. Both platforms offer cryptocurrency exchange services but with unique features that may appeal to different types of traders.

Fee Structure:

| Feature | Phemex | WhiteBIT |

|---|---|---|

| Trading Fees | Competitive rates | Varies based on volume |

| Deposit Methods | Multiple options | Wide variety |

WhiteBIT offers excellent interest rates for most coins if you commit to a 360-day lockup period. This makes it attractive for long-term holders looking to earn passive income.

Phemex provides a user-friendly platform that caters to both beginners and experienced traders. You’ll find the interface intuitive and straightforward to navigate.

Coin Support:

WhiteBIT supports a wider variety of coins compared to Phemex. This gives you more options when diversifying your cryptocurrency portfolio.

Both exchanges offer full exchange services including spot trading. However, their available trading pairs differ, so you should check if your preferred coins are supported.

User reviews indicate that both platforms have loyal followings. Trust scores for both exchanges are competitive in the cryptocurrency marketplace.

When deciding between these two platforms, consider your specific needs. Are you looking for the best interest rates? WhiteBIT might be your choice. Do you prefer ease of use? Phemex could be the better option for you.

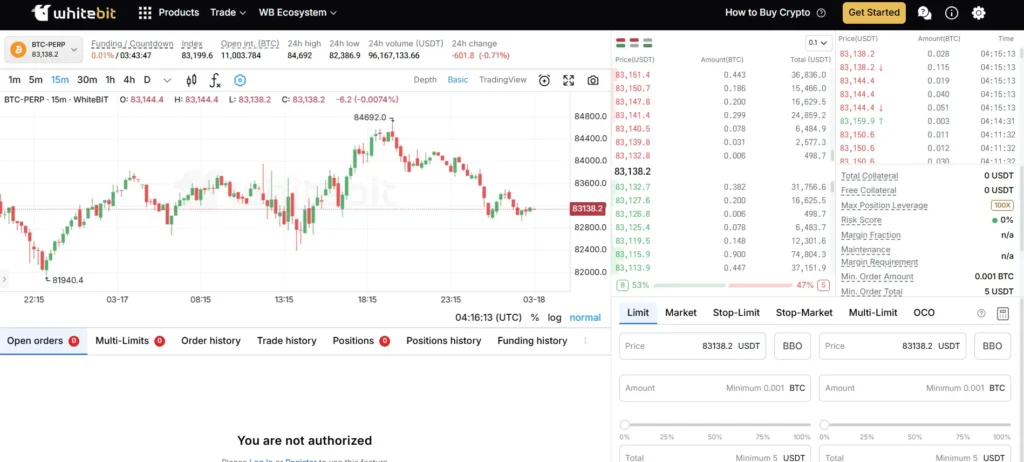

Phemex Vs WhiteBIT: Trading Markets, Products & Leverage Offered

Phemex and WhiteBIT both offer a range of trading markets and products, but with some key differences that might affect your trading experience.

Phemex provides spot trading with a good selection of cryptocurrencies. They’re particularly known for their futures trading options, offering high leverage of up to 100x on certain contracts. This allows you to amplify potential returns, though with increased risk.

WhiteBIT features a more diverse range of cryptocurrencies for spot trading. Their lending product, called “WhiteBit Crypto,” lets you earn interest on your holdings, which Phemex doesn’t currently offer.

Trading Products Comparison:

| Feature | Phemex | WhiteBIT |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ (up to 100x leverage) | ✓ (lower leverage options) |

| Lending/Interest | ✗ | ✓ (up to 360-day lockups) |

| Trading Tools | Advanced | Advanced |

WhiteBIT stands out with better interest rates for most coins if you commit to longer lockup periods (up to 360 days). This makes it potentially more attractive if you’re looking to generate passive income.

Both exchanges offer advanced trading tools to help you manage your portfolio effectively. These include limit orders, stop-losses, and charting capabilities.

Your choice between these platforms may depend on whether you prioritize high-leverage trading (Phemex) or earning interest on your crypto holdings (WhiteBIT).

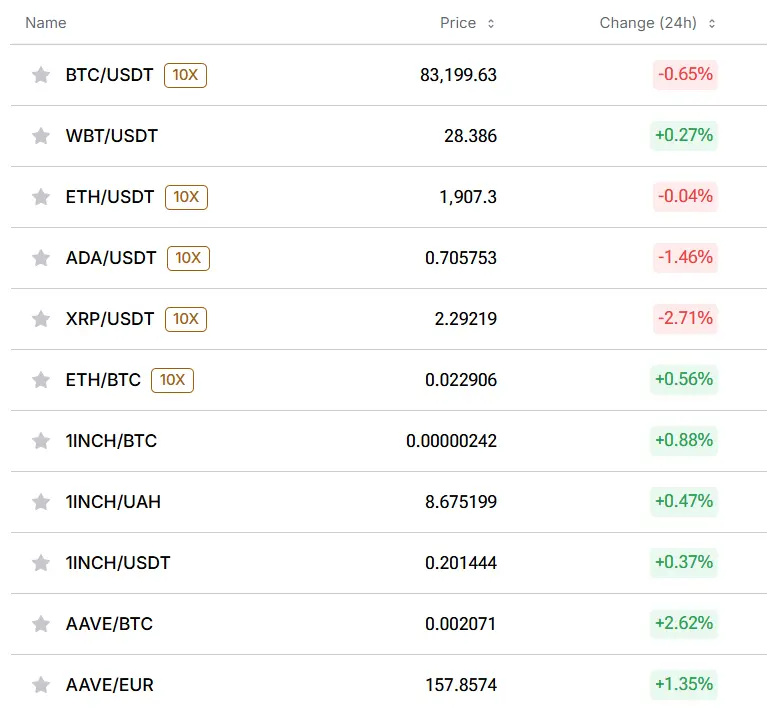

Phemex Vs WhiteBIT: Supported Cryptocurrencies

Both Phemex and WhiteBIT offer a wide range of cryptocurrencies for trading, but there are some differences in their selections.

Phemex supports major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other popular altcoins. Their platform focuses on providing a solid selection of established coins and tokens.

WhiteBIT, on the other hand, appears to support a wider variety of coins. This exchange offers both mainstream cryptocurrencies and a broader selection of altcoins.

Here’s a quick comparison of their cryptocurrency support:

| Feature | Phemex | WhiteBIT |

|---|---|---|

| Major Coins (BTC, ETH) | ✓ | ✓ |

| Altcoin Variety | Moderate | Extensive |

| New/Emerging Tokens | Limited | More Available |

When choosing between these exchanges, consider which cryptocurrencies you plan to trade. If you primarily trade mainstream coins, either platform will likely meet your needs.

For traders interested in more obscure altcoins or newer tokens, WhiteBIT might offer more options. Their wider selection could be beneficial if you’re looking to diversify your portfolio beyond the most common cryptocurrencies.

Both platforms regularly update their supported cryptocurrencies, so you might want to check their current listings directly on their websites before making your final decision.

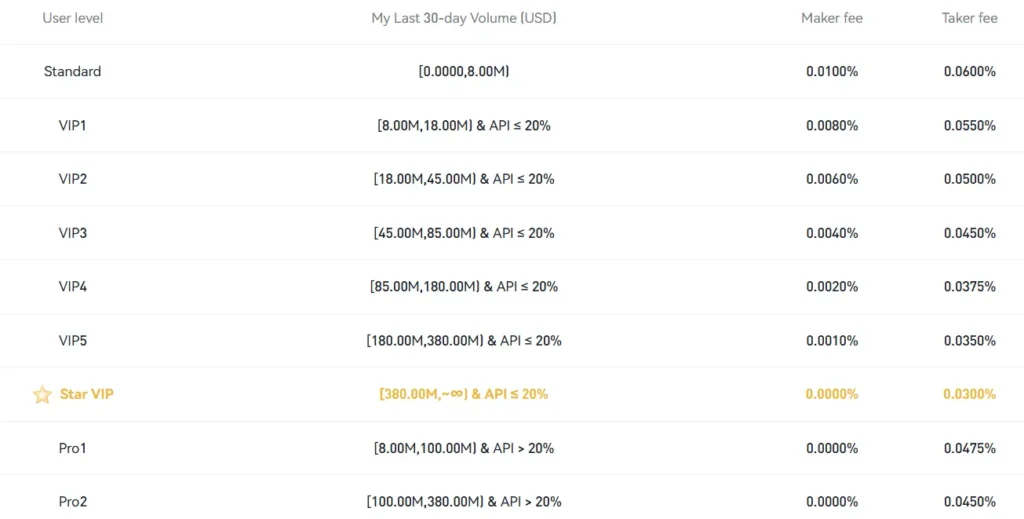

Phemex Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and WhiteBIT, understanding their fee structures is crucial for your trading strategy.

Phemex stands out with its exceptionally low trading fees. The platform offers competitive rates that make it attractive for frequent traders. Their fee structure is straightforward and transparent.

WhiteBIT, on the other hand, has a different approach to fees. While their trading fees might be slightly higher than Phemex, they offer great rates for most coins if you commit to longer lockup periods (up to 360 days).

Trading Fees Comparison:

| Exchange | Maker Fee | Taker Fee | Special Conditions |

|---|---|---|---|

| Phemex | Lower | Lower | Reduced fees with platform token |

| WhiteBIT | Higher | Higher | Better rates with longer lockups |

For withdrawals, WhiteBIT charges specific fees depending on your withdrawal method. Fiat currency withdrawals through Advcash cost 1.5% for EUR, USD, and RUB, while UAH withdrawals are higher at 4.5%.

Phemex offers flexible deposit terms, which is an advantage for many traders. However, their interest rates might be lower compared to some competitors.

Your choice between these exchanges might depend on your trading volume and frequency. If you trade often, Phemex’s lower fees could save you money in the long run.

Consider your preferred deposit methods as well. Both platforms support various options, but availability may vary depending on your region.

Phemex Vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy. Both Phemex and WhiteBIT offer various order types to help you execute trades effectively.

Phemex provides several advanced order types including limit orders, market orders, and stop orders. Their platform also supports post-only orders and immediate-or-cancel orders for more sophisticated trading strategies.

WhiteBIT offers similar basic order types but stands out with its trailing stop order feature. This tool automatically adjusts your stop price as the market moves in your favor, potentially increasing your profits.

Both exchanges support:

- Limit orders

- Market orders

- Stop-limit orders

Unique to WhiteBIT:

- Trailing stop orders

- Advanced OCO (One-Cancels-the-Other) orders

Unique to Phemex:

- Post-only orders

- Immediate-or-cancel functionality

Phemex’s mobile app has been well-received with a 4.3/5 star rating and over 500,000 downloads. The app provides access to advanced order types and real-time market data on the go.

For day traders and those using technical analysis, WhiteBIT’s trailing stop feature may be particularly valuable. It helps you lock in profits as prices rise while limiting potential losses.

Your choice between these platforms may depend on which specific order types best suit your trading style and experience level.

Phemex Vs WhiteBIT: KYC Requirements & KYC Limits

Phemex and WhiteBIT differ significantly when it comes to their Know Your Customer (KYC) requirements. KYC is an identity verification process that helps financial institutions confirm who their customers are.

Phemex KYC Policy:

- Does not require KYC for basic trading

- Based in Singapore

- Classified as a custodial cryptocurrency exchange

- Users can trade without identity verification

This makes Phemex an attractive option if you prefer privacy or want to start trading immediately without submitting personal documents.

WhiteBIT KYC Policy:

- Implements KYC procedures for users

- More structured identity verification process

- Follows regulatory compliance standards

The KYC-free nature of Phemex may be appealing, but it’s important to understand the trade-offs. Without KYC, you might face limitations on withdrawal amounts or restricted access to certain features.

Both exchanges operate in an evolving regulatory landscape. Cryptocurrency lending and investment regulations are still developing worldwide, creating regulatory risk for both platforms.

When choosing between these exchanges, consider your privacy preferences alongside security needs. WhiteBIT’s KYC process adds an extra layer of security but requires more personal information.

Remember that regulations can change quickly in the crypto space. What’s permitted today might face restrictions tomorrow, so stay informed about requirements in your jurisdiction.

Phemex Vs WhiteBIT: Deposits & Withdrawal Options

Both Phemex and WhiteBIT offer various deposit and withdrawal options for crypto traders. Understanding these options can help you choose the exchange that best fits your needs.

Deposit Methods:

- Phemex: Supports crypto deposits with no fees

- WhiteBIT: Offers free crypto deposits and some fiat deposit options

Withdrawal Fees:

| Exchange | Crypto Withdrawal | Fee Structure |

|---|---|---|

| Phemex | Yes | Variable by asset |

| WhiteBIT | Yes | Different for each crypto asset |

WhiteBIT charges withdrawal fees that vary depending on which cryptocurrency you’re withdrawing. These fees are competitive but should be checked before making transactions.

Phemex also has a flexible deposit system, making it convenient for users who need to move funds quickly. Their withdrawal fees tend to be in line with industry standards.

Processing Times:

Both exchanges process crypto deposits relatively quickly once network confirmations are received. Withdrawals typically take a few minutes to a few hours depending on network congestion.

For fiat options, WhiteBIT appears to have more variety, which might be important if you frequently move between traditional currency and crypto.

Before making large deposits or withdrawals on either platform, you should verify the current fee structure as these can change based on market conditions and platform updates.

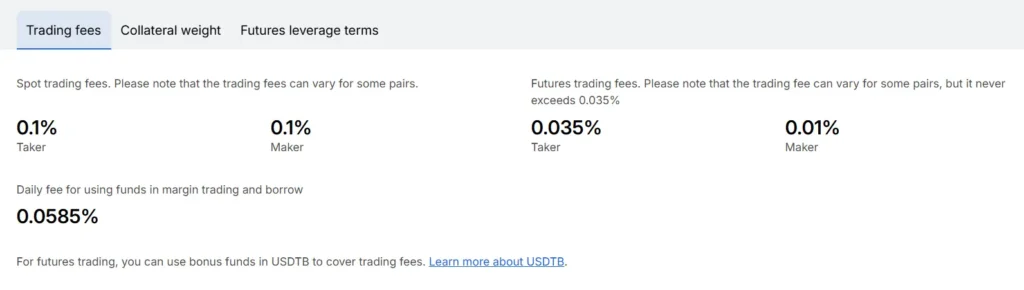

Phemex Vs WhiteBIT: Trading & Platform Experience Comparison

When choosing between Phemex and WhiteBIT, the trading experience differs in several key ways. Both platforms offer full exchange services but cater to different trader preferences.

Phemex stands out with its exceptionally low fees – just 0.01% for makers and 0.06% for takers. This makes it one of the most cost-effective platforms for frequent traders who want to maximize profits.

WhiteBIT offers a more diverse earning structure. You can enjoy great interest rates on most coins if you’re willing to lock them up for 360 days. This makes it appealing if you’re looking for passive income options.

Trading Tools Comparison:

| Feature | Phemex | WhiteBIT |

|---|---|---|

| Maker Fees | 0.01% | Higher |

| Taker Fees | 0.06% | Higher |

| Trading Tools | Powerful, professional | Standard |

| Coin Variety | Good | Wide selection |

Phemex focuses on providing professional trading tools that appeal to experienced traders. The platform includes Phemex Earn, a crypto lending product that expands your earning potential beyond just trading.

WhiteBIT’s strength lies in its wide variety of supported coins. You’ll find more options for diversifying your portfolio compared to many competitors.

The interface experience differs too. Phemex offers a more technically oriented platform, while WhiteBIT balances functionality with accessibility for newer traders.

Your trading style should guide your choice – frequent day traders might prefer Phemex’s low fees, while those seeking diverse coins and staking options might lean toward WhiteBIT.

Phemex Vs WhiteBIT: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation process is crucial for your risk management. Both Phemex and WhiteBIT have specific mechanisms to handle liquidations.

Phemex implements a clear liquidation protocol for futures trading. Liquidation happens when your account balance falls below the required maintenance margin. Specifically, this occurs when the sum of your Initial Margin, Realized PnL, and Unrealized PnL drops below the Maintenance Margin threshold.

WhiteBIT also employs a liquidation system to protect the platform from excessive losses. Their system monitors your positions continuously and may force-close them if your margin requirements aren’t met.

Key differences to consider:

| Feature | Phemex | WhiteBIT |

|---|---|---|

| Liquidation Warning | Provides alerts | Notification system |

| Partial Liquidation | Supported | Limited support |

| Liquidation Prevention | Insurance fund | Stop-loss options |

Both platforms present liquidation risks that you should be aware of. Your ability to withdraw funds might face restrictions during volatile market conditions.

To minimize liquidation risks on either platform, consider using stop-loss orders and maintaining sufficient margin in your account. This helps protect your positions during market volatility.

Remember that higher leverage increases your liquidation risk. Using conservative leverage ratios can help you avoid unexpected liquidations on both Phemex and WhiteBIT.

Phemex Vs WhiteBIT: Insurance

When trading cryptocurrencies, insurance protection is a crucial factor to consider. Both Phemex and WhiteBIT offer some form of insurance, but they differ in their approaches.

Phemex maintains an insurance fund to protect traders against auto-deleveraging. This fund helps manage risk during volatile market conditions and prevents losses from cascading liquidations.

WhiteBIT also provides insurance protection through their security measures. They store a significant portion of user funds in cold wallets, which adds an extra layer of protection against potential hacks.

Insurance Comparison:

| Feature | Phemex | WhiteBIT |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Cold Storage | 95% of assets | 96% of assets |

| Protection Focus | Trading losses | Security breaches |

| Account Insurance | Limited | Limited |

Neither exchange offers complete insurance coverage like traditional financial institutions. You should be aware that both platforms have limitations on what their insurance protects.

For added security, both exchanges use multi-signature technology and regular security audits. These measures help prevent unauthorized access to your funds.

Remember that crypto insurance differs from traditional banking insurance. Even with these protections in place, you should practice good security habits like using strong passwords and two-factor authentication.

Phemex Vs WhiteBIT: Customer Support

When choosing between cryptocurrency exchanges, customer support can be a decisive factor. Both Phemex and WhiteBIT offer multiple support channels to assist users with their questions and concerns.

Phemex provides 24/7 customer support through live chat, email, and a comprehensive help center. Their team typically responds within minutes for urgent matters, making it convenient for traders who need immediate assistance.

WhiteBIT also offers round-the-clock support with multiple language options. Their support team can be reached via live chat, email, and through social media platforms. WhiteBIT claims to serve over 8 million users within their ecosystem.

Response Times Comparison:

| Platform | Live Chat | Social Media | |

|---|---|---|---|

| Phemex | Minutes | 24 hours | 12-24 hours |

| WhiteBIT | 5-15 minutes | 24-48 hours | 24 hours |

Both exchanges provide detailed FAQs and knowledge bases where you can find answers to common questions. These self-service options help you resolve simpler issues without contacting support.

Phemex offers video tutorials and trading guides that can help you navigate the platform. WhiteBIT provides similar educational resources plus localized support in several languages.

User feedback suggests that both platforms maintain respectable customer service standards. However, during high market volatility periods, you might experience longer wait times on both exchanges.

Phemex Vs WhiteBIT: Security Features

When choosing between Phemex and WhiteBIT for your crypto trading needs, security should be a top priority. Both exchanges offer strong security measures, but they differ in some important ways.

Phemex provides robust security through its cold storage system, where most user assets are kept offline. This significantly reduces the risk of hacking. They also use multi-signature technology for all withdrawals.

WhiteBIT is recognized for its premium security features as mentioned in the search results. The platform is compliant with laws and regulations, which adds an extra layer of protection for your assets.

Two-Factor Authentication (2FA)

| Exchange | 2FA Available | Additional Security |

|---|---|---|

| Phemex | Yes | Anti-phishing codes |

| WhiteBIT | Yes | Email confirmations |

Both exchanges offer regular security audits to identify and fix potential vulnerabilities. However, WhiteBIT may have an edge in regulatory compliance based on the search information.

Phemex uses a comprehensive risk control system that monitors unusual account activities. If something suspicious happens, the system can freeze your account temporarily to protect your assets.

WhiteBIT implements strict KYC (Know Your Customer) procedures. While this might seem inconvenient, it actually helps protect users from fraud and maintains a secure trading environment.

For added security, both platforms provide withdrawal address whitelisting. This prevents unauthorized withdrawals to unknown addresses.

Is Phemex A Safe & Legal To Use?

Phemex has established itself as a trustworthy crypto exchange in the industry. As a major centralized exchange, it has maintained a strong security record with no reported hacks to date.

The platform implements various security measures to protect user funds and information. These security protocols align with industry standards to prevent unauthorized access.

For legal concerns, Phemex allows users to trade without KYC (Know Your Customer) verification. This makes it accessible if you want to start trading quickly without extensive identity verification.

However, it’s important to understand the risks involved with any crypto platform:

- Platform Risk: Your funds could be vulnerable to hacking, fraud, or platform insolvency

- Regulatory Status: Rules vary by country, so check local laws before trading

- Account Security: Always use strong passwords and two-factor authentication

Phemex offers a comprehensive trading environment with various cryptocurrency pairs and products. The platform is user-friendly and suitable for both beginners and experienced traders.

When comparing Phemex to other exchanges like WhiteBIT, consider your specific trading needs. Both platforms have their strengths, but Phemex stands out for its security track record and ease of use.

Remember that while Phemex has proven reliable so far, all cryptocurrency investments carry inherent risks. You should only invest funds you can afford to lose.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT has earned an AAA security rating with a perfect 100% security score according to current information. This high rating suggests strong security measures are in place to protect user funds and data.

The exchange is partly certified and has successfully completed penetration testing. WhiteBIT also maintains an ongoing bug bounty program, which helps identify and fix potential security vulnerabilities before they can be exploited.

When considering any crypto exchange, including WhiteBIT, you should be aware of platform risks. These include potential threats from hacking, fraud, mismanagement, or platform insolvency. These risks apply to all third-party platforms in the crypto space.

WhiteBIT appears to be suitable for travelers as it offers fewer region restrictions than some competitors. This makes it accessible to users in various locations globally.

For beginners and younger users like teenagers entering the crypto space, WhiteBIT seems to be considered a relatively safe option based on user feedback.

Before using WhiteBIT or any exchange, you should:

- Check if it’s legally available in your region

- Enable all security features like 2FA

- Use strong, unique passwords

- Consider cold storage for large amounts

- Start with small amounts until comfortable with the platform

Remember to conduct your own research about current regulations in your country, as crypto laws change frequently.

Frequently Asked Questions

Traders comparing Phemex and WhiteBIT often have specific questions about these platforms’ offerings. These questions cover important aspects like fees, security, cryptocurrency selection, and user experience.

What are the key differences in trading fees between Phemex and WhiteBIT?

Phemex and WhiteBIT have different fee structures for traders. Phemex typically offers competitive spot trading fees that decrease as your trading volume increases.

WhiteBIT’s fee structure varies more frequently, which might require you to check their current rates before trading. Their fees may also depend on whether you hold their native token.

Both exchanges charge different fees for spot versus futures trading, with maker fees generally lower than taker fees on both platforms.

How do the security measures of Phemex compare with those of WhiteBIT?

Both exchanges prioritize security but implement different approaches. Phemex utilizes cold storage solutions to keep the majority of user funds offline and safe from potential hacks.

WhiteBIT maintains a strong security infrastructure with multi-signature wallets and regular security audits. They also offer two-factor authentication (2FA) to protect user accounts.

You should enable all available security features on either platform, including withdrawal whitelisting and anti-phishing codes, to maximize your protection.

Which platform offers a wider range of cryptocurrencies, Phemex or WhiteBIT?

WhiteBIT appears to serve a larger user base with 8 million direct users and access to over 30 million in their broader ecosystem, suggesting they may offer more trading pairs.

Phemex focuses on popular cryptocurrencies and pairs but may not support as many smaller or newer tokens. The exact number of supported cryptocurrencies changes as both platforms regularly add new listings.

You should check both platforms’ current asset listings if you’re looking to trade specific cryptocurrencies, especially newer or less common tokens.

What are the customer support experiences like on Phemex versus WhiteBIT?

Both exchanges offer multiple customer support channels including live chat, ticket systems, and email support. Response times can vary based on current demand and the complexity of your issue.

Phemex provides educational resources alongside their support options to help users solve common problems independently.

WhiteBIT offers multilingual support, which can be valuable if English isn’t your first language. User reviews suggest mixed experiences with both platforms’ support teams.

How do the user interfaces and trading experiences differ between Phemex and WhiteBIT?

Phemex offers a straightforward interface designed to accommodate both beginners and experienced traders. Their platform includes essential charting tools and order types.

WhiteBIT’s interface tends to include more features which can be powerful for experienced users but potentially overwhelming for newcomers. They offer advanced charting capabilities and order options.

Both platforms provide mobile apps, but they differ in design philosophy and feature implementation. You may want to try both interfaces to see which matches your trading style.

Are there any distinct advantages of using Phemex over WhiteBIT for professional traders?

Professional traders might appreciate Phemex’s futures trading platform with high leverage options and competitive fees for high-volume traders.

WhiteBIT requires minimum lockup periods for earning interest on cryptocurrencies, with most coins needing at least 10 days and some requiring 30 days. This could affect liquidity planning for active traders.

Phemex may offer better API access for algorithmic trading, making it potentially more suitable for traders using automated strategies. The exact advantages will depend on your specific trading requirements and strategies.

Phemex Vs WhiteBIT Conclusion: Why Not Use Both?

After comparing Phemex and WhiteBIT, you might wonder which platform to choose. The truth is, you don’t necessarily have to pick just one.

Both exchanges offer valuable features that might serve different needs in your crypto journey. Phemex appears to edge out slightly in overall comparison according to some reviews, but WhiteBIT has its own strengths.

WhiteBIT offers a competitive fee structure and is known for being accessible regardless of your location. This makes it particularly useful if you travel frequently and don’t want region restrictions.

Phemex provides robust trading tools and has earned positive recognition in comparison reviews. Both platforms offer advanced charting capabilities and crypto-to-crypto trading options.

Consider your specific needs:

- Trading frequency

- Geographic considerations

- Fee sensitivity

- User interface preferences

- Security requirements

Remember that cryptocurrency exchanges carry inherent risks. Both platforms use blockchain technology and smart contracts that, while innovative, aren’t immune to potential bugs or exploits.

You might find that using both platforms gives you the best of both worlds. Perhaps use one for certain trading activities and the other for different functions based on their strengths.

The crypto landscape continues to evolve rapidly, so staying flexible with multiple trusted platforms can be a strategic approach to your cryptocurrency activities.