If you’re looking for a new crypto exchange in 2025, Phemex and TruBit Pro are likely on your radar. These platforms offer different features that might appeal to various types of traders.

When comparing Phemex vs TruBit Pro, Phemex stands out as a derivatives trading platform with advanced features like futures and perpetual contracts, while TruBit Pro focuses on being a comprehensive exchange for Latin American users with over 50 cryptocurrency trading pairs.

Both exchanges have their strengths, but your choice should depend on your trading needs. Phemex might be better for experienced traders looking for advanced tools, while TruBit Pro could be more suitable if you want a straightforward platform with good regional support in Latin America.

Phemex vs TruBit Pro Exchange: At A Glance Comparison

Phemex and TruBit Pro are two cryptocurrency exchanges that offer different features and services for traders. Based on recent data, Phemex has an overall score of 6.0, which is higher than TruBit Pro’s rating.

Phemex currently ranks #34 among cryptocurrency exchanges with a 24-hour trading volume of $111,443,334. This positions it as a mid-tier exchange with substantial trading activity.

TruBit Pro, formerly known as Mexo Exchange, underwent a name change on October 3, 2022. This rebranding happened when Mexo joined forces with the TruBit team to enhance their services.

Key Differences:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Overall Score | 6.0 | Lower than Phemex |

| Trading Volume | $111M+ daily | Not specified in results |

| Market Ranking | #34 | Not specified in results |

| Exchange Type | Centralized | Centralized |

When choosing between these platforms, you should consider factors like:

- Fees: Different fee structures affect your trading costs

- Supported cryptocurrencies: The variety of coins available to trade

- Deposit methods: How you can fund your account

- Trading types: What kinds of trades you can execute

Both exchanges have their strengths, and your choice should align with your specific trading needs and preferences.

Phemex vs TruBit Pro Exchange: Trading Markets, Products & Leverage Offered

Phemex and TruBit Pro offer different trading options for cryptocurrency investors. Understanding these differences can help you choose the exchange that best fits your needs.

Trading Markets

Both exchanges support spot trading for various cryptocurrencies. Phemex provides access to major coins like Bitcoin, Ethereum, and numerous altcoins. TruBit Pro also offers a range of cryptocurrency pairs, though it may have fewer options compared to Phemex.

Derivatives Trading

Phemex stands out with its robust derivatives offerings. You can trade futures contracts with up to 100x leverage on Phemex. This high leverage option attracts traders looking for greater exposure with less capital.

Leverage Options

- Phemex: Up to 100x leverage on derivatives

- TruBit Pro: Generally offers lower leverage options

Trading Products Comparison

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Yes | Limited |

| Maximum Leverage | 100x | Lower than Phemex |

| Zero-Fee Options | Available | Limited |

Phemex offers zero-fee trading options which can be attractive if you trade frequently. However, remember that higher leverage carries greater risk of liquidation.

It’s worth noting that Phemex does not serve US residents, which may be a deciding factor depending on your location.

The trading interface on Phemex tends to be more advanced and feature-rich compared to TruBit Pro, potentially making it more suitable for experienced traders.

Phemex vs TruBit Pro Exchange: Supported Cryptocurrencies

When choosing between Phemex and TruBit Pro, the variety of cryptocurrencies available is a key factor to consider. Both exchanges offer a range of digital assets but differ in their selection.

TruBit Pro provides access to over 50 cryptocurrency trading pairs, making it a comprehensive option for traders in Latin America. This exchange focuses on offering popular cryptocurrencies with good regional support.

Phemex, on the other hand, has established itself as a global derivatives exchange with a strong selection of cryptocurrencies. It supports major coins like Bitcoin and Ethereum, along with various altcoins.

Here’s a basic comparison of their cryptocurrency offerings:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Trading Pairs | Many major pairs | 50+ trading pairs |

| Regional Focus | Global | Latin America |

| Spot Trading | Yes | Yes |

| Derivatives | Yes | Limited |

The exchanges differ in how they add new cryptocurrencies to their platforms. Phemex tends to be more selective, while TruBit Pro has focused on expanding its offerings to serve its regional market.

You should check each exchange’s website for the most up-to-date list of supported cryptocurrencies. This is important because available coins can change as new cryptocurrencies gain popularity or existing ones lose support.

Consider your specific trading needs when comparing these exchanges. If you need access to specific altcoins, verify they’re available before creating an account.

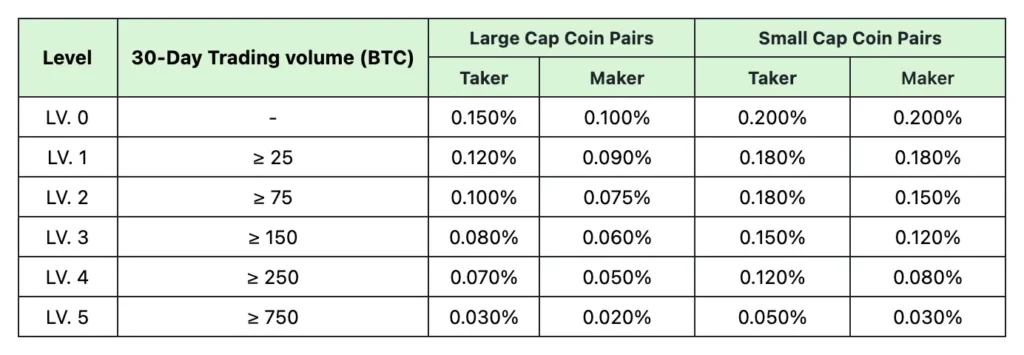

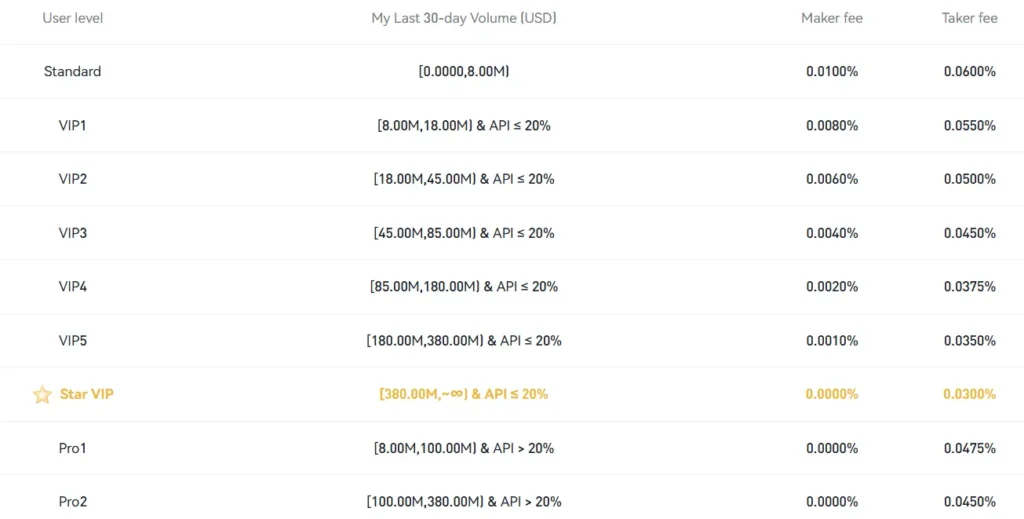

Phemex vs TruBit Pro Exchange: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and TruBit Pro, fees play a crucial role in your decision. Let’s break down how these exchanges compare in terms of costs.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Phemex | Up to 0.40% | Up to 0.40% |

| TruBit | Up to 0.1% | Up to 0.1% |

TruBit offers significantly lower trading fees compared to Phemex. This makes TruBit more cost-effective for frequent traders who want to maximize their profits.

Withdrawal Fees

| Exchange | Withdrawal Fee |

|---|---|

| Phemex | Up to $60 (or 0.0001 BTC) |

| TruBit | 0 |

Phemex charges withdrawal fees that can reach up to $60 depending on the cryptocurrency. TruBit, on the other hand, boasts much lower withdrawal fees.

Deposit Methods

Both exchanges support standard crypto deposits. Phemex offers more payment method options than TruBit, giving you more flexibility when funding your account.

Phemex has recently implemented some fee reductions, including offering 0% withdrawal fees in some cases and trading bots to help optimize your trading strategy.

If you trade frequently, these fee differences can substantially impact your bottom line. TruBit’s lower trading fees make it more attractive for high-volume traders, while Phemex might offer better overall features despite the higher fees.

Phemex vs TruBit Pro Exchange: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in executing your trading strategy. Both Phemex and TruBit Pro offer various order options to meet different trading needs.

Phemex Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Stop-Limit Orders

- One-Cancels-the-Other (OCO)

- Immediate-or-Cancel (IOC)

- Post-Only Orders

Phemex provides advanced trading features that cater to both beginners and experienced traders. Their platform is known for quick order execution, which is essential during volatile market conditions.

TruBit Pro Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Stop-Limit Orders

- Trailing Stop Orders

TruBit Pro emphasizes its “top-tier liquidity” which helps ensure your orders are filled efficiently. Their suite of order types is designed to satisfy traders in various market scenarios.

Both exchanges support the most common order types like market and limit orders. These basic options let you buy or sell crypto at current market prices or set your desired price level.

For risk management, both platforms offer stop orders to help limit potential losses. This is particularly useful in the volatile crypto market where prices can change rapidly.

Phemex seems to edge out with a few more specialized order types, but TruBit Pro focuses on providing strong liquidity for the orders they do support.

Phemex vs TruBit Pro Exchange: KYC Requirements & KYC Limits

Phemex and TruBit Pro have different approaches to Know Your Customer (KYC) requirements. Understanding these differences can help you choose the right platform for your needs.

Phemex requires KYC verification for users who want to access full trading features and withdrawal capabilities. While some crypto-to-crypto transactions can be done without KYC, complete platform access requires verification. KYC-verified users on Phemex benefit from no withdrawal limits.

TruBit Pro offers more flexibility with its tiered KYC approach. General users without KYC verification can still enjoy unlimited access to Spot trading, Grid bot features, and Derivatives trading. This makes TruBit Pro appealing if you prefer minimal identity verification.

For enhanced features on TruBit Pro, Level 1 KYC verification is available, which requires government ID verification. This tiered approach lets you decide how much personal information you’re comfortable sharing.

KYC Comparison at a Glance:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| No-KYC Trading | Limited to crypto-to-crypto | Full access to spot, grid bot, derivatives |

| KYC Requirement | Required for full access | Optional, tiered system |

| Withdrawal Limits | No limits for KYC users | Available even without KYC |

Both exchanges implement KYC to comply with regulations and ensure platform security. Your choice might depend on how much privacy you want to maintain while trading.

Phemex vs TruBit Pro Exchange: Deposits & Withdrawal Options

When comparing Phemex and TruBit Pro, their deposit and withdrawal methods can be a deciding factor for your trading experience.

Phemex supports multiple deposit options including bank transfers, credit/debit cards, and cryptocurrency deposits. They allow deposits in various cryptocurrencies like Bitcoin, Ethereum, and USDT.

TruBit Pro also offers cryptocurrency deposits but has slightly fewer supported coins than Phemex. Both exchanges support major cryptocurrencies for deposits and withdrawals.

For withdrawal options, both platforms provide cryptocurrency withdrawals with varying fees. Phemex typically processes withdrawals within 1-2 hours, while TruBit Pro might take slightly longer during peak times.

Fee comparison:

| Exchange | Deposit Fees | Withdrawal Fees |

|---|---|---|

| Phemex | Free for crypto | Varies by cryptocurrency |

| TruBit Pro | Free for crypto | Slightly higher than Phemex |

Phemex offers higher daily withdrawal limits for verified users compared to TruBit Pro. This makes Phemex more suitable if you need to move larger amounts of funds.

Both exchanges require KYC verification for fiat deposits and higher withdrawal limits. Verification processes are similar on both platforms, taking 1-3 business days to complete.

You’ll find the minimum deposit amounts are lower on Phemex, making it more accessible if you want to start with smaller amounts.

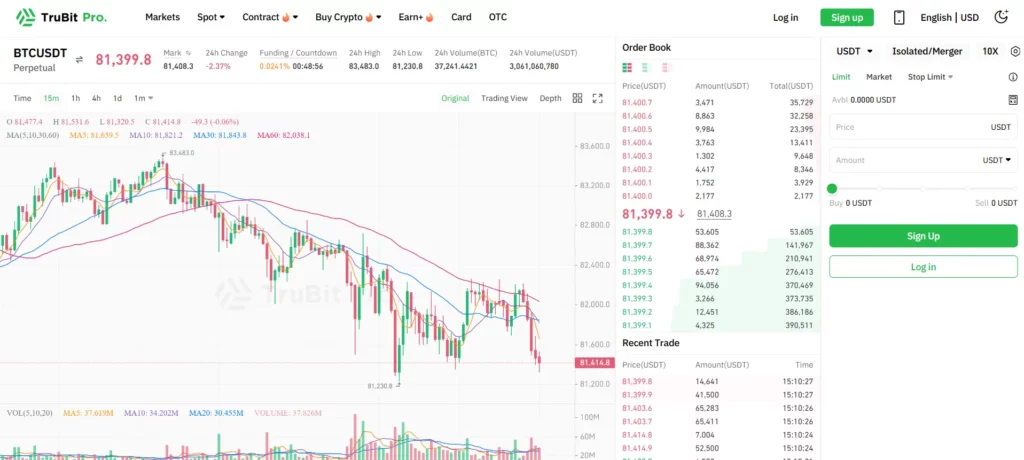

Phemex vs TruBit Pro Exchange: Trading & Platform Experience Comparison

Phemex offers a clean, professional interface that many traders find easy to navigate. The platform supports both spot trading and derivatives, including futures contracts and perpetual contracts with leverage options.

TruBit Pro provides a similar range of trading options but with a slightly different user experience. Based on available information, TruBit’s platform appears to be designed for both beginners and advanced traders.

Trading Features Comparison:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Derivatives | ✓ | ✓ |

| Mobile App | ✓ | ✓ |

| Advanced Charting | ✓ | ✓ |

When you use either platform, you’ll find trading tools like limit orders, market orders, and stop-loss features. Phemex has earned recognition for its fast execution speeds, which can be crucial during volatile market conditions.

Both exchanges offer demo accounts where you can practice trading without risking real money. This is especially helpful if you’re new to cryptocurrency trading.

The mobile experience differs slightly between the two platforms. Phemex’s mobile app maintains most functionality from the desktop version, making it convenient for trading on the go.

Trading fees vary between the platforms. Phemex uses a maker-taker fee model, which rewards users who add liquidity to the exchange. TruBit’s fee structure is competitive but differs in specific rates for various trading pairs.

Phemex vs TruBit Pro Exchange: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges like Phemex and TruBit Pro, understanding the liquidation mechanism is crucial. Liquidation happens when your position can’t meet the margin requirements.

Both Phemex and TruBit Pro have automatic liquidation systems to protect their platforms from excessive losses. These systems monitor your positions continuously and take action when necessary.

Phemex Liquidation Process:

- Uses a tiered liquidation system

- Sends warnings when approaching liquidation levels

- Offers partial liquidation options on some contracts

- Typically uses a liquidation fee of 0.5-1%

TruBit Pro Liquidation Process:

- Features a similar automatic liquidation system

- Provides margin call notifications before full liquidation

- Liquidation price depends on your leverage and initial margin

The main difference lies in how each platform handles the liquidation process. Phemex tends to have more sophisticated risk management tools that may help you avoid complete liquidation in some cases.

Your liquidation price on both platforms is determined by your entry price, leverage amount, and account balance. Higher leverage increases your liquidation risk.

To protect yourself from liquidation on either platform, consider using stop-loss orders, maintaining sufficient margin, and avoiding extremely high leverage positions.

Phemex vs TruBit Pro Exchange: Insurance

When comparing crypto exchanges, insurance protection is a critical factor to consider for your assets’ safety. Both Phemex and TruBit Pro offer different approaches to insurance coverage.

Phemex maintains a dedicated Asset Security Fund designed to protect user assets. This fund acts as an insurance mechanism against potential security breaches or hacks. The exchange allocates a portion of trading fees to continuously strengthen this fund.

TruBit Pro, on the other hand, offers more limited insurance coverage compared to Phemex. Their focus appears to be more on preventative security measures rather than comprehensive insurance solutions.

Insurance Comparison:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| Dedicated Insurance Fund | Yes | Limited |

| Coverage Scope | Trading accounts & wallets | Basic protection |

| Transparency | Regular fund updates | Limited disclosure |

It’s worth noting that neither exchange provides the same level of insurance as regulated traditional financial institutions. Your assets on both platforms may still face certain risks.

For maximum protection, you should consider using hardware wallets for long-term storage of significant crypto holdings. Only keep actively traded assets on these exchanges.

Remember to enable all available security features like two-factor authentication and withdraw limits to further protect your funds regardless of the insurance coverage offered.

Phemex vs TruBit Pro Exchange: Customer Support

When choosing a crypto exchange, reliable customer support can make a big difference in your trading experience. Both Phemex and TruBit Pro offer support options, but they differ in availability and focus.

TruBit Pro takes pride in its Latin America-based customer service team. They provide 24/7 support through both LiveChat and email options. This regional focus may benefit users in Latin American countries who prefer support in their local language and time zone.

Phemex also offers customer support through multiple channels. These typically include live chat, email tickets, and an extensive help center with guides and FAQs. Their support team handles inquiries about account issues, trading problems, and general questions.

Response times can vary between the two exchanges. During busy market periods, you might experience longer wait times on both platforms.

Both exchanges provide educational resources to help with common questions. These self-service options can solve many issues without needing to contact support directly.

Support Channel Comparison:

| Feature | Phemex | TruBit Pro |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Regional Focus | Global | Latin America |

| Language Options | Multiple | Spanish/English focus |

Remember to check recent user reviews about support quality, as this can change over time. The best support experience often depends on your specific needs and location.

Phemex vs TruBit Pro Exchange: Security Features

When you trade cryptocurrency, security should be your top priority. Both Phemex and TruBit Pro offer security features to protect your assets, but they differ in some ways.

Phemex is known for being secure and reliable. It uses cold storage for most user funds, keeping them offline and away from potential hackers. The platform also implements two-factor authentication (2FA) to add an extra layer of protection to your account.

Phemex Security Features:

- Cold wallet storage

- Two-factor authentication

- Regular security audits

- Anti-phishing codes

- IP address monitoring

TruBit Pro, popular in Latin America, also takes security seriously. The exchange describes itself as “complete and reliable” with protection systems in place to guard your cryptocurrency assets.

TruBit Pro Security Features:

- Multi-signature wallets

- 2FA authentication

- SSL encryption

- Anti-DDoS protection

- Regular security updates

Both exchanges have not reported major security breaches, which speaks to their commitment to security. However, Phemex has been in the market longer and has built a stronger reputation for security among global users.

You should enable all available security features when using either platform. This includes setting up strong passwords, activating 2FA, and being careful about phishing attempts.

Neither exchange publicly shares what percentage of funds they keep in cold storage, so you may want to consider keeping large amounts in your own wallet.

Is Phemex A Safe & Legal To Use?

Phemex has built a reputation as a secure and legitimate cryptocurrency exchange in the industry. As of March 2025, it maintains strong security measures to protect user funds and information.

The exchange is KYC-compliant, requiring ID verification from users. This helps prevent fraud and ensures regulatory compliance.

Phemex has never experienced a security breach or hack, which speaks to its robust security infrastructure. This is particularly impressive given the frequency of attacks in the crypto space.

Legal status varies by region. According to the search results, Phemex restricts services in certain areas including Quebec and other parts of Canada. You should verify if Phemex operates legally in your country before signing up.

The platform is regulated, though specific regulatory details may vary based on your jurisdiction. This regulatory oversight adds an extra layer of protection for users.

Key security features include:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

- Insurance fund protection

For most users in supported regions, Phemex provides a safe trading environment with proper security protocols. However, you should always use strong passwords and enable all available security features when using any crypto exchange.

Is TruBit Pro Exchange A Safe & Legal To Use?

TruBit Pro has established itself as a reliable cryptocurrency exchange, particularly in Latin America. According to search results, the platform manages technical functions that have made it one of the most secure exchanges worldwide.

The exchange offers more than 70 cryptocurrency assets and over 60 trading pairs, making it a comprehensive option for traders. TruBit Pro’s emphasis on security has helped build trust among its user base.

Legal Status:

- Not available to US investors

- Primarily focused on Latin American markets

- Complies with regional regulations where it operates

If you’re based in the United States, you cannot legally use TruBit Pro. You’ll need to consider alternative exchanges like Phemex or Kraken, which the search results indicate might have better features.

TruBit implements standard security measures such as two-factor authentication and cold storage for funds. These practices help protect your assets from potential threats.

When comparing TruBit with other exchanges like Phemex, it’s worth noting that Phemex has never experienced a hack throughout its operation as a major centralized exchange. This security track record is an important factor to consider.

Your choice between these exchanges should depend on your location, trading needs, and security preferences. Both platforms offer different strengths, with TruBit being more accessible to Latin American users.

Frequently Asked Questions

Traders considering Phemex and TruBit Pro Exchange often have specific concerns about fees, available products, and platform features. These questions address the most common comparisons between the two cryptocurrency exchanges.

How do the trading fees compare between Phemex and TruBit Pro Exchange?

Phemex generally offers lower trading fees than TruBit Pro Exchange. Phemex implements a maker-taker fee structure with rates starting at 0.1% for spot trading.

TruBit Pro’s fees are slightly higher, typically starting at 0.2% for basic users. Both exchanges offer fee discounts for high-volume traders and those who hold their native tokens.

Phemex provides fee discounts for users who stake their PHX token, while TruBit Pro offers similar benefits for their TRB token holders.

What types of derivatives contracts are available on Phemex and TruBit Pro Exchange?

Phemex offers a wider range of derivatives products compared to TruBit Pro. On Phemex, you can trade perpetual contracts with up to 100x leverage on major cryptocurrencies.

TruBit Pro, which rebranded from Mexo in 2020, focuses primarily on standard futures contracts with more moderate leverage options. Phemex also provides inverse contracts that settle in Bitcoin rather than USD.

Both exchanges support the major cryptocurrency pairs, but Phemex typically lists new derivative products more quickly than TruBit Pro.

Which exchange, Phemex or TruBit Pro, offers better security features to its users?

Phemex has more robust security features than TruBit Pro. Phemex uses cold storage for the majority of user funds and implements multi-signature technology for withdrawals.

TruBit Pro also employs cold storage solutions but has fewer additional security layers than Phemex. Both exchanges offer two-factor authentication (2FA) and anti-phishing protection.

Phemex has never experienced a major security breach, which provides additional confidence to users concerned about the safety of their funds.

Can users from the USA legally trade on Phemex and TruBit Pro Exchange?

Neither Phemex nor TruBit Pro officially supports USA-based traders. Due to regulatory restrictions, both exchanges restrict access to users from the United States.

TruBit Pro has a stronger focus on the Latin American market, with its origins in Mexico. Phemex targets a more global audience but specifically excludes certain jurisdictions including the USA.

Users should always verify the current regulatory status as exchange policies can change based on evolving cryptocurrency regulations.

What are the key differences in user interface and experience between Phemex and TruBit Pro Exchange?

Phemex offers a more advanced and feature-rich trading interface compared to TruBit Pro. The Phemex platform includes customizable charts, multiple order types, and a more sophisticated trading view.

TruBit Pro provides a simpler, more straightforward interface that may be easier for beginners to navigate. Phemex’s mobile app is more highly rated than TruBit Pro’s app in most app stores.

Both platforms support multiple languages, but Phemex typically offers better documentation and learning resources for new traders.

How do Phemex and TruBit Pro Exchange rank in terms of liquidity and trading volume?

Phemex significantly outranks TruBit Pro in terms of liquidity and daily trading volume. Phemex typically processes several billion dollars in daily trading volume across its spot and derivatives markets.

TruBit Pro has considerably lower liquidity, which can result in wider spreads and more slippage when executing large orders. This difference is most noticeable when trading less popular cryptocurrency pairs.

For traders prioritizing tight spreads and minimal price impact, Phemex provides a more liquid trading environment than TruBit Pro.

TruBit Pro Exchange vs Phemex Conclusion: Why Not Use Both?

When comparing these exchanges, it’s clear that both Phemex and TruBit Pro have their strengths. Phemex scores higher overall (6.0) according to comparison sites, but this doesn’t mean TruBit Pro lacks valuable features.

Phemex excels in offering advanced trading features like futures contracts and perpetual contracts. It’s designed with sophisticated traders in mind who need derivative trading options.

TruBit Pro may appeal to different types of traders with its own unique offerings. The exact features that make it stand out aren’t detailed in the search results, but different exchanges often cater to different needs.

Why consider using both platforms:

- Diversified trading options – Access to different trading pairs and features

- Risk management – Spreading assets across multiple platforms

- Fee optimization – Take advantage of lower fees for specific transactions

- Feature access – Use each platform for its strongest features

You might find that Phemex works better for derivative trading while TruBit Pro could offer advantages for other types of transactions.

Many experienced crypto traders maintain accounts on multiple exchanges to capitalize on the best aspects of each. This approach lets you use the most suitable platform for each specific trading need.

As the crypto landscape continues to evolve through 2025, staying flexible with multiple exchange options could be a strategic advantage for your trading activities.