When choosing a crypto trading platform, two names that often come up are Phemex and Poloniex. Both platforms offer various trading options, but they differ in several key areas including fees, available cryptocurrencies, and user experience. Understanding these differences can help you make a better choice for your trading needs.

Comparing Phemex and Poloniex side-by-side reveals important distinctions in their fee structures, deposit methods, supported cryptocurrencies, and trading types that directly impact your trading experience. While Phemex is known for its intuitive trading dashboard with advanced charting tools and technical indicators, Poloniex has its own set of features that might better suit certain traders.

As you look for the right crypto platform in 2025, it’s worth examining both options carefully. Each platform has strengths and weaknesses that may align differently with your trading goals, experience level, and preferred trading style. This comparison will help you understand what each platform offers so you can make an informed decision.

Phemex Vs Poloniex: At A Glance Comparison

Phemex and Poloniex are popular cryptocurrency exchanges with distinct features that may suit different trading needs. Let’s compare them on key aspects to help you decide which platform might work better for you.

Fee Structure:

- Phemex: Known for exceptionally low trading fees

- Poloniex: Competitive but generally higher than Phemex

Trading Tools:

| Feature | Phemex | Poloniex |

|---|---|---|

| Advanced charts | Yes | Yes |

| Mobile app | Yes | Yes |

| Futures trading | Yes | Limited |

Phemex offers powerful trading tools and a user-friendly interface that appeals to both beginners and experienced traders. The platform stands out with its low fee structure and comprehensive futures trading options.

Poloniex has been around longer in the crypto space and offers a wide range of altcoins. The exchange provides solid trading features but may not match Phemex’s advanced tools for technical traders.

Earning Opportunities:

Phemex provides a crypto lending product called “Phemex Earn” that allows you to generate passive income on your holdings. Poloniex also offers staking and interest-earning options, though with different terms and supported coins.

Security:

Both exchanges emphasize security measures, but you should always research their latest security practices and any history of breaches before choosing where to trade.

Your trading volume, preferred cryptocurrencies, and whether you need futures trading should guide your choice between these platforms.

Phemex Vs Poloniex: Trading Markets, Products & Leverage Offered

Both Phemex and Poloniex offer leverage trading up to 100x, giving you powerful tools to maximize your trading potential. This high leverage allows for larger positions with smaller capital.

Phemex stands out with its zero-fee trading options, making it cost-effective for frequent traders. The platform uses a user-oriented approach to develop powerful features that help you buy and sell trust contracts easily.

Poloniex is a well-established exchange operating since the early 2010s. It supports over 350 digital assets, giving you a wide range of trading options.

Leverage Comparison:

| Exchange | Maximum Leverage |

|---|---|

| Phemex | Up to 100x |

| Poloniex | Up to 100x |

Phemex offers a crypto lending product called “Phemex Earn,” which allows you to generate interest on your holdings. This feature provides an additional way to make your crypto work for you beyond just trading.

Both platforms provide crypto futures trading, but their user interfaces and additional tools may differ in complexity and accessibility.

When choosing between these exchanges, consider which trading products match your strategy. Phemex might appeal to you if cost-efficiency is important, while Poloniex could be your choice if you value asset variety and established reputation.

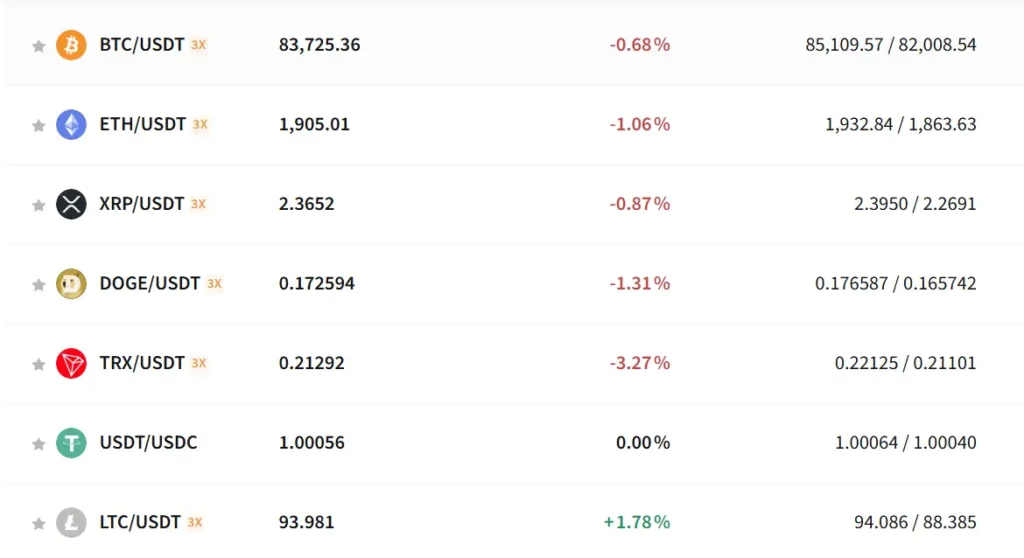

Phemex Vs Poloniex: Supported Cryptocurrencies

When choosing between Phemex and Poloniex, the range of supported cryptocurrencies is an important factor to consider.

Poloniex offers a wider selection of cryptocurrencies compared to Phemex. On Poloniex, you can trade over 100 different cryptocurrencies, making it a good choice if you’re interested in altcoins and newer tokens.

Phemex has a more focused selection, supporting around 40+ cryptocurrencies. While this number is smaller, Phemex includes all the major cryptocurrencies that most traders typically need.

Both exchanges support popular cryptocurrencies such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- XRP

Phemex stands out for its strong focus on futures trading pairs, offering up to 100x leverage on major cryptocurrencies. This makes it particularly attractive if you’re interested in crypto derivatives trading.

Poloniex, with its broader selection, might be more suitable if you want to explore lesser-known cryptocurrencies or emerging projects.

You should check the platforms directly for the most current list of supported cryptocurrencies, as both exchanges regularly update their offerings to include new tokens and remove others based on market conditions and regulatory requirements.

Phemex Vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and Poloniex, understanding their fee structures is essential for maximizing your trading profits.

Trading Fees

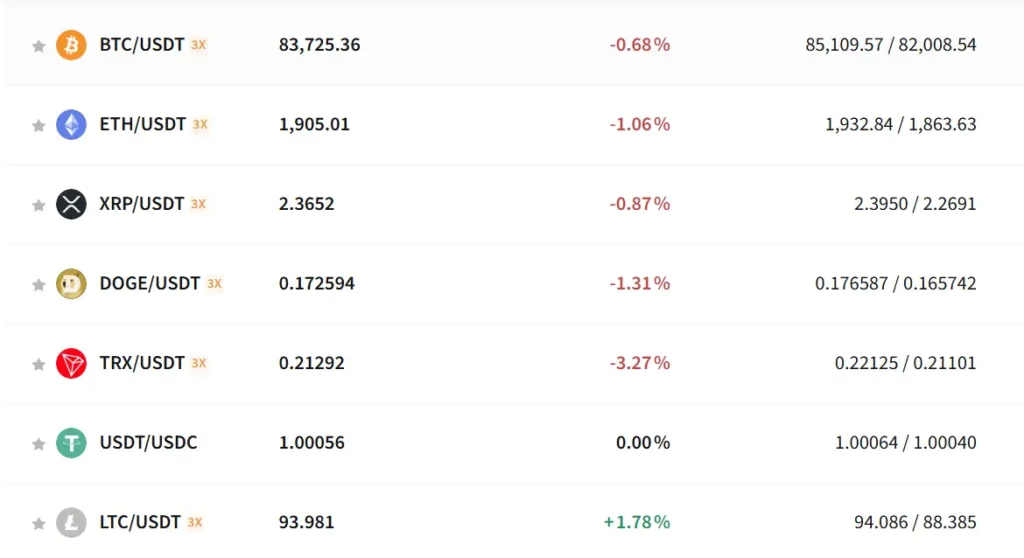

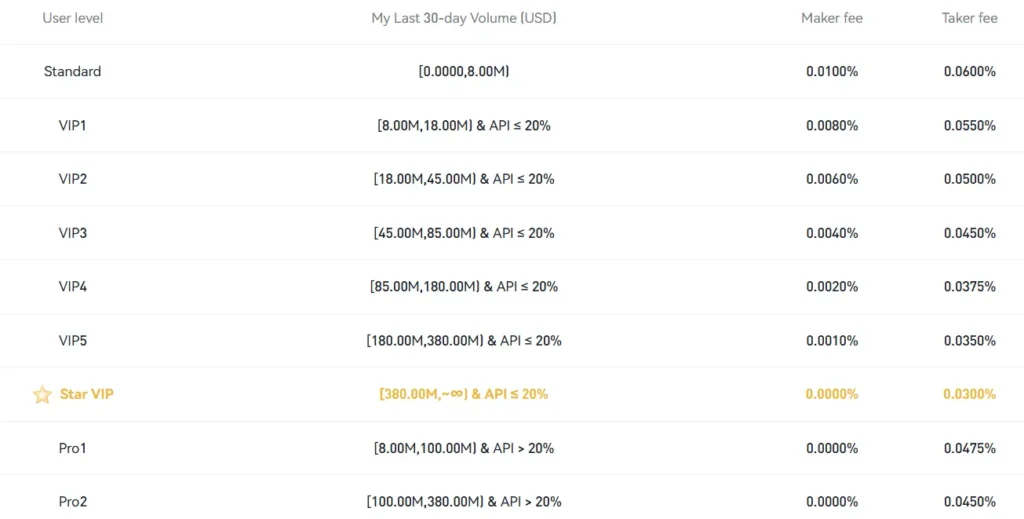

Phemex offers exceptionally low trading fees compared to many exchanges. Their maker-taker fee structure is competitive for frequent traders.

Poloniex starts with a maker fee of 0.145% and a taker fee of 0.155%. You can reduce these fees by increasing your trading volume on the platform.

Both exchanges offer fee discounts based on trading volume, but they structure these discounts differently.

Deposit Fees

Phemex provides flexible deposit terms, which can be advantageous depending on your trading style.

Poloniex generally doesn’t charge for crypto deposits, making it easy to fund your account without extra costs.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. These fees cover the blockchain transaction costs when you move assets off the exchange.

Poloniex’s withdrawal fees are fairly standard in the industry, while Phemex aims to keep these costs competitive.

Fee Comparison Table

| Fee Type | Phemex | Poloniex |

|---|---|---|

| Maker Fee | Low | Starts at 0.145% |

| Taker Fee | Low | Starts at 0.155% |

| Deposit Fee | $0 (crypto) | $0 (crypto) |

| Withdrawal | Varies by coin | Varies by coin |

You should check both platforms for the most current fee information, as exchanges regularly update their fee structures.

Phemex Vs Poloniex: Order Types

When trading on cryptocurrency exchanges, the available order types can greatly impact your trading strategy. Both Phemex and Poloniex offer several order options, but they differ in some key ways.

Phemex provides a comprehensive range of order types divided into basic and advanced categories. You can use market orders, limit orders, and stop orders for standard trading needs.

For more strategic trading, Phemex offers advanced options like conditional orders and trailing stops. These tools help you maximize profit potential while managing risk.

Poloniex also supports common order types including market and limit orders. One standout feature is their trailing stop order, which can automatically adjust your stop price as the market moves in your favor.

Both platforms allow for stop-loss orders to protect your investments from significant downturns. However, Phemex generally offers more sophisticated order options for experienced traders.

Here’s a quick comparison of order types:

| Order Type | Phemex | Poloniex |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop Orders | ✓ | ✓ |

| Trailing Stops | ✓ | ✓ |

| Conditional Orders | ✓ | Limited |

| Advanced Charting Tools | ✓ | Basic |

Phemex’s intuitive trading dashboard includes advanced charting tools and technical indicators that work well with their order types. This makes it easier for you to execute complex strategies.

Phemex Vs Poloniex: KYC Requirements & KYC Limits

When trading cryptocurrency, understanding KYC (Know Your Customer) requirements is essential for a smooth experience. Both Phemex and Poloniex have different approaches to identity verification that affect your trading capabilities.

Phemex KYC Policy:

- KYC is optional for basic accounts

- No verification needed for basic crypto trading

- Higher withdrawal limits available for verified users

Phemex allows you to trade without completing KYC verification, making it attractive if you value privacy. However, your trading features and withdrawal limits will be restricted without verification.

Poloniex KYC Policy:

- KYC verification recommended for full platform access

- Approximately 400K active users

- Enhanced features and higher limits for verified accounts

Poloniex requires KYC verification to access increased limits and additional platform features. The exchange stores most user funds offline for added security.

Comparison of KYC Limits:

| Feature | Phemex (Unverified) | Phemex (Verified) | Poloniex (Unverified) | Poloniex (Verified) |

|---|---|---|---|---|

| Withdrawal Limits | Restricted | Higher limits | Very limited | Increased limits |

| Trading Features | Basic access | Full access | Basic access | Full access |

| Fiat Transactions | Limited | Available | Limited | Available |

Both platforms follow standard industry verification processes, requiring documents like government ID and proof of address for complete verification.

Phemex Vs Poloniex: Deposits & Withdrawal Options

When choosing between Phemex and Poloniex, deposit and withdrawal options are important factors to consider. Both platforms offer various methods to fund your account and withdraw your assets.

Deposit Methods

- Phemex: Supports cryptocurrency deposits, bank transfers, and credit/debit card payments through third-party providers.

- Poloniex: Primarily accepts cryptocurrency deposits only, with limited fiat options.

Phemex gives you more flexibility for adding funds, especially if you prefer using traditional payment methods. Poloniex focuses mainly on crypto-to-crypto transactions.

Withdrawal Options

- Phemex: Allows crypto withdrawals and fiat withdrawals via bank transfers in supported regions.

- Poloniex: Primarily offers cryptocurrency withdrawals to external wallets.

Processing Times

| Platform | Crypto Deposits | Crypto Withdrawals | Fiat Processing |

|---|---|---|---|

| Phemex | Quick (minutes) | 1-2 hours typically | 1-3 business days |

| Poloniex | Quick (minutes) | Can take longer | Limited options |

Both exchanges implement security measures like withdrawal confirmations and KYC verification for larger transactions. This helps protect your funds but might add processing time.

Phemex generally offers lower withdrawal fees for most cryptocurrencies compared to Poloniex. However, fees can vary based on the specific cryptocurrency and network congestion.

Phemex Vs Poloniex: Trading & Platform Experience Comparison

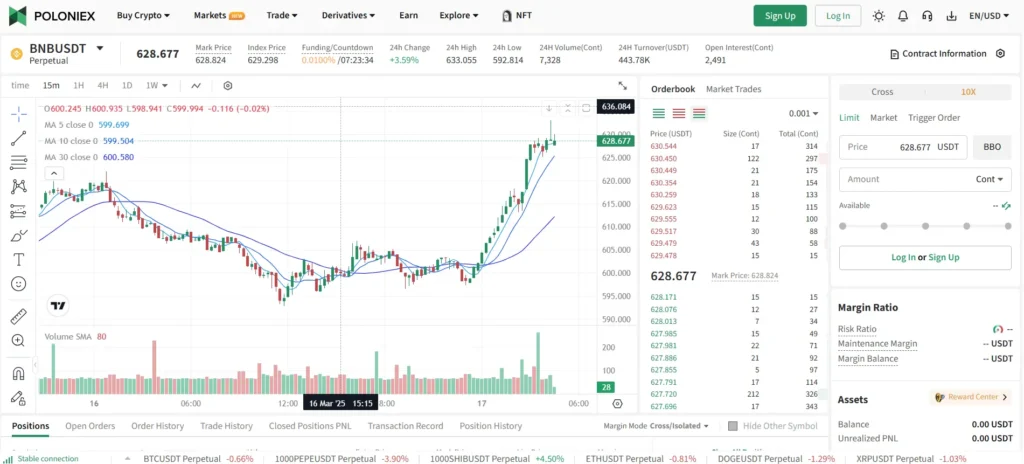

When comparing Phemex and Poloniex, both platforms offer unique trading experiences with different strengths.

Phemex stands out with its exceptionally low fees and zero-fee trading options. The platform provides powerful trading tools that help you execute trades efficiently.

Poloniex, being a well-established exchange, offers a familiar interface that many experienced traders appreciate. Both exchanges support leverage trading up to 100x, giving you flexibility for advanced trading strategies.

User Interface Comparison:

- Phemex: Clean, modern interface with intuitive navigation

- Poloniex: Traditional exchange layout that experienced traders find familiar

Trading Features:

| Feature | Phemex | Poloniex |

|---|---|---|

| Max Leverage | 100x | 100x |

| Fee Structure | Extremely low, zero-fee options | Standard competitive rates |

| Mobile App | User-friendly, comprehensive | Functional, straightforward |

| Trading Tools | Advanced charting, risk management | Solid analysis tools, good for altcoins |

Phemex includes a crypto lending product called “Phemex Earn,” allowing you to generate passive income on your holdings.

Poloniex has a longer history in the crypto space, which may provide more stability and established trading pairs for your needs.

The choice between these platforms will depend on your specific trading priorities. If you value low fees and modern tools, Phemex might be your better option. If you prefer established reputation and familiar interfaces, Poloniex could be more suitable.

Phemex Vs Poloniex: Liquidation Mechanism

Both Phemex and Poloniex offer leverage trading options up to 100x, but their liquidation mechanisms have some key differences that traders should understand.

Phemex uses a tiered liquidation system that aims to protect traders from complete loss. When your position approaches the liquidation price, Phemex first issues warnings through email or app notifications.

Poloniex employs a more traditional liquidation approach. Your position will be automatically closed when your margin ratio falls below the maintenance margin requirement, which helps prevent negative balances.

Liquidation Prices Calculation:

| Exchange | Calculation Method | Partial Liquidation | Warning System |

|---|---|---|---|

| Phemex | Progressive tiers based on leverage | Yes | Yes – multiple alerts |

| Poloniex | Fixed threshold based on maintenance margin | No | Limited alerts |

Phemex offers a partial liquidation feature that reduces your position size instead of closing it completely. This can help you stay in promising trades even during temporary market volatility.

Poloniex tends to liquidate positions entirely once they hit the threshold. This approach is more straightforward but offers less flexibility during market fluctuations.

Both platforms provide liquidation calculators to help you determine risk levels before entering trades. You should use these tools to set appropriate stop-loss orders.

Risk management is crucial on both platforms. You should carefully consider your leverage levels and position sizes to avoid unexpected liquidations during volatile market conditions.

Phemex Vs Poloniex: Insurance

When choosing between Phemex and Poloniex, understanding their insurance policies is crucial for your funds’ safety.

Phemex offers a Secure Asset Fund for Users (SAFU) to protect against potential losses from security breaches. This insurance fund sets aside a portion of trading fees to cover unexpected losses.

Poloniex also maintains an insurance fund, primarily focused on covering liquidation losses in margin trading. However, their specific coverage details aren’t as prominently advertised as Phemex’s.

Both exchanges implement cold storage solutions for most user assets. This means your crypto is kept offline, away from potential online threats.

Insurance Coverage Comparison:

| Feature | Phemex | Poloniex |

|---|---|---|

| Insurance Fund | SAFU fund | Trading insurance fund |

| Primary Purpose | Security breaches | Liquidation losses |

| Cold Storage | Yes | Yes |

| Transparency | More detailed reporting | Limited public information |

Neither exchange offers full insurance coverage like traditional financial institutions. Your funds might not be completely protected in case of major hacks or security failures.

It’s worth noting that both platforms regularly update their security measures to prevent issues before they happen. This proactive approach helps reduce the need to use insurance funds.

Before depositing large amounts, you should review each platform’s current insurance terms as these policies can change over time.

Phemex Vs Poloniex: Customer Support

When choosing between Phemex and Poloniex, customer support can make a big difference in your trading experience. Both exchanges offer several ways to get help, but they differ in quality and response times.

Phemex provides 24/7 customer support through live chat, email, and a comprehensive help center. Many users report quick response times, usually within a few hours for email inquiries and minutes for live chat.

Poloniex also offers 24/7 support through similar channels including email tickets and a knowledge base. However, some users have reported longer wait times during peak periods.

Support Channels Comparison:

| Feature | Phemex | Poloniex |

|---|---|---|

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Help Center | Comprehensive | Basic |

| Response Time | Generally faster | Can be slower |

| Community Forum | Active | Available |

Both exchanges offer multilingual support, which is helpful if English isn’t your first language.

Phemex has gained a reputation for more personalized support, with representatives often following up on resolved issues to ensure user satisfaction.

Poloniex’s support team handles a large volume of requests, which sometimes leads to delayed responses. However, they do provide detailed solutions once they respond.

For new crypto traders, Phemex’s customer service seems more beginner-friendly with clearer explanations and guides available through their support channels.

Phemex Vs Poloniex: Security Features

When choosing between Phemex and Poloniex, security should be at the top of your priority list. Both exchanges have implemented various security measures to protect your assets.

Phemex uses cold storage to keep most user funds offline and away from potential hackers. They also employ multi-signature technology for withdrawals, which adds an extra layer of protection.

Poloniex also utilizes cold storage systems and has implemented two-factor authentication (2FA) to secure user accounts. This helps protect your account even if your password is compromised.

Both platforms offer KYC (Know Your Customer) verification. On Phemex, it’s required for higher trading limits. Poloniex makes KYC optional for smaller accounts but offers increased limits for verified users.

Key Security Features Comparison:

| Feature | Phemex | Poloniex |

|---|---|---|

| Cold Storage | Yes | Yes |

| 2FA | Yes | Yes |

| KYC | Required for higher limits | Optional for small accounts |

| Multi-signature | Yes | Yes |

| Insurance Fund | Yes | Limited |

Phemex has built a reputation for security with no major hacks reported to date. Their platform includes additional security features like anti-phishing codes and withdrawal address management.

Poloniex had a security breach in 2014 but has significantly strengthened its security protocols since then. They now implement regular security audits and have improved their internal controls.

You should consider enabling all available security features regardless of which platform you choose. This includes setting strong passwords, activating 2FA, and being cautious with phishing attempts.

Is Phemex A Safe & Legal To Use?

Phemex is considered a safe and legal cryptocurrency exchange for most users. As a centralized exchange, it has built a strong reputation for security and has never experienced a successful hack, making it trustworthy for your crypto assets.

The platform implements standard security features like two-factor authentication (2FA) and cold wallet storage to protect your funds. These measures help keep your investments secure from potential threats.

Phemex operates legally in many countries, though regulations vary by location. You should verify that cryptocurrency exchanges are permitted in your region before using the platform.

The exchange follows Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to maintain compliance with financial regulations. This means you’ll need to verify your identity for certain transaction levels.

Key Security Features:

- Never been successfully hacked

- Two-factor authentication

- Cold wallet storage for majority of funds

- KYC/AML compliance

User reviews generally confirm Phemex’s reliability and security measures. The platform continues to be recognized as one of the trustworthy options in the cryptocurrency exchange market as of 2025.

Remember that all cryptocurrency investments carry inherent risks, regardless of the exchange’s security measures. You should always use strong passwords and enable all available security features when using Phemex.

Is Poloniex A Safe & Legal To Use?

Poloniex has been operating in the cryptocurrency exchange market since 2014, establishing a reasonable track record of stability. This nearly decade-long experience suggests some level of reliability in the crypto space.

Security-wise, Poloniex has faced challenges. The exchange experienced a security breach in the past, but has since improved its security measures. It now ranks among the more secure cryptocurrency exchanges, comparable to platforms like Binance.

Legal status varies by location. The most important restriction to note is that Poloniex does not allow users from the United States to open accounts or conduct any financial activities on the platform.

If you’ve been using Poloniex, be aware that some users have reported issues with customer support. According to search results, there have been complaints about account access problems and difficulty resolving disputes.

When comparing with Phemex, Poloniex offers a wider selection of cryptocurrencies. This might be beneficial if you’re looking to trade less common digital assets.

Important considerations for Poloniex users:

- Not available for US residents

- Has experienced security incidents in the past

- Offers a large variety of cryptocurrencies

- Some users have reported customer service concerns

Always use two-factor authentication and strong passwords with any exchange to enhance your security.

Frequently Asked Questions

Traders often have specific questions when comparing cryptocurrency exchanges like Phemex and Poloniex. These platforms differ in several key aspects including security measures, fee structures, and available features.

How do Phemex and Poloniex compare in terms of security features?

Both exchanges prioritize security but implement different approaches. Phemex utilizes cold storage solutions for most user assets and has never experienced a major security breach.

Poloniex employs two-factor authentication (2FA) and stores the majority of funds in offline cold wallets. However, Poloniex has faced security incidents in the past, including a hack in 2014.

You should enable all available security features regardless of which platform you choose. This includes setting up 2FA, using strong passwords, and being cautious with withdrawal addresses.

What are the differences in trading fees between Phemex and Poloniex?

Phemex typically offers lower spot trading fees starting at 0.1% for makers and takers. Their fee structure rewards higher trading volumes with reduced rates.

Poloniex has a slightly higher fee structure with standard rates around 0.155% for takers and 0.055% for makers. Both exchanges offer fee discounts for users who hold their native tokens or maintain high trading volumes.

You’ll find that Phemex tends to be more competitive for futures trading, while Poloniex may offer better rates for certain spot trading pairs.

Can users from all countries use both Phemex and Poloniex?

Neither exchange is available worldwide. Phemex restricts access from several jurisdictions including the United States, Singapore, and countries under international sanctions.

Poloniex also blocks users from the United States, Cuba, Iran, North Korea, and other sanctioned regions. Regulatory requirements continue to change, so you should check the current status for your location.

Always verify the legal status of any exchange in your country before registering and depositing funds.

What range of cryptocurrencies can be traded on Phemex versus Poloniex?

Poloniex offers a wider selection of cryptocurrencies with over 100 different tokens and altcoins. They’re known for listing emerging projects and smaller-cap coins.

Phemex focuses more on established cryptocurrencies and offers fewer total coins. However, Phemex provides more robust options for derivatives trading, including perpetual contracts with leverage.

You’ll find major cryptocurrencies like Bitcoin and Ethereum on both platforms, but the availability of specific altcoins varies significantly.

How do user experiences differ when using Phemex compared to Poloniex?

Phemex offers a more modern and intuitive interface that appeals to both beginners and advanced traders. Their mobile app receives higher ratings than Poloniex’s app.

Poloniex has a functional but somewhat dated interface. Long-term users appreciate its familiar layout, but new users often report a steeper learning curve.

You’ll find that Phemex typically provides faster customer support response times. Both platforms offer knowledge bases and tutorial sections, but Phemex’s educational resources are generally more comprehensive.

What are the unique features that distinguish Phemex from Poloniex?

Phemex stands out with its earn products, allowing you to stake cryptocurrencies for passive income. They also offer a demo trading account for practice without risking real funds.

Poloniex distinguishes itself with its margin trading options and crypto lending marketplace. Their platform allows you to lend your crypto assets to other users and earn interest.

You might prefer Phemex if futures trading is important to you, as they offer up to 100x leverage on certain contracts. Poloniex excels if you’re interested in trading a wide variety of altcoins not available on other exchanges.

Poloniex Vs Phemex Conclusion: Why Not Use Both?

When deciding between Poloniex and Phemex, you don’t necessarily have to choose just one platform. Both exchanges offer unique benefits that might serve different aspects of your trading strategy.

Poloniex has a higher overall score of 6.0 compared to Phemex, according to recent comparisons. It has been around longer in the crypto space, which might give you more confidence in its stability.

Phemex, on the other hand, stands out with its exceptionally low fees and powerful trading tools. It also offers Phemex Earn, a crypto lending product that could help diversify your crypto income streams.

For security, Phemex uses cold storage to keep most funds offline, which reduces online risks. This is an important feature if security is your top priority.

You might consider using Poloniex for its wider range of cryptocurrencies and established reputation, while using Phemex for leverage trading and earning interest on your holdings.

Many experienced traders use multiple exchanges to take advantage of different fee structures, trading pairs, and features. This approach helps you avoid putting all your crypto assets in one place.

Before creating accounts on both platforms, make sure to compare their availability in your region and their compliance with local regulations. Also check their withdrawal fees and limits, as these can affect your overall trading costs.