Choosing the right cryptocurrency exchange can make a big difference in your trading journey. Phemex and OKX are two popular platforms that offer various features for crypto traders in 2025. Both exchanges provide similar services, but they differ in important ways that might affect your decision.

When comparing Phemex vs OKX, you’ll find differences in their fee structures, available cryptocurrencies, trading options, and user experience that could impact your trading success. These platforms have evolved significantly since their launch, with each developing unique strengths that appeal to different types of traders.

Whether you’re new to cryptocurrency trading or an experienced investor looking for a change, understanding what each platform offers is crucial. This comparison will help you determine which exchange better suits your trading style, financial goals, and technical preferences.

Phemex Vs OKX: At A Glance Comparison

When choosing between Phemex and OKX, it’s helpful to see how they stack up against each other. Both are popular cryptocurrency exchanges, but they have key differences.

Overall Rating:

- OKX: 7.8/10

- Phemex: Slightly lower overall score

Key Features Comparison:

| Feature | OKX | Phemex |

|---|---|---|

| Trading Options | Spot, futures, options, margin | Spot, futures, margin |

| User Interface | Comprehensive but complex | Simple, beginner-friendly |

| Mobile App | Full-featured | Streamlined |

| Security | High security standards | Strong security measures |

| Fee Structure | Competitive, tiered | Low fees, simple structure |

Trading Experience:

OKX offers a more extensive range of trading options and tools. You’ll find it suitable if you’re an advanced trader looking for variety.

Phemex provides a cleaner interface that you might prefer if you’re newer to crypto trading. Its platform is easier to navigate.

Accessibility:

Both platforms are available in multiple countries, but OKX has a wider global reach. You should check if either exchange operates in your region.

Customer Support:

OKX and Phemex both offer 24/7 customer support through various channels. Response times can vary based on user volume and issue complexity.

Mobile Trading:

You can use both exchanges on mobile devices. OKX’s app includes more features, while Phemex focuses on essential functions with less clutter.

Phemex Vs OKX: Trading Markets, Products & Leverage Offered

Both Phemex and OKX offer a variety of trading options for crypto enthusiasts in 2025. Let’s examine what each platform provides in terms of markets, products, and leverage capabilities.

Leverage Options:

- OKX: Offers up to 100x leverage for bitcoin and crypto trading

- Phemex: Also provides up to 100x leverage trading options

Trading Products:

| Feature | OKX | Phemex |

|---|---|---|

| Spot Trading | Yes (extensive markets) | Yes |

| Futures | Yes | Yes |

| Options | Yes | Limited |

| Margin Trading | Yes | Yes |

OKX is particularly known for its robust spot trading markets. You can access a wide range of cryptocurrencies and trading pairs through their platform.

Phemex stands out with its user-friendly mobile app, making it ideal if you prefer trading on the go. The platform also offers fast fiat deposit options to quickly fund your trading activities.

Both exchanges support various order types including limit, market, and stop orders. You can use these to implement different trading strategies based on your risk tolerance.

When selecting between these platforms, consider which specific markets you plan to trade in. OKX might offer more extensive options for experienced traders, while Phemex provides a more streamlined experience.

The availability of 100x leverage on both platforms gives you flexibility for amplified trading positions, though remember this also increases potential risks.

Phemex Vs OKX: Supported Cryptocurrencies

When choosing between Phemex and OKX, the variety of supported cryptocurrencies is an important factor to consider. Both platforms offer a wide range of digital assets, but there are some differences worth noting.

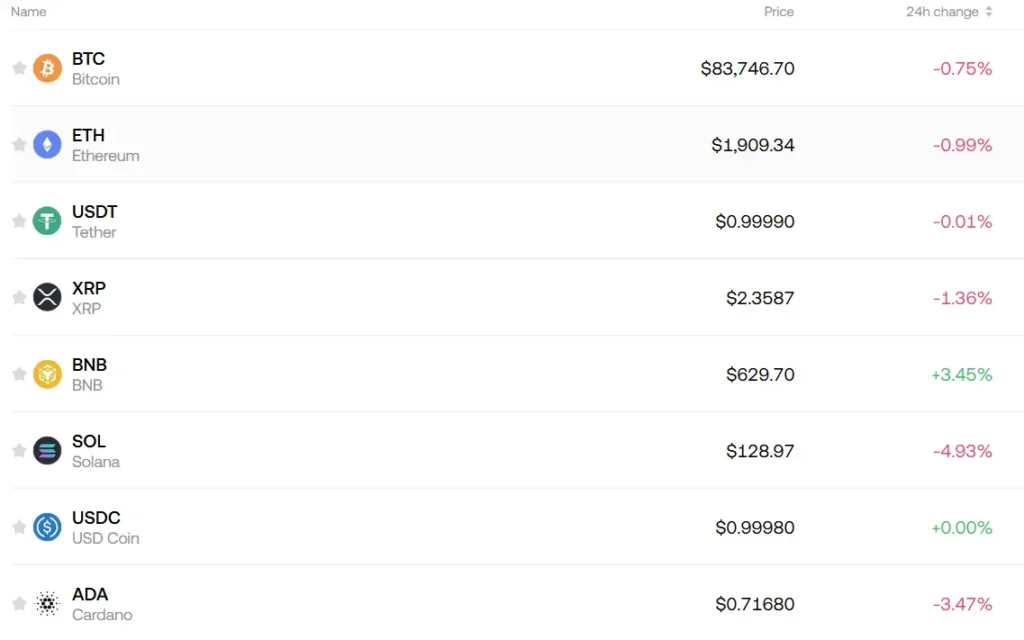

OKX currently supports over 350 cryptocurrencies for trading. This extensive selection includes major coins like Bitcoin and Ethereum, as well as a variety of altcoins, DeFi tokens, and newer projects.

Phemex offers fewer cryptocurrencies, with approximately 150+ supported assets. While this is less than OKX, Phemex still covers all the major cryptocurrencies that most traders typically use.

Key Cryptocurrencies Supported by Both:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Ripple (XRP)

- Dogecoin (DOGE)

OKX has an advantage if you’re looking to trade more obscure altcoins or newer token projects. Their listing process tends to add new cryptocurrencies more frequently.

For most average traders, both platforms will likely satisfy your needs since they cover all major cryptocurrencies and popular altcoins. However, if you’re interested in trading a specific, less common token, you should check both platforms to ensure it’s available.

The quality of trading pairs also matters. OKX offers more trading pairs overall, giving you more flexibility in how you trade your assets.

Phemex Vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

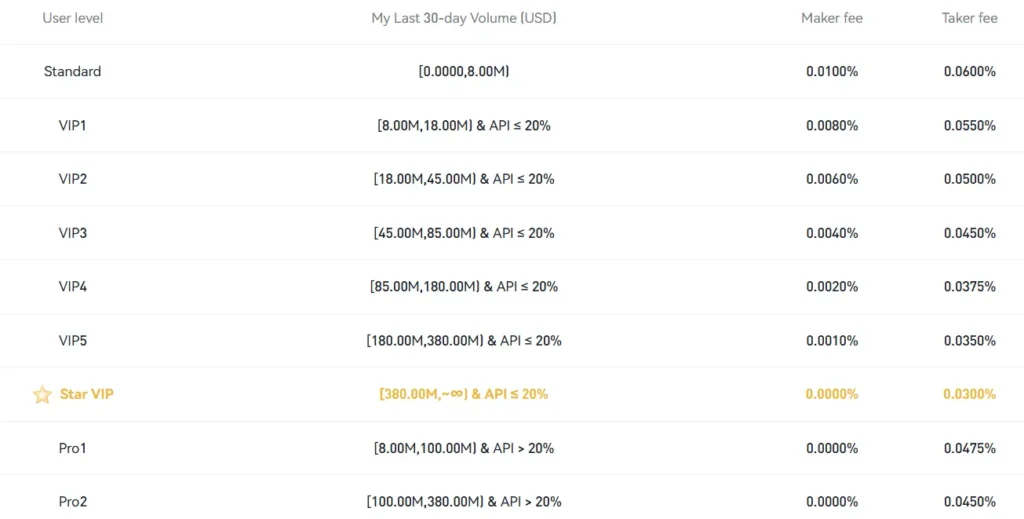

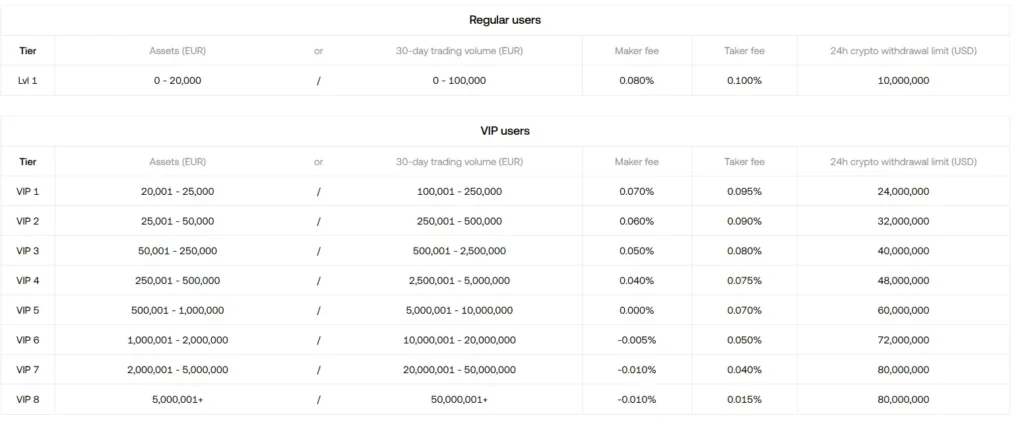

When choosing between Phemex and OKX, fees play a crucial role in your decision. Both exchanges offer competitive fee structures, but there are notable differences.

Phemex offers lower trading fees with a base rate of 0.01% for makers. This is more competitive than OKX’s standard rates which typically start higher.

OKX operates on a tiered fee structure based on your 30-day trading volume and asset holdings. Their fees range from 0.08% to -0.01% for makers, while taker fees start at 0.10%.

Trading Fee Comparison:

| Exchange | Maker Fee (Base) | Taker Fee (Base) |

|---|---|---|

| Phemex | 0.01% | 0.06% |

| OKX | 0.08% | 0.10% |

Both platforms offer fee discounts for high-volume traders. Holding each platform’s native tokens can also reduce your trading costs.

For deposits, both exchanges typically offer free options for most cryptocurrencies. However, fiat deposits may incur charges depending on your payment method.

Withdrawal fees vary by cryptocurrency on both platforms. OKX tends to adjust withdrawal fees based on network congestion, while Phemex maintains more consistent rates.

You should consider your trading style before deciding. If you’re a high-frequency trader, Phemex’s lower base rates might save you money. For higher-volume traders, OKX’s tiered discount system could be more beneficial in the long run.

Phemex Vs OKX: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is crucial for executing your strategy effectively. Both Phemex and OKX offer a variety of order types to meet different trading needs.

Phemex provides the standard market, limit, and stop orders that most traders are familiar with. You can place limit orders to buy or sell at specific prices and market orders for immediate execution at current market prices.

OKX offers these basic order types too, but also includes advanced options like trailing stops and iceberg orders. These additional tools give you more control over your trading strategy.

Common Order Types on Both Platforms:

- Market orders

- Limit orders

- Stop-limit orders

- Take-profit orders

OKX Exclusive Order Types:

- Iceberg orders (for large trades without market impact)

- Trailing stop orders

- OCO (One-Cancels-the-Other)

Phemex shines with its user-friendly interface that makes placing orders straightforward for beginners. The platform displays clear confirmations before executing trades.

OKX’s order system is more complex but offers greater flexibility for advanced trading strategies. You can set more detailed conditions for your trades.

Both platforms support conditional orders for futures trading, allowing you to set triggers based on price movements.

For new traders, Phemex’s simpler order system might be easier to navigate. Experienced traders may prefer OKX’s comprehensive suite of order types for precise trade execution.

Phemex Vs OKX: KYC Requirements & KYC Limits

Phemex and OKX differ significantly in their approach to KYC (Know Your Customer) requirements. If you’re concerned about privacy and verification processes, these differences might influence your choice.

Phemex KYC Requirements:

- Does not strictly require KYC verification for basic trading

- You can trade without completing identity verification

- Some features and higher withdrawal limits may require verification

Phemex’s no-KYC option makes it attractive if you prefer to maintain privacy while trading. This policy allows you to start trading immediately without submitting personal documents.

OKX KYC Requirements:

- Implements a tiered KYC system

- Basic trading requires at least minimal verification

- Higher trading volumes and full platform access need complete verification

When trading on OKX, you’ll need to complete some level of verification even for basic functions. This follows more traditional financial security protocols.

Withdrawal Limits:

| Exchange | No KYC Limit | Basic KYC | Full KYC |

|---|---|---|---|

| Phemex | Limited | Increased | Highest |

| OKX | Not available | Moderate | Highest |

Remember that cryptocurrency regulations continue to evolve globally. Both platforms may adjust their KYC policies to comply with changing regulations in different jurisdictions.

Consider your privacy preferences and trading needs when choosing between these platforms based on their KYC requirements.

Phemex Vs OKX: Deposits & Withdrawal Options

Both Phemex and OKX offer multiple ways to deposit and withdraw funds, but they differ in some important aspects.

Deposit Methods:

Phemex allows crypto deposits with no minimum deposit requirement. You can transfer your existing cryptocurrencies directly to your Phemex wallet.

OKX supports both crypto deposits and fiat options. You can deposit using bank transfers, credit/debit cards, and third-party payment processors like Apple Pay in some regions.

Withdrawal Options:

| Feature | Phemex | OKX |

|---|---|---|

| Crypto withdrawals | Yes | Yes |

| Fiat withdrawals | Limited | More extensive |

| Withdrawal fees | Varies by crypto | Varies by crypto |

| Processing time | 2-24 hours | 1-24 hours |

Phemex charges network fees for withdrawals based on blockchain congestion. The exact fee depends on which cryptocurrency you’re withdrawing.

OKX withdrawal fees also vary by cryptocurrency but tend to be competitive with industry standards. They occasionally offer fee discounts during promotions.

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication (2FA). You’ll need to verify your identity before making withdrawals above certain limits.

For new traders, OKX might offer more flexibility with its fiat options. However, if you’re primarily dealing with crypto-to-crypto transactions, both platforms provide similar functionality.

Processing times can vary based on network congestion, especially during high market activity periods. Most withdrawals process within 24 hours on both platforms.

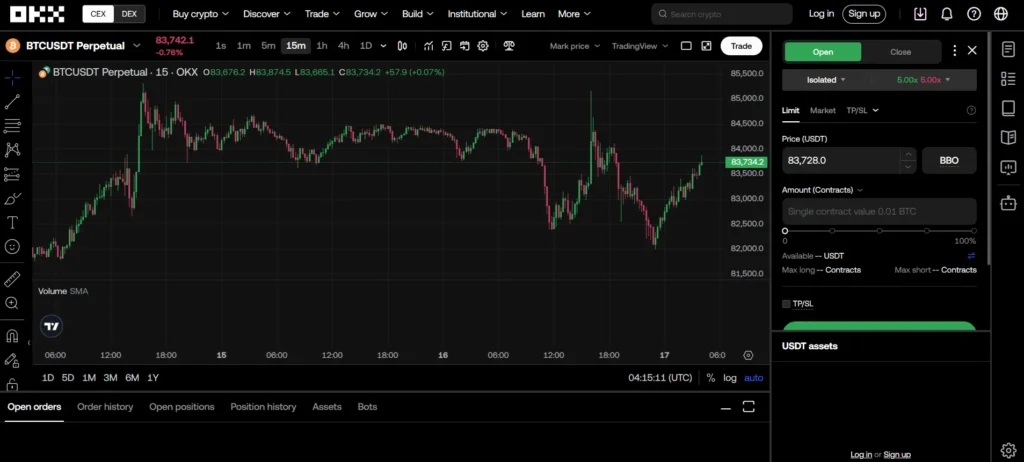

Phemex Vs OKX: Trading & Platform Experience Comparison

When choosing between Phemex and OKX, the trading experience and platform usability are key factors to consider.

User Interface

Phemex offers a clean, intuitive interface that beginners find easy to navigate. OKX features a more comprehensive dashboard with advanced charting tools that experienced traders appreciate.

Trading Options

Both platforms support spot and derivatives trading, but they differ in specific offerings:

| Feature | Phemex | OKX |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures | Yes | Yes |

| Options | Limited | Extensive |

| Margin Trading | Up to 100x | Up to 125x |

Mobile Experience

You’ll find both platforms offer mobile apps for iOS and Android. OKX’s app includes more features, while Phemex’s app focuses on simplicity and speed.

Order Types

Both platforms support basic order types like market, limit, and stop orders. OKX provides more advanced order types including OCO (One-Cancels-the-Other) orders.

Platform Speed

Phemex prides itself on fast execution speeds with its matching engine processing up to 300,000 transactions per second. OKX also offers robust performance but may experience more congestion during peak trading times.

Demo Accounts

You can try both platforms risk-free. Phemex offers a demo account with $100,000 in virtual funds, while OKX provides a similar practice environment for testing strategies.

Phemex Vs OKX: Liquidation Mechanism

Liquidation happens when your position can’t maintain the required margin level. Both Phemex and OKX have systems to handle this, but they work differently.

Phemex uses a tiered liquidation mechanism. When your margin ratio falls below maintenance requirements, Phemex first sends warnings. If you don’t add funds, they gradually reduce your position size instead of closing everything at once.

OKX employs a more traditional approach. They use an insurance fund to manage liquidations and prevent negative balances. When your position risks falling below maintenance margin, OKX will liquidate it entirely.

Liquidation Thresholds:

| Exchange | Initial Margin | Maintenance Margin |

|---|---|---|

| Phemex | 1-10% (varies) | 0.5-3% (varies) |

| OKX | 1-20% (varies) | 0.5-10% (varies) |

Phemex offers partial liquidation, which helps you keep some of your position during market volatility. This can be valuable for preserving part of your investment during unexpected price swings.

OKX provides position insurance for some contracts, letting you pay a premium to protect against liquidation risks.

Both platforms have liquidation price calculators to help you understand risks. You can use these tools to determine how much price movement your position can withstand before facing liquidation.

Remember to set stop-loss orders on both platforms to prevent unexpected liquidations. This helps manage your risk before the exchange’s automatic systems take over.

Phemex Vs OKX: Insurance

When choosing a crypto exchange, protection against potential losses is crucial. Both Phemex and OKX offer insurance funds to safeguard user assets, but they differ in important ways.

Phemex maintains an insurance fund that primarily covers losses from liquidations in their futures trading platform. This fund helps ensure that winning traders receive their profits even if losing traders cannot cover their losses.

OKX also operates an insurance fund, but with broader coverage. Their fund protects against both liquidation losses and potential security breaches. As of March 2025, OKX’s insurance fund is significantly larger than Phemex’s due to their bigger market share.

Key Insurance Differences:

| Feature | Phemex | OKX |

|---|---|---|

| Insurance Fund Size | Smaller | Larger |

| Coverage Scope | Mainly liquidations | Liquidations and security |

| Transparency | Regular reports | Regular reports with more detail |

| User Protection Level | Good | Excellent |

Neither exchange offers FDIC-like insurance that you might find with traditional banks. Your crypto assets aren’t protected against all forms of loss.

You should note that OKX publishes more detailed information about their insurance fund activities and balance. This transparency gives you better insight into how well protected your assets might be.

For extra security, both exchanges recommend using their security features like two-factor authentication and withdrawal limits regardless of insurance protections.

Phemex Vs OKX: Customer Support

When choosing between Phemex and OKX, customer support can be a deciding factor. Both platforms offer multiple ways to get help, but there are some differences worth noting.

Phemex Support Options:

- 24/7 live chat

- Email ticket system

- Comprehensive help center

- Active community forums

OKX Support Options:

- 24/7 chat support

- Email support

- Knowledge base articles

- Social media assistance

Response times for both platforms vary depending on the issue complexity. Phemex typically responds to basic inquiries within minutes through live chat. OKX also offers quick responses, but during peak times you might wait longer.

The quality of support differs slightly too. Phemex agents are known for their technical knowledge and ability to solve complex trading problems. OKX support is reliable but sometimes requires escalation for more technical issues.

Both platforms provide extensive self-help resources. You’ll find tutorials, FAQs, and guides on their websites. This can save you time for common questions.

Language support is another consideration. OKX offers assistance in more languages than Phemex, which is helpful if English isn’t your first language.

For new users, Phemex provides more personalized onboarding support. OKX offers more automated resources but less direct guidance for beginners.

Phemex Vs OKX: Security Features

When choosing between Phemex and OKX, security should be a top priority for your crypto investments. Both platforms offer strong security measures, but with some key differences.

Phemex provides enterprise-grade security protocols to protect your assets. They use cold storage for the majority of user funds, keeping them offline and away from potential hackers.

OKX (formerly OKEx) also emphasizes security with their multi-signature wallet system. This requires multiple approvals before transactions can be completed, adding an extra layer of protection.

Two-Factor Authentication (2FA)

| Platform | SMS 2FA | Google Auth | Email Verification |

|---|---|---|---|

| Phemex | ✓ | ✓ | ✓ |

| OKX | ✓ | ✓ | ✓ |

Both exchanges offer additional security features:

- Anti-phishing codes to verify legitimate communications

- IP address monitoring for unusual login attempts

- Regular security audits by third-party firms

Phemex has built a reputation for its robust security infrastructure with no major hacks reported to date. OKX has faced some security challenges in the past but has significantly improved its security measures in recent years.

You should also consider enabling all available security features on either platform. This includes setting up strong passwords, using a dedicated email, and regularly reviewing account activity.

Remember that your own security practices play a crucial role regardless of which platform you choose.

Is Phemex Safe & Legal To Use?

Phemex is generally considered a safe and legal cryptocurrency exchange for users worldwide. Based on the search results, Phemex has established itself as a legitimate and trustworthy centralized exchange.

One of the strongest points in Phemex’s favor is its security record. The platform has never been hacked, which demonstrates robust security measures to protect user funds and information.

Phemex operates as a major centralized exchange, which means it follows standard regulations and compliance requirements for cryptocurrency trading platforms. This adds another layer of legitimacy to its operations.

The exchange offers flexible deposit terms, making it accessible for different types of investors. However, it’s worth noting that Phemex’s interest rates may be lower than some competing platforms.

When comparing to OKX, Phemex supports fewer cryptocurrencies. This might limit your trading options but can also mean a more focused and carefully curated selection of assets.

For safety-conscious users, Phemex provides a secure crypto wallet to store your digital assets. This is an essential feature for protecting your investments.

Before using Phemex, you should verify its legal status in your specific country or region, as cryptocurrency regulations vary globally. What’s legal in one jurisdiction may be restricted in another.

Is OKX Safe & Legal To Use?

OKX is a legal cryptocurrency exchange registered in Malta and Hong Kong. It operates under the Virtual Financial Asset Act (VFAA), which provides regulatory oversight for the platform.

Safety is a key concern for crypto users, and OKX has a strong record in this area. The exchange has not experienced any security breaches or hacking incidents as of 2025, which is promising for potential users.

Independent security firms have evaluated OKX favorably. CertiK, a blockchain security company, gave OKX an “AA” rating and ranked it as the #3 safest crypto exchange in their assessment.

The company behind OKX is Aux Cayes FinTech Co Ltd, a Seychelles registered company, giving it a legitimate corporate structure.

Key Security Features:

- Strong encryption protocols

- Two-factor authentication

- Cold storage for most user funds

- Regular security audits

When comparing OKX to other platforms like Phemex, security measures are similar, but always verify the current security practices before depositing significant funds.

Remember that while OKX appears safe and legitimate, all cryptocurrency exchanges carry inherent risks. Market volatility, regulatory changes, and other factors can impact your experience.

You should always use strong passwords, enable all security features, and consider using hardware wallets for long-term storage of large crypto holdings.

Frequently Asked Questions

Traders looking to choose between Phemex and OKX need answers to specific questions about fees, security, and functionality. These platforms differ in several key areas that can impact your trading experience and profitability.

What are the primary differences in trading fees between Phemex and OKX?

Phemex and OKX structure their fees differently, with variations in both spot and futures trading. OKX typically charges slightly higher spot trading fees, with standard rates around 0.10% for makers and 0.15% for takers.

Phemex offers lower spot trading fees for regular users, often starting at 0.1% for both makers and takers. Both exchanges provide fee discounts based on trading volume and token holdings.

For futures trading, Phemex tends to be more competitive with fees as low as 0.01% for makers and 0.06% for takers. OKX futures fees are comparable but may be slightly higher depending on your VIP level.

How do the security features of Phemex and OKX compare?

Both exchanges implement industry-standard security measures including two-factor authentication (2FA), cold storage for most assets, and regular security audits. OKX maintains approximately 95% of user assets in cold storage, protecting them from online threats.

Phemex offers a comprehensive security setup with multi-signature wallets and regular penetration testing. Both platforms have established insurance funds to protect users against unexpected losses.

OKX has faced some security challenges in its history but has significantly improved its infrastructure. Phemex, while newer to the market, has maintained a clean security record since its launch.

What variety of cryptocurrencies can be traded on Phemex and OKX?

OKX offers a substantially larger selection of cryptocurrencies, supporting over 350 different tokens and coins. This makes it a better choice if you’re looking to trade less common altcoins.

Phemex provides a more curated selection of approximately 40-50 cryptocurrencies, focusing on established tokens with higher market caps. Both platforms regularly add new tokens based on market demand.

For derivative products, OKX again leads with more variety in futures, options, and swap contracts. Phemex offers fewer derivative pairs but ensures high liquidity for the ones it does support.

How do user experiences differ when using Phemex versus OKX platforms?

Phemex is often praised for its cleaner, more intuitive interface that new traders find easier to navigate. The platform loads quickly and experiences fewer downtime issues during high market volatility.

OKX offers a feature-rich experience that can initially seem overwhelming but provides more tools and options for customization. Its mobile app receives higher ratings than Phemex’s for functionality and reliability.

User reviews indicate that Phemex provides faster customer support response times, while OKX offers support in more languages. Both platforms have educational resources, but OKX’s learning materials are more comprehensive.

Which exchange offers more valuable tools for advanced traders, Phemex or OKX?

OKX provides a wider range of advanced trading tools, including more detailed charting options with over 100 indicators and multiple timeframes. Its algorithmic trading features allow for more sophisticated strategy implementation.

Phemex excels with its trading simulator that lets you practice strategies risk-free. Both exchanges offer API access for algorithmic trading, but OKX’s documentation is more comprehensive.

For market analysis, OKX provides more detailed order book visualization and market depth information. Phemex compensates with faster order execution speeds, which can be crucial during volatile market conditions.

Can traders use leverage on both Phemex and OKX, and if so, how do the conditions vary?

Both exchanges offer leveraged trading, but with different maximum limits. Phemex provides up to 100x leverage on certain futures contracts, making it attractive for traders seeking higher risk positions.

OKX offers up to 125x leverage on some pairs, slightly higher than Phemex. However, the actual available leverage depends on your account level, trading volume, and the specific cryptocurrency pair.

Liquidation mechanisms differ slightly between the platforms. OKX implements a tiered liquidation system that may help prevent complete position liquidation during short-term price spikes. Phemex uses a more straightforward liquidation process but offers insurance funds to protect against negative balances.

OKX Vs Phemex Conclusion: Why Not Use Both?

Both OKX and Phemex offer strong cryptocurrency exchange options with unique advantages. While OKX provides a robust bot marketplace supporting major assets like BTC and ETH, Phemex is noted for its user-friendly interface.

OKX has earned a higher overall score of 7.8 compared to Phemex’s score based on recent comparisons. However, scores don’t tell the complete story about which platform might work best for your specific needs.

One limitation of OKX is its lack of fiat-offramp support. This means you can’t sell crypto for cash and withdraw to your bank directly, which might be important for your trading strategy.

Key Considerations:

- OKX: Free bot marketplace, higher overall rating

- Phemex: Strong user experience, different fee structure

- Both: Support for major cryptocurrencies

You don’t necessarily need to choose between them. Many traders use multiple exchanges to take advantage of different features, fee structures, and trading opportunities.

Using both platforms allows you to:

- Capitalize on price differences between exchanges

- Access different trading tools and bots

- Reduce risk through platform diversification

- Take advantage of promotional offers on both platforms

Remember to consider your trading volume, preferred features, and geographic restrictions when deciding how to distribute your trading across these platforms.