Choosing between cryptocurrency exchanges can be a tough decision, especially when comparing popular platforms like Phemex and Coinbase. Each platform offers unique features that might better suit your trading needs and goals.

Phemex attracts new traders with its user-friendly interface and lower trading fees, while Coinbase is known for higher liquidity and a more established reputation in the market. When selecting between these exchanges, you’ll want to consider factors like fees, supported cryptocurrencies, and available trading options.

Both platforms have their strengths – Phemex might save you money on transactions, but Coinbase could offer more peace of mind for beginners through its widespread adoption and intuitive design. Let’s explore the key differences between these exchanges to help you make the best choice for your crypto journey.

Phemex Vs Coinbase: At A Glance Comparison

Phemex and Coinbase offer different experiences for crypto traders in 2025. Here’s how they stack up against each other:

| Feature | Phemex | Coinbase |

|---|---|---|

| Trading Fees | Lower fees structure | Higher fees compared to Phemex |

| User Interface | User-friendly for new traders | Clean but geared toward both beginners and experienced users |

| Trading Options | Strong focus on derivatives and futures | Primarily spot trading with limited derivatives |

| Target Users | Appeals to new traders | Attracts more seasoned traders |

| Security | Strong security measures | Industry-leading security protocols |

Phemex stands out with its exceptionally low fee structure, making it attractive if you’re cost-conscious. The platform offers powerful trading tools that don’t sacrifice user-friendliness.

Coinbase, while charging higher fees, provides a more regulated environment that many experienced traders prefer. Its interface balances simplicity with advanced features.

You’ll find Phemex particularly suitable if you’re interested in futures and derivatives trading. The platform has built a reputation for these specialized trading options.

Coinbase shines in its regulatory compliance and institutional-grade security. These features might be worth the higher fees if security is your priority.

Both platforms offer mobile apps, but user reviews suggest Phemex’s app provides a smoother trading experience on the go compared to Coinbase’s offering.

Phemex Vs Coinbase: Trading Markets, Products & Leverage Offered

Phemex and Coinbase offer different trading experiences for crypto investors in 2025. Your choice between these platforms may depend on what trading options you’re looking for.

Phemex stands out by offering up to 100x leverage trading, making it appealing if you want to amplify your trading potential. This platform supports both spot trading and futures contracts, giving you more variety in how you trade.

Coinbase provides a more conservative approach with less emphasis on leverage trading. It focuses primarily on spot trading with a wide selection of cryptocurrencies available for purchase.

Available Products:

- Phemex: Spot trading, futures contracts, leveraged trading up to 100x

- Coinbase: Spot trading, limited derivatives, staking options

Phemex offers a simulated trading market where you can practice without risking real money. This feature is particularly helpful if you’re new to day trading or want to test strategies.

Trading fees differ significantly between the platforms. Phemex provides zero-fee trading options in some cases, while Coinbase is known for higher fees but with added security features.

For mobile traders, Phemex has developed a user-friendly app that supports its high-leverage trading options. The platform also offers fast fiat deposit options to quickly fund your account.

Both exchanges support a variety of cryptocurrencies, though Coinbase typically lists more established coins while Phemex includes more trading pairs for active traders.

Phemex Vs Coinbase: Supported Cryptocurrencies

When choosing between Phemex and Coinbase, the variety of available cryptocurrencies is a key factor to consider.

Coinbase offers access to over 200 cryptocurrencies for trading. You’ll find all major coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), plus many popular altcoins and tokens.

Phemex supports fewer cryptocurrencies compared to Coinbase, with approximately 50+ tokens available. However, it still covers all the major coins that most traders typically focus on.

Here’s a quick comparison of supported cryptocurrencies:

| Exchange | Number of Cryptocurrencies | Popular Coins |

|---|---|---|

| Coinbase | 200+ | BTC, ETH, SOL, ADA, DOT, LINK, MATIC |

| Phemex | 50+ | BTC, ETH, SOL, ADA, DOT, LINK, MATIC |

Coinbase regularly adds new cryptocurrencies to its platform, making it a better choice if you want to trade emerging or less common tokens.

Phemex focuses more on quality over quantity, supporting the most traded cryptocurrencies with high liquidity. This approach works well if you primarily trade established coins.

Your decision might depend on whether you need access to niche cryptocurrencies or are satisfied with trading the most popular options. If you’re a beginner or only interested in mainstream coins, both platforms will likely meet your needs.

Phemex Vs Coinbase: Trading Fee & Deposit/Withdrawal Fee Compared

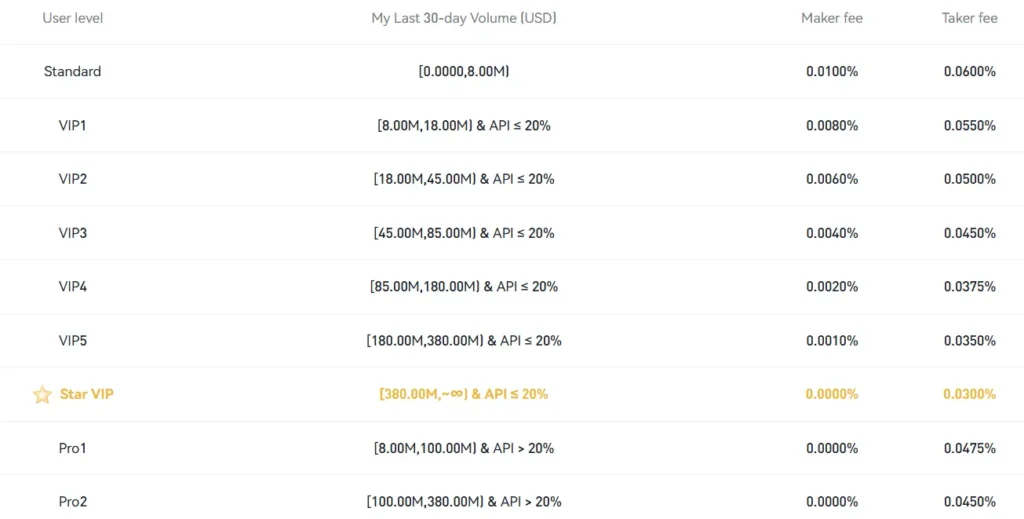

When choosing between Phemex and Coinbase, fees play a crucial role in your decision. Based on current data from 2025, Coinbase offers trading fees of up to 0.60%, while Phemex charges around 0.30% to 0.40%.

Phemex stands out with its competitive fee structure. The platform provides lower trading fees compared to Coinbase and offers 0% withdrawal fees, making it an economical choice for frequent traders.

Coinbase, while having slightly higher trading fees, provides flexible deposit terms and is known for its user-friendly interface.

Trading Fee Comparison:

| Exchange | Trading Fees |

|---|---|

| Phemex | 0.30% – 0.40% |

| Coinbase | Up to 0.60% |

For deposits, Phemex supports zero-fee crypto deposits and offers multiple fiat deposit methods including SWIFT, ACH, SEPA, and FPS. The platform charges approximately 0.8% for fiat transactions.

Coinbase’s deposit methods are equally versatile, though their fee structure may vary depending on your payment method and location.

When it comes to withdrawals, Phemex has an advantage with its 0% withdrawal fees policy. This can lead to significant savings if you move funds frequently.

You should consider your trading volume and frequency when choosing between these platforms. For high-volume traders, Phemex’s lower fee structure may result in substantial savings over time.

Phemex Vs Coinbase: Order Types

When trading cryptocurrencies, the types of orders available can greatly impact your strategy. Phemex and Coinbase offer different order options to suit various trading needs.

Coinbase provides basic order types for beginners. On Coinbase, you can place market orders (buy/sell at current price) and limit orders (buy/sell at a specific price).

Phemex offers more advanced trading options. Beyond the basics, Phemex includes:

- Market orders

- Limit orders

- Stop-limit orders

- Take-profit orders

- Conditional orders

This variety gives you more control over your trading strategy on Phemex.

For futures trading, Phemex pulls ahead with additional specialized order types. These include trailing stops and post-only orders that help manage risk in volatile markets.

Coinbase focuses on simplicity, making it easier for beginners to navigate. However, this simplicity means fewer advanced options for experienced traders.

The table below summarizes the key differences:

| Order Type | Phemex | Coinbase |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-Limit | ✓ | Limited |

| Take-Profit | ✓ | No |

| Conditional | ✓ | No |

| Trailing Stop | ✓ | No |

If you’re new to trading, Coinbase’s simpler approach might work better for you. For more advanced trading strategies, Phemex provides the tools you need to execute complex trades.

Phemex Vs Coinbase: KYC Requirements & KYC Limits

When using crypto exchanges, Know Your Customer (KYC) verification is an important process you’ll likely encounter. Both Phemex and Coinbase have specific KYC policies that affect how you can use their platforms.

Coinbase KYC Requirements:

- KYC is mandatory for all users

- You must provide ID verification before trading

- Complete verification unlocks full platform access

- Process includes providing government ID and personal information

Coinbase implements strict KYC policies from the start of your account creation. You cannot trade or use the platform meaningfully without completing verification.

Phemex KYC Requirements:

- Despite some marketing suggesting “NO KYC required,” Phemex now requires KYC for all users who wish to deposit, withdraw, or trade

- Previous optional KYC has been replaced with mandatory verification

- Your withdrawal limits are directly tied to your KYC level

It’s worth noting that some users have reported unexpected KYC requests after beginning transactions on Phemex. This can potentially lead to account restrictions if you’re not prepared to complete verification.

KYC Limits Comparison:

| Exchange | Without KYC | Basic KYC | Advanced KYC |

|---|---|---|---|

| Coinbase | No access | Limited trading | Full access with higher limits |

| Phemex | Very limited | Higher withdrawal limits | Maximum withdrawal limits |

Your withdrawal capabilities on Phemex correspond directly to your verification level, making KYC an essential step for serious trading.

Phemex Vs Coinbase: Deposits & Withdrawal Options

When choosing between Phemex and Coinbase, understanding your deposit and withdrawal options is crucial for smooth transactions.

Coinbase offers more traditional payment methods. You can deposit funds using bank transfers, credit/debit cards, and PayPal in many regions. This makes it accessible for beginners just entering the crypto space.

Phemex typically focuses on crypto deposits and withdrawals. While it has fewer fiat currency options than Coinbase, it often processes transactions faster and with lower fees.

Both exchanges support major cryptocurrencies like Bitcoin and Ethereum for deposits and withdrawals. Coinbase supports more cryptocurrencies overall, with over 150 options available for transactions.

For withdrawal limits, Coinbase sets them based on your verification level and account history. New users face lower limits that increase over time.

Phemex usually offers higher withdrawal limits for verified users, which appeals to active traders who move larger amounts.

Processing times differ between the platforms:

| Method | Coinbase | Phemex |

|---|---|---|

| Crypto | 1-5 hours | 10 minutes-2 hours |

| Bank transfer | 1-5 business days | 1-3 business days |

| Card withdrawals | 1-3 business days | Limited availability |

Remember to verify your account on either platform to access higher limits and more payment options. Both exchanges require KYC verification for fiat transactions.

Phemex Vs Coinbase: Trading & Platform Experience Comparison

When it comes to trading cryptocurrencies, both Phemex and Coinbase offer distinct platform experiences tailored to different types of traders.

Coinbase provides a clean, intuitive interface that’s perfect for beginners. You’ll find the basic buy and sell functions easy to navigate, with clear pricing and simple order types. The mobile app mirrors this simplicity, making it accessible even if you’re new to crypto trading.

Phemex, on the other hand, caters more to experienced traders. You get access to advanced charting tools, multiple order types, and leverage options up to 100x on some assets. The platform includes features like stop-loss orders and take-profit settings that active traders value.

Trading Features Comparison:

| Feature | Coinbase | Phemex |

|---|---|---|

| User Interface | Beginner-friendly, simplified | Advanced, feature-rich |

| Order Types | Basic (market, limit) | Multiple (market, limit, stop, OCO) |

| Leverage Trading | Limited | Up to 100x on select pairs |

| Mobile Experience | Excellent, simplified | Good, but more complex |

| Charting Tools | Basic | Advanced with multiple indicators |

Coinbase Pro offers more advanced features than regular Coinbase, but still doesn’t match Phemex’s depth for serious traders.

Trading fees also differ significantly. Coinbase charges higher fees (typically 0.5% to 4.5%), while Phemex offers more competitive rates, especially for high-volume traders.

You’ll find Coinbase more suitable if you value simplicity and security over advanced features. Choose Phemex if you need sophisticated trading tools and lower fees.

Phemex Vs Coinbase: Liquidation Mechanism

When trading with leverage, understanding how liquidations work is critical. Both Phemex and Coinbase handle liquidations differently.

Phemex triggers liquidation when your account value falls below the maintenance margin requirement. According to their protocol, liquidation occurs when the sum of your Initial Margin, Realized PnL, and Unrealized PnL drops below the Maintenance Margin.

Coinbase takes a more conservative approach to liquidations. They typically use higher maintenance margin requirements, which might offer you more protection but less leverage flexibility.

Here’s a comparison of their liquidation features:

| Feature | Phemex | Coinbase |

|---|---|---|

| Liquidation Warning | Yes | Yes |

| Auto-Deleveraging | Yes | Limited |

| Liquidation Fee | 0.3-0.5% | 0.5-1% |

| Partial Liquidation | Available | Limited |

Phemex offers up to 100x leverage on popular cryptocurrencies, which means higher profit potential but also higher liquidation risk for your positions.

You’ll receive warnings from both platforms before liquidation occurs. This gives you time to add funds or reduce your position size.

Phemex provides more detailed liquidation information in real-time through their trading interface. This transparency helps you better manage your risk.

Remember to set stop-loss orders on both platforms to protect yourself from unexpected market movements that could trigger liquidations.

Phemex Vs Coinbase: Insurance

When choosing a crypto exchange, insurance coverage is a key factor to consider for your assets’ security. Both Phemex and Coinbase offer protection, but there are important differences.

Coinbase provides robust insurance coverage for users. If the platform experiences a security breach, Coinbase’s insurance policy kicks in to compensate users for lost funds. This gives you an extra layer of protection beyond their security measures.

For crypto held in Coinbase’s hot wallets (online storage), they maintain a commercial crime insurance policy. This covers losses from theft, including cybersecurity breaches and employee theft.

Phemex also prioritizes user asset protection. While specific details about their insurance coverage aren’t as widely advertised as Coinbase’s, they focus on transparency and security measures to prevent the need for insurance claims.

Both exchanges use cold storage for most user funds. This keeps your crypto offline and away from potential online attacks.

Insurance Comparison:

| Feature | Coinbase | Phemex |

|---|---|---|

| Insurance against hacks | Yes – explicit coverage | Limited public information |

| FDIC insurance (USD) | Yes (up to $250,000) | Not specified |

| Cold storage | Yes (98% of assets) | Yes (percentage not specified) |

You should consider how much insurance matters to you when deciding between these exchanges. If comprehensive, clearly defined insurance coverage is your priority, Coinbase currently offers more transparency in this area.

Phemex Vs Coinbase: Customer Support

When choosing between cryptocurrency exchanges, customer support quality can make a big difference in your experience. Both Phemex and Coinbase offer support options, but they differ in availability and response times.

Coinbase provides customer support through email tickets, chat support, and phone assistance for certain account issues. You can access their help center with extensive documentation on common problems. However, during high-traffic periods, you might experience longer wait times.

Phemex offers 24/7 customer support primarily through live chat and email ticket systems. Their support team is known for relatively quick response times, usually within 24 hours for email inquiries.

Support Channels Comparison:

| Platform | Live Chat | Phone | Help Center | |

|---|---|---|---|---|

| Coinbase | ✓ | ✓ | ✓ | ✓ |

| Phemex | ✓ | ✓ | ✗ | ✓ |

Both platforms offer support in multiple languages, which is helpful if English isn’t your first language. You’ll find that Coinbase has a more extensive help database due to its larger size and longer history in the market.

User feedback suggests Phemex generally provides faster initial responses, while Coinbase might have more thorough resolution processes for complex issues. This difference reflects their user base sizes, with Coinbase serving approximately 8.8 million active users compared to Phemex’s 5 million.

Remember to check each platform’s current support policies, as cryptocurrency exchanges frequently update their customer service systems.

Phemex Vs Coinbase: Security Features

When choosing a crypto exchange, security should be your top priority. Both Phemex and Coinbase offer strong security features to protect your digital assets.

Coinbase Security Highlights:

- Two-factor authentication (2FA)

- 98% of assets stored in cold storage

- USD balances insured up to $250,000

- AES-256 encryption for digital wallets

- Biometric login options

Coinbase has built a reputation as one of the most secure exchanges in the industry. Their security protocols have helped them maintain a clean record with no major hacks.

Phemex Security Highlights:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Real-time monitoring systems

- Regular security audits

- Transparent security practices

Phemex emphasizes transparency in their security approach. They regularly publish security updates and maintain open communication about their protection measures.

Both platforms use similar core security features like cold storage and 2FA, but their approaches differ slightly. Coinbase offers insurance on USD balances, providing an extra layer of protection for your fiat currency.

You should enable all available security features regardless of which platform you choose. This includes setting up strong passwords, enabling 2FA, and being cautious of phishing attempts.

Neither platform has suffered major security breaches, which speaks to their commitment to protecting user assets. Their ongoing security investments help maintain this strong track record.

Is Phemex A Safe & Legal To Use?

Phemex is widely regarded as a safe and legitimate cryptocurrency exchange. It has built a reputation for security, having never experienced a hack since its establishment.

The platform is registered as a Money Services Business with FinCEN, which allows it to operate legally in many jurisdictions. This regulatory compliance adds a layer of legitimacy to its operations.

For US residents, there are some restrictions to be aware of. Phemex permits OTC crypto buying for US customers. However, contract trading (leverage/margin) is banned for US users.

Key Security Features:

- Strong security protocols

- No history of security breaches

- Regulatory compliance in multiple regions

You can use Phemex without mandatory KYC verification for basic functions. This means you can deposit, withdraw, and trade without going through extensive identity verification processes.

When comparing safety measures with other major centralized exchanges, Phemex stands up well. It implements industry-standard security practices to protect user funds and information.

Always exercise caution when using any cryptocurrency platform. Take time to understand the platform’s features and limitations before committing significant funds.

Is Coinbase A Safe & Legal To Use?

Coinbase is widely recognized as one of the most secure cryptocurrency exchanges available today. It operates legally in over 100 countries and complies with strict regulatory requirements in each jurisdiction where it offers services.

As a US-based company, Coinbase is registered with FinCEN and operates under appropriate licenses. The platform implements robust security measures including two-factor authentication (2FA) and 98% of user funds stored in offline cold storage to protect against hacking attempts.

Coinbase has built a strong reputation for security over the years. Unlike many competitors that have faced serious breaches, Coinbase has maintained a relatively clean security record, which contributes to its status as a trustworthy platform.

Key Security Features:

- FDIC insurance on USD balances (up to $250,000)

- AES-256 encryption for digital wallets

- Biometric fingerprint logins

- Regular security audits

When you use Coinbase, your identity verification is required, which adds an additional layer of protection against fraud. This KYC (Know Your Customer) process is standard for legal compliance.

For beginners especially, Coinbase offers a user-friendly interface with educational resources to help you navigate cryptocurrency safely. The platform provides 24/7 account monitoring and has established protocols for suspicious activity detection.

Remember that while Coinbase is secure, you should always practice good security habits like using strong passwords and enabling all available security features.

Frequently Asked Questions

When choosing between Phemex and Coinbase, many traders want specific information about key features before making their decision. These platforms differ significantly in security approaches, fee structures, interest-earning options, and available cryptocurrencies.

How does the security of Phemex compare to that of Coinbase?

Coinbase has established itself as an industry leader in security with its SOC certifications, cold storage solutions, and FDIC insurance for USD balances up to $250,000. The platform employs two-factor authentication and advanced encryption for all transactions.

Phemex offers strong security features including cold wallet storage for most funds and multi-signature technology. Their system includes risk control mechanisms and regular security audits.

Both exchanges have strong track records regarding security, but Coinbase’s regulatory compliance in more jurisdictions and longer history may give some users additional confidence.

What are the differences in fees between Phemex and Coinbase?

Phemex typically offers lower trading fees compared to Coinbase, with maker-taker fees starting around 0.1% for spot trading. Premium members can access zero-fee spot trading through their subscription model.

Coinbase charges higher fees on its standard platform, ranging from 0.5% to 4.5% depending on payment method and transaction size. Their advanced platform, Coinbase Pro, offers more competitive rates but still typically exceeds Phemex’s fee structure.

Deposit and withdrawal fees also differ, with Phemex generally maintaining lower costs for crypto transfers. Coinbase often charges higher fees for convenience but provides more payment options for fiat deposits.

Can users earn interest on their holdings on Phemex and Coinbase, and how do these features differ?

Phemex offers flexible and fixed savings products where you can earn interest on various cryptocurrencies. Their rates are often competitive, with staking options for several tokens and savings products with different lock-up periods.

Coinbase provides staking rewards for assets like ETH, SOL, and others. They also offer a “Learn and Earn” program where you can earn free crypto by watching educational videos.

The interest rates vary between the platforms and change frequently based on market conditions. Phemex typically offers more flexible earning options, while Coinbase’s offerings may be more accessible to beginners but with generally lower yields.

How do the trading interfaces and user experiences contrast on Phemex and Coinbase?

Coinbase offers a straightforward, beginner-friendly interface focused on simplicity. Their basic platform is designed for newcomers with minimal charts and technical features, while Coinbase Pro provides more advanced tools.

Phemex targets more experienced traders with comprehensive charting tools, multiple order types, and advanced trading features like futures and margin trading. Their interface includes more technical indicators and customization options.

Both platforms offer mobile apps, but Phemex’s app includes more advanced trading features. Coinbase prioritizes ease of use and clean design over technical complexity, making it more approachable for beginners.

What variety of cryptocurrencies can be traded on Phemex vs Coinbase?

Coinbase supports over 200 cryptocurrencies for trading, including major coins and many altcoins. Their listing process is selective, which often provides some quality assurance for listed assets.

Phemex offers fewer spot trading pairs but includes access to cryptocurrency derivatives, futures contracts, and leveraged trading options not available on Coinbase.

For standard spot trading of major cryptocurrencies like Bitcoin and Ethereum, both platforms provide adequate options. However, if you’re looking for specific altcoins, checking current listings is important as both platforms regularly add new tokens.

What customer support options are available on Phemex versus those on Coinbase?

Phemex provides 24/7 customer support through live chat, email, and an extensive knowledge base. Their response times are generally quick, with priority support available for premium members.

Coinbase offers email support, a help center, and phone support for specific issues. They’ve expanded their support options in recent years following criticism about response times.

Both platforms maintain active community forums and social media presence. Phemex typically receives better reviews for support responsiveness, while Coinbase has improved their previously criticized support system through significant investments in customer service.

Coinbase Vs Phemex Conclusion: Why Not Use Both?

Both Coinbase and Phemex offer unique advantages that can benefit different types of crypto users. Instead of choosing just one, you might consider using both platforms for a complete crypto experience.

Coinbase shines with its user-friendly interface, strong security measures, and regulatory compliance. It scores an impressive 9.6 overall rating based on the search results. If you’re new to crypto or prefer a straightforward experience with easy fiat transactions, Coinbase is an excellent choice.

Phemex stands out with its competitive trading fees and specialized features. It’s particularly strong for futures trading, copy trading, and earn features that Coinbase doesn’t offer.

Your trading habits should guide your decision. Do you primarily buy and hold popular cryptocurrencies? Coinbase might be sufficient. Are you interested in futures trading or more advanced trading options? Phemex would be valuable.

Consider this approach:

- Use Coinbase for simple purchases, beginners’ needs, and converting fiat to crypto

- Use Phemex for futures trading, lower fees, and access to earn features

The crypto exchange ecosystem continues to evolve, and as of March 2025, both platforms maintain strong positions in the market. Your specific needs might change over time, making the flexibility of having accounts on both platforms beneficial.

Remember to maintain proper security practices regardless of which exchange you use, including strong passwords and two-factor authentication.