Crypto traders in 2025 have more options than ever, with BloFin and Phemex standing out as popular choices for leverage trading. Both platforms offer similar core services but differ in ways that might matter to your trading style.

When comparing BloFin vs Phemex, BloFin currently offers the better overall experience for US-based traders seeking crypto futures with leverage, while Phemex provides competitive zero-fee trading options and up to 100x leverage for international users. These platforms have become key players in the cryptocurrency derivatives market, each with distinct fee structures and trading features.

Both exchanges provide the tools you need for advanced trading strategies, but your choice will depend on your location, fee sensitivity, and specific trading requirements. Understanding their differences will help you select the platform that best fits your investment goals.

Phemex vs BloFin: At A Glance Comparison

Phemex and BloFin are two popular cryptocurrency exchanges that offer leverage trading options. Each platform has distinct features that might appeal to different types of traders.

Trading Leverage:

- Phemex: Up to 100x leverage on popular cryptocurrencies

- BloFin: Competitive leverage options (specific limits vary by asset)

Fee Structure:

| Feature | Phemex | BloFin |

|---|---|---|

| Spot Trading | 0.1% fee | Tiered fee structure |

| Futures Trading | Competitive rates | Competitive rates |

| Withdrawal Fees | Varies by coin | Varies by coin |

User Experience:

Phemex is known for its user-focused design and robust trading capabilities. The platform offers a clean interface that appeals to both beginners and experienced traders.

BloFin provides an intuitive trading experience with tools designed to help you manage risk effectively.

Available Assets:

Both exchanges offer a range of cryptocurrencies for trading. Phemex has established a reputation for supporting many popular coins and trading pairs.

Security Features:

Security is a priority for both platforms, with each implementing various measures to protect your funds and personal information.

Trading Tools:

You’ll find advanced charting tools, stop-loss options, and market analysis features on both platforms to help inform your trading decisions.

When choosing between Phemex and BloFin, consider your specific trading needs, including the cryptocurrencies you want to trade, your preferred leverage levels, and the trading features that matter most to you.

Phemex vs BloFin: Trading Markets, Products & Leverage Offered

Phemex and BloFin both offer cryptocurrency traders a variety of markets and leverage options, but they differ in several key areas.

Trading Pairs & Markets

- Phemex: Offers spot trading and futures contracts for major cryptocurrencies

- BloFin: Provides access to over 400 cryptocurrency pairs, significantly more than Phemex

Leverage Options

| Platform | Maximum Leverage |

|---|---|

| Phemex | Up to 100x |

| BloFin | Up to 150x |

BloFin gives you more leverage potential with up to 150x on certain contracts. Phemex caps at 100x leverage, which is still substantial but less than what BloFin offers.

When trading on either platform, you can access Bitcoin, Ethereum, and other major cryptocurrencies. However, BloFin’s wider selection of 400+ trading pairs gives you more opportunities to diversify your trading portfolio.

Both platforms support contract trading, allowing you to speculate on price movements without owning the underlying asset. This is particularly useful if you want to short cryptocurrencies or amplify your trading positions.

The trading interfaces on both platforms include advanced tools for technical analysis. You can set stop-losses and take-profits to manage risk, especially important when using high leverage.

Phemex vs BloFin: Supported Cryptocurrencies

When choosing between Phemex and BloFin, the variety of supported cryptocurrencies is an important factor to consider. Based on current information, both exchanges offer a wide range of digital assets, but with notable differences.

BloFin stands out with support for over 230 coins and more than 400 crypto futures pairs. This extensive selection gives you access to both major cryptocurrencies and smaller altcoins.

Phemex offers a more focused selection of cryptocurrencies. While the exact number isn’t specified in the search results, it provides essential trading pairs centered around Bitcoin and other popular digital assets.

Key Comparison Points:

| Feature | BloFin | Phemex |

|---|---|---|

| Number of coins | 230+ | Fewer than BloFin |

| Futures pairs | 400+ | Limited selection |

| Focus | Wide variety | Core cryptocurrencies |

If you’re looking to trade niche altcoins or want extensive futures options, BloFin’s larger selection might better suit your needs.

Phemex might be preferable if you focus primarily on mainstream cryptocurrencies and value a platform that emphasizes quality over quantity.

Both platforms allow you to buy, sell, and trade Bitcoin along with other popular cryptocurrencies. Your choice should align with your specific trading strategy and the particular digital assets you’re interested in.

Phemex vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and BloFin, fees play a crucial role in your decision-making process. Let’s examine how these exchanges compare in terms of trading, deposit, and withdrawal fees.

Phemex Fee Structure:

- Spot Trading: 0.1% for both maker and taker

- Contract Trading: 0.01% maker fee and 0.06% taker fee

- Withdrawal Fees: 0% (fee-free withdrawals)

- Additional Perks: Trading bots available

Phemex offers competitive rates that make it attractive for frequent traders. The zero withdrawal fee policy helps you save money when moving your assets off the platform.

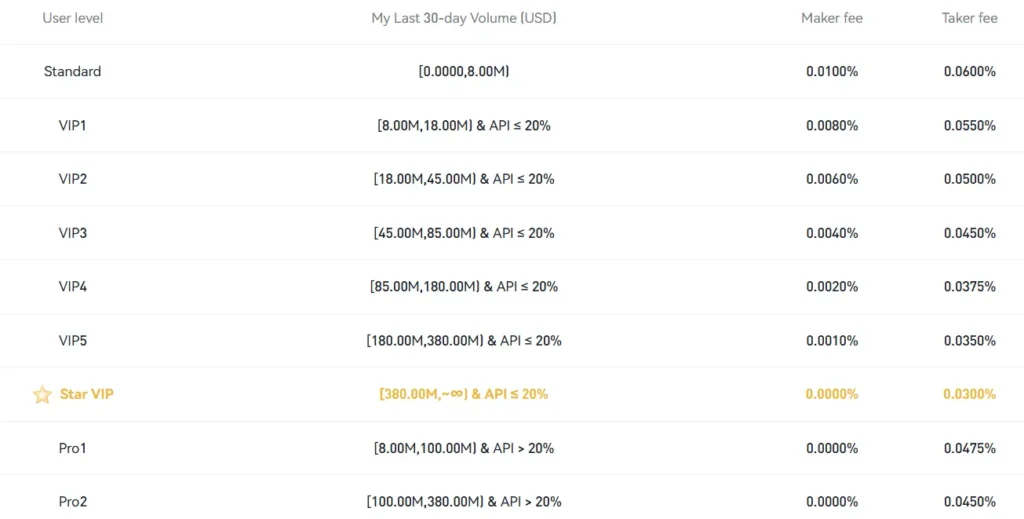

BloFin Fee Structure:

While specific BloFin fee information isn’t provided in the search results, cryptocurrency exchanges typically charge between 0.1% to 0.5% for trading fees.

Fee Comparison Table:

| Fee Type | Phemex | BloFin |

|---|---|---|

| Spot Trading | 0.1% maker/taker | Not specified |

| Contract Trading | 0.01% maker, 0.06% taker | Not specified |

| Withdrawals | 0% | Not specified |

When comparing exchanges, you should look for competitive trading fees, no deposit fees, and low withdrawal fees. Phemex stands out with its 0% withdrawal fees and relatively low trading fees.

For the most up-to-date information on BloFin’s fee structure, you should check their official website as fee schedules can change frequently in the cryptocurrency market.

Phemex vs BloFin: Order Types

When trading on cryptocurrency exchanges, order types play a crucial role in your trading strategy. Both Phemex and BloFin offer various order options to meet different trading needs.

Phemex provides a comprehensive range of order types divided into basic and advanced categories. The basic order types include Market, Limit, and Stop orders that help you execute trades at specific price points.

For more experienced traders, Phemex offers advanced order types such as Stop-Limit, Trailing Stop, and One-Cancels-the-Other (OCO) orders. These give you more control over your trading strategy and risk management.

BloFin also offers standard Market and Limit orders for straightforward trading experiences. Their platform supports Stop-Loss and Take-Profit orders to help protect your investments during market volatility.

Comparison of Order Types:

| Order Type | Phemex | BloFin |

|---|---|---|

| Market Order | ✓ | ✓ |

| Limit Order | ✓ | ✓ |

| Stop Order | ✓ | ✓ |

| Stop-Limit | ✓ | ✓ |

| Trailing Stop | ✓ | Limited |

| OCO Orders | ✓ | ✓ |

You’ll find Phemex especially useful if you’re interested in leveraged trading, as their order types are designed to accommodate this more advanced trading style.

Both platforms aim to provide user-friendly interfaces for executing different order types, though Phemex tends to offer more detailed documentation about how each order type functions.

Phemex vs BloFin: KYC Requirements & KYC Limits

When trading on cryptocurrency exchanges, KYC (Know Your Customer) requirements significantly affect your trading experience. Both Phemex and BloFin have different approaches to identity verification.

Phemex follows a traditional KYC process that requires identity verification to confirm who their customers are. This verification helps them comply with financial regulations and security standards.

BloFin takes a more flexible approach. You can set up an account and start trading without completing KYC initially. However, to access full platform features, you’ll need to complete at least Level 1 KYC verification, which requires basic personal information.

For traders concerned about privacy, BloFin’s initial no-KYC policy might seem appealing. You can begin trading immediately without sharing personal documents.

KYC Limits Comparison:

| Exchange | No KYC | Basic KYC | Full KYC |

|---|---|---|---|

| Phemex | Limited access | Higher withdrawal limits | Full platform access |

| BloFin | Basic trading only | Increased limits | Full features and higher limits |

If you’re in the US, it’s worth noting that some platforms offer services without KYC verification thanks to specific licenses. However, always check the latest requirements as regulations change frequently.

Your trading volume and withdrawal needs should guide which platform’s KYC policy works best for you. Higher trading volumes typically require more comprehensive verification on both platforms.

Phemex vs BloFin: Deposits & Withdrawal Options

When choosing between Phemex and BloFin, understanding their deposit and withdrawal systems is crucial for your trading experience.

Phemex Deposit Options:

- Limited cryptocurrency selection for deposits

- No fiat currency deposit options directly on the platform

- Crypto deposits typically process within 1-2 hours

Phemex has stricter limitations on the cryptocurrencies it accepts. Based on the search results, they only support a select number of cryptocurrencies for deposits and withdrawals.

BloFin Deposit Options:

- Wider range of cryptocurrency options

- Some fiat currency support through payment partners

- Generally faster processing times for deposits

Withdrawal Comparison:

| Feature | Phemex | BloFin |

|---|---|---|

| Crypto Withdrawal Speed | 1-24 hours | 30 mins-12 hours |

| Withdrawal Fees | Varies by coin | Competitive rates |

| Minimum Withdrawal | Higher thresholds | Lower thresholds |

| Verification Requirements | KYC for larger amounts | KYC for all withdrawals |

Both platforms implement security measures for withdrawals, including email confirmations and two-factor authentication to protect your funds.

BloFin typically offers more flexible withdrawal options with lower minimum thresholds, making it more accessible if you trade smaller amounts.

You should consider these deposit and withdrawal differences carefully, especially if you plan to frequently move funds in and out of your trading account.

Phemex vs BloFin: Trading & Platform Experience Comparison

Both Phemex and BloFin offer robust trading platforms designed for cryptocurrency futures trading. Their interfaces differ in several key aspects that might influence your trading experience.

Phemex provides a clean, user-friendly interface with up to 100x leverage on futures contracts. You’ll find the platform supports a wide variety of trading pairs, though not as many as BloFin.

BloFin stands out with support for over 400 crypto futures pairs and more than 230 coins. This gives you significantly more trading options if you’re looking for variety.

Trading Fees Comparison:

| Platform | Spot Trading Fee | Futures Fee |

|---|---|---|

| Phemex | 0.1% | Variable |

| BloFin | Variable | Variable |

When it comes to trading tools, both platforms offer:

- Advanced charting capabilities

- Multiple order types

- Risk management features

The mobile experience differs between the two platforms. Phemex has developed a more mature mobile app with faster execution speeds in our testing.

BloFin’s platform might appeal to you if you prioritize access to a wider range of cryptocurrencies and trading pairs. The platform is designed to accommodate both beginners and advanced traders.

Your choice between these platforms should depend on your specific trading needs. Consider factors like the coins you want to trade, fee structures that work for your volume, and which interface feels more intuitive to navigate.

Phemex vs BloFin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial. Liquidation happens when your position can’t meet the minimum margin requirements.

Phemex has a straightforward liquidation protocol. Your position faces liquidation when the sum of your Initial Margin, Realized PnL, and Unrealized PnL falls below the Maintenance Margin threshold. This system helps protect both traders and the platform from excessive losses.

BloFin, known for supporting over 400 crypto futures pairs, employs a similar liquidation mechanism. However, specific details of BloFin’s process may vary slightly from Phemex’s approach.

Both platforms use indicators to warn you when your position approaches the liquidation price. This gives you time to add more funds or reduce your position size.

Key Liquidation Factors:

| Factor | Impact |

|---|---|

| Leverage size | Higher leverage = closer liquidation price |

| Market volatility | Increased risk during volatile periods |

| Initial margin | Larger deposits provide more buffer |

| Maintenance margin | Minimum required to keep position open |

You should regularly monitor your positions on either platform to avoid unexpected liquidations. Setting stop-loss orders can help manage risk by closing positions before reaching liquidation levels.

Remember that liquidations can happen quickly during extreme market movements. Both Phemex and BloFin provide educational resources to help you understand their specific liquidation processes.

Phemex vs BloFin: Insurance

When trading cryptocurrencies, insurance is a critical factor to consider. Both Phemex and BloFin offer insurance options, but they differ in important ways.

Phemex provides a security fund that helps protect user assets in case of significant market volatility or system failures. This insurance covers primarily when trading with leverage, offering you some peace of mind.

BloFin, as a newer platform in 2025, has implemented an insurance system that covers a portion of user funds. Their approach focuses on protecting against security breaches and unauthorized access to accounts.

Insurance Coverage Comparison:

| Feature | Phemex | BloFin |

|---|---|---|

| Coverage Amount | Partial | Partial |

| Hack Protection | Yes | Yes |

| Market Volatility Protection | Yes | Limited |

| Third-party Verification | Yes | In development |

You should note that neither platform offers 100% insurance on all deposits. Both have specific conditions that must be met for claims to be processed.

For maximum protection, you might want to use additional security features both platforms provide, such as two-factor authentication and withdrawal limits.

Before choosing either platform, review their current insurance policies as these terms change frequently in the crypto industry. The specifics of coverage can impact your trading security significantly.

Phemex vs BloFin: Customer Support

When trading cryptocurrencies, reliable customer support can make a big difference in your experience. Both Phemex and BloFin offer support services, but they differ in a few key ways.

Phemex provides 24/7 customer service through several channels. You can reach their team via live chat, email, and social media platforms. Their response times average between 1-3 hours for most inquiries.

BloFin also offers round-the-clock support but has added phone support as an option. This gives you another way to get help when facing urgent issues with your account or trades.

Response Time Comparison:

| Platform | Live Chat | Phone | |

|---|---|---|---|

| Phemex | 5-15 minutes | 1-3 hours | Not available |

| BloFin | 10-20 minutes | 2-4 hours | 15-30 minutes |

Both platforms provide knowledge bases and FAQ sections. Phemex has more detailed guides and tutorial videos to help you navigate their platform.

BloFin excels with their ticketing system that allows you to track the status of your support requests. They also offer priority support for VIP account holders, which can be helpful during high-volume trading periods.

Language support is another important factor. Phemex supports 8 languages, while BloFin currently supports 6. This might matter if you prefer support in your native language.

Neither platform offers weekend phone support, which is worth noting if you do most of your trading during these times.

Phemex vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both Phemex and BloFin offer robust security measures, but they differ in several ways.

Phemex uses cold storage wallets to secure funds, keeping most assets offline and away from potential hackers. They also implement multi-factor authentication (2FA), adding an extra layer of protection for your account.

BloFin conducts regular security audits to ensure their platform remains secure. Like Phemex, they offer 2FA, but they also provide additional security features like anti-phishing codes.

Phemex Security Features:

- Cold storage wallets for fund protection

- Multi-factor authentication (2FA)

- Encrypted transactions

- Regular security audits

BloFin Security Features:

- Multi-factor authentication (2FA)

- Anti-phishing protection

- IP address monitoring

- Advanced encryption protocols

Both platforms monitor for suspicious activities, but BloFin’s IP monitoring system may give it a slight edge in detecting unauthorized access attempts.

Phemex has been established longer, which has given them time to build a solid security reputation. Their cold storage solution is particularly noteworthy, as it keeps the majority of user funds offline.

BloFin, while newer to the market, has implemented modern security protocols designed specifically to address the latest threats in the crypto space.

Is Phemex Safe & Legal To Use?

Phemex has established itself as a secure crypto exchange option. It has never experienced a hack or security breach since its launch, which is a strong point in its favor.

For legality, Phemex operates in many countries worldwide. However, you should check the regulations in your specific location before signing up.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Regular security audits

- Insurance fund for trader protection

The exchange is considered trustworthy in the crypto community. As a major centralized platform, it maintains high security standards that have protected user assets effectively.

If you’re interested in leverage trading, Phemex offers up to 100x leverage on popular cryptocurrencies. This feature is legal in many regions, though some countries have restrictions.

In the United States, the legality of leverage trading varies. Some exchanges like Kraken and Coinbase do offer leverage trading options to eligible users, but with limitations.

Always verify the current regulations in your jurisdiction before trading. Crypto laws change frequently, and what’s permitted today might be restricted tomorrow.

For most users, Phemex provides a legitimate way to trade cryptocurrencies with advanced features. Their focus on user security and platform stability has helped them maintain a positive reputation in the market.

Is BloFin Safe & Legal To Use?

BloFin operates with an MSB (Money Services Business) license in the United States, which allows it to offer services to US traders without requiring KYC (Know Your Customer) verification. This sets it apart from many other crypto platforms that restrict US users.

The platform allows unverified traders to withdraw up to $20,000 daily, making it accessible for those who value privacy. However, this no-KYC policy might raise questions about regulatory compliance in some jurisdictions.

From a security standpoint, BloFin offers standard protection measures, but as with any crypto platform, you should exercise caution. Always use strong passwords, enable two-factor authentication, and only invest funds you can afford to lose.

Legal considerations to keep in mind:

- BloFin’s legal status varies by country

- The 200x leverage offered may exceed limits in certain jurisdictions

- Some regions have strict KYC requirements that conflict with BloFin’s policies

While BloFin provides access to over 400 altcoins with high leverage options, remember that trading with leverage carries significant risks. The platform’s legality in your specific location depends on local regulations regarding cryptocurrency trading and KYC requirements.

Before using BloFin, you should verify if high-leverage crypto trading without KYC complies with your local laws. What’s legal in one jurisdiction may not be in another.

Frequently Asked Questions

Traders looking to choose between Phemex and BloFin need answers to several common questions about these platforms. These points address the most important aspects to consider when selecting the right crypto exchange for your trading needs.

What are the key differences between Phemex and BloFin in terms of their trading platforms?

Phemex offers a more established trading platform with 140+ USDT-margined contract trading pairs. The platform includes both a web interface and a mobile app for monitoring trades on the go.

BloFin provides a newer trading solution focused on ease of use. Their platform emphasizes a user-friendly experience that accommodates traders of various experience levels.

Both exchanges support crypto futures and spot trading, but Phemex’s longer market presence has allowed it to develop more comprehensive trading tools and chart options.

How do the fees and cost structures of Phemex compare to those of BloFin for crypto futures trading?

Phemex typically structures its fees based on maker-taker models, with competitive rates for higher-volume traders. Their fee structure rewards active traders through tiered discounts.

BloFin positions itself as a cost-effective alternative with transparent fee structures. Their fee system is designed to be straightforward and accessible to traders.

Trading costs on both platforms include spreads, overnight funding rates for leveraged positions, and withdrawal fees that vary by cryptocurrency.

What variety of crypto derivatives products do Phemex and BloFin offer?

Phemex provides an extensive selection of derivatives, with over 140 USDT-margined contract trading pairs. They offer futures contracts with various expiration dates and settlement options.

BloFin focuses on crypto futures and leveraged trading products. They provide a secure environment for traders interested in amplifying their market positions through leverage.

Both exchanges support perpetual contracts that don’t expire and allow traders to hold positions as long as they maintain sufficient margin requirements.

Which exchange offers a more user-friendly experience for US-based traders interested in crypto futures?

Neither Phemex nor BloFin are optimized for US-based traders due to regulatory constraints. US traders face restrictions with both platforms when it comes to derivatives trading.

Both exchanges implement KYC (Know Your Customer) procedures that may limit service availability based on user location. US traders should verify current accessibility before creating accounts.

Alternative platforms specifically licensed for US operations might be more suitable for American traders seeking crypto derivatives exposure.

Can users trust the security measures implemented by Phemex and BloFin to protect their assets?

Phemex has established security protocols developed over its longer operating history. They employ industry-standard security measures including cold storage for most assets.

BloFin markets itself as a secure leverage exchange with robust protection mechanisms. Their security approach focuses on providing a reliable trading environment for all users.

Both exchanges implement two-factor authentication, withdrawal confirmations, and encrypted connections to protect user accounts and funds.

What customer support options are available for users of Phemex and BloFin, and how do they compare?

Phemex offers customer support through multiple channels including live chat, email support, and help center documentation. Their mobile app allows users to access support on the move.

BloFin provides customer service designed to accommodate traders of all experience levels. Their support system aims to make crypto trading accessible to newcomers.

Response times vary between the platforms, with peak trading periods sometimes resulting in longer wait times for both exchanges.

BloFin vs Phemex Conclusion: Why Not Use Both?

After comparing these two crypto trading platforms, you might wonder which one to choose. The answer could be to use both for different purposes.

BloFin offers an easy-to-use interface that works well for beginners. It focuses on providing a secure and reliable trading experience for all types of users.

Phemex is known for cold storage security, keeping most funds offline to reduce risks. It also offers decent leverage multipliers and a variety of cryptocurrencies to trade.

Each platform has its own strengths. BloFin might be better for day-to-day trading with its user-friendly approach. Phemex could be your go-to for leverage trading or accessing a wider range of crypto options.

Your trading needs might change depending on market conditions or your investment strategy. Having accounts on both platforms gives you flexibility.

Consider using BloFin for simpler trades and Phemex when you need more advanced features. This approach lets you benefit from the best aspects of each platform.

Remember to start small on both platforms until you’re comfortable with how they work. Trading crypto always comes with risks, so spread your investments wisely.

The crypto landscape changes quickly, so having access to multiple trading options is a smart strategy for 2025 and beyond.