Choosing the right cryptocurrency exchange can make a big difference in your trading experience. When comparing Phemex and BitMEX, two popular derivatives exchanges, it’s important to understand their key differences.

BitMEX currently has a higher overall score of 6.0 compared to Phemex, but both platforms offer leverage options up to 100x for traders looking to maximize their positions. Each platform has its own fee structure, supported cryptocurrencies, and unique features that may appeal to different types of traders.

Both exchanges focus on cryptocurrency derivatives trading, allowing you to trade futures contracts rather than buying the actual assets. They accept limited cryptocurrencies for deposits and withdrawals, which is something to consider when deciding which platform might work better for your trading needs.

Phemex Vs BitMEX: At A Glance Comparison

When choosing between Phemex and BitMEX, you should consider how they stack up against each other. Based on recent information, BitMEX has a slightly higher overall score of 6.0 compared to Phemex.

Both exchanges focus on cryptocurrency derivatives trading, allowing you to trade futures contracts and other advanced products.

Key Differences:

| Feature | Phemex | BitMEX |

|---|---|---|

| Overall Score | Lower than BitMEX | 6.0 (Higher) |

| Deposit Methods | Limited cryptocurrencies | Limited cryptocurrencies |

| User Interface | Modern design | More technical layout |

| Trading Types | Spot and derivatives | Primarily derivatives |

Phemex and BitMEX both accept only a limited number of cryptocurrencies for deposits and withdrawals. This is an important consideration if you want to trade specific coins.

The fee structures differ between these platforms, which can impact your trading costs. When making frequent trades, even small fee differences can add up significantly.

User experience is another factor to consider. BitMEX tends to have a more technical interface that might appeal to experienced traders. Phemex offers a somewhat more accessible platform while still providing advanced trading features.

Both exchanges provide leverage trading options, allowing you to amplify potential gains (and risks) in your trading strategies.

Phemex Vs BitMEX: Trading Markets, Products & Leverage Offered

Both Phemex and BitMEX offer cryptocurrency derivatives trading, but they differ in their available markets and products.

Trading Markets:

- Phemex: Offers spot trading and derivatives

- BitMEX: Primarily focuses on derivatives trading

Products Available:

| Platform | Futures | Perpetual Swaps | Options | Spot Trading |

|---|---|---|---|---|

| Phemex | ✓ | ✓ | ✗ | ✓ |

| BitMEX | ✓ | ✓ | ✓ | ✗ |

When it comes to leverage, both platforms provide similar options. You can trade with up to 100x leverage on both Phemex and BitMEX for most major cryptocurrency pairs.

Cryptocurrencies Supported:

Phemex offers trading for more cryptocurrencies than BitMEX. You’ll find popular coins like Bitcoin, Ethereum, and various altcoins on both platforms.

BitMEX has historically focused more on Bitcoin-based contracts, while Phemex provides a wider range of cryptocurrency pairs.

Contract Specifications:

BitMEX is known for its more complex contract specifications which experienced traders might prefer. Phemex offers a more straightforward approach to derivatives trading.

For new traders, Phemex’s interface may be easier to navigate. The platform was designed with user experience in mind.

It’s worth noting that available markets and products can change as both platforms regularly update their offerings to stay competitive.

Phemex Vs BitMEX: Supported Cryptocurrencies

When choosing between Phemex and BitMEX, the variety of supported cryptocurrencies is an important factor to consider. According to recent information, BitMEX supports more cryptocurrencies than Phemex.

BitMEX offers a wider range of acceptable cryptocurrencies for trading. This gives you more options if you want to diversify your crypto portfolio or trade less common tokens.

Phemex accepts a more limited number of cryptocurrencies. However, both exchanges focus primarily on major cryptocurrencies that most traders are interested in.

It’s worth noting that for both platforms, deposits and withdrawals are restricted to specific cryptocurrencies. This is an important consideration when planning your trading strategy.

While both exchanges are primarily known for their derivatives trading, the actual coins you can use as collateral or for spot trading differ between them.

If you’re looking to trade a specific cryptocurrency, you should check both platforms’ current listings before opening an account. Cryptocurrency support can change over time as exchanges update their offerings.

For most traders focusing on major cryptocurrencies like Bitcoin and Ethereum, either platform will likely meet your needs. However, if you’re interested in trading a wider variety of altcoins, BitMEX might be the better choice.

Phemex Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

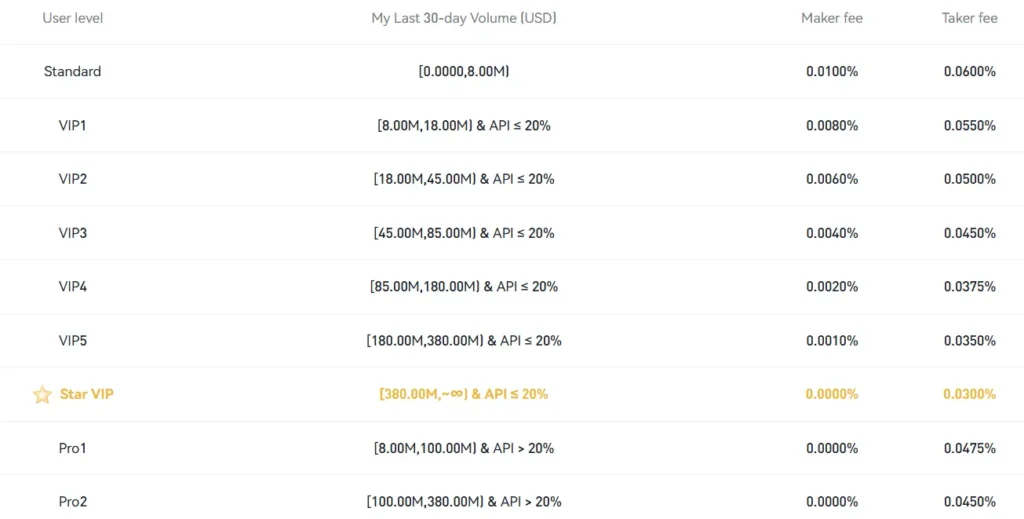

When comparing Phemex and BitMEX, fees play an important role in your trading decisions. Based on current information as of March 2025, there are clear differences between these platforms.

Phemex offers more competitive trading fees with maker fees of 0.015% and taker fees of 0.065%. BitMEX generally charges slightly higher fees for similar services.

For standard accounts, here’s how the trading fees compare:

| Fee Type | Phemex | BitMEX |

|---|---|---|

| Maker Fee | 0.015% | 0.025% |

| Taker Fee | 0.065% | 0.075% |

Both exchanges use a tiered fee structure. This means your trading fees decrease as your trading volume increases. Active traders can benefit from significant fee reductions on both platforms.

Regarding deposit fees, both exchanges offer free cryptocurrency deposits. This is standard across most crypto exchanges.

For withdrawals, Phemex charges withdrawal fees for most cryptocurrencies. These fees vary depending on the specific cryptocurrency. BitMEX also charges withdrawal fees, which are typically in line with network transaction costs.

Phemex’s overall fee structure is generally more favorable for new traders. However, high-volume traders might find advantages with either platform depending on their specific trading patterns.

Both exchanges update their fee structures periodically, so it’s worth checking their official websites for the most current rates before making your decision.

Phemex Vs BitMEX: Order Types

Both Phemex and BitMEX offer several order types to help you trade effectively. Understanding these options can improve your trading strategy.

BitMEX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Take Profit Orders

- Hidden Orders

BitMEX’s variety of order types gives you flexibility for different market conditions. The hidden orders feature is especially useful when you want to conceal your trading intentions from other market participants.

Phemex Order Types:

- Market Orders

- Limit Orders

- Conditional Orders

Phemex offers fewer order types but covers the essentials that most traders need. Their conditional orders function combines aspects of stop and take profit orders in one feature.

Both platforms allow you to set parameters for automatic execution when certain price levels are reached. This helps you manage risk without constantly watching the market.

Key Differences:

| Feature | BitMEX | Phemex |

|---|---|---|

| Order Variety | More extensive | More streamlined |

| Hidden Orders | Available | Not available |

| User Interface | More complex | More intuitive |

BitMEX might appeal to you if you’re an advanced trader who needs specialized order types. Phemex’s simpler approach works well if you prefer straightforward trading without excessive options.

Your trading style should guide which platform’s order types best suit your needs.

Phemex Vs BitMEX: KYC Requirements & KYC Limits

When trading on cryptocurrency exchanges, Know Your Customer (KYC) requirements are important to understand. These rules affect how you can use the platforms and what limits you might face.

Phemex KYC Requirements:

- Now requires KYC verification for all users

- Mandatory for deposits, withdrawals, and trading

- Previously optional but has been updated in 2025

BitMEX KYC Requirements:

- Does not require KYC verification to open an account

- You can start trading immediately without identity verification

- KYC is only required for high withdrawal amounts

This difference in approach gives BitMEX an advantage for users who prefer privacy or want to start trading quickly. Some traders use VPNs to bypass location restrictions when using BitMEX.

The verification process on Phemex has become stricter in 2025, bringing it in line with many other major exchanges. This change reflects the growing regulatory pressure in the cryptocurrency industry.

For high-volume traders, BitMEX’s limited KYC requirements can be beneficial. However, this comes with potential regulatory risks depending on your country’s laws.

Both exchanges have made changes to their policies over time, so it’s worth checking their current requirements before signing up.

Phemex Vs BitMEX: Deposits & Withdrawal Options

When comparing deposit and withdrawal options, Phemex and BitMEX show some key differences that might affect your trading experience.

BitMEX primarily supports Bitcoin (BTC) for deposits and withdrawals. This means you’ll need to convert other cryptocurrencies to BTC before using the platform.

Phemex offers more flexibility. While earlier it was similar to BitMEX with BTC-only deposits, the platform has expanded its options to include credit card payments.

Both exchanges use a crypto-based system that allows you to leverage your deposits. BitMEX offers up to 100x leverage on your BTC, which can amplify potential gains or losses.

Phemex matches this leverage capability while providing more deposit methods. This makes it slightly more accessible for traders who don’t already hold Bitcoin.

| Feature | BitMEX | Phemex |

|---|---|---|

| Crypto deposits | BTC only | Multiple cryptocurrencies |

| Fiat deposits | No | Yes (via credit card) |

| Maximum leverage | 100x | 100x |

| Direct USD deposits | No | Limited options |

Withdrawal processes on both platforms involve standard security measures like two-factor authentication and email confirmations.

Fee structures for deposits and withdrawals are competitive in both cases, though they vary based on network conditions and withdrawal amounts.

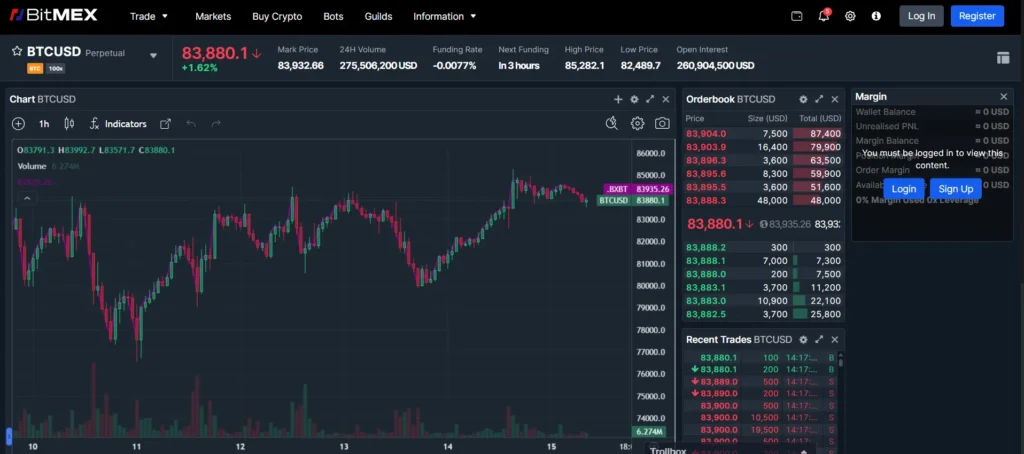

Phemex Vs BitMEX: Trading & Platform Experience Comparison

Both Phemex and BitMEX offer powerful trading platforms for cryptocurrency derivatives, but they differ in several key aspects that might influence your choice.

User Interface

- Phemex: Clean, modern interface with intuitive navigation

- BitMEX: More technical layout that can be challenging for beginners

Phemex provides a more user-friendly experience with its streamlined design. BitMEX tends to appeal to advanced traders who appreciate its comprehensive data displays.

Trading Features

| Feature | Phemex | BitMEX |

|---|---|---|

| Leverage | Up to 100x | Up to 100x |

| Order Types | Market, Limit, Stop, OCO | Market, Limit, Stop, Take Profit |

| Trading Tools | Advanced charting, indicators | Advanced charting, indicators |

| Mobile App | Yes, highly rated | Yes, functional |

Trading Speed

Phemex excels with its high-performance trading engine that processes transactions extremely quickly. BitMEX also offers decent execution speeds but may experience more slowdowns during high market volatility.

Demo Accounts

Phemex offers a practice mode where you can test strategies with simulated funds. BitMEX lacks a dedicated demo environment, which makes it less accessible for new traders.

Contract Offerings

Both platforms support futures and perpetual contracts. Phemex has expanded its offerings to include more trading pairs in recent years, closing the gap with BitMEX’s historically larger selection.

Platform Stability

BitMEX has faced criticism for server overloads during peak trading times. Phemex has invested in infrastructure that helps maintain stability even during market surges.

Phemex Vs BitMEX: Liquidation Mechanism

Both Phemex and BitMEX have liquidation mechanisms to protect their platforms from excessive losses when traders cannot meet margin requirements. These systems automatically close positions when they fall below the maintenance margin level.

BitMEX has a straightforward approach to liquidation. It only triggers liquidations based on index price movements, not market manipulations. This helps protect traders from false liquidations that might occur during short-term price spikes.

Phemex employs a dual price mechanism to prevent unfair liquidations. This system uses both mark price and last traded price to determine liquidation conditions, offering traders more protection against market volatility.

Key Differences:

| Feature | Phemex | BitMEX |

|---|---|---|

| Liquidation Trigger | Falls below maintenance margin | Falls below maintenance margin |

| Price Mechanism | Dual price system | Index price based |

| Protection Feature | Prevents unfair liquidations | Resistant to market manipulation |

Both exchanges charge liquidation fees when positions are forcibly closed. These fees can impact your overall trading costs, so you should factor them into your trading strategy.

You can reduce your liquidation risk on both platforms by using stop-loss orders and maintaining adequate margin in your account. This helps you control potential losses before the automatic liquidation process begins.

Phemex Vs BitMEX: Insurance

Both Phemex and BitMEX understand the risks of cryptocurrency trading, especially with leverage. To protect traders, they’ve established insurance funds.

These insurance funds serve as safety nets when traders can’t cover their losses. This happens when market volatility causes positions to be liquidated at prices worse than their bankruptcy prices.

BitMEX Insurance Fund has been operating longer and has accumulated substantial reserves. Their fund helps maintain platform stability during extreme market conditions.

Phemex Insurance Fund works similarly but is relatively newer in the market. It still provides crucial protection for traders using leverage on their platform.

The size of these funds matters. Larger insurance funds can better absorb market shocks and protect users during major price swings.

When choosing between these exchanges, consider how important this protection is for your trading style. If you use high leverage frequently, a robust insurance fund becomes more important.

Neither platform guarantees complete protection against all losses. Trading cryptocurrency, especially with leverage, always carries significant risk.

You should review each platform’s specific insurance fund policies before trading. The exact terms and coverage may change over time as the exchanges evolve their risk management approaches.

Phemex Vs BitMEX: Customer Support

When trading cryptocurrencies, good customer support can make a big difference, especially during urgent situations. Both Phemex and BitMEX offer customer support services, but they differ in their approach and availability.

Phemex provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and social media platforms. Many users appreciate their quick response times and helpful solutions to common trading issues.

BitMEX offers customer support primarily through email and a ticket system. Their support team is known for being knowledgeable about technical trading questions. However, response times may vary depending on inquiry volume.

Support Channels Comparison:

| Platform | Live Chat | Social Media | Knowledge Base | |

|---|---|---|---|---|

| Phemex | ✓ | ✓ | ✓ | ✓ |

| BitMEX | ✗ | ✓ | Limited | ✓ |

Both exchanges maintain extensive help centers with FAQs, tutorials, and trading guides. These resources can help you solve many common problems without contacting support directly.

Phemex has gained popularity for its more user-friendly approach to customer service. They typically respond faster and have made support accessibility a priority in their platform development.

BitMEX tends to focus their support on addressing complex trading and technical questions. Their team includes experts who can help with advanced trading scenarios.

Phemex Vs BitMEX: Security Features

When trading cryptocurrencies, security should be your top priority. Both Phemex and BitMEX offer strong security measures to protect your assets and personal information.

Two-Factor Authentication (2FA) is available on both platforms. This essential security feature adds an extra layer of protection to your account. You should always enable 2FA when trading.

Phemex uses cold storage systems to keep most user funds offline and safe from hackers. This approach significantly reduces the risk of theft through online attacks.

BitMEX also implements strong security protocols with multi-signature wallets and regular security audits. Their system requires multiple approvals before withdrawals can be processed.

Key Security Features Comparison:

| Feature | Phemex | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Multi-signature Wallets | ✓ | ✓ |

| Insurance Fund | ✓ | ✓ |

| Regular Security Audits | ✓ | ✓ |

Both platforms have built strong reputations for security in the cryptocurrency exchange market. Neither has experienced major security breaches that resulted in significant customer losses.

Phemex adds additional security through its tiered account system. This limits withdrawal amounts based on your verification level, adding protection against unauthorized access.

You’ll find both platforms offer IP address monitoring and email alerts for login attempts, helping you quickly identify suspicious activity on your account.

Is Phemex A Safe & Legal To Use?

Phemex has built a solid reputation as a safe cryptocurrency exchange. According to search results, it’s recognized as a legitimate, safe, and highly trustworthy platform. One important factor that adds to its credibility is that Phemex has never experienced a security breach or hack.

As a major centralized exchange, Phemex implements robust security measures to protect user funds and data. The platform offers a quick, secure, and user-friendly experience for trading cryptocurrencies.

When considering legality, Phemex operates as a legitimate cryptocurrency exchange. However, you should always verify if it’s available in your specific location, as crypto regulations vary by country.

Phemex offers these security features:

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Regular security audits

- Anti-phishing protection

Despite its strong security record, you should always exercise caution when using any cryptocurrency platform. Get familiar with the exchange’s features and security practices before committing significant funds.

For maximum security, consider these practices when using Phemex:

- Enable all security features

- Use a strong, unique password

- Never share your login credentials

- Consider using a hardware wallet for long-term storage

The search results indicate that Phemex receives high ratings for safety compared to other exchanges, making it a trustworthy option for your crypto trading needs.

Is BitMEX A Safe & Legal To Use?

BitMEX has faced legal challenges in the past, particularly with US regulators for violating derivatives trading laws. This has affected its reputation and availability in certain regions.

Despite these troubles, BitMEX has worked hard to rebuild trust by enhancing its compliance and security features. The platform is considered highly rated and one of the safer exchanges for margin trading cryptocurrencies.

If you’re in the United States, you should be aware that BitMEX is not legally available to US residents. Before using BitMEX, check whether it operates legally in your country.

For security, BitMEX offers strong protection measures. However, like with any exchange, you should only keep funds needed for active trading on the platform.

Safety Features of BitMEX:

- Multi-signature wallets

- Cold storage for most funds

- Two-factor authentication (2FA)

- Advanced trading engine

Remember that cryptocurrency trading involves risks, especially with leveraged trading that BitMEX specializes in. You should always practice caution and only invest what you can afford to lose.

While BitMEX is generally considered safe for traders outside restricted regions, you should do your own research regarding its current legal status in your location before creating an account.

Frequently Asked Questions

Traders evaluating cryptocurrency exchange platforms need clear answers to important questions about features, security, and usability. These FAQs address the most common inquiries about Phemex and BitMEX.

What are the key differences in features between Phemex and BitMEX?

Phemex and BitMEX differ in several key features. Phemex offers leverage options up to 100x, similar to BitMEX which also provides up to 100x leverage.

Phemex has a higher minimum deposit requirement of 0.00000001 BTC, while BitMEX has more flexible deposit options.

The overall score comparison shows BitMEX with a higher score of 6.0 compared to Phemex. Both platforms support limited cryptocurrencies for trading, though their specific offerings vary.

How do Phemex and BitMEX compare in terms of trade execution and liquidity?

Both exchanges offer derivatives trading with similar execution capabilities. However, BitMEX has been in the market longer and typically maintains higher trading volumes.

Phemex has worked to improve its liquidity since launch, but generally has lower overall trading volume compared to BitMEX. This can affect trade execution during volatile market periods.

The order matching engines on both platforms are designed for high-frequency trading, though some users report BitMEX occasionally experiences overload during extreme market conditions.

Can users from the United States trade on Phemex or BitMEX?

Neither Phemex nor BitMEX currently accepts users from the United States due to regulatory constraints. Both platforms implement geo-blocking for US IP addresses.

Users attempting to access either platform from the US will be blocked during the registration process. This restriction is due to US regulations regarding cryptocurrency derivatives trading.

What are the security measures implemented by Phemex and BitMEX to protect user funds?

Both exchanges employ cold storage solutions to secure the majority of user funds. Phemex and BitMEX use multi-signature wallets requiring multiple approvals for withdrawals.

Two-factor authentication (2FA) is mandatory on both platforms to protect user accounts. Both also offer IP whitelisting and email confirmations for withdrawals.

BitMEX has a longer track record regarding security, while Phemex emphasizes its security team’s background from traditional financial institutions.

How do withdrawal processes and limits on Phemex differ from those on BitMEX?

Phemex processes withdrawals multiple times daily, while BitMEX typically processes withdrawals once per day at a scheduled time. This can affect how quickly you receive your funds.

BitMEX has more stringent withdrawal verification procedures, often requiring additional confirmations for large withdrawals. Phemex offers a more streamlined process but may have lower limits.

Both platforms charge network fees for withdrawals, but the fee structures differ. Checking current fee schedules is recommended as they change based on network conditions.

What are the customer support experiences like on Phemex compared to BitMEX?

Phemex offers 24/7 customer support through live chat and email, with generally faster response times. Many users report receiving responses within hours.

BitMEX primarily uses a ticket-based email support system. Response times can vary from several hours to days depending on query complexity and volume.

Both platforms provide extensive knowledge bases and FAQs, but Phemex has invested more in immediate support options. BitMEX tends to focus on thorough but sometimes slower responses.

BitMEX Vs Phemex Conclusion: Why Not Use Both?

Both BitMEX and Phemex offer strong platforms for cryptocurrency derivatives trading. BitMEX has a higher overall score of 6.0 compared to Phemex, according to recent comparisons.

BitMEX brings more experience to the table as an established platform. It offers solid leverage options and has built a reputation in the crypto trading community over the years.

Phemex counters with leverage options up to 100x, giving traders more flexibility for high-risk, high-reward strategies. The platform has also maintained a strong technical record with no reported crashes or freezing issues.

Key Considerations:

- BitMEX has higher liquidity than Phemex

- Phemex has a more stable platform history

- Neither platform accepts US traders

- Both platforms limit the number of cryptocurrencies accepted

Using both platforms can give you trading advantages. You can leverage BitMEX’s higher liquidity for larger trades while using Phemex’s stable platform for daily trading.

You might also consider splitting your trading capital between both exchanges to reduce platform-specific risks. This approach lets you take advantage of different fee structures and promotions.

Remember that diversifying across platforms requires more attention to security. Use strong, unique passwords and two-factor authentication on both platforms to keep your funds safe.