Choosing the right crypto exchange can make a big difference in your trading experience. Phemex and Bitget are two popular platforms that offer various trading options, but they have some key differences worth exploring.

Both Phemex and Bitget provide low fee structures and support for leverage trading, but they differ in their available cryptocurrencies, trading tools, and user interfaces. When comparing these exchanges in 2025, you’ll want to consider factors like deposit methods, supported cryptocurrencies, and the specific trading features that match your needs.

Whether you’re a new trader or have experience in crypto markets, understanding how these platforms compare can help you make a better choice. Each exchange has its own strengths – Phemex is known for its exceptionally low fees and powerful trading tools, while Bitget offers its own set of advantages that might better suit your trading style.

Phemex Vs Bitget: At A Glance Comparison

Phemex and Bitget are popular cryptocurrency exchanges that offer leverage trading options. Both platforms have gained traction among traders looking for reliable places to trade digital assets.

When comparing these exchanges, several key factors stand out. Let’s look at how they measure up against each other:

| Feature | Phemex | Bitget |

|---|---|---|

| Founded | 2019 | 2018 |

| Trading Fees | Competitive | Competitive |

| Leverage Options | Up to 100x | Up to 100x |

| User Interface | Clean, professional | User-friendly |

| Mobile App | Available | Available |

| Security Features | Strong | Strong |

| Supported Cryptocurrencies | 50+ | 100+ |

Both exchanges offer demo accounts where you can practice trading without risking real money. This is especially helpful if you’re new to leverage trading.

Bitget appears to support more cryptocurrencies, giving you more trading options. However, Phemex is known for its clean interface and professional trading tools.

Security is a priority for both platforms, with features like two-factor authentication and cold storage for funds.

The choice between Phemex and Bitget often comes down to your specific needs. You might prefer Bitget if you want access to more cryptocurrencies, while Phemex might be better if you value a streamlined trading experience.

Trading volume is substantial on both platforms, indicating good liquidity for major trading pairs.

Phemex Vs Bitget: Trading Markets, Products & Leverage Offered

Phemex and Bitget both offer a variety of trading markets, but they differ in their specific offerings. As of March 2025, both exchanges support spot trading for hundreds of cryptocurrencies.

Spot Trading Markets:

- Phemex: 200+ cryptocurrencies

- Bitget: 300+ cryptocurrencies

For derivatives trading, both platforms provide futures contracts with leverage options. Bitget generally offers more trading pairs for futures.

Futures Trading:

| Feature | Phemex | Bitget |

|---|---|---|

| Contract Types | USDT-M, Coin-M | USDT-M, USDC-M, Coin-M |

| Trading Pairs | 60+ | 100+ |

| Max Leverage | 100x | 125x |

You’ll find copy trading features on both platforms, allowing you to follow successful traders’ strategies automatically. Bitget introduced this feature earlier and has a more developed system with more signal providers.

Both exchanges offer leveraged tokens, but Bitget provides a wider selection. These tokens let you take leveraged positions without worrying about liquidation.

For margin trading, Phemex offers cross margin while Bitget provides both cross and isolated margin options. This gives you more flexibility on Bitget for risk management.

Both platforms support demo accounts where you can practice trading without risking real funds. This is especially helpful if you’re new to leverage trading or testing strategies.

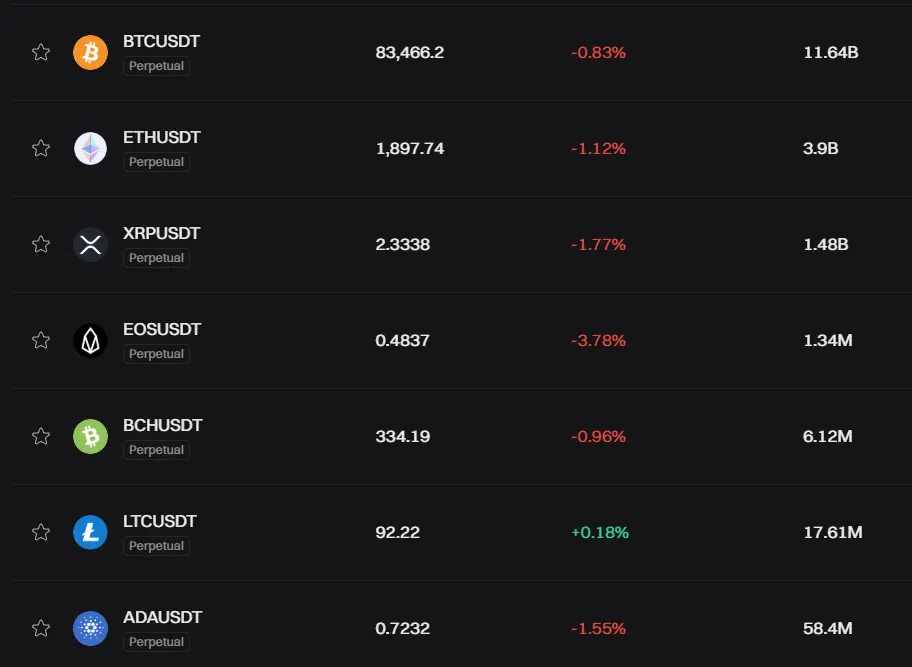

Phemex Vs Bitget: Supported Cryptocurrencies

When choosing between Phemex and Bitget, the variety of supported cryptocurrencies is an important factor to consider. Both exchanges offer a wide range of digital assets for trading.

Bitget currently supports over 200 cryptocurrencies. This includes popular coins like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), as well as numerous altcoins and tokens.

Phemex offers around 150 cryptocurrencies on its platform. While this is slightly fewer than Bitget, Phemex still covers all major cryptocurrencies that most traders need.

Key cryptocurrencies supported by both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Ripple (XRP)

- Cardano (ADA)

- Dogecoin (DOGE)

- Polkadot (DOT)

Bitget has an edge if you’re looking to trade more obscure or newer altcoins. The platform regularly adds emerging cryptocurrencies to their listings.

Phemex tends to be more selective with their listings but ensures that all supported coins meet certain quality and security standards.

Both exchanges allow you to trade cryptocurrency pairs with USD and USDT (Tether). This gives you flexibility when entering or exiting positions.

You should check each platform’s current listings if you’re interested in specific cryptocurrencies, as available assets can change as the exchanges update their offerings.

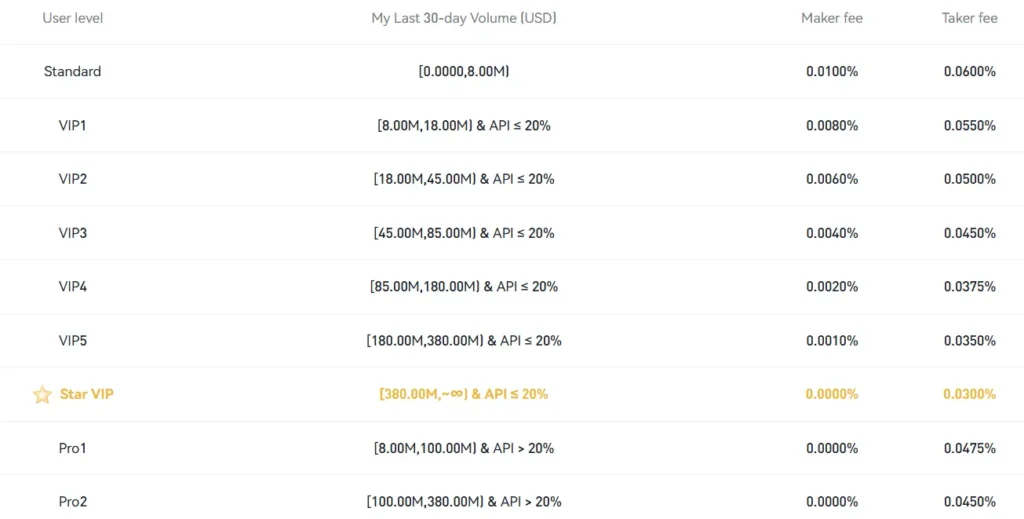

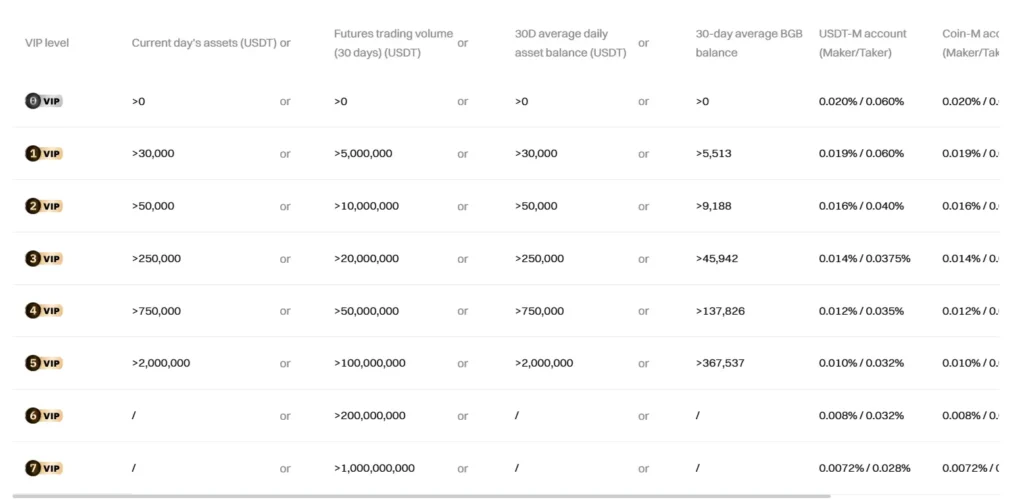

Phemex Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Phemex and Bitget, understanding the fee structure is crucial for your trading strategy. Both exchanges have different approaches to trading, withdrawal, and deposit fees.

Trading Fees

Phemex generally offers lower trading fees compared to Bitget. This can make a significant difference if you’re an active trader who makes multiple transactions daily.

Withdrawal Fees

For Bitcoin withdrawals:

- Phemex: 0.0004 BTC

- Bitget: 0.0005 BTC (some sources indicate 0.00057 BTC)

As you can see, Phemex has a slight edge with lower withdrawal fees for Bitcoin. This difference adds up if you make frequent withdrawals.

Deposit Fees

Both exchanges typically offer free crypto deposits, which is standard in the industry. However, fiat deposit methods and fees may vary depending on your region and payment method.

Fee Reduction Options

Phemex allows you to use their native token to pay for trading fees, withdrawal fees, and gas fees. This can potentially reduce your overall costs if you hold their token.

Bitget also offers fee discounts through various programs, though specific details may change based on their current promotions.

Remember to check the latest fee schedules on both platforms before making your decision, as crypto exchanges occasionally update their fee structures.

Phemex Vs Bitget: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both Phemex and Bitget offer various order options to help you execute trades effectively.

Basic Order Types Available on Both Platforms:

- Market orders

- Limit orders

- Stop-loss orders

- Take-profit orders

Phemex provides iceberg orders, which are large orders divided into smaller ones to minimize market impact. This feature is particularly useful if you’re trading with larger amounts and don’t want to cause price slippage.

Both platforms support limit conditional orders, giving you flexibility in setting your entry and exit points based on specific price conditions.

Bitget’s Special Features:

- One-click copy trading

- Grid trading automation

- Futures trading with various leverage options

Phemex’s Special Features:

- Advanced conditional orders

- OCO (One-Cancels-Other) orders

- More customizable stop-loss parameters

The interface for placing orders on Phemex tends to be more straightforward, which might be better if you’re new to crypto trading.

Bitget offers a slightly more complex but feature-rich ordering system that experienced traders might prefer.

Both exchanges support mobile trading with their order types available on their apps, letting you place sophisticated orders even when you’re on the go.

Phemex Vs Bitget: KYC Requirements & KYC Limits

Both Phemex and Bitget have KYC (Know Your Customer) requirements, but they differ in implementation and limits.

Phemex has recently updated its policy and now requires KYC verification for all users who want to deposit, withdraw, or trade cryptocurrency. Previously, KYC was optional on Phemex, but this has changed to strengthen security and compliance.

Bitget, on the other hand, only requires KYC verification for specific services like copy trading and purchasing certain products. For basic trading, you can operate without completing the verification process.

When it comes to withdrawal limits, the difference is notable. On Bitget, verified accounts can withdraw up to 200 BTC daily, which is quite generous for most traders.

KYC Requirements Comparison:

| Exchange | KYC Required For | Verification Process |

|---|---|---|

| Phemex | All deposits, withdrawals, and trading | Stringent KYC/AML process |

| Bitget | Copy trading and certain purchases | Standard verification |

Both exchanges implement these measures to protect their systems against money laundering and enhance overall platform security.

The verification process on Phemex is known to be more rigorous with a strict KYC/AML procedure. This might take longer but adds an extra layer of security for your assets.

You should consider these KYC requirements when choosing between the exchanges, especially if you prefer more privacy or need higher withdrawal limits.

Phemex Vs Bitget: Deposits & Withdrawal Options

When choosing between Phemex and Bitget, understanding their deposit and withdrawal options is essential for smooth transactions.

Deposit Methods

Both platforms support crypto deposits, allowing you to transfer your digital assets directly. Bitget offers more fiat currency options for direct deposits compared to Phemex.

Phemex primarily focuses on crypto deposits, while Bitget provides more flexibility with bank transfers and credit/debit card options in various currencies.

Withdrawal Options

| Feature | Phemex | Bitget |

|---|---|---|

| Crypto withdrawals | Yes | Yes |

| Fiat withdrawals | Limited | Multiple options |

| Processing time | 1-24 hours | 1-48 hours |

| Verification requirements | KYC needed for larger amounts | KYC for all fiat withdrawals |

Bitget allows you to withdraw to more payment methods, including bank accounts in various currencies. Phemex tends to focus more on crypto withdrawals.

Fees Structure

Both exchanges charge network fees for crypto withdrawals. Bitget’s fiat withdrawal fees vary by payment method and currency.

Phemex typically has competitive crypto withdrawal fees, but fewer options for fiat currency withdrawals compared to Bitget.

Processing Times

Crypto withdrawals on both platforms typically process within minutes to hours, depending on network congestion. Fiat withdrawals through Bitget may take 1-3 business days depending on your payment method.

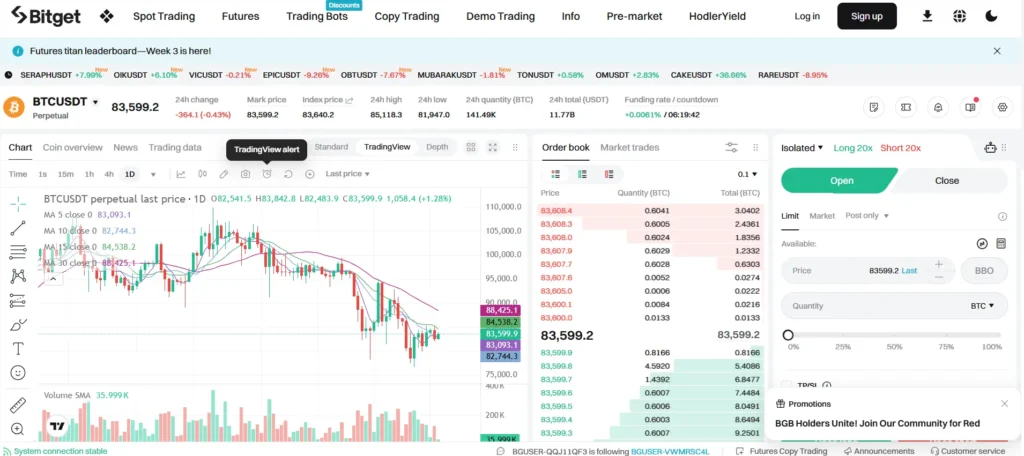

Phemex Vs Bitget: Trading & Platform Experience Comparison

Both Phemex and Bitget offer solid trading platforms, but they differ in key areas that may affect your trading experience.

Phemex provides a clean, intuitive interface that many beginners find easy to navigate. The platform loads quickly and rarely experiences downtime, which is crucial during volatile market conditions.

Bitget, on the other hand, offers a feature-rich platform that experienced traders often prefer. Its advanced charting tools and technical indicators give you more ways to analyze market movements.

Trading Features Comparison:

| Feature | Phemex | Bitget |

|---|---|---|

| Leverage Trading | Up to 100x | Up to 125x |

| Trading Pairs | 180+ | 300+ |

| Mobile App | Yes (iOS & Android) | Yes (iOS & Android) |

| Trading Bots | Limited options | Extensive options |

Both exchanges support spot and futures trading, but Bitget edges ahead with more trading pairs and slightly higher leverage options.

The mobile experience differs between the two platforms. Phemex’s mobile app focuses on simplicity and core functions, while Bitget’s app tries to include most desktop features.

Response times matter in crypto trading. Phemex generally exhibits faster execution speeds during normal market conditions, though both platforms may slow during extreme volatility.

Bitget stands out with more extensive bot trading options, allowing you to automate strategies with greater customization.

Phemex Vs Bitget: Liquidation Mechanism

When trading futures on crypto exchanges, understanding the liquidation mechanism is crucial for risk management. Both Phemex and Bitget have systems in place to protect themselves when your positions approach a point where losses might exceed your margin.

Phemex uses a tiered liquidation system that warns you before closing your position. You’ll receive alerts when your margin ratio drops below certain thresholds. This gives you time to add funds or reduce your position size.

Bitget, on the other hand, employs an immediate liquidation approach once your margin ratio hits the liquidation price. Their system might be less forgiving with fewer warning steps.

Liquidation Fees Comparison:

| Exchange | Liquidation Fee | Partial Liquidation |

|---|---|---|

| Phemex | Lower (0.1-0.2%) | Yes, progressive |

| Bitget | Higher (0.3-0.5%) | Limited options |

Both platforms use an insurance fund to manage liquidations, but Phemex’s fund is generally larger, providing more stability during volatile market conditions.

Phemex offers a liquidation price calculator directly in its trading interface. This makes it easier for you to plan your trades and set appropriate stop-losses.

Bitget has a similar feature but requires more clicks to access. Their interface might be less intuitive for beginners tracking potential liquidation prices.

For new traders, Phemex’s gradual liquidation approach provides a better safety net. Experienced traders might prefer either system based on their trading style and risk management practices.

Phemex Vs Bitget: Insurance

When trading on crypto exchanges, your funds’ safety is a top priority. Both Phemex and Bitget offer insurance protections, but they differ in significant ways.

Phemex maintains an insurance fund to protect traders against auto-deleveraging. As of March 2025, this fund has grown substantially from its earlier years. The purpose is to cover losses during extreme market volatility.

Bitget also provides an insurance fund, but takes protection a step further with their Bitget Protection Fund. This fund is worth over $300 million and is designed to safeguard user assets.

Protection Fund Comparison:

| Exchange | Insurance Fund | Special Features |

|---|---|---|

| Phemex | Yes | Focused on preventing auto-deleveraging |

| Bitget | Yes | $300M+ Protection Fund |

You should know that Bitget’s insurance approach is more transparent. They publish regular proof-of-reserves to verify they have the assets to back user funds.

Both platforms use cold storage for most user funds, keeping them offline and away from potential hackers. This is an industry standard security practice.

Neither exchange has reported major security breaches affecting user funds in recent years. This track record helps build confidence in their security systems.

Before choosing an exchange, you might want to check their current insurance policies as these can change over time.

Phemex Vs Bitget: Customer Support

When choosing between Phemex and Bitget, customer support quality can make a big difference in your trading experience. Both exchanges offer multiple ways to get help when you need it.

Phemex provides 24/7 customer support through live chat, email, and ticket systems. Their response times typically range from a few minutes to several hours, depending on the complexity of your issue.

Bitget also offers round-the-clock support with similar contact methods. They have invested in building a responsive team that can handle technical and account-related questions.

Both exchanges have detailed help centers with FAQs, tutorials, and guides. These resources can help you solve common problems without waiting for support.

The main difference appears in user experiences. Phemex often receives praise for more personalized support interactions, while Bitget is known for quick initial responses.

Language support is another important factor. Phemex supports more languages than Bitget, which might be important if English isn’t your first language.

For serious traders, both platforms offer priority support for VIP or high-volume accounts. This means faster response times and access to dedicated support agents.

Neither exchange currently offers phone support, which some users might find limiting for urgent issues.

Phemex Vs Bitget: Security Features

When choosing between Phemex and Bitget, security should be a top priority. Both exchanges offer strong security measures to protect your assets.

Phemex provides multi-factor authentication (MFA) to secure your account. They also use cold storage for most user funds, keeping them offline and away from potential hackers.

Bitget matches these security features with their own MFA system. They also implement a robust risk control system that includes real-time monitoring for suspicious activities.

Key Security Differences:

- Phemex offers an advanced encryption protocol for data transmission

- Bitget provides a dedicated security fund to protect users against potential losses

- Both platforms use cold wallet storage, but Bitget claims to keep about 98% of assets in cold storage

Common Security Features:

- Multi-factor authentication

- Cold wallet storage

- Anti-phishing codes

- Regular security audits

You should consider enabling all available security features regardless of which platform you choose. This includes setting up strong passwords and using authentication apps rather than SMS verification when possible.

Both exchanges have insurance funds to cover potential losses, but the coverage amounts differ. Bitget’s protection fund is reportedly larger, which might offer more peace of mind if you’re trading significant amounts.

Neither platform has reported major security breaches in recent history, which speaks to their commitment to security practices.

Is Phemex Safe & Legal To Use?

Phemex has established itself as a secure cryptocurrency exchange with a solid reputation in the industry. Based on available information, Phemex implements strong security measures to protect user funds and data.

The platform is regulated, which adds an extra layer of security for traders. This regulation helps ensure that Phemex follows standard financial practices and protections.

For traders concerned about security, Phemex offers:

- Strong encryption protocols

- Secure trading environment

- Regular security audits

- Account protection features

Legal status varies by location. While Phemex is accessible in many countries, some regions have restrictions on cryptocurrency trading platforms. In Canada, for example, users in British Columbia can still access Phemex as of 2023 information.

It’s worth noting that Phemex ranks among the top five cryptocurrency exchanges, providing substantial liquidity for various crypto transactions. This high ranking suggests market trust in the platform.

Phemex does not currently require KYC (Know Your Customer) verification in all regions, though regulatory changes may affect this policy. This differs from competitors like Bitget, which planned to implement KYC requirements.

Always check the current legal status of any cryptocurrency platform in your specific location before trading, as regulations change frequently in this evolving market.

Is Bitget Safe & Legal To Use?

Bitget has established itself as a reputable cryptocurrency exchange with a focus on security. The platform has not experienced major security breaches or significant losses of user funds, which is a positive sign.

Bitget operates as a fully licensed exchange, having completed regulatory processes to ensure security standards are met. This licensing provides an extra layer of protection for users.

Legal status by region:

- Not available in: United States, United Kingdom, Canada

- Restricted in: Sanctioned countries

The exchange obtained an MSB (Money Services Business) license, though there are conflicting reports about U.S. accessibility. Most reliable sources indicate U.S. traders cannot use the platform.

Some users have expressed concerns about the platform, so it’s wise to use strong security practices if you choose Bitget:

- Enable two-factor authentication

- Use a unique, strong password

- Consider a hardware wallet for long-term storage

- Start with small amounts to test the platform

Before signing up, verify Bitget’s current legal status in your country as regulations change frequently. The crypto regulatory landscape is constantly evolving.

For additional security, Bitget offers various protection measures including secure asset storage and regular security audits.

Frequently Asked Questions

Many traders compare Phemex and Bitget when choosing a crypto exchange. These platforms differ in several key aspects including security features, fee structures, cryptocurrency offerings, and trading tools.

What security measures do Phemex and Bitget implement to protect user funds?

Both exchanges prioritize security through cold storage systems. Phemex stores the majority of user assets in cold wallets that remain offline and inaccessible to hackers.

Bitget employs multi-signature technology for its wallet systems, requiring multiple approvals for withdrawals. This adds an extra layer of protection against unauthorized access.

Both platforms use two-factor authentication (2FA) to secure user accounts. They also implement anti-phishing codes and advanced encryption to protect user data and transactions.

How do trading fees compare between Phemex and Bitget?

Phemex generally offers lower trading fees compared to Bitget. For standard spot trading, Phemex charges less per transaction.

When withdrawing Bitcoin, Phemex has more favorable rates. According to recent data, Bitget’s BTC withdrawal fee is approximately 0.00057 BTC.

Phemex uses a tiered fee structure that rewards higher trading volumes with fee discounts. This makes it potentially more cost-effective for active traders.

What variety of cryptocurrencies can be traded on Phemex and Bitget?

Both exchanges support major cryptocurrencies like Bitcoin, Ethereum, and Solana. They also list numerous altcoins for trading.

Bitget typically offers a wider selection of newer and smaller-cap cryptocurrencies. This provides more options for traders interested in emerging projects.

Phemex focuses more on established cryptocurrencies but regularly adds new listings based on market demand and quality assessment.

Which exchange offers better customer support, Phemex or Bitget?

Both exchanges provide 24/7 customer support through multiple channels including live chat, email, and ticket systems.

Phemex is known for faster response times and offers support in several languages. Their knowledge base contains detailed guides for common issues.

Bitget has a comprehensive help center with articles and tutorials. Some users report longer wait times during peak periods compared to Phemex.

How do Phemex and Bitget handle regulatory compliance and user verification?

Both platforms implement Know Your Customer (KYC) procedures to comply with regulations. These typically involve identity verification through document submission.

Phemex offers limited functionality for unverified accounts but allows full access after completing KYC. They comply with international anti-money laundering standards.

Bitget also requires KYC for higher withdrawal limits and full platform access. They adjust their compliance requirements based on the user’s country of residence.

What are the differences in trading tools and features between Phemex and Bitget?

Phemex excels in derivatives trading with advanced features for futures contracts and perpetual swaps. Their platform includes detailed charting tools and technical indicators.

Bitget stands out with its user-friendly interface that’s easier for beginners. According to search results, Bitget’s interface is cleaner and more intuitive for new traders.

Both exchanges offer mobile apps, but Bitget’s app receives higher ratings for ease of use. Phemex provides more advanced order types for experienced traders, including OCO (One-Cancels-the-Other) orders.

Phemex Vs Bitget Conclusion: Why Not Use Both?

After comparing Phemex and Bitget, you might wonder which exchange to choose. The truth is, you don’t have to pick just one.

Both platforms offer strong security measures, including cold storage for your assets. This means your crypto is kept offline and safe from online threats.

Phemex offers competitive trading fees starting at 0.1% for both maker and taker, with discounts as your trading volume increases. Bitget also has a competitive fee structure.

Key reasons to use both exchanges:

- Risk diversification – Spreading your assets across multiple platforms reduces your exposure if one exchange faces issues

- Feature advantages – Each platform has unique strengths you can leverage for different trading strategies

- Market opportunities – Different exchanges sometimes offer varying prices during high volatility

You might prefer Phemex for certain contract types while finding Bitget better for others. Using both gives you flexibility.

Trading volume requirements differ between platforms, so maintaining accounts on both can help you qualify for different tier benefits.

Remember that both exchanges are reputable choices for crypto trading in 2025. Your specific needs and trading style will determine which one you use more frequently.