Choosing the right cryptocurrency exchange can impact your trading experience and investment outcomes. OKX and WhiteBIT are two popular platforms that offer various trading options for crypto enthusiasts. When comparing OKX vs WhiteBIT in 2025, you need to consider differences in fees, supported cryptocurrencies, available trading types, and user experience.

Both exchanges provide comprehensive services but cater to different user needs. OKX offers a wider range of trading products including futures and options, while WhiteBIT may appeal to those looking for specific features or regional support. Understanding how these platforms differ in deposit methods, security measures, and user interfaces can help you make an informed decision.

As you explore your exchange options, remember that the best choice depends on your individual trading goals and preferences. The comparison between these platforms involves examining their fee structures, available cryptocurrencies, and additional features that might benefit your trading strategy.

OKX Vs WhiteBIT: At A Glance Comparison

When choosing between OKX and WhiteBIT, you’ll want to compare key features that matter to traders. Both platforms offer cryptocurrency trading services but differ in several important ways.

Trading Fees

| Exchange | Maker Fees | Taker Fees | Withdrawal Fees |

|---|---|---|---|

| OKX | Lower for high-volume traders | Competitive, tier-based | Varies by cryptocurrency |

| WhiteBIT | Competitive | Slightly higher than OKX | Network-dependent |

Available Cryptocurrencies

OKX typically offers more trading pairs and cryptocurrencies than WhiteBIT. This gives you more options when diversifying your portfolio.

User Experience

OKX has a more complex interface designed for experienced traders. WhiteBIT offers a more straightforward design that newer users might find easier to navigate.

Security Features

Both exchanges implement two-factor authentication and cold storage solutions. Each platform has security measures to protect your assets.

Deposit Methods

OKX provides more fiat currency options and payment methods compared to WhiteBIT in most regions.

Trading Types

You can access spot trading on both platforms. OKX offers more advanced trading options including futures, margin trading, and options.

Mobile Experience

Both exchanges have mobile apps for trading on the go. OKX’s app tends to have more features but might be more complex for beginners.

OKX Vs WhiteBIT: Trading Markets, Products & Leverage Offered

OKX offers a more extensive range of trading markets compared to WhiteBIT. You can access over 350 cryptocurrencies on OKX, while WhiteBIT supports around 400+ trading pairs.

Both exchanges provide spot trading, but OKX goes further with its product lineup. On OKX, you can trade futures, perpetual swaps, options, and engage in margin trading.

WhiteBIT offers spot and futures trading but lacks the variety of derivative products found on OKX.

Leverage Options:

| Exchange | Maximum Leverage |

|---|---|

| OKX | Up to 125x |

| WhiteBIT | Up to 20x |

OKX stands out with its significantly higher leverage options of up to 125x for futures trading. This appeals to experienced traders looking for greater position sizing capabilities.

WhiteBIT takes a more conservative approach with leverage capped at 20x, which might be safer for newer traders.

Additional Products:

- OKX: Earn products, staking, DeFi wallet, NFT marketplace

- WhiteBIT: Staking, token sales, P2P trading

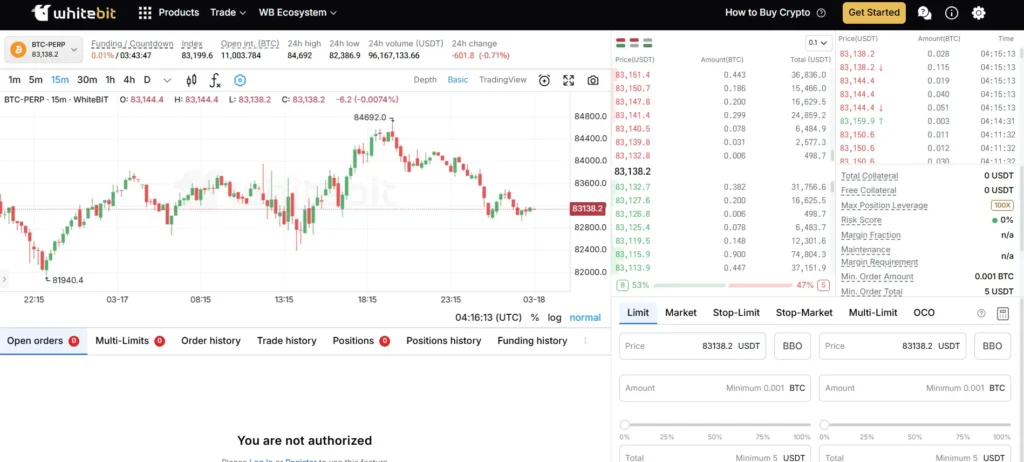

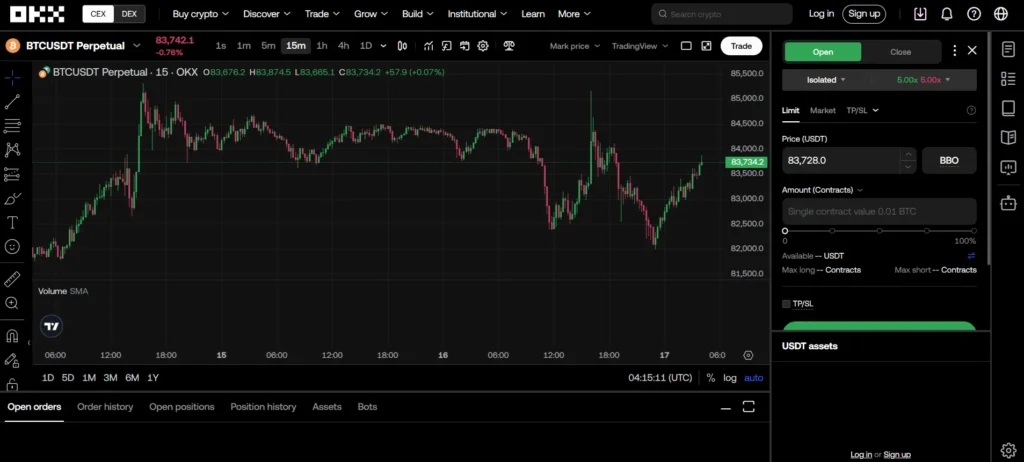

OKX’s trading interface is more complex but offers advanced tools like trading bots and detailed charting. These features make it suitable for both beginners and professional traders.

WhiteBIT’s interface is simpler and more approachable for those new to crypto trading. You’ll find it easier to navigate but with fewer advanced trading tools.

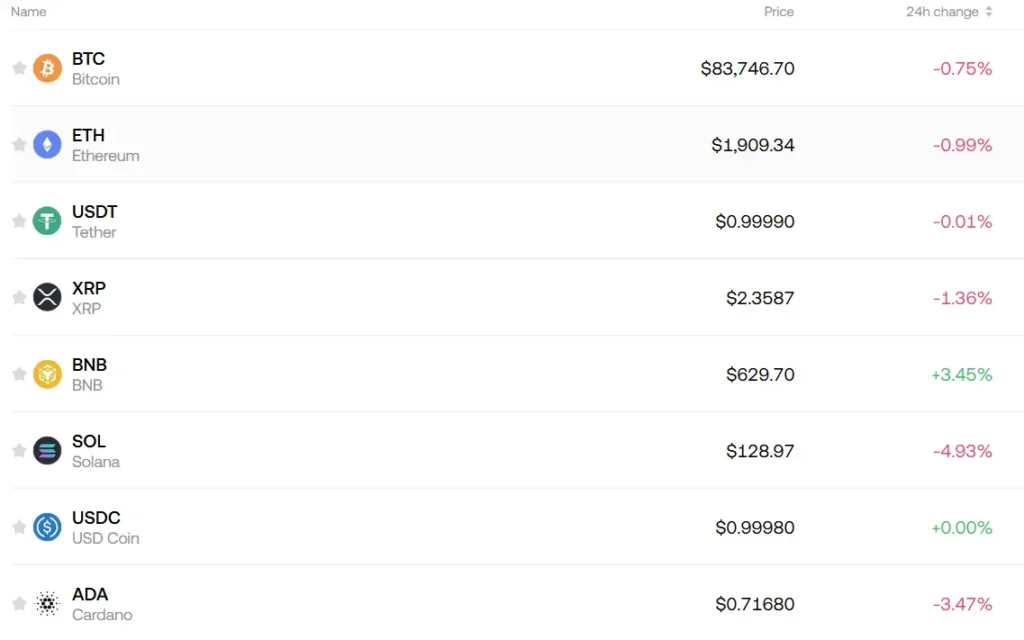

OKX Vs WhiteBIT: Supported Cryptocurrencies

When choosing between OKX and WhiteBIT, the variety of cryptocurrencies available for trading is a crucial factor to consider. Both exchanges offer a wide selection of digital assets, but there are some notable differences.

OKX supports over 350 cryptocurrencies, making it one of the more comprehensive exchanges in the market. You’ll find all major coins like Bitcoin, Ethereum, and Solana, alongside numerous altcoins and emerging tokens.

WhiteBIT offers approximately 300+ cryptocurrencies. While slightly fewer than OKX, this still represents an extensive selection that will satisfy most traders’ needs.

Key Cryptocurrency Offerings:

| Feature | OKX | WhiteBIT |

|---|---|---|

| Total cryptocurrencies | 350+ | 300+ |

| Major coins (BTC, ETH) | ✓ | ✓ |

| DeFi tokens | Extensive range | Good selection |

| New/emerging coins | Regular additions | Regular additions |

Both platforms regularly add new tokens based on market demand and proper vetting processes. You’ll find that OKX typically lists new projects slightly faster than WhiteBIT.

For specialized tokens and niche altcoins, OKX generally provides more options. However, WhiteBIT maintains strong offerings in European-based projects.

Trading pairs are another important consideration. OKX offers more trading pairs with both stablecoins and fiat currencies. WhiteBIT provides fewer pairs overall but includes some unique combinations not found on OKX.

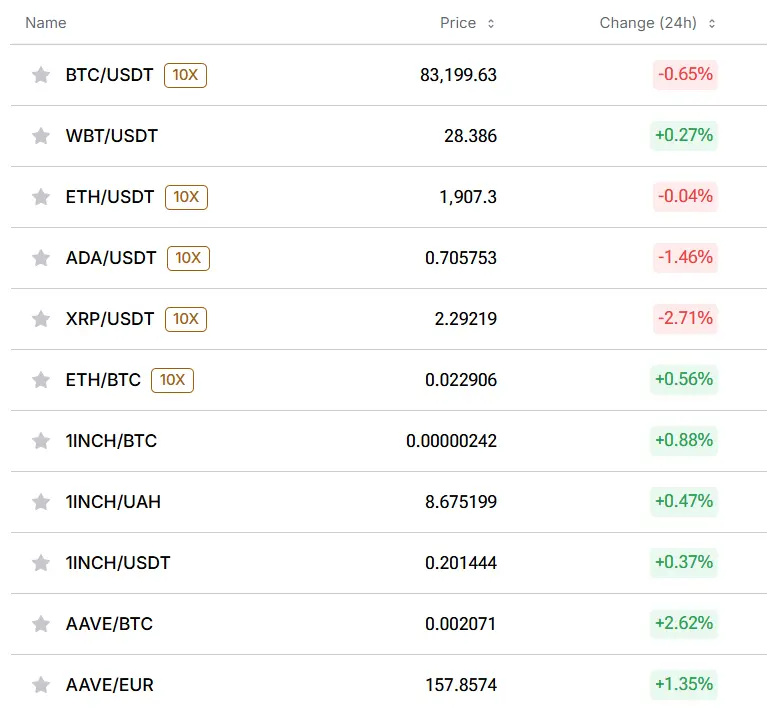

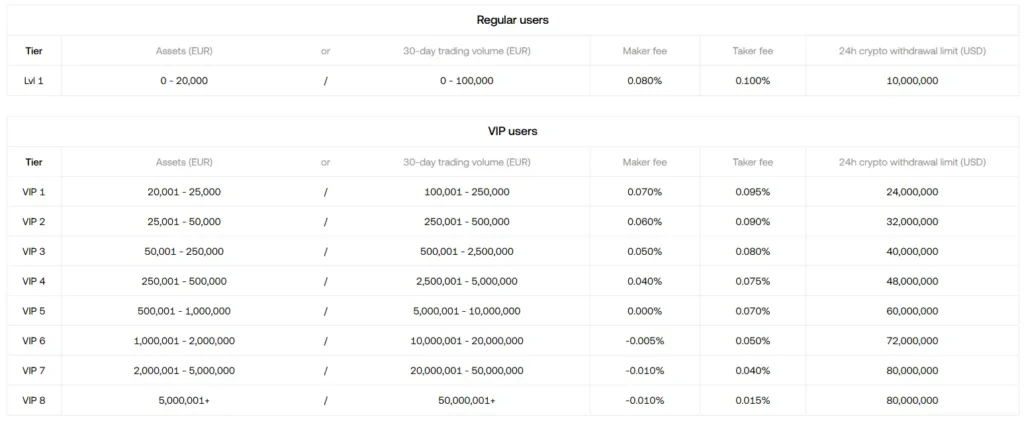

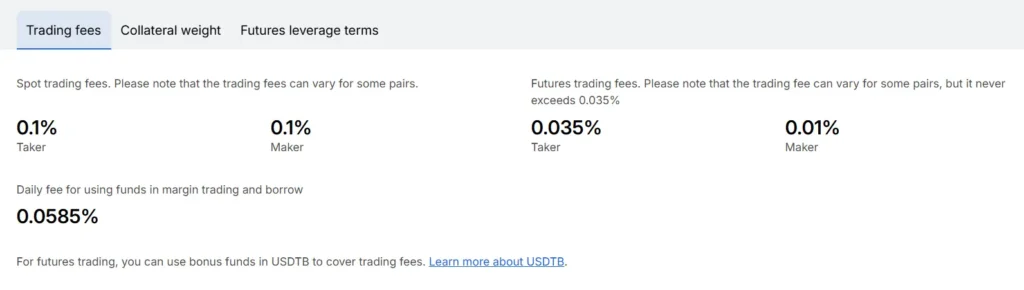

OKX Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and WhiteBIT, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees:

| Exchange | Spot Trading | Futures Trading |

|---|---|---|

| OKX | Varies based on tier | Competitive rates |

| WhiteBIT | 0.1% maker/taker | Low fees |

WhiteBIT offers a straightforward 0.1% fee for both maker and taker orders on spot trading. This simple structure makes it easy to calculate your costs.

OKX uses a tiered fee system that may offer lower rates as your trading volume increases. This can benefit high-volume traders who can qualify for reduced fees.

Deposit Methods:

Both exchanges support multiple deposit options. Your available methods may vary based on your location and the cryptocurrency you’re depositing.

Withdrawal Fees:

Withdrawal fees on both platforms vary by cryptocurrency. These fees typically cover the network transaction costs and may change based on network congestion.

WhiteBIT has gained attention for its competitive rates when you lock up funds for longer periods (up to 360 days). This feature might appeal to you if you plan to hold assets while trading.

Remember that fees can change, so check the exchanges’ official websites for the most current rates before making your decision.

OKX Vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, understanding available order types is crucial for your strategy. Both OKX and WhiteBIT offer various order options, but there are some notable differences.

OKX provides a comprehensive range of order types for traders of all levels. You can access basic orders like market, limit, and stop orders, as well as more advanced options.

WhiteBIT also offers standard order types but has received recognition for its Trailing Stop order functionality. This feature automatically adjusts your stop price as the market moves in your favor, helping maximize profits.

Here’s a comparison of the main order types available on both platforms:

| Order Type | OKX | WhiteBIT |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop Loss | ✓ | ✓ |

| Take Profit | ✓ | ✓ |

| Trailing Stop | ✓ | ✓ |

| OCO (One Cancels Other) | ✓ | ✓ |

| Post Only | ✓ | ✓ |

| Advanced Conditional | ✓ | Limited |

Both platforms allow you to set time conditions for your orders (Good Till Cancelled, Immediate or Cancel, etc.). OKX tends to offer more customization options for order execution.

For futures trading, both exchanges provide specialized order types. OKX supports more advanced features for derivatives trading, making it potentially better for experienced traders.

WhiteBIT’s interface for placing orders is generally considered more beginner-friendly, while OKX offers more tools for professional traders.

OKX Vs WhiteBIT: KYC Requirements & KYC Limits

Both OKX and WhiteBIT implement Know Your Customer (KYC) verification processes, but they differ in their requirements and withdrawal limits.

OKX KYC Requirements:

- KYC verification is required to access certain features

- Without KYC, users face restricted functionality

- KYC is necessary for higher transaction limits

WhiteBIT KYC Requirements:

- Complies with all KYC and Anti-Money Laundering (AML) requirements

- Places strong emphasis on platform security

- KYC verification unlocks full platform features

Withdrawal Limits Comparison:

| Exchange | Without KYC | With KYC |

|---|---|---|

| OKX | Limited | Higher limits based on verification level |

| WhiteBIT | Restricted | Full access with higher withdrawal limits |

For users wanting minimal verification, OKX may offer a slight advantage. Without KYC, you can reportedly withdraw up to 20 BTC per day, though this limit may vary.

WhiteBIT focuses heavily on security features and account protection. Your account will have restricted functionality until you complete their verification process.

Both exchanges use verification to protect users and comply with regulations. You’ll need to provide personal information and documentation for full platform access.

The verification process helps prevent fraud while allowing you to access higher withdrawal limits and additional trading features on both platforms.

OKX Vs WhiteBIT: Deposits & Withdrawal Options

Both OKX and WhiteBIT offer multiple ways to fund your account and withdraw your assets. Understanding these options can help you choose the exchange that best fits your needs.

OKX supports cryptocurrency deposits across a wide range of networks. You can also fund your account using credit/debit cards and bank transfers in many regions.

WhiteBIT similarly accepts crypto deposits and offers fiat payment options. They support SEPA transfers for European users and have local payment methods available in several countries.

For withdrawal methods, both exchanges allow crypto withdrawals to external wallets. OKX typically processes withdrawals faster, often within minutes for most cryptocurrencies.

Withdrawal fees vary between the platforms:

- OKX charges network fees that adjust based on blockchain congestion

- WhiteBIT has fixed fees for many cryptocurrencies

Deposit limits also differ:

- OKX has higher maximum deposit limits for verified users

- WhiteBIT implements tiered limits based on your verification level

Processing times for fiat transactions:

| Method | OKX | WhiteBIT |

|---|---|---|

| Bank Transfer | 1-3 business days | 1-5 business days |

| Card Payments | Instant | Instant |

| Crypto | Network-dependent | Network-dependent |

Security for deposits and withdrawals is robust on both platforms, with two-factor authentication and withdrawal address whitelisting available to protect your funds.

OKX Vs WhiteBIT: Trading & Platform Experience Comparison

OKX and WhiteBIT offer distinct trading experiences that cater to different types of crypto users. OKX (formerly OKEx) provides a robust platform with advanced trading features that might appeal to experienced traders.

WhiteBIT’s interface is often considered more intuitive for beginners. The platform prioritizes simplicity while still offering essential trading tools you need to get started.

Trading Features Comparison:

| Feature | OKX | WhiteBIT |

|---|---|---|

| Trading pairs | 350+ | 400+ |

| Mobile app | Yes | Yes |

| Advanced charting | Extensive | Basic to moderate |

| Demo account | Yes | Yes |

| Order types | Market, limit, stop, OCO | Market, limit, stop |

Both exchanges support spot trading, but OKX offers more extensive futures and options trading capabilities. If you’re interested in derivatives trading, OKX might better suit your needs.

Navigation on WhiteBIT feels more straightforward, with clearly labeled sections and a clean design. OKX packs more information on each screen, which can be powerful but might feel overwhelming at first.

Trading fees vary between the platforms, with both offering tier-based fee structures. Your trading volume will affect the rates you pay on both exchanges.

The mobile experience differs notably between the two. OKX’s app includes nearly all desktop features, while WhiteBIT’s mobile version offers a more streamlined experience focused on core functions.

OKX Vs WhiteBIT: Liquidation Mechanism

Liquidation happens when your position can’t be maintained due to insufficient funds. Both OKX and WhiteBIT have systems to manage this risk, but they work differently.

OKX uses a tiered liquidation system based on your account’s risk ratio. When your position approaches the liquidation threshold, you’ll receive warnings. OKX typically charges a liquidation fee between 0.5% and 2% depending on the asset and position size.

WhiteBIT employs a more straightforward approach. They monitor your margin ratio and will force-close positions when they fall below maintenance requirements. Their liquidation fees are competitive at around 1-1.5% for most assets.

Key Differences:

| Feature | OKX | WhiteBIT |

|---|---|---|

| Warning System | Multiple alerts | Basic notification |

| Liquidation Fee | 0.5-2% | 1-1.5% |

| Partial Liquidation | Available | Limited availability |

| Insurance Fund | Yes, robust | Yes, smaller |

OKX offers partial liquidation options, allowing you to save portions of larger positions. WhiteBIT typically liquidates the entire position at once, which can be more abrupt.

Both exchanges maintain insurance funds to prevent socialized losses, but OKX’s fund is considerably larger due to its higher trading volume.

You can reduce liquidation risk on both platforms by setting stop-loss orders and using lower leverage. WhiteBIT offers simpler liquidation mechanisms that may be easier for beginners to understand, while OKX provides more advanced options for experienced traders.

OKX Vs WhiteBIT: Insurance

When comparing cryptocurrency exchanges, insurance protection is a crucial factor to consider for your assets’ safety. Both OKX and WhiteBIT offer insurance options, but with notable differences.

OKX maintains a dedicated insurance fund that currently exceeds $300 million. This fund is designed to protect users against unexpected market volatility and potential system failures. Your assets on OKX have this additional layer of protection against certain types of losses.

WhiteBIT also provides insurance protection through their asset security system. They keep approximately 96% of user funds in cold storage wallets, which significantly reduces the risk of hacks or unauthorized access.

Insurance Comparison Table:

| Feature | OKX | WhiteBIT |

|---|---|---|

| Insurance Fund | $300+ million | Not specified |

| Cold Storage | Yes | 96% of funds |

| SAFU Equivalent | Yes | Limited |

| Third-Party Insurance | Limited | Available |

Both exchanges implement security measures beyond just insurance. These include two-factor authentication, withdrawal confirmations, and anti-phishing codes to protect your account.

You should note that neither exchange offers comprehensive insurance against all possible risks. Market volatility losses, personal account breaches due to compromised credentials, or certain regulatory actions may not be covered.

Before choosing either platform, it’s wise to review their current insurance policies as these details may change over time.

OKX Vs WhiteBIT: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a big difference in your trading experience. Both OKX and WhiteBIT offer support options, but they differ in important ways.

OKX provides 24/7 customer support through multiple channels. You can reach their team via live chat, email tickets, and social media platforms. The exchange also maintains an extensive knowledge base with guides and FAQs to help solve common issues.

WhiteBIT also offers 24/7 support as mentioned in the search results. Their support team is available through similar channels including live chat and email support. WhiteBIT has built a reputation for responsive customer service.

Response times can vary between the two exchanges. During busy periods, you might wait longer for assistance. OKX tends to have faster initial response times but may take longer to resolve complex issues.

Both platforms offer support in multiple languages, though OKX covers more languages due to its larger global presence. This can be important if English isn’t your first language.

For new users, WhiteBIT’s support team is often praised for being more beginner-friendly. OKX’s support, while comprehensive, sometimes assumes more technical knowledge from users.

Neither platform offers phone support, which might be disappointing if you prefer talking to a representative directly.

OKX Vs WhiteBIT: Security Features

When choosing between OKX and WhiteBIT exchanges, security should be your top priority. Both platforms offer robust security measures, but they differ in specific features.

OKX implements 2FA authentication, cold storage for most user funds, and regular security audits. Their risk management system includes anti-phishing codes and withdrawal whitelist features to protect your assets.

WhiteBIT provides similar core protections with multi-signature wallets and keeps up to 96% of assets in cold storage. Their compliance with international security standards helps ensure your funds remain safe.

Both exchanges use KYC verification processes to prevent fraud and comply with regulations. This adds an extra layer of security to your account.

OKX offers an Account Shield feature that alerts you to suspicious activities. This proactive approach helps detect potential threats before they affect your assets.

WhiteBIT’s IP detection system helps prevent unauthorized access from unfamiliar locations. You’ll receive notifications when login attempts occur from new devices.

Security Feature Comparison:

| Feature | OKX | WhiteBIT |

|---|---|---|

| 2FA Authentication | ✓ | ✓ |

| Cold Storage | ~95% | ~96% |

| Anti-phishing | ✓ | ✓ |

| Insurance Fund | ✓ | Limited |

| Compliance | Global | European-focused |

Each platform regularly updates their security systems to address emerging threats. Your choice might depend on which specific features align with your security priorities.

Is OKX A Safe & Legal To Use?

OKX is generally considered a safe crypto exchange to use in 2025. The platform implements several advanced security measures to protect user funds and data.

Some key security features include two-factor authentication (2FA), cold storage for most crypto assets, and withdrawal address whitelisting. OKX also uses anti-phishing codes to help users verify authentic communications.

The exchange meets standard KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, making it legal in most jurisdictions where crypto trading is permitted.

For traders concerned about safety, OKX offers:

- Account protection tools: Security settings to prevent unauthorized access

- Cold wallet storage: Most funds kept offline away from potential hackers

- Regular security audits: Ongoing review of platform vulnerabilities

- Insurance fund: Additional protection for certain trading activities

When comparing OKX to other platforms like WhiteBIT, both exchanges prioritize security. However, legal status varies by country, so you should verify if OKX is approved in your specific location.

The platform is suitable for both beginners and experienced traders looking to buy Bitcoin and other cryptocurrencies in 2025. Its focus on security while maintaining usability makes it a competitive option in the crypto exchange market.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT is generally considered a safe cryptocurrency exchange with several security features in place. The platform complies with both Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, which helps prevent fraud and illegal activities.

Your funds on WhiteBIT benefit from secure storage solutions, though it’s important to remember that all exchanges carry some level of platform risk. This includes potential vulnerabilities to hacking, fraud, or company insolvency.

WhiteBIT has built a reputation for reliability in the crypto space. Many users praise its solid security measures that help protect investments. The exchange operates legally in many jurisdictions, though specific regulations vary by country.

When using WhiteBIT, you should:

- Enable all available security features

- Use strong passwords and two-factor authentication

- Be aware of your country’s regulations regarding cryptocurrency trading

Remember that while WhiteBIT implements strong security practices, no exchange is completely risk-free. It’s always wise to only keep trading amounts on any exchange and store long-term holdings in personal wallets where you control the private keys.

WhiteBIT continues to maintain compliance with evolving regulations in the cryptocurrency industry, making it a legitimate option for most traders in 2025.

Frequently Asked Questions

Traders considering OKX and WhiteBIT often have specific concerns about fees, supported assets, and platform features. Both exchanges offer distinct advantages depending on your trading style and needs.

What are the key differences between OKX and WhiteBIT in terms of trading fees?

OKX typically offers a tiered fee structure based on your trading volume and OKB token holdings. Maker fees start around 0.08% and taker fees at 0.10%, potentially decreasing with higher volume.

WhiteBIT employs a similar volume-based approach but generally starts with slightly higher base rates. Their fee structure includes discounts for WBT token holders.

The actual fee you’ll pay depends on your trading level and token holdings. OKX might edge out WhiteBIT for high-volume traders, while occasional traders may find the differences minimal.

How do OKX and WhiteBIT compare in their range of supported cryptocurrencies?

OKX supports over 350 cryptocurrencies and offers hundreds of trading pairs. This extensive selection includes most major coins and many smaller altcoins.

WhiteBIT offers approximately 300 cryptocurrencies. While slightly less than OKX, their selection covers all major assets and many popular altcoins.

Both platforms regularly add new tokens, but OKX generally introduces new listings more frequently. Your preference may depend on specific tokens you want to trade.

What security features do OKX and WhiteBIT offer to protect users’ funds?

OKX implements multi-signature wallets, cold storage for most assets, and two-factor authentication. They also maintain an insurance fund to protect against unexpected losses.

WhiteBIT stores up to 96% of user funds in cold wallets and has received ISO 27001 certification for information security management. They offer standard security features like 2FA and anti-phishing protection.

Both exchanges have strong security track records. WhiteBIT emphasizes its compliance with European regulations, while OKX focuses on its technical security infrastructure.

Which platform between OKX and WhiteBIT provides a better user experience for beginners?

WhiteBIT offers a more straightforward interface with a cleaner design that new users often find easier to navigate. Their platform includes helpful guides and a more intuitive trading experience.

OKX provides more advanced features and trading options, which can overwhelm beginners. However, they offer a “Lite Mode” specifically designed for new users.

For complete beginners, WhiteBIT’s simpler approach may be preferable. OKX becomes more advantageous as you gain experience and need more sophisticated trading tools.

How do the staking and savings services offered by OKX and WhiteBIT compare?

OKX provides an extensive range of earning products including flexible savings, fixed staking, and DeFi staking. Annual percentage yields typically range from 1-30% depending on the asset and lock-up period.

WhiteBIT offers staking services with competitive rates but has fewer options overall. Their staking usually requires a minimum 10-day lockup period, as noted in the search results.

OKX generally provides more earning flexibility with various term options. WhiteBIT’s offerings are more streamlined but may have more restrictive conditions.

Are there any significant differences in the liquidity and trading volume between OKX and WhiteBIT?

OKX ranks among the top global exchanges with daily trading volumes often exceeding $1 billion. This high liquidity means lower slippage and better execution for large trades.

WhiteBIT has lower overall volume compared to OKX but maintains good liquidity for major trading pairs. Their market depth is strongest in European markets where they focus.

The volume difference matters most for traders executing large orders or trading less popular pairs. For average traders dealing with mainstream cryptocurrencies, both provide sufficient liquidity.

OKX Vs WhiteBIT Conclusion: Why Not Use Both?

Both OKX and WhiteBIT offer strong features for crypto traders in 2025. Each platform has its own strengths that might appeal to different aspects of your trading strategy.

OKX stands out with its competitive fee structure, which can be further reduced if you hold OKB tokens. This makes it attractive for frequent traders who want to minimize costs.

WhiteBIT, on the other hand, may offer different advantages in terms of user experience or specific cryptocurrencies supported.

Why consider using both platforms:

- Risk distribution – Spreading your assets across multiple exchanges reduces your exposure to platform-specific risks

- Feature utilization – Take advantage of the best features from each platform

- Trading opportunities – Some coins or trading pairs may be more liquid on one platform than the other

Remember that both platforms use blockchain technology and smart contracts, which come with inherent risks despite their innovations.

The ideal approach might be to test both platforms with smaller amounts first. This hands-on experience will help you determine which interface, fee structure, and feature set works best for your specific trading needs.

You might find that using OKX for certain trades and WhiteBIT for others gives you the most comprehensive trading toolkit.