Choosing the right crypto trading platform can make a big difference in your trading success. OKX and PrimeXBT are two popular options that offer different features for traders. Both platforms provide a range of trading tools, but they differ in their fee structures, available assets, and user experience.

When comparing OKX (formerly OKEx) and PrimeXBT, you’ll find that each platform has its strengths. PrimeXBT appeals to traders of all experience levels with its wide selection of assets and advanced trading tools. OKX, on the other hand, has established itself as a comprehensive exchange with competitive features.

Understanding the key differences between these platforms will help you decide which one better fits your trading style and needs. Both platforms continue to evolve in 2025, adding new features and improving their offerings to stay competitive in the rapidly changing crypto market.

OKX Vs PrimeXBT: At A Glance Comparison

When choosing between OKX and PrimeXBT, understanding their key differences can help you make the right decision for your trading needs.

Trading Options

- OKX: Cryptocurrency trading, futures, options, spot trading

- PrimeXBT: Multi-asset platform with crypto, CFDs, futures trading

Fee Structure

- OKX: Known for low trading fees, comparable to Binance and KuCoin

- PrimeXBT: Competitive fee structure focused on derivatives trading

Special Features

| Feature | OKX | PrimeXBT |

|---|---|---|

| Copy Trading | Available | Available |

| Mobile App | Full-featured | Basic functionality |

| User Interface | Complex but powerful | Streamlined for new users |

Both platforms offer copy trading capabilities, allowing you to mirror successful traders’ moves. This feature is particularly helpful if you’re new to trading or want to learn from experts.

OKX provides a wider range of cryptocurrency options, while PrimeXBT focuses on CFD trading across multiple asset classes.

Security measures are important on both platforms, but you should research their specific protocols before depositing funds.

Based on user reviews, OKX tends to appeal to more experienced traders looking for advanced features. PrimeXBT often attracts traders interested in leveraged trading across different markets.

Your trading experience level and preferred assets should guide your choice between these platforms.

OKX Vs PrimeXBT: Trading Markets, Products & Leverage Offered

When comparing OKX and PrimeXBT, their trading markets and leverage options stand out as key differentiators.

OKX offers crypto options trading with specific support for BTC/USD and ETH/USD markets. You’ll find advanced options trading tools that cater to both beginners and experienced traders.

PrimeXBT is known for its impressive leverage offerings – up to 200x for cryptocurrency trading. This makes it attractive if you’re looking to amplify potential returns, though it comes with increased risk.

Both platforms provide access to cryptocurrency markets, but their product range differs significantly.

Trading Products Comparison:

| Platform | Cryptocurrencies | Options | Other Markets | Max Leverage |

|---|---|---|---|---|

| OKX | Multiple coins | BTC/USD, ETH/USD | Limited | Varies by asset |

| PrimeXBT | Multiple coins | Limited | Multiple assets beyond crypto | Up to 200x |

PrimeXBT allows you to trade across multiple markets beyond just cryptocurrencies, giving you more diversification options.

OKX stands out with its options trading capabilities, making it suitable if you’re interested in more sophisticated trading strategies.

Your trading style and risk tolerance should guide your choice between these platforms. If you prefer higher leverage, PrimeXBT might be more appealing. For options trading, OKX offers better specialized tools.

Consider your experience level too – higher leverage platforms require more trading knowledge to use safely.

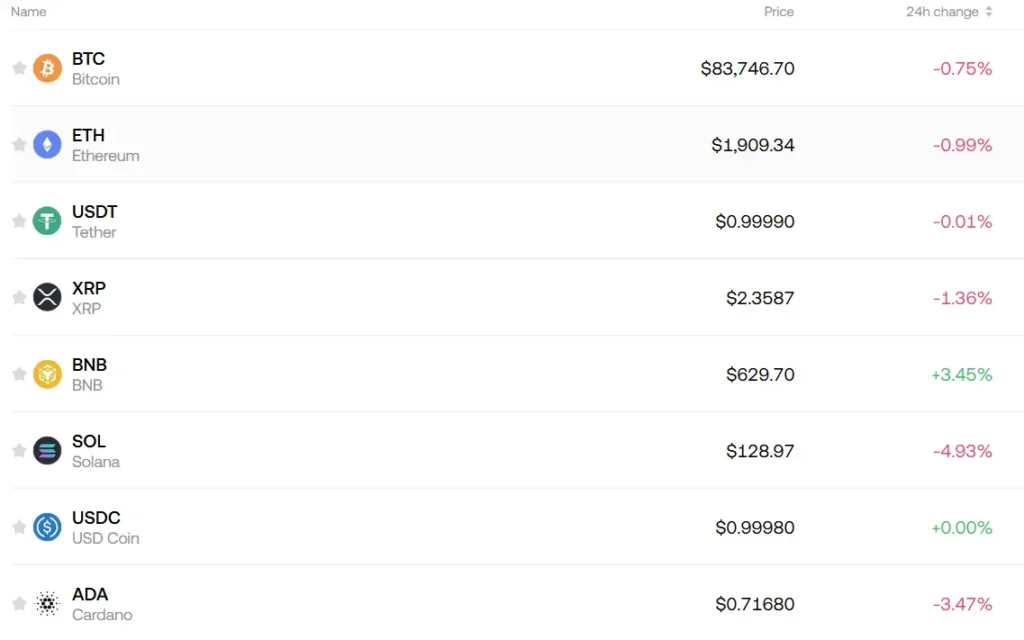

OKX Vs PrimeXBT: Supported Cryptocurrencies

When choosing between OKX and PrimeXBT, the range of supported cryptocurrencies is an important factor to consider. These platforms differ significantly in this aspect.

OKX offers a much wider selection of cryptocurrencies compared to PrimeXBT. You can trade hundreds of different digital assets on OKX, making it suitable if you’re interested in exploring beyond mainstream tokens.

PrimeXBT, on the other hand, supports a more limited range of cryptocurrencies. This platform focuses more on traditional finance trading options alongside a select few major cryptocurrencies.

If you’re primarily interested in Web3 and DeFi applications, OKX provides better options. Their platform integrates more deeply with various blockchain ecosystems and emerging tokens.

Here’s a quick comparison:

| Feature | OKX | PrimeXBT |

|---|---|---|

| Number of cryptocurrencies | Hundreds | Limited selection |

| DeFi tokens | Extensive support | Minimal support |

| Focus | Crypto-first approach | TradFi with crypto options |

You might find OKX more suitable if you want to diversify your crypto portfolio across many different tokens. Their exchange caters to crypto enthusiasts who want exposure to both established and emerging projects.

PrimeXBT would be your better choice if you’re primarily a traditional finance trader who only needs access to major cryptocurrencies like Bitcoin and Ethereum.

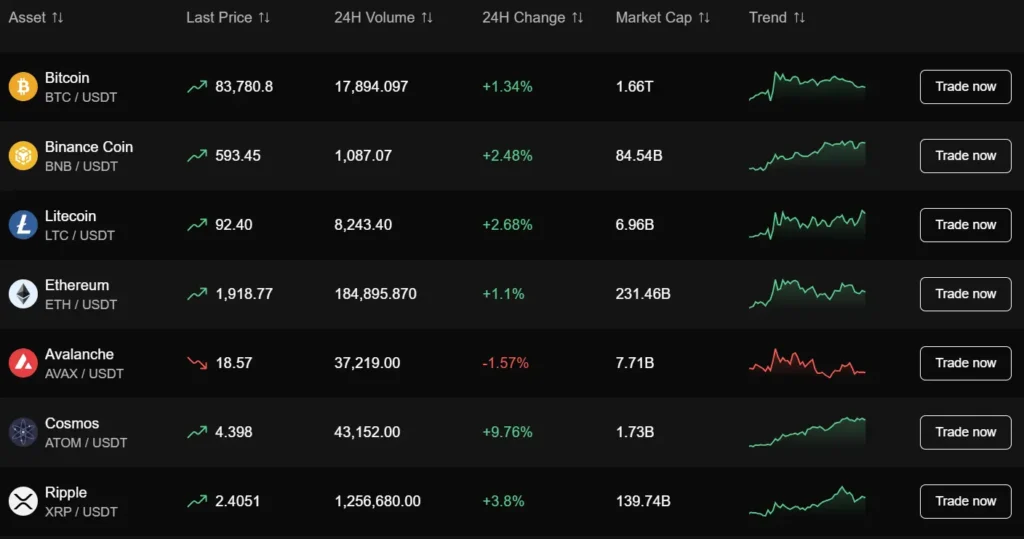

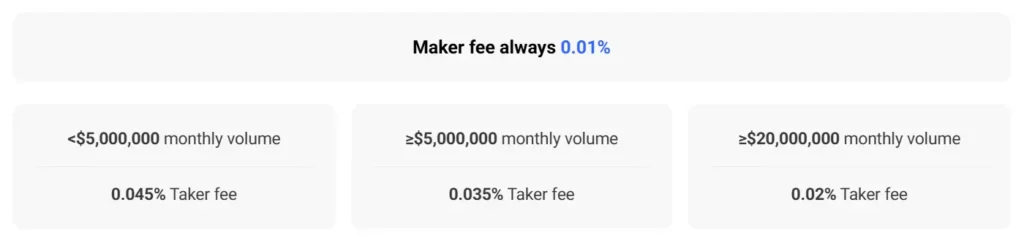

OKX Vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and PrimeXBT, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| OKX | 0.08% – 0.10% | 0.10% – 0.15% |

| PrimeXBT | Around 0.05% | Around 0.05% |

PrimeXBT offers more competitive trading fees at approximately 0.05% per trade for most cryptocurrencies. This flat fee structure is simpler and often lower than OKX’s tiered system.

OKX uses a maker-taker fee model that varies based on your trading volume and VIP level. Higher-volume traders can access reduced fees, which might benefit frequent traders.

Deposit Fees

Both platforms typically offer free crypto deposits. However, you should check for any network fees that might apply depending on the blockchain you’re using.

Withdrawal Fees

Withdrawal fees vary by cryptocurrency on both platforms. OKX tends to charge network fees plus a small processing fee depending on the asset.

PrimeXBT generally has competitive withdrawal fees that align with network costs. The exact amount varies based on the cryptocurrency you’re withdrawing.

You should consider these fee differences alongside other factors like available trading pairs, platform security, and user interface when deciding which exchange better suits your needs.

OKX Vs PrimeXBT: Order Types

When trading on cryptocurrency exchanges, the available order types can greatly impact your trading strategy. Both OKX and PrimeXBT offer various order options to meet different trading needs.

OKX provides a comprehensive range of order types. You can use market orders for immediate execution at current prices. Limit orders let you set specific price points for buying or selling.

OKX also offers advanced options like stop-loss, take-profit, and trailing stop orders to help manage risk automatically. Their OCO (One-Cancels-Other) orders are useful for setting both stop-loss and take-profit levels simultaneously.

PrimeXBT features a more streamlined selection of order types. You’ll find standard market and limit orders available on all trading pairs.

Their platform also supports stop orders and protection orders to help secure your positions against sudden market movements.

Here’s a quick comparison of order types available on both platforms:

| Order Type | OKX | PrimeXBT |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| Trailing Stop | ✓ | Limited |

| OCO | ✓ | ✗ |

For day traders who need precise control, OKX offers more sophisticated order options. PrimeXBT’s simpler approach might appeal to newer traders or those who prefer straightforward trading tools.

OKX Vs PrimeXBT: KYC Requirements & KYC Limits

OKX and PrimeXBT have different approaches to Know Your Customer (KYC) requirements, which may impact your trading experience.

OKX requires KYC verification for all account levels. You must complete their identity verification process to access the platform’s full features. This includes submitting personal documents to confirm your identity.

In contrast, PrimeXBT does not require KYC verification for its users. You can trade on the platform without providing identity documents or going through verification steps. This allows for more privacy and faster account setup.

The no-KYC policy at PrimeXBT appeals to traders who value privacy and want to avoid sharing personal information. However, this might limit some features or access in certain regions due to regulatory requirements.

OKX supports fiat currency deposits, which can be useful if you want to use traditional money to buy crypto. This feature comes with the trade-off of mandatory KYC procedures.

KYC Requirements Comparison:

| Platform | KYC Required | ID Documents Needed | Fiat Support |

|---|---|---|---|

| OKX | Yes (All levels) | Yes | Yes (Deposits) |

| PrimeXBT | No | No | Limited |

The choice between these platforms may depend on how you value privacy versus access to certain features like fiat currency support.

OKX Vs PrimeXBT: Deposits & Withdrawal Options

When choosing between OKX and PrimeXBT, understanding their deposit and withdrawal options is crucial for your trading experience.

OKX offers multiple deposit and withdrawal methods with reasonable fees. You can fund your account using cryptocurrencies, bank transfers, and various payment services. This flexibility makes it accessible for both crypto enthusiasts and traditional finance users.

PrimeXBT focuses primarily on cryptocurrency deposits and withdrawals. The platform doesn’t support fiat currency options directly. This might limit your options if you prefer using traditional banking methods.

For withdrawal speeds, both platforms process cryptocurrency transactions at similar rates, typically within 24 hours depending on network congestion.

Fee structures differ between the two exchanges:

| Exchange | Crypto Withdrawal Fees | Fiat Options | Processing Time |

|---|---|---|---|

| OKX | Variable by cryptocurrency | Yes | 1-24 hours |

| PrimeXBT | Variable by cryptocurrency | No | 1-24 hours |

If you’re looking for more deposit options, OKX provides greater versatility with both crypto and fiat currencies. This makes it easier to move between traditional and crypto markets.

PrimeXBT’s crypto-focused approach works well if you already hold digital assets and prefer to keep your trading within the cryptocurrency ecosystem.

Your choice should align with how you prefer to fund your trading activities and access your profits.

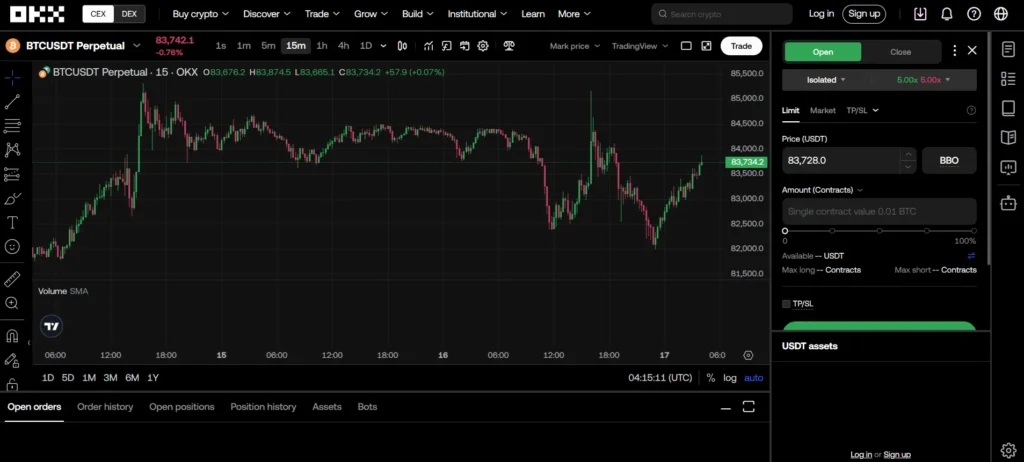

OKX Vs PrimeXBT: Trading & Platform Experience Comparison

When comparing OKX and PrimeXBT, the trading experience differs significantly across both platforms. Each offers unique features that may appeal to different types of traders.

User Interface

- OKX provides a clean, user-friendly interface suitable for both beginners and advanced traders

- PrimeXBT focuses on a professional trading dashboard with detailed charts and tools

- Both platforms offer mobile apps, but OKX’s app receives higher ratings for functionality

Available Trading Options

| Feature | OKX | PrimeXBT |

|---|---|---|

| Spot Trading | Yes | Limited |

| Futures/Margin | Yes | Yes |

| Copy Trading | Yes | Yes |

| Leverage Options | Up to 125x | Up to 200x |

OKX stands out with its extensive cryptocurrency selection, making it ideal if you want access to a wide range of digital assets. The platform also offers a user-friendly copy trading feature where you can follow successful traders.

PrimeXBT excels in leverage trading, allowing you to amplify your positions more than OKX. This appeals to experienced traders looking for higher risk-reward opportunities.

Trading tools on OKX include advanced charting, technical indicators, and trading bots. PrimeXBT counters with its Covesting module and integrated analysis tools.

Platform security is robust on both exchanges, with OKX implementing strict KYC protocols while PrimeXBT offers a more streamlined verification process.

Your trading style and experience level should guide your choice between these platforms.

OKX Vs PrimeXBT: Liquidation Mechanism

When trading with leverage on either OKX or PrimeXBT, understanding the liquidation mechanism is crucial to protect your investments. Both platforms have systems in place to manage risk when positions move against you.

OKX uses a tiered liquidation system that begins with warnings as your margin ratio approaches dangerous levels. The platform typically starts liquidation when your margin ratio falls below 100%.

PrimeXBT employs a similar mechanism but focuses on maintaining your margin level above the required maintenance margin. Once your equity falls below this threshold, liquidation begins.

Key differences:

| Feature | OKX | PrimeXBT |

|---|---|---|

| Warning system | Multiple alerts | Limited warnings |

| Partial liquidation | Available | Not always available |

| Liquidation speed | Gradual in most cases | Can be more immediate |

| Protection measures | Insurance fund backup | Maintenance margin requirements |

OKX offers partial liquidations in many cases, allowing you to reduce position size rather than closing everything at once. This can help preserve some of your capital during volatile market conditions.

PrimeXBT’s liquidation process tends to be straightforward with less room for partial liquidations. Their system aims to protect both the trader and the platform from excessive losses.

You can reduce liquidation risks on both platforms by setting stop-loss orders, using lower leverage, and monitoring your positions regularly. Adding more margin when positions move against you can also prevent liquidation.

OKX Vs PrimeXBT: Insurance

When comparing OKX and PrimeXBT, insurance protection is a crucial factor to consider for your crypto assets.

OKX offers a Protection Fund that safeguards users against potential losses from exchange hacks or security breaches. This fund is maintained by allocating a portion of trading fees to build reserves.

In contrast, PrimeXBT’s insurance approach is more limited. They implement security measures but don’t advertise a dedicated insurance fund comparable to OKX’s offering.

OKX Insurance Features:

- Dedicated Protection Fund

- Regular fund balance updates

- Coverage for hack-related losses

- Transparent reporting

PrimeXBT Insurance Features:

- Basic security protocols

- Cold storage for majority of funds

- Limited explicit insurance coverage

- Focus on prevention rather than compensation

You should note that neither exchange provides FDIC-like insurance that traditional banks offer. Your crypto assets face different risk profiles than fiat currency deposits.

For maximum protection, consider using hardware wallets for long-term holdings regardless of which exchange you choose. Only keep trading amounts on these platforms.

Both exchanges continue to evolve their security and protection measures as the crypto market matures in 2025, but OKX currently provides more robust insurance protection for your digital assets.

OKX Vs PrimeXBT: Customer Support

When trading crypto, good customer support can make a big difference. Both OKX and PrimeXBT offer 24/7 customer support, but there are some key differences to consider.

OKX provides a solid support system with multiple contact options. You can reach their team through live chat, email, or social media channels. Recent reviews indicate OKX scored a 9.1 for Quality of Support on G2, which is good but suggests some users faced delays.

PrimeXBT’s customer service has received positive feedback for being responsive and helpful. Users specifically mention that their chat agents are knowledgeable and friendly, which can be reassuring when you need help with trading issues.

Both platforms offer comprehensive help centers with guides and FAQs. These resources can solve many common problems without needing to contact support directly.

Response times vary between the platforms. During peak trading periods, you might experience longer wait times with OKX compared to PrimeXBT.

For new users, PrimeXBT seems to offer more hand-holding through the initial setup process. OKX’s support tends to be more technical and detailed, which experienced traders might prefer.

If you’re new to crypto trading, the quality of customer support should be a key factor in your decision between these platforms.

OKX Vs PrimeXBT: Security Features

When choosing between OKX and PrimeXBT, security should be a top priority for your crypto investments. Both platforms offer various security measures, but they differ in implementation.

OKX focuses strongly on security with multiple protective layers. They employ two-factor authentication (2FA), advanced encryption, and cold storage for most user funds. These measures help keep your assets safe from unauthorized access.

OKX is also regulated by several financial authorities. This regulatory oversight adds an extra layer of security for your investments.

PrimeXBT takes a different approach to security. They use a cold storage system to protect user funds and implement multi-signature technology for withdrawals.

Key Security Features Comparison:

| Feature | OKX | PrimeXBT |

|---|---|---|

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Yes | Yes |

| Encryption | Advanced | Standard |

| Regulatory Compliance | Multiple authorities | Limited |

| Multi-signature Wallets | Limited | Yes |

PrimeXBT has fewer regulatory approvals compared to OKX. This might be important if you value regulatory oversight in your crypto trading platforms.

Both platforms offer insurance funds to protect users against potential losses. However, OKX’s insurance fund is generally larger and more comprehensive.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious about phishing attempts.

Is OKX Safe & Legal To Use?

OKX is generally considered a safe cryptocurrency exchange. Based on the search results, millions of people use OKX, which suggests a level of trust in the platform. The exchange has high security measures in place to protect user assets.

Safety on OKX comes from multiple security features. These include two-factor authentication, cold storage for most funds, and regular security audits. The platform also offers insurance protection for some assets.

Regarding legality, OKX operates in many countries worldwide but has some restrictions. You should check if OKX is available in your specific location before signing up. In some countries, regulatory compliance may limit certain features.

The exchange received a score of 9.1 for Quality of Support according to G2 reviews. This indicates decent customer support, though some users have reported delays when seeking assistance.

For beginners and experienced traders alike, OKX provides a secure environment for buying and selling cryptocurrencies in 2025. The platform is especially suitable if you’re interested in crypto trading with some exposure to Web3 and DeFi products.

Remember to use standard security practices when using any exchange. Enable all security features, use strong passwords, and never share your private keys with anyone.

Is PrimeXBT Safe & Legal To Use?

PrimeXBT is considered a legitimate cryptocurrency exchange platform that prioritizes user privacy. Based on recent information from 2025, the platform maintains a strong stance on respecting users’ privacy while trading.

One notable feature of PrimeXBT is that it doesn’t require mandatory KYC (Know Your Customer) verification. This makes it one of the “No KYC” crypto exchanges where you can trade without submitting personal identification documents.

The platform accepts payments through Visa and Mastercard, giving you convenient options to fund your account. PrimeXBT also offers services to hold your cryptocurrency or spend it as needed.

For legal compliance, it’s important to note that regulations vary by country. You should verify if PrimeXBT services are allowed in your region before using the platform.

The exchange primarily caters to TradFi (Traditional Finance) traders, making it suitable if you’re coming from conventional trading backgrounds. This differs from OKX, which focuses more on crypto enthusiasts with interest in Web3 and DeFi.

When considering safety, remember that all cryptocurrency exchanges carry inherent risks. You should use strong passwords, enable two-factor authentication if available, and never invest more than you can afford to lose.

Frequently Asked Questions

Trading platforms like OKX and PrimeXBT have distinct features that affect your trading experience. These differences span across security measures, fee structures, leverage options, cryptocurrency variety, and customer support quality.

What are the main differences between OKX and PrimeXBT trading platforms?

OKX operates as a full-featured cryptocurrency exchange with spot trading, derivatives, and additional services like staking and an NFT marketplace. PrimeXBT focuses primarily on leveraged trading across cryptocurrencies and traditional assets.

The user interfaces differ significantly. OKX offers a more comprehensive dashboard with multiple tools and analytics. PrimeXBT provides a streamlined interface centered around trading with leverage.

OKX requires more extensive KYC (Know Your Customer) verification, while PrimeXBT has historically had more flexible verification requirements depending on your region and trading volume.

Which exchange offers better security features, OKX or PrimeXBT?

OKX implements multi-signature wallets, cold storage for most user funds, and regular security audits by third parties. They also offer multiple 2FA options and anti-phishing codes for enhanced protection.

PrimeXBT employs cold storage solutions and multi-signature technology as well. Their platform includes address whitelisting and device management for additional security.

Both platforms have experienced security incidents in the past but have since strengthened their protocols. OKX generally has a more established security record due to its larger size and longer market presence.

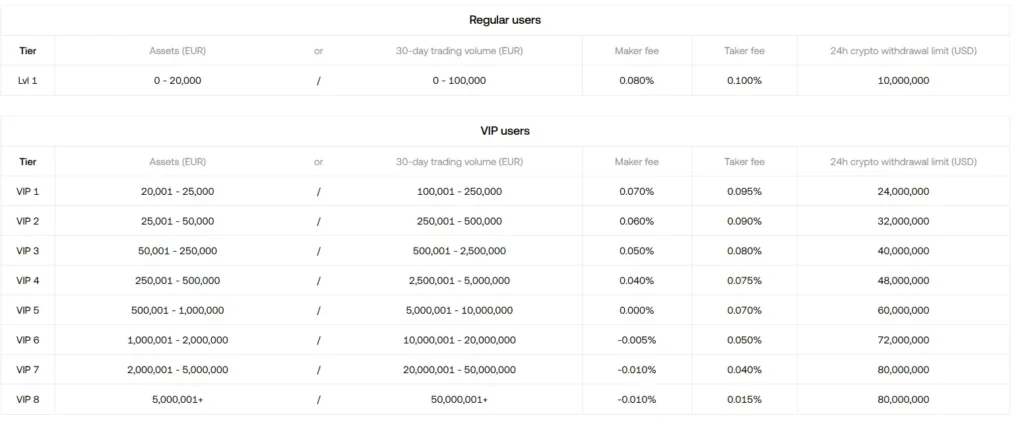

How do the fees between OKX and PrimeXBT compare for trading and withdrawals?

OKX uses a tiered fee structure based on your 30-day trading volume and OKB token holdings. Maker fees range from 0.080% to 0.005%, while taker fees range from 0.100% to 0.010% for regular users.

PrimeXBT charges a flat 0.05% fee for all trades regardless of volume or asset type. This simplifies fee calculation but may not benefit high-volume traders who could qualify for lower rates elsewhere.

Withdrawal fees vary by cryptocurrency on both platforms. OKX typically adjusts withdrawal fees based on network conditions, while PrimeXBT tends to have competitive withdrawal fees for major cryptocurrencies.

Can users access leverage trading on both OKX and PrimeXBT, and how do their terms differ?

Both platforms offer leverage trading, but with different approaches. PrimeXBT specializes in high leverage trading with options up to 100x on certain cryptocurrencies and up to 1000x on some forex pairs.

OKX provides leverage up to 125x on futures contracts, but with more stringent risk management systems. They implement tiered margin requirements that change based on position size and market volatility.

Liquidation procedures differ between the platforms. OKX uses a partial liquidation system to help traders avoid complete position liquidation, while PrimeXBT typically uses a more traditional all-or-nothing liquidation approach.

What variety of cryptocurrencies can traders find on OKX compared to PrimeXBT?

OKX supports over 350 cryptocurrencies for spot trading and a smaller selection for derivatives trading. They regularly add new tokens and have extensive altcoin options for diverse portfolio building.

PrimeXBT offers a more limited selection focused on major cryptocurrencies like Bitcoin, Ethereum, and a handful of popular altcoins. Their focus is more on trading instruments than cryptocurrency variety.

OKX also provides more trading pairs with both stablecoins and fiat currencies. This gives you more options for entering and exiting positions without unnecessary conversion steps.

How do the customer support services of OKX and PrimeXBT stack up against each other?

OKX provides 24/7 customer support through live chat, email, and an extensive knowledge base. They offer support in multiple languages and have dedicated teams for different types of issues.

PrimeXBT also offers 24/7 support primarily through live chat and email. Their response times are generally good, but they support fewer languages compared to OKX.

Both platforms maintain active community forums and social media presence for general updates. OKX tends to have more educational resources for beginners, while PrimeXBT focuses their support on trading-specific issues.

PrimeXBT Vs OKX Conclusion: Why Not Use Both?

After comparing these platforms, you might wonder which one to choose. The truth is, you could benefit from using both for different purposes.

OKX offers a broader range of crypto assets and has stronger connections to the Web3 and DeFi ecosystems. If you’re primarily interested in crypto trading and want access to many different tokens, OKX makes more sense.

PrimeXBT, on the other hand, excels for traditional finance traders. It doesn’t focus on spot trading or offering many cryptocurrencies. Instead, it provides powerful tools for margin trading and derivatives.

Your trading style should guide your choice. Do you prefer spot trading with many crypto options? OKX might be your best bet. Are you more interested in leverage trading across different markets? PrimeXBT could be more suitable.

Key Differences:

- OKX: More crypto assets, spot trading, Web3 features

- PrimeXBT: Fewer cryptocurrencies, no spot trading, focused on derivatives

Similar Features:

- Both offer mobile apps

- Both provide leverage trading options

- Both have reasonable fee structures

You might find that using OKX for your crypto spot trading and PrimeXBT for leveraged positions gives you the best of both worlds. Many traders maintain accounts on multiple platforms to take advantage of different strengths.

Remember to consider your personal trading goals before deciding which platform deserves more of your attention.