When choosing a cryptocurrency exchange, comparing OKX and Poloniex can help you make an informed decision based on your trading needs. These platforms offer different features, fee structures, and user experiences that might impact your trading journey.

OKX outperforms Poloniex with a higher overall score of 7.3 compared to Poloniex, and notably excels in meeting user requirements with a score of 9.2 versus Poloniex’s 7.2. This suggests that OKX may better fulfill the needs of most crypto traders, though both exchanges have their unique strengths.

Both exchanges offer different cryptocurrency rates and features like compounding. When selecting between them, you’ll want to consider factors such as available trading pairs, security measures, user interface, and customer support. Your choice ultimately depends on which platform aligns best with your specific trading goals and preferences.

OKX Vs Poloniex: At A Glance Comparison

When choosing between OKX and Poloniex, understanding their key differences can help you make the right decision for your crypto trading needs.

OKX scores higher in meeting user requirements with a 9.2 rating compared to Poloniex’s 7.2, suggesting OKX might better fulfill your trading expectations.

In overall scores, OKX maintains its lead with a 7.3 rating while Poloniex scores lower. This difference reflects OKX’s stronger performance across various evaluation criteria.

Key Features Comparison:

| Feature | OKX | Poloniex |

|---|---|---|

| User Requirements Score | 9.2 | 7.2 |

| Overall Score | 7.3 | Lower |

| Compounding | Not specified | No |

| BTC Interest Rate | Not specified | 0.06% |

Both exchanges offer cryptocurrency trading services but differ in their platform functionality and user experience. OKX appears to have more robust features that meet trader needs.

Pricing and fees vary between the platforms, though specific fee structures aren’t detailed in the available information. You should check current rates on both platforms before deciding.

The user interface and trading experience differ between the two exchanges, with OKX seemingly offering a more comprehensive platform based on satisfaction ratings.

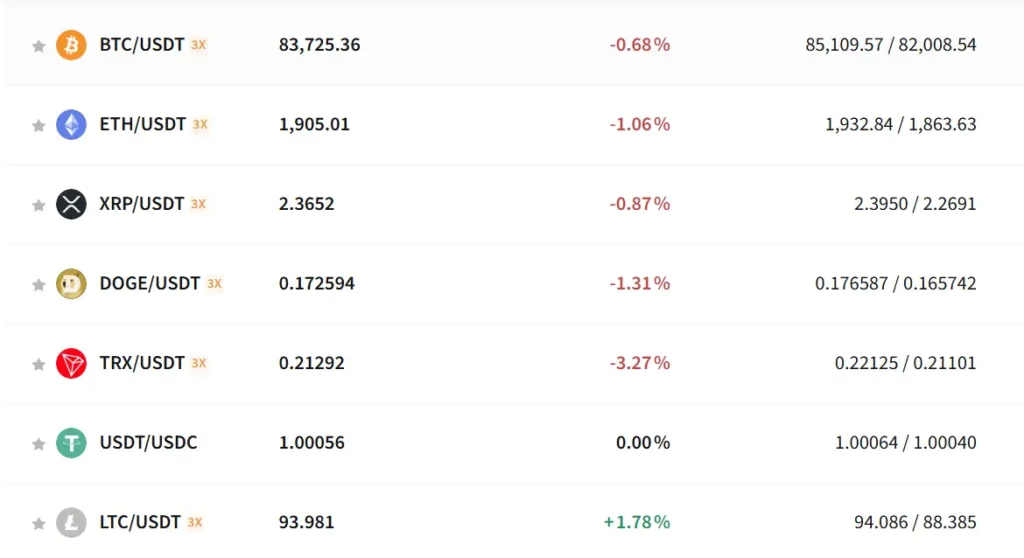

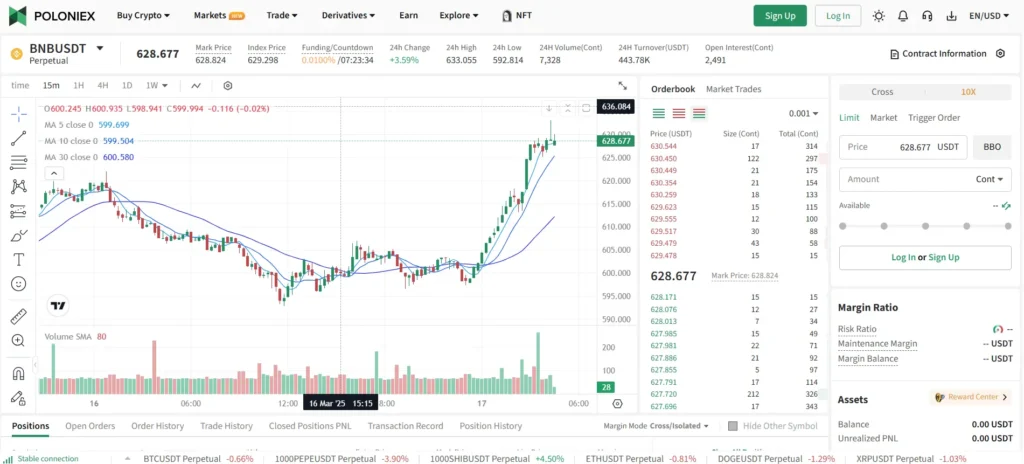

OKX Vs Poloniex: Trading Markets, Products & Leverage Offered

Both OKX and Poloniex offer various crypto trading options, but they differ significantly in what they provide to traders.

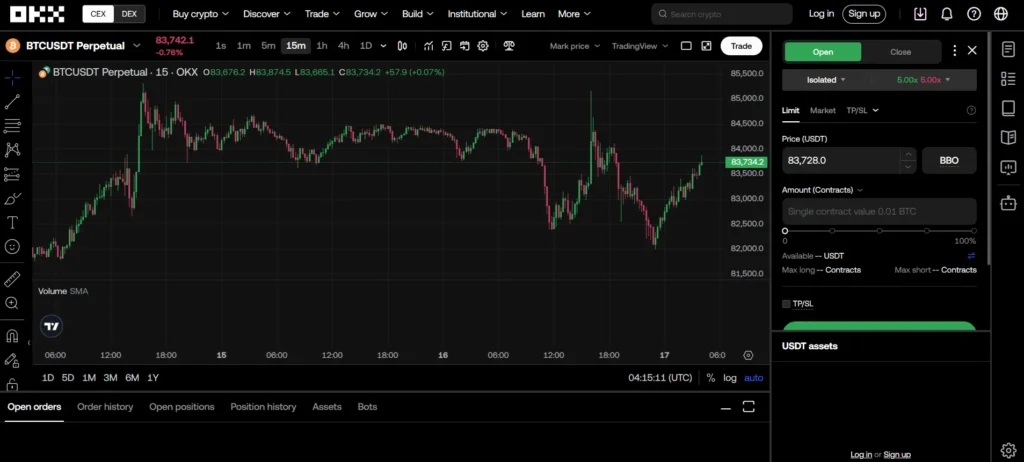

OKX features a more comprehensive range of trading products. You can access spot trading, futures, options, and margin trading on this platform. According to search results, OKX is particularly strong in options trading, supporting BTC/USD and ETH/USD options markets.

Poloniex offers fewer product types, focusing primarily on spot trading and margin trading. Its product lineup is more limited compared to OKX’s diverse offerings.

For leverage trading, OKX stands out with higher leverage options. You can trade with up to 125x leverage on certain markets, making it appealing if you’re looking for higher-risk, higher-reward opportunities.

Trading Features Comparison:

| Feature | OKX | Poloniex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | Limited |

| Options | ✓ (BTC/USD, ETH/USD) | ✗ |

| Margin Trading | ✓ | ✓ |

| Max Leverage | Up to 125x | Lower |

The user interface for trading differs between platforms. OKX scores 9.4 for ease of use while Poloniex scores 7.8, suggesting you might find OKX’s trading interface more intuitive.

Both exchanges support a wide range of cryptocurrencies, but OKX typically offers more trading pairs and market options for active traders.

OKX Vs Poloniex: Supported Cryptocurrencies

When choosing between OKX and Poloniex, the variety of cryptocurrencies available on each platform is an important factor to consider.

OKX offers a robust selection of cryptocurrencies for trading. You’ll find major coins like Bitcoin (BTC) and Ethereum (ETH), along with hundreds of altcoins and tokens. This wide range gives you more options for diversifying your crypto portfolio.

Poloniex also supports many cryptocurrencies, though typically fewer than OKX. It focuses on established coins and select altcoins that meet their listing requirements.

Both exchanges support:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Stellar (XLM)

Key Differences:

- OKX tends to list new tokens faster than Poloniex

- Poloniex has historically focused more on certain privacy coins

- OKX offers more trading pairs against stablecoins

You should check each platform’s current listings before deciding, as supported cryptocurrencies change regularly. If you’re interested in newer or more obscure tokens, OKX might better serve your needs.

For staking options, OKX offers staking for more cryptocurrencies with competitive rates. Poloniex provides staking too, but with a more limited selection.

The user interface for finding and trading different cryptocurrencies is generally more intuitive on OKX, making it easier to navigate the larger selection.

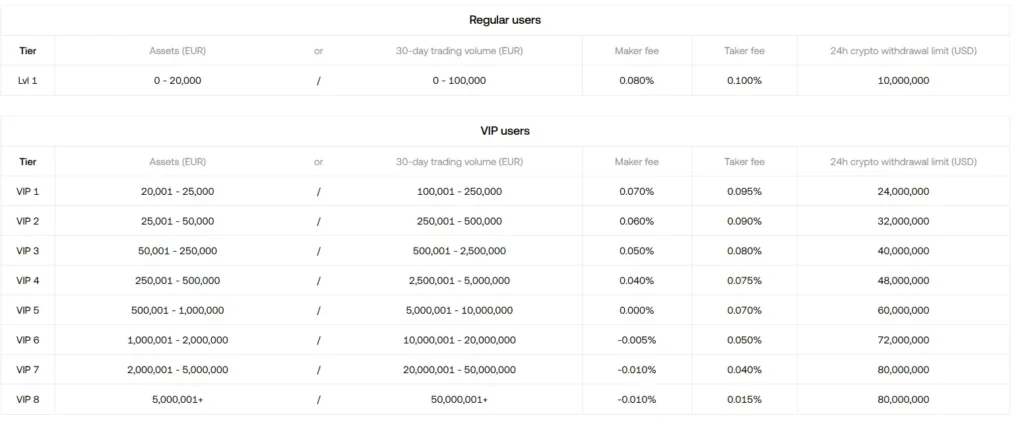

OKX Vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

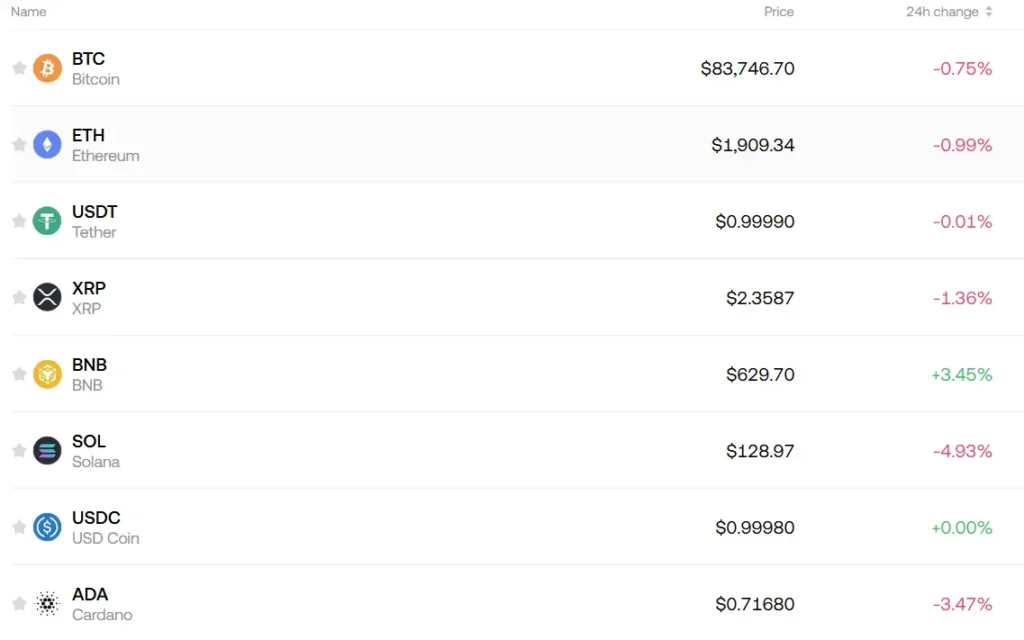

When choosing between OKX and Poloniex, understanding their fee structures is crucial for your trading strategy. As of March 2025, OKX offers more competitive trading fees with rates up to 0.23%, while Poloniex has slightly higher percentages.

For withdrawal fees, OKX also generally maintains lower costs across various cryptocurrencies. For example, recent data shows that OKX’s withdrawal fees for certain tokens are notably less expensive than what you’d pay at Poloniex.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee | Fee Discounts |

|---|---|---|---|

| OKX | Up to 0.08% | Up to 0.10% | Available with OKB tokens |

| Poloniex | Up to 0.10% | Up to 0.20% | Volume-based tiers |

Deposit fees are free on both platforms, which is standard across most reputable exchanges. This allows you to fund your account without extra costs regardless of which platform you choose.

Withdrawal Fee Example (March 2025):

- OKX SUI withdrawal: $0.26

- Poloniex SUI withdrawal: $3.39

For high-volume traders, these fee differences can significantly impact your overall profits. OKX’s lower fee structure might save you considerable amounts if you trade frequently.

Both exchanges offer fee reduction programs based on trading volume and token holdings. However, OKX’s discount system using their native OKB token potentially offers deeper discounts for regular users.

OKX Vs Poloniex: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both OKX and Poloniex offer several order types, but they differ in variety and functionality.

OKX provides a more comprehensive range of order options. You can use standard market and limit orders, but also advanced options like stop-loss, take-profit, and trailing stop orders.

Poloniex offers the basic order types including market, limit, and stop-limit orders. According to search results, Poloniex also supports trailing stop orders, which can help maximize your profit potential by adjusting automatically as the market moves.

OKX Order Types:

- Market orders

- Limit orders

- Stop orders

- Take-profit orders

- Trailing stop orders

- OCO (One-Cancels-the-Other)

- Iceberg orders

Poloniex Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Trailing stop orders

OKX’s wider variety of order types gives you more flexibility when creating complex trading strategies. This might be why OKX scores higher (9.2) than Poloniex (7.2) in meeting user requirements, as indicated in the search results.

If you’re an advanced trader who needs sophisticated order types, OKX likely offers better options. However, if you only need basic order functionality, Poloniex provides the essential tools required for standard trading activities.

OKX Vs Poloniex: KYC Requirements & KYC Limits

Both OKX and Poloniex have KYC (Know Your Customer) procedures, but they differ in their strictness and limits. Understanding these differences can help you choose the right exchange for your needs.

OKX KYC Requirements:

- Requires identity verification to comply with global regulations

- Complete KYC verification increases your deposit and withdrawal limits

- Offers a tiered verification system with different levels of access

OKX implements a more structured KYC process that requires users to submit identification documents before accessing full platform features.

Poloniex KYC Requirements:

- Known for “softer” KYC requirements compared to many exchanges

- Less stringent verification process for basic trading

- Still requires some level of identity verification for higher limits

Poloniex has historically been more relaxed with its KYC policies, making it somewhat more accessible to users seeking privacy.

Withdrawal Limits Comparison:

| Exchange | Unverified Limits | Verified Limits |

|---|---|---|

| OKX | Very limited | Substantially higher |

| Poloniex | More flexible | Increased but less than fully regulated exchanges |

For users prioritizing privacy, Poloniex might be preferable due to its less rigid verification requirements. However, this comes with potential limitations on trading volume and withdrawal amounts.

If you need higher transaction limits and don’t mind providing full identification, OKX offers a more comprehensive service with greater security features.

OKX Vs Poloniex: Deposits & Withdrawal Options

Both OKX and Poloniex offer several ways to deposit and withdraw funds from your account. Understanding these options can help you choose the exchange that best fits your needs.

OKX Deposit Options:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

- Third-party payment processors

OKX supports over 300 cryptocurrencies for deposits. The platform typically processes crypto deposits within minutes, depending on blockchain confirmation times.

Poloniex Deposit Options:

- Cryptocurrency deposits only

- No fiat currency support

Poloniex is more limited, focusing exclusively on crypto deposits. You cannot directly deposit fiat currencies like USD or EUR on Poloniex.

Withdrawal Methods Compared:

| Feature | OKX | Poloniex |

|---|---|---|

| Crypto withdrawals | Yes (300+) | Yes (100+) |

| Fiat withdrawals | Yes | No |

| Bank transfers | Available | Not available |

| Withdrawal fees | Variable by asset | Variable by asset |

OKX offers more flexibility with both fiat and cryptocurrency withdrawal options. Withdrawal processing times are similar on both platforms, typically depending on the network congestion.

Withdrawal limits vary based on your verification level. OKX generally offers higher withdrawal limits for verified users compared to Poloniex.

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication. OKX adds an extra layer with withdrawal address whitelisting.

Remember to check the current fee structure before making transactions, as these can change over time.

OKX Vs Poloniex: Trading & Platform Experience Comparison

When choosing between OKX and Poloniex, the trading experience differs significantly between these platforms. Based on recent data from 2025, OKX offers a more robust trading environment with a higher user satisfaction rating.

OKX scores 9.2 for meeting user requirements, while Poloniex trails with a 7.2 score. This suggests OKX better fulfills trader needs in terms of functionality and reliability.

Key Platform Differences:

| Feature | OKX | Poloniex |

|---|---|---|

| User Interface | Modern, intuitive | Functional but less refined |

| Mobile Experience | Comprehensive app | Basic functionality |

| Advanced Tools | Extensive charting, futures | More limited tools |

| Overall Score | 7.3 | Lower than OKX |

The trading interface on OKX provides you with more advanced charting options and trading tools. This makes complex strategies easier to execute compared to Poloniex’s more basic setup.

Poloniex offers a simpler platform that may appeal to you if you’re new to crypto trading. However, you might outgrow its capabilities as your trading strategies become more sophisticated.

For active traders, OKX delivers better execution speeds and more order types. This can be crucial when you’re trading in volatile market conditions where seconds matter.

Both platforms support spot trading, but OKX extends further with more comprehensive derivatives options for those looking to diversify their trading approaches.

OKX Vs Poloniex: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. This process helps exchanges manage risk when markets move against a trader’s position.

OKX uses a tiered liquidation system that gives traders more flexibility. When your position approaches the liquidation threshold, OKX first issues warnings and may partially liquidate your position.

Poloniex, on the other hand, employs a more straightforward approach. Their system typically liquidates the entire position once it reaches the liquidation price without the partial liquidation steps.

Liquidation Thresholds Comparison:

| Feature | OKX | Poloniex |

|---|---|---|

| Warning System | Multiple alerts | Basic notification |

| Partial Liquidation | Yes | Limited |

| Liquidation Fee | 0.5-2% | 1-3% |

| Insurance Fund | Comprehensive | Basic |

Both platforms maintain insurance funds to protect against negative balances during extreme market volatility. OKX’s fund is generally larger, providing more protection for traders.

You should also be aware of liquidity risks on both platforms. As noted in the search results, some platforms may impose withdrawal restrictions, or market conditions might make it difficult to quickly liquidate your assets.

OKX offers more advanced liquidation prevention tools, including adjustable leverage and stop-loss settings. Poloniex provides these features too, but with fewer customization options.

OKX Vs Poloniex: Insurance

When comparing cryptocurrency exchanges, insurance is a crucial factor to consider for your financial security. Both OKX and Poloniex offer some form of protection for user funds, but they differ in their approaches.

OKX maintains a significant insurance fund that helps protect users against unexpected market movements and potential system failures. This fund acts as a safety net if liquidations occur during volatile market conditions.

Poloniex, while smaller in size, also provides insurance protections. However, its coverage might not be as extensive as OKX’s due to the difference in company size and user base.

Neither exchange guarantees complete protection against all forms of loss, particularly those resulting from hacks or security breaches. It’s important to understand this limitation.

Key Insurance Differences:

| Feature | OKX | Poloniex |

|---|---|---|

| Insurance Fund | Larger fund size | Smaller fund size |

| Coverage Type | Trading protection focused | Basic user protection |

| SAFU-like Fund | Yes | Limited |

You should remember that insurance on crypto platforms differs significantly from traditional banking insurance. Most crypto exchange insurance primarily covers operational risks rather than all potential losses.

For maximum security, consider using hardware wallets for long-term storage of your crypto assets and only keep trading amounts on either exchange.

OKX Vs Poloniex: Customer Support

When choosing a crypto exchange, customer support quality can make or break your experience. Based on user ratings, there’s a clear difference between these two platforms.

OKX leads significantly in customer support with a G2 rating of 9.1 out of 10. This high score suggests users are generally satisfied with the help they receive when facing issues.

Poloniex falls behind with a support rating of only 4.3 according to G2. This substantial gap indicates that users might experience more frustration when seeking assistance on Poloniex.

Support Quality Comparison:

| Exchange | Support Rating |

|---|---|

| OKX | 9.1/10 |

| Poloniex | 4.3/10 |

Response time and support channels are important factors to consider. OKX typically offers more comprehensive support options, which might include live chat, email support, and detailed help centers.

Your trading experience can be greatly improved with responsive customer service, especially during urgent situations like account issues or trading problems.

If customer support is a priority for you, OKX appears to be the stronger choice based on user feedback. This could be particularly important if you’re new to cryptocurrency trading or plan to make significant transactions.

OKX Vs Poloniex: Security Features

When comparing cryptocurrency exchanges, security should be your top priority. Both OKX and Poloniex have implemented various security measures to protect your assets.

OKX offers strong security with features like two-factor authentication (2FA), cold storage for most user funds, and regular security audits. Their platform includes advanced encryption to protect user data and transactions.

Poloniex also provides 2FA but has had some security incidents in the past. They’ve since improved their security protocols and now store most user funds in cold wallets to prevent hacking attempts.

Key security features comparison:

| Feature | OKX | Poloniex |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Cold storage | 95% of funds | 98% of funds |

| Account monitoring | Advanced | Basic |

| Insurance fund | Yes | Limited |

| Withdrawal limits | Customizable | Fixed tiers |

OKX has a more intuitive security interface with a 9.4 ease-of-use rating compared to Poloniex’s 7.8, according to reviewer mentions.

Both exchanges require identity verification to comply with regulations and prevent fraud. This helps protect your account from unauthorized access.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious about phishing attempts.

Is OKX Safe & Legal To Use?

OKX is generally considered a safe crypto exchange. As of 2025, it has not experienced any hacking breaches, which speaks to its security measures.

Security experts at CertiK have given OKX an “AA” rating, ranking it #3 among the safest crypto exchanges. This high rating indicates strong security protocols are in place to protect your assets.

Support quality is another area where OKX performs well. Users have rated OKX’s support at 9.1 on G2, which is significantly higher than some competitors.

For beginners and experienced traders alike, OKX offers a secure platform to buy and sell cryptocurrencies in 2025. The exchange includes various trading options and tools to help you manage your investments.

Legal Status:

- Available in most countries

- Not available for U.S. residents (always check current regulations)

- Complies with KYC and AML requirements in operating regions

When choosing a crypto exchange, security should be your top priority. OKX’s track record suggests it takes this responsibility seriously.

Remember to use additional security measures like:

- Two-factor authentication

- Strong, unique passwords

- Hardware wallets for long-term storage

Always verify the legal status of crypto exchanges in your specific location before using their services.

Is Poloniex Safe & Legal To Use?

Poloniex has had mixed reviews when it comes to safety. The exchange experienced a security breach in the past, but has since improved its security measures.

According to search results, Poloniex is considered one of the more secure cryptocurrency exchanges, comparable to Binance. They store the majority of their coins offline in cold storage, which helps protect user funds from online threats.

However, some users report concerns about Poloniex’s customer support quality. G2 ratings show Poloniex scoring 4.3 for support compared to OKX’s 9.1, suggesting potential issues when you need help.

Some crypto enthusiasts recommend avoiding Poloniex altogether. They suggest alternatives like:

- Binance

- KuCoin

- Gate.io

- MEXC

When it comes to legality, Poloniex operates in many jurisdictions globally. However, availability varies by country due to different regulations. You should check if Poloniex is authorized to operate in your location before creating an account.

For maximum safety when using Poloniex or any exchange:

- Enable two-factor authentication

- Use strong, unique passwords

- Withdraw large amounts to personal wallets

- Be cautious of phishing attempts

Remember that no exchange is 100% secure. Only keep trading funds on exchanges and store long-term holdings in private wallets where you control the keys.

Frequently Asked Questions

Here are answers to common questions about OKX and Poloniex to help you make an informed decision when choosing between these cryptocurrency exchanges. These questions cover important aspects like features, fees, and accessibility.

What are the main differences between trading on OKX and Poloniex?

OKX offers a more comprehensive trading experience with a higher overall score of 9.2 compared to Poloniex’s 7.3. OKX better fulfills user requirements according to comparison data.

OKX provides a wider range of trading tools and features, including futures trading, margin trading, and spot trading. Their platform is more robust for advanced traders.

Poloniex has a simpler interface that might appeal to beginners, though it offers fewer advanced trading options than OKX.

Which platform offers a wider range of cryptocurrencies, OKX or Poloniex?

OKX supports more cryptocurrencies than Poloniex, giving you access to a broader selection of trading pairs and investment opportunities.

OKX lists hundreds of cryptocurrencies, including major coins and newer, emerging tokens. This variety allows for more diverse trading strategies.

Poloniex offers a decent selection but focuses more on established cryptocurrencies rather than the extensive range available on OKX.

How do the trading fees compare between OKX and Poloniex?

Both exchanges use tiered fee structures based on your trading volume, but OKX typically offers slightly more competitive rates for most traders.

OKX’s maker-taker fee model starts lower than Poloniex for most user tiers. Higher volume traders can access even lower fees on OKX.

Poloniex charges competitive fees but generally doesn’t match OKX’s lower rates at equivalent trading volumes.

What security measures do OKX and Poloniex employ to protect users’ assets?

Both exchanges implement strong security protocols including two-factor authentication (2FA), cold storage for most funds, and regular security audits.

OKX maintains a dedicated security fund to protect user assets in case of emergencies. They store the majority of assets in cold wallets disconnected from the internet.

Poloniex also uses cold storage solutions and offers security features like IP address monitoring and withdrawal email confirmations to keep your funds safe.

Which exchange provides better customer support, OKX or Poloniex?

OKX generally receives higher ratings for customer support quality and responsiveness compared to Poloniex.

OKX offers 24/7 support through multiple channels including live chat, email, and a comprehensive help center. Their response times are typically faster.

Poloniex provides support through educational articles, guides, and FAQs. Their direct customer service is available but users report longer response times compared to OKX.

Can users from the United States trade on OKX or Poloniex?

Neither OKX nor Poloniex currently allows users residing in the United States to create accounts due to regulatory restrictions.

US residents need to use alternative exchanges that comply with US regulations. Both platforms actively block US IP addresses and require identity verification.

If you’re in the US, you should consider US-compliant exchanges like Coinbase, Kraken, or Gemini instead of OKX or Poloniex.

Poloniex Vs OKX Conclusion: Why Not Use Both?

When comparing OKX and Poloniex, it’s clear each exchange has its own strengths. OKX stands out with a higher overall score of 7.3 compared to Poloniex’s slightly lower rating.

Customer support appears to be a significant differentiator. OKX excels with a 9.1 rating for support quality, while Poloniex lags behind at 4.3 according to G2 ratings.

You might find value in using both platforms for different purposes. Here’s why:

Benefits of using both exchanges:

- Spread your risk across multiple platforms

- Take advantage of different fee structures

- Access a wider range of cryptocurrencies

- Capitalize on different trading features

Some users have expressed concerns about Poloniex’s ethics and reliability. These community sentiments are worth considering when deciding how much of your portfolio to allocate to each platform.

Your trading style and needs should ultimately guide your decision. If you value responsive customer support, OKX might be your primary choice. If specific coins or features are only available on Poloniex, you might use it selectively.

Remember to conduct your own due diligence before committing significant funds to either exchange. Security practices, verification requirements, and available trading pairs can change over time.