Choosing the right cryptocurrency exchange can be challenging. OKX and Phemex are two popular platforms that offer various trading options for crypto enthusiasts. Both exchanges provide spot and derivatives trading with competitive fee structures, but they differ in available cryptocurrencies, user interface, and additional features.

When selecting between OKX and Phemex, you should consider your specific trading needs. OKX generally supports more cryptocurrencies and has higher trading volume, while Phemex offers a simpler interface that might be more approachable for beginners. The exchanges also differ in their verification requirements and available payment methods.

Security features, withdrawal limits, and customer support quality are other important factors to examine before making your decision. In this comparison, we’ll break down the key differences between OKX and Phemex to help you determine which platform better suits your cryptocurrency trading goals in 2025.

OKX vs Phemex: At A Glance Comparison

When choosing between OKX and Phemex crypto exchanges, understanding their key differences can help you make the right decision for your trading needs.

Trading Features Comparison:

| Feature | OKX | Phemex |

|---|---|---|

| Overall Score | 7.8 | Lower than OKX |

| User Interface | Professional, comprehensive | Clean, beginner-friendly |

| Trading Types | Spot, futures, options, margin | Spot, futures, margin |

| Mobile App | Available for iOS and Android | Available for iOS and Android |

- Fee Structure: Both platforms offer competitive fee structures. OKX typically uses a maker-taker model, while Phemex offers similar pricing with some differences in their VIP levels.

- Security Features: Both exchanges prioritize security with two-factor authentication and cold storage solutions for user funds.

- Available Cryptocurrencies: OKX generally supports more cryptocurrencies and trading pairs than Phemex, giving you access to a wider range of assets.

- Additional Services: OKX offers more advanced features including DeFi services, an NFT marketplace, and more extensive staking options. Phemex focuses on providing a simplified trading experience with strong educational resources.

- User Experience: If you’re new to crypto trading, Phemex’s simpler interface might be preferable. For more experienced traders, OKX’s comprehensive tools and advanced features could be more valuable.

Both platforms have solid reputations in the cryptocurrency space and offer reliable trading services as of 2025.

OKX vs Phemex: Trading Markets, Products & Leverage Offered

Both OKX and Phemex offer a variety of trading markets and products to meet different trading needs.

OKX supports spot trading, futures, options, and margin trading. It’s particularly strong in options trading, with dedicated BTC/USD and ETH/USD options markets.

Phemex focuses on spot and futures markets. It provides a straightforward interface that many traders appreciate, especially those using mobile devices.

When it comes to leverage, there are notable differences:

| Platform | Maximum Leverage | Notable Features |

|---|---|---|

| OKX | Up to 125x | Advanced options chain, wider product range |

| Phemex | Up to 100x | User-friendly, especially for mobile trading |

You’ll find more cryptocurrency pairs available on OKX, making it better if you’re looking to trade less common altcoins.

Both platforms offer perpetual futures contracts, allowing you to hold positions without expiration dates.

For beginners, Phemex’s simpler interface might be more approachable. However, if you’re interested in options trading, OKX provides more comprehensive tools.

Each platform offers demo accounts where you can practice trading strategies without risking real money.

The trading fees vary between the platforms, with both offering tier-based fee structures that reward higher trading volumes with lower fees.

OKX vs Phemex: Supported Cryptocurrencies

When selecting a cryptocurrency exchange, the variety of available assets is crucial. Both OKX and Phemex offer a range of cryptocurrencies, but there are some differences in their offerings.

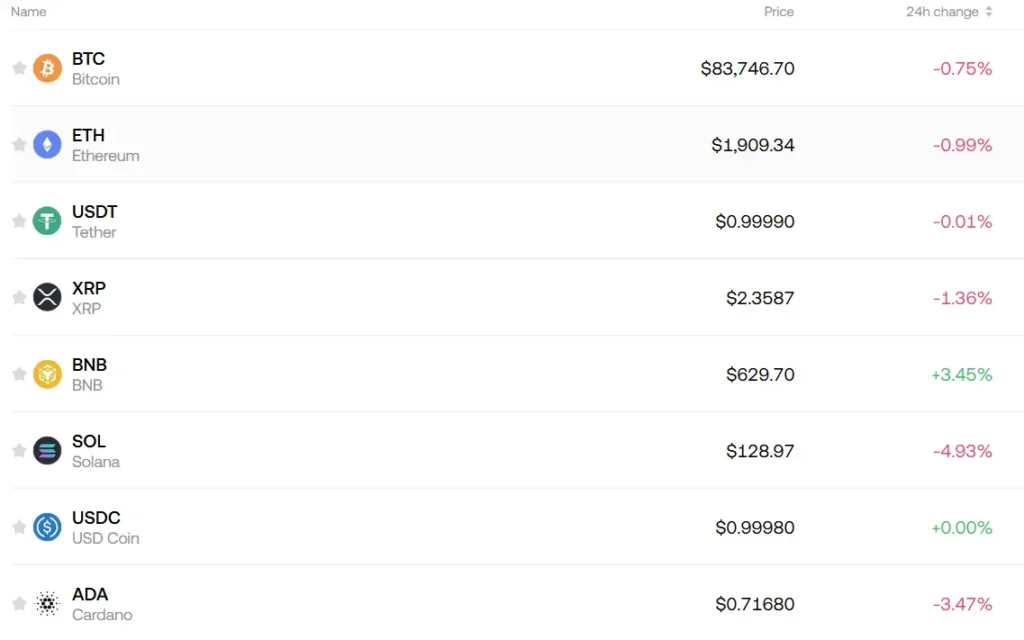

OKX supports over 350 cryptocurrencies, giving you access to both major coins and many altcoins. This includes Bitcoin, Ethereum, Solana, and hundreds of smaller projects. The platform regularly adds new tokens as they gain popularity.

Phemex offers fewer cryptocurrencies overall, with approximately 150+ supported assets. While this covers all major coins and many popular altcoins, you’ll find a smaller selection of newer or more niche tokens.

Key Cryptocurrency Support Comparison:

| Feature | OKX | Phemex |

|---|---|---|

| Total cryptocurrencies | 350+ | 150+ |

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Stablecoins | Multiple options | Multiple options |

| DeFi tokens | Extensive selection | Good selection |

| New listings | Frequent | Moderate |

Both exchanges support staking for proof-of-stake coins, though OKX typically offers more staking options due to its larger asset selection.

If you prioritize access to a wide range of cryptocurrencies, especially newer altcoins, OKX likely has the edge. However, if you mainly trade established cryptocurrencies, both platforms should meet your needs effectively.

OKX vs Phemex: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing OKX and Phemex exchanges, fees play a key role in your decision-making process. Both platforms offer competitive fee structures, but they differ in several important ways.

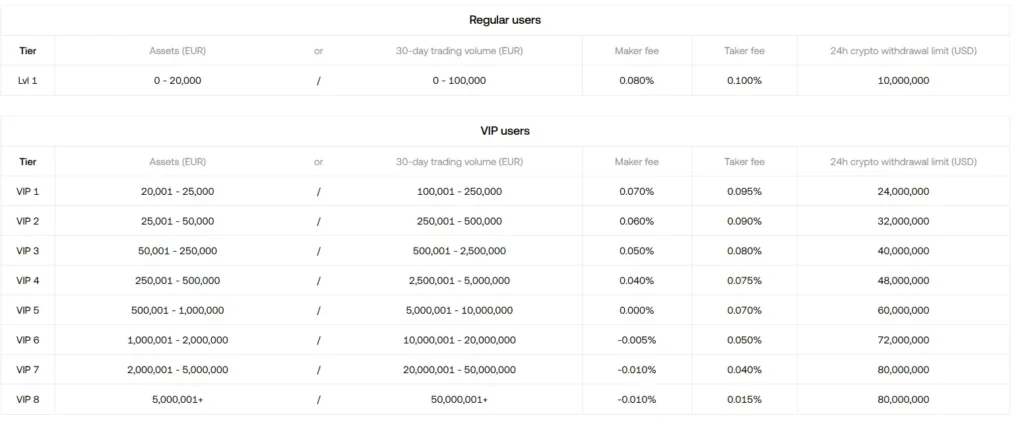

OKX’s trading fees range from 0.08% to -0.01% (yes, negative fees are possible), depending on your 30-day trading volume and asset holdings. The taker fee starts at 0.10% for most users.

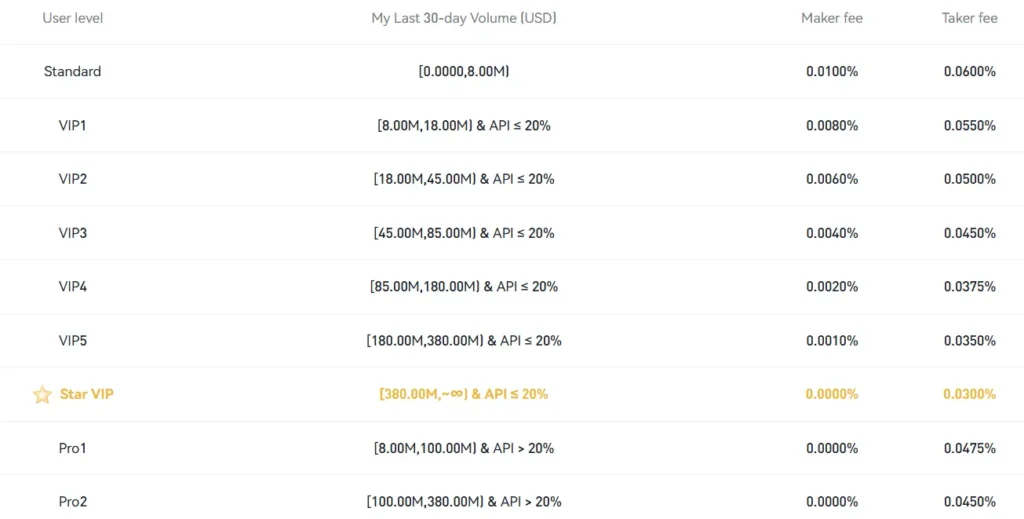

Phemex, on the other hand, offers a standard trading fee of 0.01% according to the search results. This flat rate is simpler to understand compared to OKX’s tiered structure.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee | Fee Structure |

|---|---|---|---|

| OKX | 0.08% to -0.01% | 0.10% and up | Tiered based on volume |

| Phemex | 0.01% | 0.01% | Flat rate |

For deposit fees, both exchanges typically offer free crypto deposits. However, fiat deposit methods may incur charges depending on your payment method.

Withdrawal fees vary by cryptocurrency on both platforms. These fees change regularly based on network conditions and blockchain congestion.

You should consider your trading volume when choosing between these exchanges. If you’re a high-volume trader, OKX’s negative maker fees might save you money. For occasional traders, Phemex’s flat 0.01% fee could be more straightforward.

Remember that fees can change without notice. It’s always best to check the current fee schedules on both platforms before making your final decision.

OKX vs Phemex: Order Types

When trading on cryptocurrency exchanges, the order types available can impact your trading strategy. Both OKX and Phemex offer a variety of order types to help you execute trades effectively.

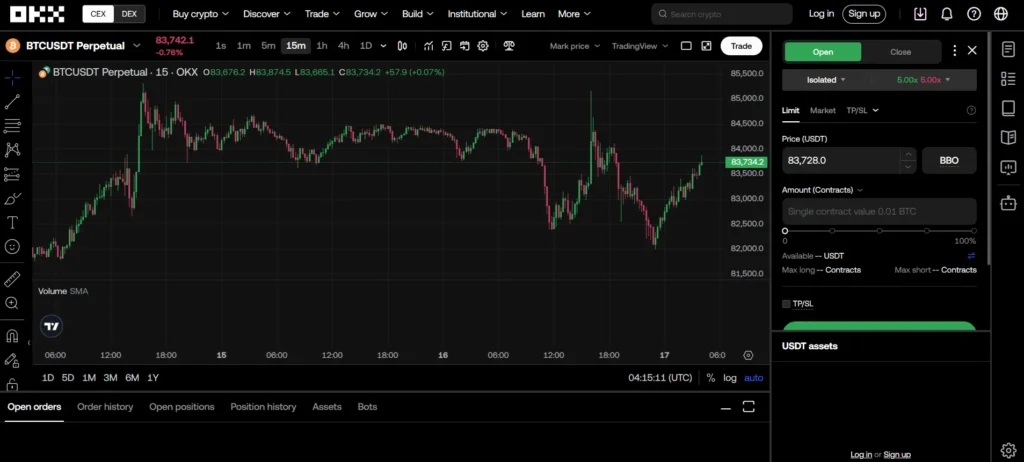

OKX provides a comprehensive range of order options. You can use market orders, limit orders, and stop orders for basic trading needs. For more advanced strategies, OKX offers trailing stop orders, iceberg orders, and time-weighted average price (TWAP) orders.

Phemex keeps things straightforward with standard order types including market, limit, and stop orders. They also feature conditional orders and take-profit/stop-loss combinations that can be set at the time of your initial trade.

OKX generally offers more flexibility with its wider variety of order types. This can be beneficial if you employ complex trading strategies or algorithmic trading approaches.

Phemex’s order interface is often praised for being user-friendly and less cluttered. This makes it easier for beginners to place trades without feeling overwhelmed by too many options.

Both platforms support cross and isolated margin modes for their futures trading, allowing you to manage risk according to your preference.

If you’re new to trading, Phemex’s simpler order selection might be more approachable. For experienced traders who need more specialized tools, OKX’s extensive order types provide additional trading possibilities.

OKX vs Phemex: KYC Requirements & KYC Limits

OKX and Phemex have different approaches to Know Your Customer (KYC) verification, which can impact your trading experience.

Phemex KYC Policy:

Phemex does not require KYC verification for basic trading. This means you can start trading quickly without submitting identity documents.

However, without KYC verification on Phemex, you may face withdrawal limits. The no-KYC approach makes Phemex popular among traders who value privacy and convenience.

OKX KYC Policy:

OKX typically requires KYC verification to access full platform features. This involves submitting identity documents to comply with regulations.

The verification process at OKX has multiple levels, with higher verification tiers allowing larger withdrawal limits and more trading options.

Why KYC Matters:

- Withdrawal Limits: Both platforms set different limits based on verification level

- Feature Access: Some advanced features may require KYC completion

- Regulatory Compliance: KYC helps exchanges comply with local laws

KYC requirements can change based on your location and regulatory developments. Cryptocurrency regulations are still evolving in many regions.

When choosing between OKX and Phemex, consider how important quick account setup is to you versus higher withdrawal limits and full platform access.

Remember that even with no-KYC options, your trading activity might still be traceable through blockchain analysis.

OKX vs Phemex: Deposits & Withdrawal Options

Both OKX and Phemex offer multiple ways to fund your account and withdraw your assets. These options can affect how quickly you can trade and access your funds.

OKX Deposit Methods:

- Cryptocurrency deposits

- Bank transfers (SWIFT)

- Credit/debit cards

- Third-party payment processors

- P2P trading

Phemex Deposit Methods:

- Cryptocurrency deposits

- Credit/debit cards

- Limited bank transfer options

- Fewer third-party processors than OKX

OKX generally provides more fiat currency options for deposits. This makes it easier if you’re looking to convert traditional money into crypto directly on the platform.

Withdrawal Processing Times:

| Method | OKX | Phemex |

|---|---|---|

| Crypto | 1-3 hours | 1-2 hours |

| Fiat | 1-5 business days | 1-7 business days |

Phemex often processes crypto withdrawals slightly faster than OKX. However, OKX typically has more reliable fiat withdrawal times.

Both exchanges implement security measures like withdrawal confirmations and address whitelisting. These features help protect your funds but may add time to the withdrawal process.

Fee structures differ between platforms. OKX charges network fees for crypto withdrawals, while Phemex has fixed withdrawal fees for many cryptocurrencies. For fiat withdrawals, OKX typically has lower fees for bank transfers compared to Phemex.

You should check the current fee schedules on both platforms before making your decision, as these can change based on market conditions.

OKX vs Phemex: Trading & Platform Experience Comparison

When choosing between OKX and Phemex, the trading platform experience can make a big difference in your success. Both exchanges offer web platforms and mobile apps with real-time charts and trading tools.

OKX provides a more comprehensive trading interface with advanced charting options. You’ll find over 350 cryptocurrencies available for trading, which gives you more options than Phemex offers.

Phemex counters with a cleaner, more user-friendly interface that beginners might prefer. The platform loads quickly and executes trades with minimal lag.

Trading Features Comparison:

| Feature | OKX | Phemex |

|---|---|---|

| User Interface | Complex, feature-rich | Clean, streamlined |

| Mobile App | Comprehensive | Simple, fast |

| Trading Pairs | 350+ | 250+ |

| Chart Tools | Advanced | Basic to intermediate |

| Order Types | Market, limit, stop-limit, trailing stop | Market, limit, stop-limit |

Phemex offers demo accounts where you can practice trading with fake money. This is especially helpful if you’re new to crypto trading.

OKX stands out with its trading bots and automated strategies. You can set up bots to trade for you based on specific signals and conditions.

Both platforms support leverage trading, but OKX offers higher leverage options on certain pairs. Be careful though – higher leverage means higher risk.

Loading times and execution speed are generally faster on Phemex, which might matter if you’re an active trader making multiple trades daily.

OKX vs Phemex: Liquidation Mechanism

When trading with leverage on OKX or Phemex, understanding their liquidation mechanisms is crucial. These systems help prevent total loss of your funds when trades move against you.

OKX uses a tiered liquidation system that triggers partial liquidations before full account liquidation. This approach gives you a chance to add more margin or reduce positions when your account reaches certain risk levels.

Phemex employs a similar system but with some distinct differences. It uses a progressive liquidation process that gradually reduces your position size as you approach the liquidation price.

Liquidation Price Calculation:

| Platform | Calculation Method |

|---|---|

| OKX | Based on maintenance margin ratio (typically 0.5-1%) |

| Phemex | Uses a risk limit system tied to position size |

Both platforms issue warnings before liquidation occurs. You’ll receive notifications when your margin ratio falls below certain thresholds.

OKX offers a feature called “Auto-Deleveraging” that can help reduce the impact of sudden market moves on your positions. Phemex provides a “Kill Switch” function that lets you quickly close all positions in emergencies.

The fees charged during liquidation also differ. OKX typically charges standard trading fees plus a small liquidation fee. Phemex often has lower liquidation penalties in comparison.

To avoid liquidation on either platform, consider using stop-loss orders, monitoring your position margin carefully, and avoiding excessive leverage when market volatility is high.

OKX vs Phemex: Insurance

When choosing a crypto exchange, security is a top priority. Both OKX and Phemex offer insurance protection, but there are some key differences.

OKX maintains a dedicated Protection Fund to safeguard user assets. This fund contains over $300 million to cover potential losses from security breaches or hacks. The exchange also implements cold storage for the majority of user funds.

Phemex provides insurance through its Phemex Insurance Fund. This fund helps protect traders from severe losses during extreme market volatility. It primarily focuses on protecting futures trading positions from auto-liquidations.

Neither exchange offers FDIC insurance, which is important to note. This is common in the crypto industry, as government-backed insurance typically doesn’t extend to digital assets.

Both platforms use multi-signature wallets and two-factor authentication to enhance security. These measures work alongside their insurance funds to create multiple layers of protection.

OKX has a slightly more robust insurance system based on the size of its protection fund. However, Phemex’s focus on preventing liquidation losses may be more valuable to active futures traders.

When deciding between these exchanges, consider your trading style and risk tolerance. If you prioritize overall asset protection, OKX might be the better choice. If you trade futures frequently, Phemex’s liquidation protection could be more beneficial.

OKX vs Phemex: Customer Support

When choosing a cryptocurrency exchange, customer support can make or break your experience. Both OKX and Phemex offer several support channels to help users with their questions and issues.

OKX provides 24/7 customer support through live chat, email, and a comprehensive help center. Their support team typically responds within minutes for urgent matters. You can also find answers in their extensive FAQ section and community forums.

Phemex also offers round-the-clock support via live chat and email. Their response times are generally quick, usually within 1-2 hours for most inquiries. Their knowledge base contains detailed guides and tutorials for beginners.

Both platforms offer multilingual support, though OKX covers more languages (15+) compared to Phemex (8+). This can be important if English isn’t your primary language.

For complex issues, OKX provides ticket-based support with case tracking. Phemex offers similar functionality but adds a direct phone line for premium users.

Social media support is available on both platforms. You can reach out via Twitter, Telegram, or Discord for quick responses to simple questions.

User feedback suggests OKX excels at handling technical problems, while Phemex receives praise for their friendly and patient approach with newer traders. Both platforms actively update their FAQs based on common user questions.

Neither platform offers dedicated account managers unless you’re a high-volume trader with VIP status.

OKX vs Phemex: Security Features

Both OKX and Phemex prioritize security to protect your cryptocurrency assets. Understanding their security features can help you make an informed choice between these exchanges.

Two-Factor Authentication (2FA) is offered by both platforms. This adds an extra layer of protection when you log in or make transactions.

OKX uses a combination of cold storage wallets and hot wallets. About 95% of user funds are kept in cold storage, away from internet connections and potential hackers.

Phemex also implements cold wallet storage for most user assets. Their system includes multi-signature technology that requires multiple approvals for withdrawals.

Account security features on both platforms include:

- Anti-phishing codes

- Withdrawal whitelist options

- Email alerts for suspicious activities

- Device management tools

OKX has obtained ISO 27001 and ISO 27701 certifications, showing their commitment to information security standards. The platform also runs a bug bounty program to identify vulnerabilities.

Phemex features a unique account recovery process that helps you regain access if you lose your login credentials. They also conduct regular security audits.

Neither exchange has experienced major security breaches in recent years, which speaks to their robust security measures.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords and keeping your recovery phrases in secure locations.

Is OKX A Safe & Legal To Use?

OKX is considered a safe and legal cryptocurrency exchange for traders in 2025. The platform is registered in Malta and Hong Kong and complies with the Virtual Financial Asset Act (VFAA), showing its commitment to regulatory standards.

Security is a priority for OKX, which has earned an “AA” rating from CertiK, ranking #3 among the safest crypto exchanges. This high security rating is reinforced by the fact that OKX has not experienced any hacking breaches to date.

The exchange is operated by Aux Cayes FinTech Co Ltd, a company registered in Seychelles. This legal structure provides a foundation for OKX’s operations across global markets.

Important note for users: OKX is not available for traders in the United States. If you’re based in the US, you’ll need to consider alternative platforms for your cryptocurrency trading needs.

Key security features include:

- Advanced encryption protocols

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Regular security audits

When using OKX, you can trade with confidence knowing the platform maintains high security standards. The exchange offers various trading options suitable for both beginners and experienced traders.

Is Phemex A Safe & Legal To Use?

Phemex is considered a safe and legitimate cryptocurrency platform for trading. It is registered as a Money Services Business with FinCEN, which allows it to operate legally in various jurisdictions.

Security is a major strength for Phemex. The exchange has maintained a strong security record and has never been hacked, which is noteworthy in the crypto industry where security breaches are common.

For traders concerned about regulatory compliance, Phemex meets important legal requirements to operate as a cryptocurrency exchange. This provides you with some peace of mind when trading on their platform.

Phemex offers features that enhance safety for users:

- Cold storage for the majority of assets

- Two-factor authentication (2FA)

- Anti-phishing protection

- Regular security audits

The platform is particularly good for newer traders as it provides a simulated trading market. This allows you to practice trading strategies without risking real money.

When comparing to other exchanges like OKX, Phemex maintains competitive security standards while offering user-friendly features. This makes it accessible for both beginners and experienced traders.

Remember to always use strong passwords and enable all available security features when creating your account on any exchange, including Phemex.

Frequently Asked Questions

Traders need clear answers about these popular crypto exchanges before making their choice. The following questions address key differences in fees, security, available cryptocurrencies, unique features, customer support, and leverage options.

What are the differences in trading fees between OKX and Phemex?

OKX charges a standard spot trading fee of 0.10% for makers and 0.15% for takers. These fees decrease as your trading volume increases.

Phemex offers a slightly different fee structure with 0.10% for both makers and takers on their spot exchange. For contract trading, Phemex charges 0.01% for makers and 0.06% for takers.

You can reduce fees on both platforms by holding their native tokens or achieving higher VIP levels through trading volume.

How do the security features of OKX and Phemex compare?

Both exchanges use cold storage solutions to protect the majority of user funds. OKX implements multi-signature technology and stores 95% of assets in cold wallets.

Phemex offers similar security with cold storage protection and a comprehensive risk management system. They also provide two-factor authentication (2FA) and anti-phishing codes.

OKX has experienced security breaches in the past, while Phemex has maintained a relatively clean security record since its launch in 2019.

Which platform offers a wider range of cryptocurrencies, OKX or Phemex?

OKX supports over 350 cryptocurrencies with more than 600 trading pairs. This gives you significant variety for diversifying your portfolio.

Phemex offers fewer options with approximately 150+ cryptocurrencies and 200+ trading pairs. The platform focuses on the most popular coins and tokens.

If you’re looking to trade niche altcoins, OKX likely offers better selection. Both platforms regularly add new coins based on market demand.

Are there any unique trading tools or features provided by OKX or Phemex?

OKX offers a comprehensive trading bot system with grid trading, DCA, and spot-futures arbitrage. Their “Demo Trading” feature lets you practice without risking real funds.

Phemex provides a unique Earn platform where you can stake coins for fixed returns. Their Trading Terminal includes advanced charting tools and one-click order execution.

OKX has better DeFi integration through their web3 wallet, while Phemex stands out with their Lite version for beginners and Contract Calculator for futures trading.

How do the customer support services of OKX and Phemex differ?

OKX provides 24/7 customer support through live chat, email, and an extensive knowledge base. Response times average around 10-15 minutes for live chat.

Phemex offers similar 24/7 support options but typically responds faster, with average chat wait times under 5 minutes. Their support team is known for being more hands-on.

Both platforms provide multi-language support, but Phemex edges out with slightly more personal attention for technical issues and account-related problems.

What are the advantages and disadvantages of using leverage on OKX versus Phemex?

OKX offers leverage up to 125x on futures contracts with flexible adjustment options. Their liquidation mechanism is relatively forgiving with partial liquidations.

Phemex provides up to 100x leverage on futures trading. Their platform includes better risk management tools like stop-loss and take-profit orders that execute reliably.

You’ll find more advanced leverage features on OKX, but Phemex offers a more user-friendly interface for margin trading with clearer liquidation warnings and built-in calculators.

Phemex vs OKX Conclusion: Why Not Use Both?

Both OKX and Phemex offer strong cryptocurrency exchange services in 2025. Each platform has unique strengths that might appeal to different aspects of your trading strategy.

OKX scores higher overall with a 7.8 rating compared to Phemex’s slightly lower score. However, ratings alone shouldn’t be your only deciding factor.

You might prefer OKX for its wider range of features and possibly more extensive cryptocurrency options. The platform has developed a robust ecosystem that many experienced traders appreciate.

Phemex, on the other hand, might offer advantages in specific areas like user interface or certain trading tools that better match your personal preferences.

Why choose just one? Many crypto traders maintain accounts on multiple exchanges to:

- Take advantage of different fee structures

- Access coins only available on certain platforms

- Diversify exchange risk

- Capitalize on different promotional offers

Neither exchange offers complete fiat offramps, so you might still need another exchange like Binance for certain transactions anyway.

The best approach is to try both platforms with small amounts first. See which interface feels more intuitive and which features actually matter to your trading style.

Your trading volume, preferred cryptocurrencies, and regional availability might ultimately determine which platform serves you better – or why using both makes the most sense.