Choosing the right cryptocurrency exchange is important for your trading success. In 2025, MEXC and OKX remain popular options, each with unique strengths that might fit different trading needs.

Based on recent 2025 comparisons, MEXC edges ahead with a 4.5/5 rating compared to OKX’s 4.35/5, but the better choice depends on what you value most. MEXC stands out for technological advancements and non-traditional investment opportunities, while OKX offers competitive fees with 0.08% maker and 0.10% taker rates versus MEXC’s 0.20% standard spot trading fee.

You’ll find distinct advantages with each platform. MEXC might appeal if you’re looking for cutting-edge features and diverse investment options. OKX could be more suitable if lower trading fees are your priority. Let’s examine both exchanges in detail to help you make the right choice for your crypto trading journey.

OKX vs MEXC: At A Glance Comparison

When choosing between OKX and MEXC exchanges, understanding their key differences helps you make a better decision for your crypto trading needs.

Trading Experience

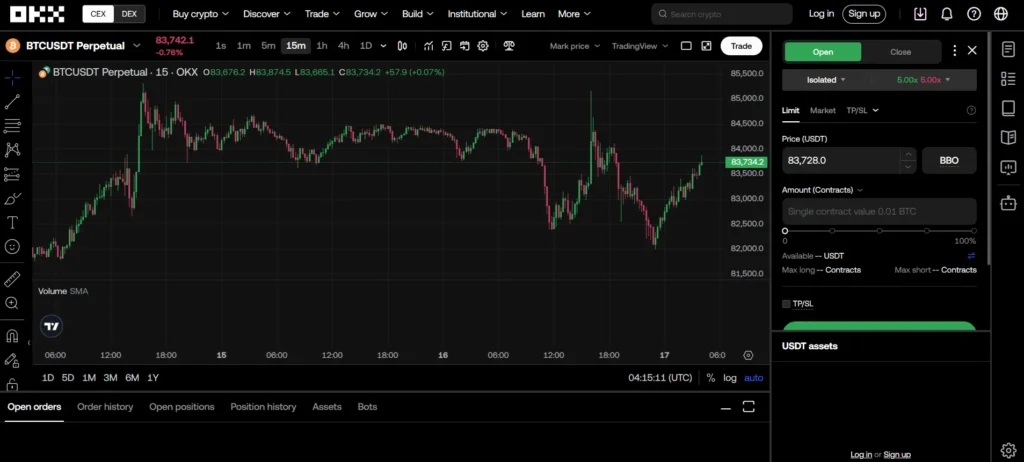

- OKX offers powerful charting tools that appeal to technical traders

- MEXC provides more resources for altcoin exploration and trading

Fee Comparison

| Feature | OKX | MEXC |

|---|---|---|

| Trading Fees | Competitive | Generally low |

| Withdrawal Fees | Varies by crypto | Varies by crypto |

Cryptocurrency Selection

- Both exchanges offer a wide range of cryptocurrencies

- MEXC typically lists more altcoins and newer tokens

- OKX focuses on established cryptocurrencies with higher liquidity

Platform Security

Both exchanges implement standard security features including two-factor authentication and cold storage for funds.

User Interface

OKX has a more polished interface that may appeal to traders looking for advanced features. MEXC offers a straightforward experience that newer users might find less overwhelming.

Additional Features

- OKX: Advanced trading options, stronger charting capabilities

- MEXC: More altcoin pairs, generally faster listing of new tokens

Your choice between these exchanges should depend on whether you prioritize technical trading tools (OKX) or access to a wider variety of altcoins (MEXC).

OKX vs MEXC: Trading Markets, Products & Leverage Offered

Both OKX and MEXC offer extensive trading options, but with some key differences that might affect your trading experience.

OKX provides access to over 350 cryptocurrencies and supports spot trading, futures, options, and margin trading. You can trade with leverage up to 125x on futures contracts, giving you more power with your capital.

MEXC slightly edges out with support for more than 1,500 cryptocurrencies, making it better if you’re looking for newer or less common tokens. MEXC also offers spot trading, futures, and margin trading with leverage up to 200x on some contracts.

Trading Products Comparison:

| Feature | OKX | MEXC |

|---|---|---|

| Cryptocurrencies | 350+ | 1,500+ |

| Max Leverage | 125x | 200x |

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | ✗ |

| Margin Trading | ✓ | ✓ |

OKX stands out with its options trading, which MEXC doesn’t offer. This gives you more ways to hedge positions or speculate on price movements.

For beginners interested in leverage trading, both platforms provide demo accounts to practice without risking real money. This helps you understand how leverage works before using actual funds.

Advanced traders might appreciate MEXC’s higher leverage options, while those looking for diverse trading products might prefer OKX’s options trading capabilities.

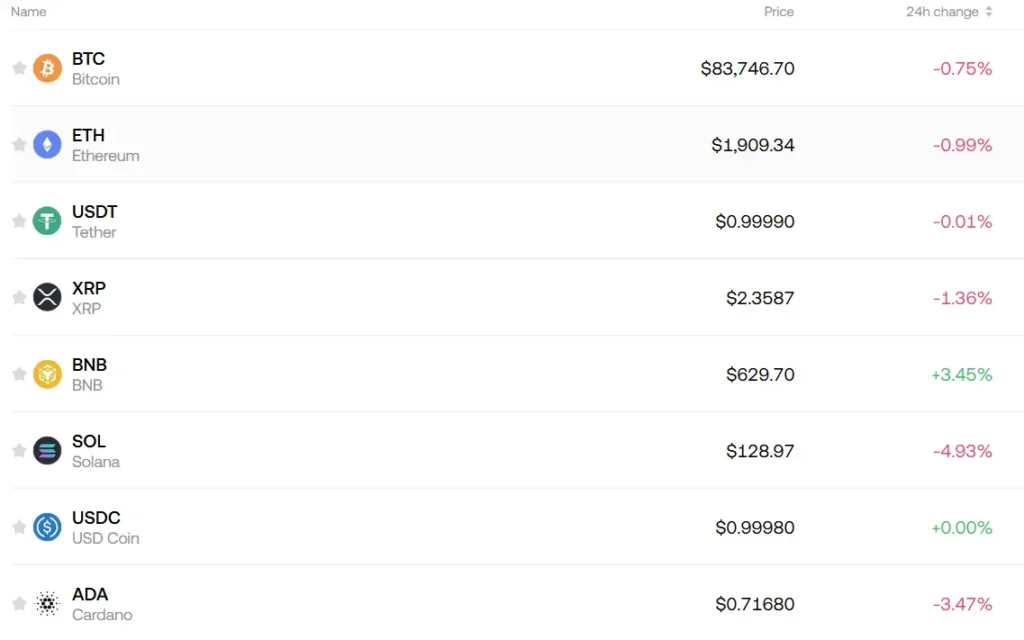

OKX vs MEXC: Supported Cryptocurrencies

When choosing between OKX and MEXC, the variety of cryptocurrencies available is a key factor to consider. Both exchanges offer a wide selection, but there are some differences worth noting.

OKX supports over 350 cryptocurrencies for trading. You’ll find all major coins like Bitcoin, Ethereum, and Solana, plus many altcoins and newer tokens. Their selection includes both established projects and emerging cryptocurrencies.

MEXC takes the lead in this category with support for over 1,500 cryptocurrencies. This makes MEXC particularly attractive if you’re interested in trading newer or less common tokens. Many smaller market cap coins appear on MEXC before they reach other major exchanges.

Comparison of Supported Cryptocurrencies:

| Feature | OKX | MEXC |

|---|---|---|

| Total cryptocurrencies | 350+ | 1,500+ |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| New token listings | Regular | Very frequent |

| Small-cap altcoins | Good selection | Extensive selection |

MEXC is known for listing new projects quickly, often being among the first exchanges to support emerging tokens. This can give you early access to potential opportunities, though newer coins may carry higher risk.

Both exchanges regularly add new cryptocurrencies to their platforms. You can expect the selection to grow over time as the crypto market continues to expand.

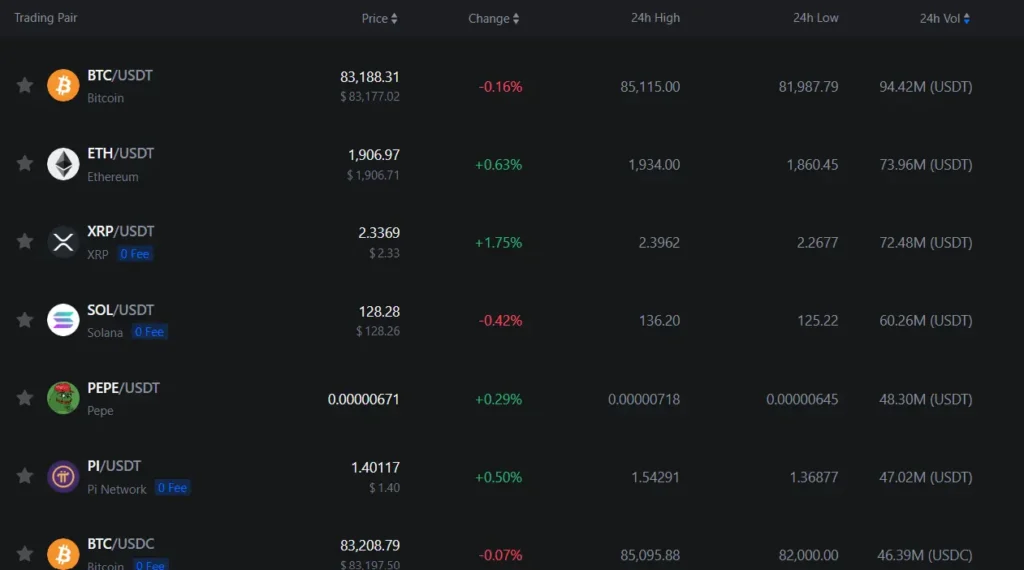

OKX vs MEXC: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing OKX and MEXC, fees are a crucial factor to consider for your trading decisions. Based on 2025 data, MEXC offers more competitive trading fees overall.

Trading Fees Comparison:

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| MEXC | 0% | 0.02% |

| OKX | Higher | Higher |

MEXC stands out with its zero maker fees and very low 0.02% taker fees for spot trading. This makes it particularly attractive if you trade frequently or work with large volumes.

For total transaction costs, MEXC appears more economical. When comparing similar transactions across platforms, OKX tends to charge around $632.27 while MEXC comes in lower.

Deposit and Withdrawal Fees:

Both exchanges charge network fees for cryptocurrency withdrawals, which vary by asset. These fees fluctuate based on blockchain congestion and the specific cryptocurrency.

MEXC often offers free deposits across most supported cryptocurrencies. Withdrawal fees depend on the network used but are generally competitive.

OKX’s fee structure is slightly higher overall, which might impact your long-term trading costs if you make frequent transactions.

Your trading volume and patterns should guide your choice between these platforms. High-volume traders may benefit more from MEXC’s fee structure, while those who value other features might find OKX’s slightly higher fees acceptable.

OKX vs MEXC: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both OKX and MEXC offer a variety of order types to suit different trading needs.

OKX provides a comprehensive set of order options including:

- Market orders: Execute immediately at current market price

- Limit orders: Set your desired price for execution

- Stop orders: Trigger at a specified price point

- Trailing stop orders: Follow price movements with adjustable parameters

- OCO (One Cancels Other): Place two orders where execution of one cancels the other

MEXC also offers a strong selection of order types:

- Market orders: Buy or sell at current best available price

- Limit orders: Specify your execution price

- Stop-limit orders: Combine stop triggers with limit pricing

- Post-only orders: Ensure you’re always a market maker, not taker

Both platforms support advanced conditional orders, but OKX has a slight edge with more sophisticated order types like iceberg orders that hide the true order size from the market.

For beginners, both exchanges provide the essential market and limit orders you’ll need to start trading. As you advance, you might find OKX’s additional order options more beneficial for complex strategies.

Trading interface responsiveness is comparable between the two platforms, with orders executing quickly when market conditions permit.

OKX vs MEXC: KYC Requirements & KYC Limits

OKX implements mandatory KYC (Know Your Customer) procedures for all users. Without completing verification, you’ll face significant withdrawal restrictions. OKX uses these requirements alongside two-factor authentication for enhanced security.

MEXC offers more flexibility with its three-tier account system. Unlike OKX, MEXC doesn’t make KYC mandatory for basic trading. You can operate an unverified account with limited functionality.

The three MEXC account levels are:

- Unverified: Basic access with lower withdrawal limits

- Primary KYC: Moderate withdrawal limits

- Verified Plus: Maximum withdrawal capabilities

This difference makes MEXC more appealing if you value privacy or want to start trading immediately without identity verification. However, you’ll still face withdrawal limits without completing some level of KYC.

OKX’s stricter approach means more initial setup time but potentially higher security standards. Your maximum withdrawal amounts directly depend on your verification level.

If KYC requirements are a major concern for your trading strategy, MEXC provides more options for unverified trading. This flexibility has contributed to MEXC’s slightly higher rating (4.5/5) compared to OKX (4.35/5) in 2025 comparisons.

Both exchanges balance security and accessibility differently. Your choice depends on whether you prioritize immediate access or comprehensive security measures.

OKX vs MEXC: Deposits & Withdrawal Options

Both OKX and MEXC provide several methods for depositing and withdrawing funds. Understanding these options can help you decide which platform better fits your needs.

OKX Deposit Options:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

- Third-party payment processors

OKX supports over 300 cryptocurrencies for deposits. Their fiat options vary by region, with bank transfers being widely available in most countries.

MEXC Deposit Options:

- Cryptocurrency deposits

- Credit/debit cards

- P2P trading

- Third-party payment providers

MEXC accepts deposits in more than 250 cryptocurrencies. Their P2P option allows you to buy crypto directly from other users.

Withdrawal Methods Comparison:

| Feature | OKX | MEXC |

|---|---|---|

| Crypto withdrawals | Yes (300+) | Yes (250+) |

| Fiat withdrawals | Yes (region-dependent) | Limited |

| Withdrawal fees | Variable | Generally lower |

| Processing time | 1-24 hours | 30 min – 24 hours |

MEXC typically offers faster crypto withdrawal processing times and lower fees compared to OKX. However, OKX provides more comprehensive fiat withdrawal options in most regions.

Both exchanges implement withdrawal limits that increase with account verification level. New users on both platforms face stricter limits until they complete identity verification.

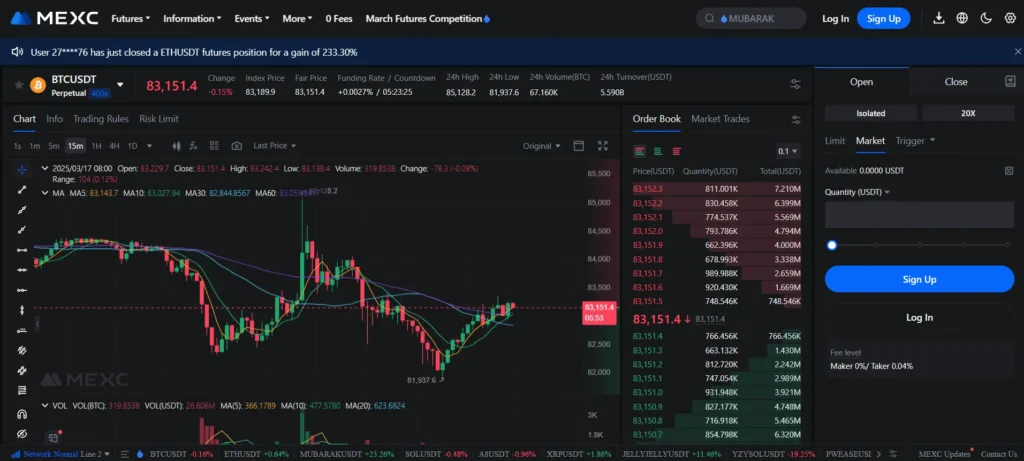

OKX vs MEXC: Trading & Platform Experience Comparison

MEXC offers a user-friendly interface that makes it ideal for beginners. The platform features a clean design with intuitive navigation that helps new traders find their way around easily.

OKX provides a more advanced trading experience with sophisticated tools and charts. Its platform includes features like advanced order types and technical analysis tools that experienced traders value.

Interface Comparison:

- MEXC: Simple, clean, beginner-focused

- OKX: Feature-rich, technical, advanced-user oriented

Both exchanges offer mobile apps, but their usability differs. MEXC’s mobile app maintains its simplicity, making quick trades possible even for newcomers. OKX’s app includes most desktop features but has a steeper learning curve.

Trading fees also impact your platform experience. MEXC generally offers slightly lower trading fees than OKX, especially for spot trading. However, OKX may provide better fee discounts for high-volume traders.

Available Trading Types:

| Feature | MEXC | OKX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | Limited | Extensive |

| Copy Trading | ✓ | ✓ |

When it comes to execution speed, both platforms perform well. OKX has a slight edge in terms of system stability during high market volatility.

You’ll find MEXC’s customer support more responsive for basic issues, while OKX offers more comprehensive technical support for complex trading problems.

OKX vs MEXC: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial. Both OKX and MEXC have systems in place to protect themselves when your position approaches significant losses.

OKX uses a tiered liquidation system that begins with warnings when your margin ratio falls below certain thresholds. The platform typically starts liquidation when your margin ratio drops below 100%.

MEXC offers up to 200x leverage for BTC and ETH trading, which is higher than OKX. This higher leverage comes with increased liquidation risks for traders.

Key Differences in Liquidation Approaches:

| Feature | OKX | MEXC |

|---|---|---|

| Liquidation Warning | Yes, multi-tier alerts | Basic notification system |

| Partial Liquidation | Available on select contracts | Less common |

| Insurance Fund | Well-funded for preventing socialized losses | Smaller fund compared to OKX |

| Liquidation Price Calculation | More transparent formulas provided | Less detailed documentation |

Both exchanges use an insurance fund to handle liquidations when the market moves too quickly to liquidate at the exact liquidation price.

OKX provides more detailed information about their liquidation process in their documentation, making it easier for you to understand the risks.

MEXC’s higher leverage options (up to 200x) mean liquidations can happen more quickly and with smaller price movements against your position.

OKX vs MEXC: Insurance

When choosing between OKX and MEXC, insurance protection is a key factor to consider for your crypto assets. Both exchanges offer some form of protection, but they differ in implementation.

OKX maintains a dedicated Protection Fund worth over $300 million to safeguard user assets. This fund acts as a safety net if security breaches occur. OKX also implements regular security audits and cold storage for most user funds.

MEXC offers its own User Protection Fund, though it’s smaller than OKX’s fund. The exchange allocates a portion of trading fees to continuously grow this insurance pool.

Key Insurance Differences:

| Feature | OKX | MEXC |

|---|---|---|

| Protection Fund Size | $300+ million | Smaller (exact figure not disclosed) |

| Cold Storage | 95% of assets | 90% of assets |

| Insurance Coverage | Covers security breaches | Limited to specific incidents |

| SAFU Equivalent | Yes (Protection Fund) | Yes (User Protection Fund) |

Neither exchange offers full insurance for all potential loss scenarios. Market volatility, personal account compromises, and certain types of hacks may not be covered.

You should note that both exchanges recommend using additional security measures like 2FA and withdrawal whitelists to protect your assets. These features work alongside the insurance protections to create more comprehensive security.

OKX vs MEXC: Customer Support

When choosing between OKX and MEXC, customer support quality can make a big difference in your trading experience.

OKX offers more comprehensive documentation compared to MEXC. This can be helpful when you need to solve problems on your own.

Another advantage of OKX is its support for multiple global languages. This makes it more accessible if English isn’t your first language.

MEXC seems to focus on response speed. Based on search results, users who need quick help might prefer MEXC’s prompt support system.

Both exchanges offer 24/7 customer support, ensuring you can get help whenever trading issues arise. This is especially important in the crypto market, which operates around the clock.

Support channels typically include:

- Live chat

- Email support

- Help center documentation

- FAQ sections

Response times can vary between the two platforms depending on user volume and query complexity. During high-traffic periods, you might experience longer wait times on both exchanges.

The quality of technical support is particularly important when dealing with deposit or withdrawal issues. Make sure to check recent user reviews about support experiences before committing to either platform.

For new crypto traders, the quality of educational support resources might also be worth considering when choosing between OKX and MEXC.

OKX vs MEXC: Security Features

When choosing between OKX and MEXC, security should be a top priority for your crypto investments. According to recent Cer.live security ratings, MEXC holds an AA rating with an 86.50% security score, while OKX has an A rating with 81.80%.

Both exchanges offer two-factor authentication (2FA) to protect your account from unauthorized access. This extra layer of security requires you to verify your identity using a second method beyond just your password.

MEXC’s Key Security Features:

- AA security rating (86.50%)

- Two-factor authentication (2FA)

- Cold storage mechanisms for assets

- Advanced encryption protocols

OKX’s Key Security Features:

- A security rating (81.80%)

- Two-factor authentication (2FA)

- Fund security systems

- Regular security audits

MEXC’s higher security rating suggests it might be the better choice if security is your main concern. Their cold storage solution keeps most user funds offline, making them less vulnerable to hacking attempts.

OKX, while slightly lower rated, still maintains strong security standards with its comprehensive security systems. Their regular audits help identify and address potential vulnerabilities before they can be exploited.

You should enable all available security features regardless of which platform you choose. This includes using strong, unique passwords and activating 2FA immediately after creating your account.

Is OKX Safe & Legal To Use?

OKX is generally considered safe for cryptocurrency trading in 2025. The exchange has earned an AA security rating from CertiK and ranks #3 among the safest crypto exchanges according to recent evaluations.

A key strength of OKX is that it hasn’t experienced any major hacking breaches since its establishment in 2017. The platform maintains an 81.80% security score, which is respectable in the cryptocurrency exchange landscape.

Safety Features:

- Advanced encryption

- Two-factor authentication

- Regular security audits

- Cold storage for most user funds

Regarding legality, OKX is based in Seychelles and operates in many countries worldwide. However, you should check if OKX is permitted in your specific location, as regulations vary by country.

One potential concern to be aware of is that OKX’s terms indicate they reserve the right to deposit your funds in their name or a custodian’s name. This could potentially affect your claim to funds if the company faces bankruptcy.

When using OKX, you should follow standard security practices like using strong passwords, enabling all security features, and being cautious with withdrawal permissions.

The platform is suitable for both beginners and experienced traders, offering various trading tools and options while maintaining adequate security measures.

Is MEXC Safe & Legal To Use?

MEXC has established itself as a reliable cryptocurrency exchange with an AA security rating. This high rating reflects the platform’s commitment to protecting user assets and data.

The exchange serves over 10 million users worldwide, showing its widespread acceptance in the crypto community.

However, there are some concerning reports about MEXC allegedly banning profitable traders and withholding funds. These claims should be considered when evaluating the platform’s trustworthiness.

MEXC implements several security features to protect users:

- Two-factor authentication (2FA)

- Cold storage for most crypto assets

- Regular security audits

When it comes to legality, MEXC operates in many countries, but you should verify its legal status in your specific location. Cryptocurrency regulations vary widely by country and region.

The exchange complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements in jurisdictions where it’s legally required. This helps prevent fraud and illegal activities on the platform.

For maximum security when using MEXC, you should:

- Enable all security features

- Use a strong, unique password

- Be cautious of phishing attempts

- Only invest amounts you can afford to lose

Remember that all cryptocurrency exchanges carry inherent risks, and even the most secure platforms can face challenges.

Frequently Asked Questions

Traders comparing OKX and MEXC often have specific questions about their features, fees, and security. These answers can help you decide which platform better suits your trading needs.

What are the main differences in features between OKX and MEXC?

OKX offers a more comprehensive suite of trading tools including futures, options, and margin trading with an intuitive interface. The platform also provides OKX Web3 wallet functionality.

MEXC focuses on listing a wider variety of altcoins and new tokens faster than most competitors. It offers over 1,500 trading pairs, making it attractive for traders seeking emerging cryptocurrencies.

The user interfaces differ significantly, with OKX generally considered more polished and beginner-friendly. MEXC’s interface prioritizes functionality for experienced traders who value access to many coins.

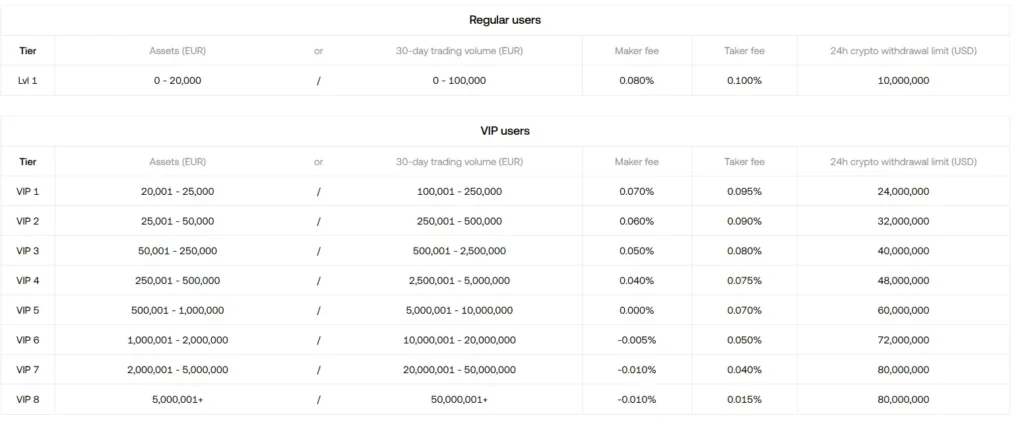

How do the trading fees compare between OKX and MEXC platforms?

MEXC offers significantly lower trading fees than OKX, with approximately 80% less than some major exchanges. Standard maker/taker fees on MEXC start at 0.1%/0.1%.

OKX has a tiered fee structure that starts at 0.08%/0.1% for maker/taker fees. These fees decrease based on trading volume and OKB token holdings.

Both platforms offer fee discounts through their native tokens and VIP programs. MEXC’s competitive fee structure makes it particularly attractive for high-volume traders looking to minimize costs.

Which exchange offers better customer support, OKX or MEXC?

OKX provides 24/7 multilingual customer support through live chat, email, and an extensive knowledge base. Response times are generally faster than industry average.

MEXC’s customer support is available through similar channels but has mixed reviews regarding response times. Their support team handles inquiries in multiple languages.

Both platforms offer community-based support through social media channels and forums. OKX tends to have more consistent and reliable support experiences according to user feedback.

What are the security measures implemented by OKX and MEXC to protect user assets?

OKX employs multi-signature wallets, cold storage for majority of funds, and regular security audits. The platform also offers two-factor authentication and anti-phishing codes.

MEXC implements similar security features including cold storage, two-factor authentication, and withdrawal whitelist functionality. They maintain a security fund to protect against potential breaches.

Both exchanges have experienced security incidents in the past but have strengthened their security protocols over time. Neither has suffered major hacks in recent years.

How is the liquidity and trading volume different on OKX compared to MEXC?

OKX generally maintains higher overall trading volume and liquidity, particularly for major cryptocurrencies like Bitcoin and Ethereum. This results in tighter spreads for popular trading pairs.

MEXC offers better liquidity for smaller altcoins and newly listed tokens. Their focus on listing emerging cryptocurrencies creates unique trading opportunities not available on larger exchanges.

Trading volumes fluctuate on both platforms, but OKX consistently ranks among the top global exchanges by volume. MEXC shows stronger volume in altcoin markets specifically.

What are the user experiences regarding withdrawal process on OKX and MEXC?

OKX withdrawal processes are streamlined with clear fee structures and processing times. Most withdrawals complete within 1-2 hours, with some taking up to 24 hours during high network congestion.

MEXC withdrawals have received mixed reviews, with some users reporting occasional delays. However, the platform offers competitive withdrawal fees compared to other exchanges.

Both platforms implement security measures during withdrawals including email confirmations and two-factor authentication. Withdrawal limits vary based on verification level on both exchanges.

MEXC vs OKX Conclusion: Why Not Use Both?

Both MEXC and OKX offer unique advantages that appeal to different types of crypto traders. OKX stands out with better documentation and multilingual support, making it more accessible for global users.

MEXC is known for its fast listing speed and low fees, which can be attractive if you’re looking to trade newer tokens before they hit larger exchanges.

However, MEXC has faced criticism regarding withdrawal issues and customer support quality. This is something to consider if reliable access to your funds is a top priority.

OKX offers stronger security features, which might give you more peace of mind when storing larger amounts of cryptocurrency on the platform.

For futures trading, both platforms have solid offerings. MEXC specializes in perpetual futures with no expiry dates, while OKX provides a more comprehensive trading environment overall.

Why limit yourself to just one platform? Many traders maintain accounts on both exchanges to:

- Take advantage of different fee structures

- Access a wider range of tokens

- Reduce custody risk by spreading assets

- Use each platform for its specific strengths

The ideal approach may be using MEXC for quick access to new tokens and low-fee trading, while relying on OKX for longer-term holdings where security and support matter more.

Remember to always enable two-factor authentication and follow security best practices regardless of which platform you choose.