Choosing between OKX and KuCoin can be tough when both are popular crypto exchanges in 2025. These platforms have different strengths that might suit your trading needs. OKX currently ranks #9 for spot trading and #3 for futures, while KuCoin holds the #5 and #4 positions in these categories.

OKX offers lower fees than KuCoin, with 0.08% maker fees for spot trading compared to KuCoin’s 0.1%, and 0.05% taker fees for futures versus KuCoin’s 0.06%. This fee difference might save you money if you trade often or with large amounts. However, fees aren’t everything when picking an exchange.

When comparing the overall experience, KuCoin scores slightly higher with a 7.9 overall score compared to OKX’s score. Your choice between these exchanges will depend on what matters most to you – whether that’s lower fees, better customer support, or specific trading features. We’ll explore all these aspects to help you decide which platform is best for your crypto trading in 2025.

OKX vs KuCoin: At A Glance Comparison

When choosing between OKX and KuCoin, understanding their key differences helps you make an informed decision for your crypto trading needs.

OKX currently ranks as the #9 exchange for spot trading while KuCoin holds the #5 position globally. For derivatives trading, OKX places higher at #3 with KuCoin following at #4.

KuCoin has achieved a higher overall score of 7.9 in comparison ratings, while OKX (formerly known as OKEx) received a slightly lower score in head-to-head comparisons.

| Feature | OKX | KuCoin |

|---|---|---|

| Global Rank (Spot) | #9 | #5 |

| Global Rank (Derivatives) | #3 | #4 |

| Overall Rating | Lower | 7.9 (Higher) |

| User Interface | Modern, comprehensive | User-friendly |

| Coin Selection | Wide range | Extensive altcoin options |

Both exchanges offer competitive fee structures, though they differ in specific trading costs. You should compare their current fee schedules based on your expected trading volume.

The exchanges also vary in their available features, security measures, and regional availability. While both serve international customers, certain functions might be restricted in some countries.

Trading tools on both platforms cater to beginners and advanced traders alike, but with different learning curves and specialized features.

OKX vs KuCoin: Trading Markets, Products & Leverage Offered

Both OKX and KuCoin offer a wide range of trading options for cryptocurrency investors. The platforms provide access to numerous cryptocurrencies and trading pairs, making them popular choices for traders.

Available Trading Products:

- Spot trading

- Futures trading

- Margin trading

- Options (OKX)

- Staking

- Lending services

When it comes to leverage trading, both exchanges allow you to amplify your position size. KuCoin offers up to 100x leverage for futures trading, giving traders significant flexibility for high-risk, high-reward strategies.

OKX provides similar leverage capabilities with up to 10x leverage on certain trading pairs. This makes both platforms suitable for traders looking to maximize their potential returns.

Trading fees are competitive on both platforms. KuCoin charges around 0.1% for spot trading, which is fairly standard in the industry. OKX offers comparable fee structures.

Market Access Comparison:

| Feature | KuCoin | OKX |

|---|---|---|

| Cryptocurrencies | 700+ | 350+ |

| Trading pairs | Extensive | Extensive |

| Max leverage | 100x | 10x |

| Derivatives | Yes | Yes |

For new traders, both platforms might seem overwhelming at first due to their extensive features. However, they both provide educational resources to help you navigate their trading products.

The choice between KuCoin and OKX often comes down to which specific cryptocurrencies you want to trade and your preferred leverage options.

OKX vs KuCoin: Supported Cryptocurrencies

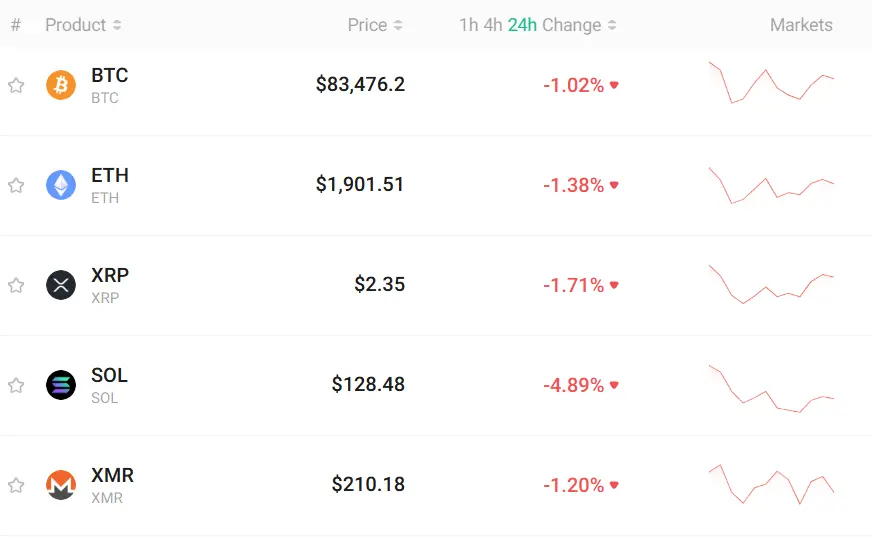

Both OKX and KuCoin offer a wide range of cryptocurrencies for trading. As of March 2025, these exchanges support hundreds of digital assets to meet diverse trader needs.

KuCoin has earned the nickname “People’s Exchange” partly due to its extensive selection of altcoins. It frequently lists new and emerging tokens before they appear on larger exchanges. This makes KuCoin attractive if you’re looking to invest in newer projects.

OKX also provides a robust selection of cryptocurrencies, though it tends to be slightly more selective with listings. Both exchanges support major cryptocurrencies like Bitcoin, Ethereum, and Solana, along with numerous altcoins.

Comparison of Supported Assets:

| Feature | KuCoin | OKX |

|---|---|---|

| Number of coins | 700+ | 600+ |

| New token listings | Very frequent | Regular |

| Trading pairs | 1200+ | 1000+ |

| Staking options | Extensive | Comprehensive |

KuCoin typically offers higher leverage opportunities compared to OKX. This can be beneficial if you’re interested in margin trading with a variety of cryptocurrencies.

Both platforms allow you to purchase crypto with fiat currencies, though available options may vary based on your location. You can also participate in token sales and earning programs on both exchanges.

When choosing between these exchanges, consider which specific cryptocurrencies you plan to trade, as availability can change over time.

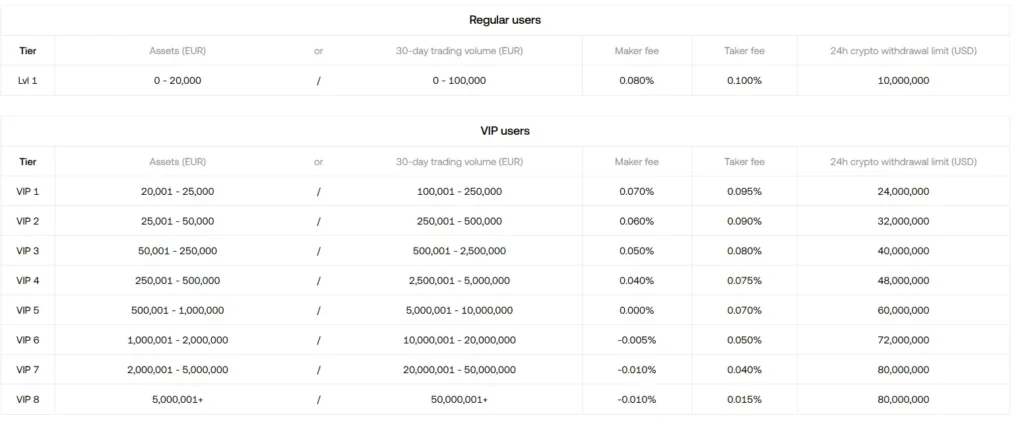

OKX vs KuCoin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing OKX and KuCoin, fees are a major factor to consider for your trading decisions. Both exchanges offer some of the lowest trading fees in the crypto industry in 2025.

Trading Fees

| Exchange | Maker Fee | Taker Fee | Fee Discounts |

|---|---|---|---|

| KuCoin | 0.1% | 0.1% | KCS holders |

| OKX | 0.08% | 0.1% | OKB holders |

OKX has a slight edge with maker fees at 0.08% compared to KuCoin’s 0.1%. Both platforms offer lower fees if you hold their native tokens (KCS or OKB).

Withdrawal Fees

KuCoin charges 0.0002 BTC ($16.78) for Bitcoin withdrawals and 0.0027 ETH ($5.22) for Ethereum withdrawals as of March 17, 2025.

OKX withdrawal fees are comparable but vary by network. They tend to adjust fees based on blockchain congestion.

Deposit Fees

Good news! Both exchanges offer free deposits for most cryptocurrencies, making it easy to fund your account without extra costs.

Both platforms also provide fee discounts for high-volume traders. The more you trade, the less you pay in fees.

You should check each exchange’s current fee schedule before trading as they may change their rates based on market conditions or promotional offers.

OKX vs KuCoin: Order Types

Both OKX and KuCoin offer various order types to meet different trading needs. Understanding these options can help you make better trading decisions.

Market Orders are available on both platforms. These execute immediately at the current market price, giving you quick trades when speed matters more than exact price.

Limit Orders let you set a specific price at which you want to buy or sell. Both exchanges support this popular order type, giving you more control over your entry and exit points.

KuCoin and OKX both offer Stop Orders to help manage risk. These trigger when the market reaches a certain price, helping protect your investments from unexpected moves.

Advanced Order Types:

- OCO (One Cancels Other) – Available on both platforms

- Trailing Stop Orders – Both exchanges support these

- Post-Only Orders – Helpful for market makers on both platforms

OKX has a slight edge with more specialized order types for futures trading, including Trigger Orders and Advanced Trailing Stops with customizable parameters.

KuCoin offers unique Grid Trading tools that automatically buy low and sell high within a price range you specify.

Both exchanges support Time-Weighted Average Price (TWAP) and Iceberg Orders for larger traders who need to minimize market impact when placing big orders.

OKX vs KuCoin: KYC Requirements & KYC Limits

KuCoin now requires KYC (Know Your Customer) verification for all trading levels as of February 1, 2025. This is a notable change, as until around July 2023, KuCoin didn’t require customers to provide identifying information.

When you complete KYC verification on KuCoin, you gain access to higher daily withdrawal limits and additional features. Without verification, your trading capabilities will be restricted.

OKX also implements KYC requirements, but with some differences. The exchange employs offline security measures and has physical location restrictions for funds stored on the platform.

KYC Comparison Table:

| Feature | KuCoin | OKX |

|---|---|---|

| KYC Required | Yes, for all trading levels | Yes |

| Implementation Date | February 2025 (full requirement) | Already established |

| Previous Policy | Optional until 2023 | Established requirements |

| Location Restrictions | Singapore-based | Has physical location restrictions |

For traders in the US, it’s important to note that KuCoin’s new KYC policies affect your ability to place trade orders and sell assets. Without completing verification, you won’t be able to execute trades.

Both exchanges offer increased daily withdrawal limits with completed KYC verification. This is a standard practice to comply with global financial regulations.

When choosing between these exchanges, consider your comfort with providing personal information and your location, as these factors impact your trading experience.

OKX vs KuCoin: Deposits & Withdrawal Options

Both OKX and KuCoin offer several options for depositing and withdrawing your funds. These options can impact how quickly you can move your money and what fees you’ll pay.

OKX Deposit Options:

- Cryptocurrency transfers

- Bank transfers/Wire transfers

- Credit/Debit cards

- Third-party payment processors

KuCoin Deposit Options:

- Cryptocurrency transfers

- Credit/Debit cards

- Third-party payment processors

OKX has a slight edge with the addition of wire transfers, giving you more flexibility when moving fiat currency to the platform.

Withdrawal Methods Comparison:

| Method | OKX | KuCoin |

|---|---|---|

| Crypto | Yes | Yes |

| Bank Transfer | Yes | No |

| Third-party | Yes | Yes |

Both exchanges support multiple cryptocurrencies for deposits and withdrawals. You can move Bitcoin, Ethereum, and many altcoins between your wallets and these platforms.

Withdrawal fees vary depending on the cryptocurrency network. These fees can change frequently based on network conditions.

Processing times also differ between the platforms. Crypto withdrawals typically process within minutes to hours on both exchanges, though KuCoin sometimes experiences delays during high traffic periods.

For fiat withdrawals, OKX offers more direct options. This makes it potentially more convenient if you need to convert your crypto back to traditional currency.

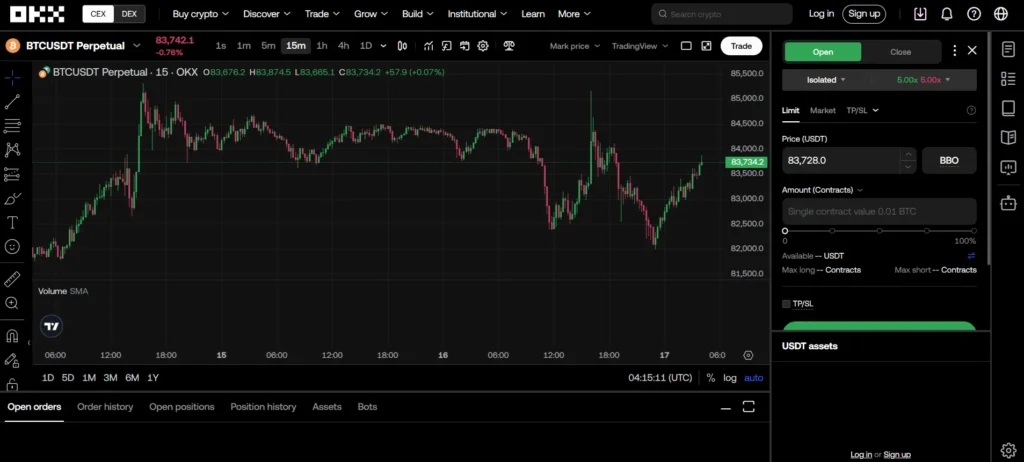

OKX vs KuCoin: Trading & Platform Experience Comparison

When choosing between OKX and KuCoin, the trading interface and overall platform experience are key factors to consider.

User Interface

OKX offers a sleek, modern interface that beginners find approachable. KuCoin’s interface is feature-rich but may feel more complex to newcomers.

Trading Tools

Both exchanges provide essential trading tools, but they differ in execution:

| Feature | OKX | KuCoin |

|---|---|---|

| Charts | Advanced TradingView integration | Basic charting with customization |

| Order types | Market, limit, stop-loss, OCO | Market, limit, stop-limit, OCO |

| Mobile app | Highly rated, comprehensive | Functional but occasionally buggy |

Trading Fees

KuCoin typically offers slightly lower spot trading fees, starting at 0.1% for makers and takers. OKX fees begin at 0.1% for makers and 0.15% for takers, based on recent data.

Trading Pairs

KuCoin excels with its wide selection of altcoins and trading pairs. OKX offers fewer pairs but focuses on more established cryptocurrencies.

Platform Stability

OKX generally provides more consistent uptime during high-volume trading periods. KuCoin has improved reliability but still experiences occasional outages during market volatility.

Extra Features

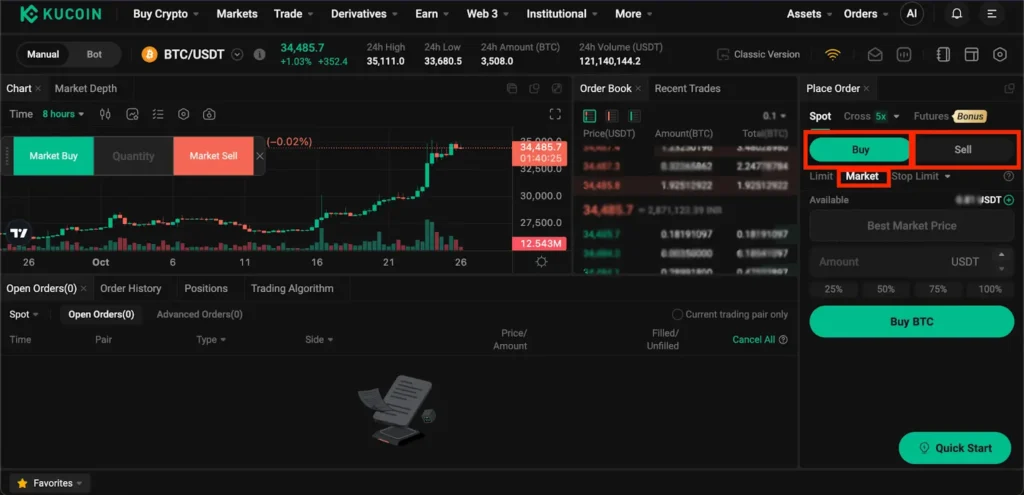

OKX stands out with its demo trading account, allowing you to practice without risk. KuCoin offers Trading Bot features that help automate your trading strategies.

Both platforms support desktop and mobile trading, giving you flexibility in how you access your account.

OKX vs KuCoin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial for managing your risk. Both OKX and KuCoin have their own approaches to liquidations.

OKX uses a tiered liquidation system that gradually reduces your position size as you approach the liquidation price. This helps you avoid complete position liquidation in many cases. The exchange implements partial liquidations when your margin ratio falls below maintenance requirements.

KuCoin takes a slightly different approach with its insurance fund to manage liquidations. When your position reaches the liquidation price, KuCoin will take over your position and attempt to close it at market price.

Both platforms send warnings as your positions approach liquidation levels. OKX provides multiple alerts at different margin ratios, while KuCoin typically sends notifications when you reach about 80% of your margin level.

Liquidation Fees Comparison:

| Feature | OKX | KuCoin |

|---|---|---|

| Liquidation Fee | 0.2% – 0.5% | 0.1% – 0.3% |

| Insurance Fund | Yes | Yes |

| Partial Liquidation | Yes | Limited |

| Liquidation Warnings | Multiple stages | Single warning |

You can reduce your liquidation risk on both platforms by adding more collateral, reducing position size, or setting stop-loss orders before liquidation prices are reached.

The primary difference is OKX’s more gradual liquidation process versus KuCoin’s generally simpler but sometimes more abrupt liquidation mechanism.

OKX vs KuCoin: Insurance

When choosing a crypto exchange, security should be a top priority. Both OKX and KuCoin offer insurance funds to protect users against financial losses in certain situations.

OKX maintains a significant insurance fund to protect users from unexpected losses during trading. This fund is designed primarily to prevent auto-deleveraging in futures trading and covers potential losses when liquidations occur at unfavorable prices.

KuCoin also offers protection through its insurance fund, which serves a similar purpose for derivatives traders. Additionally, KuCoin has implemented the “Safeguard Program” following a security incident in 2020 when they experienced a hack.

Insurance Fund Comparison:

| Feature | OKX | KuCoin |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Primary Purpose | Prevent auto-deleveraging | Protect derivatives traders |

| Additional Protection | Regular security audits | Safeguard Program after 2020 hack |

Neither exchange offers complete insurance for all user funds or scenarios. The insurance primarily focuses on specific trading situations rather than comprehensive coverage for all assets.

You should note that these insurance funds don’t function like traditional insurance policies. They’re designed to maintain market stability and protect traders from specific risks rather than offering complete coverage against all potential losses.

For maximum protection, consider using hardware wallets for long-term storage and only keep trading funds on these exchanges.

OKX vs KuCoin: Customer Support

Both OKX and KuCoin offer responsive customer support options to help you with any issues you might encounter. While they share similarities, there are some key differences worth noting.

KuCoin provides 24/7 support through multiple channels including live chat, email, and an active presence on social media platforms. Their team is known for quick response times, especially through live chat.

OKX also offers 24/7 support with similar channels, but puts extra emphasis on their comprehensive FAQ section. This self-service option can help you find answers to common questions without needing to contact a representative.

Both exchanges offer support in multiple languages, which is helpful if English isn’t your first language.

Support Options Comparison:

| Feature | OKX | KuCoin |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| FAQ Section | Comprehensive | Basic |

| Social Media Support | ✓ | ✓ |

| Response Time | Quick | Quick |

If you prefer detailed self-help resources, OKX might be the better option. However, if you value direct communication with support staff, both exchanges perform similarly well.

Remember that during high-volume trading periods or market volatility, response times for both exchanges may be longer than usual.

OKX vs KuCoin: Security Features

When choosing between OKX and KuCoin, security should be your top priority. Both exchanges have implemented strong security measures to protect user funds and data.

OKX offers multi-factor authentication (MFA), anti-phishing codes, and regular security audits. Their cold storage solution keeps approximately 95% of user assets offline, protecting them from potential online threats.

KuCoin matches these features with their own MFA system and advanced encryption protocols. They also employ a similar cold storage approach, keeping the majority of user funds in offline wallets.

Both platforms provide insurance funds to protect users against unexpected losses. OKX maintains a significant insurance fund that has grown over time, while KuCoin offers their Safeguard Program for added protection.

Key Security Features Comparison:

| Feature | OKX | KuCoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ (95%) | ✓ (Majority) |

| Insurance Fund | ✓ (Large fund) | ✓ (Safeguard Program) |

| Anti-phishing Protection | ✓ | ✓ |

| Regular Security Audits | ✓ | ✓ |

KuCoin had a security breach in 2020 but successfully recovered all user funds. This led to significant security upgrades on their platform.

Remember to enable all available security features on whichever exchange you choose. Use strong passwords, activate two-factor authentication, and consider hardware wallets for additional protection of your digital assets.

Is OKX Safe & Legal To Use?

OKX is considered a safe platform to buy and sell cryptocurrencies in 2025. According to search results, OKX implements robust security protocols, including keeping 95% of its funds in cold storage and using multi-person access control for enhanced protection.

The exchange has built a reputation as one of the most secure and reputable options in the industry. This makes it suitable for both beginners and experienced traders looking for a reliable platform.

Regarding legality, the situation is more complex. Unlike KuCoin, which has faced legal issues in the US for allegedly violating anti-money laundering laws, the search results don’t specifically mention similar problems for OKX.

However, you should be aware that cryptocurrency regulations vary by country. Before using OKX, it’s important to check if the exchange is permitted to operate in your jurisdiction.

Some exchanges restrict access to users from certain countries or require additional verification steps to comply with local laws. Always verify the current legal status of any exchange in your location before depositing funds.

When using OKX or any exchange, following these safety practices is recommended:

- Enable two-factor authentication

- Use unique, strong passwords

- Withdraw large amounts to personal wallets

- Keep most of your crypto in cold storage

- Stay updated on security alerts from the exchange

Is KuCoin Safe & Legal To Use?

KuCoin’s safety and legality present significant concerns for users in the United States. On March 26, 2024, KuCoin and two of its founders were criminally charged with violating the Bank Secrecy Act and operating an unlicensed money transmission business.

Unlike OKX, KuCoin lacks proper regulation and licensing, which creates potential risks for your funds and personal information. This regulatory gap is a major distinction between the two exchanges.

While some users consider KuCoin less problematic than other exchanges in what some call the “cartel” (including Binance, HTX, and Poloniex), this doesn’t mean it’s entirely trustworthy. The criminal charges suggest serious compliance issues.

For US-based users, using KuCoin may expose you to legal risks. The exchange has been accused of flouting US anti-money laundering laws while growing into one of the world’s largest cryptocurrency platforms.

If you’re considering KuCoin, be aware of these important facts:

- Currently faces criminal charges in the US

- Lacks proper regulatory licenses

- Has been accused of violating anti-money laundering laws

- May present legal risks for US users

Your decision to use KuCoin should carefully weigh these safety and legal concerns against any potential benefits the platform offers.

Frequently Asked Questions

Many crypto traders have specific questions when choosing between OKX and KuCoin. These exchanges differ in important ways that affect trading costs, security features, available cryptocurrencies, and overall user experience.

What are the key differences in trading fees between OKX and KuCoin?

OKX and KuCoin structure their fees differently. OKX typically charges maker fees ranging from 0.08% to 0.10% and taker fees from 0.10% to 0.15%, depending on your trading volume and VIP level.

KuCoin offers maker fees starting at 0.1% and taker fees at 0.1%, with discounts available when using their native KCS token. Both exchanges provide fee reductions for high-volume traders, though their tier structures vary.

Fee comparisons should include withdrawal costs, which differ by cryptocurrency on both platforms.

How do OKX and KuCoin differ in terms of security measures?

Both exchanges implement strong security practices, but with different approaches. OKX uses multi-signature wallets and stores most user funds in cold storage, maintaining a significant security reserve fund.

KuCoin offers two-factor authentication, advanced encryption, and also keeps most assets in cold storage. After experiencing a hack in 2020, KuCoin strengthened its security protocols and fully reimbursed affected users.

Both platforms require KYC verification for higher withdrawal limits, though the specific requirements and limits differ.

What are the advantages of using OKX over KuCoin for cryptocurrency trading?

OKX stands out with its deeper liquidity pools and more advanced trading features. It ranks higher in global volume (#3 for derivatives trading compared to KuCoin’s #4 position).

OKX offers a more comprehensive suite of trading products, including a wider range of futures and options contracts. Their platform includes advanced charting tools and a more robust API for algorithmic traders.

OKX’s educational resources are generally more extensive, making it valuable for traders looking to develop advanced skills.

Which exchange offers a wider range of altcoins, OKX or KuCoin?

KuCoin has earned the nickname “King of Altcoins” by listing over 700 cryptocurrencies and more than 1,200 trading pairs. This makes it particularly attractive for traders seeking exposure to newer, emerging projects.

OKX offers fewer cryptocurrencies overall, focusing more on established tokens with higher market caps. However, OKX still provides a substantial selection of over 350 cryptocurrencies.

If you’re looking for obscure, low-cap altcoins or newly launched tokens, KuCoin typically lists these assets sooner than OKX.

How do the user interfaces of OKX and KuCoin compare for novice traders?

KuCoin offers a more beginner-friendly interface with a cleaner layout and simpler navigation. Its basic trading view presents essential information without overwhelming new users.

OKX’s interface tends to be more feature-rich but potentially overwhelming for beginners. It displays more technical indicators and trading options upfront.

Both platforms offer mobile apps, but KuCoin’s app is generally considered more intuitive for newcomers while OKX’s app provides more advanced features.

What customer support options are available on OKX and KuCoin?

Both exchanges provide 24/7 customer support through multiple channels. OKX offers live chat, email support, and an extensive FAQ section that covers most common issues.

KuCoin provides similar support options with live chat and email assistance. They’re known for responsive ticket systems but sometimes experience delays during high-volume periods.

According to search results, OKX focuses more on comprehensive FAQ documentation, while KuCoin’s direct support team is noted for being responsive and quick when addressing user issues.

OKX vs KuCoin Conclusion: Why Not Use Both?

Both OKX and KuCoin offer excellent trading experiences for crypto enthusiasts. They feature competitive trading fees that rank among the lowest in the industry, making either platform a cost-effective choice.

KuCoin stands out with its margin trading options and intuitive chart interface that lets you check prices with a simple screen touch. It also provides access to a wide selection of cryptocurrencies.

OKX, meanwhile, boasts a zero-breach security record—a significant advantage for institutional investors and those particularly concerned with safety.

Benefits of using both platforms:

- Wider coin selection: Access to more trading pairs and unique assets

- Risk distribution: Spreading your assets across multiple exchanges enhances security

- Feature flexibility: Use each platform for its strongest features

You don’t need to limit yourself to just one exchange. Many traders maintain accounts on both platforms to take advantage of:

- Different trading promotions

- Varying liquidity during market volatility

- Backup access if one platform experiences downtime

The slight learning curve of managing multiple accounts is outweighed by the increased trading options and security benefits. Consider your specific needs—perhaps KuCoin for altcoin variety and OKX for superior security measures.