Choosing the right cryptocurrency exchange can make a big difference in your trading experience. OKX and Deepcoin are two popular options that many traders consider in 2025. If you’re trying to decide between them, comparing their features, fees, and services is essential.

OKX scores higher overall with a 7.3 rating compared to Deepcoin, suggesting it might be the better choice for most users. However, each platform has its own strengths that might align better with your specific trading needs.

Both exchanges offer various trading options and support multiple cryptocurrencies, but they differ in important ways. Their fee structures, user interfaces, and available features can impact your trading strategy and results. Understanding these differences will help you make an informed decision about which platform better suits your investment goals.

Okx Vs Deepcoin: At A Glance Comparison

When comparing OKX and Deepcoin, you’ll find notable differences in their overall performance and features. Based on recent data from 2025, OKX scores higher with a 7.3 overall rating compared to Deepcoin.

Both exchanges offer cryptocurrency trading services but differ in several key aspects. Here’s a quick comparison table to help you decide which platform might suit your needs better:

| Feature | OKX | Deepcoin |

|---|---|---|

| Overall Trust Score | 7.3 | Lower than OKX |

| Trading Volume | Higher | Lower |

| Available Cryptocurrencies | Wide selection | Good variety |

| Trading Features | Comprehensive | Interesting assortment |

| User Interface | Well-established | Newer platform |

OKX stands out with its higher trading volumes and established reputation in the market. The platform offers a robust set of features that cater to both beginners and experienced traders.

Deepcoin, while scoring lower overall, provides an interesting range of features that might appeal to specific user needs. The exchange continues to develop its offerings in the competitive crypto market.

Your choice between these platforms should depend on what matters most to you: higher trust scores and trading volume with OKX, or perhaps specific features offered by Deepcoin that align with your trading strategy.

OKX Vs Deepcoin: Trading Markets, Products & Leverage Offered

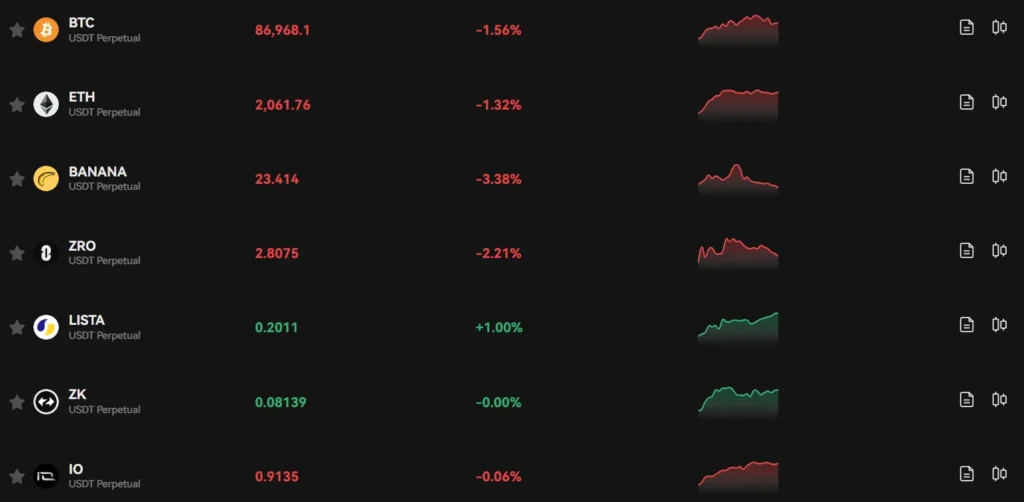

OKX and Deepcoin both offer cryptocurrency derivatives trading, but with different features and options. Let’s explore what each platform provides.

OKX has a wider range of trading markets. You can access spot trading, futures, options, and swap contracts. Their platform supports over 350 cryptocurrencies with hundreds of trading pairs.

Deepcoin offers fewer cryptocurrencies but still provides a solid selection of trading pairs. They focus more on derivatives trading with futures and perpetual swaps.

For leverage options, OKX allows up to 125x leverage on futures trading. This means you can control $125 worth of assets with just $1. However, higher leverage comes with greater risk.

Deepcoin also offers high leverage trading, though specific limits may vary by market. Both platforms provide adjustable leverage settings so you can manage your risk level.

| Feature | OKX | Deepcoin |

|---|---|---|

| Cryptocurrencies | 350+ | More limited selection |

| Trading types | Spot, futures, options, swaps | Mainly futures and perpetual swaps |

| Max leverage | Up to 125x | High leverage available |

| Trading tools | Advanced charting, bots, copy trading | Basic to intermediate tools |

Both exchanges offer mobile apps, making it easy to trade on the go. OKX has more advanced trading tools and analysis features compared to Deepcoin.

For beginners, OKX might be overwhelming with its many features. Deepcoin offers a somewhat simpler interface but still provides essential trading functions.

OKX Vs Deepcoin: Supported Cryptocurrencies

Both OKX and Deepcoin offer a variety of cryptocurrencies for trading, but there are some differences in their selections.

OKX provides access to over 350 cryptocurrencies, making it one of the more comprehensive exchanges available today. You’ll find all major coins like Bitcoin, Ethereum, and Solana, as well as numerous altcoins and newer tokens.

Deepcoin supports fewer cryptocurrencies compared to OKX, with approximately 180 coins available. While this covers all the major cryptocurrencies, you might find the selection of altcoins somewhat limited.

Here’s a quick comparison of their offerings:

| Feature | OKX | Deepcoin |

|---|---|---|

| Total cryptocurrencies | 350+ | ~180 |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoin variety | Excellent | Good |

| Token listings | Regular new additions | Fewer new listings |

Both exchanges support direct purchasing of major cryptocurrencies. OKX tends to add new tokens more frequently, which might be important if you’re interested in emerging projects.

If you’re mainly focused on trading popular cryptocurrencies, either platform will meet your needs. However, if you want access to a wider range of altcoins or newer tokens, OKX offers more options.

The quality of coins listed on both platforms is generally high, with proper vetting processes in place to protect users from scam tokens.

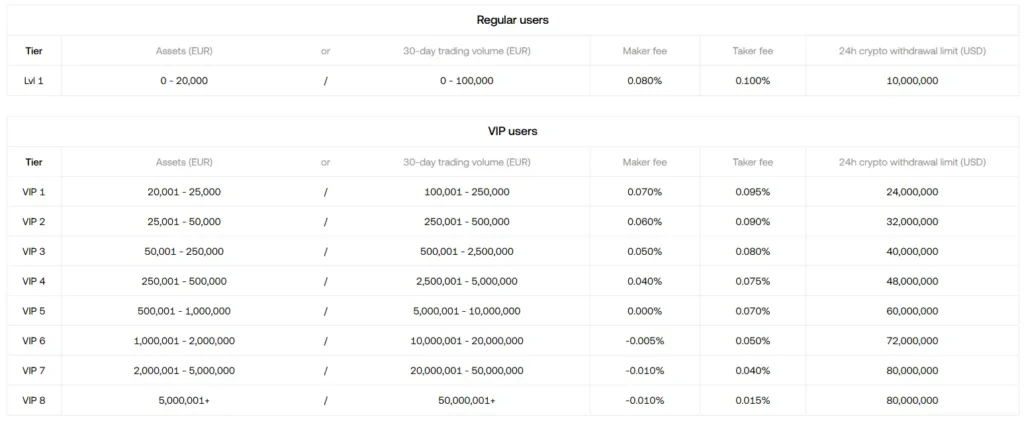

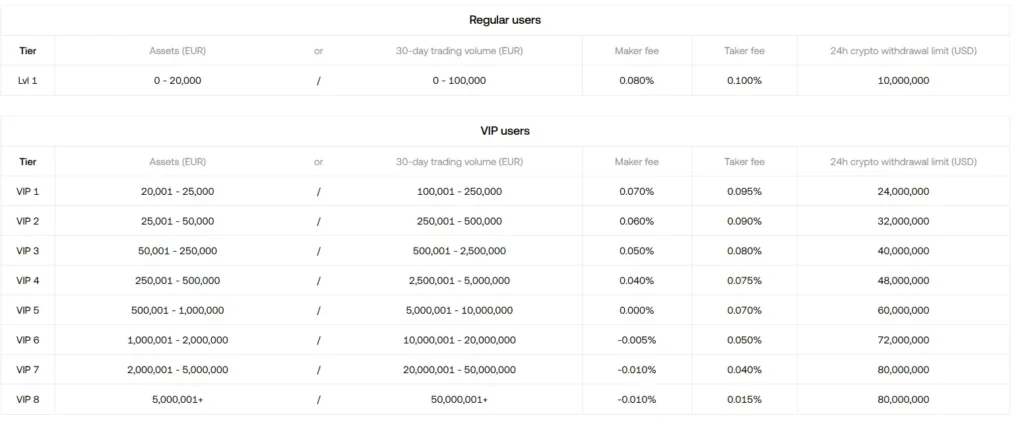

OKX Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and Deepcoin, understanding their fee structures is crucial for your trading strategy.

Trading Fees

- OKX: Charges vary based on your trading volume, but standard fees are competitive in the market

- Deepcoin: Offers a fixed fee of 0.1% for both makers and takers

Deepcoin maintains the same fee regardless of your trading volume, which can be simpler to understand. OKX, however, may offer lower rates as your trading volume increases.

Deposit Fees

- OKX: Free deposits to your account

- Deepcoin: Generally free deposits, similar to most exchanges

Both platforms allow you to add funds without extra charges, making it easy to start trading.

Withdrawal Fees

- OKX: Dynamic fees based on network congestion

- Deepcoin: Varies by cryptocurrency with minimum order amounts

When withdrawing from OKX, you’ll notice the fee changes depending on how busy the network is. This can sometimes mean higher costs during peak times.

Deepcoin has established specific minimum withdrawal amounts that you need to be aware of before trading on their platform.

For active traders, these fee differences can significantly impact your profits over time. Consider your trading frequency and volume when deciding which exchange might be more cost-effective for your needs.

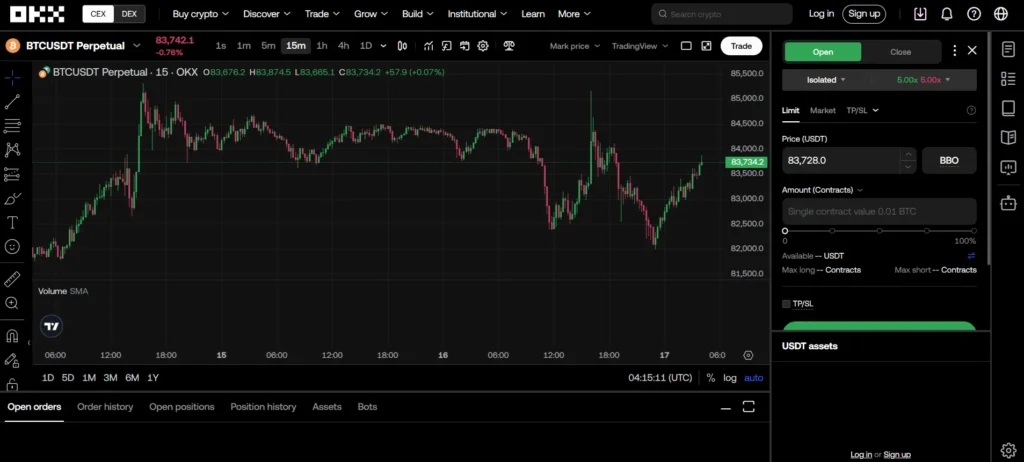

OKX Vs Deepcoin: Order Types

When trading on cryptocurrency exchanges, order types play a key role in your strategy. Let’s compare what OKX and Deepcoin offer in this area.

OKX provides a comprehensive range of order types to suit different trading needs. Their platform includes basic limit orders that let you buy or sell at specific prices or better.

For more advanced trading, OKX supports various specialized order types. Their system is integrated with TradingView charts, making it easier for you to make informed decisions.

Deepcoin also offers order types for traders, though based on available information, their selection may not be as extensive as OKX’s.

OKX Order Types:

- Limit orders

- Market orders

- Stop orders

- Advanced conditional orders

- Trading view-powered platform

OKX seems to cater well to both beginners and professional traders with their order type options. Their 7.3 overall score (compared to Deepcoin’s lower score) suggests stronger performance in this area.

When choosing between these exchanges, consider how important varied order types are to your trading strategy. If you need advanced order capabilities for complex trades, OKX appears to have the edge.

The right order types can help you manage risk and maximize opportunities in the volatile crypto market. Take time to understand the different options each platform offers before deciding where to trade.

OKX Vs Deepcoin: KYC Requirements & KYC Limits

OKX requires identity verification to meet Know Your Customer (KYC) requirements. Completing this verification process directly impacts your deposit and withdrawal limits on the platform.

As of March 2025, users report that OKX has strengthened its KYC policies. You now need to complete verification to withdraw funds, even when using a VPN.

In contrast, Deepcoin offers a different approach to KYC. It stands out as a centralized exchange that doesn’t mandate KYC verification checks.

This no-KYC policy at Deepcoin makes it attractive to users who value privacy or want to start trading quickly without identity verification steps.

KYC Requirements Comparison:

| Exchange | Mandatory KYC | Withdrawal Without KYC |

|---|---|---|

| OKX | Yes | No |

| Deepcoin | No | Yes |

The lack of mandatory verification at Deepcoin places it among the best no-KYC crypto exchanges in 2025, according to recent reviews.

Remember that KYC policies can affect your trading experience in several ways. With OKX, you’ll need to share personal information, but this may provide additional security and features.

With Deepcoin, you can maintain more privacy but might face different limitations or considerations regarding regulatory compliance.

Okx Vs Deepcoin: Deposits & Withdrawal Options

When choosing between OKX and Deepcoin, understanding their deposit and withdrawal options is crucial for a smooth trading experience.

OKX supports a wide range of deposit methods including bank transfers, credit/debit cards, and various payment processors. They also allow deposits in multiple fiat currencies, making it accessible for global users.

Deepcoin similarly offers broad support for global fiat currency deposits. This feature enables users to directly purchase major cryptocurrencies without complicated conversion steps.

Withdrawal options comparison:

| Feature | OKX | Deepcoin |

|---|---|---|

| Crypto withdrawals | Extensive selection | Major cryptocurrencies |

| Fiat withdrawals | Multiple currencies | Limited options |

| Processing time | 1-24 hours (varies) | 1-48 hours (varies) |

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication to protect your funds.

OKX has a slightly higher overall score (7.3) compared to Deepcoin based on comprehensive evaluations of their services, including their withdrawal systems.

Withdrawal fees vary between the platforms. You’ll find that both charge network fees, but the exact amounts differ by cryptocurrency. It’s worth checking their current fee structures before making large transactions.

Remember to verify your account fully on either platform to access higher withdrawal limits and reduce restrictions on your account.

Okx Vs Deepcoin: Trading & Platform Experience Comparison

When comparing OKX and Deepcoin, the trading experience differs in several key areas. OKX has earned a higher overall trust score of 7.3 compared to Deepcoin, according to recent evaluations.

User Interface

- OKX offers a polished interface with intuitive navigation

- Deepcoin provides a straightforward design focused on trading efficiency

- Both platforms support mobile trading through dedicated apps

Trading Features

| Feature | OKX | Deepcoin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Margin Trading | Advanced | Basic |

OKX tends to offer more advanced trading tools that appeal to experienced traders. You’ll find detailed charting options and technical analysis features that can help with complex trading strategies.

Deepcoin focuses on providing a gateway to cryptocurrency trading with a simpler approach. You might find it easier to navigate if you’re newer to crypto trading.

Trading fees vary between the platforms, with competitive structures on both sides. OKX typically offers volume-based discounts that benefit active traders.

The platform experience also differs in terms of available cryptocurrencies. OKX generally supports a wider range of coins and trading pairs compared to Deepcoin.

Response time and execution speed are important factors to consider. OKX has invested heavily in their infrastructure, which often results in faster order execution during high-volume trading periods.

Okx Vs Deepcoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for managing your risk. OKX and Deepcoin handle this process differently, which could impact your trading experience.

OKX has developed a specialized system to improve the efficiency of liquidated futures and swaps positions. Their methodology aims to minimize market impact while maintaining liquidity during the liquidation process.

The OKX liquidation system works systematically to protect both the trader and the platform from excessive losses. When your position approaches the liquidation price, OKX’s system will begin the liquidation process.

Deepcoin, while offering competitive features, has a different approach to liquidations. Based on comparison data, OKX scores higher overall with a 7.3 rating compared to Deepcoin.

Unlike some platforms that use “smart liquidation” to reduce user losses, some exchanges employ more direct liquidation methods. While the search results don’t specifically detail Deepcoin’s exact mechanism, it’s important to understand these differences.

Key differences to consider:

- Efficiency: OKX focuses on transaction efficiency for liquidated positions

- Market Impact: OKX aims to minimize effects on market liquidity

- User Protection: Different exchanges offer varying levels of protection during liquidation

To protect yourself from liquidation on either platform:

- Maintain adequate margin levels

- Set stop-loss orders proactively

- Monitor market volatility closely

- Avoid excessive leverage

OKX Vs Deepcoin: Insurance

When trading cryptocurrencies, security is a top concern. Both OKX and Deepcoin offer insurance protections, but they differ in key ways.

OKX maintains a dedicated Protection Fund worth over $300 million. This fund helps cover user losses in case of security breaches or hacks. They also implement cold storage for most user assets.

Deepcoin’s insurance approach focuses on their Investor Protection Fund. While smaller than OKX’s fund, it still offers basic coverage against potential security incidents.

Here’s a quick comparison of their insurance features:

| Feature | OKX | Deepcoin |

|---|---|---|

| Protection Fund | $300+ million | Smaller fund |

| Cold Storage | Majority of assets | Available |

| Insurance Coverage | Security breaches, hacks | Basic protection |

| SAFU-style Fund | Yes | Limited |

OKX generally provides more robust insurance options for traders. Their larger protection fund gives you more security when trading high volumes.

Deepcoin has been working to improve their insurance offerings as they expand globally. In 2025, they’ve enhanced their security measures, but their insurance fund still hasn’t reached the level of larger exchanges like OKX.

You should consider these insurance differences when choosing between these exchanges, especially if you plan to hold significant amounts of cryptocurrency on either platform.

OKX Vs Deepcoin: Customer Support

When choosing a crypto exchange, good customer support is key. Both OKX and Deepcoin offer help when you need it, but there are some differences worth noting.

Deepcoin provides live chat support that connects you with real agents right away. This instant access can be helpful when you have urgent questions about your account or trades.

OKX also offers live chat support, but they go further with additional options. You can reach them through email tickets and an extensive help center with guides and FAQs.

Both exchanges provide 24/7 support, understanding that crypto markets never sleep. This means you can get help any time, regardless of your time zone.

Response times can vary between the two platforms. Deepcoin typically offers quick responses through their chat system. OKX might have slightly longer wait times during peak periods due to their larger user base.

For beginners, OKX’s help resources might be more valuable. Their educational content helps you learn about the platform while solving problems.

Language support is another factor to consider. OKX offers support in more languages, making it accessible to a global audience. Deepcoin has been expanding its language options but still covers fewer languages than OKX.

Both exchanges maintain active social media presence where you can find updates and sometimes get responses to questions.

OKX Vs Deepcoin: Security Features

When comparing cryptocurrency exchanges, security is a top priority. Both OKX and Deepcoin offer several security features to protect your assets.

OKX implements multi-signature wallets that require multiple approvals before transactions are processed. This adds an extra layer of protection against unauthorized access.

Deepcoin uses cold storage for most user funds, keeping them offline and away from potential hackers. This approach significantly reduces the risk of theft through online attacks.

Two-Factor Authentication (2FA)

| Exchange | 2FA Options |

|---|---|

| OKX | Google Authenticator, SMS, Email |

| Deepcoin | Google Authenticator, Email |

Both platforms offer regular security audits by third-party firms. These audits help identify vulnerabilities before they can be exploited.

OKX has established a dedicated security fund to compensate users in case of a security breach. This provides you with additional peace of mind when trading on their platform.

Deepcoin features advanced encryption protocols for all user data and transactions. Your personal information and trading activities remain protected from unauthorized access.

Anti-phishing measures are present on both exchanges. You’ll receive email confirmations for account changes and withdrawal requests to verify their legitimacy.

IP address monitoring helps detect suspicious login attempts from unfamiliar locations. Both platforms will alert you if someone tries to access your account from an unknown device.

Is Okx A Safe & Legal To Use?

OKX is generally considered a safe cryptocurrency exchange with strong security measures. Based in Seychelles since 2017, it maintains an A security rating with a security score of 81.80%.

The platform implements several key security features to protect your assets:

- Two-factor authentication (2FA) for account access

- Cold storage for over 90% of user assets

- Withdrawal address whitelisting to prevent unauthorized transfers

- Anti-phishing codes to combat scam attempts

OKX stores the majority of cryptocurrency offline in cold wallets, which significantly reduces the risk of hacking. Even their online storage implements essential security protocols to maximize protection.

However, it’s important to understand that OKX operates in an offshore jurisdiction. This means it’s less regulated than traditional financial institutions like banks.

Some users express concerns about this regulatory status. As one source notes, if issues arise, you might have limited recourse compared to dealing with regulated entities.

Regarding legality, OKX’s availability varies by country. You should verify that using the platform complies with your local laws before trading or investing.

For maximum security when using OKX, enable all available security features on your account and consider using hardware wallets for long-term storage of significant crypto holdings.

Is Deepcoin A Safe & Legal To Use?

Deepcoin ranks as one of the safest cryptocurrency exchanges currently available. It utilizes a self-developed third-generation security system to protect user assets and information.

The exchange implements industry-standard security measures including two-factor authentication (2FA) and advanced encryption protocols. These features help safeguard your account from unauthorized access.

For asset protection, Deepcoin maintains separate hot and cold wallets. Most funds are stored in cold wallets, which remain offline and less vulnerable to hacking attempts.

While Deepcoin provides its own wallet for convenience, consider using hardware wallets for long-term storage of significant crypto assets. Hardware wallets offer superior security for your investments.

Regarding legality, Deepcoin operates as a legitimate cryptocurrency exchange in most jurisdictions. However, cryptocurrency regulations vary significantly by country.

Key security features:

- Third-generation security system

- Two-factor authentication

- Advanced encryption

- Cold wallet storage

- Regular security audits

Before using Deepcoin, verify that cryptocurrency trading is legal in your country. Some nations have restrictions or outright bans on crypto trading, which could affect your ability to use the platform legally.

Always conduct your own research about legal compliance and security when choosing any cryptocurrency exchange.

Frequently Asked Questions

Traders often have specific questions when comparing OKX and Deepcoin. These exchanges differ in important ways that affect trading experience, accessibility, and costs.

What differentiates OKX from Deepcoin in terms of trading volume and liquidity?

OKX maintains higher trading volume and liquidity compared to Deepcoin. This difference means you’ll typically experience tighter spreads and less slippage when executing large trades on OKX.

Deepcoin has grown its liquidity pools but still lags behind OKX in most trading pairs. This gap is most noticeable during market volatility when trading volume spikes.

For new or less popular tokens, the liquidity difference can be significant. OKX’s larger user base contributes to its stronger market depth across most trading pairs.

How do regulations affect both OKX and Deepcoin, particularly with regards to US traders?

Neither OKX nor Deepcoin currently accepts traders from the United States due to regulatory constraints. Both exchanges operate primarily in markets outside the US regulatory framework.

OKX has obtained licenses in several jurisdictions including Malta and Dubai, providing some regulatory clarity for users in those regions. Deepcoin operates with fewer regulatory approvals, which might concern compliance-focused traders.

Regulatory status can affect features available to you based on your location. Both platforms implement KYC (Know Your Customer) procedures, though requirements vary by region.

What security measures do OKX and Deepcoin implement to protect user assets?

OKX employs multi-signature wallets, cold storage for most funds, and two-factor authentication (2FA). They also maintain an insurance fund to protect against unexpected losses.

Deepcoin offers similar basic security features including 2FA and cold wallet storage. However, OKX has a longer track record of security and has weathered more market cycles without major incidents.

Both exchanges offer API key management with granular permissions. This helps you control exactly what automated systems can do with your account.

Which platform offers a broader range of cryptocurrencies, OKX or Deepcoin?

OKX supports more cryptocurrencies than Deepcoin, with hundreds of trading pairs available. This gives you more options for diversifying your portfolio or finding specific assets.

Deepcoin focuses on popular cryptocurrencies and some selected altcoins. While their selection is growing, it remains more limited than what OKX offers.

Both exchanges regularly add new tokens, but OKX typically lists new projects faster. This can be important if you want to trade newly launched tokens.

How do the customer support services of OKX compare to those of Deepcoin?

OKX provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive help center. Their response times are generally faster than Deepcoin’s.

Deepcoin offers basic support options but may have longer wait times. Language support is also more limited on Deepcoin compared to OKX’s multilingual support team.

Both platforms maintain active community forums where you can find answers to common questions. OKX’s larger user base means more community resources are available.

What are the differences in fee structures between OKX and Deepcoin?

OKX uses a maker-taker fee model with discounts based on trading volume and OKX token holdings. Standard fees start around 0.1% for takers and 0.08% for makers.

Deepcoin generally offers competitive fees, sometimes lower than OKX for certain trading pairs. This can make it attractive for frequent traders looking to minimize costs.

Withdrawal fees vary by cryptocurrency on both platforms. OKX tends to adjust these fees more frequently based on network conditions, while Deepcoin’s withdrawal fees might remain static for longer periods.

Deepcoin Vs Okx Conclusion: Why Not Use Both?

Both Deepcoin and OKX offer valuable features for cryptocurrency traders. While OKX scores higher overall (7.3) according to comparison data, Deepcoin brings its own unique advantages to the table.

Deepcoin provides users with a wide assortment of features and doesn’t restrict trading across different markets. The platform includes two separate trading markets designed for different trader types.

OKX (formerly OKEx) implements strong security measures that protect your transactions. This is particularly important for US traders concerned about safety.

Key Differences:

- OKX has a higher overall rating

- Deepcoin offers unrestricted trading across markets

- Both platforms provide different fee structures

- Security features are robust on both exchanges

You might find that each platform serves different needs in your trading journey. OKX could be your go-to for certain transactions, while Deepcoin might offer better options for others.

Consider using both exchanges to take advantage of their unique strengths. This approach allows you to access the widest range of features, markets, and opportunities.

Your trading strategy might benefit from the flexibility of maintaining accounts on multiple platforms. This way, you’re never limited by the constraints of a single exchange.