In the fast-paced world of cryptocurrency trading, choosing the right exchange can make a significant difference in your trading experience. OKX and Bybit stand out as two popular platforms in 2025, each with unique strengths that cater to different types of traders.

For experienced traders looking for lower fees, Bybit offers an advantage with its zero-fee spot trading, while OKX provides competitive rates with discounts for VIP users. When comparing these exchanges, you’ll find that OKX tends to be more user-friendly, with a well-organized interface that separates different areas of the app clearly.

Your trading style and priorities will likely determine which platform suits you better. OKX appears to be the preferred choice for security-conscious users and beginners, while Bybit shines with more advanced trading tools and robust Web3 features. Both exchanges have continued to evolve and improve their offerings since 2023, making this comparison relevant for anyone looking to make an informed decision.

OKX vs Bybit: At A Glance Comparison

When choosing between OKX and Bybit, understanding key differences can help you make an informed decision. Here’s how these popular crypto exchanges compare:

Overall Score:

- OKX: 7.5/10

- Bybit: 8.0/10

Trading Fees:

- OKX offers lower maker fees for spot trading (0.08% vs Bybit’s 0.1%)

- Both have competitive futures trading fees

Key Strengths:

| Feature | OKX | Bybit |

|---|---|---|

| Web3 & DeFi | Stronger ecosystem | Less developed |

| Derivatives | Comprehensive | Specialized focus |

| Fiat Support | More options | Limited options |

| Product Range | Wider variety | More focused |

OKX stands out with better Web3, DeFi, and NFT innovation. You’ll find more comprehensive earning options and better fiat currency support on OKX.

Bybit excels in derivatives trading with a more focused approach. Their specialized tools might appeal to you if futures trading is your priority.

Both exchanges offer reliable platforms for crypto trading, but they target slightly different audiences. OKX appeals to users seeking a comprehensive ecosystem with diverse products.

If you’re primarily interested in derivatives trading with a straightforward interface, Bybit might be your preferred choice.

OKX vs Bybit: Trading Markets, Products & Leverage Offered

Both OKX and Bybit offer a wide range of trading options for crypto investors in 2025. Let’s look at what each platform provides.

OKX features more trading pairs than Bybit, giving you access to a broader variety of cryptocurrencies. The exchange supports spot trading, futures, options, and perpetual swaps.

Bybit counters with zero-fee spot trading, making it attractive if you’re looking to trade without additional costs. However, it offers fewer trading pairs overall compared to OKX.

Leverage Options:

| Exchange | Maximum Leverage |

|---|---|

| OKX | Up to 125x |

| Bybit | Up to 100x |

When it comes to products, OKX takes the lead in Web3, DeFi, and NFT innovation. You’ll find a more comprehensive ecosystem of crypto-related services on OKX, including a robust DeFi wallet.

Bybit offers a cleaner interface that many beginners find easier to navigate. Its trading platform is known for reliability during high market volatility.

For derivatives traders, both platforms provide advanced tools, but OKX generally maintains higher liquidity. This means your larger trades might experience less slippage on OKX.

If you’re looking for variety in trading instruments, OKX has a slight edge. But if simple fee structures and user experience are priorities, Bybit might be more suitable for your needs.

OKX vs Bybit: Supported Cryptocurrencies

When choosing between OKX and Bybit, the variety of cryptocurrencies available plays a crucial role in your decision.

Bybit offers a broader selection of cryptocurrencies compared to OKX. Based on recent data, Bybit supports over 400 different cryptocurrencies, giving you more options for diversifying your portfolio.

OKX, while having fewer total cryptocurrencies, focuses on trusted projects with strong fundamentals. This approach helps you avoid potentially risky investments.

Cryptocurrency Support Comparison:

| Feature | OKX | Bybit |

|---|---|---|

| Total cryptocurrencies | ~300 | ~400+ |

| New coin listings | Regular but selective | Frequent additions |

| Staking options | Multiple chains | Extensive options |

| Token standards | ERC-20, BEP-20, TRC-20, etc. | Multiple standards supported |

Both exchanges support major cryptocurrencies like Bitcoin, Ethereum, and popular altcoins. You’ll find all the top market cap coins on either platform.

For those interested in newer, emerging projects, Bybit tends to list new tokens faster. This gives you early access to potential high-growth assets.

If you’re looking for niche or specialized tokens, Bybit’s larger selection might better serve your needs. However, OKX’s careful selection process means the tokens available generally have stronger fundamentals.

Remember that cryptocurrency availability may vary by region due to regulations, so check the specific offerings in your location.

OKX vs Bybit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and Bybit, fees play a big role in your decision. Let’s look at how these exchanges compare in terms of costs.

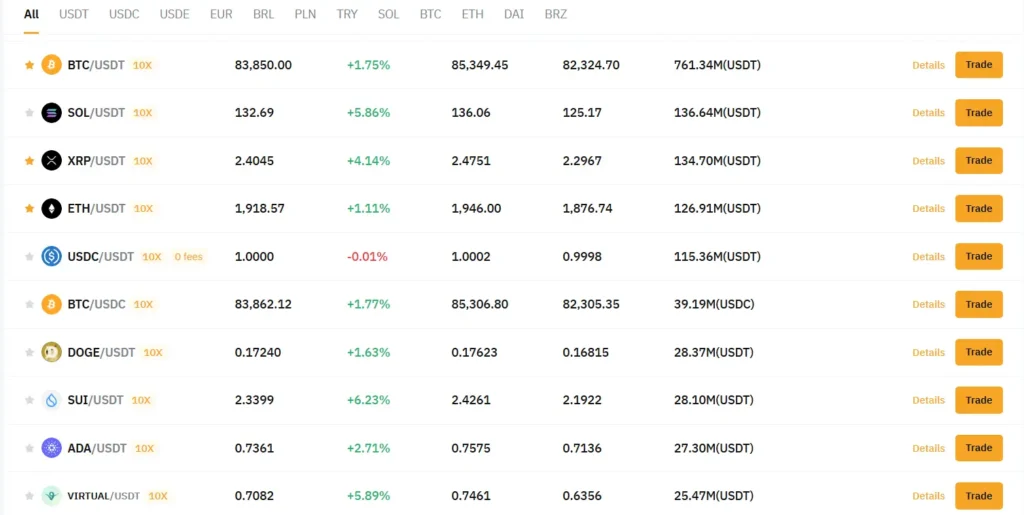

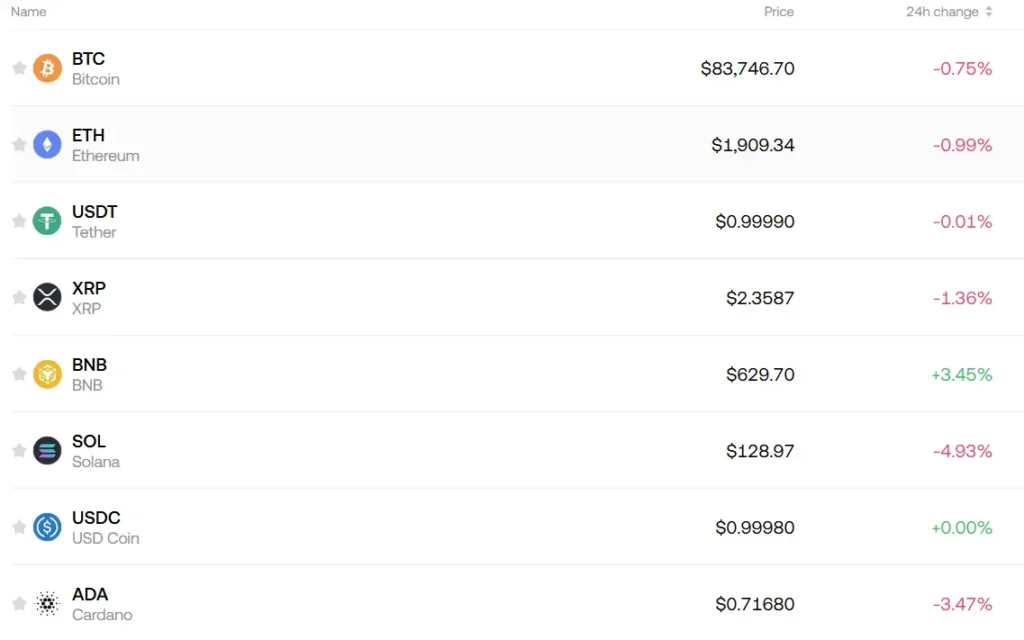

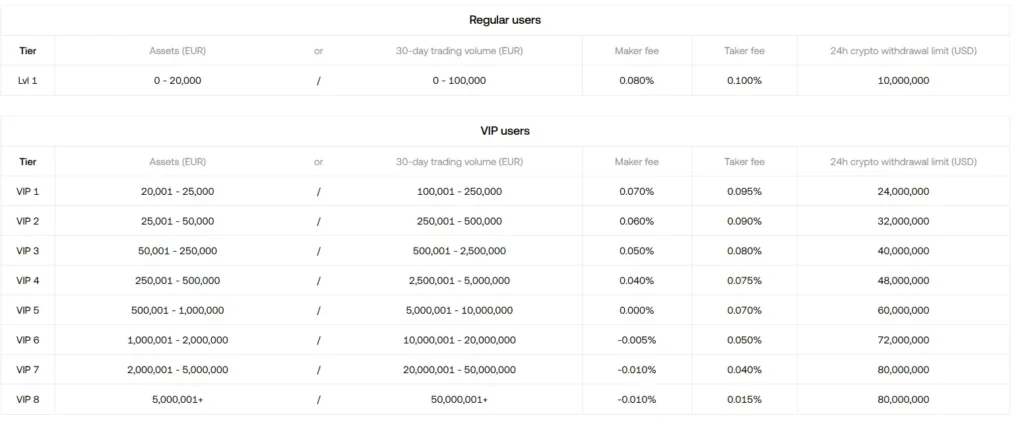

Spot Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| OKX | 0.08% | 0.10% |

| Bybit | 0.10% | 0.10% |

OKX offers slightly lower maker fees for spot trading at 0.08% compared to Bybit’s 0.10%. However, Bybit has introduced zero-fee spot trading for certain trading pairs, which can save you money if you trade those specific pairs frequently.

Futures/Derivatives Fees

Both exchanges have competitive fees for futures trading. OKX generally has lower futures fees overall, which benefits active traders who use leverage.

Withdrawal Fees

Bybit’s withdrawal fees can be higher, reaching up to $60 in some cases. OKX has more reasonable withdrawal fees – for example, Bitcoin withdrawals cost around 0.0001 BTC on Bybit versus 0.00003 BTC on OKX.

Deposit Fees

Both exchanges offer free deposits for cryptocurrencies. For fiat deposits, OKX provides better support and generally lower fees across more payment methods.

Fee discounts are available on both platforms if you hold their native tokens or maintain high trading volumes. OKX’s overall fee structure tends to be more favorable for most traders, especially those who trade frequently.

OKX vs Bybit: Order Types

When trading crypto, the types of orders available can make a big difference in your strategy. Both OKX and Bybit offer a variety of order types to help you execute trades effectively.

Bybit Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Take profit/stop loss orders

- Conditional orders

- TWAP (Time-Weighted Average Price)

OKX Order Types:

- Market orders

- Limit orders

- Stop orders

- Iceberg orders

- TWAP orders

- Trailing stop orders

- OCO (One-Cancels-the-Other)

OKX generally offers more advanced order types, including iceberg orders that hide your true position size from the market. This can be valuable if you’re trading large amounts and don’t want to impact market prices.

Bybit keeps things simpler but still provides all the essential order types most traders need. Their conditional orders are especially user-friendly for beginners.

Both platforms let you set take profit and stop loss levels when opening positions, which helps manage risk automatically. You won’t need to manually close trades when targets are hit.

For algorithmic trading, OKX has a slight edge with more complex order types. However, if you’re new to trading, Bybit’s interface makes their order types easier to understand and use.

The right choice depends on your trading style. If you use sophisticated strategies, OKX’s additional order options might serve you better. For straightforward trading, both platforms offer comparable basics.

OKX vs Bybit: KYC Requirements & KYC Limits

Both OKX and Bybit require Know Your Customer (KYC) verification for their users, though with some differences in their approaches and limitations.

Bybit prioritizes security compliance, making KYC verification mandatory for all users. This means you must complete identity verification before you can fully use their platform.

Bybit may also require KYC verification to approve withdrawal requests at any time, even if you’ve been using the platform without it previously.

OKX also implements KYC procedures, but their approach to verification has traditionally been more flexible in some regions. However, regulatory requirements are constantly changing.

Trading Limits Based on KYC Levels:

| Exchange | No KYC | Basic KYC | Full KYC |

|---|---|---|---|

| Bybit | Limited or no access | Higher withdrawal limits | Full platform access |

| OKX | Limited features | Increased withdrawal limits | Complete access to all services |

It’s worth noting that neither exchange offers true “No KYC” services in most regions due to increasing global regulatory pressure.

For US users, both platforms face strict regulatory requirements, with Bybit particularly limited in its US operations due to compliance issues.

If you value privacy, you should know that both exchanges collect personal information during the KYC process, including government-issued ID, proof of address, and sometimes a selfie for verification.

OKX vs Bybit: Deposits & Withdrawal Options

Both OKX and Bybit offer various methods to deposit and withdraw your funds. Let’s compare what each platform provides so you can decide which better suits your needs.

OKX Deposit Options:

- Cryptocurrency transfers

- Bank transfers

- Credit/debit cards

- Third-party payment providers

OKX supports more fiat currencies than Bybit, making it easier for you to deposit using your local currency. They also have better overall fiat support, which is helpful if you’re new to crypto.

Bybit Deposit Options:

- Cryptocurrency transfers

- Bank transfers

- Credit/debit cards

- Limited third-party payment options

When it comes to withdrawal speeds, both exchanges process crypto withdrawals quickly. However, fiat withdrawals typically take 1-3 business days on both platforms.

Withdrawal Fees Comparison:

| Method | OKX | Bybit |

|---|---|---|

| Bitcoin | Network fee | Network fee + small processing fee |

| Ethereum | Network fee | Network fee + small processing fee |

| Fiat | Varies by method | Slightly higher fees overall |

OKX generally offers lower withdrawal fees compared to Bybit, especially for fiat currencies. This can make a difference if you plan to move money in and out frequently.

Both exchanges implement security measures during withdrawals, including email confirmations, 2FA verification, and withdrawal address whitelisting to protect your funds.

OKX vs Bybit: Trading & Platform Experience Comparison

Both OKX and Bybit offer user-friendly trading platforms, but they differ in several key aspects.

OKX provides a more comprehensive trading experience with higher liquidity and more trading pairs. This gives you more options when looking to diversify your crypto portfolio.

Bybit, on the other hand, offers a cleaner interface that many beginners find easier to navigate. Its platform is known for being more intuitive with faster loading times.

Trading Features Comparison:

| Feature | OKX | Bybit |

|---|---|---|

| Trading Pairs | 600+ | 400+ |

| Liquidity | Higher | Good |

| UI/UX | Complex but powerful | Clean and intuitive |

| Mobile App | Feature-rich | Streamlined |

OKX stands out with its advanced Web3 integration, DeFi options, and NFT marketplace. If you’re interested in exploring beyond traditional crypto trading, OKX offers more innovation.

Bybit excels in futures trading with a responsive platform that executes orders quickly. Many traders report fewer slippage issues when using Bybit for leveraged trades.

Both exchanges offer demo accounts so you can practice trading without risking real money. This is especially helpful if you’re new to crypto trading.

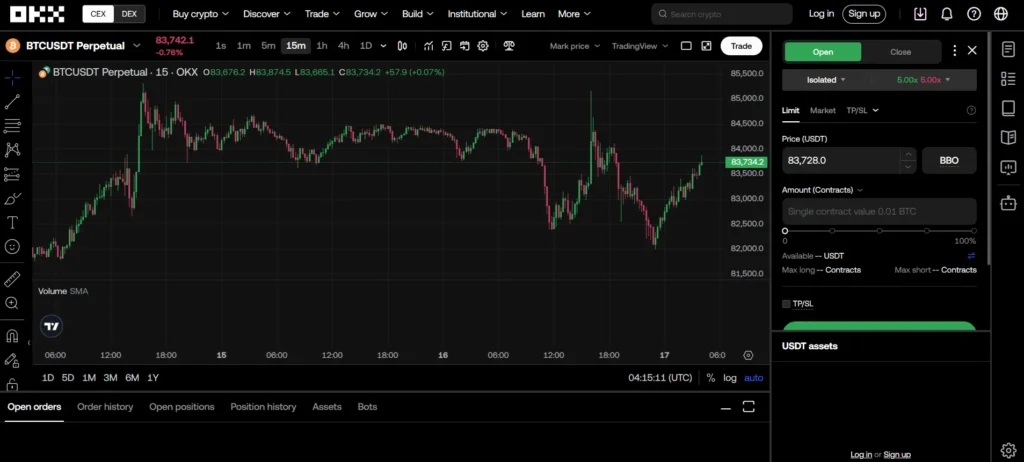

OKX’s trading interface includes more advanced charting tools and technical indicators. However, this can make it appear cluttered if you’re just starting out.

OKX vs Bybit: Liquidation Mechanism

When trading with leverage, understanding how exchanges handle liquidations is crucial for managing risk. Both OKX and Bybit have developed mechanisms to protect traders from sudden market movements.

Bybit uses a dual price mechanism that helps reduce unfair liquidations. This system calculates liquidation prices using a mark price rather than the last traded price, which offers more protection against price manipulation and flash crashes.

OKX employs a similar mark price system, but with some differences in execution. Their liquidation mechanism includes partial liquidations in some cases, allowing you to potentially salvage a portion of your position rather than losing it entirely.

Both exchanges provide liquidation warnings to alert you when your position approaches dangerous territory. These notifications give you time to add margin or reduce your position size.

Here’s a quick comparison of their liquidation features:

| Feature | Bybit | OKX |

|---|---|---|

| Price Mechanism | Dual price system | Mark price system |

| Partial Liquidation | Available | Available |

| Liquidation Warnings | Yes | Yes |

| Insurance Fund | Yes | Yes |

Bybit’s system is often praised for being more trader-friendly, with fewer instances of premature liquidations during volatile market conditions.

The insurance funds maintained by both exchanges help ensure that winning traders receive their full profits even when the losing side’s position cannot cover the losses.

OKX vs Bybit: Insurance

When trading crypto, your assets need protection. Both OKX and Bybit offer insurance funds to help manage this risk.

OKX maintains a substantial insurance fund worth over $300 million. This fund protects users against unexpected market conditions and prevents auto-deleveraging events during high volatility.

Bybit’s insurance fund is smaller but still significant at approximately $150 million. While less than OKX’s fund, it provides similar protection against trading losses during extreme market conditions.

Both exchanges contribute a portion of trading fees to their insurance funds. This ensures the funds grow over time to match increasing trading volumes.

Neither exchange offers full coverage for all assets. The funds primarily protect futures and margin trading positions rather than spot holdings.

For added security, both platforms use cold storage for most user funds. OKX keeps about 95% of assets in cold storage, while Bybit maintains around 90%.

Insurance Fund Comparison:

| Feature | OKX | Bybit |

|---|---|---|

| Fund Size | $300+ million | $150+ million |

| Coverage | Futures, margin | Futures, margin |

| Cold Storage | 95% of assets | 90% of assets |

Remember that insurance funds don’t guarantee complete protection of your investments. They mainly prevent socialized losses during extreme market conditions.

OKX vs Bybit: Customer Support

When choosing a crypto exchange, good customer support can make a big difference. Both OKX and Bybit understand this and offer several ways to get help.

OKX provides 24/7 customer service through live chat, email, and social media. Their response times are generally quick, with most users reporting resolution within hours. They also have a detailed help center with guides and FAQs.

Bybit also offers round-the-clock support with similar contact options. Their team is known for being thorough in addressing technical issues, especially for their advanced trading features.

According to search results, Binance and OKX are noted for quick resolution times. However, Bybit seems to focus on catering to more complex trading needs.

Both platforms offer support in multiple languages, though English support tends to be the most responsive. You’ll find that response times may vary depending on your issue’s complexity and current trading volume.

For beginners, OKX’s customer support might be slightly more approachable. Their help materials are organized in a user-friendly way with simpler explanations.

If you’re an advanced trader, you might appreciate Bybit’s technical expertise when dealing with complex trading issues or platform features.

Neither platform currently offers phone support, which is fairly standard in the crypto exchange industry.

OKX vs Bybit: Security Features

When choosing a crypto exchange, security should be your top priority. Both OKX and Bybit offer strong security measures, but they differ in several important ways.

OKX features multiple security layers including Multi-Factor Authentication (MFA), cold storage for most user funds, and real-time monitoring systems to prevent fraud. Their security team actively works to detect unusual activities on user accounts.

Bybit, while also providing solid security, has been noted to have some knowledge gaps in their security approach. A recent incident mentioned in the search results suggests OKX had to clarify that they weren’t being investigated due to Bybit’s “lack of security know-how.”

Key Security Features Comparison:

| Feature | OKX | Bybit |

|---|---|---|

| Multi-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Real-time Monitoring | ✓ | ✓ |

| Security Reputation | Stronger | Some concerns noted |

OKX is often recommended for users who prioritize security, especially beginners who might be more vulnerable to security issues.

You should enable all available security features regardless of which platform you choose. This includes setting up strong passwords, enabling MFA, and being cautious about phishing attempts.

Remember that no exchange is completely immune to security risks, so consider keeping large amounts of crypto in personal wallets rather than on exchanges.

Is OKX A Safe & Legal To Use?

OKX has built a solid reputation for security in the cryptocurrency exchange landscape. According to recent security assessments, OKX received an “AA” rating from CertiK and ranks #3 among the safest crypto exchanges as of 2025.

One notable point in OKX’s favor is that it has not experienced any major security breaches or hacking incidents so far. This clean track record stands in contrast to some competitors, including Bybit which recently suffered a significant $1.5 billion hack.

However, OKX is currently facing increased regulatory scrutiny, particularly from European authorities following the Bybit incident. This examination appears to be related to compliance with MiCA (Markets in Crypto-Assets) regulations.

When using OKX, you benefit from several security features:

- Two-factor authentication (2FA)

- Cold storage for the majority of user funds

- Regular security audits

- Insurance fund to protect against unexpected losses

Regarding legality, OKX operates in many jurisdictions worldwide, but availability varies by location. You should check if OKX is permitted in your specific country or region before creating an account.

The exchange continues to work on regulatory compliance across different markets. This ongoing process may affect service availability and features depending on where you live.

Is Bybit A Safe & Legal To Use?

Bybit operates as a major cryptocurrency exchange with security measures in place to protect user funds. However, recent events have raised some concerns. In early 2025, Bybit experienced a significant security breach resulting in a $1.5 billion hack, one of the largest in crypto history.

Despite this incident, Bybit maintains regulatory compliance in several jurisdictions. The platform uses standard security features like two-factor authentication, cold storage for most assets, and regular security audits.

The legality of Bybit varies by country. You should check your local regulations before using the service. Some countries restrict or prohibit cryptocurrency trading platforms entirely.

Security Features:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Regular security audits

- Insurance fund for user protection

After the recent hack, Bybit has reportedly been working to strengthen its security protocols. OKX, a competitor exchange, has offered assistance in the aftermath of the breach.

For your protection when using Bybit, enable all security features, use strong passwords, and consider keeping large holdings in personal wallets rather than on the exchange.

Remember that all cryptocurrency exchanges carry inherent risks. The recent security incident suggests you should exercise caution when deciding how much to trust any single platform with your assets.

Frequently Asked Questions

Traders often have specific questions when comparing OKX and Bybit. These questions cover important aspects like fees, security, leverage options, and user experience that can help you make an informed decision.

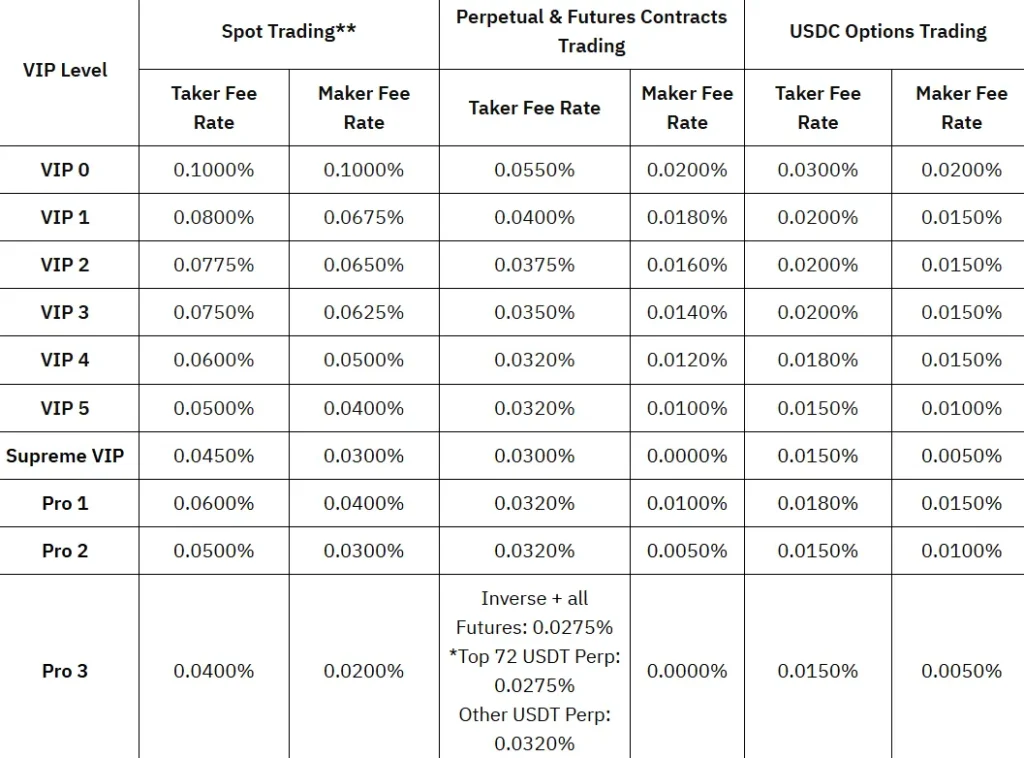

What are the key differences in trading fees between OKX and Bybit?

Bybit offers zero-fee spot trading, giving it a cost advantage for spot traders. This can result in significant savings for high-volume traders.

OKX charges modest spot trading fees but provides tiered discounts for VIP users based on trading volume. As you trade more, your fees decrease.

Both exchanges use maker-taker fee structures for futures trading, but Bybit’s base rates are slightly lower than OKX’s for most users.

Which platform, OKX or Bybit, offers better security features for users?

Both exchanges employ strong security measures including two-factor authentication (2FA) and cold wallet storage for most funds.

OKX has invested heavily in security infrastructure and maintains a comprehensive insurance fund to protect users against unexpected losses.

Bybit emphasizes its multi-signature wallet technology and regular security audits. Neither exchange has suffered major security breaches recently.

How do the leverage options on OKX compare with those available on Bybit?

Both exchanges offer high leverage trading, but with some differences. Bybit provides up to 100x leverage on major cryptocurrency pairs like BTC/USDT.

OKX offers similar maximum leverage levels but provides more customization options for advanced traders. You can adjust risk parameters more precisely on OKX.

Leverage availability varies by country due to regulations, so your location may affect your maximum allowed leverage on either platform.

Between OKX and Bybit, which exchange provides a broader range of cryptocurrencies to trade?

OKX supports a wider variety of cryptocurrencies, with over 350 coins and 600+ trading pairs available. This includes many smaller altcoins and newer projects.

Bybit offers fewer overall cryptocurrencies but ensures all major coins and tokens are available. Their selection is sufficient for most traders.

OKX has a clear advantage if you’re interested in trading less popular or emerging cryptocurrencies.

Can users expect superior customer support on OKX or Bybit?

Bybit offers 24/7 customer support through live chat, email, and social media channels. Their response times average under 30 minutes for most inquiries.

OKX also provides round-the-clock support with multilingual assistance, but some users report slightly longer wait times during peak periods.

Both platforms maintain extensive knowledge bases and FAQ sections, though Bybit’s educational resources receive slightly higher user ratings overall.

How do the user interfaces and trading experiences on OKX and Bybit differ for new traders?

Bybit features a clean, intuitive interface that many beginners find easier to navigate. The platform offers simplified trading views specifically designed for new users.

OKX provides more customization options and advanced features, which can overwhelm beginners but becomes advantageous as you gain experience.

Both platforms offer mobile apps, but Bybit’s app receives higher ratings for ease of use and reliability when trading on the go.

Bybit vs OKX Conclusion: Why Not Use Both?

After comparing these exchanges, you might wonder if you need to choose just one. The truth is, many crypto traders use multiple platforms to take advantage of different benefits.

Why use both Bybit and OKX:

- Different fee structures for various trading styles

- Access to a wider range of cryptocurrencies

- Risk diversification across platforms

- Take advantage of unique features from each

Bybit offers a lifetime commission structure that provides long-term benefits, while OKX has some of the lowest fees among major exchanges.

For beginners, OKX provides a more user-friendly interface and trusted projects. If you’re looking for a broader selection of cryptocurrencies, Bybit might be your preferred choice.

Consider your trading volume and frequency when deciding which platform to use for specific trades. You might use OKX for lower-fee spot trading and Bybit for certain derivatives.

Both exchanges have strong security measures, but spreading your assets across platforms can be a smart risk management strategy.

You can create accounts on both platforms and test which one works better for different types of trades. This hands-on experience will help you decide when to use each exchange.

Remember that market conditions and exchange policies change. What works best today might not be optimal tomorrow.