When looking for a crypto exchange in 2025, OKX and BloFin often stand out as top choices. These platforms have gained popularity for their range of features, security measures, and trading options that appeal to both beginners and experienced traders.

Both OKX and BloFin offer leverage trading with access to hundreds of cryptocurrency pairs, making them versatile options for your trading needs. OKX is recognized for its strength in leveraged crypto options trading, while BloFin has built a reputation as a secure leverage exchange with over 400 crypto pairs available.

You’ll want to compare these exchanges based on several key factors including trading fees, security features, user interface, and available cryptocurrencies. Each platform has unique strengths that might make one more suitable for your specific trading style and goals.

OKX vs BloFin: At A Glance Comparison

When choosing between OKX and BloFin, you’ll want to compare their key features side by side. Both platforms offer cryptocurrency trading services but differ in several important aspects.

OKX stands out as one of the top crypto exchanges in 2025. It provides a diverse range of trading products including futures, perpetual swaps, and options.

BloFin, while less mentioned in the search results, competes in the cryptocurrency exchange market with its own set of features.

Trading Options Comparison:

| Feature | OKX | BloFin |

|---|---|---|

| Futures Trading | Yes | Limited |

| Perpetual Swaps | Yes | Yes |

| Options | European-style | Basic |

| Leverage Trading | Advanced | Standard |

OKX offers more advanced trading tools and higher liquidity. You can trade with greater flexibility using their European-style options, which allow entering and exiting positions freely.

BloFin provides a more straightforward interface that might appeal to beginners. Its simplified approach makes it easier to start trading without extensive knowledge.

Security measures vary between the platforms. OKX has invested heavily in security protocols to protect user assets. BloFin offers standard security features but may not match OKX’s comprehensive protections.

Fee structures differ too. OKX uses a tiered fee system based on trading volume. BloFin typically charges flat fees regardless of your trading activity.

Your choice between these platforms should depend on your trading needs, experience level, and risk tolerance.

OKX vs BloFin: Trading Markets, Products & Leverage Offered

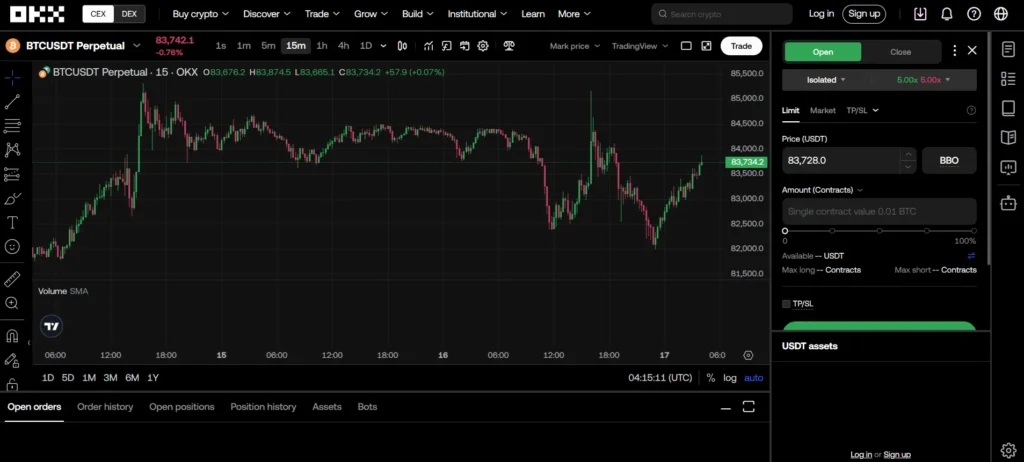

OKX provides a comprehensive range of trading options for crypto enthusiasts. You can access spot trading, futures, perpetual swaps, and options all on one platform. Their leverage offering is quite competitive, allowing up to 100x leverage on certain trading pairs.

For margin trading, OKX offers both cross margin and isolated margin options. Cross margin uses your entire account balance as collateral, while isolated margin limits your risk to just the amount allocated to a specific position.

The platform features over 350 cryptocurrencies and more than 600 trading pairs. This gives you plenty of options to diversify your portfolio or find specific assets that match your trading strategy.

BloFin, while newer to the market, offers a more streamlined selection of trading products. Their focus appears to be on user-friendly interfaces and simplified trading experiences for beginners.

Leverage Comparison:

| Platform | Max Leverage | Margin Types | Trading Products |

|---|---|---|---|

| OKX | Up to 100x | Cross, Isolated | Spot, Futures, Perpetual Swaps, Options |

| BloFin | Limited info | Limited info | Spot, Some Derivatives |

You’ll find OKX particularly strong for derivatives trading with its variety of futures contracts and perpetual swaps. Their extensive product lineup caters to both beginner and advanced traders looking to employ different strategies.

OKX vs BloFin: Supported Cryptocurrencies

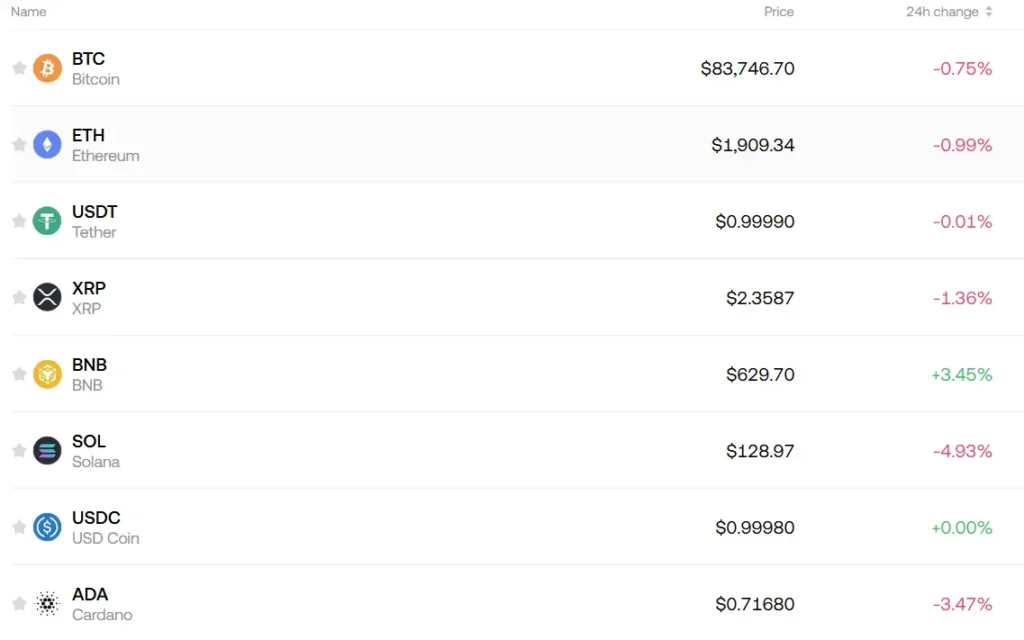

OKX offers a vast selection of cryptocurrencies for trading. You can access over 350 cryptocurrencies and more than 600 trading pairs on the platform. This includes major coins like Bitcoin and Ethereum, as well as a wide range of altcoins and newer tokens.

BloFin provides a more limited selection with approximately 150 cryptocurrencies available for trading. While it covers most major coins, you might find fewer emerging or niche tokens compared to OKX.

Both platforms support the following popular cryptocurrencies:

| Cryptocurrency | OKX | BloFin |

|---|---|---|

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Solana (SOL) | ✓ | ✓ |

| Cardano (ADA) | ✓ | ✓ |

| BNB | ✓ | ✓ |

OKX stands out with its extensive selection of DeFi tokens and newer blockchain projects. This makes it particularly attractive if you’re interested in emerging crypto ecosystems.

BloFin focuses more on established coins with higher market caps. While this means fewer options, it can be easier to navigate for beginners.

Both exchanges regularly add new cryptocurrencies, but OKX typically adds new listings faster. You’ll generally find new trending tokens on OKX before they appear on BloFin.

For staking options, OKX supports more cryptocurrencies for earning passive income through their Earn feature compared to BloFin’s staking program.

OKX vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing crypto exchanges, fees often make a big difference to your trading profits. Let’s look at how OKX and BloFin stack up in this area.

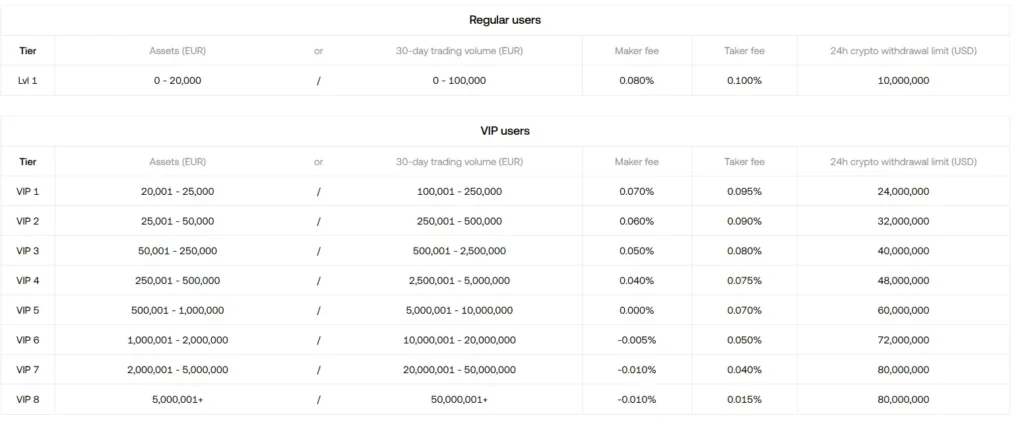

OKX charges 0.08% maker and 0.1% taker fees for standard users. These rates are competitive in the crypto exchange market. VIP users can access even lower fees based on their trading volume.

BloFin’s fee structure is slightly different, typically charging around 0.1% for both maker and taker orders for regular users.

Deposit Fees:

| Exchange | Crypto Deposit | Fiat Deposit |

|---|---|---|

| OKX | Free | Varies by method |

| BloFin | Free | 1-3% depending on method |

OKX doesn’t charge for cryptocurrency deposits, which is standard across most exchanges. Withdrawal fees on OKX vary depending on the cryptocurrency and current network conditions.

BloFin follows a similar pattern for withdrawals but may have different fee tiers based on user levels and verification status.

Both platforms offer fee discounts for high-volume traders and those who hold their native tokens.

For frequent traders, OKX might provide a slight edge with its lower maker fees. However, the best choice depends on which cryptocurrencies you trade most often.

Always check the current fee schedules before making large transactions, as these rates can change with market conditions.

OKX vs BloFin: Order Types

When trading on cryptocurrency exchanges, understanding the available order types can greatly impact your success. Both OKX and BloFin offer various order options to help you execute trades effectively.

OKX provides a comprehensive set of order types for traders at all levels. You can use market orders for immediate execution at current prices. Limit orders let you set specific buy or sell prices.

OKX also offers stop orders as part of their algorithmic trading strategies. These help you limit losses by setting trigger prices that activate when market conditions change.

BloFin supports the fundamental order types needed for trading. Their platform includes market orders for quick execution and limit orders for price-specific trades.

On BloFin, you can also close positions directly on the K-line chart or use reverse orders if you already have an open position.

Key Order Types Comparison:

| Order Type | OKX | BloFin |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop Orders | ✓ | Limited |

| Advanced Algorithmic | ✓ | Basic |

OKX tends to offer more advanced order options, making it suitable for experienced traders who need sophisticated tools. Their platform is designed to accommodate both beginners and advanced investors.

BloFin provides a more streamlined approach with essential order types that cover most trading needs. This simplicity might appeal to newer traders who don’t need complex order options.

OKX vs BloFin: KYC Requirements & KYC Limits

When using crypto exchanges, you’ll find different KYC (Know Your Customer) requirements that affect how you can trade. Let’s compare OKX and BloFin in this area.

OKX requires KYC verification for most users. You’ll need to provide personal information and identity documents to use their platform fully. Without completing KYC, your trading capabilities and withdrawal limits will be significantly restricted.

BloFin offers more flexibility with KYC requirements. According to recent information, BloFin doesn’t require KYC verification for basic trading activities. This makes it appealing if you value privacy.

However, BloFin does implement withdrawal limits for non-verified users. You can withdraw up to 20,000 USDT without KYC verification. For amounts exceeding this limit, you’ll need to complete identity verification.

Here’s a quick comparison table:

| Feature | OKX | BloFin |

|---|---|---|

| Basic KYC Required | Yes | No |

| Withdrawal Without KYC | Limited | Up to 20,000 USDT |

| Full Access | Requires complete verification | Requires verification for large withdrawals |

Your choice between these platforms may depend on how much you value privacy versus security. While BloFin offers more flexibility for those wanting to avoid KYC, remember that verified accounts typically provide better security and recovery options.

Trading without KYC also comes with potential regulatory concerns depending on your location.

OKX vs BloFin: Deposits & Withdrawal Options

When comparing OKX and BloFin, deposit and withdrawal options play a crucial role in your trading experience.

OKX offers comprehensive deposit and withdrawal services for users worldwide. Based on the search results, OKX is described as “the fastest and most reliable crypto trading app for professional traders everywhere.”

For deposits, OKX supports both cryptocurrency and fiat options. You can fund your account using major cryptocurrencies or traditional currency through bank transfers and card payments.

BloFin, as a newer platform, offers standard deposit methods but with fewer options than OKX. The platform supports major cryptocurrencies for deposits, but its fiat options may be more limited.

Withdrawal Process Comparison:

| Feature | OKX | BloFin |

|---|---|---|

| Cryptocurrency withdrawals | Wide range | Limited range |

| Fiat withdrawals | Multiple options | Basic options |

| Processing time | Fast | Standard |

| Verification requirements | Standard KYC | Standard KYC |

OKX withdrawal processing tends to be faster, making it advantageous for traders who need quick access to funds. The platform has established robust systems for handling large transaction volumes.

BloFin’s withdrawal process is functional but may take longer during peak times. The platform is still developing its infrastructure to match competitors like OKX.

Both platforms implement security measures for withdrawals, including two-factor authentication and withdrawal address whitelisting to protect your funds.

OKX vs BloFin: Trading & Platform Experience Comparison

OKX offers a comprehensive trading environment with a wide range of features. The platform provides futures, perpetual swaps, and options trading with up to 100x leverage.

The OKX interface is feature-rich but may feel overwhelming for beginners. Advanced traders appreciate the customizable charts and technical analysis tools available.

BloFin’s platform focuses on simplicity while maintaining essential trading capabilities. Their interface is more intuitive, making it accessible for crypto newcomers.

Trading Features Comparison:

| Feature | OKX | BloFin |

|---|---|---|

| Leverage | Up to 100x | Up to 50x |

| Trading Types | Spot, Futures, Options, Perpetuals | Spot, Futures, Perpetuals |

| Analysis Tools | Advanced | Basic to Intermediate |

| Mobile App | Comprehensive | Streamlined |

OKX excels in customization options. You can tailor your risk management tools to fit your trading strategy, which is valuable for active traders.

BloFin emphasizes speed and reliability. Their platform experiences fewer outages during high market volatility, which can be crucial when you need to execute trades quickly.

For copy trading, OKX provides more flexibility. You can follow experienced traders while adjusting risk parameters to match your comfort level.

BloFin’s charting tools are simpler but cover the essentials that most traders need daily. This makes the learning curve much gentler if you’re new to crypto trading.

OKX vs BloFin: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management strategy.

OKX employs a systematic liquidation approach designed to maintain market stability. Their system focuses on efficient processing of liquidated futures and swap positions without disrupting market liquidity.

BloFin takes a different approach with its Insurance Fund mechanism. This fund acts as a buffer against massive liquidation risks in volatile market conditions.

The Insurance Fund at BloFin is composed of funds provided by the platform itself along with proceeds from liquidation events. This creates a safety net for traders during extreme market movements.

Key Differences:

| Feature | OKX | BloFin |

|---|---|---|

| Liquidation Focus | Transaction efficiency | Risk resistance |

| Protection Mechanism | Methodical position clearing | Insurance Fund |

| Market Impact | Designed to minimize disruption | Aims to absorb shock |

OKX’s liquidation system prioritizes maintaining market function during high volatility. Their methodology helps prevent cascading liquidations that could affect all traders.

BloFin’s Insurance Fund approach offers you additional protection during market turmoil. This can be particularly valuable when trading volatile assets with higher leverage.

Your trading style and risk tolerance should guide which liquidation mechanism better suits your needs. More conservative traders might appreciate BloFin’s protection, while active traders may prefer OKX’s efficiency.

OKX vs BloFin: Insurance

When trading on crypto exchanges, insurance provides crucial protection for your assets. Both OKX and BloFin offer insurance options, but they differ in important ways.

OKX maintains a dedicated User Protection Fund worth over $300 million. This fund helps safeguard your assets against potential security breaches or hacks.

BloFin, though newer to the market, also emphasizes security through their insurance protocols. Their coverage focuses primarily on protecting user funds against unauthorized access.

OKX provides monthly Proof of Reserve releases, which adds transparency about their ability to cover user assets. This regular verification helps you confirm that your funds are properly backed.

Insurance Coverage Comparison:

| Feature | OKX | BloFin |

|---|---|---|

| Protection Fund | $300+ million | Not specified |

| Proof of Reserve | Monthly releases | Not regularly published |

| Coverage Scope | Exchange hacks, breaches | Unauthorized access |

| Insurance Cap | Varies by account level | Standard across accounts |

Neither exchange offers complete protection against market volatility or trading losses. The insurance primarily covers security incidents rather than investment performance.

You should verify the current insurance terms before depositing significant funds. Insurance policies can change, and coverage limits may apply based on your account type or trading volume.

Both exchanges continue to evolve their insurance offerings as the crypto market matures and regulatory requirements develop.

OKX vs BloFin: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both OKX and BloFin offer support services, but they differ in some key ways.

OKX provides 24/7 customer support through multiple channels including live chat, email, and a comprehensive help center. They typically respond within 24 hours for email inquiries.

BloFin has created a customer-centric platform with support that’s described as “top-notch” and comparable to the best international standards. This focus on user experience is a significant selling point for BloFin.

Both exchanges offer:

- Live chat support

- Email ticket systems

- Extensive FAQ sections

- Community forums

Response times vary between the platforms. OKX sometimes experiences delays during high traffic periods, while BloFin generally maintains consistent response times.

User Feedback Comparison:

| Feature | OKX | BloFin |

|---|---|---|

| Response Time | Good | Very Good |

| Knowledge Base | Extensive | Comprehensive |

| Language Options | Many | Several |

| Social Media Support | Active | Very Active |

You might find BloFin’s support more personalized, while OKX’s larger size means they have more resources but sometimes less individual attention.

For beginners, BloFin’s customer-centric approach might be more welcoming. Experienced traders might appreciate OKX’s technical depth in their support materials.

OKX vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both OKX and BloFin offer strong security features, but with some key differences.

OKX implements multi-factor authentication (MFA) to protect your account from unauthorized access. They also use cold storage solutions to keep most user funds offline and safe from hackers.

BloFin prioritizes security and transparency according to recent reviews. They have robust security measures that include advanced encryption techniques and regular security audits.

Key Security Features Comparison:

| Security Feature | OKX | BloFin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | ✓ | ✓ |

| Transparency Reports | Limited | Comprehensive |

BloFin stands out with its transparent fee structures and security protocols. This transparency helps you understand how your assets are protected.

OKX has been in the industry longer, which has given them time to develop and refine their security infrastructure. Their experience can provide peace of mind for traders concerned about platform reliability.

Both exchanges require KYC (Know Your Customer) verification to comply with regulatory standards and prevent fraud. This adds an extra layer of security to your trading experience.

Remember to always enable all available security features when setting up your account on either platform. Use strong, unique passwords and consider a password manager for additional protection.

Is OKX a Safe & Legal To Use?

OKX is widely regarded as a safe and legitimate cryptocurrency exchange. It employs robust security measures to protect your funds, including two-factor authentication (2FA), cold storage for assets, and withdrawal address whitelisting.

The platform also uses anti-phishing codes to help you verify legitimate communications from the exchange. OKX is considered one of the top cryptocurrency exchanges for trading Bitcoin and other digital assets.

A key security advantage is that OKX offers non-custodial options, meaning you can maintain control of your private keys. This gives you greater authority over your funds compared to many centralized exchanges.

However, some users have reported issues with fund access. There are claims of withdrawals being disabled without notice and terms of service changes occurring without proper notification.

Security Features at OKX:

- Two-factor authentication (2FA)

- Cold storage for majority of assets

- Withdrawal address whitelisting

- Anti-phishing protection

- Option for non-custodial control

Before using OKX, verify it’s legal in your jurisdiction. Cryptocurrency regulations vary by country, and you should ensure compliance with local laws before trading on any exchange.

For additional protection, consider using hardware wallets for long-term storage and only keeping trading amounts on the exchange platform.

Is BloFin a Safe & Legal To Use?

BloFin is generally considered a legitimate cryptocurrency platform that operates within legal frameworks. According to search results, it is regulated by relevant financial authorities and follows strict security protocols to protect user assets.

The platform adheres to regulatory requirements in the jurisdictions where it operates. This regulatory compliance helps ensure that your funds and personal information remain protected while using their services.

One notable aspect of BloFin is its approach to KYC (Know Your Customer) procedures. Unlike many exchanges, BloFin offers optional KYC verification, allowing for anonymous trading for those who prefer privacy.

For security, BloFin implements various protective measures:

- Advanced encryption technology

- Two-factor authentication (2FA)

- Regular security audits

- Cold storage for most user funds

The exchange was founded relatively recently in 2024, making it newer compared to some established competitors. While newer platforms sometimes face more scrutiny, BloFin has focused on building a secure and reliable infrastructure for crypto investing.

If you’re concerned about safety, it’s worth noting that BloFin appears committed to security best practices. However, as with any cryptocurrency platform, you should exercise caution and only invest funds you can afford to lose.

Frequently Asked Questions

Traders often want to know specific details about exchanges before committing their funds. These common questions highlight important differences between OKX and BloFin that can help you make an informed decision.

What are the key differences in trading fees between OKX and BloFin?

OKX and BloFin have different fee structures that impact your trading costs. OKX typically charges fees based on trading volume and user level, with maker fees ranging from 0.08% to 0.10% and taker fees between 0.10% to 0.15%.

BloFin offers competitive trading fees compared to other exchanges. They provide fee discounts based on trading volume and token holdings. BloFin also supports deposits and withdrawals in over 80 fiat currencies, which can save on conversion costs.

The fee structure for both platforms may change during promotional periods, so it’s worth checking their current rates before trading.

How do the security features of OKX compare with those of BloFin for safeguarding assets?

OKX stands out with its non-custodial approach, giving you control over your private keys. This means you maintain direct access to your funds rather than the exchange holding them.

BloFin markets itself as a secure and reliable trading platform. According to reviews, BloFin implements standard security measures like two-factor authentication and cold storage for most assets.

Both exchanges use security protocols like multi-signature wallets and regular security audits, but their specific implementation differs. OKX’s non-custodial option provides an extra layer of security for users concerned about exchange hacks.

In terms of liquidity and trade volume, how does OKX stand against BloFin?

OKX generally maintains higher liquidity and trading volumes as one of the more established exchanges in the market. This results in tighter spreads and less price slippage on popular trading pairs.

BloFin is newer to the market but has been growing its liquidity pools. As mentioned in search results, some traders consider BloFin alongside other platforms like Apex for algorithmic trading, suggesting it offers sufficient liquidity for automated strategies.

The difference in liquidity is most noticeable during market volatility, where OKX’s larger order books typically provide more stable trading conditions.

Which platform offers a wider range of cryptocurrencies, OKX or BloFin?

OKX typically offers a more extensive selection of cryptocurrencies and trading pairs. Their platform supports hundreds of different tokens, including both major cryptocurrencies and smaller altcoins.

BloFin provides a growing selection of cryptocurrencies but may not match OKX’s range. BloFin focuses on providing reliable trading for the most popular tokens with strong liquidity.

Both platforms regularly add new cryptocurrencies based on market demand and after security evaluations.

How do user reviews and ratings for OKX and BloFin differ on reputable forums?

OKX receives mixed reviews, with users praising its non-custodial features and trading tools. Common criticisms include customer service response times and complex fee structures.

BloFin reviews highlight its user-friendly interface and customer support. According to search results, BloFin is described as providing an “easy-to-use, secure, and reliable trading experience.”

Forum discussions mention both platforms for algorithmic trading, with BloFin sometimes grouped with newer exchanges like Apex and Hyperliquid, while OKX is often compared with established platforms like Binance and Bybit.

What are the advantages and disadvantages of using OKX versus BloFin for a novice trader?

OKX’s advantages include its non-custodial options and extensive market history. However, new traders might find its interface overwhelming and the variety of trading options confusing.

The platform’s advanced features benefit experienced traders but can create a steeper learning curve for beginners.

BloFin appears to target accessibility, with reviews mentioning its easy-to-use platform. Their support for numerous fiat currencies makes initial deposits simpler for newcomers.

A potential disadvantage of BloFin for novices is its relative newness in the market, which means fewer educational resources and community support compared to more established exchanges.

BloFin vs OKX Conclusion: Why Not Use Both?

After comparing BloFin and OKX, it’s clear that both platforms offer valuable features for crypto traders in 2025. Each has unique strengths that might benefit your trading strategy.

BloFin stands out with its deep liquidity and advanced trading features. The platform prioritizes security and transparency with clear fee structures. Many traders appreciate its robust security measures.

OKX utilizes both cold and hot wallets for fund management, keeping most assets offline for better security. They offer two-factor authentication (2FA) among other security features that protect your investments.

For leverage trading, both platforms provide solid options. BloFin has gained popularity recently, with some users considering it the best option currently available in the US market.

Why choose just one? Using both platforms might be the optimal strategy. This approach lets you:

- Take advantage of different fee structures

- Access wider variety of trading pairs

- Minimize risk through platform diversification

- Utilize the best features of each exchange

Your trading needs may vary day to day. Having accounts on both BloFin and OKX gives you flexibility to choose the right platform for each specific trading opportunity.

Remember to consider your personal trading style, security preferences, and fee sensitivity when deciding how to allocate your activities between these two reputable exchanges.