Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Today we’re comparing two popular platforms: OKX and Bitunix. Both exchanges offer services for crypto traders, but they differ in important ways that might affect which one is best for you.

Bitunix supports over 270 cryptocurrencies and focuses on both spot and derivatives trading, while OKX also offers comprehensive trading options with its own unique features and fee structure. Understanding these differences will help you make an informed decision about where to conduct your crypto transactions in 2025.

You’ll want to consider factors like trading volume, available coins, security measures, and fee structures when comparing these exchanges. Each platform has strengths that might align better with your specific trading needs and experience level.

OKX vs Bitunix: At A Glance Comparison

When looking for a crypto exchange, comparing key features helps you make an informed decision. Here’s how OKX and Bitunix stack up against each other.

OKX is an established cryptocurrency exchange with a solid reputation in the market. It offers interest on BTC at a rate of 1% and includes compounding, which helps your crypto grow faster over time.

Bitunix is a newer competitor in the crypto exchange space. While specific interest rates weren’t provided in the search results, it’s positioned as an alternative to OKX.

| Feature | OKX | Bitunix |

|---|---|---|

| BTC Interest Rate | 1% | Not specified |

| Compounding | Yes | Not specified |

| Platform Type | Full exchange | Full exchange |

Both exchanges are ranked and scored based on factors like traffic, trading volume, and legitimacy. These metrics help determine their trustworthiness in the crypto market.

When choosing between these platforms, you should consider fees, which can significantly impact your trading profits. The crypto exchange landscape in 2025 is competitive, with many platforms trying to offer the lowest fees.

Remember to look beyond just the interest rates. Consider the number of available coins, trading pairs, and user interface when making your decision.

OKX vs Bitunix: Trading Markets, Products & Leverage Offered

OKX offers a wide range of trading options including spot trading, futures, perpetual swaps, and options. The platform is now available to users in the United States, expanding its global reach.

Bitunix is a centralized cryptocurrency exchange that specializes in both spot and derivatives trading. It has gained recognition for its security features, including proof of reserves, which adds an extra layer of protection for your assets.

Trading Products Comparison:

| Feature | OKX | Bitunix |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Perpetual Swaps | ✓ | ✓ |

| Options | ✓ | Limited |

When it comes to leverage trading, both platforms provide competitive options. OKX is known for its diverse range of leverage trading products, making it popular among traders looking to amplify their positions.

Bitunix has been gaining attention as a strong alternative to top-tier exchanges. Some users report that its trading interface and product offerings compare favorably to more established platforms.

For US-based traders, OKX’s recent expansion into the American market provides a new option for accessing derivatives trading with leverage.

Both exchanges offer mobile apps and desktop platforms to help you trade on the go or from your home office.

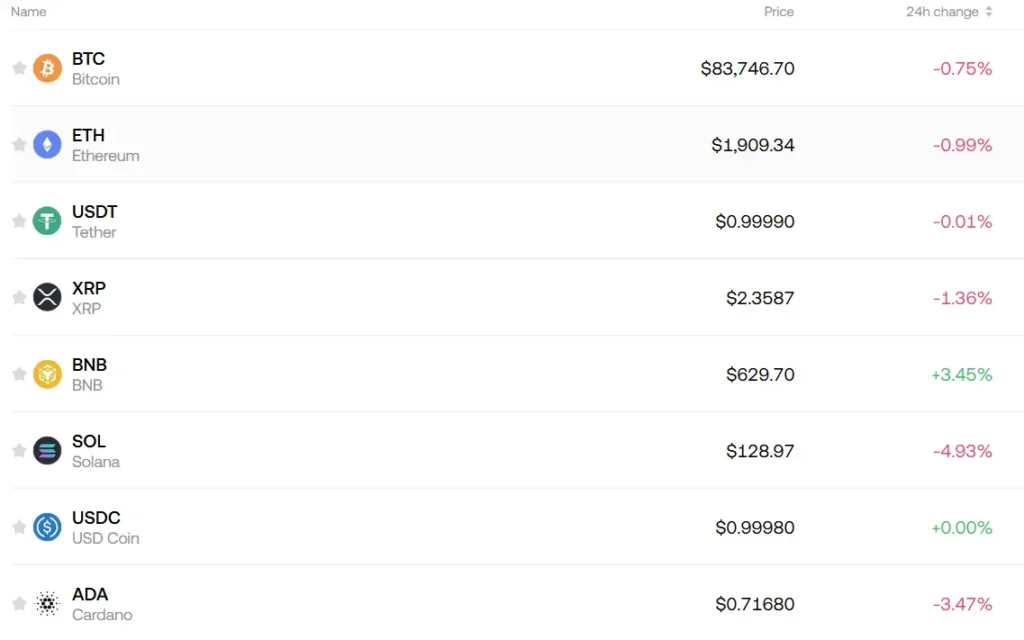

OKX vs Bitunix: Supported Cryptocurrencies

When choosing between OKX and Bitunix, the range of supported cryptocurrencies is a key factor to consider for your trading needs.

Bitunix offers access to over 270 cryptocurrencies for trading. This extensive selection includes most popular coins that traders typically look for.

OKX, as one of the largest cryptocurrency exchanges globally, supports a wide array of cryptocurrencies as well. It ranks among the top 3 exchanges alongside Binance and Bitget.

Both platforms cover major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and other established altcoins. However, their offerings may differ when it comes to newer or less common tokens.

Supported Cryptocurrencies Comparison:

| Exchange | Number of Cryptocurrencies | Notable Features |

|---|---|---|

| OKX | 200+ | Top 3 exchange, strong liquidity |

| Bitunix | 270+ | Focus on both spot and derivatives trading |

For traders interested in niche or emerging cryptocurrencies, Bitunix might offer more options based on their larger selection.

It’s worth checking each platform’s current listings if you’re looking to trade specific tokens, as supported cryptocurrencies can change over time with new listings and delistings.

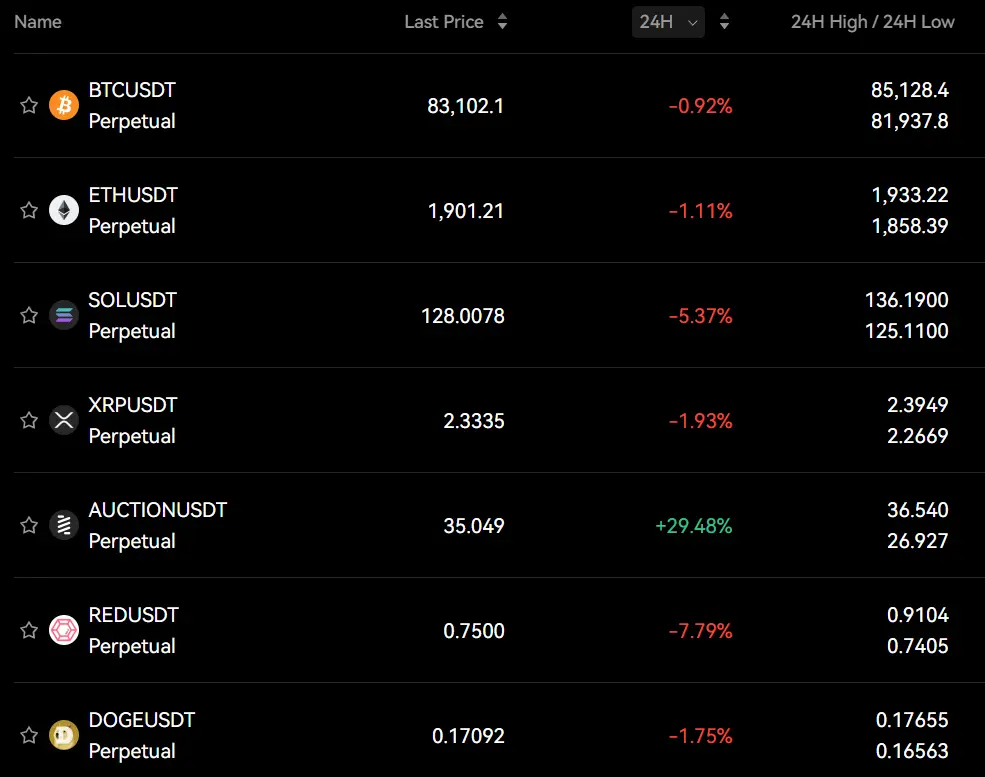

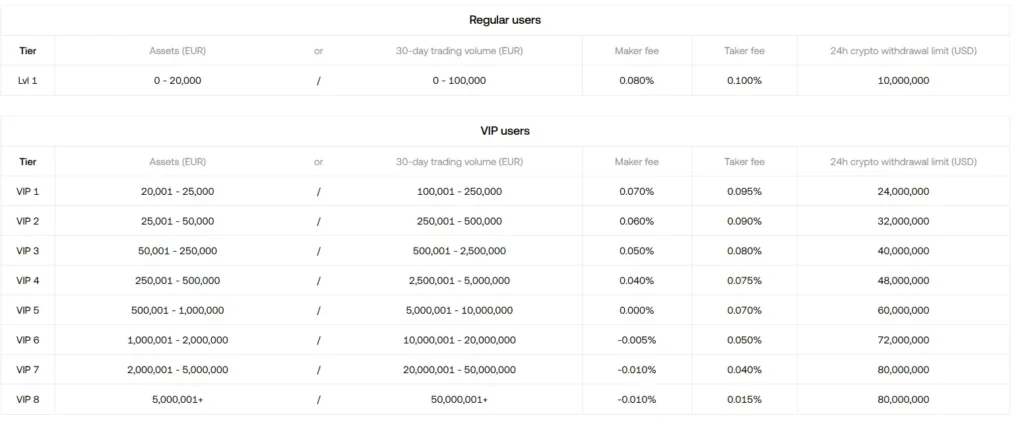

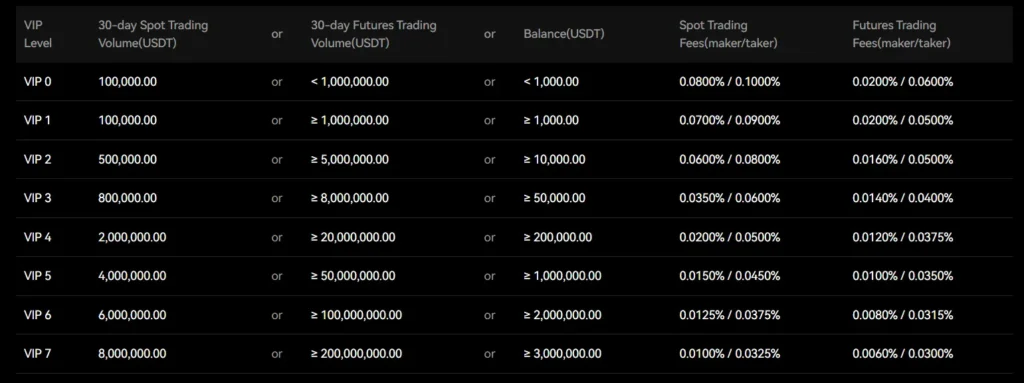

OKX vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and Bitunix, understanding their fee structures can help save you money on your crypto transactions.

OKX charges a standard trading fee of 0.01%, making it one of the most competitive exchanges in the market for 2025. This low fee applies to most trading pairs on their platform.

Bitunix, on the other hand, has a slightly higher trading fee at 0.02%. While this difference might seem small, it can add up significantly with larger trading volumes.

For withdrawal fees, OKX tends to be on the higher side. According to recent data, OKX charges approximately $632.27 for certain withdrawals, which is notably higher than some competitors.

Deposit fees are generally free on both platforms, which is standard across most crypto exchanges.

Here’s a quick comparison:

| Fee Type | OKX | Bitunix |

|---|---|---|

| Trading Fee | 0.01% | 0.02% |

| Deposit Fee | Free | Free |

| Withdrawal Fee | Higher ($632.27) | Varies by crypto |

Trading volume discounts are available on both platforms. The more you trade, the lower your fees can go.

Remember to consider these fees alongside other factors like security, available trading pairs, and user experience when making your choice.

Always check the current fee schedule on each exchange’s website as rates may change over time.

OKX vs Bitunix: Order Types

When trading on OKX or Bitunix, you’ll find various order types to help with your trading strategy. Both exchanges offer the basic market and limit orders for spot and derivatives trading.

OKX provides more advanced order types including:

- Stop orders – Trigger at a specific price

- Take profit orders – Automatically close positions at profit targets

- Trailing stop orders – Follow price movements with adjustable parameters

- Iceberg orders – Hide the true size of large orders

- Time-weighted average price (TWAP) – Split orders over time periods

Bitunix supports standard order types with a clean interface that’s easier for beginners to navigate. Their platform focuses on simplicity while still offering:

- Market orders – Execute immediately at current market price

- Limit orders – Set specific buy/sell prices

- Stop-limit orders – Combine stop triggers with limit pricing

OKX generally caters to more advanced traders with complex needs, while Bitunix provides a more straightforward trading experience.

You can access all order types through both exchanges’ mobile apps, giving you flexibility to trade on the go.

For newer traders, Bitunix’s simpler order selection might be preferable. More experienced traders might appreciate OKX’s additional options for precise trade execution.

OKX vs Bitunix: KYC Requirements & KYC Limits

When choosing between OKX and Bitunix, understanding their KYC (Know Your Customer) requirements can help you make an informed decision.

OKX requires identity verification to meet KYC requirements. Once you complete this process, you can increase your deposit and withdrawal limits. This verification is standard practice for regulated exchanges.

Bitunix offers a tiered KYC system that affects your withdrawal limits. This system helps prevent money laundering while giving users flexibility.

Bitunix KYC Levels:

- Basic KYC: Requires personal information, ID, and a selfie

- Higher KYC levels: Offer increased daily withdrawal limits

While OKX follows stricter KYC protocols, Bitunix is often mentioned in searches for “no KYC crypto exchanges.” However, Bitunix still implements KYC measures – just with different tiers and options.

For users prioritizing privacy, Bitunix may offer more flexibility with its tiered approach. You can start with lower limits and upgrade as needed.

OKX’s verification process is more straightforward but might feel more restrictive if you value privacy.

Your choice depends on your priorities: higher limits with full verification (OKX) or a more flexible, tiered approach (Bitunix).

OKX vs Bitunix: Deposits & Withdrawal Options

When choosing a crypto exchange, deposit and withdrawal options are crucial. Both OKX and Bitunix offer various methods, but they differ in important ways.

OKX supports multiple deposit methods including crypto transfers, bank transfers, and credit/debit cards. Withdrawal options include cryptocurrency transfers to external wallets and bank withdrawals in certain regions.

Bitunix focuses on cryptocurrency deposits and withdrawals across its 270+ supported coins. The platform emphasizes quick processing times for crypto transactions.

Based on the search results, neither platform seems to excel in fiat currency options compared to some competitors. However, this information may be limited as we don’t have complete details about Bitunix’s fiat capabilities.

Fee structures vary between the exchanges:

| Feature | OKX | Bitunix |

|---|---|---|

| Crypto deposits | Free | Free |

| Crypto withdrawals | Varies by coin | Varies by coin |

| Processing time | Standard | Emphasizes speed |

| Supported coins | Large selection | 270+ |

You should check both platforms’ current fee schedules before deciding, as withdrawal fees can significantly impact your overall costs when moving funds regularly.

Security measures for deposits and withdrawals are important factors to consider. Both exchanges implement verification processes to protect your funds during transfers.

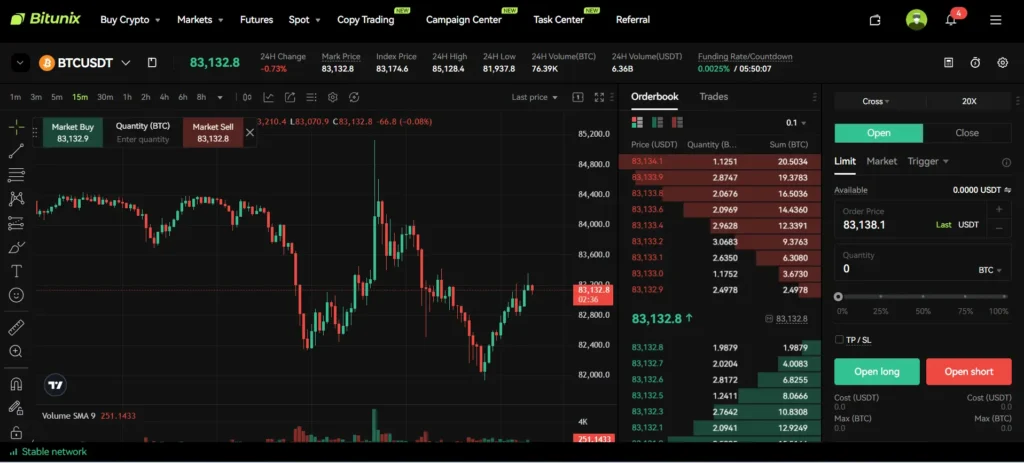

OKX vs Bitunix: Trading & Platform Experience Comparison

When comparing OKX and Bitunix for trading experience, several key differences stand out. OKX is an established platform founded in 2017 with its headquarters in Seychelles, serving users in over 100 countries.

Bitunix is newer to the crypto exchange scene but offers competitive features for traders looking for alternatives.

User Interface

- OKX: Clean, professional interface with advanced charting tools

- Bitunix: Simpler design focused on ease of use for newcomers

Trading Features

| Feature | OKX | Bitunix |

|---|---|---|

| Margin Trading | Yes (with high leverage) | Limited options |

| Trading Pairs | 300+ | Fewer options |

| Mobile App | Highly rated | Basic functionality |

| API Access | Advanced | Standard |

OKX stands out with its low fee structure, making it attractive for high-volume traders. Their platform offers compounding interest at a rate of 1% for Bitcoin holdings.

Bitunix focuses more on providing a straightforward trading experience with fewer complex features. This makes it potentially better for beginners who might feel overwhelmed by OKX’s robust toolset.

OKX provides more advanced trading options including futures, options, and margin trading with significant leverage. Their platform also includes built-in risk management tools.

You’ll find OKX’s platform more suitable for technical analysis with its comprehensive charting capabilities and indicators. Bitunix offers adequate but more basic analytical tools.

OKX vs Bitunix: Liquidation Mechanism

When trading on platforms like OKX and Bitunix, understanding the liquidation mechanism is crucial for your risk management strategy. Liquidation happens when your position can’t meet the margin requirements.

OKX has developed a systematic liquidation mechanism to improve transaction efficiency. Their system is designed to handle liquidated futures and swaps positions without affecting market liquidity. This helps maintain a stable trading environment even during volatile market conditions.

Bitunix also employs a liquidation system, though it differs in some aspects from OKX. Both platforms aim to protect themselves from losses while giving traders a fair chance to manage their positions.

Key Differences in Liquidation Processes:

| Feature | OKX | Bitunix |

|---|---|---|

| Warning system | Sends notifications when approaching liquidation | Provides alerts at critical margin levels |

| Liquidation threshold | Tiered based on leverage and asset | Generally uniform across assets |

| Partial liquidation | Available for larger positions | Limited availability |

Your funds may be at risk due to these liquidation mechanisms, especially during high market volatility. It’s important to monitor your positions carefully and use stop-loss orders to protect yourself.

Both platforms charge liquidation fees, which can add to your losses if your position gets liquidated. Understanding these fees beforehand can help you plan your trading strategy better.

OKX vs Bitunix: Insurance

When choosing a crypto exchange, insurance is a crucial factor to consider. It protects your assets if the platform experiences security breaches or other issues.

OKX offers a Protection Fund that acts as insurance for its users. This fund is designed to cover losses in case of system failures or security breaches. The company regularly publishes reports on the fund’s status to maintain transparency.

Bitunix also provides insurance coverage for its users. They implement robust security measures and backup funds to protect user assets. Their proof of reserves system adds an extra layer of security by verifying that all customer deposits are fully backed.

Both platforms understand the importance of protecting your investments. However, the specifics of coverage limits and conditions may differ between the two exchanges.

It’s worth noting that neither exchange offers full insurance protection like traditional banks with FDIC coverage. Crypto exchange insurance typically has limitations and specific conditions.

Before depositing large amounts, you should review each platform’s insurance policy details. Look for information about:

- Coverage limits

- What triggers a claim

- How quickly funds are reimbursed

- Any exceptions to coverage

Always remember to practice good security habits regardless of exchange insurance. Use two-factor authentication and consider cold storage for large holdings.

OKX vs Bitunix: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both OKX and Bitunix offer support options, but they differ in some important ways.

OKX provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and social media platforms. Their help center contains detailed guides and FAQs to help solve common issues.

Bitunix also offers round-the-clock support, focusing on quick response times. Their customer service team is accessible through chat support and email tickets. Many users report positive experiences with their response times.

Both exchanges offer support in multiple languages, though OKX covers more languages due to its larger global presence. This can be important if English isn’t your first language.

Response times vary between the two platforms. OKX, being a larger exchange, sometimes has longer wait times during peak periods. Bitunix, being smaller, often provides faster initial responses.

Here’s a quick comparison of their support features:

| Feature | OKX | Bitunix |

|---|---|---|

| 24/7 Support | Yes | Yes |

| Live Chat | Yes | Yes |

| Email Support | Yes | Yes |

| Phone Support | Limited | No |

| Help Center | Comprehensive | Basic |

| Multiple Languages | Many | Several |

Your preference might depend on what type of support you value most – OKX’s extensive resources or Bitunix’s potentially quicker response times.

OKX vs Bitunix: Security Features

When choosing a crypto exchange, security should be your top priority. Both OKX and Bitunix offer several security features to protect your investments.

Bitunix stands out by offering proof of reserves, as mentioned in the search results. This transparency allows you to verify that the exchange actually holds the assets it claims to have.

OKX implements multiple security layers including two-factor authentication (2FA), anti-phishing codes, and cold storage for most user funds. These measures help protect your account from unauthorized access.

Bitunix also uses cold storage technology to keep the majority of user assets offline and safe from hackers. Their platform includes additional security features like withdrawal whitelisting and email confirmations.

Both exchanges have risk management systems in place for their trading platforms. These systems help detect unusual activity and can freeze accounts if suspicious behavior is detected.

Security Comparison Table:

| Feature | OKX | Bitunix |

|---|---|---|

| Proof of Reserves | Limited | Yes |

| Two-Factor Authentication | Yes | Yes |

| Cold Storage | Yes | Yes |

| Anti-phishing Protection | Yes | Yes |

| Withdrawal Whitelisting | Yes | Yes |

Remember to enable all available security features when setting up your account on either platform. This includes using a strong, unique password and activating 2FA immediately.

Regular security audits are conducted by both exchanges to identify and fix potential vulnerabilities before they can be exploited.

Is OKX A Safe & Legal To Use?

OKX is considered a safe and legitimate cryptocurrency exchange. As of 2025, it has earned an “AA” rating from CertiK, ranking #3 among the safest crypto exchanges. This high security rating reflects the platform’s commitment to protecting user assets.

The exchange has maintained a solid security record with no reported hacking breaches to date. This is noteworthy in an industry where security incidents are not uncommon.

For online storage, OKX implements essential security measures to protect digital assets. While online wallets generally carry more risk than cold storage options, OKX works to make them as secure as possible.

Security features include:

- Proof of reserves system

- Advanced encryption protocols

- Two-factor authentication (2FA)

- Regular security audits

From a legal standpoint, OKX operates as a regulated exchange in multiple jurisdictions. However, availability varies by country, so you should verify that it’s accessible in your location before registering.

When comparing safety with other major exchanges like Binance, OKX stands up well. Both platforms have strong reputations for security, compliance, and user experience.

Remember to use standard security practices when using OKX or any crypto exchange. Enable all available security features and consider using hardware wallets for long-term storage of significant cryptocurrency holdings.

Is Bitunix A Safe & Legal To Use?

Bitunix has built a solid reputation for security in the cryptocurrency exchange space. According to search results, the platform has not experienced any hacks to date, which is a positive sign for users concerned about safety.

The exchange implements a Proof of Reserves system, adding an extra layer of security for your funds. This transparency measure allows you to verify that the platform actually holds the assets it claims to have.

Bitunix complies with anti-money laundering (AML) regulations, showing its commitment to legal operations. This regulatory compliance helps protect you from potential fraudulent activities on the platform.

The exchange also maintains complete licensing and fund custody arrangements. These measures provide additional protection for your assets while trading on the platform.

When comparing safety features with other exchanges, Bitunix appears to prioritize security protocols. Their focus on both spot and derivatives trading is supported by their safety infrastructure.

Bitunix supports over 270 cryptocurrencies, offering you a wide range of trading options within a secure environment. This combination of variety and security makes it an appealing option for many traders.

Before using any exchange, always conduct your own research and consider using additional security measures like two-factor authentication and strong passwords to further protect your investments.

Frequently Asked Questions

Traders and investors often need quick answers about cryptocurrency exchanges before making important decisions. These common questions address key differences between OKX and Bitunix that matter most to users.

What are the notable differences in security features between OKX and Bitunix?

OKX employs multi-signature wallets and cold storage for over 95% of user funds, while Bitunix uses a combination of cold storage and insurance funds. OKX has faced security challenges in the past but has since strengthened its protocols.

Bitunix offers two-factor authentication, anti-phishing codes, and advanced encryption. Their security record remains clean without major breaches reported to date.

You should note that OKX’s terms of service contain provisions about depositing your funds in their name or a custodian’s name. This could potentially affect your claim to assets if the platform encounters financial difficulties.

How do the trading fees compare between OKX and Bitunix?

OKX charges trading fees of approximately 0.10% for makers and 0.15% for takers on standard accounts. Fee discounts are available based on trading volume and OKB token holdings.

Bitunix maintains a similar fee structure with 0.10% for makers and 0.15% for takers. Their loyalty program offers progressive discounts based on 30-day trading volume rather than token holdings.

Withdrawal fees vary by cryptocurrency on both platforms, with OKX generally charging slightly higher fees for most popular coins. Bitunix offers lower withdrawal fees for BTC and ETH specifically.

Which platform, OKX or Bitunix, offers a wider range of cryptocurrencies?

OKX supports over 350 cryptocurrencies with more than 600 trading pairs. This extensive selection includes most major coins and many emerging altcoins across various blockchain networks.

Bitunix offers approximately 200 cryptocurrencies with around 400 trading pairs. While smaller in range, Bitunix focuses on providing deeper liquidity for its supported assets rather than maximizing token variety.

You’ll find all major cryptocurrencies on both platforms, but OKX holds a clear advantage for traders seeking exposure to newer or more obscure digital assets.

Can you detail the user experience contrast between OKX and Bitunix?

OKX features a comprehensive but potentially overwhelming interface with advanced charting tools, multiple order types, and extensive settings. The mobile app mirrors most desktop functionality but can feel cluttered on smaller screens.

Bitunix presents a more streamlined experience with intuitive navigation and simplified menus. Their interface prioritizes essential functions while keeping advanced features accessible but not distracting.

New users typically find Bitunix easier to navigate initially, while experienced traders may prefer OKX’s depth of tools and customization options. Both platforms offer demo accounts to practice trading without risking real funds.

What are the liquidity levels of OKX compared to Bitunix?

OKX maintains significantly higher liquidity with daily trading volumes exceeding $1.5 billion across all markets. This results in tighter spreads on major pairs and minimal slippage for most reasonable order sizes.

Bitunix handles approximately $300-500 million in daily volume, concentrated primarily in major cryptocurrencies. You may notice wider spreads on altcoin pairs compared to OKX, particularly during volatile market conditions.

For trading popular pairs like BTC/USDT or ETH/USDT, both platforms offer sufficient liquidity for most retail traders. However, OKX provides noticeably better execution for larger orders and less common trading pairs.

How do the customer support services of OKX and Bitunix stack up against each other?

OKX offers 24/7 customer support through live chat, email, and an extensive knowledge base with detailed FAQs. Response times average 10-30 minutes for live chat and 1-2 days for complex email inquiries.

Bitunix provides support via live chat, email, and a ticket system with typical response times of 15-45 minutes. Their support team operates in multiple languages but has fewer total staff members than OKX.

Both platforms maintain active community forums and social media channels for additional assistance. OKX edges out Bitunix in documentation quality and depth, while Bitunix sometimes offers more personalized support for individual cases.

OKX vs Bitunix Conclusion: Why Not Use Both?

After comparing OKX and Bitunix, you might wonder if you need to choose just one platform. The truth is, using both exchanges can be a smart strategy for many crypto traders.

OKX offers lower fees and a wider range of features including DeFi and GameFi options. It’s been around since 2017 and has established itself as a trusted exchange with Proof of Reserves.

Bitunix is newer but growing quickly in the derivatives market. It has also implemented Proof of Reserves, joining trusted exchanges like OKX, Bybit, and Bitget.

Benefits of using both platforms:

- Risk diversification – Keeping assets on multiple exchanges reduces your exposure if one platform faces issues

- Fee optimization – Use each platform when its fee structure benefits your specific trade

- Market opportunities – Access unique trading pairs and features available on each exchange

You can use OKX for its lower fees on regular trades while turning to Bitunix for specific derivatives trading when advantageous.

Remember that both platforms have volatility risks, as with all cryptocurrency exchanges. Prices can change rapidly, affecting the value of your digital assets.

The best approach is to evaluate your personal trading needs and risk tolerance. Many experienced traders maintain accounts on multiple exchanges to maximize opportunities while spreading risk.