When choosing between cryptocurrency exchanges, OKX and BitMEX offer different experiences for traders. OKX provides a more user-friendly platform with a wider range of assets, making it accessible for beginners and experienced traders alike. BitMEX, on the other hand, specializes in leverage trading and has built a historical reputation in the crypto space.

OKX scores higher overall with a 7.3 rating compared to BitMEX’s lower score, and users find OKX significantly easier to use with a 9.4 usability rating versus BitMEX’s 6.3. This difference in user experience can be crucial when you’re making trading decisions quickly in volatile markets.

Your choice between these platforms will depend on your trading goals. If you’re looking for variety and ease of use, OKX might be your better option. If you’re specifically interested in leverage trading and don’t mind a steeper learning curve, BitMEX could serve your needs. Let’s examine their fees, features, and performance to help you make an informed decision.

OKX vs BitMEX: At A Glance Comparison

OKX and BitMEX are popular cryptocurrency exchanges that offer advanced trading features. Here’s how they compare:

| Feature | OKX | BitMEX |

|---|---|---|

| User Interface | More user-friendly (9.4/10) | Less intuitive (6.3/10) |

| Target Users | Both beginners and advanced traders | Primarily experienced traders |

| Asset Selection | Wide range of cryptocurrencies | More limited selection |

| Trading Tools | Comprehensive suite | Advanced but specialized |

| Leverage Options | Multiple leverage levels | Known for high leverage trading |

OKX provides a more accessible platform for new traders while still offering advanced features. The interface is designed to help you navigate easily through different trading options.

BitMEX has built its reputation on leverage trading and appeals to experienced traders. You might find it more challenging to use, but it offers specialized tools for sophisticated trading strategies.

When choosing between these platforms, consider your experience level. If you’re new to crypto trading, OKX’s user-friendly interface might be better suited for your needs.

For advanced traders, both platforms offer valuable features. Your choice depends on which specific trading tools you prioritize and which cryptocurrencies you want to trade.

Both exchanges provide competitive services but cater to slightly different trading preferences and skill levels.

OKX vs BitMEX: Trading Markets, Products & Leverage Offered

OKX offers a more diverse range of trading products compared to BitMEX. When using OKX, you can access spot trading, futures, options, and leveraged tokens all in one platform.

BitMEX specializes primarily in futures trading with high leverage options. It has built its reputation on this focus, which attracts experienced traders looking for specific derivatives tools.

Available Products Comparison:

| Feature | OKX | BitMEX |

|---|---|---|

| Spot Trading | ✓ | ✗ |

| Futures | ✓ | ✓ |

| Options | ✓ | Limited |

| Leveraged Tokens | ✓ | ✗ |

For leverage trading, both platforms offer significant options. BitMEX has historically been known for high leverage trading, which appeals to experienced traders looking for amplified positions.

OKX provides leverage trading too, but within a broader ecosystem of products. This makes it potentially more suitable if you want to diversify your trading activities beyond just futures.

The asset selection also differs between platforms. OKX supports a wider range of cryptocurrencies across its various trading products. BitMEX offers fewer assets but with specialized contract types for futures traders.

If you’re a beginner, OKX’s user interface might be more approachable. BitMEX tends to cater to more experienced traders with its specialized focus on derivative products.

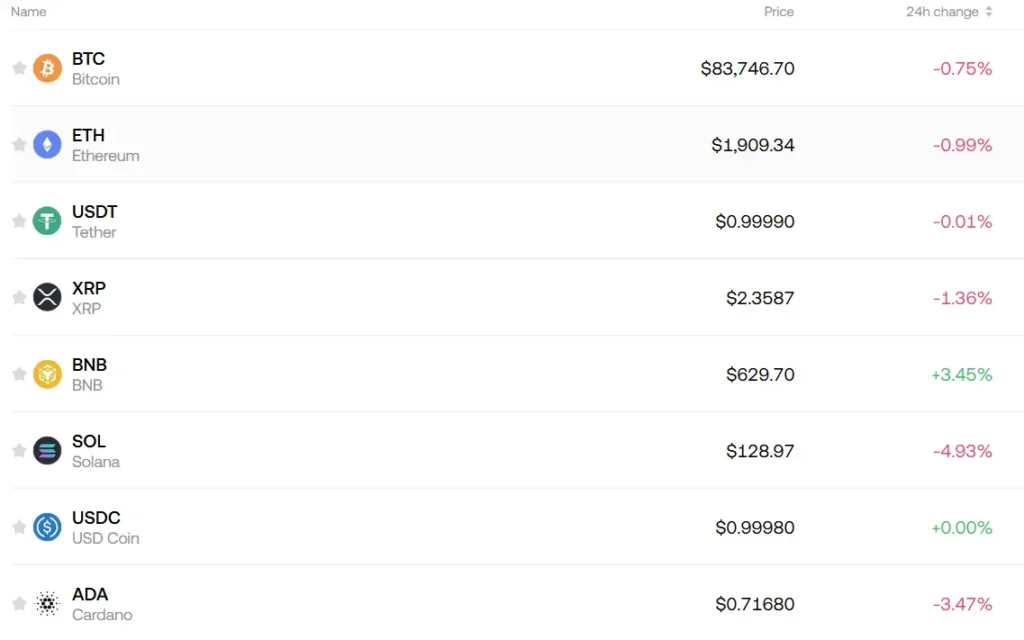

OKX vs BitMEX: Supported Cryptocurrencies

When choosing between OKX and BitMEX exchanges, the variety of supported cryptocurrencies is an important factor to consider.

OKX offers a much wider range of cryptocurrencies for trading. You can access hundreds of different tokens and coins on their platform, giving you more flexibility in your trading strategy.

BitMEX, in contrast, supports a more limited selection of cryptocurrencies. It primarily focuses on Bitcoin and a handful of major altcoins, which might be sufficient if you mainly trade popular cryptocurrencies.

Here’s a quick comparison of supported assets:

| Exchange | Number of Cryptocurrencies | Primary Focus |

|---|---|---|

| OKX | 300+ | Wide variety |

| BitMEX | ~15 | Bitcoin & major altcoins |

If you want to trade newer or less common altcoins, OKX is likely the better choice. Their platform regularly adds new tokens as they gain popularity in the market.

BitMEX’s more focused approach allows them to offer deep liquidity for their supported assets. This can be advantageous if you only need to trade the most established cryptocurrencies.

Both exchanges offer futures and derivatives products, but OKX provides these options across more cryptocurrency pairs. This gives you more opportunities to diversify your trading strategy.

Your choice between these exchanges may ultimately depend on which specific cryptocurrencies you wish to trade.

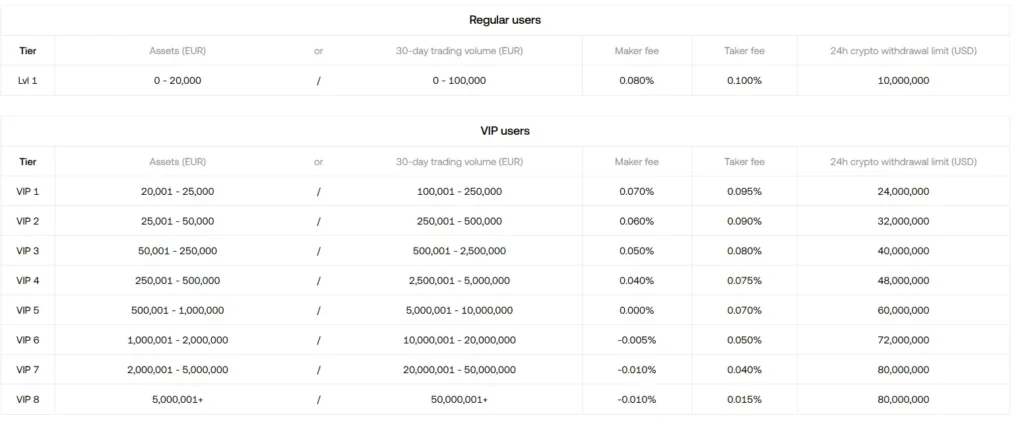

OKX vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and BitMEX, fee structures play a crucial role in your trading decisions. Understanding these costs can help maximize your profits.

Trading Fees

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| OKX | Up to 0.40% | Up to 0.40% |

| BitMEX | -0.025% (rebate) | Up to 0.075% |

BitMEX offers a more competitive fee structure for active traders. The platform provides a 0.025% maker rebate, meaning you actually earn when adding liquidity to the market.

OKX’s trading fees are higher, reaching up to 0.40% per trade. However, these may decrease based on your trading volume and OKX token holdings.

Withdrawal Fees

| Exchange | Withdrawal Fee |

|---|---|

| OKX | Up to $60 (varies by asset) |

| BitMEX | 0.00003 BTC (fixed amount) |

BitMEX uses a fixed withdrawal fee structure based on Bitcoin. This makes costs predictable but might be expensive for small withdrawals.

OKX’s withdrawal fees vary by cryptocurrency, with some reaching up to $60. You should check their current fee schedule before withdrawing.

Neither platform charges deposit fees, which is standard across most cryptocurrency exchanges.

Your trading style and frequency will determine which fee structure works better for you. High-volume traders might benefit from BitMEX’s maker rebates, while occasional traders might find other factors more important.

OKX vs BitMEX: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both OKX and BitMEX offer various order types, but with some key differences.

OKX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Trailing Stop Orders

- Iceberg Orders

- Time-Weighted Average Price (TWAP)

- Advanced Conditional Orders

OKX provides a wider range of order types, making it more versatile for different trading strategies. You can use their advanced conditional orders to create complex trading rules based on multiple factors.

BitMEX Order Types:

- Market Orders

- Limit Orders

- Stop Orders

- Take Profit Orders

- Hidden Orders

- Post-Only Orders

BitMEX focuses more on derivatives trading with high leverage. Their platform is optimized for professional traders who need specific order execution options.

Both platforms offer the essential order types like market, limit, and stop orders. However, OKX gives you more advanced options for algorithmic trading.

The user interface for placing orders also differs between the exchanges. OKX has a more modern, user-friendly interface while BitMEX maintains a more technical trading terminal approach.

Your trading style should guide your choice. If you need a wide variety of order types for complex strategies, OKX might be the better option. For focused derivative trading with specific order execution needs, BitMEX could serve you well.

OKX vs BitMEX: KYC Requirements & KYC Limits

BitMEX now requires all users to complete KYC verification before trading. This process involves submitting government-issued identification and proof of address documents.

There are no trading limits for verified BitMEX users. Once verified, you can deposit and withdraw unlimited amounts, giving you flexibility for large-scale trading.

OKX also implements KYC requirements but offers a tiered verification system. Basic verification requires personal information, while higher tiers need additional documentation for increased trading limits.

BitMEX KYC Process:

- Mandatory for all trading activities

- Requires government ID submission

- No unverified trading allowed

- Unlimited deposits/withdrawals for verified users

OKX KYC Process:

- Tiered verification system

- Basic tier: limited functionality

- Advanced tiers: higher withdrawal and trading limits

- Similar document requirements (ID, proof of address)

The verification time varies between exchanges. BitMEX typically processes KYC within 1-2 business days, while OKX might complete basic verification faster, sometimes within hours.

Both exchanges comply with global regulatory standards. This helps protect your assets and ensures the platforms operate legally in their jurisdictions.

If you value privacy, it’s worth noting both exchanges now require identity verification, marking a shift from earlier crypto exchange practices that allowed anonymous trading.

OKX vs BitMEX: Deposits & Withdrawal Options

When choosing between OKX and BitMEX, understanding the deposit and withdrawal options is crucial for your trading experience. These features affect how easily you can move your funds in and out of the platforms.

BitMEX charges withdrawal fees based on dynamic Bitcoin prices. The platform offers a more limited range of deposit options compared to OKX. Some users may find BitMEX’s withdrawal fees relatively high, with reports suggesting they can reach up to 0.00003 BTC per transaction.

OKX provides more diverse deposit and withdrawal methods. This platform’s withdrawal fees can go up to $60, depending on the cryptocurrency and network you choose. OKX generally appeals to traders who need flexibility with their payment options.

Both exchanges use blockchain confirmations for deposits, which means transfer times depend on network congestion. Your deposits might be faster or slower based on current blockchain conditions.

When withdrawing funds, OKX typically processes requests more quickly than BitMEX. You should consider these processing times when planning your trading strategy, especially if you need quick access to your funds.

Security measures for deposits and withdrawals are robust on both platforms. They employ multi-signature wallets and cold storage solutions to protect your assets during transfers.

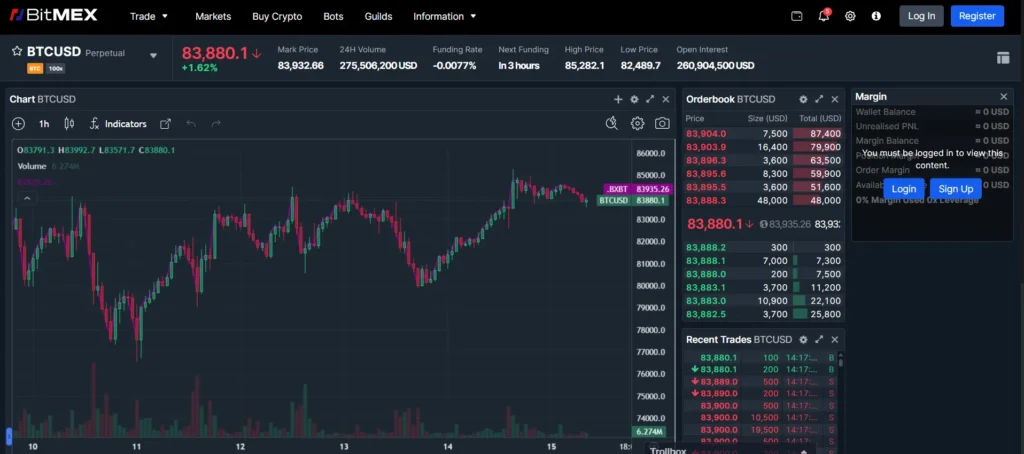

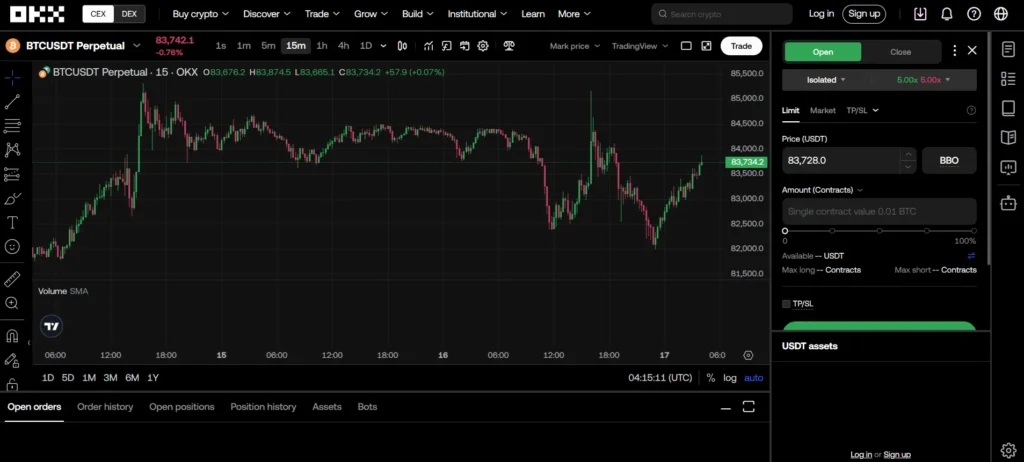

OKX vs BitMEX: Trading & Platform Experience Comparison

When comparing OKX and BitMEX trading platforms, ease of use stands out as a key difference. OKX scores significantly higher (9.4) than BitMEX (6.3) for user-friendliness, making it more accessible for new traders.

BitMEX has built its reputation on leverage trading and attracts experienced traders. However, its interface can be challenging to navigate for beginners. The platform offers sophisticated tools but requires a steeper learning curve.

OKX provides a more comprehensive range of trading options. You can access perpetual swaps, futures, and options all in one place. This variety gives you more flexibility to execute different trading strategies.

Both platforms offer mobile apps, but OKX’s app tends to mirror its user-friendly web experience. You’ll find the mobile trading experience more intuitive on OKX compared to BitMEX.

Trading fees structure differs between the platforms. Before choosing, you should compare their fee schedules based on your typical trading volume and preferred contract types.

Platform Features Comparison:

| Feature | OKX | BitMEX |

|---|---|---|

| Ease of Use | 9.4/10 | 6.3/10 |

| Trading Options | Perpetuals, futures, options | Primarily leverage trading |

| Beginner Friendly | Yes | No |

| Asset Variety | Wide range | More limited |

| Mobile Experience | Smooth, intuitive | Less user-friendly |

Your trading style and experience level should guide your choice between these platforms. OKX works better for most traders, while BitMEX appeals to those who prioritize advanced leverage trading features.

OKX vs BitMEX: Liquidation Mechanism

When trading with leverage, understanding how exchanges handle liquidations is crucial for your risk management. OKX and BitMEX have different approaches to this process.

OKX supports isolated margin trading, which means only the funds you allocate to a specific trade can be liquidated. This protects your other positions and account balance from being affected.

BitMEX, on the other hand, has faced criticism for its liquidation mechanism. During volatile market conditions, their system has been accused of leading to more frequent user liquidations, especially for traders using high leverage.

OKX has implemented a liquidation sharing mechanism. This feature distributes liquidation responsibilities across users, potentially reducing the impact of large market movements on individual traders.

BitMEX’s liquidation process has historically been more aggressive. This has led to notorious liquidation events that some traders refer to as “liquidation cascades” where one large liquidation can trigger many others.

For new traders, OKX’s isolated margin approach offers better protection against total account liquidation. You can limit potential losses to just the funds in a specific position.

BitMEX’s system might be more suitable for experienced traders who understand the risks and can manage their positions accordingly during high volatility.

When choosing between these platforms, consider your trading experience level and risk tolerance regarding how liquidations are handled.

OKX vs BitMEX: Insurance

When trading cryptocurrencies, you need to consider how your funds are protected. Both OKX and BitMEX offer insurance funds, but they differ in several ways.

OKX maintains a robust insurance fund worth over $600 million as of 2025. This fund protects users from auto-deleveraging during extreme market volatility. Your positions are less likely to be forcibly closed when prices swing wildly.

BitMEX’s insurance fund is smaller but still substantial at approximately $250 million. It serves a similar purpose of protecting traders during volatile market conditions.

Key Differences:

| Feature | OKX | BitMEX |

|---|---|---|

| Fund Size | ~$600 million | ~$250 million |

| Transparency | Daily reports | Weekly updates |

| Coverage Scope | All trading pairs | Bitcoin-focused |

OKX provides more detailed transparency reports on their insurance fund usage. You can check daily updates on their website about fund movements and allocations.

BitMEX focuses its insurance protection more heavily on Bitcoin-related trading pairs. If you primarily trade BTC contracts, this specialized focus might benefit you.

Neither platform offers direct FDIC-like insurance for your crypto holdings. Your funds remain subject to platform risk regardless of these protections.

When choosing between these exchanges, consider how much of your trading will involve volatile positions that might need insurance fund protection.

OKX vs BitMEX: Customer Support

When trading cryptocurrencies, access to reliable customer support can make a big difference. Based on review data, OKX appears to have a significant advantage in this area.

OKX receives much higher ratings for customer support quality, with a score of 9.1 compared to BitMEX’s 6.1. This suggests that OKX users generally experience more satisfactory support interactions.

OKX Support Features:

- 24/7 support availability

- Multiple contact channels (live chat, email, ticket system)

- Comprehensive help center with guides

- Generally faster response times

BitMEX Support Features:

- Email ticket system

- Help center documentation

- Community forums

- Slower average response times

You might find OKX more suitable if you value responsive customer service, especially as a newer trader who may need more guidance. BitMEX’s support, while functional, appears less robust according to user feedback.

Response time is another important factor to consider. OKX typically provides faster replies to user inquiries, which can be crucial during urgent trading situations or account issues.

Both exchanges offer self-help resources, but OKX’s documentation tends to be more user-friendly and comprehensive for beginners. BitMEX’s resources often assume a higher level of trading knowledge.

OKX vs BitMEX: Security Features

When comparing OKX and BitMEX, security should be a top priority for your trading decisions. Both platforms offer various security measures to protect your assets.

OKX provides strong security through multi-signature wallets and cold storage for most user funds. They also use two-factor authentication (2FA) to add an extra layer of protection to your account.

BitMEX has built a solid reputation for security over the years. They store most user funds in cold wallets that are disconnected from the internet. This approach helps protect against online hacking attempts.

Both exchanges offer:

- Two-factor authentication

- Cold storage for funds

- Email confirmations for withdrawals

- IP address monitoring

OKX seems to have better customer support for security issues based on user reviews. The search results indicate that OKX has a 9.1 rating for support quality, while BitMEX scores only 6.1.

BitMEX’s security model focuses on its operational structure, which many experienced traders find trustworthy. Their system has withstood market volatility and maintained security during high-traffic periods.

Security Feature Comparison:

| Feature | OKX | BitMEX |

|---|---|---|

| Cold Storage | Yes | Yes |

| 2FA | Yes | Yes |

| Support Rating | 9.1 | 6.1 |

| Insurance Fund | Yes | Yes |

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious with account access.

Is OKX a Safe & Legal To Use?

OKX is generally considered a safe and legal cryptocurrency exchange to use. It has received an “AA” rating from CertiK, ranking as the #3 safest crypto exchange based on recent evaluations.

Security is a strong point for OKX. Unlike some competitors, the platform has not experienced any major hacking breaches to date, which is reassuring for users concerned about their funds.

The exchange implements standard security features you would expect from a reputable platform. These include:

- Two-factor authentication (2FA)

- Cold storage for most user funds

- Regular security audits

- Anti-phishing measures

From a legal standpoint, OKX operates with licenses in several jurisdictions. However, availability varies by country, so you should verify if the service is permitted in your location before signing up.

The platform balances security with user-friendliness, making it accessible for both beginners and experienced traders. Its interface is designed to be navigable while maintaining robust protection of your assets.

When comparing OKX to BitMEX, OKX often scores higher in overall evaluations. According to search results, OKX has an overall score of 7.3 compared to BitMEX’s lower rating.

Before using any crypto exchange, you should always conduct your own research and consider your specific trading needs and risk tolerance.

Is BitMEX a Safe & Legal To Use?

BitMEX has faced legal challenges in recent years that raise concerns about its safety and legality. In 2020, the platform encountered issues with U.S. regulators, which led to significant changes in their operations.

Currently, BitMEX is not available to users in the United States and several other restricted regions. If you live in these areas, you cannot legally use the platform.

For users in permitted regions, BitMEX has worked to improve its reputation by enhancing compliance and security features. The exchange now implements stronger KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

BitMEX offers security features like two-factor authentication and withdrawal address whitelisting to protect your account. Their multi-signature wallet system adds an extra layer of protection for stored funds.

Despite these improvements, some traders still express concerns about BitMEX’s past. The platform has been associated with complaints, investigations, and allegations of unethical practices.

When considering BitMEX, remember this advice from experienced users: “Trust it as far as you need for your trades but don’t accumulate on it more than what you need.” This suggests keeping only necessary trading funds on the platform.

BitMEX is technically legal to use if you’re outside restricted regions, but you should weigh the platform’s history against its recent improvements before deciding to trade there.

Frequently Asked Questions

Traders often have specific concerns when choosing between cryptocurrency exchanges. These questions address the key differences between OKX and BitMEX across several important aspects of trading platforms.

What are the main differences in the fee structures between OKX and BitMEX?

OKX and BitMEX have different fee structures that impact your trading costs. OKX typically offers a tiered fee system based on your trading volume and OKX token holdings.

BitMEX uses a maker-taker fee model where makers (those adding liquidity) often receive rebates while takers (those removing liquidity) pay fees. Their fee schedule is generally straightforward but may be higher for certain contract types.

The specific rates change periodically, so you should check their official websites for the most current fee information before trading.

Which exchange provides a wider range of cryptocurrencies for trading, OKX or BitMEX?

OKX offers a significantly larger selection of cryptocurrencies and trading pairs compared to BitMEX. On OKX, you can trade hundreds of different digital assets across spot, margin, and derivatives markets.

BitMEX has a more limited focus, primarily offering Bitcoin and a select few altcoin derivatives contracts. Their platform specializes in cryptocurrency derivatives rather than supporting a wide variety of tokens.

If variety is important to you, OKX provides more options for diversifying your trading portfolio.

How do the security features of OKX compare with those offered by BitMEX?

Both exchanges implement strong security measures, but with different approaches. OKX provides features like two-factor authentication, anti-phishing codes, and multi-signature wallets to protect your funds.

BitMEX is known for its security infrastructure that includes multi-signature wallets and cold storage for customer funds. They also run regular security audits of their systems.

Neither exchange has experienced major security breaches in recent years, though both have faced regulatory challenges at different points.

Which platform, OKX or BitMEX, is known for providing a more user-friendly trading experience?

OKX generally offers a more user-friendly experience with a cleaner interface that appeals to both beginners and experienced traders. Their platform includes educational resources and a more intuitive design.

BitMEX has traditionally catered to experienced traders with a more technical interface. Users report that BitMEX has a lower ease of use rating (6.3) compared to OKX (9.4), making it potentially more challenging for newcomers to navigate.

If you’re new to cryptocurrency trading, you might find OKX easier to use, while experienced traders may appreciate BitMEX’s advanced features.

What are the leverage options available on OKX versus BitMEX for traders?

Both exchanges offer high leverage options, but with different maximums. OKX provides leverage of up to 125x on futures contracts, depending on the specific cryptocurrency pair and market conditions.

BitMEX has been known for offering up to 100x leverage on certain contracts, particularly Bitcoin perpetual contracts. This high leverage is one of the features that initially made BitMEX popular among risk-tolerant traders.

You should approach high leverage with caution as it significantly increases both potential profits and losses.

Do OKX and BitMEX both offer futures and derivatives trading, and how do they compare?

Yes, both platforms specialize in cryptocurrency derivatives trading, but with different strengths. OKX offers a wider range of derivatives including futures, perpetual swaps, options, and more recently added DeFi products.

BitMEX focuses primarily on perpetual contracts and futures, with particular emphasis on Bitcoin derivatives. They pioneered the perpetual swap contract that has become standard across the industry.

OKX provides more variety in contract types and underlying assets, while BitMEX offers a more specialized experience with potentially deeper liquidity in its core markets.

BitMEX vs OKX Conclusion: Why Not Use Both?

Choosing between BitMEX and OKX doesn’t have to be an either/or decision. You can benefit from using both platforms based on your specific trading needs.

BitMEX offers strong liquidity and was the first to launch perpetual contracts. However, it has a steeper learning curve with a user interface that many beginners find challenging.

OKX provides a more user-friendly experience with a higher ease of use rating (9.4 compared to BitMEX’s 6.3). It also offers a wider range of assets for trading.

Key strengths of each platform:

| Platform | Strengths |

|---|---|

| BitMEX | High liquidity, advanced trading features, historical reputation |

| OKX | User-friendly interface, wide asset selection, better for beginners |

You might consider using BitMEX for specific advanced trading strategies while relying on OKX for day-to-day trading or when exploring new assets.

Many experienced traders maintain accounts on multiple exchanges to take advantage of different fee structures, liquidity pools, and unique features.

Your trading volume, preferred assets, and comfort with complex interfaces should guide your decision. Start with the platform that feels most comfortable, then expand to the other as you gain experience.

Remember to verify the regulatory status of both platforms in your region before opening accounts.