Choosing between cryptocurrency exchanges can be tough with so many options available. OKX and BingX are two popular platforms that offer various services for crypto traders. Both exchanges provide quick load times and efficient trade execution, but they differ in their features, fees, and user experience.

OKX stands out with more advanced analytical tools and trading features, making it suitable for experienced traders who need detailed market analysis. BingX, on the other hand, offers a more straightforward approach that might appeal to beginners. You’ll want to consider factors like supported cryptocurrencies, trading fees, and available features when making your choice.

When comparing these platforms, you should think about your trading style and needs. OKX might be better if you’re looking for advanced tools, while BingX could be the right choice if you value simplicity and ease of use. The right exchange depends on what matters most to you as a trader.

OKX vs BingX: At A Glance Comparison

When choosing between OKX and BingX, you need to understand their key differences. Both platforms offer cryptocurrency trading but have distinct features that set them apart.

OKX is a more established exchange with a wider range of cryptocurrencies and trading options. BingX specializes in copy trading and social trading features, making it appealing for beginners.

Here’s a quick comparison of the main features:

| Feature | OKX | BingX |

|---|---|---|

| Founded | 2017 | 2018 |

| Available Cryptocurrencies | 350+ | 150+ |

| Trading Fees | 0.08-0.10% maker/taker | 0.10-0.15% maker/taker |

| Special Features | Advanced trading tools, DeFi hub | Copy trading, social features |

| Mobile App | Yes | Yes |

| Beginner Friendly | Moderate | High |

OKX offers more advanced trading options including futures, options, and margin trading. The platform caters to experienced traders who need sophisticated tools.

BingX stands out with its copy trading system. You can follow successful traders and automatically copy their strategies, which is helpful if you’re new to crypto trading.

Security is important for both platforms. They use two-factor authentication and cold storage solutions to protect your assets. However, OKX generally has a stronger reputation for security measures.

The user interface differs between the two. BingX offers a simpler, more intuitive experience while OKX provides more detailed charts and analysis tools.

OKX vs BingX: Trading Markets, Products & Leverage Offered

Both OKX and BingX offer a variety of trading options for cryptocurrency enthusiasts. Your choice between them may depend on what specifically you want to trade.

OKX provides a comprehensive range of cryptocurrencies and trading products. It has built a strong reputation in the market as one of the top crypto exchanges in 2025. The platform offers spot trading, futures, options, and margin trading.

BingX is known for its substantial leverage options across different trading instruments. The leverage limits vary depending on the product you choose to trade.

Leverage Comparison:

| Platform | Max Leverage |

|---|---|

| BingX | Higher leverage on certain pairs |

| OKX | Competitive leverage options |

When it comes to trading markets, both platforms support a wide selection of cryptocurrencies. OKX tends to offer more comprehensive trading options, making it attractive if you want variety.

For margin and leverage trading specifically, BingX is recognized as one of the best crypto leverage trading platforms in 2025. It stands alongside major competitors like Binance, MEXC, and Bybit.

Your trading style and risk tolerance should guide your choice. If you prefer higher leverage for potentially larger gains (and risks), BingX might be more suitable. For a broader selection of trading products and cryptocurrencies, OKX could be the better option.

Both platforms continue to update their offerings regularly to stay competitive in the fast-paced crypto market.

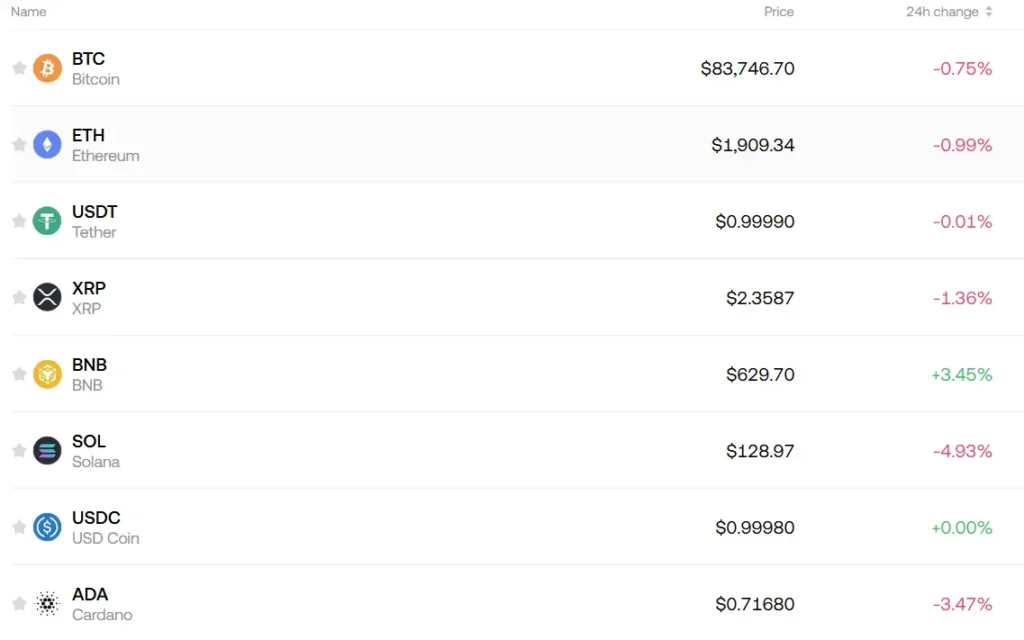

OKX vs BingX: Supported Cryptocurrencies

When choosing between OKX and BingX, the range of available cryptocurrencies is an important factor to consider. Both exchanges offer a variety of digital assets, but there are some differences worth noting.

OKX provides access to a more extensive selection of cryptocurrencies. You can trade hundreds of different tokens on their platform, including major coins like Bitcoin and Ethereum as well as numerous altcoins and newer projects.

BingX, while still offering a solid range of cryptocurrencies, typically has a smaller selection compared to OKX. You’ll find all the major cryptocurrencies on BingX, but the platform may not list as many emerging or niche tokens.

Here’s a quick comparison of the cryptocurrency support:

| Feature | OKX | BingX |

|---|---|---|

| Total cryptocurrencies | 300+ | 150+ |

| Major coins (BTC, ETH) | ✓ | ✓ |

| Stablecoins | ✓ | ✓ |

| DeFi tokens | Extensive | Limited |

| New listings | Frequent | Less frequent |

Both exchanges regularly update their offerings, adding new cryptocurrencies as they gain popularity or market significance. You should check their official websites for the most current list of supported coins if you’re looking for specific tokens.

Trading pairs also differ between the platforms. OKX typically offers more trading pair combinations, giving you greater flexibility in how you trade between different cryptocurrencies.

OKX vs BingX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between OKX and BingX, understanding their fee structures can help you make a better decision. Both exchanges offer competitive rates, but they differ in several ways.

OKX Trading Fees:

- Spot trading: 0.1% standard fee

- Futures trading: 0.02% maker fee / 0.05% taker fee

BingX Trading Fees:

- Both exchanges use a tiered fee structure where higher trading volumes result in lower fees

- Their base rates are competitive in the crypto exchange marketplace

The deposit methods also vary between these platforms. You’ll find that both exchanges support multiple cryptocurrency deposit options, but the specific coins and tokens supported may differ.

Withdrawal fees are another important consideration for your trading strategy. These fees typically vary by cryptocurrency and can change based on network conditions.

Both OKX and BingX have created fee structures that become more advantageous as your trading volume increases. This rewards active traders with better rates.

When comparing these exchanges, you should check their current fee schedules directly on their websites. Crypto exchange fees can change frequently based on market conditions and competition.

Your trading style will determine which fee structure works best for you. If you’re a high-volume trader, the tiered discounts might be more beneficial. For occasional traders, the base rates and withdrawal fees might matter more.

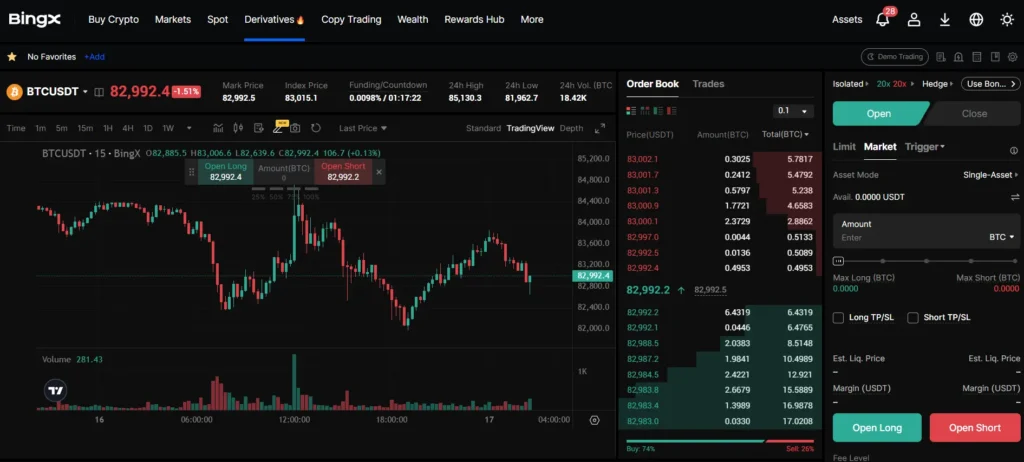

OKX vs BingX: Order Types

When trading on cryptocurrency exchanges, the types of orders available can significantly impact your trading strategy. Both OKX and BingX offer a variety of order types to meet different trading needs.

OKX provides a comprehensive range of order options. You can use market orders for immediate execution at the current market price. Limit orders allow you to set a specific price for buying or selling.

OKX also supports stop-loss and take-profit orders to manage risk. More advanced traders can access trailing stops and OCO (One-Cancels-Other) orders for sophisticated strategies.

BingX offers similar basic order types including market and limit orders. Their platform includes stop-loss functionality to protect your positions from significant losses.

One notable difference is BingX’s copy trading feature, which lets you automatically replicate the trades of successful traders. This can be helpful if you’re new to trading or want to learn from experienced traders.

Both platforms support conditional orders, but OKX tends to offer more complex order combinations for advanced trading strategies.

The user interface for placing orders on BingX is generally considered more beginner-friendly. OKX’s order interface provides more options but might feel overwhelming if you’re just starting out.

For mobile trading, both exchanges offer functional apps where you can place various order types on the go.

OKX vs BingX: KYC Requirements & KYC Limits

Both OKX and BingX have different approaches to Know Your Customer (KYC) verification, which affects your trading experience and withdrawal limits.

OKX requires users to complete KYC verification by submitting personal information and identification documents. This process is similar to other major exchanges and helps ensure platform security.

BingX offers more flexibility with KYC. You can trade on BingX without completing KYC verification, but you’ll face certain limitations.

Withdrawal Limits Comparison:

| Exchange | Without KYC | With KYC |

|---|---|---|

| BingX | Up to 50,000 USDT daily | Higher limits |

| OKX | Very limited | Standard limits |

BingX’s daily withdrawal limit of 50,000 USDT without KYC is quite generous compared to industry standards.

For frequent traders or those handling larger amounts, completing KYC on either platform is recommended. This will unlock all features and higher withdrawal limits.

It’s worth noting that AlphaX was mentioned in search results as a decentralized exchange (DEX) alternative that doesn’t require KYC, similar to the trading experience of OKX or BingX.

When choosing between these platforms, consider your privacy preferences and trading volume needs. If minimal verification is important to you, BingX offers more flexibility. For those comfortable with standard verification, OKX provides a secure, fully-featured experience.

OKX vs BingX: Deposits & Withdrawal Options

When choosing between OKX and BingX, understanding their deposit and withdrawal options is crucial for your trading experience.

OKX provides multiple deposit methods with reasonable fees. You can fund your account through bank transfers and various cryptocurrency options.

BingX also offers diverse deposit methods, including bank transfers and cryptocurrency deposits. Their system is designed to accommodate different user preferences.

Both exchanges support cryptocurrency deposits, which is essential for traders who already hold digital assets. This option typically processes faster than traditional banking methods.

For withdrawals, both platforms have established procedures with varying fee structures. OKX is known for its reasonable withdrawal fees, while BingX’s fees are competitive within the market.

Comparison Table:

| Feature | OKX | BingX |

|---|---|---|

| Bank Transfers | Available | Available |

| Crypto Deposits | Multiple coins supported | Multiple coins supported |

| Withdrawal Options | Various options | Various options |

| Fee Structure | Reasonable | Competitive |

Processing times may differ between the two platforms. Some users report faster transactions on one platform versus the other, though this can vary based on network congestion and verification requirements.

You should consider these deposit and withdrawal options in relation to your location, as availability of certain methods might depend on your country of residence.

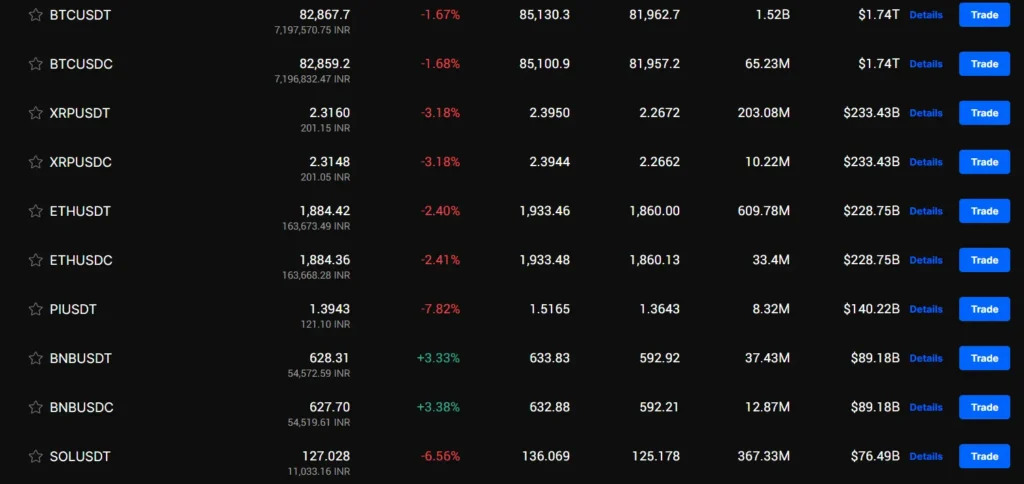

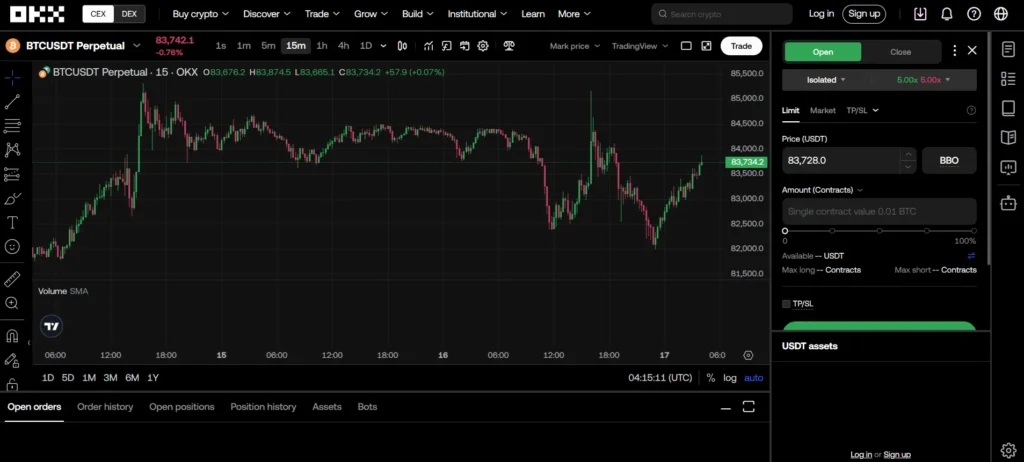

OKX vs BingX: Trading & Platform Experience Comparison

When choosing between OKX and BingX, your trading experience will be shaped by their unique platform features and interfaces.

OKX offers a comprehensive trading environment that caters to both beginners and advanced traders. You’ll find a clean interface with detailed charting tools and multiple order types to execute your trading strategies.

BingX, on the other hand, has gained popularity for its user-friendly approach and social trading features. You can copy successful traders’ strategies directly, making it appealing if you’re new to cryptocurrency trading.

Trading Tools Comparison:

| Feature | OKX | BingX |

|---|---|---|

| Mobile App | ✓ | ✓ |

| Desktop Platform | ✓ | ✓ |

| Advanced Charts | Advanced | Intermediate |

| Copy Trading | Limited | Extensive |

| Demo Account | ✓ | ✓ |

BingX stands out with its copy trading capabilities, which let you automatically mirror experienced traders’ moves. This feature is particularly valuable if you’re still learning the ropes.

OKX provides more advanced trading tools and a wider range of order types. You’ll appreciate these features if you have specific trading strategies that require precise execution.

Both platforms offer demo accounts where you can practice trading without risking real money. This is helpful for testing strategies before committing actual funds.

Your choice should ultimately depend on your trading style and experience level. OKX might better serve advanced traders, while BingX offers an easier entry point for beginners.

OKX vs BingX: Liquidation Mechanism

When trading with leverage on OKX and BingX, understanding the liquidation mechanism is crucial for your risk management. Both platforms have systems in place to protect themselves when your positions approach their maintenance margin levels.

OKX uses a tiered liquidation system based on your account’s risk ratio. When this ratio approaches critical levels, you’ll receive warnings before any action is taken. The platform typically begins partial liquidation to give you time to add funds.

BingX employs a similar risk management approach but often provides a slightly longer window before liquidation occurs. Their system calculates your position’s health based on current market prices and your collateral value.

Liquidation Thresholds Comparison:

| Platform | Initial Warning | Partial Liquidation | Full Liquidation |

|---|---|---|---|

| OKX | 80% risk ratio | 90% risk ratio | 100% risk ratio |

| BingX | 85% risk ratio | 95% risk ratio | 100% risk ratio |

Both platforms offer liquidation prevention tools like stop-loss orders and automatic margin additions. OKX provides more advanced risk management features with its portfolio margin system for experienced traders.

BingX stands out with its more beginner-friendly liquidation notifications, sending alerts through multiple channels (app, email, SMS) when your positions approach dangerous levels.

You can reduce liquidation risk on both platforms by trading with lower leverage and setting appropriate stop-loss orders ahead of time.

OKX vs BingX: Insurance

When choosing a crypto exchange, insurance protection is a crucial factor to consider. Both OKX and BingX offer some form of insurance to protect user funds, but there are important differences.

OKX maintains a dedicated insurance fund that helps protect traders from extreme market volatility. This fund acts as a safety net when liquidations occur but market conditions prevent the exchange from closing positions at the bankruptcy price.

BingX also offers an insurance fund, though it’s generally considered smaller than OKX’s offering. Their protection focuses primarily on covering losses that might occur during system failures or security breaches.

Key Insurance Features Comparison:

| Feature | OKX | BingX |

|---|---|---|

| Insurance Fund | Larger fund size | Smaller fund size |

| Coverage Focus | Trading losses, liquidations | System failures, security |

| Transparency | Regular fund reports | Limited disclosure |

| SAFU Equivalent | Yes | Partial |

Neither exchange offers the same level of insurance as regulated traditional financial institutions. You should note that these insurance funds don’t guarantee complete protection of all assets under all circumstances.

For maximum security, you should consider using hardware wallets for long-term storage regardless of which exchange you choose. Only keep trading amounts on the exchange platform.

Remember that insurance policies can change without notice, so it’s wise to check the current terms directly on each platform before making your decision.

OKX vs BingX: Customer Support

When choosing a crypto exchange, reliable customer support can make a big difference in your trading experience. Both OKX and BingX offer customer support options, but with some notable differences.

OKX provides a more comprehensive support system. You can reach their team through email, live chat, and phone support. This three-channel approach gives you flexibility in how you communicate with their support staff.

BingX offers fewer contact options, with support primarily available through email and live chat. The absence of phone support might be inconvenient if you prefer speaking directly with a representative.

Response times and quality of support can vary for both platforms. Some users report faster responses from OKX due to their larger support infrastructure, but experiences may differ based on your specific issue and timing.

Both exchanges offer help centers with FAQs and tutorials to help you troubleshoot common problems. These self-service resources can often resolve simple issues without needing to contact support directly.

For new traders, having multiple support options might be especially valuable. OKX’s additional phone support channel could be a deciding factor if you anticipate needing more hands-on assistance with your trading activities.

OKX vs BingX: Security Features

When choosing a crypto exchange, security should be your top priority. Both OKX and BingX offer robust security features, but they differ in implementation.

OKX uses a multi-layered security approach that includes two-factor authentication (2FA), encryption, and cold storage for most user funds. It’s regulated by multiple financial authorities, giving users additional confidence.

BingX also employs 2FA but adds enhanced security features specifically designed for its trading platform. Their flash trade feature provides real-time trading during high market volatility without compromising security.

Key Security Features Comparison:

| Feature | OKX | BingX |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Encryption | ✓ | ✓ |

| Regulatory Compliance | Multiple authorities | ✓ |

| Flash Trade Security | ❌ | ✓ |

You should consider enabling all available security features when using either platform. This includes setting up strong passwords, using authenticator apps, and regularly checking account activity.

Both exchanges store most user funds in offline cold wallets, protecting them from potential online threats. This approach significantly reduces the risk of large-scale hacks.

Regular security audits are conducted by both platforms to identify and fix potential vulnerabilities before they can be exploited. These proactive measures help maintain the integrity of your trading environment.

Is OKX Safe & Legal To Use?

OKX is generally considered a safe cryptocurrency exchange to use in 2025. It employs several security measures like two-factor authentication (2FA), encryption protocols, and cold storage for funds to protect users’ assets.

The platform is regulated by multiple financial authorities, which adds an extra layer of legitimacy and oversight. This regulatory compliance helps ensure that OKX follows industry standards for security and operational procedures.

For traders concerned about safety, OKX offers:

- Two-factor authentication for account protection

- Encryption of sensitive data

- Cold storage for the majority of crypto assets

- Regulatory compliance in multiple jurisdictions

The legality of using OKX depends on your location. Some countries have restrictions on cryptocurrency trading platforms. You should check your local regulations before creating an account.

As of March 2025, many countries allow citizens to use OKX legally. However, some nations have partial or complete bans on crypto trading platforms.

The exchange is considered reliable for both beginners and experienced traders. It provides various trading tools and services while maintaining security standards expected of major cryptocurrency exchanges.

Remember to always use strong passwords and enable all available security features when using any crypto exchange, including OKX.

Is BingX Safe & Legal To Use?

BingX is considered a safe and reliable platform for cryptocurrency trading. The exchange implements strict compliance protocols and advanced security measures to protect user funds and data.

The platform uses standard security measures like two-factor authentication (2FA) and cold storage for cryptocurrencies. These features help keep your assets secure from unauthorized access.

BingX operates legally and complies with regulatory requirements in various jurisdictions. It is registered as a financial services provider in multiple countries.

However, it’s worth noting that BingX is not regulated by top-tier financial authorities. This might be a concern if you prioritize exchanges with oversight from major financial regulators.

Most user reviews suggest BingX is legitimate and not a scam. The platform maintains transparent practices, which builds trust with its users.

When using BingX, you should still follow basic security practices:

- Enable 2FA on your account

- Use strong, unique passwords

- Be cautious with phishing attempts

- Only access the platform through official channels

The crypto community generally views BingX as a legitimate exchange option in 2025, especially for those interested in social and copy trading features.

Frequently Asked Questions

Traders choosing between OKX and BingX need answers to several common questions about these cryptocurrency exchanges. Each platform offers distinct advantages that may appeal to different types of users based on their specific trading needs.

What features distinguish OKX from BingX in terms of trading options and flexibility?

OKX provides a wider range of trading instruments, including futures, options, and margin trading with higher leverage options. The platform caters to more advanced traders with detailed charting tools and technical analysis features.

BingX focuses more on social trading, allowing users to copy successful traders’ strategies. Their copy trading feature is particularly helpful for beginners who want to learn while earning.

OKX offers more complex trading pairs and derivatives products, while BingX emphasizes a simpler approach with its user-friendly copy trading system.

How do the security measures implemented by OKX and BingX compare?

OKX employs multi-signature wallets, regular security audits, and keeps the majority of funds in cold storage. They have a more established security history as a larger exchange.

BingX offers similar security features including two-factor authentication and cold storage options. However, they don’t have as long a track record as OKX in the industry.

Both exchanges have insurance funds to protect users from unexpected losses, but OKX’s fund is substantially larger due to its higher trading volume and longer presence in the market.

Can users expect different fee structures between OKX and BingX, and how do they affect trading costs?

OKX typically charges trading fees ranging from 0.08% to 0.10% for makers and takers on spot trading. Their fee structure becomes more competitive for high-volume traders.

BingX offers slightly lower fees for regular traders, especially for copy trading activities. Their maker and taker fees start around 0.075% to 0.20% depending on the trading pair.

Both exchanges offer fee discounts when using their native tokens, but OKX’s tiered structure rewards high-volume traders more significantly than BingX’s model.

How do the customer support experiences offered by OKX and BingX differ?

OKX provides 24/7 customer support through multiple channels including live chat, email, and an extensive knowledge base. Their response times average 1-2 hours for most inquiries.

BingX focuses on immediate assistance with faster average response times for basic issues. They offer support in more languages, making them more accessible to global users.

OKX has more comprehensive technical support for complex trading problems, while BingX excels at providing quick solutions to common user questions.

What are the differences in the selection of cryptocurrencies available for trading on OKX versus BingX?

OKX supports over 350 cryptocurrencies and more than 600 trading pairs. This extensive selection caters to traders looking for both mainstream and niche altcoins.

BingX offers fewer cryptocurrencies, focusing on approximately 250+ coins with emphasis on popular tokens. Their selection prioritizes quality and liquidity over quantity.

OKX typically lists new cryptocurrencies faster than BingX, which takes a more cautious approach to adding new tokens to their platform.

How do the user interface and experience of OKX and BingX contrast?

OKX features a comprehensive interface with advanced charting tools and customizable trading screens. The platform can seem complex to beginners but offers powerful features for experienced traders.

BingX provides a streamlined, intuitive interface that prioritizes ease of use. Their mobile app is particularly well-designed with simpler navigation and clearer visual cues.

OKX caters to technical traders who need detailed market analysis tools, while BingX appeals to casual users and beginners with its straightforward design and social trading focus.

BingX vs OKX Conclusion: Why Not Use Both?

After comparing BingX and OKX, it’s clear that both platforms have distinct strengths. BingX offers user-friendly features and stands out for copy trading, which many beginners find helpful.

OKX, on the other hand, provides a more comprehensive range of services and trading options that experienced traders might prefer.

You don’t necessarily need to choose between them. Many crypto traders maintain accounts on multiple exchanges to take advantage of different features and opportunities.

Here’s why using both platforms might make sense:

- Diversify your trading options: Access different coins and trading pairs

- Capitalize on varying fee structures: Save money depending on transaction type

- Minimize risk: Avoid keeping all assets on a single platform

- Test different features: Use BingX for copy trading and OKX for its broader services

The crypto market changes quickly, and having access to multiple exchanges gives you flexibility. Based on recent 2025 comparisons, both exchanges remain competitive in the market alongside Binance, Bybit, and Toobit.

Your specific needs should guide your decision. If you’re new to crypto, start with one platform and expand as you gain confidence. If you’re experienced, maintaining accounts on both exchanges lets you use each for its strengths.