Exploring the features of the OKEx options exchange opens up a realm of possibilities for engaging in diverse trading strategies. Founded in 2017 and rebranded as OKX, this platform offers advanced trading tools and competitive fees, positioning itself as a favorite among both novices and seasoned traders. You can leverage its user-friendly interface and automated trading options to enhance your crypto trading experience.

Customer support is available 24/7, a crucial element when dealing with dynamic markets, ensuring you have assistance whenever needed. The exchange provides multiple investment paths, such as staking and passive income opportunities, making it versatile in catering to different risk appetites. Its rebranding strategy underscores a commitment to growth, and you can expect continued innovation and expansion.

Whether assessing fees, features, or global access, the OKEx options exchange remains a robust platform for crypto enthusiasts. With comprehensive trading options and an accessible design, you are well-poised to navigate the exciting yet challenging world of cryptocurrency with confidence.

What Are OKEX Options?

OKEX Options offer a way to engage with cryptocurrency trading akin to traditional financial options. You can buy or sell options on various cryptocurrencies, using these derivative contracts to either hedge your positions or speculate on future price movements.

OKEX Options enable you to choose between call options and put options. A call option gives you the right to purchase an asset at a predetermined price, while a put option allows you to sell.

The flexibility of OKEX Options lies in their potential for risk management. Traders can use these tools to protect their investments against unfavorable market volatility and achieve returns even in bearish markets. Also, it is advised for beginners to use risk management tools like crypto options paper trading to gain experience.

You can trade options for various cryptocurrencies, including Bitcoin, Ether, and more. OKEX ensures you have access to a wide array of underlying assets, broadening your potential strategies.

OKEX Options support is available through a user-friendly interface, making it manageable for both novice and experienced traders. The platform provides educational resources to enhance your understanding and application of options strategies.

For risk-conscious traders, OKEX Options offer a range of expiry dates, allowing you to customize your trades based on your outlook. This feature enables you to align your risk exposure with your market analysis.

Remember, trading options involves complexities and risks. As you engage with OKEX Options, consider evaluating market conditions and deploying strategies that align with your financial goals and risk tolerance.

OKEX Options Products Offerings

The OKEX platform caters to cryptocurrency traders by offering a comprehensive range of options products. You can find a variety of Bitcoin options, alongside other popular cryptocurrencies like Ethereum. These options provide flexibility and are tailored to meet diverse trading strategies.

For beginners and seasoned traders alike, OKEX offers user-friendly tools and resources. The platform’s intuitive interface ensures you can easily navigate through different options products without hassle.

OKEX enhances your trading experience with advanced features. You have access to multiple order types, leverage options, and risk management tools. It’s ideal for those looking to optimize their trading strategy.

Security is a top priority, with features such as multi-factor authentication protecting your transactions. Furthermore, OKEX employs cold storage solutions to ensure your assets are safe from online threats.

The platform regularly updates its offerings to add new cryptocurrencies and features. This dynamic approach allows you to keep up with the ever-evolving crypto market.

User support is robust, so you’ll always have assistance when needed. Whether you face technical issues or have questions about options, help is readily available.

For those interested in exploring decentralized finance, OKEX integrates DeFi options into its portfolio. This expands your investment possibilities beyond traditional financial products.

Overall, the OKEX options products offerings provide a solid foundation for exploring the crypto options market. Whether your focus is on diversification or leveraging, OKEX accommodates various trading preferences.

OKEX Supported Coins For Options Trading

OKEX offers a diverse range of coins for options trading, giving you flexibility and choice in the crypto market. Popular coins like Bitcoin (BTC) and Ethereum (ETH) are widely available, providing robust crypto options trading opportunities.

Table of Supported Coins for Options Trading:

| Coin | Ticker |

|---|---|

| Bitcoin | BTC |

| Ethereum | ETH |

Beyond Bitcoin and Ethereum, you may find other altcoins supported, depending on market conditions and demand.

OKEX regularly updates its supported coin list to accommodate new and emerging cryptocurrencies. Staying informed about these updates ensures you can leverage the full potential of the platform for your trading strategy.

When choosing coins for options trading on OKEX, consider the liquidity and market trends of each cryptocurrency. This information can guide your trading decisions and help optimize your investments in the options market.

OKEX Options Leverage

When trading options on OKEX, leverage is an essential tool that can amplify your potential gains or losses. Leverage ratios vary across different contracts, allowing you to maximize your market exposure relative to your initial investment.

In options trading, BTC/USD and ETH/USD contracts often offer higher leverage limits, like up to 1:125, compared to other altcoins. This is because of their higher liquidity and trading volume, reducing potential volatility risks.

For other, less liquid altcoin contracts, the leverage available tends to be lower. This conservative approach aims to mitigate potential risks associated with higher price volatility, typically resulting in leverage values 2-3 times less than those of BTC/USD or ETH/USD.

Consider using leverage carefully. While it can significantly enhance your profits, using it also increases the risk of substantial losses. Always evaluate your risk tolerance and market conditions before deciding on a leverage ratio.

Leveraged trading requires a comprehensive understanding of how leverage impacts your trades. If you’re new to options trading, familiarize yourself with the unique characteristics of OKEX’s offerings to make informed decisions.

OKEX Options Calculator

The OKEX Options Calculator is a valuable tool for traders and investors involved in cryptocurrency derivatives trading.

With this calculator, you can estimate the necessary metrics that influence your trading decisions. It includes parameters such as premium prices, implied volatility, and potential profit/loss scenarios for various options strategies.

The interface of the calculator is user-friendly, allowing you to input variables like the strike price, expiration date, and market conditions easily. This helps you visualize how different factors impact your options trading outcomes.

The options trading calculator supports a wide range of options, including CALL and PUT options, across numerous cryptocurrencies. You can assess both short-term trading tactics and long-term investment strategies.

Additionally, with features like customizable analytics, you can simulate real-time market scenarios. This enables smart forecasting and strategic planning in your trading approach.

Utilizing the OKEX Options Calculator empowers you to make informed decisions with precision in the volatile world of crypto options.

OKEX Options Types

When exploring OKEX options, you’ll find various contract styles to suit your trading preferences. The most common are European and American options.

European Options can only be exercised at expiration, making them more predictable for certain strategies.

American Options, on the other hand, offer the flexibility to exercise at any point up to expiration.

Besides these, OKEX also offers vanilla options, which are standard call and put contracts providing a straightforward way to hedge risks or speculate on market movements.

Each option requires you to pay a premium, which is essentially the cost of purchasing the option.

The payoff structure varies by option type, with call options giving you the right to buy an asset, and put options allowing you to sell.

Trading on OKEX also involves understanding the pricing and fees. The premium paid is influenced by factors like volatility and time to expiration.

It’s key to be aware of any trading fees in addition to the premium when making decisions.

OKEX is continually evolving, adding new trading options and pairs, which may include unique derivative options not covered by traditional models.

This makes it a dynamic and engaging platform for traders looking to explore various strategies in the crypto landscape.

OKEX Order Types

When trading on OKEx, you have access to a variety of order types that cater to diverse trading strategies.

Limit Order: Sets a maximum or minimum price at which you’re willing to buy or sell. Ensures execution only at your specified price or better, giving you control over the trade.

Market Order: Executes immediately at the current market price. Ideal for quick trades, it prioritizes speed over price precision.

Stop Order: Triggers a market order once a specified stop price is reached. Useful for limiting losses or securing profits.

Trigger Order: Offers more flexibility by setting conditions based on prices. Once conditions are met, it executes as a limit order.

Advanced Limit Order: Includes variations like post-only or fill-or-kill for specific trading conditions. Post-only ensures it enters the order book without immediate execution. Fill-or-kill requires the order to be entirely filled or canceled.

Each order type serves a distinct purpose. Your choice should align with your trading goals and risk tolerance. Use market and limit orders for immediate needs. Implement stop and trigger orders for strategic moves. Adjust your order type to your specific requirements and market conditions, ensuring you maintain the control you need while leveraging OKEx’s dynamic trading environment.

OKEX Options Data

OKEX provides traders with comprehensive data to aid in making informed decisions when trading options. You’ll find detailed information on trading volumes, pricing trends, and other key metrics crucial for successful trading.

Volume & Prices

Understanding volume and prices on OKEX gives you a clear edge. Trading volumes indicate the liquidity of the market, showing how active the trading environment is for specific options like Bitcoin and Ethereum. High trading volumes often mean better price stability and lower spreads.

Prices on OKEX reflect current market conditions and demand. Keeping an eye on pricing trends helps you anticipate potential market movements. It’s vital to monitor these metrics regularly to optimize your trading strategies and maximize potential returns.

OKEX Liquidation Mechanism

When trading on OKEx, understanding the liquidation mechanism is crucial. OKEx employs an advanced system to manage risk and maintain market stability. If your margin balance falls below the maintenance margin requirement, your position may be liquidated to ensure you don’t owe more than you deposit.

Key Features of OKEx Liquidation Mechanism:

- Automatic Position Reduction: If the equity in your account is insufficient, OKEx automatically reduces your position. This helps prevent further losses.

- Tiered Maintenance Margin Ratio: OKEx uses a tiered margin system. As your position size increases, so does the required maintenance margin. This structure effectively manages risk based on exposure.

- Forced Liquidation Mechanism: In the event of extreme market conditions, OKEx employs a forced liquidation system to protect all parties. Positions are closed to prevent account balances from falling into negative territory.

- Insurance Fund: OKEx maintains an insurance fund to cover losses that exceed traders’ margins. This fund is designed to protect traders from counterparty risks and maintain confidence in the platform.

- Market Order Execution: During liquidation, orders are executed at market prices to close positions quickly, ensuring the market remains orderly.

These components of the liquidation mechanism are essential for effective risk management. Familiarize yourself with these elements to effectively navigate trading on the OKEx platform.

OKEX Options Trading Fees

When trading options on OKEX, you will encounter competitive and structured fees. These fees are crucial to consider as they impact your trading costs and potential profits.

Fees for options trading are generally based on the maker-taker model. Maker fees apply when you add liquidity by placing limit orders, while taker fees occur when you remove liquidity through market orders.

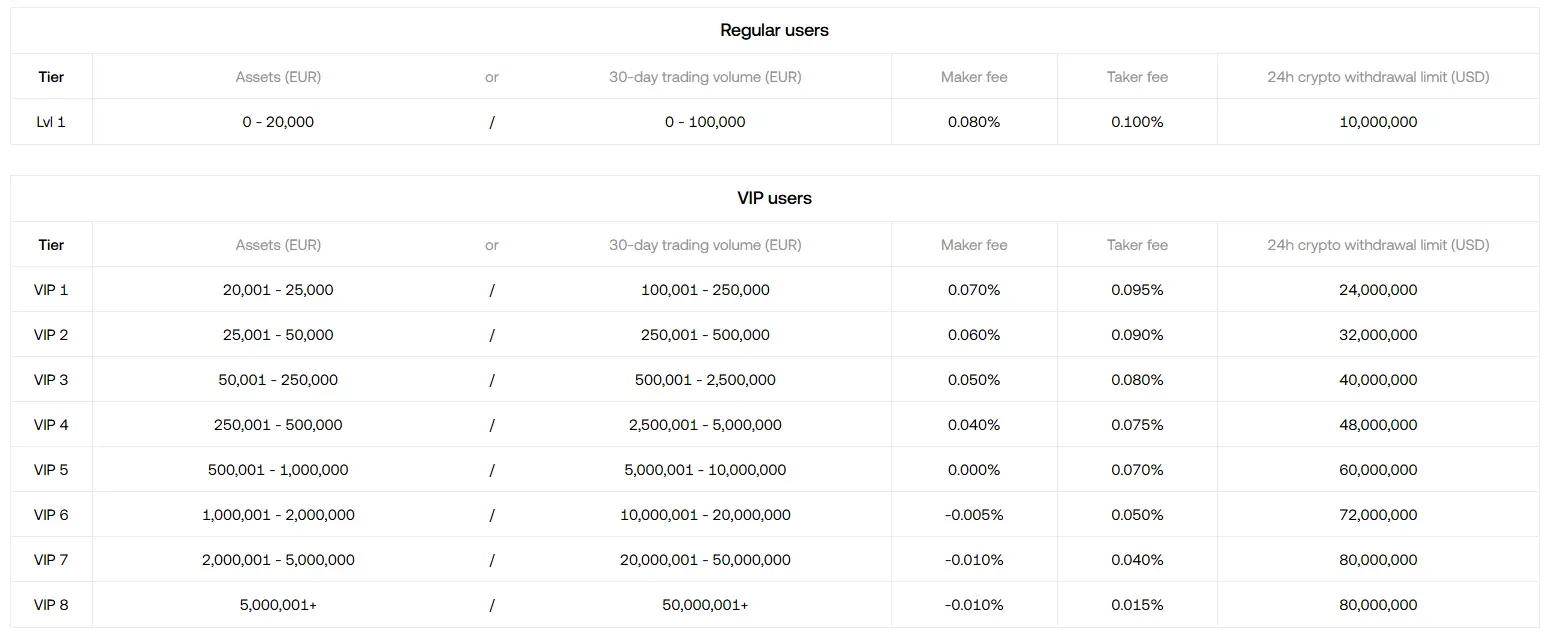

For new or general users, maker fees for options trading typically start at 0.08%, and taker fees are 0.1%. Meanwhile, more experienced traders, often qualify for reduced fees, enhancing cost efficiency.

VIP users benefit from even lower rates. As an example, higher VIP tiers might have maker fees as low as -0.01%, providing incentives for high-volume traders to engage more on the platform.

Fees are calculated accounting for multiple factors like the number of contracts and the multiplier. It’s essential to stay informed about the latest fee structures on the OKEX website or through their support channels to optimize trading strategies.

If you engage in leveraging or hedging strategies, be aware that fees can vary considerably depending on your trading actions and status level. Knowing the exact breakdown of costs can significantly help manage your trading budgets and expectations.

Keep an eye on fee adjustments as they can shift based on market conditions or promotional offers, ensuring you are always trading on the most favorable terms.

OKEX Options Funding Rates/Fees

When trading options on OKEX, understanding the funding rates and fees is crucial. The platform uses a dynamic funding rate system to balance long and short positions. These rates are derived from the interest rate differentials and the premiums or discounts between perpetual and spot prices.

Funding Rates:

- Funding rates change every 8 hours.

- A positive rate means long positions pay short positions.

- A negative rate means short positions pay long positions.

Fees Structure:

OKEX employs a tiered fee structure, rewarding high-volume traders and those holding the company’s native token, OKB. Below is an overview of fees:

| Asset Holdings/Trade Volume | Maker Fee | Taker Fee |

|---|---|---|

| Under $100,000 | 0.08% | 0.10% |

| High-volume traders or >1,000 OKB | 0.06% | 0.06% |

The tiered system encourages active trading by offering reduced rates as your activity increases.

It’s important to monitor these rates regularly, as they significantly impact your total trading costs. Adapting your strategy to these dynamic elements can optimize your expenses and enhance returns.

OKEX Account Types & KYC Tiers & Limits

When you open an account on OKEX, you can choose from a range of account types tailored to suit your trading needs. These include standard accounts for regular trading and VIP accounts for high-volume traders.

To ensure the safety of transactions, the platform implements a Know Your Customer (KYC) process with several tiers.

OKEX offers three KYC verification levels:

- Basic Tier: Requires only email and mobile verification. This tier allows you to engage in limited trading activities.

- Intermediate Tier: Demands more detailed personal information. This level increases your withdrawal limits and account functionalities.

- Advanced Tier: Necessitates comprehensive verification, including ID and address proof. It grants the highest withdrawal limits and access to exclusive features.

Each KYC level comes with corresponding benefits and restrictions. Higher tiers generally provide greater withdrawal limits, up to $40 million for top-tier VIP users.

Understanding these KYC levels is crucial for accessing the full features of OKEX, allowing you to maximize your trading potential while ensuring compliance with regulations.

OKEX Trading Platform & Tools

OKEX offers a robust trading platform that is tailored for both new and experienced traders. Whether you prefer web-based access or a desktop application, the interface provides a seamless trading experience. For on-the-go trading, the mobile app is available for both Android and iOS devices, ensuring accessibility and convenience.

The user-friendly layout is a key feature across all platforms, making it intuitive to navigate. You have access to a wide range of tools, such as crypto trading bots and block trading. These tools enhance trading efficiency and provide greater flexibility in managing your assets.

Within the platform, you can trade a variety of products, including futures, tokenized stocks, and over 150 coins. The inclusion of advanced trading options means you can tailor your strategies to suit market conditions. The platform supports spot trading and derivatives, expanding your trading possibilities.

Security remains a priority with features like cold storage and multi-factor authentication. These security measures help protect your assets, allowing you to trade with peace of mind. Additionally, you can explore the Web3 ecosystem through OKEX’s portal, which opens up new opportunities in the crypto landscape.

With continuous updates and enhancements, OKEX ensures that its platform remains competitive and responsive to user needs. This commitment to improvement is evident in the steady addition of new trading options and features. The integrated tools and comprehensive platform enhance your experience in the ever-evolving world of cryptocurrency trading.

OKEX Insurance Fund

The OKEX Insurance Fund plays a critical role in supporting traders during financial uncertainties. It serves as a safety net for those instances where positions cannot be liquidated above the bankruptcy price. This mechanism ensures that users are protected from potential losses due to abrupt market movements.

The fund is maintained by collecting initial margins from users on all trades. When a position is liquidated, these initial margins replenish the insurance fund, reinforcing its capacity to cover shortfalls. This proactive approach adds a robust layer of security for the trading environment on OKEX.

In addition to mitigating bankruptcy risks, the insurance fund enhances user confidence. As a trader, knowing that your potential risks are mitigated by such a fund gives you more assurance in your trading activities. This initiative contributes to a more stable trading atmosphere.

User Security is further amplified with the presence of this fund. It underscores OKEX’s commitment to prioritizing the safety and security of its traders. With over 20 million users, such a backup provides peace of mind, ensuring that their trading experiences remain seamless and secure.

By entrusting initial margins to the insurance fund, OKEX ensures its continuity and effectiveness. This strategic financial management illustrates a deep commitment to safeguarding your interests in the volatile crypto market. The insurance fund is a testament to maintaining transparency and reliability within the exchange platform.

OKEX Deposit Methods

Bank Transfer

You can fund your account via bank transfers. This method is secure and suitable for users who prefer traditional banking methods. Ensure that you follow the instructions provided by OKEX for completing these transfers successfully.

Credit/Debit Card

Using a credit or debit card is a convenient option for many users. OKEX partners with providers like MoonPay to facilitate these transactions. This method allows for quick deposits, making it accessible and efficient.

Third-Party Payment Providers

Third-party services such as Mercuryo can be used to deposit funds. These platforms often provide additional flexibility and may offer various payment methods, aligning with different preferences and regional availability.

Peer-to-Peer (P2P)

Peer-to-Peer (P2P) deposits allow you to directly buy cryptocurrencies without intermediaries. This method provides privacy and often reduced transaction fees. Ensure you follow the platform’s guidelines for secure transactions.

Cryptocurrency Transfers

You can deposit cryptocurrencies by transferring from an external wallet. Go to the ‘Assets’ tab and select the ‘Deposit’ option to generate a wallet address for your chosen cryptocurrency. Always double-check the address and network to ensure successful transfers.

OKEX Security Features

When considering a platform for trading options, security is your top priority. OKEX recognizes this by implementing multiple layers of robust security features.

Multi-Factor Authentication

You are encouraged to enable multi-factor authentication (MFA) to add an extra layer of protection to your account. This secure login method significantly reduces the chance of unauthorized access.

Wallet Security

The exchange uses a dual-wallet system, incorporating both cold and hot wallets. A significant portion of assets is stored offline in cold wallets, providing enhanced security against hacking attempts. Hot wallets facilitate daily transactions.

Encryption Protocols

Your data and transactions are secured with industry-standard encryption protocols. This ensures the confidentiality and integrity of your information while using the platform.

Regular Security Audits

OKEX conducts routine security audits, helping to identify vulnerabilities and refine defensive measures. This proactive approach works to maintain the trust and safety of your digital assets.

Withdrawal Whitelisting

To protect your assets further, OKEX allows you to whitelist certain addresses. This feature ensures withdrawals only go to safe and pre-approved destinations, minimizing the risk of unauthorized transactions.

By prioritizing these security measures, OKEX remains a reliable choice for options traders who value safety and protection in their trading activities.

OKEX Customer Support

When you encounter issues on OKEx, you have several support options. The platform provides a 24/7 help center with useful articles to guide you. You can access a wide range of topics that address common problems and frequently asked questions.

If self-help isn’t enough, OKEx offers additional channels. The chat feature on the official website lets you get in touch with support representatives directly. This is a convenient way to solve urgent issues quickly.

Phone support is also available, ensuring that you can speak to a real person if needed. This option is valuable when you prefer direct verbal communication to resolve your questions or concerns.

For complex inquiries, email support might be suitable. It allows you to explain your issues in detail and attach relevant files or screenshots for better clarity. Keep in mind that response times can vary with this method.

Community forums and social media platforms related to OKEx are also worth exploring. They can be useful for insights from other users and may offer alternative solutions or perspectives on your issues.

Is OKEX A Legal & Safe Platform

If you’re wondering about the legality and safety of OKEX, you’re in the right place.

Legal Status

OKEX is a cryptocurrency exchange that operates under stringent regulatory measures. It is recognized in multiple jurisdictions, ensuring compliance with local laws. This recognition adds a layer of trust for you as a user.

Safety Measures

Your security is a top priority for OKEX. The platform implements state-of-the-art security protocols, including two-factor authentication (2FA) and cold storage for your assets. These measures help protect your funds and personal information.

Reputation

The platform has a substantial user base, indicating trust in its operations. For a long-standing exchange like OKEX, maintaining a positive reputation is essential, and this is evident from its continuous user growth.

Historical Perspective

Established in 2017, OKEX has stood the test of time. Its history of avoiding major controversies speaks volumes about its operational integrity. If it had any major flaws, they would likely have surfaced by now.

In short, legal recognition and robust security features make OKEX a reliable option for your trading needs.

Frequently Asked Questions

Explore important aspects of OKEx options, including its availability, access to trading, and specific features. Knowing the details of trading pairs and requirements helps streamline your trading experience.

Is OKEx options allowed in the US?

OKEx options are not available for residents of the United States due to regulatory restrictions. Users from other countries should check local regulations to ensure compliance.

How to enable option trading in OKEx?

To enable options trading on OKEx, you must complete identity verification and activate your account for options trading in the platform’s settings. Ensure you meet the specified criteria to start trading.

What trading pairs are available for OKEx options?

OKEx offers a range of trading pairs for options, primarily focused on popular cryptocurrencies such as Bitcoin and Ethereum. These pairs are available for both call and put options.

What is the minimum amount required to trade options on OKEx?

The minimum amount required to trade options on OKEx varies, but traders typically need to maintain a minimum margin that can depend on the trading pair and the current market conditions.

What’s the difference between OKEx’s options trading and futures trading?

In options trading, the risk is limited to the premium paid, allowing you to choose to execute the contract. Futures trading obligates you to buy or sell at the set price, typically requiring a higher margin and involving greater risk.

What are the specifications of OKEx options trading contracts?

OKEx options contracts include specific contract sizes, expiration times, and settlement methods. They are European-style options, which only allow execution at expiration, and are settled in cryptocurrency.

Conclusion

When considering OKX for your cryptocurrency trading, you encounter a platform known for its extensive range of options, including spot, futures, and options trading. Offering competitive fees, it appeals to both beginners and experienced traders.

The user-friendly interface supports ease of use while also boasting advanced trading tools for more seasoned users.

Security is a strong focus for OKX, with robust measures in place to protect your assets. The exchange’s flexible design and global presence make it accessible, although certain regional restrictions apply.

Passive income opportunities through various crypto products are an additional attraction, providing ways to earn without active trading. The clean interface enhances your trading experience, allowing you to navigate effortlessly.

Headquartered in Malta, OKX has a reputation for being legitimate and secure. It was originally founded in Hong Kong and maintains a presence there with its offices.

As you explore your trading options, OKX’s diverse offerings and innovative features present a competitive choice. Adapting to market needs, the platform continues to attract a broad user base with its comprehensive services.

Want more options? Check out these crypto exchanges: