Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Today, we’re comparing two popular platforms: MEXC and WhiteBIT. Both exchanges offer various features, but they differ in important ways that might impact your decision.

MEXC and WhiteBIT differ in their fee structures, available cryptocurrencies, and user interface design, which can affect your overall trading costs and experience. By understanding these differences, you can make a more informed choice about which platform better suits your needs.

You might also be interested to know that WhiteBIT Token (WBT) is available on MEXC, allowing you to purchase, hold, transfer, and stake the token directly on the MEXC platform. This cross-platform availability gives you more flexibility in how you manage your crypto assets.

MEXC Vs WhiteBIT: At A Glance Comparison

When choosing between MEXC and WhiteBIT, you need to understand how these cryptocurrency exchanges differ. Both platforms offer crypto trading services but have distinct features that might appeal to different users.

Trading Fees Comparison:

| Feature | MEXC | WhiteBIT |

|---|---|---|

| Maker Fee | 0.1% | 0.1% |

| Taker Fee | 0.1% | 0.1% |

| Fee Discounts | Available with platform token | Available with platform token |

Key Features:

- MEXC supports over 1,500 cryptocurrencies, giving you access to a wide range of trading options.

- WhiteBIT offers a more user-friendly interface that beginners might find easier to navigate.

Both exchanges provide spot trading, but MEXC has more advanced features for experienced traders, including futures trading and margin options.

Security Measures:

- Two-factor authentication on both platforms

- Cold wallet storage for most funds

- Regular security audits

Your location matters when choosing between these exchanges. WhiteBIT has stronger presence in European markets, while MEXC has deeper liquidity in Asian markets.

Deposit methods vary between the platforms. WhiteBIT supports more fiat currency options for direct deposits, which might be convenient if you’re new to crypto.

Mobile app experience differs too. MEXC’s app includes all the features of their web platform, making it ideal if you trade on the go.

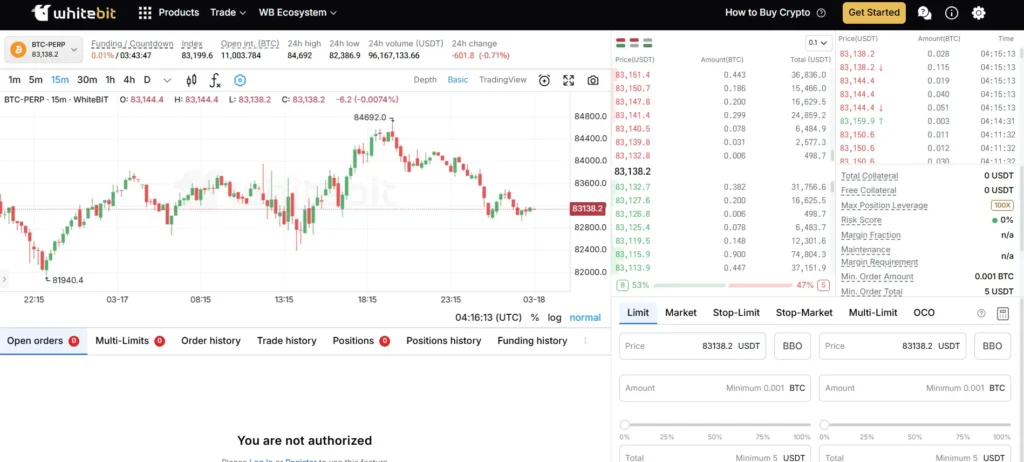

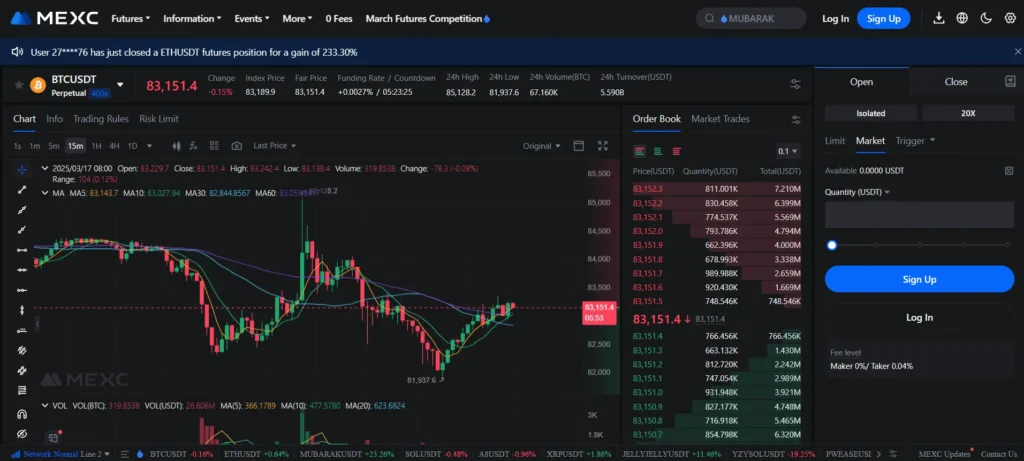

MEXC Vs WhiteBIT: Trading Markets, Products & Leverage Offered

MEXC and WhiteBIT both offer various trading options for crypto enthusiasts, but their offerings differ in several ways.

Trading Markets

MEXC provides access to over 1,500 cryptocurrencies through spot trading. WhiteBIT offers fewer cryptocurrencies but still maintains a substantial selection for traders.

Products Available

| Feature | MEXC | WhiteBIT |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Copy Trading | ✓ | ✗ |

| Staking | ✓ | ✓ |

MEXC stands out with its futures trading platform, charging only 0.02% per transaction (both when opening and closing positions). This makes it one of the most competitive options for futures traders.

WhiteBIT offers its native token (WBT) which you can purchase, hold, transfer, and stake directly on their platform.

Leverage Options

MEXC allows you to trade with up to 200x leverage on some futures contracts, giving you more potential for profit (with increased risk).

WhiteBIT offers more conservative leverage options, which might be more suitable if you’re looking for less risky trading experiences.

The low fees on MEXC make it particularly attractive for active futures traders, while WhiteBIT provides a solid all-around trading experience with its own ecosystem token.

When choosing between these exchanges, consider which products you’ll use most frequently and what level of risk you’re comfortable with through leverage trading.

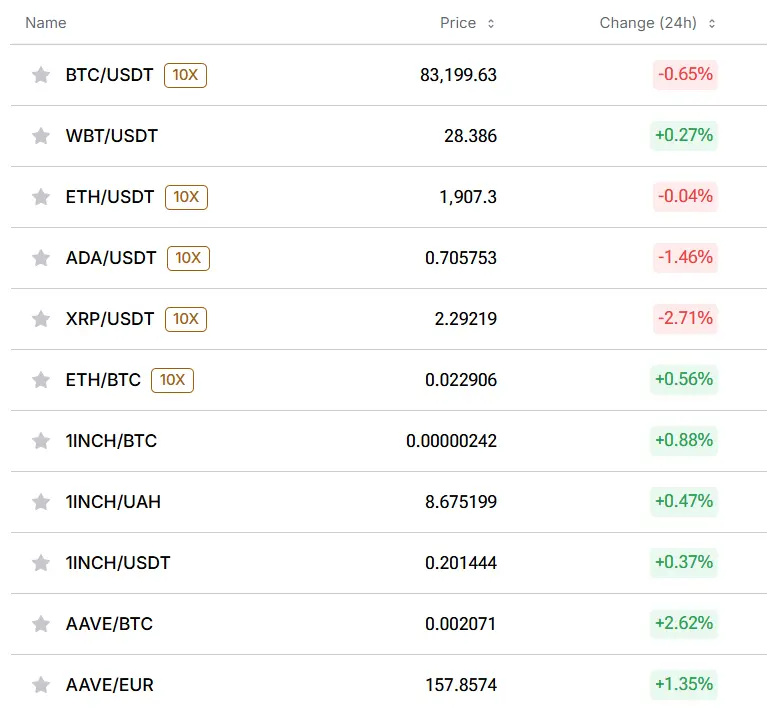

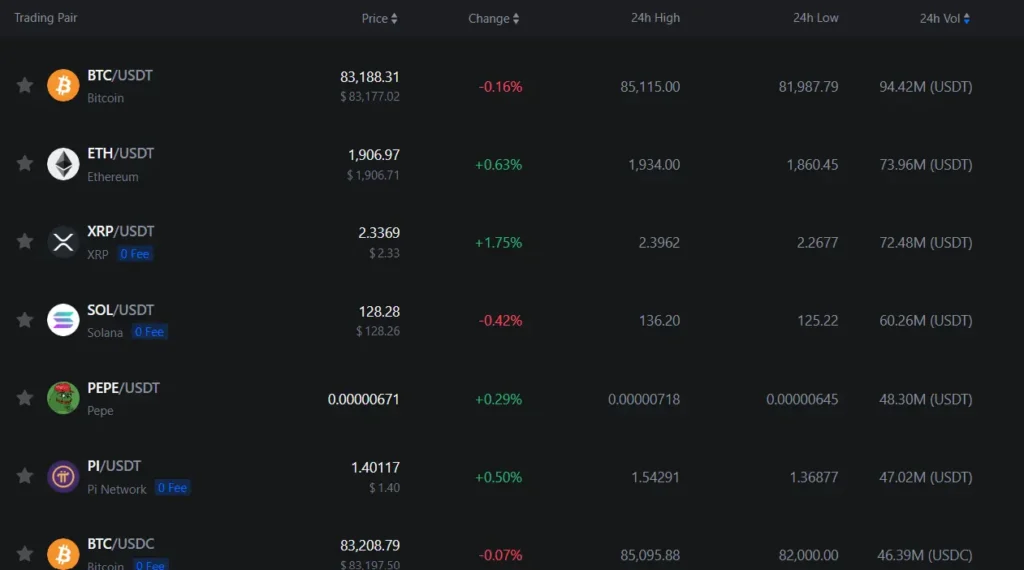

MEXC Vs WhiteBIT: Supported Cryptocurrencies

MEXC and WhiteBIT both offer a wide range of cryptocurrencies for trading, but they differ in their selection. MEXC typically provides access to over 1,500 cryptocurrencies, making it one of the exchanges with the largest variety of digital assets available.

WhiteBIT, while not supporting as many cryptocurrencies as MEXC, still offers a substantial selection with approximately 400+ digital assets. This includes major cryptocurrencies and many altcoins.

Both exchanges support popular cryptocurrencies such as:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Ripple (XRP)

MEXC stands out for listing new and emerging tokens much faster than most competitors. If you’re interested in trading newly launched cryptocurrencies or more obscure altcoins, MEXC might be your better option.

WhiteBIT features its own native token called WhiteBIT Token (WBT), which you can purchase, hold, transfer, and stake directly on their platform. MEXC also has its native token, MEXC Token (MX).

When choosing between these exchanges, consider which specific cryptocurrencies you want to trade. If you need access to niche or newly launched tokens, MEXC’s extensive listing might better serve your needs. However, if you primarily trade mainstream cryptocurrencies, both platforms will likely meet your requirements.

Remember to verify that the specific cryptocurrencies you’re interested in are available on your chosen platform before registering, as available assets can change.

MEXC Vs WhiteBIT: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and WhiteBIT, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

| Exchange | Spot Trading | Futures Trading |

|---|---|---|

| WhiteBIT | 0.1% maker/taker | Low-fee structure |

| MEXC | Similar competitive rates | Competitive rates |

Both exchanges offer competitive trading fees that are comparable to industry standards. WhiteBIT’s 0.1% maker/taker fee for spot trading is clearly defined in the available information.

Deposit Methods

The exchanges differ in their deposit methods, which can affect your overall costs when funding your account. This is an important consideration if you frequently move funds in and out of exchanges.

Withdrawal Fees

Withdrawal fees vary between the two platforms and typically depend on the cryptocurrency you’re withdrawing. These fees can significantly impact your profits, especially if you make frequent withdrawals.

Supported Cryptocurrencies

WhiteBIT supports over 270 cryptocurrencies and 500+ trading pairs. This wide selection gives you more trading options and potential fee variations depending on your preferred coins.

You should check both platforms’ current fee schedules before making your decision, as these can change over time. Fee structures may also include discounts based on trading volume or token holdings.

MEXC Vs WhiteBIT: Order Types

When trading on cryptocurrency exchanges, the variety of order types can greatly impact your trading strategy. Both MEXC and WhiteBIT offer several order types to help you execute trades effectively.

MEXC provides an impressive range of order types. You can use market orders, limit orders, and stop-limit orders on the platform. MEXC also supports advanced order types like trailing stop orders and post-only orders.

WhiteBIT offers similar basic order types including market, limit, and stop orders. The platform also features OCO (One-Cancels-Other) orders, which let you set up two conditional orders where executing one automatically cancels the other.

One key difference is MEXC’s exceptional order-matching speed. The platform can handle up to 1.4 million positions per second, which might give you an edge in fast-moving markets.

Common Order Types on Both Platforms:

- Market orders (instant execution at current price)

- Limit orders (execution at specified price or better)

- Stop orders (triggered when price reaches certain level)

MEXC Special Features:

- Faster order execution

- Trailing stop orders

- Post-only orders

WhiteBIT Special Features:

- OCO orders

- Conditional orders

The right platform for you depends on your trading style. If you value execution speed, MEXC might be preferable. If you use complex conditional orders regularly, WhiteBIT’s OCO feature could be more valuable.

MEXC Vs WhiteBIT: KYC Requirements & KYC Limits

MEXC offers a more flexible approach to KYC (Know Your Customer) verification compared to WhiteBIT. If you’re concerned about privacy, MEXC allows withdrawals of up to 10 BTC equivalent daily without completing KYC verification.

WhiteBIT takes a stricter approach to verification. The platform fully complies with KYC and AML (Anti-Money Laundering) requirements, making security and regulatory compliance central to their operations.

MEXC KYC Policy:

- KYC not mandatory for basic trading

- Up to 10 BTC daily withdrawal limit without KYC

- Higher limits available with completed verification

WhiteBIT KYC Policy:

- KYC verification required for full platform access

- Strong focus on security features and account protection

- Complete compliance with regulatory standards

For teenagers or users wanting to try crypto with minimal verification, MEXC provides an easier entry point. You can start trading immediately without identity verification processes.

WhiteBIT’s stricter KYC approach might feel restrictive, but it offers enhanced security benefits. Their verification requirements help protect your account from unauthorized access and reduce fraud risks.

Your choice between these exchanges should consider your privacy preferences and security needs. If minimal verification is important to you, MEXC offers more flexibility. If you prefer stronger security measures, WhiteBIT’s comprehensive approach might be more suitable.

MEXC Vs WhiteBIT: Deposits & Withdrawal Options

Both MEXC and WhiteBIT offer multiple options for depositing and withdrawing funds, but they differ in several key aspects.

Deposit Methods:

- MEXC: Supports cryptocurrency deposits and some fiat options

- WhiteBIT: Offers cryptocurrency deposits (free) and more extensive fiat options including bank transfers

Withdrawal Options:

- MEXC: Primarily crypto withdrawals with variable fees

- WhiteBIT: Crypto withdrawals with fees that vary by asset

WhiteBIT charges different withdrawal fees depending on which cryptocurrency you’re moving. These fees are specific to each asset on their platform.

Fiat Support:

| Exchange | Fiat Currencies | Payment Methods |

|---|---|---|

| MEXC | Limited | Limited |

| WhiteBIT | More extensive | Bank transfers, cards |

Processing times for both platforms are generally quick for crypto transactions, with fiat transfers taking longer as expected.

You should check the current fee structure on both platforms before making large transfers. Withdrawal fees can significantly impact your overall costs when moving funds frequently.

Both exchanges implement security measures for withdrawals, including confirmation emails and two-factor authentication to protect your funds.

When comparing deposit and withdrawal convenience, WhiteBIT appears to offer more comprehensive fiat options, which might be important if you frequently move between traditional currency and crypto.

MEXC Vs WhiteBIT: Trading & Platform Experience Comparison

When choosing between MEXC and WhiteBIT, the trading experience differs significantly. MEXC offers a more extensive range of trading options, including futures trading with fees as low as 0.02% per position.

WhiteBIT provides a user-friendly interface that many beginners find easier to navigate. Its trust score ranks relatively high among crypto exchanges, making it a reliable choice for new traders.

Trading Fees Comparison:

| Exchange | Spot Trading Fee | Futures Fee |

|---|---|---|

| MEXC | Competitive | 0.02% |

| WhiteBIT | Standard market | Higher |

Both platforms support a variety of cryptocurrencies, but MEXC typically offers more trading pairs. This gives you more options if you’re interested in trading less common altcoins.

The mobile experience is solid on both platforms. You can easily check prices, place trades, and manage your portfolio on the go.

WhiteBIT tends to focus more on security features and compliance, which might appeal if safety is your top priority. MEXC leans toward offering more diverse trading products and options.

Key Platform Differences:

- MEXC: More trading pairs, lower futures fees, more advanced features

- WhiteBIT: More beginner-friendly, stronger focus on security, cleaner interface

Your trading style and needs should guide your choice. Active traders might prefer MEXC’s lower fees and more options, while newer users might appreciate WhiteBIT’s simpler approach.

MEXC Vs WhiteBIT: Liquidation Mechanism

Liquidation mechanisms are vital when trading on cryptocurrency exchanges, especially when using leverage. Both MEXC and WhiteBIT have systems in place to protect themselves when positions become too risky.

MEXC’s Liquidation Process works through a forced liquidation mechanism. When your account reaches the liquidation price, MEXC automatically closes your position to prevent further losses. This helps you trade futures more effectively by understanding the boundaries.

WhiteBIT’s Approach similarly triggers liquidation when your position reaches a certain threshold. Their system aims to balance risk management while giving traders sufficient warning before positions are closed.

Both exchanges calculate liquidation prices based on your leverage amount, position size, and market volatility. Higher leverage means your liquidation price will be closer to your entry price, increasing risk.

Here’s a simple comparison:

| Feature | MEXC | WhiteBIT |

|---|---|---|

| Warning Notifications | Yes | Yes |

| Partial Liquidation | Available | Available |

| Liquidation Fee | Varies by market | Competitive rates |

| Risk Management Tools | Multiple options | Multiple options |

Understanding these mechanisms helps you trade more safely. You can better manage risk by using lower leverage and setting stop-loss orders before hitting liquidation thresholds.

Both platforms offer educational resources to help you understand their liquidation processes and avoid unexpected position closures.

MEXC Vs WhiteBIT: Insurance

When choosing a crypto exchange, insurance protection is a critical factor to consider. Both MEXC and WhiteBIT offer different approaches to protecting user funds.

MEXC maintains an “Investor Protection Fund” designed to compensate users in case of security breaches. This fund sets aside a portion of the exchange’s revenue to cover potential losses.

WhiteBIT takes security seriously with its insurance system that covers up to $90 million in assets. This protection helps safeguard your investments against unauthorized access or theft.

Insurance Coverage Comparison:

| Feature | MEXC | WhiteBIT |

|---|---|---|

| Insurance Fund | Investor Protection Fund | Up to $90M coverage |

| Cold Storage | Majority of assets | 96% of assets |

| Protection Focus | Compensation after breaches | Prevention and compensation |

Both exchanges emphasize cold wallet storage as their primary security measure. WhiteBIT stores approximately 96% of user assets in cold wallets, while MEXC also maintains a significant portion offline.

You should note that neither exchange offers full insurance on all assets. Coverage terms can change, and certain assets may have different protection levels.

For maximum security, consider enabling all available security features on your preferred platform. This includes two-factor authentication, anti-phishing codes, and withdrawal address whitelisting.

MEXC Vs WhiteBIT: Customer Support

When comparing MEXC and WhiteBIT, customer support can be a deciding factor for your trading experience. Based on available information, these exchanges offer different levels of support.

WhiteBIT has some limitations in its customer support options. The platform doesn’t offer live chat support, which might be inconvenient if you need immediate assistance. This can be frustrating when you face urgent trading issues.

MEXC provides more comprehensive support channels. You can reach their team through email, tickets, and live chat. This variety gives you more options to get help when you need it.

Response times differ between the platforms. WhiteBIT users sometimes report longer wait times for ticket resolutions. MEXC typically responds faster, especially through their live chat feature.

Neither platform stands out for educational support. WhiteBIT lacks learning portals and guides that could help beginners. MEXC offers some basic resources but doesn’t excel in this area.

Language support is another consideration. Both exchanges serve international users, but MEXC supports more languages in their customer service communications.

Support Comparison Table:

| Feature | MEXC | WhiteBIT |

|---|---|---|

| Live Chat | Yes | No |

| Email Support | Yes | Yes |

| Response Time | Faster | Slower |

| Educational Resources | Basic | Limited |

| Language Options | More | Fewer |

You should consider how important readily available support is for your trading needs before choosing between these platforms.

MEXC Vs WhiteBIT: Security Features

When choosing between MEXC and WhiteBIT, security should be a top priority for your crypto assets. Both exchanges have implemented various security measures to protect users.

WhiteBIT stands out with its premium security features. The exchange complies with regulatory requirements and follows strict security protocols. It employs two-factor authentication (2FA) to add an extra layer of protection to your account.

MEXC also offers robust security measures including 2FA and advanced encryption technologies. The platform uses cold storage solutions to keep the majority of user funds offline and safe from potential online threats.

Key Security Features Comparison:

| Feature | MEXC | WhiteBIT |

|---|---|---|

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | ✅ | ✅ |

| Regulatory Compliance | Partial | Strong |

| KYC Requirements | Yes | Yes |

| Insurance Fund | Available | Available |

WhiteBIT has gained recognition for its commitment to legal compliance. This focus on following regulations provides you with additional protection against potential issues.

Both platforms conduct regular security audits to identify and fix vulnerabilities. They also monitor transactions for suspicious activities to prevent fraud.

You should enable all available security features on either platform to maximize protection. This includes using strong, unique passwords and activating email notifications for account activities.

Is MEXC A Safe & Legal To Use?

MEXC has established itself as a legitimate cryptocurrency exchange operating since 2018. According to recent information, MEXC has maintained a clean security record with no reported hacks or loss of user funds as of 2025.

The exchange offers zero trading fees, making it an affordable option for crypto traders. This feature has contributed to its growing popularity among both beginners and experienced traders.

MEXC has implemented various security measures to protect users’ funds. These security protocols help maintain the platform’s reputation as a safe trading environment.

One thing to note is that MEXC operates as a decentralized exchange that allows trading without KYC (Know Your Customer) requirements. This means you can trade on the platform without identity verification in some regions.

The platform specializes in perpetual futures trading, which doesn’t require expiry dates. This makes it suitable for both short-term and long-term trading strategies.

When choosing MEXC, consider these key points:

- Operating since: 2018

- Security record: No reported hacks

- Trading fees: Zero

- KYC requirements: Minimal in many regions

- Trading options: Includes perpetual futures

Before using any exchange, you should verify its legal status in your specific country or region, as cryptocurrency regulations vary worldwide.

Is WhiteBIT A Safe & Legal To Use?

WhiteBIT is generally considered a safe cryptocurrency exchange. It employs a Web Application Firewall (WAF) to detect and block online attacks like cross-site scripting and SQL injection, enhancing platform security.

The exchange follows KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, which are important regulatory standards in the crypto industry. This compliance helps ensure that the platform operates legally in jurisdictions where these regulations apply.

WhiteBIT offers secure storage for user funds, which is crucial for protecting your digital assets. This security feature helps reduce the risk of unauthorized access or theft.

Key Security Features:

- Web Application Firewall

- KYC and AML compliance

- Secure crypto storage

- Protection against common online attacks

The legal status of WhiteBIT depends on your location. Cryptocurrency regulations vary by country, so you should check if WhiteBIT is authorized to operate in your region before using it.

For traders looking for a safe platform for trading futures, WhiteBIT provides perpetual futures contracts with various trading tools. This makes it suitable for both beginners and experienced traders.

Before creating an account, verify WhiteBIT’s availability and legal status in your country. Also review their terms of service to understand any limitations or requirements that might affect you.

Frequently Asked Questions

Traders often have specific questions when comparing MEXC and WhiteBIT exchanges. These platforms differ in several key areas including fees, security measures, and available cryptocurrencies.

What are the primary differences between MEXC and WhiteBIT in terms of trading fees?

MEXC typically offers maker fees starting at 0.2% and taker fees at 0.2%. These fees can decrease based on your trading volume and if you hold their native token.

WhiteBIT generally charges slightly lower fees, with maker fees starting at 0.1% and taker fees at 0.1%. They also provide fee discounts for users who stake their native WhiteBIT token.

Both exchanges offer fee discounts for high-volume traders, though WhiteBIT’s fee structure tends to be more favorable for beginners.

How does the security of assets compare between MEXC and WhiteBIT?

MEXC implements industry-standard security measures including two-factor authentication, cold storage for the majority of user funds, and regular security audits.

WhiteBIT advertises that it stores 96% of user assets in cold wallets and has earned compliance certifications for its security practices. They also offer anti-phishing protection and withdrawal address management.

Neither exchange has experienced major security breaches in recent years, which speaks to their commitment to security protocols.

Which platform, MEXC or WhiteBIT, offers a wider range of cryptocurrencies?

MEXC provides access to over 1,400 cryptocurrencies and 2,200+ trading pairs. They frequently list new tokens and emerging projects before other exchanges.

WhiteBIT offers approximately 350 cryptocurrencies and 500+ trading pairs. While this selection is smaller, it includes all major cryptocurrencies and many popular altcoins.

If you’re seeking access to micro-cap altcoins and new project launches, MEXC generally provides more options.

Are there any notable variations in user experience and interface between MEXC and WhiteBIT?

MEXC’s interface is feature-rich but can feel overwhelming for beginners. It offers advanced charting tools and trading options that appeal to experienced traders.

WhiteBIT provides a cleaner, more intuitive interface that beginners find easier to navigate. Their trading screens are less cluttered while still offering essential tools.

Both platforms have dark mode options and customizable layouts, but WhiteBIT generally receives higher marks for user-friendliness.

What are the customer support options available on MEXC versus WhiteBIT?

MEXC offers 24/7 customer support through live chat, email, and ticket systems. They provide support in multiple languages but response times can vary during peak periods.

WhiteBIT provides customer support via live chat, email, and an extensive knowledge base. Their support team operates 24/7 and typically responds within 1-2 hours.

Both exchanges maintain active community forums and social media channels where users can seek assistance.

How do the mobile app features of MEXC and WhiteBIT differ?

MEXC’s mobile app includes nearly all features available on the desktop platform. You can access spot trading, futures, staking, and lending directly from your phone.

WhiteBIT’s app offers a streamlined experience focused on basic trading functions. While less comprehensive than MEXC’s app, it provides a smoother, more responsive interface.

Both apps support biometric authentication and push notifications for price alerts, but MEXC’s app generally offers more advanced trading features.

MEXC Vs WhiteBIT Conclusion: Why Not Use Both?

Both MEXC and WhiteBIT offer unique advantages that can benefit different types of crypto traders. MEXC stands out with its impressively low trading fees of just 0.02% for futures trading, making it cost-effective for frequent traders.

MEXC also offers leverage options up to 200x for futures trading, which appeals to experienced traders looking for higher risk opportunities. However, it may not be as user-friendly for beginners compared to more established platforms.

WhiteBIT, on the other hand, focuses on security and transparency. Its token promises to be a secure asset with free AML checks and ERC20 withdrawal options, making it potentially safer for newer users.

For beginners, WhiteBIT might offer a gentler learning curve. MEXC could be better suited for more experienced traders who value lower fees and advanced trading options.

You might consider using both platforms strategically. WhiteBIT could serve as your entry point for buying crypto and basic trading. MEXC could be your platform for more advanced trading strategies and futures contracts.

Your trading needs will likely evolve over time. Starting with simpler platforms and gradually exploring more complex ones is often a smart approach. There’s no rule saying you must limit yourself to just one exchange.

Remember to always prioritize security and only invest what you can afford to lose, regardless of which platform you choose.