Choosing the right crypto exchange can make a big difference in your trading experience. Both MEXC and PrimeXBT are popular platforms in 2025, but they serve different needs for crypto traders.

MEXC offers over 1600 cryptocurrencies without mandatory KYC verification, while PrimeXBT focuses on providing advanced trading features like copy trading and diverse asset classes. Understanding these key differences will help you decide which platform better matches your trading goals.

Each exchange has its own fee structure, deposit methods, and trading types that might appeal to different kinds of traders. Whether you’re looking for the widest selection of altcoins or powerful trading tools, comparing these platforms side by side will help you make an informed decision about where to trade.

MEXC Vs PrimeXBT: At A Glance Comparison

When choosing between MEXC and PrimeXBT, understanding their key differences helps you make the right choice for your trading needs.

Trading Fees

- MEXC: 0% maker fees and 0.01% taker fees for derivatives

- PrimeXBT: Generally higher fees than MEXC

Cryptocurrency Selection

- MEXC: Supports over 1600 cryptocurrencies

- PrimeXBT: Fewer crypto options but includes major coins

Margin Trading

- MEXC: Offers thousands of margin products with 0% commission

- PrimeXBT: Known as one of the best overall margin platforms for 2025

KYC Requirements

- MEXC: No mandatory KYC verification

- PrimeXBT: Limited KYC requirements compared to many exchanges

User Experience

- MEXC: Used by millions daily, known for its large selection

- PrimeXBT: Often praised for its trading interface and tools

Trading Types

- MEXC: Spot, futures, margin, and more

- PrimeXBT: Strong focus on derivatives and margin trading

Both platforms appeal to different types of traders. MEXC might be your better choice if you want lower fees and more cryptocurrency options. PrimeXBT could be preferable if you’re looking for an established margin trading platform with advanced features.

Your trading experience level and specific needs will determine which platform serves you better. Consider trying both platforms with small amounts to see which interface and feature set works best for your trading style.

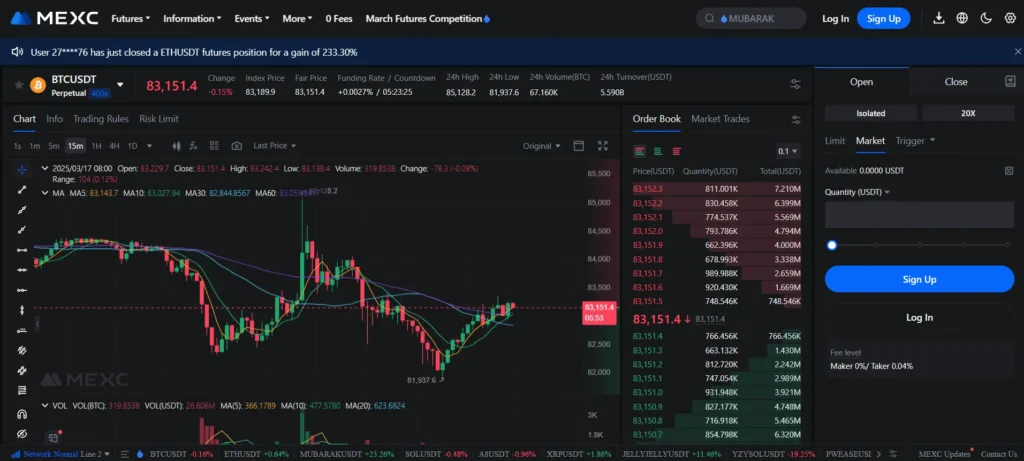

MEXC Vs PrimeXBT: Trading Markets, Products & Leverage Offered

MEXC and PrimeXBT both offer various trading options, but they differ in several key aspects.

MEXC provides access to over 1600 cryptocurrencies, making it ideal if you’re looking for lesser-known tokens and new projects. Their platform has become popular for traders seeking variety in their crypto portfolio.

PrimeXBT focuses on leverage trading and is considered the overall best platform for crypto trading with leverage. While they offer fewer cryptocurrencies than MEXC, they excel in derivative products.

For leverage trading, MEXC offers competitive options with derivatives that can reach up to 100x leverage. However, PrimeXBT is specifically built around leverage trading as its core feature.

Trading fees also differ between the platforms:

- MEXC: Offers very low fees (0% in some cases) for both spot and futures trading

- PrimeXBT: Competitive fee structure focused on leverage traders

Market Comparison Table:

| Feature | MEXC | PrimeXBT |

|---|---|---|

| Cryptocurrencies | 1600+ | Fewer options |

| Max Leverage | Up to 100x | High leverage focus |

| Trading Types | Spot, Futures | Primarily derivatives |

| Fee Structure | Very low (0% possible) | Competitive for leverage |

You’ll find MEXC better if you want a wide selection of cryptocurrencies with low fees. Choose PrimeXBT if leverage trading is your primary goal.

Both platforms don’t require KYC verification, which appeals to users seeking privacy in their trading activities.

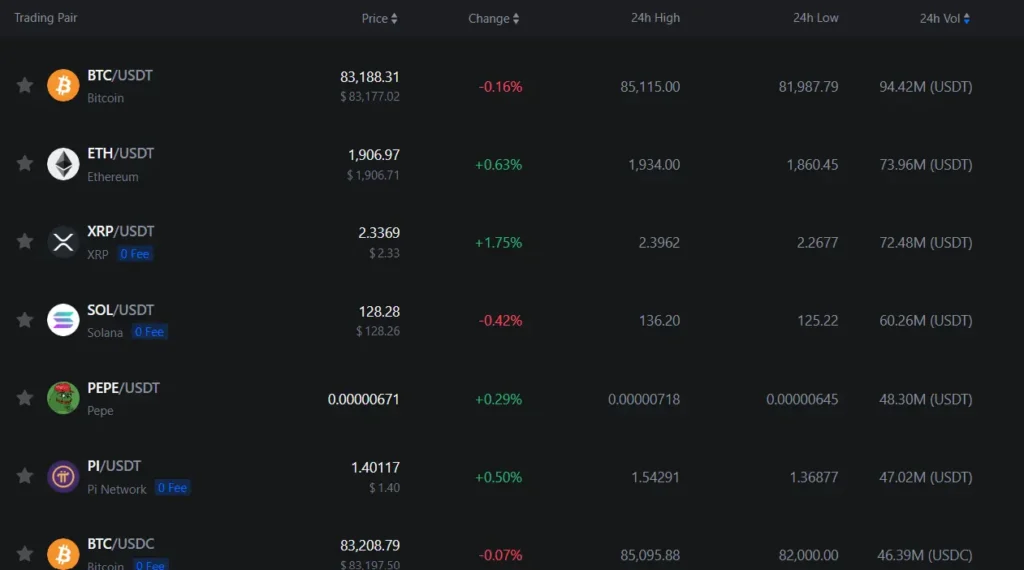

MEXC Vs PrimeXBT: Supported Cryptocurrencies

When choosing between MEXC and PrimeXBT, the range of supported cryptocurrencies is a major factor to consider. MEXC significantly outperforms PrimeXBT in this category.

MEXC offers access to over 1600 cryptocurrencies for trading. This extensive selection makes it an excellent choice if you’re interested in trading both established coins and newer, emerging tokens.

PrimeXBT, in contrast, supports a much narrower range of cryptocurrencies. This limited selection is one of the platform’s notable drawbacks.

Here’s a quick comparison of supported cryptocurrencies:

| Platform | Number of Cryptocurrencies | Support for New Tokens |

|---|---|---|

| MEXC | 1600+ | Excellent |

| PrimeXBT | Limited selection | Limited |

If you’re looking to diversify your crypto portfolio beyond the major coins, MEXC provides significantly more options. This is particularly valuable if you want to invest in newer projects or niche cryptocurrencies.

Both platforms offer the major cryptocurrencies like Bitcoin and Ethereum. However, MEXC’s broader selection gives you more flexibility in your trading strategy.

For traders focused exclusively on major cryptocurrencies, PrimeXBT’s limited selection might be sufficient. But if you want access to a wider crypto market, MEXC is clearly the better option.

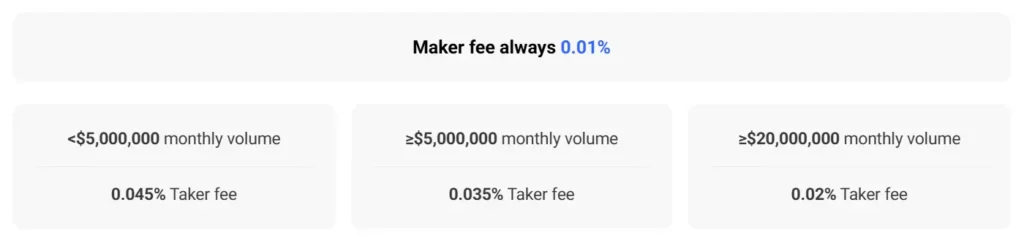

MEXC Vs PrimeXBT: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing MEXC and PrimeXBT, fees are a crucial factor to consider for your trading decisions. Both platforms offer competitive rates that can affect your overall trading costs.

Trading Fees:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| MEXC | 0.05% | 0.05% |

| PrimeXBT | 0.05% | 0.05% |

Both exchanges maintain a flat fee structure of 0.05% for crypto trades. This places them among the most affordable options in the market for active traders.

MEXC offers discounts for users who hold their native MXC token. This can further reduce your trading costs if you’re willing to invest in their ecosystem.

Deposit Fees: PrimeXBT doesn’t charge deposit fees, making it cost-effective to fund your account. MEXC similarly keeps deposit costs minimal to attract users.

Withdrawal Fees: Withdrawal fees vary by cryptocurrency on both platforms. PrimeXBT maintains minimal withdrawal fees compared to industry standards.

MEXC’s withdrawal fees are competitive but depend on the specific cryptocurrency you’re transferring. These fees may change based on network conditions.

Your trading volume can influence fee structures on both platforms. Higher volume traders might qualify for additional discounts, especially on MEXC.

When choosing between these exchanges, consider how frequently you plan to deposit, trade, and withdraw funds to determine which fee structure works best for your needs.

MEXC Vs PrimeXBT: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both MEXC and PrimeXBT offer various order types to help you execute trades effectively.

MEXC provides a comprehensive range of order types including market orders, limit orders, and stop-limit orders. You can use these to set specific price points for buying or selling assets.

PrimeXBT offers similar basic order types but also includes advanced options like OCO (One-Cancels-the-Other) orders, which allow you to place two orders simultaneously.

Both platforms support market orders for immediate execution at the current market price. This is useful when you want to enter or exit positions quickly.

Limit orders are available on both exchanges, letting you set a specific price at which you want to buy or sell. Your order will only execute when the market reaches your set price.

MEXC Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- Post-only orders

PrimeXBT Order Types:

- Market orders

- Limit orders

- Stop orders

- OCO orders

For margin trading, both platforms support special order types. PrimeXBT’s interface is particularly designed for leverage trading, with order types that help manage risk when using up to 200x leverage.

MEXC offers trailing stop orders, which automatically adjust your stop price as the market moves. This feature helps maximize profits during favorable market movements.

MEXC Vs PrimeXBT: KYC Requirements & KYC Limits

MEXC offers a flexible approach to KYC (Know Your Customer) verification. While MEXC does have KYC procedures, they aren’t mandatory for all users. The platform features three account tiers: unverified, primary KYC, and verified plus.

Without KYC verification on MEXC, you can still access basic trading functions, though with some limitations on withdrawal amounts and certain features.

PrimeXBT similarly provides services with minimal KYC requirements. You don’t need to complete full identity verification to begin trading on the platform. This makes it appealing if you value privacy in your trading activities.

MEXC KYC Tiers:

- Unverified: Basic access with limited withdrawals

- Primary KYC: Increased limits and features

- Verified Plus: Full platform access with highest limits

PrimeXBT KYC:

- Minimal verification needed to start trading

- Uses a VPN requirement for users in restricted regions like the US

Both platforms offer low entry barriers for new users who prefer to maintain privacy. However, higher withdrawal limits and full platform features typically require some level of verification.

If you’re in the US, note that you’ll need a VPN to access these platforms as they have geographic restrictions.

For margin trading specifically, both platforms keep requirements low with entry positions requiring just 0.5% when entering trades.

MEXC Vs PrimeXBT: Deposits & Withdrawal Options

When choosing between MEXC and PrimeXBT, deposit and withdrawal options play a crucial role in your trading experience. Both platforms offer different methods to fund your account and cash out your profits.

MEXC supports a wider range of deposit options. You can fund your account with numerous cryptocurrencies from their selection of over 1,600 supported assets. MEXC also allows fiat deposits, giving you more flexibility.

PrimeXBT focuses primarily on cryptocurrency deposits. The platform accepts BTC, ETH, USDT, USDC, and COV directly. If you don’t already own crypto, PrimeXBT offers third-party options to purchase cryptocurrencies first.

Both exchanges process withdrawals smoothly, but fees and processing times may vary. MEXC typically has competitive withdrawal fees across their large selection of cryptocurrencies.

Deposit Methods Comparison:

| Method | MEXC | PrimeXBT |

|---|---|---|

| Cryptocurrency | Yes (1,600+) | Yes (Limited) |

| Fiat | Yes | No (third-party only) |

For withdrawal speed, both platforms maintain efficient processing times. Your withdrawal experience will largely depend on the cryptocurrency network you choose and its current congestion levels.

If you prefer depositing with fiat currency directly, MEXC offers more convenience. If you already hold popular cryptocurrencies and prefer simpler options, PrimeXBT’s streamlined approach might work better for you.

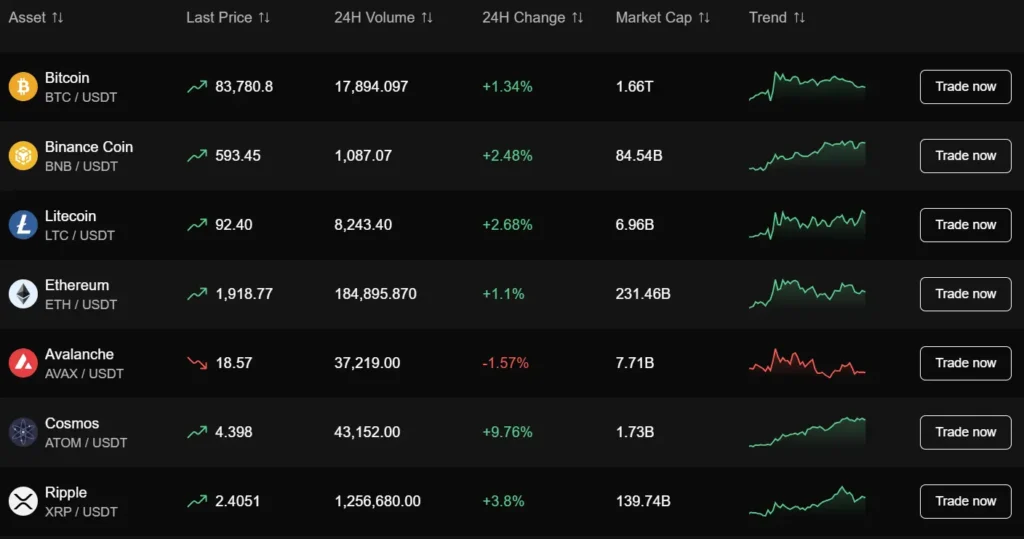

MEXC Vs PrimeXBT: Trading & Platform Experience Comparison

Both MEXC and PrimeXBT offer distinct trading experiences that cater to different types of crypto traders. Let’s examine how they compare in key areas.

Leverage Options:

- MEXC: Offers up to 200x leverage (0.5% margin requirement)

- PrimeXBT: Also provides 200x leverage on certain assets

Supported Assets:

| Platform | Asset Range |

|---|---|

| MEXC | Wider variety of cryptocurrencies |

| PrimeXBT | More limited selection (Bitcoin, Ethereum, Litecoin, XRP, EOS) |

PrimeXBT’s interface tends to focus on simplicity with trading tools designed for both beginners and advanced traders. You’ll find their platform straightforward to navigate.

MEXC provides a more comprehensive crypto selection, making it better if you’re looking to trade lesser-known altcoins. Their platform accommodates various trading preferences.

Trading Features:

- Both platforms offer margin trading

- PrimeXBT includes additional markets beyond crypto

- MEXC typically provides more trading pairs

When using these platforms, you’ll notice PrimeXBT has a more streamlined approach but with fewer cryptocurrencies. MEXC offers more variety but might feel more complex to newcomers.

Your trading style will largely determine which platform serves you better. If you prefer a focused selection with strong leverage options, PrimeXBT might be your choice. For broader crypto exposure, MEXC delivers more options.

MEXC Vs PrimeXBT: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for managing risk. Both MEXC and PrimeXBT have systems in place to protect themselves when your positions approach dangerous territory.

MEXC employs a forced liquidation mechanism that triggers when your margin ratio falls below the maintenance margin requirement. This system helps you avoid losing more than your initial investment.

PrimeXBT takes a similar approach but offers up to 200x leverage on cryptocurrency trading, which creates a higher risk of liquidation for inexperienced traders. The higher your leverage, the closer your liquidation price will be to your entry price.

The key differences in their liquidation approaches:

| Feature | MEXC | PrimeXBT |

|---|---|---|

| Max Leverage | Varies by asset | Up to 200x |

| Liquidation Warning | Provides alerts | Limited warnings |

| Partial Liquidation | Available | Not always available |

| Liquidation Fee | Applied | Applied |

You should regularly monitor your positions on both platforms, especially during volatile market conditions. Setting stop-loss orders can help you avoid forced liquidations.

Both exchanges calculate your liquidation price based on your position size, leverage used, and the maintenance margin requirement. Higher leverage means smaller price movements can trigger liquidation.

Neither platform guarantees you’ll only lose your initial margin during extreme market volatility. Slippage can occur during the liquidation process.

MEXC Vs PrimeXBT: Insurance

When trading on cryptocurrency exchanges, insurance protection can be a crucial factor in your decision-making process. Both MEXC and PrimeXBT offer different approaches to security and insurance coverage.

MEXC maintains a Protection Fund designed to safeguard user assets. This fund acts as a safety net in case of security breaches or other unexpected events that might impact user funds.

PrimeXBT, on the other hand, implements a multi-tier security system. While not explicitly marketed as insurance, their security measures include cold storage of assets and advanced encryption protocols to protect your investments.

Neither platform offers traditional insurance coverage like FDIC protection that you might find with conventional banking. This is common in the cryptocurrency space.

It’s worth noting that both exchanges emphasize security measures over insurance policies:

| Exchange | Insurance Approach | Key Features |

|---|---|---|

| MEXC | Protection Fund | Compensation mechanism for potential losses |

| PrimeXBT | Security-focused | Cold storage, encryption, multi-tier security |

You should carefully review each platform’s terms of service regarding insurance and liability. Both exchanges outline specific conditions under which they may compensate users for losses.

Remember that the crypto industry has limited regulation compared to traditional finance. Your best protection is to use strong security practices like two-factor authentication and only keeping trading amounts on exchanges.

MEXC Vs PrimeXBT: Customer Support

When choosing between MEXC and PrimeXBT, customer support can be a deciding factor. MEXC offers 24/7 customer support, giving you round-the-clock access to help when trading issues arise.

PrimeXBT also provides customer support, though user experiences vary. Some traders find PrimeXBT’s support more professionally oriented, which might appeal to experienced traders.

Both platforms offer multiple support channels, including:

- Live chat

- Email support

- Help centers

- FAQ sections

Response times differ between the platforms. MEXC typically responds quickly through their 24/7 system, which can be crucial during urgent trading situations.

PrimeXBT’s support quality is generally solid, but some users report varying experiences. Since both are offshore exchanges, support becomes especially important if you encounter account or trading problems.

Language options are more extensive on MEXC, which supports multiple languages for their customer service. PrimeXBT’s support is primarily English-focused.

For new users, MEXC’s support documentation tends to be more beginner-friendly. PrimeXBT’s resources often target traders with more experience.

You should test each platform’s support responsiveness before depositing large amounts. Send a test question to both support teams to gauge their helpfulness and response time.

MEXC Vs PrimeXBT: Security Features

When trading cryptocurrency, security should be your top priority. Both MEXC and PrimeXBT offer security features to protect your assets, but they differ in some key ways.

MEXC implements multi-factor authentication (MFA) to add an extra layer of security to your account. They also use cold storage for most user funds, keeping them offline and away from potential hackers.

PrimeXBT focuses on encryption technology and also offers multi-signature wallets. This means multiple approvals are needed before transactions can be completed, reducing the risk of unauthorized access.

Key Security Features Comparison:

| Feature | MEXC | PrimeXBT |

|---|---|---|

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | ✅ | ✅ |

| Anti-Phishing Code | ✅ | ❌ |

| Multi-signature Wallets | ❌ | ✅ |

| Insurance Fund | Limited | Yes |

MEXC has gained recognition for its high-performance trading engine while maintaining security protocols. Their system includes regular security audits to identify and fix vulnerabilities.

PrimeXBT uses advanced DDoS protection to prevent service disruptions during high-volume trading periods. This helps keep your trading experience smooth and secure.

Both platforms offer withdrawal address management, letting you create whitelists of approved withdrawal addresses. This prevents unauthorized withdrawals even if someone gains access to your account.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record with no reported hacks or loss of user funds. This track record is important when considering a cryptocurrency exchange.

The platform uses advanced encryption and security measures to protect user accounts and transactions. These security features help make MEXC a relatively safe option for crypto trading.

Regarding legality, MEXC is available globally but has different policies depending on your location. The exchange offers no-KYC (Know Your Customer) options for some users, allowing you to trade without providing extensive personal information.

However, some users have reported experiencing unexpected mandatory KYC requirements after using the platform for some time. There have also been complaints about issues with withdrawing funds and trade execution problems.

Despite these concerns, MEXC serves millions of daily users and offers trading for over 1,600 cryptocurrencies. The platform charges zero trading fees, making it attractive for frequent traders.

Before using MEXC, you should:

- Check if it’s legal in your jurisdiction

- Understand the KYC requirements that might apply to you

- Start with smaller amounts until you’re comfortable with the platform

- Set up all available security features for your account

The platform’s longevity and large user base suggest it’s legitimate, but like all crypto exchanges, you should exercise caution and due diligence.

Is PrimeXBT A Safe & Legal To Use?

PrimeXBT operates as a global cryptocurrency exchange that also offers trading in forex, commodities CFDs, and stock indices. The platform serves over a million users across more than 150 countries, providing a professional-grade trading environment.

When it comes to legality, PrimeXBT’s status varies by location. The platform doesn’t require KYC (Know Your Customer) verification, which makes it attractive to users seeking privacy. However, this feature creates complications for users in certain regions.

Important note for US residents: If you’re located in the United States, you would need to use a VPN to access PrimeXBT services, as indicated in the search results. This suggests the platform isn’t officially authorized to operate in the US.

The platform accepts payments via Visa and Mastercard, and offers services to hold cryptocurrency or spend it. Based on the search results, it appears to be considered legitimate by users.

Regarding safety, PrimeXBT provides a professional trading environment, but the lack of KYC requirements may raise concerns about security standards. Always consider the following when evaluating safety:

- Regulatory compliance in your region

- Security measures for your funds

- Transparency of the company

- User reviews and experiences

Before using PrimeXBT, you should verify its legal status in your specific location and assess whether its security features meet your personal standards.

Frequently Asked Questions

Both MEXC and PrimeXBT have unique features and limitations that traders should understand before choosing a platform. These key differences span privacy options, fee structures, country restrictions, support quality, available instruments, and security implementations.

What features differentiate MEXC from PrimeXBT for users seeking privacy?

MEXC offers a no-KYC option for basic trading accounts with limited withdrawal amounts, making it appealing to privacy-focused users. You can start trading immediately without identity verification.

PrimeXBT also provides no-KYC trading options, though with certain restrictions. The platform allows you to trade Bitcoin, Ethereum, and other major cryptocurrencies without completing extensive verification processes.

Both platforms prioritize user privacy, but their approaches to data collection and withdrawal limits differ significantly.

How do MEXC and PrimeXBT compare in terms of trading fees and transaction costs?

MEXC charges a flat 0.05% trading fee for both makers and takers in their spot market. This straightforward fee structure is based on your trading volume.

PrimeXBT typically has higher trading fees compared to MEXC, though the exact rates vary by instrument. Their fee structure is more complex and tiered based on trading volume and asset class.

Withdrawal fees also differ between platforms, with MEXC often offering more competitive rates for crypto withdrawals.

Are there any legal restrictions on using PrimeXBT for US-based traders?

PrimeXBT does not serve US-based traders due to regulatory constraints. If you’re in the United States, you won’t be able to create an account or access their trading services.

MEXC has similar restrictions for US traders, though their policies may vary for different states. Always check the current terms of service as regulations change frequently.

Both platforms use IP detection and verification processes to enforce these geographic restrictions.

What level of customer support can traders expect from MEXC compared to PrimeXBT?

MEXC provides customer support through multiple channels including live chat, email, and social media. You can typically expect response times within 24 hours for most inquiries.

PrimeXBT offers 24/7 customer support with live chat being their primary contact method. Their support team handles technical issues, account questions, and trading concerns.

Response quality and wait times can vary significantly between the two platforms, especially during high-volume trading periods or market volatility.

Which platform between MEXC and PrimeXBT offers a wider variety of trading instruments?

MEXC provides a broader range of cryptocurrencies for trading, with hundreds of tokens available. You’ll find both established coins and newer, smaller cap projects on their exchange.

PrimeXBT offers a more modest selection of cryptocurrencies including Bitcoin, Ethereum, Litecoin, XRP, and EOS. However, they complement this with traditional assets like forex, commodities, and indices.

Your choice should depend on whether you prefer access to numerous cryptocurrencies or a mix of crypto and traditional assets.

How do the security measures implemented by MEXC stack up against those at PrimeXBT?

MEXC employs industry-standard security features including two-factor authentication, cold storage for most funds, and regular security audits. You can enhance your account security with email confirmations and anti-phishing codes.

PrimeXBT utilizes multi-signature cold storage wallets and maintains an SSL-encrypted platform. Their security framework includes DDoS protection and regular penetration testing.

Both platforms have avoided major security breaches, though neither offers the same level of insurance protection found on some larger exchanges.

PrimeXBT Vs MEXC Conclusion: Why Not Use Both?

Both PrimeXBT and MEXC offer unique advantages that might make using both platforms beneficial for your trading strategy.

PrimeXBT stands out by offering diverse trading options beyond just cryptocurrencies. You can trade forex, gold, and stocks all in one place. This makes it convenient if you want to diversify your investment portfolio.

MEXC, on the other hand, provides access to over 1600 cryptocurrencies and offers zero-fee spot and futures trading. This can be very appealing if you’re looking to maximize your profits by avoiding trading fees.

Key Benefits of Using Both:

| Platform | Main Advantages |

|---|---|

| PrimeXBT | • Multi-asset trading (crypto, forex, stocks, gold) • Quick daily withdrawals • Single platform convenience |

| MEXC | • No mandatory KYC verification • Zero-fee trading options • Larger selection of cryptocurrencies (1600+) |

Using both platforms allows you to leverage MEXC for fee-free crypto trading while utilizing PrimeXBT when you want to expand into traditional markets.

You might consider using MEXC for exploring newer cryptocurrencies and PrimeXBT when you need to quickly move between crypto and traditional assets like forex.

The choice ultimately depends on your specific trading needs, but having accounts on both platforms gives you more flexibility and trading options.