When choosing a cryptocurrency exchange, you need to consider factors like fees, available coins, and user experience. MEXC and Poloniex are two popular exchanges that offer different advantages for crypto traders.

MEXC Exchange offers competitive trading fees that work well for both high-volume traders and occasional users, while Poloniex provides a different fee structure and feature set. Both platforms support various cryptocurrencies and trading types, but they differ in important ways that might affect your trading experience.

You’ll want to examine specific aspects like withdrawal options, security features, and supported payment methods before making your choice. Some users have noted that both exchanges, along with others like HTX, have occasionally suspended withdrawals for certain cryptocurrencies like XMR, which might impact your trading strategy depending on which coins you prefer to trade.

MEXC vs Poloniex: At A Glance Comparison

When choosing between MEXC and Poloniex, understanding their key differences can help you make the right decision for your trading needs.

Both platforms offer cryptocurrency trading services, but they differ in several important aspects.

Trading Fees

| Exchange | Maker Fees | Taker Fees | Special Features |

|---|---|---|---|

| MEXC | 0.1% – 0.2% | 0.1% – 0.2% | Fee discounts with native token |

| Poloniex | 0.1% – 0.2% | 0.1% – 0.2% | Volume-based fee tiers |

Available Cryptocurrencies

- MEXC offers a wider selection of altcoins and new tokens

- Poloniex focuses on established cryptocurrencies with some altcoin options

Security Features

- Both exchanges utilize two-factor authentication (2FA)

- Cold storage for majority of user funds

- Regular security audits

User Interface

MEXC provides a more modern interface that beginners might find easier to navigate. Poloniex offers a classic exchange layout that experienced traders often prefer.

Geographical Availability

Your location matters when choosing between these exchanges. MEXC serves more countries globally, while Poloniex has more restrictions on user locations.

Additional Services

- MEXC: Futures trading, staking options, launchpad for new tokens

- Poloniex: Margin trading, lending features, some staking options

The best choice depends on your specific trading goals, experience level, and where you’re located.

MEXC vs Poloniex: Trading Markets, Products & Leverage Offered

Both MEXC and Poloniex offer a variety of trading options, but they differ in several key areas.

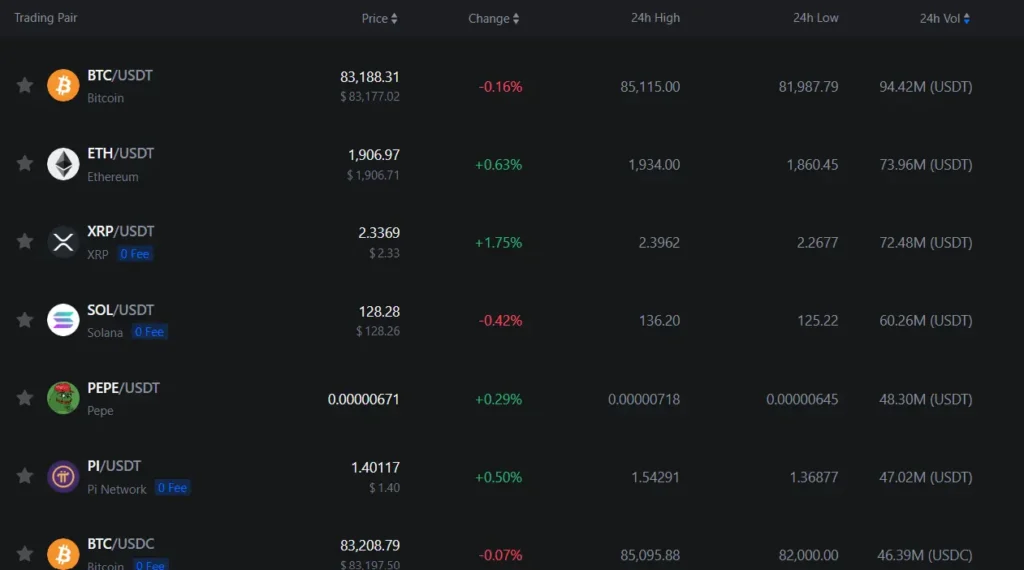

MEXC provides access to thousands of trading pairs, making it one of the more diverse platforms for crypto traders. You can find both popular cryptocurrencies and newer, emerging tokens on this exchange.

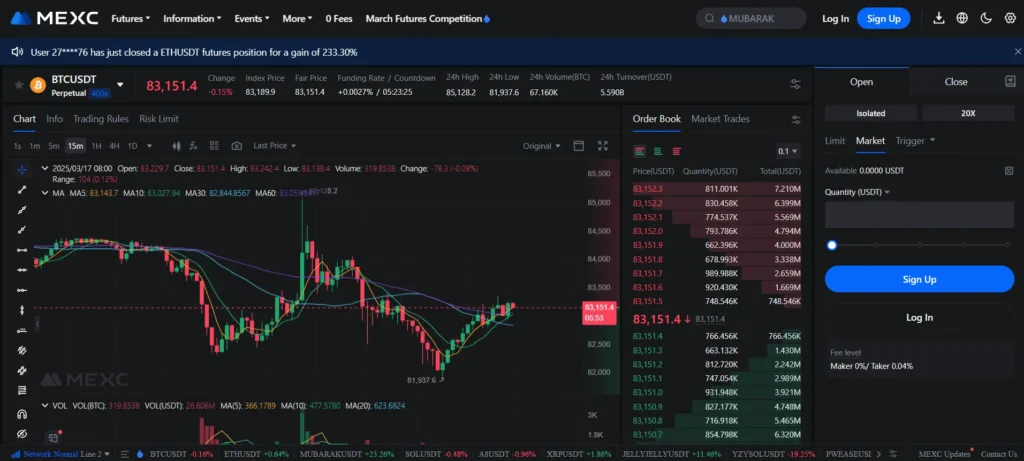

MEXC stands out with its futures trading platform, offering high leverage options that can go up to 200x on select pairs. This makes it attractive if you’re interested in amplified trading positions.

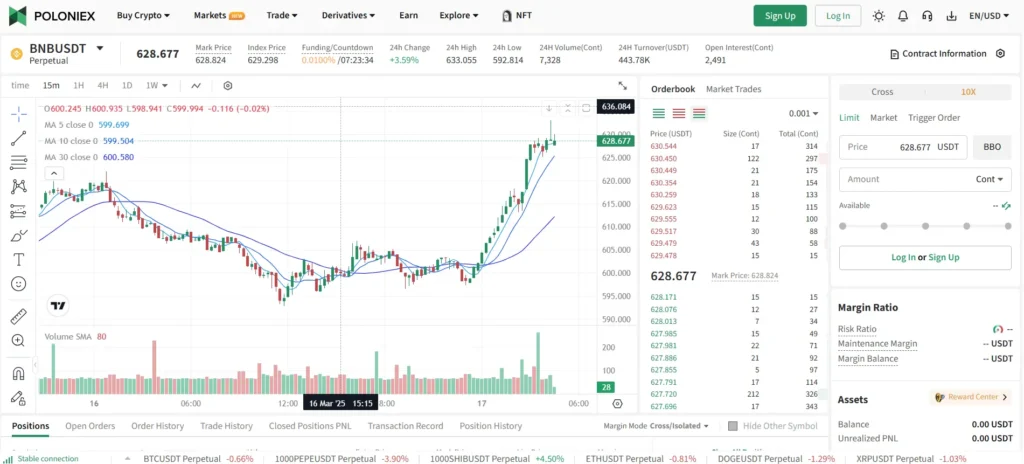

Poloniex also offers a solid selection of cryptocurrencies but typically has fewer trading pairs compared to MEXC. The platform focuses more on established coins and tokens.

When it comes to products, both exchanges offer:

| Feature | MEXC | Poloniex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Staking | ✓ | ✓ |

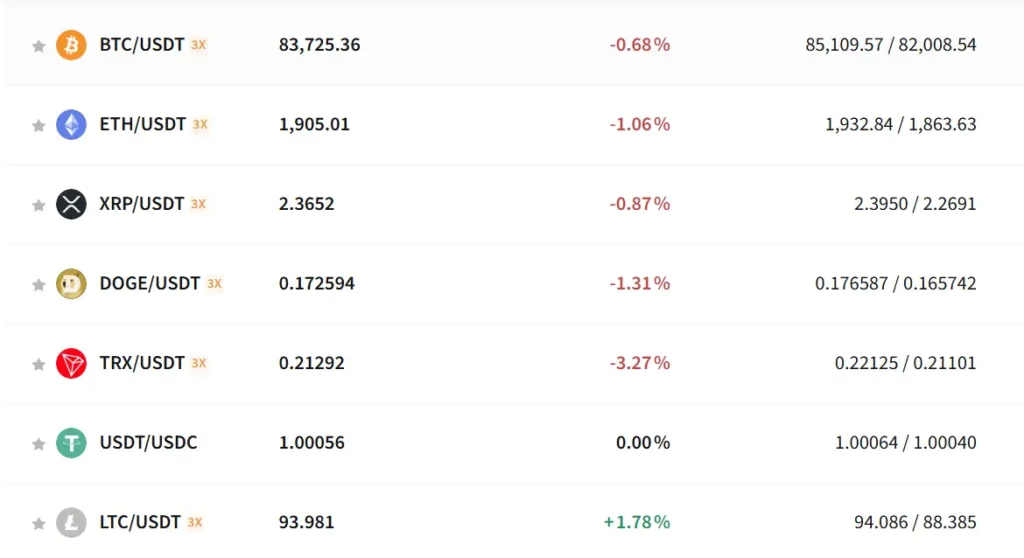

Poloniex typically offers more conservative leverage options compared to MEXC. You’ll find leverage ranging from 3x to 100x depending on the trading pair.

MEXC has gained popularity as one of the best crypto futures trading platforms with its competitive fee structure for high-volume traders.

Both platforms allow you to engage in various trading strategies, but MEXC might be better suited if you’re looking for more exotic trading pairs and higher leverage options.

MEXC vs Poloniex: Supported Cryptocurrencies

MEXC offers a wider range of cryptocurrencies compared to Poloniex. You’ll find over 1,400 different coins and tokens available on MEXC, making it a good choice if you’re looking for newer or less common assets.

Poloniex supports approximately 300+ cryptocurrencies, which is still substantial but significantly less than MEXC. Both exchanges cover all major cryptocurrencies including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Cardano (ADA)

- Solana (SOL)

MEXC Advantages:

- More altcoins and newer tokens

- Better selection of DeFi projects

- Regularly adds emerging cryptocurrencies

- Strong focus on listing tokens from developing blockchain ecosystems

Poloniex Advantages:

- More established history with certain tokens

- Carefully vetted selection process

- Better liquidity for some mid-cap altcoins

If you’re interested in trading mainstream cryptocurrencies, both exchanges will meet your needs. However, if you want access to niche or newly launched tokens, MEXC typically lists these faster and offers a broader selection.

Both platforms support spot trading and futures markets, though the specific trading pairs available differ between them.

MEXC vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and Poloniex, understanding their fee structures is crucial. Let’s compare how these exchanges stack up in terms of trading, deposit, and withdrawal fees.

Trading Fees:

| Exchange | Maker Fee | Taker Fee | Fee Discounts |

|---|---|---|---|

| MEXC | 0.2% | 0.2% | Available with MX token holdings |

| Poloniex | 0.15% | 0.25% | Available based on trading volume |

Poloniex offers slightly better maker fees at 0.15%, which benefits you if you’re adding liquidity to the market. MEXC maintains consistent fees for both maker and taker trades.

Deposit Fees:

Both exchanges typically offer free deposits for most cryptocurrencies. However, blockchain network fees still apply when you transfer assets to either platform.

Withdrawal Fees:

Withdrawal fees vary significantly by cryptocurrency on both platforms. Poloniex tends to have competitive withdrawal fees for major cryptocurrencies like Bitcoin and Ethereum.

MEXC’s withdrawal fees change based on network congestion, which means they can be unpredictable at times. You might pay more during busy periods.

Both exchanges offer fee reductions through loyalty programs. MEXC provides discounts when you hold their native MX token, while Poloniex reduces fees based on your 30-day trading volume.

For the most accurate and current fee information, you should check each exchange’s fee schedule directly as these rates may have changed since early 2025.

MEXC vs Poloniex: Order Types

When trading on cryptocurrency exchanges, the types of orders available can greatly impact your trading strategy. Both MEXC and Poloniex offer a variety of order types to help you execute trades effectively.

MEXC provides a comprehensive selection of order types that cater to different trading needs. You can use market orders for immediate execution at current market prices or limit orders to set your desired price point.

Poloniex also offers these standard order types, allowing you to control your entry and exit positions.

Both platforms support stop-limit orders, which help you manage risk by setting trigger prices for automatic trade execution.

MEXC goes a step further by offering advanced order types like trailing stop orders and OCO (One-Cancels-the-Other) orders. These give you more flexible trading options, especially during volatile market conditions.

Poloniex’s interface presents order types in a straightforward manner that beginners can navigate easily. Meanwhile, MEXC’s platform may offer more technical options for experienced traders.

The execution speed for orders is generally reliable on both platforms. However, during high market volatility, you might experience slight delays.

For margin trading, both exchanges provide specialized order types, though MEXC tends to offer more variety in this area.

Consider your trading style when choosing between these platforms. If you prefer simple, straightforward trading, Poloniex’s order system might suit you better. For more complex strategies requiring diverse order types, MEXC potentially offers more tools.

MEXC vs Poloniex: KYC Requirements & KYC Limits

Both MEXC and Poloniex have different approaches to Know Your Customer (KYC) requirements. Understanding these differences can help you choose the exchange that best fits your privacy preferences.

MEXC markets itself as a “no KYC exchange” for basic trading. You can trade on MEXC without completing identity verification initially. However, it’s important to note that MEXC may require KYC verification later, especially for larger withdrawals.

Poloniex, on the other hand, requires KYC verification for all users. You’ll need to submit identity documents before being able to use their platform fully.

Withdrawal Limits Based on KYC Status:

| Exchange | No KYC Withdrawal Limit | With KYC Withdrawal Limit |

|---|---|---|

| MEXC | Limited (varies) | Higher limits |

| Poloniex | Not available | Full access |

MEXC’s approach offers more initial privacy and faster account setup. You can start trading quickly without identity verification.

Poloniex’s mandatory KYC provides more regulatory clarity but requires more time to set up your account. You must complete verification before trading.

Be aware that MEXC might still request KYC information if they flag unusual account activity or if you try to withdraw larger amounts. Some users have reported unexpected KYC requests after using the platform.

Your choice between these exchanges should consider how important immediate trading without KYC is to you versus long-term account stability.

MEXC vs Poloniex: Deposits & Withdrawal Options

When choosing between MEXC and Poloniex, understanding their deposit and withdrawal options is crucial for your trading experience.

MEXC offers multiple methods for funding your account. You can deposit via bank transfers or by sending cryptocurrency directly to your wallet. This flexibility makes it convenient for both new and experienced traders.

Poloniex also provides several deposit options including bank transfers. Their system supports various cryptocurrencies for deposits, giving you choices based on your preferences.

Comparison of Deposit Methods:

| Method | MEXC | Poloniex |

|---|---|---|

| Bank Transfer | ✓ | ✓ |

| Cryptocurrency | ✓ | ✓ |

| Credit/Debit Cards | Varies by region | Limited availability |

For withdrawals, both exchanges allow you to transfer your funds back to your bank account or withdraw as cryptocurrency to your personal wallet.

Processing times can vary between the platforms. Bank transfers typically take 1-3 business days on both exchanges, while crypto withdrawals are generally faster.

Fee structures differ slightly between MEXC and Poloniex. You should check their current fee schedules before making large transactions as these can impact your overall costs.

Both platforms implement security measures for deposits and withdrawals, including verification processes to protect your funds.

MEXC vs Poloniex: Trading & Platform Experience Comparison

MEXC and Poloniex offer different trading experiences that may suit various types of crypto traders. Both platforms provide spot trading options, but with notable differences in their interfaces and features.

MEXC stands out with its five business models including Spot Trading, C2C, Derivatives, and PoS Pool. The platform utilizes high-performance mega-transaction match engine technology, which helps execute trades quickly and efficiently.

Poloniex has a more established history in the crypto space and offers a straightforward trading interface. Many users find it approachable for both beginners and experienced traders.

When comparing user interfaces, MEXC offers a more modern design with customizable features. Poloniex maintains a simpler layout that some traders prefer for its clarity.

Trading Features Comparison:

| Feature | MEXC | Poloniex |

|---|---|---|

| Trading Types | Spot, Futures, Margin | Spot, Margin |

| Mobile App | Yes (highly rated) | Yes |

| Order Types | Market, Limit, Stop-limit | Market, Limit, Stop-limit |

| Trading View Integration | Yes | Yes |

Both exchanges support various order types, giving you flexibility in how you execute trades. MEXC generally offers more advanced trading options, especially with its derivatives platform.

You’ll find that MEXC tends to list more newer cryptocurrencies and trading pairs compared to Poloniex. This gives you access to emerging projects earlier in their lifecycle.

MEXC vs Poloniex: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial to manage your risk. Both MEXC and Poloniex have systems in place to protect themselves when your positions lose too much value.

MEXC uses a forced liquidation mechanism that kicks in when your margin ratio falls below the maintenance margin requirement. This helps prevent further losses on your account and protects the platform from negative balances.

Poloniex handles liquidation through an Auto-Deleveraging (ADL) mechanism. This system automatically reduces positions when they become too risky, helping to maintain stability on the platform.

Key Differences:

| Feature | MEXC | Poloniex |

|---|---|---|

| Liquidation Type | Forced Liquidation | ADL Mechanism |

| Warning System | Yes, margin alerts | Basic warnings |

| Transparency | Detailed FAQ available | Limited documentation |

| User Control | More settings to adjust risk | Fewer customization options |

MEXC provides more detailed information about their liquidation process, which can help you trade futures more effectively. Their educational resources explain how the system works and what to expect.

You should set stop-loss orders on both platforms to prevent liquidation before it happens. This gives you more control over your exit prices rather than letting the automatic systems take over.

Remember that higher leverage (up to 200x on MEXC) means a higher risk of liquidation. Always trade within your risk tolerance and use leverage cautiously.

MEXC vs Poloniex: Insurance

When comparing MEXC and Poloniex exchanges, insurance policies are important to consider for your asset protection. Both platforms offer some form of security measures, but they differ in their specific insurance coverage approaches.

MEXC has established an “Investor Protection Fund” to safeguard user assets. This fund is designed to provide compensation in case of security breaches or other incidents that might affect user funds.

Poloniex also implements security measures but has experienced issues in the past. In 2019, the exchange faced a significant hack that resulted in losses, which led them to strengthen their security protocols.

Neither exchange offers FDIC insurance since cryptocurrency assets don’t qualify for this protection. This is different from traditional financial institutions where your deposits might be insured.

Both platforms use cold storage techniques to store most user funds offline. This approach significantly reduces the risk of online attacks and unauthorized access.

For additional protection, you should consider:

- Enabling two-factor authentication (2FA)

- Using strong, unique passwords

- Withdrawing large amounts to personal wallets

- Regularly monitoring your account activities

The insurance and security features continue to evolve as both exchanges adapt to the changing cryptocurrency landscape and security challenges.

MEXC vs Poloniex: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both MEXC and Poloniex offer support options, but they differ in availability and methods.

MEXC provides more comprehensive customer support channels. You can reach their team through email, live chat, and phone support. This variety gives you flexibility when you need help with your account or transactions.

Poloniex also offers customer support, though with potentially fewer contact methods. Their support system aims to help users with trading issues and account problems.

Response times can vary for both exchanges. During high trading volume periods or market volatility, you might experience longer wait times for assistance.

Support Comparison:

| Feature | MEXC | Poloniex |

|---|---|---|

| Email Support | ✓ | ✓ |

| Live Chat | ✓ | Limited |

| Phone Support | ✓ | Not specified |

Both exchanges offer knowledge bases and FAQs to help you solve common problems without contacting support. These self-help resources can be valuable for quick troubleshooting.

User experiences with support quality vary for both platforms. Some users report positive interactions while others mention delays or unresolved issues.

When deciding between these exchanges, consider how important immediate support access is for your trading style. If you’re new to crypto trading, robust support options might be especially valuable to you.

MEXC vs Poloniex: Security Features

When choosing a crypto exchange, security should be your top priority. Both MEXC and Poloniex offer similar security features to protect your assets.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection beyond just your password. You’ll need to confirm your identity through a second method when logging in.

Both exchanges utilize cold storage systems for most user funds. This means the majority of cryptocurrencies are kept offline, away from potential online threats.

MEXC Security Features:

- Two-factor authentication

- Cold storage for majority of assets

- Regular security audits

- Anti-phishing codes

- Withdrawal whitelisting

Poloniex Security Features:

- Two-factor authentication

- Cold storage solutions

- IP address verification

- Email confirmation for withdrawals

- Advanced API key permissions

You should note that both exchanges have faced security challenges in the past. Some users have reported issues with account freezes during verification processes.

Remember to always enable all available security features when using either platform. Create strong passwords and never share your authentication details with anyone.

While these exchanges implement strong security measures, you should consider using a hardware wallet for long-term storage of large cryptocurrency holdings.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record with no reported hacks or lost user funds. This track record suggests a strong commitment to security.

The exchange employs robust security protocols, including a multi-tier security system to protect user assets and information. These measures help safeguard your investments while trading on the platform.

As of 2025, MEXC is considered a legitimate cryptocurrency exchange available in most countries. However, you should verify its legal status in your specific location before using it.

Important KYC Update: While MEXC was previously known as a “no KYC” exchange, this changed in 2024. KYC (Know Your Customer) verification is now mandatory for users.

MEXC has sometimes been criticized for inconsistent KYC enforcement. Some users report that the exchange operates without KYC until certain situations arise, at which point verification may suddenly be required.

When comparing safety features to Poloniex, both exchanges offer reliable security measures to protect your assets. Your specific needs and location may determine which platform is better suited for you.

Before using MEXC, you should:

- Verify it’s legal in your country

- Understand the KYC requirements

- Use additional security features like 2FA

- Start with smaller amounts until you’re comfortable with the platform

Is Poloniex A Safe & Legal To Use?

Poloniex has a mixed reputation when it comes to safety. The exchange has faced security issues in the past, including a notable breach. However, it has since improved its security measures.

Poloniex implements several security protocols to protect user funds. These include cold storage solutions, two-factor authentication (2FA), and encryption technologies. These measures help keep your assets safer from potential threats.

Security Features:

- Cold storage for most funds

- Two-factor authentication

- Encrypted data

In terms of legality, Poloniex operates in many countries worldwide but has important restrictions. Most notably, Poloniex does not allow users from the United States to open accounts or perform any financial activities on the platform.

If you’re a US resident, you’ll need to look for alternative exchanges like Binance, KuCoin, Gate.io, or MEXC. These platforms are often mentioned as better alternatives by cryptocurrency users.

When comparing security with other exchanges, Poloniex falls somewhere in the middle. While it’s not considered the most secure platform available, it has made efforts to strengthen its security after past incidents.

Before using Poloniex, you should verify it’s legal in your country and consider keeping only trading amounts on the platform rather than storing large holdings long-term.

Frequently Asked Questions

Traders often wonder about key differences between MEXC and Poloniex when choosing an exchange. These questions cover important aspects like fees, security features, and cryptocurrency selection that impact your trading experience.

What are the differences in fees between MEXC and Poloniex?

MEXC offers a competitive fee structure with spot trading fees starting at 0.2% for makers and takers. These fees can decrease based on your trading volume and MEXC token holdings.

Poloniex charges slightly higher standard fees at 0.25% for makers and takers. They also offer fee discounts based on 30-day trading volume and TRX holdings.

MEXC has lower withdrawal fees for most cryptocurrencies compared to Poloniex. Deposit fees are free on both platforms, giving you cost-efficient options for adding funds.

How do MEXC and Poloniex compare in terms of security measures?

Both exchanges implement two-factor authentication (2FA) and cold storage for most user funds. MEXC adds extra security with anti-phishing codes and advanced risk control systems.

Poloniex offers IP address monitoring and email confirmations for withdrawals. They maintain insurance funds to protect users against potential losses.

MEXC has had fewer security incidents in recent years. Poloniex experienced a major hack in 2014 but has significantly improved its security infrastructure since then.

What variety of cryptocurrencies are available on MEXC compared to Poloniex?

MEXC supports over 1,500 cryptocurrencies and more than 2,100 trading pairs. Their selection includes major coins, new tokens, and many emerging altcoins.

Poloniex offers around 300 cryptocurrencies and 450 trading pairs. They focus more on established coins but still provide access to popular DeFi and NFT tokens.

MEXC typically lists new projects faster than Poloniex. This gives you earlier access to emerging cryptocurrencies with growth potential.

How user-friendly are the platforms of MEXC and Poloniex for beginners?

MEXC has a clean interface with helpful guides and a simple registration process. Their mobile app is highly rated and includes all features from the desktop version.

Poloniex offers a more traditional trading interface that might feel familiar to experienced traders. Their platform includes basic educational resources but has a steeper learning curve.

Both exchanges provide demo accounts or practice modes where you can test trading strategies without risking real money. MEXC’s simplified view option makes it more approachable for beginners.

Can traders from all countries access both MEXC and Poloniex?

MEXC is available in over 200 countries but restricts access for users from the United States, Singapore, and a few other regions with strict regulations.

Poloniex does not serve customers from the United States, Cuba, Iran, North Korea, Syria, and the Crimea region. They require KYC verification in most supported countries.

Both exchanges may have limited functionality in certain jurisdictions. Always check the current restrictions for your location before creating an account.

What are the customer support options available on MEXC and Poloniex?

MEXC provides 24/7 customer support through live chat, email, and ticket systems. They also maintain active community channels on Telegram and Twitter.

Poloniex offers email support and a ticket system with generally longer response times. Their help center includes detailed guides for common issues.

MEXC’s support team typically responds within hours, while Poloniex may take 1-2 days for complex issues. Both platforms have extensive FAQs and knowledge bases for self-service problem-solving.

Poloniex vs MEXC Conclusion: Why Not Use Both?

After reviewing both MEXC and Poloniex, you might wonder which exchange to choose. The answer could be simpler than you think: consider using both.

MEXC offers impressive market depth that has doubled recently, making it surprisingly deep for trading. It provides a wide variety of coins and tokens, giving you access to a comprehensive selection of cryptocurrencies.

Poloniex brings its own strengths to the table. It’s backed by Goldman Sachs, providing institutional credibility. The platform serves both individual traders and firms dealing in crypto.

Benefits of using both exchanges:

- Wider coin selection: Access more trading pairs across both platforms

- Risk diversification: Avoid keeping all your assets on a single exchange

- Different fee structures: Take advantage of lower fees for specific transactions

- Backup trading option: If one platform experiences downtime, you have an alternative

Be aware that while MEXC advertises as “no KYC,” users report they may require verification in certain situations. This flexibility might be helpful or concerning depending on your needs.

By using both exchanges, you get the best of both worlds. You can leverage MEXC’s deep liquidity and extensive coin offerings alongside Poloniex’s institutional backing and reliability.