Choosing between MEXC and Phemex can be tricky for crypto traders looking to find their ideal exchange. Both platforms offer varied features for buying, selling, and trading digital assets, but they differ in important ways that might impact your experience.

When comparing MEXC vs Phemex in 2025, key differences emerge in their fee structures, available cryptocurrencies, leverage trading options, and user interfaces that can significantly affect your trading results. While MEXC tends to support a wider range of altcoins, Phemex often appeals to traders focused on futures and leverage trading.

You’ll want to consider factors like deposit methods, security measures, and trading tools before making your decision. Both exchanges have built solid reputations in the crypto space, but your specific trading needs and preferences will ultimately determine which platform better suits your strategy.

MEXC Vs Phemex: At A Glance Comparison

When choosing between MEXC and Phemex for cryptocurrency trading, you’ll want to consider several key factors. Both exchanges offer leverage trading options but differ in important ways.

Trading Fees

| Exchange | Spot Trading | Futures Trading |

|---|---|---|

| MEXC | Lower fees | Competitive rates |

| Phemex | Competitive | Premium subscription option |

Available Cryptocurrencies

MEXC typically offers a wider selection of altcoins and new tokens. Phemex focuses on established cryptocurrencies with strong liquidity.

User Interface

Phemex provides a cleaner, more intuitive dashboard that beginners find easier to navigate. MEXC offers more features but might feel overwhelming if you’re new to crypto trading.

Security Features

Both exchanges implement two-factor authentication and cold storage solutions. Phemex emphasizes its security measures more prominently in marketing materials.

Mobile Experience

You can access both platforms via mobile apps. Phemex’s app receives slightly higher ratings for stability and user experience.

Customer Support

Response times vary between the exchanges. MEXC offers multiple support channels including live chat. Phemex provides educational resources alongside traditional support options.

Trading Tools

Phemex offers advanced charting capabilities and trading bots. MEXC provides a broader range of order types for specialized trading strategies.

Your choice between MEXC and Phemex should depend on your specific trading needs, experience level, and the cryptocurrencies you’re interested in trading.

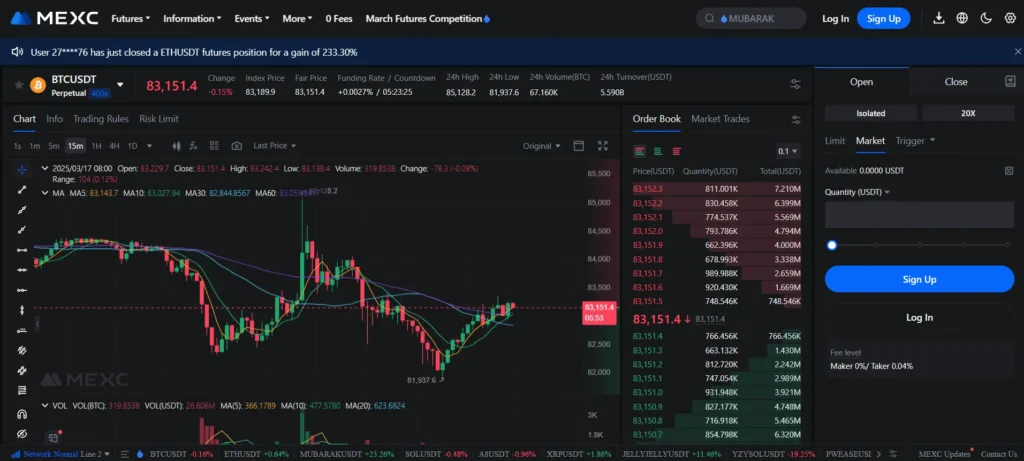

MEXC Vs Phemex: Trading Markets, Products & Leverage Offered

MEXC and Phemex offer diverse trading options for crypto traders. Both platforms provide spot trading for buying and selling cryptocurrencies directly.

MEXC supports thousands of trading pairs, giving you more variety when choosing which cryptocurrencies to trade. Phemex offers fewer pairs but focuses on popular cryptocurrencies with high liquidity.

Derivatives Trading:

- MEXC: Futures trading with up to 200X leverage

- Phemex: Derivatives trading with up to 100X leverage

Both exchanges support margin trading, allowing you to borrow funds to increase your position size. This amplifies both potential gains and losses.

Phemex stands out for its derivatives trading platform, making it popular among traders who focus on futures contracts. MEXC, however, offers more extensive market options overall.

Product Comparison:

| Feature | MEXC | Phemex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Derivatives | ✓ | ✓ |

| Max Leverage | 200X | 100X |

| Trading Pairs | Thousands | Hundreds |

| Margin Trading | ✓ | ✓ |

You’ll find MEXC better if you’re looking for a wider selection of altcoins and higher leverage options. Phemex might suit you better if you prefer a platform specialized in derivatives trading with strong features for that purpose.

Both exchanges offer mobile apps so you can trade on the go, with similar core functionalities available on desktop and mobile versions.

MEXC Vs Phemex: Supported Cryptocurrencies

When choosing between MEXC and Phemex, the number of supported cryptocurrencies is a crucial factor to consider for your trading experience.

According to recent data, MEXC significantly outpaces Phemex in cryptocurrency variety. MEXC supports approximately 2,700+ cryptocurrencies and offers 3,000+ trading pairs. This extensive selection makes it an excellent choice if you want access to a wide range of tokens.

Phemex, while more limited, still provides a substantial offering with support for about 350 spot cryptocurrencies. This selection covers most major coins and many popular altcoins that you might want to trade.

Here’s a quick comparison:

| Exchange | Supported Cryptocurrencies | Trading Pairs |

|---|---|---|

| MEXC | 2,700+ | 3,000+ |

| Phemex | 350 | Not specified |

The difference in supported assets might impact your decision based on your trading needs. If you frequently trade niche altcoins or want exposure to newer tokens, MEXC’s larger selection could be more beneficial for you.

Phemex’s more focused selection might be sufficient if you primarily trade established cryptocurrencies. The platform still covers all major coins that most traders regularly use.

Both exchanges regularly add new cryptocurrencies to their platforms, so it’s worth checking their current listings if you’re looking for specific tokens to trade.

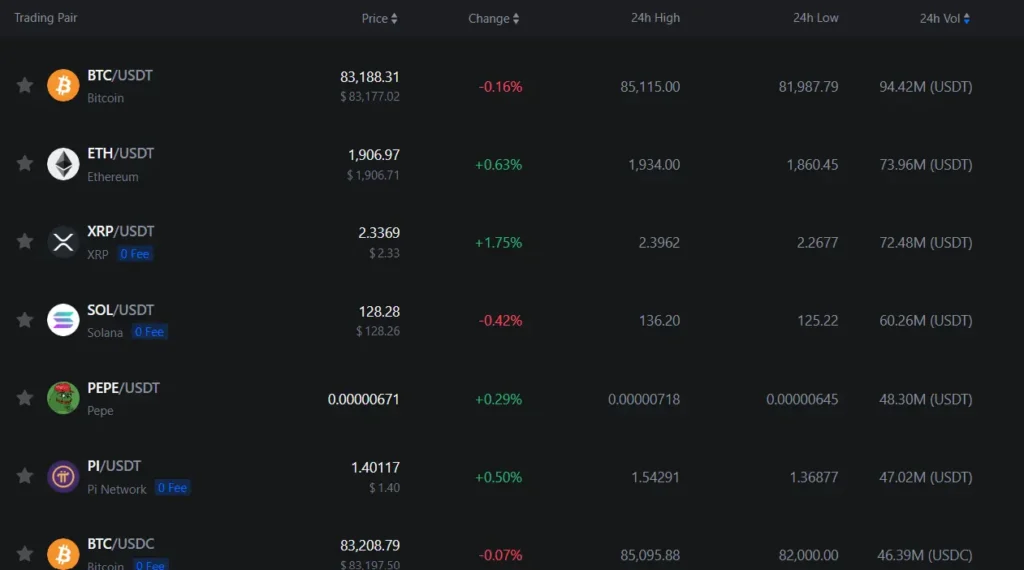

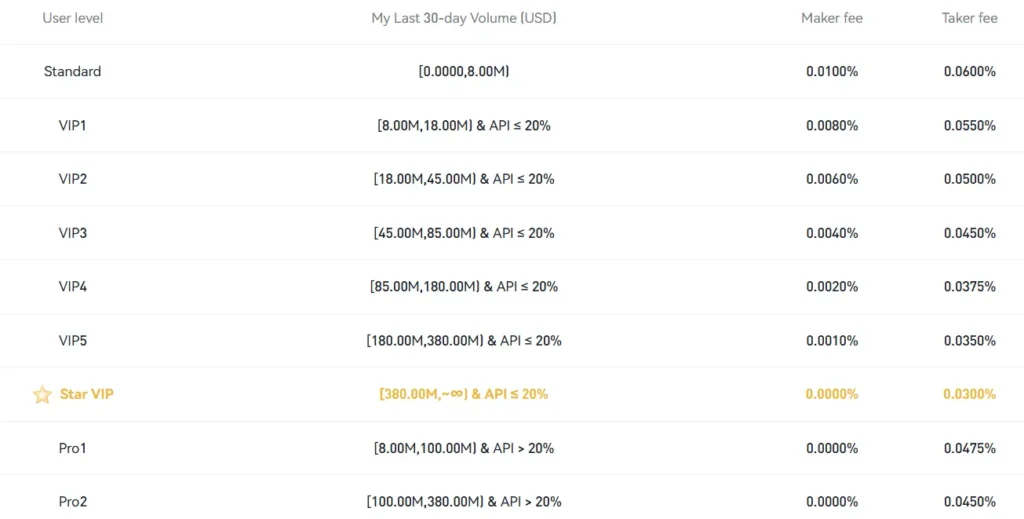

MEXC Vs Phemex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and Phemex, understanding their fee structures is crucial for your trading strategy. Both exchanges offer competitive rates, but there are notable differences.

Trading Fees:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| MEXC | 0.1% | 0.1% |

| Phemex | 0.1% | 0.1% |

While basic trading fees appear similar, both platforms offer fee discounts based on trading volume and native token holdings. Phemex users can reduce fees by holding their PHX token, while MEXC offers similar benefits with their MX token.

Deposit Fees:

Both exchanges typically offer free crypto deposits. However, fiat deposit methods may include various fees depending on your payment method and location.

Withdrawal Fees:

Withdrawal fees vary by cryptocurrency on both platforms. MEXC and Phemex charge network fees that fluctuate based on blockchain congestion. Generally, MEXC supports more cryptocurrencies (over 3,000) than Phemex, giving you more options with varying withdrawal fees.

You should check the current fee schedule on both platforms before making your decision. Fee structures in crypto exchanges change frequently based on market conditions.

For high-volume traders, these seemingly small fee differences can significantly impact your overall profits. Consider your trading patterns and frequency when choosing between these platforms.

MEXC Vs Phemex: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is crucial for executing your strategy effectively. Both MEXC and Phemex offer a variety of order types to meet different trading needs.

MEXC Order Types:

- Market Orders

- Limit Orders

- Stop-Limit Orders

- One-Cancels-the-Other (OCO)

- Trailing Stop Orders

MEXC provides solid options for both beginners and advanced traders. Their platform supports conditional orders, which can help you manage risk when you’re unable to monitor the market constantly.

Phemex Order Types:

- Market Orders

- Limit Orders

- Stop-Limit Orders

- Conditional Orders

- Take Profit/Stop Loss

Phemex stands out with its user-friendly interface for placing different order types. The platform makes it easy to set up complex trading strategies with just a few clicks.

Both exchanges support the essential market and limit orders that most traders use regularly. However, Phemex offers slightly more intuitive placement of stop-loss and take-profit orders within the same trading interface.

For leverage trading, both platforms provide similar order type functionality. You can set conditional orders based on price triggers to help manage your positions automatically.

Your trading style will determine which platform’s order types work better for you. Frequent traders might appreciate Phemex’s streamlined order placement, while MEXC offers comparable functionality with a different interface layout.

MEXC Vs Phemex: KYC Requirements & KYC Limits

MEXC offers a more flexible approach to KYC (Know Your Customer) verification. While MEXC does have KYC, it isn’t mandatory for basic trading activities. The platform has two account tiers: primary and advanced.

For unverified users on MEXC, you can still trade but will face certain withdrawal limits. This makes MEXC attractive if you prefer privacy or want to start trading immediately without going through identity verification.

If you’re in the US, you should note that MEXC requires using a VPN, as indicated by user experiences.

Phemex also has KYC requirements, though specific details about their verification process weren’t extensively covered in the search results. The comparison video mentioned “KYC Limits” as a comparison point between the two platforms.

Both platforms implement KYC primarily to determine withdrawal limits and available features. Your choice between them may depend on how important KYC-free trading is to your strategy.

Neither platform requires full verification to begin basic trading, making them both accessible options for new traders or those concerned about privacy.

When deciding between MEXC and Phemex, consider how their KYC policies align with your trading needs, location restrictions, and privacy preferences.

MEXC Vs Phemex: Deposits & Withdrawal Options

Both MEXC and Phemex offer multiple options for depositing and withdrawing funds. These options play a crucial role in your trading experience.

MEXC Deposit Methods:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

- Third-party payment processors

MEXC typically processes deposits quickly, with crypto deposits showing up after network confirmations. Fiat deposits might take 1-3 business days depending on your payment method.

Phemex Deposit Methods:

- Cryptocurrency deposits

- Bank transfers (limited regions)

- Credit/debit cards

- P2P trading options

Phemex focuses more on crypto deposits, making it especially suitable if you already hold digital assets. Their system confirms deposits after the required network confirmations.

Withdrawal Comparison:

| Feature | MEXC | Phemex |

|---|---|---|

| Crypto withdrawals | Yes | Yes |

| Fiat withdrawals | Yes (limited regions) | Limited |

| Withdrawal fees | Variable by asset | Variable by asset |

| Processing time | 1-24 hours (crypto) | 1-24 hours (crypto) |

Both exchanges implement security measures for withdrawals, including email confirmations and two-factor authentication requirements. You’ll need to complete KYC verification on both platforms to access all withdrawal options.

The minimum and maximum withdrawal amounts vary by cryptocurrency and payment method. Phemex tends to have competitive withdrawal fees for popular cryptocurrencies like Bitcoin and Ethereum.

You should check the current fee structure on both platforms before deciding, as these can change based on network conditions.

MEXC Vs Phemex: Trading & Platform Experience Comparison

When comparing MEXC and Phemex trading platforms, several key differences stand out that might affect your trading experience.

User Interface

MEXC offers a straightforward interface that beginners can navigate easily. Phemex provides a more polished look with customizable charts and trading views that appeal to experienced traders.

Trading Tools

- MEXC: Basic charting tools, multiple order types

- Phemex: Advanced technical analysis features, demo trading account

Phemex’s demo account lets you practice strategies without risking real money. This feature is particularly valuable if you’re new to leverage trading.

Mobile Experience

Both exchanges offer mobile apps, but Phemex’s app receives higher marks for stability and feature parity with the desktop version.

Trading Types

| Feature | MEXC | Phemex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Leverage | Up to 200x | Up to 100x |

| Options | Limited | More extensive |

MEXC typically offers more trading pairs, especially for newer and smaller cap cryptocurrencies. This gives you access to a wider range of assets.

Phemex tends to have more reliable performance during high market volatility. Your trades are less likely to be affected by system slowdowns during major market movements.

The platform you choose should align with your trading style and experience level. MEXC might suit you better if you prioritize asset variety, while Phemex could be preferable if trading tool sophistication matters more.

MEXC Vs Phemex: Liquidation Mechanism

Liquidation mechanisms protect exchanges when traders can’t cover their losses. Both MEXC and Phemex have systems to automatically close positions when your collateral falls below required levels.

MEXC uses a forced liquidation system that triggers when your margin ratio becomes too low. This helps maintain platform stability and protects other traders from excessive market impact.

Phemex also employs automatic liquidation but with some different parameters. Their system monitors your positions continuously and may liquidate when your maintenance margin requirement isn’t met.

Key Differences:

| Feature | MEXC | Phemex |

|---|---|---|

| Liquidation Warning | Sends alerts before liquidation | Provides notification system |

| Partial Liquidation | Available on some assets | More widely implemented |

| Liquidation Fees | Varies by asset | Generally competitive |

Both platforms offer high leverage – MEXC allows up to 200x leverage on major cryptocurrencies like Bitcoin and Ethereum. This high leverage increases profit potential but also raises liquidation risk.

You should understand the liquidation process before trading with leverage. Setting stop-loss orders can help manage risk and prevent complete liquidation.

The liquidation price depends on your position size, leverage used, and initial margin. Higher leverage means your liquidation price will be closer to your entry price.

Both exchanges provide calculators to help you determine potential liquidation prices before entering trades.

MEXC Vs Phemex: Insurance

Both MEXC and Phemex offer insurance funds to protect traders from extreme market conditions. These funds help prevent auto-liquidations when markets become volatile.

MEXC Insurance Fund

- Established to protect users from negative balance risks

- Covers futures trading losses that exceed a user’s margin

- Fund size is not publicly disclosed in detail

Phemex Insurance Fund

- Substantial protection with a clearly visible fund size

- Updates fund balance regularly on their platform

- Uses the fund to prevent socialized losses during market crashes

Phemex tends to be more transparent about their insurance fund operations. You can easily find information about the current size of their fund on their website.

MEXC is more private about their exact insurance fund details. However, they still maintain protection for traders against unexpected market movements.

Neither exchange has experienced major insurance fund failures in recent market downturns. This speaks to their risk management systems working effectively.

When choosing between these exchanges, consider how important insurance transparency is to your trading strategy. If you want clear visibility into protection mechanisms, Phemex offers more detailed information.

Both platforms ultimately aim to protect you from worst-case scenarios in volatile trading environments. Their insurance systems work behind the scenes to maintain market stability during extreme price movements.

MEXC Vs Phemex: Customer Support

When choosing between MEXC and Phemex, customer support quality can make a big difference in your trading experience. Both exchanges offer several support channels to help solve your problems.

MEXC provides 24/7 customer support through live chat, email, and ticket systems. You can also find help through their comprehensive knowledge base and FAQ section. Many users report fast response times, usually within a few hours.

Phemex also offers around-the-clock support with similar contact options. Their live chat feature is particularly praised for quick resolution of basic issues. They maintain an extensive help center with tutorials and guides for new users.

Support Channels Comparison:

| Feature | MEXC | Phemex |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Ticket System | ✓ | ✓ |

| Social Media | Twitter, Telegram | Twitter, Telegram |

| Knowledge Base | Extensive | Extensive |

| Response Time | 2-6 hours (avg) | 1-4 hours (avg) |

Language support is another important factor to consider. MEXC offers support in more languages than Phemex, making it more accessible if English isn’t your primary language.

Both platforms have active community forums where you can find answers to common questions. These peer-to-peer support options often provide quick solutions to typical problems.

For complex issues like account recovery or verification problems, Phemex typically resolves matters slightly faster based on user reviews from 2025 comparisons.

MEXC Vs Phemex: Security Features

When choosing a crypto exchange, security should be your top priority. Both MEXC and Phemex offer robust security measures to protect your assets.

MEXC implements two-factor authentication (2FA), which adds an extra layer of security to your account. They also use cold storage for most user funds, keeping them offline and away from potential hackers.

Phemex also offers 2FA but goes a step further with their cold wallet system that stores 99% of user assets. Their security team includes former Morgan Stanley executives who understand financial security protocols.

Key Security Features Comparison:

| Feature | MEXC | Phemex |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | Partial | 99% of funds |

| Insurance Fund | Limited | Comprehensive |

| KYC Requirements | Basic | More stringent |

| Security Team | Standard | Ex-Wall Street professionals |

Both platforms use SSL encryption to protect your data during transactions. They also monitor for suspicious activities and have automatic risk control systems.

Phemex requires more thorough KYC (Know Your Customer) verification than MEXC. This might feel inconvenient but actually helps protect against fraud and money laundering.

MEXC offers IP whitelisting, allowing you to restrict account access to specific devices. Phemex provides regular security audits from third-party firms to identify potential vulnerabilities.

Neither platform has experienced any major security breaches as of March 2025, which speaks to their commitment to security.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record with no reported hacks or loss of user funds. This track record is important when evaluating crypto exchanges.

The platform is legal to use in many jurisdictions, though availability varies by country. You should verify MEXC’s legal status in your location before signing up.

Some users have reported issues with MEXC, including:

- Unexpected mandatory KYC requirements

- Difficulties withdrawing funds

- Problems with trade execution

Despite these concerns, MEXC is listed among the top ten crypto platforms for day trading in 2025, alongside competitors like Binance, Coinbase, and Phemex.

MEXC offers zero trading fees, which is attractive for frequent traders. The platform also provides numerous features for various trading styles.

When using MEXC, consider these safety practices:

- Enable two-factor authentication

- Use strong, unique passwords

- Keep most assets in cold storage

- Start with small amounts to test withdrawal processes

You should also be aware that cryptocurrency exchanges face evolving regulations worldwide. MEXC’s compliance measures, including KYC requirements, may change in response to these regulations.

If security is your primary concern, compare MEXC with other established exchanges to determine which best meets your specific trading needs and risk tolerance.

Is Phemex A Safe & Legal To Use?

Phemex stands as a legitimate and secure crypto exchange in the industry. According to search results, it has maintained a strong security record with no reported hacks since its launch.

The platform employs robust security measures to protect your funds and personal information. Phemex uses a multi-signature cold wallet system to store most user assets offline, keeping them safe from potential online threats.

For traders concerned about privacy, Phemex offers certain crypto-to-crypto transactions without KYC requirements. This feature provides you with flexibility while still maintaining necessary security protocols.

The exchange has established itself as a trustworthy centralized platform within the cryptocurrency space. Its reputation for security makes it a viable option for both beginners and experienced traders.

When comparing with other platforms like MEXC, Phemex particularly excels in futures trading and offers a straightforward user experience. This simplicity doesn’t compromise its security standards.

You can trade on Phemex with confidence knowing it employs industry-standard security practices. The platform continues to operate as a legal entity in jurisdictions where cryptocurrency trading is permitted.

Frequently Asked Questions

Traders often have specific questions when comparing MEXC and Phemex. Both exchanges offer unique features, fee structures, and security measures that cater to different trading needs.

What are the unique selling points of MEXC compared to Phemex for traders?

MEXC stands out with its extensive selection of altcoins, offering over 1,500 cryptocurrencies compared to Phemex’s more limited selection. This makes MEXC particularly attractive if you’re looking to trade emerging or niche tokens.

MEXC also provides a Launchpad platform for new token offerings, giving you early access to promising projects. Their MX token offers utility within the ecosystem, including fee discounts.

Phemex differentiates itself with a more user-friendly interface and stronger focus on derivatives trading. Their platform includes simulated trading environments that let you practice strategies without risking real funds.

Are there any differences in the fee structures between MEXC and Phemex?

MEXC typically charges spot trading fees of 0.2% for makers and takers, which can be reduced by holding MX tokens. Their futures trading fees start at 0.02% for makers and 0.06% for takers.

Phemex offers a more competitive standard spot fee structure at 0.1% for both makers and takers. They also provide a unique Premium membership option that eliminates trading fees entirely for a monthly subscription fee.

Both exchanges offer fee discounts based on trading volume, but Phemex’s tier system tends to reward high-volume traders more generously. This makes Phemex potentially more cost-effective for active traders.

How do the security measures of MEXC and Phemex compare?

MEXC implements multi-signature wallets, cold storage for majority of funds, and two-factor authentication. They maintain an insurance fund to protect users against unexpected losses during extreme market volatility.

Phemex emphasizes their security credentials with a team from traditional finance backgrounds. They store 99% of assets in cold wallets and use a comprehensive risk management system developed by former Morgan Stanley executives.

Both exchanges have solid track records regarding security incidents, but Phemex more prominently features their security measures in their marketing. Neither exchange has experienced major hacks as of March 2025.

Which trading pairs are available on MEXC and Phemex, and how do they differ?

MEXC offers more than 1,500 trading pairs across spot, margin, and futures markets. You’ll find extensive altcoin options including many low-cap tokens not available on other major exchanges.

Phemex focuses on approximately 300 trading pairs with emphasis on major cryptocurrencies and popular DeFi tokens. Their derivatives offerings include up to 100x leverage on futures contracts for Bitcoin and other major cryptocurrencies.

MEXC provides more options for token-to-token trading, while Phemex offers more structured products like crypto-backed loans and savings accounts. Your choice depends on whether you prioritize variety or specialization.

What customer support options are available for users of MEXC and Phemex?

MEXC provides 24/7 support through live chat, email, and ticketing systems. They offer multilingual support in over 10 languages but have received mixed reviews about response times during peak periods.

Phemex operates customer service around the clock with live chat as their primary contact method. Their response time averages under 30 minutes, and they maintain active community managers on Telegram and Discord.

Both exchanges offer extensive FAQs and knowledge bases, but Phemex tends to receive higher ratings for customer service quality and resolution effectiveness in user reviews.

Do MEXC and Phemex offer any educational resources for new traders?

MEXC provides a learning center with basic articles about cryptocurrency trading and platform features. Their educational content focuses on platform guidance rather than comprehensive trading education.

Phemex offers a more robust academy with structured courses on technical analysis, risk management, and trading psychology. Their “Learn and Earn” program rewards you with small amounts of crypto for completing educational modules.

Both platforms maintain blogs with market analysis, but Phemex invests more in beginner-friendly tutorials and interactive learning tools. This makes Phemex potentially more suitable if you’re new to cryptocurrency trading.

Phemex Vs MEXC Conclusion: Why Not Use Both?

When comparing Phemex and MEXC, it’s hard to declare a clear winner as both platforms offer unique advantages. Each exchange has its own strengths that might appeal to different trading needs.

MEXC stands out with its extensive selection of altcoins and reportedly lower fees. The platform is known for listing new tokens earlier than many competitors, which can be advantageous for traders seeking early opportunities.

Phemex, on the other hand, offers a robust trading experience with strong security features and a user-friendly interface. Their bonus structure (up to $8800 according to search results) might be appealing to new users.

Key Differences:

| Feature | MEXC | Phemex |

|---|---|---|

| Bonus | Up to $1000 | Up to $8800 |

| Coin Selection | Wider variety | More established coins |

| Best For | Altcoin traders | Security-focused users |

You don’t need to limit yourself to just one platform. Using both exchanges allows you to capitalize on the strengths of each while minimizing their weaknesses.

This dual-platform approach gives you access to a wider range of trading pairs and opportunities. You can use MEXC for newer altcoins while leveraging Phemex for its security and interface benefits.

Remember to implement proper security measures on both platforms, including two-factor authentication and careful management of your API keys.