When choosing a crypto exchange in 2025, MEXC and Deepcoin are two platforms that often come up in comparison discussions. These exchanges offer various features for cryptocurrency traders, including different fee structures, supported coins, and trading options.

Both MEXC and Deepcoin rank among the numerous exchanges available today, with each platform having its own strengths and weaknesses regarding trading volumes, user experience, and security measures. You’ll find that comparing these exchanges can help you make a more informed decision about where to trade your digital assets.

Understanding the differences between these platforms is important for your trading strategy. While MEXC has been around longer and has established more user reviews, Deepcoin is also competing in the market with its own set of features and supported cryptocurrencies.

MEXC Vs Deepcoin: At A Glance Comparison

When choosing between MEXC and Deepcoin exchanges, you need to understand their key differences. Both platforms offer cryptocurrency trading services but have distinct features that might influence your decision.

MEXC ranks higher on most exchange comparison sites based on trust score and trading volume. It typically offers more cryptocurrencies and trading pairs than Deepcoin, giving you more options.

Deepcoin focuses on derivatives trading and has gained popularity for its futures contracts. The platform has been growing but still hasn’t reached MEXC’s market position.

Here’s a quick comparison table:

| Feature | MEXC | Deepcoin |

|---|---|---|

| Founded | 2018 | 2018 |

| Trading Volume | Higher | Lower |

| Available Cryptocurrencies | More extensive | More limited |

| Fee Structure | Competitive | Competitive |

| User Interface | Well-developed | Developing |

| Trust Score | Higher | Lower |

MEXC offers more deposit methods compared to Deepcoin. This makes funding your account easier and more flexible with MEXC.

Security features are crucial for both platforms, but MEXC has established a longer track record of security practices.

User reviews generally favor MEXC for beginners due to its more intuitive interface and broader educational resources.

Deepcoin may appeal to you if you’re specifically interested in derivatives trading with its specialized tools.

MEXC Vs Deepcoin: Trading Markets, Products & Leverage Offered

MEXC and Deepcoin both offer diverse trading options for cryptocurrency investors, but they differ in key ways.

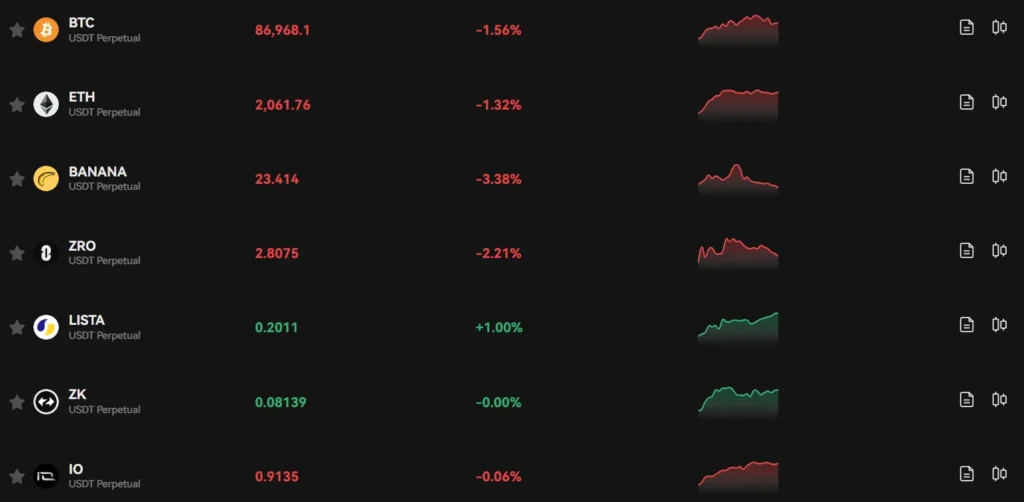

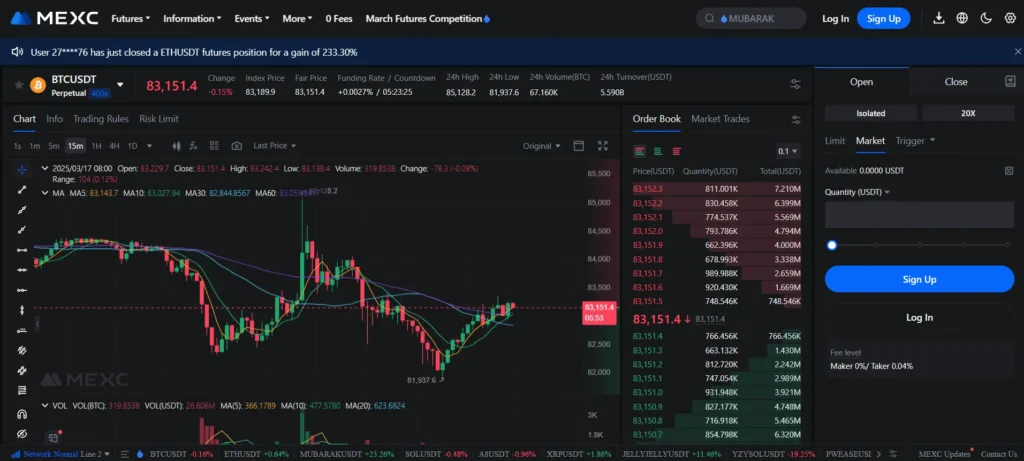

MEXC provides an impressive leverage of up to 400x on futures trading, making it one of the highest in the industry. This allows you to potentially achieve larger profits with a smaller initial investment.

Deepcoin offers competitive leverage as well, though not quite at MEXC’s level. Both platforms support spot trading for direct cryptocurrency purchases.

Trading Products Comparison:

| Feature | MEXC | Deepcoin |

|---|---|---|

| Spot Trading | Yes | Yes |

| Futures Trading | Yes | Yes |

| Max Leverage | Up to 400x | Lower than MEXC |

| Trading Fees (Spot) | 0.05% maker/taker | Varies |

| Trading Fees (Futures) | 0.01% maker, 0.04% taker | Varies |

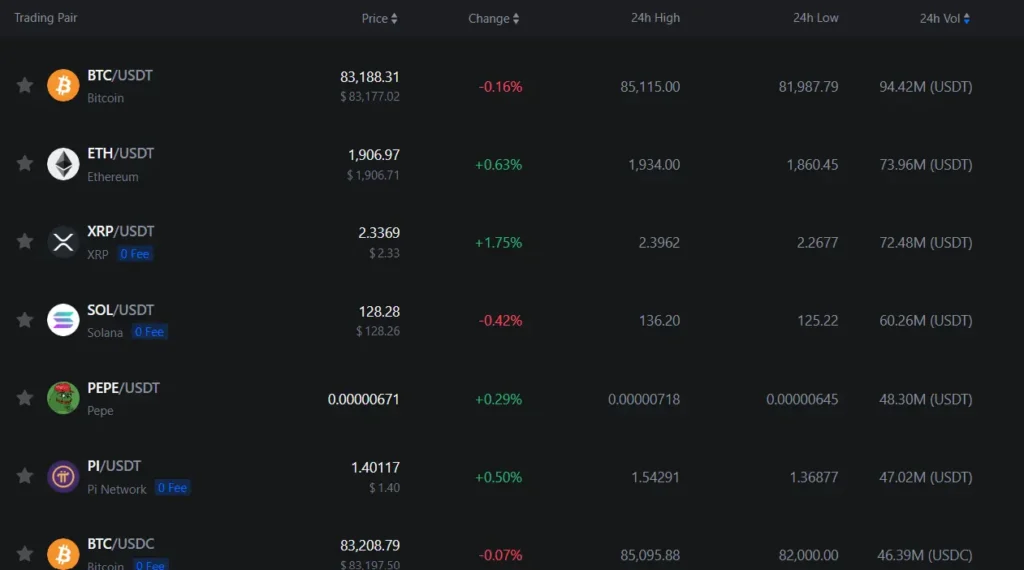

MEXC shines with its extensive cryptocurrency offerings, including major coins like Bitcoin and Ethereum, plus numerous altcoins.

Both exchanges provide futures trading with various contract types, but MEXC’s 400x leverage stands out as a significant advantage for traders looking for high-risk, high-reward opportunities.

Remember that higher leverage means greater potential profits but also increased risk of losses. Always use risk management strategies when trading with leverage.

MEXC also offers attractive staking options with up to 300% APR on 22 different coins, providing additional ways to earn passive income beyond trading.

MEXC Vs Deepcoin: Supported Cryptocurrencies

When choosing between MEXC and Deepcoin exchanges, the variety of available cryptocurrencies is an important factor to consider. Both platforms offer a wide range of digital assets, but there are some notable differences.

MEXC generally supports more cryptocurrencies than Deepcoin. With MEXC, you can trade hundreds of different tokens, including major coins like Bitcoin and Ethereum, as well as many smaller altcoins and newly launched projects.

Deepcoin also offers popular cryptocurrencies but tends to have a more limited selection compared to MEXC. However, Deepcoin still provides access to the most commonly traded coins that most investors seek.

Here’s a quick comparison of supported cryptocurrencies:

| Feature | MEXC | Deepcoin |

|---|---|---|

| Total cryptocurrencies | 1,500+ | 300+ |

| Major coins (BTC, ETH, etc.) | ✅ | ✅ |

| New token listings | Frequent | Less frequent |

| DeFi tokens | Extensive selection | Limited selection |

MEXC is known for listing new tokens quickly after their launch. This can be beneficial if you’re interested in investing in emerging projects early.

Both exchanges support trading pairs with stablecoins like USDT and USDC, giving you options for managing market volatility. Most trading pairs on both platforms use these stablecoins as the base currency.

If you’re looking for niche altcoins or newer tokens, MEXC likely offers more options. For traders focused mainly on established cryptocurrencies, either exchange would meet your basic needs.

MEXC Vs Deepcoin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and Deepcoin exchanges, fees play a crucial role in your decision-making process. Both platforms offer competitive fee structures, but there are important differences to consider.

MEXC Fee Structure:

- Spot trading: 0% for makers and 0.02% for takers

- Low withdrawal fees across most cryptocurrencies

- No deposit fees (standard in the industry)

MEXC stands out with its maker-taker model that allows you to place limit orders without any fees. This makes it especially attractive if you’re a patient trader who doesn’t need immediate execution.

Deepcoin Fee Structure:

- Competitive trading fees, though not as low as MEXC for makers

- Similar withdrawal fee structure to other major exchanges

- No deposit fees

When comparing the two exchanges, MEXC generally offers lower overall trading fees, which can make a significant difference if you trade frequently or in large volumes.

For deposits, both platforms won’t charge you anything to fund your account. This is standard practice across most crypto exchanges in 2025.

Withdrawal fees vary by cryptocurrency on both platforms. These fees cover the blockchain transaction costs and tend to fluctuate based on network congestion.

If minimizing fees is your primary concern, MEXC’s 0% maker fee gives it an edge over Deepcoin for regular traders who can wait for their orders to fill.

MEXC Vs Deepcoin: Order Types

Both MEXC and Deepcoin offer a variety of order types to meet different trading needs. Understanding these options can help you make better trading decisions.

MEXC Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One Cancels Other)

- Trailing stop orders

MEXC provides advanced order types for both beginners and experienced traders. Their platform supports conditional orders which can help you automate your trading strategy.

Deepcoin Order Types:

- Market orders

- Limit orders

- Stop orders

- Take profit orders

- Conditional orders

Deepcoin’s trading interface offers a robust layout with various order types. Their system is designed to execute orders quickly, which is crucial during volatile market conditions.

Both exchanges support spot and futures trading with appropriate order types for each. For futures trading, they offer leverage options and various position management tools.

The main difference lies in the execution speed and user interface. MEXC tends to have more order varieties, while Deepcoin focuses on fast execution and a clean trading experience.

You should consider which order types are most important for your trading style before choosing between these exchanges. If you need specialized order types, review each platform’s most recent features as they frequently update their offerings.

MEXC Vs Deepcoin: KYC Requirements & KYC Limits

MEXC offers a flexible approach to KYC verification. While KYC is available on the platform, it isn’t strictly mandatory for all users.

Without KYC verification, you can still use MEXC with daily withdrawal limits between 10-30 BTC. This option gives you basic access while maintaining some privacy.

MEXC has different verification tiers:

- Unverified: Limited functionality with 10-30 BTC daily withdrawal

- Primary KYC: Requires basic personal information with 80 BTC daily limit

- Advanced KYC: Full verification with higher limits

Completing KYC on MEXC helps protect your account security and reduces risks of fraud and money laundering.

Deepcoin, in contrast, has its own KYC policy. The platform generally requires some form of identity verification for higher withdrawal limits and full platform access.

Both exchanges use KYC as a security measure, but MEXC tends to be more flexible with its tiered approach. This makes MEXC potentially more appealing if you value privacy or prefer minimal verification.

Your choice between these platforms may depend on how much you value privacy versus security. MEXC’s optional KYC system offers more flexibility, while Deepcoin follows a more standard verification approach.

Remember that KYC requirements can change based on regulations, so always check the latest policies before making your decision.

MEXC Vs Deepcoin: Deposits & Withdrawal Options

When choosing between MEXC and Deepcoin exchanges, understanding their deposit and withdrawal options is crucial for your trading experience.

MEXC offers more diverse payment methods, including Visa and Mastercard for direct cryptocurrency purchases. The platform supports over 2,960 coins with more than 2,110 trading pairs, giving you extensive options.

Deepcoin also accepts Visa and Mastercard payments, allowing you to instantly receive your purchased assets. However, it generally supports fewer cryptocurrencies compared to MEXC.

Both exchanges charge withdrawal fees, but they differ in structure. MEXC maintains competitive withdrawal fees across its large selection of coins. The spot trading fee is approximately 0.1%.

Deepcoin’s withdrawal fees vary by cryptocurrency. Before making transactions, you should check their current fee schedule as these can change.

Deposit Methods Comparison:

| Feature | MEXC | Deepcoin |

|---|---|---|

| Credit Cards | ✓ | ✓ |

| Bank Transfer | ✓ | Limited |

| Crypto Deposits | All listed coins | All listed coins |

When making your choice, consider which cryptocurrencies you plan to trade and your preferred payment methods. MEXC might be better if you need extensive coin options, while Deepcoin could work well if their specific offerings match your needs.

Remember to verify the current fees and supported payment methods directly on each platform before making your decision, as these details may have updated since March 2025.

MEXC Vs Deepcoin: Trading & Platform Experience Comparison

When choosing between MEXC and Deepcoin exchanges, the trading interface and overall platform experience can make a significant difference in your cryptocurrency journey.

MEXC ranks among the top 15 cryptocurrency exchanges according to trading volume and offers a relatively smooth user experience. The platform supports numerous cryptocurrencies and trading pairs, giving you diverse options for your portfolio.

Deepcoin, while less well-known than MEXC, has been growing in popularity. However, when compared to other platforms like Crypto.com, Deepcoin’s user experience is considered less intuitive.

Trading Features Comparison:

| Feature | MEXC | Deepcoin |

|---|---|---|

| User Interface | Clean, organized | More complex |

| Mobile Experience | Well-developed app | Functional but less refined |

| Trading Types | Spot, futures, margin | Spot, futures, options |

| Chart Tools | Comprehensive | Basic |

Some users have reported concerns about MEXC allegedly banning profitable traders and withholding funds. These claims appear in community discussions on platforms like Reddit, suggesting you should approach with caution.

Both exchanges offer competitive fee structures, though they differ in specifics like withdrawal limits and trading discounts.

For beginners, MEXC might provide an easier starting point due to its more straightforward interface and larger community support. Deepcoin could appeal to traders looking for specific trading options not found on larger exchanges.

MEXC Vs Deepcoin: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial for risk management. Both MEXC and Deepcoin have systems in place to handle forced liquidations, but they differ in significant ways.

MEXC uses a straightforward forced liquidation system that triggers when your margin reaches the maintenance margin level. This means your positions will be automatically closed to prevent further losses when your account can no longer support the open positions.

Deepcoin, on the other hand, offers a dual-price liquidation protection mechanism. This system is specifically designed to protect traders who use high leverage from experiencing significant losses during volatile market conditions.

The dual-price approach helps reduce the impact of short-term price spikes that might otherwise trigger unnecessary liquidations. This can be particularly valuable for traders who prefer to use higher leverage in their trading strategies.

For new traders especially, Deepcoin’s protection mechanism may provide an extra layer of security. It helps prevent situations where momentary market fluctuations could wipe out your position.

Both exchanges aim to create fair liquidation processes, but Deepcoin seems to place more emphasis on protecting highly leveraged traders from sudden losses.

When choosing between these platforms, consider your trading style and risk tolerance. If you frequently use high leverage, Deepcoin’s liquidation protection might better suit your needs.

MEXC Vs Deepcoin: Insurance

When choosing a crypto exchange, insurance protection for your assets is a crucial factor to consider. This aspect can determine how safe your funds are in case of security breaches or platform failures.

Deepcoin appears to offer some form of regulatory deposit insurance, according to the search results. This could provide a safety net for users if something happens to the platform.

MEXC, on the other hand, doesn’t have clear information about insurance from the provided search results. This doesn’t necessarily mean they don’t have any protection measures, but it’s not prominently mentioned in the available information.

Key comparison points:

| Exchange | Insurance Information |

|---|---|

| Deepcoin | Offers regulatory deposit insurance |

| MEXC | No clear information about insurance from search results |

You should always verify the current insurance policies directly on each platform’s website. Insurance terms can change over time, and what was true yesterday might not be true today.

Remember that even with insurance, you should practice good security habits like using strong passwords and two-factor authentication to protect your crypto assets.

Consider reaching out to customer support for both exchanges if insurance coverage is a deciding factor for you. They can provide the most up-to-date information about their specific protection measures.

MEXC Vs Deepcoin: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your trading experience. Both MEXC and Deepcoin offer support options, but they differ in some ways.

Deepcoin provides a live chat feature that connects you directly with available support agents. This instant communication can help resolve issues quickly without long waiting periods.

MEXC also offers customer support through multiple channels including email tickets and social media. Their support team typically responds within 24 hours for most inquiries.

Both exchanges provide FAQ sections and knowledge bases where you can find answers to common questions without contacting support directly.

Language support is another important factor. MEXC offers support in more languages compared to Deepcoin, which might be important if English isn’t your primary language.

Response time can vary between the two platforms. While Deepcoin emphasizes quick responses through their live chat, MEXC might take longer depending on the complexity of your issue and current support volume.

Neither exchange offers phone support, which is fairly standard in the crypto exchange industry.

For complex trading problems or account issues, both exchanges may require additional verification steps before resolving your concerns, so having your account information ready can speed up the process.

MEXC Vs Deepcoin: Security Features

When choosing between MEXC and Deepcoin, security should be your top priority. Both exchanges implement multiple protection layers to safeguard your assets.

MEXC employs industry-standard security measures including two-factor authentication (2FA), anti-phishing codes, and regular security audits. Their cold storage policy keeps most user funds offline, reducing hacking risks.

Deepcoin also offers 2FA protection and uses a multi-signature wallet system for fund management. They maintain a comprehensive risk control system that monitors unusual account activities.

Key Security Features Comparison:

| Feature | MEXC | Deepcoin |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Anti-Phishing Protection | ✓ | Limited |

| Insurance Fund | Available | Available |

| KYC Verification | Required for higher limits | Required |

MEXC has been operating longer with a more established security track record. Their platform undergoes regular third-party security audits to identify vulnerabilities.

Deepcoin focuses on real-time monitoring systems and has implemented automated risk assessment tools to detect suspicious activities quickly.

Both exchanges offer account fund protection, but you should always enable all available security features. This includes using strong passwords, activating 2FA, and being cautious with phishing attempts.

Remember that no exchange is completely immune to security threats. Consider spreading your assets across multiple platforms and using hardware wallets for long-term storage.

Is MEXC A Safe & Legal To Use?

MEXC is considered safe and legal to use in 2025 for most crypto traders. The exchange has established itself as a legitimate platform, ranking among the top 15 crypto exchanges globally.

Security is a priority at MEXC, with the platform implementing proof of reserves and advanced security measures to protect user funds. This transparency helps build trust with customers who want to ensure their assets are properly backed.

MEXC offers crypto-to-crypto trading options, making it accessible for various trading needs. The platform has zero trading fees, which is a significant advantage compared to many competitors.

However, there have been some concerning reports. Some users have alleged that MEXC banned profitable traders and withheld funds. These claims should be considered when evaluating the platform’s reliability.

When using MEXC, you should:

- Enable two-factor authentication

- Use strong, unique passwords

- Be aware of withdrawal limits and requirements

- Keep most of your crypto in cold storage if you’re not actively trading

The exchange is available in many countries, but you should check your local regulations as crypto laws vary widely by location.

For your protection, start with small amounts when first using the platform to test its services before committing larger sums.

Is Deepcoin A Safe & Legal To Use?

Deepcoin is considered one of the safer cryptocurrency exchanges available today. According to search results, the exchange uses a self-developed third-generation security system to protect user assets.

However, the legal status of Deepcoin varies depending on your location. For US traders specifically, there’s important information to consider.

While Deepcoin does allow US investors to use its platform, these users will have no fund protection. This creates a significant risk for US-based traders.

The regulatory landscape for cryptocurrency exchanges is constantly changing. As of March 2025, many major exchanges face increasing restrictions in certain regions.

For Canadian users, search results indicate that access to several big exchanges (including MEXC) may be limited in the coming weeks. This regulatory trend affects multiple platforms.

When comparing safety features between exchanges like Deepcoin and competitors, you should consider:

- Security protocols

- Regulatory compliance

- Insurance protection

- Fund security measures

- User verification requirements

Your geographic location plays a crucial role in determining whether using Deepcoin is both safe and legal for your specific situation. Always research the latest regulations in your country before trading.

Before choosing Deepcoin, verify that it meets your local legal requirements and offers suitable security protections for your trading activities.

Frequently Asked Questions

Traders often need specific information when comparing exchanges like MEXC and Deepcoin. Below are answers to common questions about their fees, trading volumes, cryptocurrency offerings, regulatory compliance, security features, and customer service quality.

What are the key differences in fees between MEXC and Deepcoin?

MEXC charges a standard spot trading fee of 0.2% for makers and takers. This fee can be reduced when using the platform’s native token, MX, or achieving higher trading volumes.

Deepcoin offers slightly lower fees with 0.1% for standard accounts. They also provide fee discounts for high-volume traders and users who hold their native DPC token.

For derivatives trading, MEXC typically charges 0.05% while Deepcoin averages around 0.04%, giving Deepcoin a slight edge for futures traders.

How do the trading volumes of MEXC compare with those of Deepcoin?

MEXC consistently maintains higher daily trading volumes, often exceeding $5 billion across all markets. This places it among the top 10 exchanges globally by volume.

Deepcoin handles significantly lower volumes, typically in the range of $1-2 billion daily. This difference reflects MEXC’s larger user base and longer presence in the market.

Higher trading volumes on MEXC generally result in better liquidity for most trading pairs, allowing for smoother execution of large orders.

What range of cryptocurrencies is offered by MEXC versus Deepcoin?

MEXC supports over 1,500 cryptocurrencies and more than 2,100 trading pairs. This extensive selection makes it one of the most comprehensive exchanges for altcoin traders.

Deepcoin offers approximately 300-400 cryptocurrencies with about 500 trading pairs. While substantial, this selection is notably smaller than MEXC’s offering.

Both exchanges regularly add new tokens, but MEXC typically lists new projects faster and maintains a broader selection of emerging cryptocurrencies.

Can users from the United States legally trade on Deepcoin, and is MEXC compliant with US regulations?

Deepcoin does not officially serve US customers and lacks the necessary regulatory approvals to operate legally within the United States. American IP addresses are generally restricted.

MEXC also restricts access to US residents and is not registered with US regulatory bodies like FinCEN or the SEC. The platform blocks US IP addresses from registration.

Neither exchange currently holds the appropriate licenses to legally serve US traders, requiring American users to look for domestically licensed alternatives.

Which exchange between MEXC and Deepcoin provides better security features for its users?

MEXC implements industry-standard security measures including two-factor authentication, multi-signature wallets, cold storage for most user funds, and regular security audits.

Deepcoin offers similar security features but keeps a larger percentage of funds in hot wallets. Both exchanges provide anti-phishing codes and withdrawal confirmation procedures.

MEXC has a longer track record without major security breaches, while Deepcoin is newer but has maintained a clean security history since its launch.

How do users rate the customer service experience of MEXC in comparison to Deepcoin?

MEXC receives generally positive feedback for its customer service, offering 24/7 support through live chat, a ticket system, and multilingual assistance in over 20 languages.

Response times for MEXC average between 1-24 hours depending on issue complexity and user verification level.

Deepcoin’s customer support is less established, with longer average response times of 24-48 hours. Users report more inconsistent experiences with their support team compared to MEXC.

Deepcoin Vs MEXC Conclusion: Why Not Use Both?

After comparing Deepcoin and MEXC, you might wonder which platform to choose. The truth is, you don’t necessarily need to pick just one.

Both exchanges offer different strengths that can complement each other in your trading strategy. Deepcoin provides two separate trading markets for different trading styles, while MEXC is often known for its no-KYC approach (though this may change in certain situations).

Using both platforms gives you access to a wider range of cryptocurrencies and trading options. You can take advantage of different fee structures and promotions across both exchanges to maximize your trading efficiency.

Consider using Deepcoin for its specialized trading markets and MEXC for its broader cryptocurrency selection. This dual approach helps you diversify your trading activities and reduces dependency on a single platform.

Remember to verify the current regulatory status of both platforms in your region. Cryptocurrency exchange policies can change rapidly, especially regarding KYC requirements and available services.

For beginners, you might want to start with the platform that offers a smoother user experience. According to comparison data, other exchanges may offer better user experiences than Deepcoin.

The crypto market moves quickly, and having accounts on multiple exchanges positions you to act swiftly when opportunities arise.