Choosing between MEXC and Crypto.com can be challenging with so many factors to consider. These popular cryptocurrency exchanges offer different features, fees, and trading options that might affect your trading experience.

Both platforms differ significantly in their fee structures, available cryptocurrencies, and user interfaces. MEXC typically offers more cryptocurrency options and trading pairs, while Crypto.com provides a more comprehensive ecosystem with additional services like a visa card and earn products.

You should consider your specific needs when selecting between these exchanges. Trading fees, withdrawal costs, supported deposit methods, and available cryptocurrencies all play important roles in making the right choice for your crypto journey. Security features and user experience also matter greatly depending on whether you’re a beginner or experienced trader.

MEXC Vs Crypto.com: At A Glance Comparison

When choosing between MEXC and Crypto.com, understanding their key differences helps you make the right decision for your crypto trading needs.

Trading Fees

| Feature | MEXC | Crypto.com |

|---|---|---|

| Maker fees | Generally lower | Tiered based on volume |

| Taker fees | Competitive | Decreases with higher trading volume |

Cryptocurrency Selection

MEXC offers a wider variety of cryptocurrencies, especially newer and less established tokens. Crypto.com focuses more on established cryptocurrencies but still provides a solid selection.

User Experience

Crypto.com has a more polished interface that’s beginner-friendly. MEXC’s platform caters more to experienced traders with additional features and options.

Security Features

Both exchanges implement strong security measures. Crypto.com has earned a reputation for its security focus with features like multi-factor authentication and cold storage.

Additional Services

- Crypto.com: Credit card, interest-earning accounts, NFT marketplace

- MEXC: Futures trading, staking options, launchpad for new projects

Deposit Methods

Crypto.com offers more fiat on-ramps including credit/debit cards and bank transfers. MEXC has more limited fiat options but excellent crypto-to-crypto trading capabilities.

Mobile Experience

Both exchanges provide mobile apps, but Crypto.com’s app receives higher user satisfaction ratings for its intuitive design and comprehensive functionality.

Your choice depends on your priorities – MEXC might work better if you seek variety in trading pairs, while Crypto.com excels in user-friendliness and additional services beyond just trading.

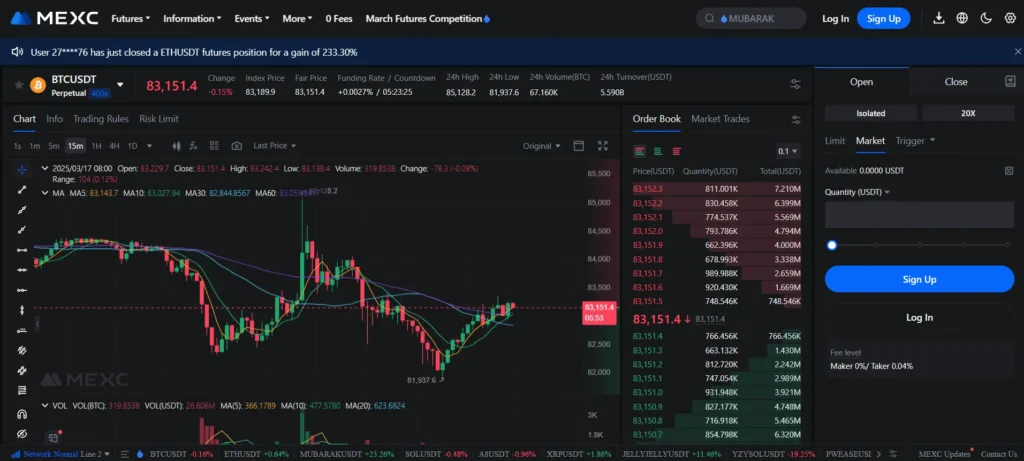

MEXC Vs Crypto.com: Trading Markets, Products & Leverage Offered

MEXC stands out with impressive leverage options of up to 200x for Bitcoin and Ethereum trading. Some reports even suggest up to 400x leverage on certain assets. This is significantly higher than what Crypto.com offers to traders.

Both platforms provide spot trading, but their fee structures differ. MEXC charges approximately 0.05% for both maker and taker fees on spot trading. For futures trading, MEXC offers competitive rates at 0.01% for makers and 0.04% for takers.

Crypto.com’s trading products include spot, futures, and margin trading. The platform is known for its user-friendly interface that appeals to beginners. You’ll also find staking options, though with lower APRs than MEXC.

Key Product Comparison:

| Feature | MEXC | Crypto.com |

|---|---|---|

| Max Leverage | Up to 200x (possibly 400x) | Lower leverage options |

| Spot Trading | Yes (0.05% fees) | Yes |

| Futures Trading | Yes (0.01%/0.04% maker/taker) | Yes |

| Staking | Up to 300% APR on 22 coins | Lower APR options |

MEXC appears to target more advanced traders with its high leverage options and competitive fee structure. The platform has been operating since 2018 and has expanded its offerings significantly.

When choosing between these platforms, consider your trading experience level and risk tolerance. High leverage can amplify both profits and losses in your trading activities.

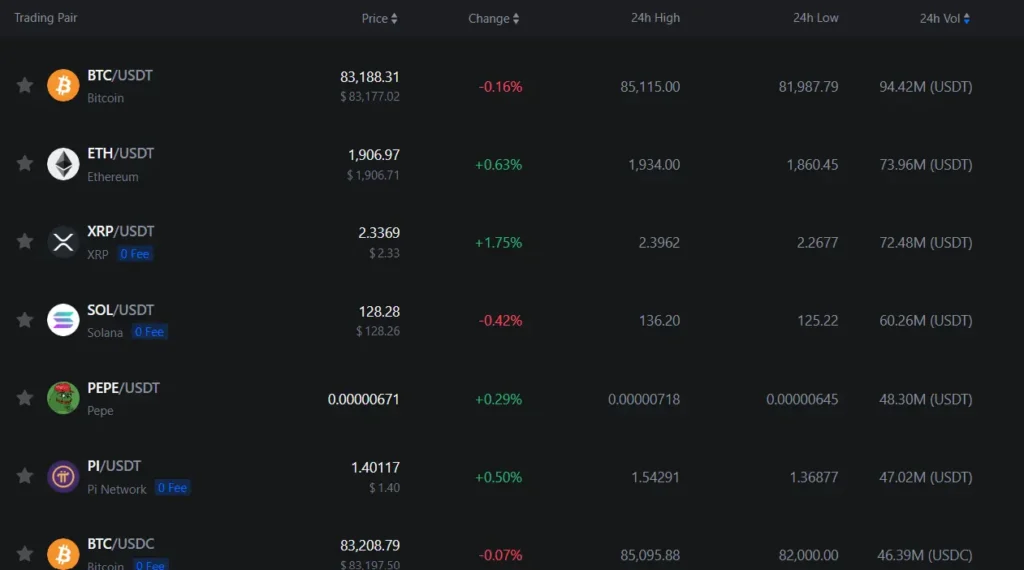

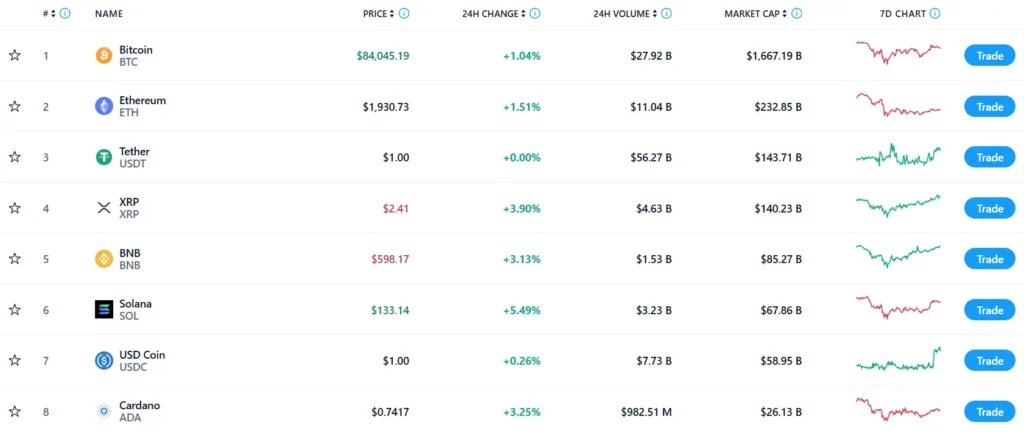

MEXC Vs Crypto.com: Supported Cryptocurrencies

When choosing between MEXC and Crypto.com, the number of available cryptocurrencies is an important factor to consider. Based on recent data, MEXC has a clear advantage in this area.

MEXC supports over 3,000 cryptocurrencies for trading. This extensive selection makes it an excellent choice if you’re looking to trade newer altcoins or niche tokens that aren’t available on other platforms.

Crypto.com, while offering a solid selection, supports fewer cryptocurrencies than MEXC. They typically list around 250+ cryptocurrencies on their exchange.

Here’s a quick comparison:

| Exchange | Number of Supported Cryptocurrencies |

|---|---|

| MEXC | 3,000+ |

| Crypto.com | 250+ |

Both platforms support all major cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

The difference becomes noticeable when you want to trade newer or less popular tokens. MEXC often lists new cryptocurrencies more quickly than Crypto.com.

If you’re mainly interested in trading established cryptocurrencies, both platforms will meet your needs. However, if you want access to a wider variety of altcoins and emerging tokens, MEXC provides significantly more options.

You should also consider that more supported currencies means more trading pairs, giving you additional flexibility in your trading strategy.

MEXC Vs Crypto.com: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing MEXC and Crypto.com, fees are a crucial factor that can affect your trading profits. Let’s examine how these two exchanges stack up in terms of costs.

Trading Fees:

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| MEXC | 0% | 0.02% |

| Crypto.com | Varies (higher) | Varies (higher) |

MEXC offers an impressive fee structure with 0% for makers and just 0.02% for takers in spot trading. This makes it one of the most competitive exchanges for fee-conscious traders in 2025.

Crypto.com, while popular, typically charges higher trading fees than MEXC. Their exact rates vary based on your trading volume and whether you stake their native token.

Withdrawal Fees:

MEXC’s withdrawal fees depend on the cryptocurrency you’re withdrawing. They aim to keep these fees competitive, though they can fluctuate with network congestion.

Crypto.com also charges withdrawal fees that vary by cryptocurrency. Generally, their withdrawal fees tend to be slightly higher than MEXC’s for most popular coins.

Deposit Methods:

Both exchanges offer multiple deposit options. Crypto.com provides more fiat currency deposit methods, which might be convenient if you’re moving money from traditional banking.

MEXC focuses more on crypto-to-crypto transactions but does support some fiat options as well.

The fee difference between these exchanges can significantly impact your profits, especially if you trade frequently or in large volumes.

MEXC Vs Crypto.com: Order Types

When trading on cryptocurrency exchanges, order types matter. They determine how your trades execute and can affect your results.

MEXC offers four types of spot orders: Limit Orders, Market Orders, Stop-limit Orders, and OCO (One-Cancels-the-Other) Orders. For futures trading, MEXC provides five options: limit orders, market orders, trigger orders, trailing stop orders, and post-only orders.

Crypto.com also offers standard market and limit orders for spot trading. However, their selection is generally more limited compared to MEXC.

Here’s a quick comparison of order types between the platforms:

| Order Type | MEXC | Crypto.com |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Stop-limit Orders | ✓ | ✓ |

| OCO Orders | ✓ | ✗ |

| Trailing Stop Orders | ✓ (Futures) | ✗ |

| Post-only Orders | ✓ (Futures) | ✗ |

If you’re an advanced trader, MEXC’s wider range of order types gives you more control over your trading strategy. The OCO order is particularly useful as it lets you set both a take-profit and stop-loss simultaneously.

Crypto.com focuses on simplicity, which may suit beginners better. You’ll find the essential order types without overwhelming options.

Your trading style should guide your choice. For complex strategies, MEXC’s variety of order types provides more flexibility. For straightforward trades, both platforms offer the basics you need.

MEXC Vs Crypto.com: KYC Requirements & KYC Limits

MEXC offers more flexibility with KYC requirements compared to Crypto.com. Based on recent information, KYC verification is not mandatory on MEXC for basic trading activities.

Without completing KYC on MEXC, you can withdraw between 10-30 BTC daily. This limit is generous and sufficient for most individual traders.

Crypto.com, on the other hand, requires mandatory KYC verification before you can start trading. You cannot use their platform without verifying your identity.

MEXC KYC Overview:

- Not mandatory for basic trading

- Higher withdrawal limits with KYC completion

- Protects your account and assets when completed

- Supports global users with flexible verification options

Crypto.com KYC Overview:

- Mandatory verification before trading

- Multi-tier verification process

- Stricter withdrawal limits tied to verification levels

- Complies with regulatory requirements in all operating regions

While MEXC provides initial flexibility, completing KYC on either platform gives you access to enhanced security features and higher transaction limits.

Both exchanges follow standard KYC procedures including document verification, identity confirmation, and possibly address verification depending on your location and intended trading volume.

Remember that KYC requirements may change based on regulatory updates and your specific location.

MEXC Vs Crypto.com: Deposits & Withdrawal Options

Both MEXC and Crypto.com offer various deposit and withdrawal options for users, but they differ in some key ways.

Deposit Methods:

- Crypto.com: Supports USD and EUR fiat transfers alongside cryptocurrency deposits

- MEXC: Primarily focuses on cryptocurrency deposits with limited fiat options

Crypto.com provides more flexibility for users who want to move between traditional currency and crypto. This makes it more accessible for beginners who might not already own cryptocurrency.

Withdrawal Options:

- Crypto.com: Supports the same USD and EUR transfer methods for withdrawals as deposits

- MEXC: Primarily crypto withdrawals with some limitations

Fees Structure:

| Exchange | Deposit Fees | Withdrawal Fees |

|---|---|---|

| MEXC | No fees for crypto deposits | Varies by cryptocurrency |

| Crypto.com | No fees for crypto deposits | Varies by cryptocurrency |

Neither platform charges fees for cryptocurrency deposits, which is standard across the industry. However, withdrawal fees vary depending on which cryptocurrency you’re moving.

Some users report that MEXC has been known to implement KYC (Know Your Customer) requirements selectively when processing withdrawals, despite marketing itself as a “no KYC exchange.” This can cause unexpected delays.

When choosing between these platforms, consider your preferred deposit method and which cryptocurrencies you plan to withdraw. Crypto.com might be better if you need robust fiat options, while MEXC could work if you mainly deal in crypto-to-crypto transactions.

MEXC Vs Crypto.com: Trading & Platform Experience Comparison

MEXC and Crypto.com offer distinct trading experiences tailored to different types of crypto users. Both platforms have their strengths when it comes to interface design, available features, and overall usability.

MEXC provides a more technical trading interface that advanced traders might appreciate. It supports over 3,000 cryptocurrencies, giving you access to a wider range of trading options compared to Crypto.com.

Crypto.com’s platform is more polished and beginner-friendly. Its intuitive design makes navigation simpler for newcomers, though it offers fewer cryptocurrencies than MEXC.

Trading Tools Comparison:

- MEXC: Advanced charting tools, futures trading, margin options

- Crypto.com: Simpler charts, spot trading focus, staking options

The mobile experience differs between the two exchanges as well. Crypto.com’s app is highly rated and integrates seamlessly with their other products like the Crypto.com Visa card. MEXC’s mobile app is functional but less refined.

Transaction speeds vary, with MEXC generally processing trades faster during high-volume periods. However, Crypto.com offers better stability during market volatility.

For day traders, MEXC might be preferable due to its anonymous trading capabilities and extensive trading pairs. Casual investors may find Crypto.com more approachable with its cleaner interface and educational resources.

Both platforms offer demo modes to practice trading, but Crypto.com provides more comprehensive learning materials to help you understand the trading process.

MEXC Vs Crypto.com: Liquidation Mechanism

When trading futures on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. This feature helps manage risk but works differently on MEXC and Crypto.com.

MEXC employs a forced liquidation mechanism that triggers when a position reaches its liquidation price. This happens when the fair price of the futures contract hits this threshold. The system is designed to help traders manage risk effectively.

Crypto.com also uses liquidation protocols, but with some differences in implementation. Their system monitors positions and activates liquidation based on specific risk parameters.

Key Differences:

| Feature | MEXC | Crypto.com |

|---|---|---|

| Liquidation Trigger | Fair price reaching liquidation price | Risk parameters and margin requirements |

| Notification | Provides alerts before liquidation | Offers liquidation warnings |

| Prevention Tools | Risk management features | Position adjustment options |

You should consider these differences when choosing which platform to use. MEXC’s documentation emphasizes that understanding their liquidation mechanism can help you trade futures more effectively.

Both platforms aim to protect users and the exchange from excessive losses. However, the specific thresholds and processes differ.

Remember to maintain sufficient margin in your account to avoid liquidation on either platform. Setting stop-loss orders can also help protect your positions before they reach liquidation levels.

MEXC Vs Crypto.com: Insurance

When choosing a crypto exchange, insurance protection is a crucial factor to consider. This protection can safeguard your assets in case of hacks or security breaches.

Crypto.com offers a more robust insurance program compared to MEXC. They maintain a $750 million insurance policy that covers digital assets held in their cold storage systems. This provides you with significant protection against potential security incidents.

MEXC’s insurance coverage is less transparent. While they claim to have security measures in place, they don’t publicly specify the exact amount of insurance coverage they maintain for user funds.

Both exchanges employ cold storage solutions to keep most user assets offline and safe from online threats. This is an industry standard practice that adds an important layer of security.

Insurance Comparison:

| Feature | MEXC | Crypto.com |

|---|---|---|

| Insurance Amount | Not clearly disclosed | $750 million |

| Cold Storage | Yes | Yes |

| Transparency | Limited details | More detailed information |

You should note that neither exchange offers complete protection for all scenarios. Most crypto exchange insurance policies focus on cold storage funds and may not cover all situations like hot wallet breaches or individual account compromises.

When making your decision, consider how important comprehensive insurance coverage is for your trading needs. If you prioritize clearly defined insurance protection, Crypto.com might be the better option for you.

MEXC Vs Crypto.com: Customer Support

When choosing between MEXC and Crypto.com, customer support can be a deciding factor. Both platforms offer different support options to help you with your crypto trading needs.

MEXC provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and ticket submission. Many users appreciate their quick response times, especially through the live chat feature.

Crypto.com also offers round-the-clock support but puts more emphasis on their mobile app support. Their in-app chat is convenient for solving issues without leaving the platform. They also maintain an extensive help center with guides and FAQs.

Response times can vary between the two exchanges. MEXC typically responds within minutes on live chat, while Crypto.com might take longer during peak times.

Language support is another important consideration. MEXC supports more languages, making it accessible to a global audience. Crypto.com primarily focuses on English support, though they’ve expanded to include other major languages.

Both platforms provide:

- Live chat support

- Email assistance

- Help centers with FAQs

- Community forums

If you’re new to crypto trading, Crypto.com might have an edge with their beginner-friendly guides and support materials. MEXC tends to be more technical in their support responses.

Remember to check current user reviews about support quality, as this can change over time as platforms evolve their service offerings.

MEXC Vs Crypto.com: Security Features

When choosing a crypto exchange, security should be your top priority. Both MEXC and Crypto.com offer strong security features, but they differ in several important ways.

MEXC employs multi-signature wallets and cold storage solutions to protect user funds. The platform also uses two-factor authentication (2FA) to add an extra layer of security to your account.

Crypto.com has earned a reputation for its robust security measures. The exchange holds ISO/IEC 27001:2013 certification and uses air-gapped cold wallets to store the majority of user assets offline.

Key Security Features Comparison:

| Feature | MEXC | Crypto.com |

|---|---|---|

| Cold Storage | Yes | Yes (Air-gapped) |

| Two-Factor Authentication | Yes | Yes |

| Insurance | Limited | $750M insurance coverage |

| Regulatory Compliance | Moderate | Strong |

| Security Certifications | Basic | ISO/IEC 27001:2013 |

Crypto.com also offers a significant advantage with its $750 million insurance policy that covers digital assets in case of theft or security breach.

Both platforms conduct regular security audits, but Crypto.com’s regulatory compliance appears stronger in most markets. This can provide you with additional peace of mind when trading.

MEXC has implemented anti-phishing codes for email verification, which helps protect your account from common phishing attempts.

For maximum security on either platform, you should enable all available security features including 2FA, anti-phishing protection, and withdrawal address whitelisting.

Is MEXC A Safe & Legal To Use?

MEXC is generally considered a safe and legitimate cryptocurrency exchange. Operating since 2018, the platform has maintained a solid security record with no reported hacks or loss of user funds.

The exchange implements advanced security measures and provides proof of reserves to ensure transparency. This helps protect your assets while trading on the platform.

MEXC is a top 15 cryptocurrency exchange that offers crypto-to-crypto trading services. While it’s legitimate, some users have reported issues with account restrictions.

There have been allegations about MEXC banning profitable traders and withholding funds. These claims should be considered when deciding whether to use the platform.

MEXC operates as a non-KYC (Know Your Customer) exchange in some regions, meaning you may not need to provide identification in certain jurisdictions. Instead, they may track users by IP address.

If you’re concerned about regional restrictions, some users report that using a VPN can bypass geographical limitations. However, using VPNs to circumvent restrictions may violate terms of service.

As of March 2025, MEXC continues to operate as a legitimate exchange option for cryptocurrency traders, though you should research current regulations in your specific location before using the service.

Is Crypto.com A Safe & Legal To Use?

Crypto.com is considered one of the safer cryptocurrency exchanges available today. The platform employs a “Zero Trust – Defense in Depth” security strategy across its systems, which provides robust protection for users’ assets.

Security is a top priority at Crypto.com, with 100% of customer funds stored in cold wallets. This approach keeps your digital assets offline and away from potential hackers.

The exchange also maintains a substantial $360 million insurance policy to protect user funds. This additional layer of security can give you peace of mind when trading or storing crypto on the platform.

Crypto.com has earned ISO/IEC 27001:2013 certification, an internationally recognized standard for information security management. This certification demonstrates their commitment to maintaining high security standards.

When it comes to legality, Crypto.com operates as a legitimate business with proper regulatory compliance in the jurisdictions where it operates. You can use the platform legally in most countries where cryptocurrency trading is permitted.

While fees on Crypto.com might be higher compared to some competitors, the platform offers a comprehensive range of services. This makes it particularly suitable if you’re primarily focused on holding and accumulating cryptocurrency rather than frequent trading.

The exchange partners with respected security consulting firms to ensure their protection measures remain current and effective against emerging threats.

Frequently Asked Questions

Traders and investors often need clear answers about cryptocurrency exchanges before making decisions. These questions address key comparison points between MEXC and Crypto.com that impact trading experience and costs.

What are the primary differences in features between MEXC and Crypto.com?

MEXC positions itself as a trading-focused platform with zero-fee trading options and minimal KYC requirements in many cases. The platform emphasizes high-volume trading and futures markets.

Crypto.com offers a more comprehensive ecosystem including a Visa card program, earn features, and an NFT marketplace. Their approach includes more integrated services beyond just trading.

MEXC typically appeals to experienced traders seeking advanced tools, while Crypto.com attracts users looking for an all-in-one cryptocurrency platform with lifestyle integration.

How do the transaction fees compare between MEXC and Crypto.com?

MEXC advertises zero-fee trading on certain pairs and generally maintains competitive maker/taker fees. Their withdrawal fees vary by cryptocurrency but are generally market competitive.

Crypto.com uses a tiered fee structure based on 30-day trading volume and CRO token staking. Higher volume traders and those staking CRO can access substantially reduced fees.

The fee advantage can shift between platforms depending on your trading volume, preferred cryptocurrencies, and whether you’re willing to stake platform tokens.

Which platform offers better security, MEXC or Crypto.com?

Crypto.com has invested heavily in security certifications including SOC 2 compliance and has obtained insurance coverage for assets in cold storage. They implement multi-layer protection systems.

MEXC utilizes industry standard security practices including cold storage for most assets and two-factor authentication. However, they have less public documentation about their security protocols.

You should enable all available security features regardless of which platform you choose, including strong passwords, 2FA, and withdrawal whitelisting.

Can you explain the user experience and interface of MEXC versus Crypto.com?

MEXC’s interface caters to experienced traders with detailed charts, order book depth, and advanced order types. Navigation might feel complex for beginners but provides flexibility for trading strategies.

Crypto.com presents a more streamlined, user-friendly design with simplified trading views. Their mobile app is particularly polished and intuitive for newcomers.

Both platforms offer mobile apps, but Crypto.com has received higher user ratings for app stability and design consistency across devices.

Which platform provides a wider range of cryptocurrencies, MEXC or Crypto.com?

MEXC typically lists more cryptocurrencies, including many smaller-cap and newly launched tokens. Their strategy involves being early to list emerging projects.

Crypto.com offers over 350 cryptocurrencies, which is substantial but generally focuses on more established projects with proven track records or significant market capitalizations.

If you’re seeking niche altcoins or new token launches, MEXC often provides earlier access than Crypto.com.

How do the customer support services of MEXC and Crypto.com differ?

Crypto.com provides 24/7 customer support through live chat and email, with generally faster response times and more language options. Their help center documentation is extensive.

MEXC customer support operates primarily through tickets and email, with response times varying based on query complexity. Some users report language barriers when seeking support.

You may experience longer resolution times with MEXC for complex issues, while Crypto.com typically provides more immediate assistance through their live chat option.

Crypto.com Vs MEXC Conclusion: Why Not Use Both?

Both Crypto.com and MEXC offer unique advantages that could benefit your trading strategy.

MEXC provides access to over 1600 cryptocurrencies with competitive fees – 0% for makers and just 0.02% for takers in spot trading. Their platform can handle 1.4 million transactions per second, ensuring smooth trading even during busy periods.

However, as of March 2025, MEXC is no longer available to U.S. customers. This is a significant limitation for American traders.

Crypto.com, on the other hand, maintains strong regulatory compliance and offers a broader ecosystem including a visa card, NFT marketplace, and staking options.

Why consider using both platforms?

- Wider coin selection: Access MEXC’s extensive altcoin offerings alongside Crypto.com’s established tokens

- Fee optimization: Choose the platform with better rates for specific trades

- Risk distribution: Spread your assets across multiple exchanges for security

For non-U.S. traders, using both platforms provides flexibility and more trading options. You can leverage MEXC’s futures demo trading tool to practice strategies risk-free before applying them on either platform.

Remember to consider your geographic location, trading needs, and security preferences when deciding which platform(s) work best for you.