When choosing a cryptocurrency exchange, the options can seem overwhelming. Two platforms that often come up in discussions are MEXC and Bitunix. Each has its own set of features, fee structures, and security measures that might make one better suited to your trading needs.

Based on trust scores and user feedback, Bitunix appears to offer better security features with its proof of reserves system compared to many top-tier exchanges. This added layer of transparency gives traders more confidence in the platform’s reliability and safety of their assets.

Both exchanges rank well in various cryptocurrency exchange listings, with MEXC often scoring higher in terms of trading volume and available pairs. Your choice between these two platforms will ultimately depend on what you value most – whether that’s lower fees, more trading options, better security features, or user experience.

MEXC Vs Bitunix: At A Glance Comparison

When choosing between MEXC and Bitunix crypto exchanges, several factors come into play. Both platforms have distinct features that may appeal to different types of traders.

Fee Structure

| Exchange | Trading Fees | Withdrawal Fees |

|---|---|---|

| MEXC | Competitive, with 5% discount available | Varies by cryptocurrency |

| Bitunix | Lower compared to top-tier exchanges | Varies by cryptocurrency |

Security Features

MEXC offers standard security protocols. Bitunix stands out with its proof of reserves system, adding an extra layer of security for your funds.

KYC Requirements

MEXC typically requires KYC verification for higher trading limits. Bitunix appears to offer no-KYC options for traders who value privacy.

User Experience

Both platforms provide intuitive interfaces. MEXC has been established longer, potentially offering a more refined experience.

Available Cryptocurrencies

Both exchanges support a wide range of cryptocurrencies, though specific offerings may vary.

Geographic Restrictions

MEXC may require VPN use in some regions. Bitunix advertises no VPN requirements, making it potentially more accessible globally.

Trading Volume

MEXC typically has higher trading volumes, which can mean better liquidity for your trades.

You should consider your specific needs when choosing between these exchanges. Your trading volume, privacy concerns, and geographic location will all influence which platform works best for you.

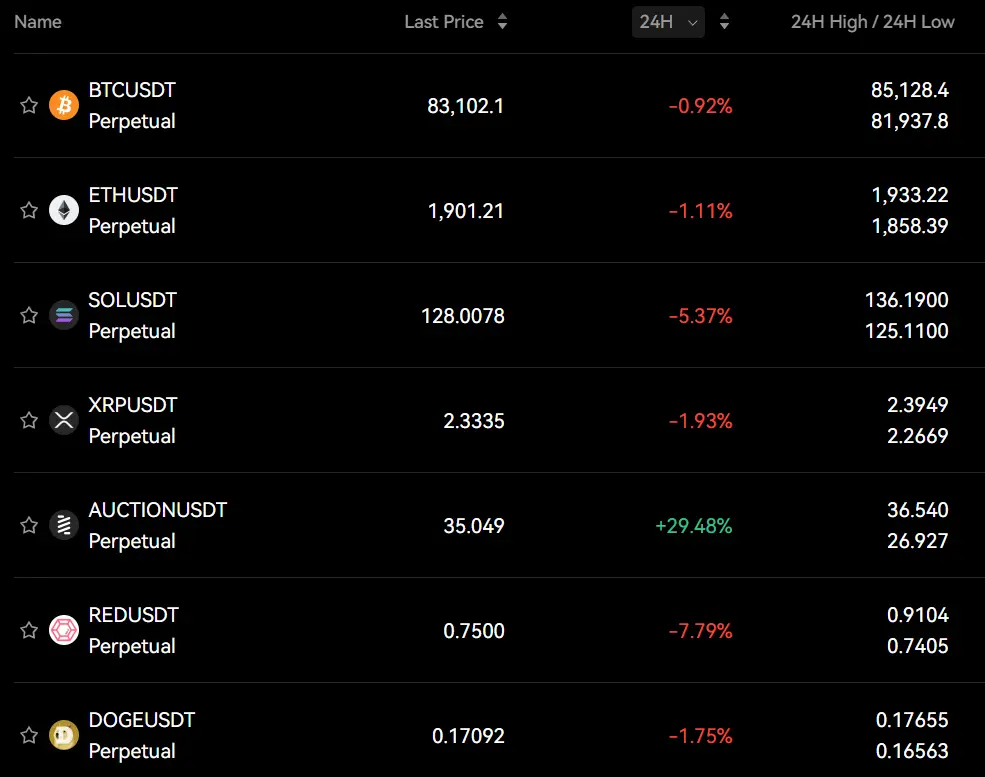

MEXC Vs Bitunix: Trading Markets, Products & Leverage Offered

MEXC and Bitunix offer different trading options for cryptocurrency investors. MEXC, established in 2018, has had more time to expand its offerings compared to Bitunix, which was founded in 2021.

MEXC Trading Markets:

- 1,600+ cryptocurrency pairs

- Spot trading

- Futures contracts

- Margin trading with up to 10x leverage

- Options trading

- Perpetual contracts

MEXC particularly stands out for its extensive altcoin selection, making it attractive if you’re looking to trade newer or less common cryptocurrencies.

Bitunix Trading Markets:

- 300+ cryptocurrency pairs

- Spot trading

- Futures trading

- Margin trading with up to 5x leverage

- Copy trading features

Bitunix, while newer, offers a simpler interface that beginners might find easier to navigate. Their copy trading feature lets you automatically mimic successful traders’ strategies.

| Feature | MEXC | Bitunix |

|---|---|---|

| Year Founded | 2018 | 2021 |

| Trading Pairs | 1,600+ | 300+ |

| Max Leverage | 10x | 5x |

| Options Trading | Yes | No |

| Copy Trading | No | Yes |

Fee structures differ between the platforms as well. MEXC typically charges 0.1% for spot trades, while Bitunix fees range from 0.1% to 0.2% depending on your trading volume.

You might prefer MEXC if you need access to a wider range of cryptocurrencies and advanced trading products. Bitunix could be better if you value simplicity and social trading features.

MEXC Vs Bitunix: Supported Cryptocurrencies

When choosing between MEXC and Bitunix, the range of cryptocurrencies each platform supports is a key factor to consider.

MEXC offers an extensive selection with over 1,500 cryptocurrencies available for trading. This includes major coins like Bitcoin and Ethereum, as well as numerous altcoins and newer tokens.

Bitunix, while newer to the market, provides a solid selection of cryptocurrencies. It focuses on offering the most established coins and a curated selection of promising altcoins.

MEXC Strengths:

- Wider variety of smaller cap altcoins

- Often lists new tokens earlier than competitors

- More trading pairs available

Bitunix Strengths:

- Strong focus on security for supported coins

- Clear proof of reserves for major cryptocurrencies

- Well-vetted selection of tokens

If you’re looking to trade niche or newly launched tokens, MEXC likely offers more options. Their platform typically adds emerging cryptocurrencies faster than many competitors.

Bitunix takes a more measured approach. While offering fewer total cryptocurrencies, they emphasize security and verification of the coins they list.

Both exchanges support the major cryptocurrencies that most traders focus on. Your choice may depend on whether you value a wider selection (MEXC) or a more carefully curated listing with enhanced security measures (Bitunix).

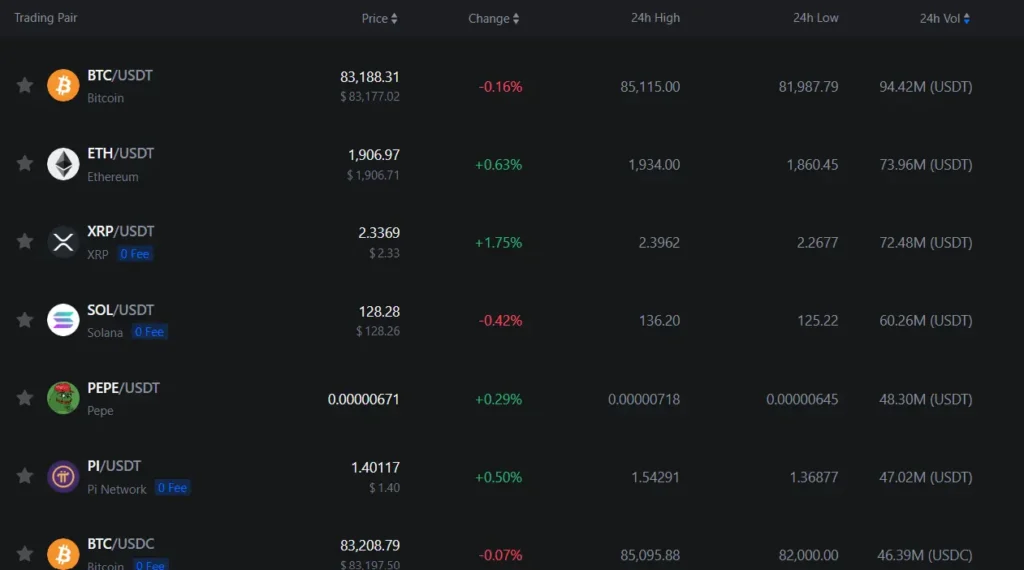

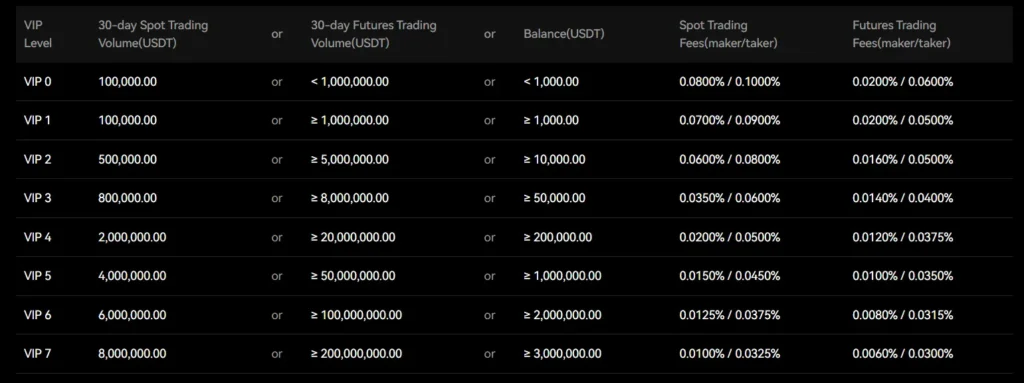

MEXC Vs Bitunix: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and Bitunix, trading fees play a crucial role in your decision. Let’s break down how these exchanges compare.

MEXC offers surprisingly competitive rates with 0% fees for spot trading (both maker and taker). For futures trading, MEXC charges 0% for makers and 0.03% for takers.

Bitunix operates on a tiered fee structure based on your 30-day trading volume. Their fees are generally reasonable according to user feedback, though specific percentages vary based on your trading activity.

Deposit Fees:

- MEXC: Generally free for most cryptocurrencies

- Bitunix: Most crypto deposits are free

Withdrawal Fees:

| Exchange | Withdrawal Fees |

|---|---|

| MEXC | Varies by cryptocurrency |

| Bitunix | Varies by cryptocurrency |

Both exchanges adjust their withdrawal fees based on network conditions and the specific cryptocurrency being withdrawn.

Users report that Bitunix offers a user-friendly interface with reasonable transaction costs. This makes it particularly appealing if you’re looking for a straightforward trading experience.

Your trading volume will impact the fees you pay on Bitunix due to their tiered structure. Higher volume traders typically benefit from lower percentages.

Before committing to either platform, check their current fee schedules as these can change. Also consider other factors like security features and available trading pairs.

MEXC Vs Bitunix: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both MEXC and Bitunix offer various order options, but they differ in some important ways.

MEXC provides a comprehensive selection of order types for traders. You can use market orders for immediate execution at current prices and limit orders to buy or sell at specific price points.

MEXC also offers stop-limit orders, which combine features of stop orders and limit orders. These activate when the market reaches a certain price, then place a limit order.

For more advanced traders, MEXC includes OCO (One-Cancels-the-Other) orders and trailing stop orders. These give you more control over managing risk and automating trading decisions.

Bitunix, while newer to the market, provides the essential order types most traders need. You’ll find standard market and limit orders available on their platform.

Bitunix also offers stop orders to help manage risk. Their interface is known for being user-friendly, making these order types accessible even to beginners.

Here’s a quick comparison of order types:

| Order Type | MEXC | Bitunix |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop | ✓ | ✓ |

| Stop-Limit | ✓ | ✘ |

| OCO | ✓ | ✘ |

| Trailing Stop | ✓ | ✘ |

If you need advanced order types, MEXC offers more options. However, Bitunix provides the essential orders that meet most trading needs with a simpler interface.

MEXC Vs Bitunix: KYC Requirements & KYC Limits

Both MEXC and Bitunix have different approaches to KYC (Know Your Customer) requirements, which directly affect how you can use these platforms.

Bitunix KYC Levels:

Bitunix operates with tiered KYC levels that determine your daily withdrawal limits. The Basic KYC level requires personal information, ID, and a selfie.

Without completing any KYC on Bitunix, you’ll face trading limitations and won’t be able to use credit card payment options. However, Bitunix is often mentioned among no-KYC exchanges, suggesting some functionality without full verification.

MEXC KYC Approach:

MEXC also implements KYC verification procedures, though specific details aren’t provided in the search results. The platform’s verification process affects available features and trading capabilities.

Comparing the Two:

If privacy is your priority, both exchanges offer some functionality without full KYC, but with limitations. Bitunix clearly outlines its tiered system with specific withdrawal limits tied to verification levels.

For those seeking more anonymous trading options, it’s worth noting that both exchanges appear in lists of “no-KYC” or limited-KYC crypto exchanges, though neither offers completely anonymous trading at full functionality.

Your decision should balance your privacy needs against the trading features and withdrawal limits you require.

MEXC Vs Bitunix: Deposits & Withdrawal Options

When choosing between MEXC and Bitunix, understanding their deposit and withdrawal options is crucial for managing your crypto assets efficiently.

MEXC offers a more comprehensive range of deposit options. You can fund your account through bank transfers, which is a significant advantage for beginners who prefer traditional banking methods.

Bitunix provides a user-friendly interface for deposits, but has fewer fiat on-ramping options compared to MEXC.

Withdrawal Methods Comparison:

| Feature | MEXC | Bitunix |

|---|---|---|

| Crypto withdrawals | Wide range | Standard options |

| Fiat withdrawals | Bank transfer support | Limited |

| Processing time | Generally fast | Reasonable |

| Withdrawal fees | Competitive | Reasonable |

Both exchanges support the major cryptocurrencies for deposits and withdrawals, including Bitcoin, Ethereum, and popular altcoins.

MEXC stands out with its seamless fiat on-ramping process, making it easier for you to move between traditional currency and crypto assets.

Transaction fees are competitive on both platforms, but MEXC might offer better rates for certain withdrawal methods.

You should consider your primary use case when deciding. If you frequently move between fiat and crypto, MEXC’s more robust banking integration could be beneficial for your needs.

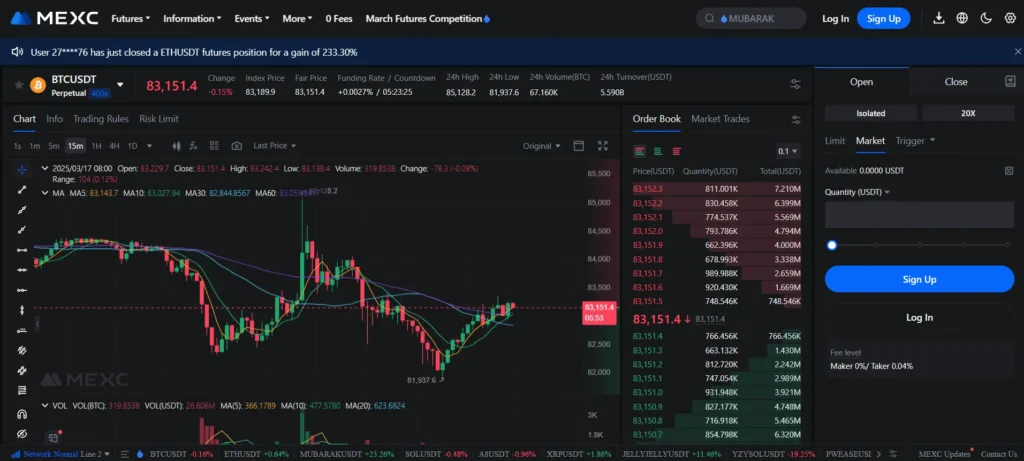

MEXC Vs Bitunix: Trading & Platform Experience Comparison

When comparing MEXC and Bitunix trading platforms, you’ll find several key differences that might influence your choice.

MEXC offers a more established platform with a wider range of trading options. You can access futures, spot trading, and margin capabilities all within one interface.

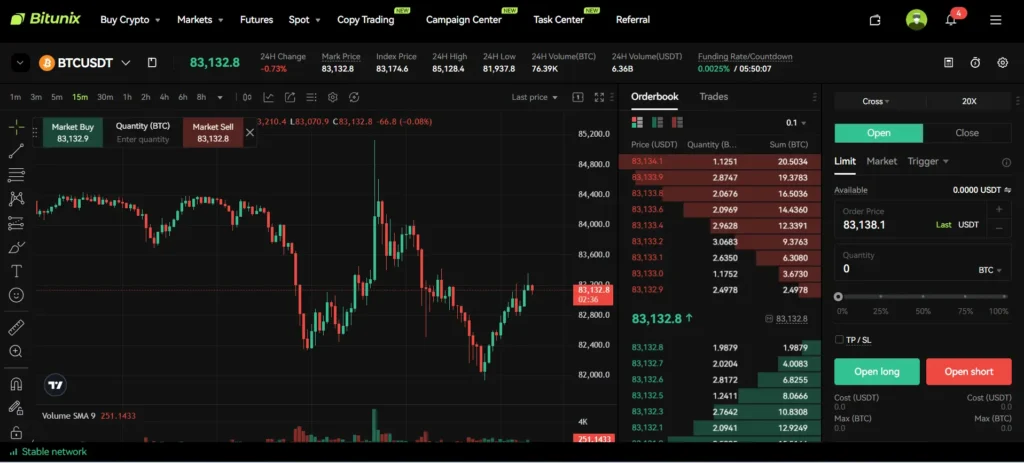

Bitunix, while newer to the market, has gained recognition for its security features. According to user feedback, Bitunix implements proof of reserves, adding an extra layer of security for your assets.

User Interface Comparison:

- MEXC: More complex with advanced charting tools

- Bitunix: Cleaner, more beginner-friendly design

Trading Fees:

| Exchange | Maker Fee | Taker Fee | Withdrawal Fee |

|---|---|---|---|

| MEXC | 0.1% | 0.1% | Varies by coin |

| Bitunix | 0.08% | 0.1% | Varies by coin |

Bitunix typically offers slightly lower trading fees compared to MEXC, which could save you money with frequent trading.

Mobile experience differs between the two platforms. MEXC’s app provides more features but can feel overwhelming at first. Bitunix focuses on simplicity, making it easier to execute trades quickly.

Trading volume on MEXC tends to be higher, potentially leading to better liquidity for popular trading pairs. This means you might experience less slippage on larger trades.

Both platforms offer staking opportunities, but MEXC generally provides more options for earning passive income on your crypto holdings.

MEXC Vs Bitunix: Liquidation Mechanism

When trading on crypto exchanges with leverage, understanding the liquidation process is crucial. Liquidation happens when your position cannot be maintained due to insufficient margin.

Bitunix Liquidation System

Bitunix provides an Estimated Liquidation Price feature that clearly shows at what price your position will be closed by the exchange. This helps you manage risk better by seeing exactly where your danger zone lies.

The interface is designed to be simple and user-friendly, making it easier for traders to monitor their positions. Many users find Bitunix’s reasonable transaction fees and straightforward approach appealing.

MEXC Liquidation System

MEXC implements forced liquidation when your margin reaches the maintenance margin level. This system kicks in to protect the exchange from losses when market movements go against your position.

MEXC’s documentation emphasizes that once liquidation occurs, your position will be closed even if the price later returns to favorable levels. Their educational materials aim to help traders understand this mechanism better.

Key Differences

| Feature | Bitunix | MEXC |

|---|---|---|

| Transparency | Clear liquidation price display | Detailed educational resources |

| User Experience | Simple, straightforward interface | Comprehensive trading tools |

| Recovery | Not specified in results | No position recovery after liquidation |

Both exchanges liquidate positions to protect themselves, but they differ in how they present this information to users. Your trading style and experience level might determine which approach works better for you.

MEXC Vs Bitunix: Insurance

When trading on cryptocurrency exchanges, insurance protection is a crucial factor to consider. It safeguards your assets against potential hacks, theft, or platform failures.

MEXC offers a dedicated protection fund that covers users in case of security breaches. This fund is maintained separately from operational funds to ensure it’s available when needed.

The exchange regularly publishes updates about the size of their insurance fund, which helps build transparency and trust among users.

Bitunix, being a newer exchange founded in 2021, has a less established insurance system. Their protection measures are still developing compared to more mature platforms.

Both exchanges implement cold storage solutions for the majority of user funds. This approach keeps assets offline and away from potential online threats.

Insurance Comparison:

| Feature | MEXC | Bitunix |

|---|---|---|

| Insurance Fund | Yes, well-established | Limited, still developing |

| Transparency | Regular updates on fund size | Limited information available |

| Cold Storage | Majority of assets | Majority of assets |

| Coverage Details | Clearly documented | Less detailed documentation |

You should check the current insurance policies on both platforms before making your decision. Insurance terms can change, and newer exchanges typically strengthen their protection measures as they grow.

Remember that even with insurance, using two-factor authentication and maintaining strong passwords are essential practices for protecting your crypto investments.

MEXC Vs Bitunix: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both MEXC and Bitunix offer support options, but they differ in key ways.

MEXC provides customer service through multiple channels. You can reach them via email, live chat, and ticket systems. Response times typically range from a few hours to 24 hours depending on query complexity.

Bitunix has gained recognition for its fast customer support. According to user feedback, their team often responds quickly to issues. One search result specifically mentions that Bitunix is “definitely worth a try” if you’re looking for good customer support.

Both platforms offer help centers with FAQs and guides. These resources can solve many common problems without needing to contact support directly.

Support Channels Comparison:

| Feature | MEXC | Bitunix |

|---|---|---|

| Live Chat | ✓ | ✓ |

| Email Support | ✓ | ✓ |

| Response Time | Hours to 1 day | Generally fast |

| Help Center | Comprehensive | Basic but growing |

| Community Forums | Active | Limited |

Language support is another consideration. MEXC offers multilingual support for global users. Bitunix’s language options are more limited but sufficient for English speakers.

During high market volatility, both exchanges can experience delayed response times. You might want to test their support with a simple question before committing to either platform for large trades.

MEXC Vs Bitunix: Security Features

When choosing between MEXC and Bitunix, security should be a top priority for your crypto investments. Both exchanges offer important safety features, but with notable differences.

MEXC has built a strong reputation for robust security measures. The platform uses multi-signature wallets, cold storage for most assets, and two-factor authentication (2FA) to protect user accounts.

Bitunix stands out with its proof of reserves system. This feature allows you to verify that the exchange actually holds the assets it claims, providing an extra layer of transparency not found on all platforms.

Key Security Features Comparison:

| Feature | MEXC | Bitunix |

|---|---|---|

| 2FA Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Proof of Reserves | ✗ | ✓ |

| Multi-signature Wallets | ✓ | Limited |

| Regular Security Audits | ✓ | ✓ |

MEXC has earned recognition for its strong community presence, which can sometimes lead to faster security issue reporting and resolution.

Both exchanges employ standard encryption techniques to protect your data during transactions. They also have security teams that monitor for suspicious activities.

You should enable all available security features on whichever platform you choose. This includes using strong passwords, enabling 2FA, and being cautious about phishing attempts targeting exchange users.

Is MEXC A Safe & Legal To Use?

MEXC appears to be a safe and legitimate cryptocurrency exchange option for traders in 2025. According to search results, the platform has been operating since 2018 and has not experienced any hacks or loss of user funds during this time.

Safety is a critical factor when choosing a crypto exchange. MEXC has built a reputation over several years in the cryptocurrency space, which helps establish its legitimacy.

The exchange has implemented security measures to protect users’ assets. However, like with any exchange, you should still practice good security habits such as using strong passwords and two-factor authentication.

From a legal perspective, MEXC is available to users in many countries. You should check if the platform is permitted in your specific location, as cryptocurrency regulations vary worldwide.

Some exchanges require Know Your Customer (KYC) verification for compliance with regulations. Recent information suggests MEXC may be implementing KYC requirements in certain regions, which is a common practice for legal compliance.

When considering MEXC or any exchange, you should:

- Research current security practices

- Verify its regulatory status in your country

- Check user reviews for recent experiences

- Compare fees and available trading pairs

- Test customer support responsiveness

Trust scores from sites like CoinGecko can also help you evaluate MEXC’s standing among other exchanges.

Is Bitunix A Safe & Legal To Use?

Bitunix has established itself as a legitimate cryptocurrency exchange with several security features in place. According to search results, the platform maintains a proof of reserves system, which adds an extra layer of security for users.

The exchange also claims to have complete licensing and funds custody protocols. This provides additional protection for traders using the platform.

Users can access Bitunix from anywhere, making it convenient for trading cryptocurrencies. The platform is designed to be user-friendly, allowing you to buy, sell, and trade blockchain cryptocurrencies with ease.

When comparing to other exchanges, some users consider Bitunix to be better than top-tier exchanges in terms of security and usability. The platform focuses on creating a safe trading environment.

Bitunix offers various trading options including:

- Futures trading (USDT-M)

- Cryptocurrency buying and selling

- Trading platform access

Before using any exchange, you should verify its current regulatory status in your jurisdiction. While Bitunix appears to be legitimate based on available information, always conduct your own research about licensing and security measures.

Remember to use strong security practices when trading on any platform, such as enabling two-factor authentication and using unique passwords.

Frequently Asked Questions

Traders considering MEXC and Bitunix need clear answers about key differences between these exchanges. These questions address the most important factors for making an informed decision about which platform might better suit your trading needs.

How do MEXC and Bitunix compare in terms of trading fees?

MEXC typically charges a standard spot trading fee of 0.2% for makers and takers. This rate can be reduced based on trading volume and MX token holdings.

Bitunix offers a slightly different fee structure with base rates around 0.1% to 0.15%. Based on search results, Bitunix positions itself as a competitive option, though specific fee details aren’t widely publicized.

Both exchanges offer fee discounts for high-volume traders and token holders. MEXC’s tiered system tends to be more transparent and established in the market.

What security measures do MEXC and Bitunix implement to protect user funds?

MEXC employs multi-signature wallets, cold storage for most funds, and two-factor authentication (2FA). They also maintain an insurance fund to protect users against potential breaches.

Bitunix claims to use advanced security protocols including cold storage solutions. However, details about their security practices are less comprehensive in public documentation compared to more established exchanges.

Neither exchange has reported major security breaches recently. MEXC has a longer track record of maintaining security, which some traders find reassuring.

What range of cryptocurrencies is available on MEXC versus Bitunix?

MEXC offers an impressive selection of over 1,500 cryptocurrencies and 2,100+ trading pairs. They’re known for listing new and emerging tokens quickly.

Bitunix provides a more limited selection focusing on major cryptocurrencies and select altcoins. The exact number isn’t widely published, but it’s generally considered smaller than MEXC’s extensive offerings.

MEXC clearly has an advantage for traders seeking exposure to low-cap or newly launched tokens. This diversity makes it appealing to those looking beyond mainstream crypto assets.

How do user reviews rate MEXC against Bitunix for customer service?

MEXC receives mixed reviews for customer service, with some users praising their 24/7 support while others report slow response times. Their multilingual support is frequently highlighted as a positive.

Bitunix has fewer published user reviews overall. From available information, their customer service appears to be developing, with some users mentioning response delays during peak times.

Established platforms like MEXC generally have more robust support infrastructure due to their larger size and longer market presence.

What are the liquidity levels like on MEXC compared to Bitunix?

MEXC maintains strong liquidity across major trading pairs, with daily trading volumes often exceeding $1 billion. This results in tighter spreads and less slippage for popular cryptocurrencies.

Bitunix appears to have lower overall liquidity based on available market data. This can potentially lead to wider spreads and more significant price impact when executing larger trades.

Higher liquidity on MEXC makes it generally more suitable for traders executing large orders or those who prioritize quick execution at expected prices.

How do MEXC and Bitunix platforms differ in terms of user interface and ease of use?

MEXC offers both basic and advanced trading interfaces to accommodate different user skill levels. Their platform includes comprehensive charting tools and technical analysis features.

Bitunix seems to focus on a streamlined approach that might appeal to beginners. Their mobile app is mentioned in search results as being designed for a “seamless” experience.

MEXC provides more advanced trading features and customization options. Bitunix may offer a simpler experience that new traders could find less overwhelming.

Bitunix Vs MEXC Conclusion: Why Not Use Both?

Both Bitunix and MEXC offer unique benefits for crypto traders. There’s no rule saying you must choose just one platform.

MEXC stands out with its extensive coin selection and competitive low fees. This makes it ideal for traders looking to access a wide variety of cryptocurrencies in one place.

Bitunix offers an easy-to-use interface that many beginners find appealing. However, it’s important to note that Bitunix is not available for users in the United States, Syria, Sudan, and North Korea.

Using multiple exchanges can be a smart strategy. Here’s why:

- Diversified options: Access more trading pairs and features

- Risk management: Avoid keeping all your assets on one platform

- Fee optimization: Take advantage of lower fees for specific transactions

- Backup access: If one platform experiences downtime, you have alternatives

You might use MEXC for its broad selection of altcoins while using Bitunix for its specific features or trading pairs not available elsewhere.

Remember to consider your location before signing up. US-based traders cannot use Bitunix and should look for alternatives.

The best approach is to evaluate your specific trading needs and choose the platform(s) that align with your goals. Sometimes that means using both exchanges for different purposes.