Choosing the right cryptocurrency exchange is crucial for your trading success. MEXC and BitMEX are two popular platforms that offer various features for crypto traders, but they differ in significant ways. Comparing MEXC vs BitMEX helps you understand which platform better suits your specific trading needs based on fees, available cryptocurrencies, and trading options.

Both exchanges have established themselves in the crypto market, with BitMEX being known for its derivatives trading focus and MEXC offering a wider range of cryptocurrency options. When deciding between these platforms, you’ll want to consider factors like user experience, security measures, and the types of trading products available on each exchange.

MEXC Vs BitMEX: At A Glance Comparison

When choosing between MEXC and BitMEX cryptocurrency exchanges, understanding their key differences can help you make the right decision for your trading needs.

Both platforms offer cryptocurrency trading services but have distinct features and advantages. Let’s compare them across essential categories.

| Feature | MEXC | BitMEX |

|---|---|---|

| Founded | 2018 | 2014 |

| Trading Fees | Generally lower fees | Higher fees for some transactions |

| Supported Cryptocurrencies | Wider selection | More limited selection |

| User Interface | Modern interface, suitable for beginners | Complex interface, better for experienced traders |

| Security | Strong security measures | Strong security with additional features |

| Trading Volume | High volume | High volume, especially for Bitcoin futures |

MEXC tends to support more cryptocurrencies, giving you access to a broader range of trading options. This makes it attractive if you’re looking to explore altcoins.

BitMEX specializes in cryptocurrency derivatives and futures trading. It has established itself as a leading platform for Bitcoin futures trading over its longer history.

For beginners, MEXC’s interface might be more approachable. BitMEX caters more to experienced traders who understand complex trading instruments.

Both exchanges have competitive trading volumes, but they differ in their fee structures. You’ll generally find MEXC offers more competitive fees across various transaction types.

Your choice between these platforms should depend on your trading experience, preferred cryptocurrencies, and the specific features that matter most to your trading strategy.

MEXC Vs BitMEX: Trading Markets, Products & Leverage Offered

Both MEXC and BitMEX offer cryptocurrency trading options, but they differ in what they provide to traders.

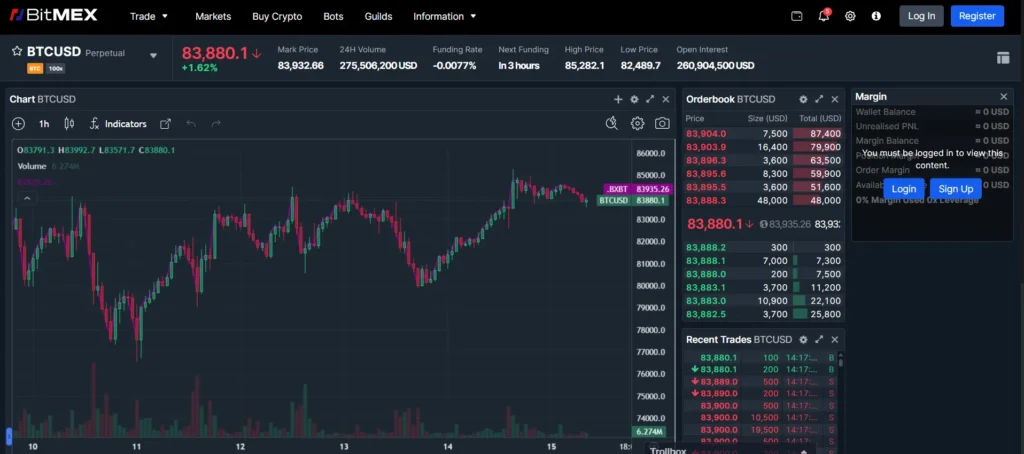

BitMEX is known for Bitcoin futures and swaps with up to 100x leverage. This platform focuses on derivatives trading with fast execution and competitive fees.

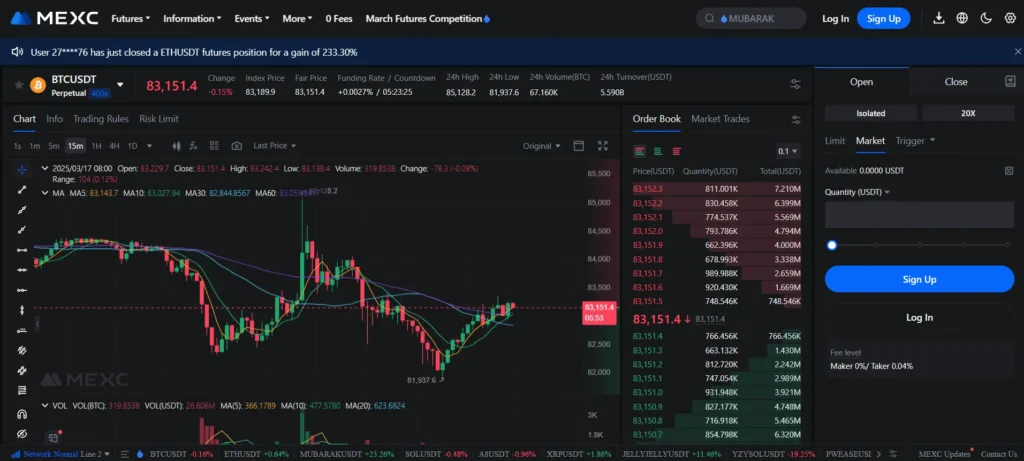

MEXC has lower trading fees at just 0.02% for futures trading. This fee applies when you open and close positions, making it cost-effective for active traders.

Leverage Options:

- BitMEX: Up to 100x leverage

- MEXC: Competitive leverage options

Product Offerings:

| Platform | Futures | Swaps | Spot Trading | Prediction Markets |

|---|---|---|---|---|

| BitMEX | ✓ | ✓ | Limited | Recently added |

| MEXC | ✓ | ✓ | Extensive | Not featured |

BitMEX has recently expanded into prediction markets, showing innovation beyond traditional crypto derivatives trading.

When choosing between these platforms, consider your trading preferences. BitMEX might be better if you focus mainly on Bitcoin trading with high leverage.

MEXC could be more suitable if you want lower fees and a wider range of cryptocurrencies to trade. The 0.02% fee structure makes it attractive for frequent traders.

Both platforms offer mobile apps and web interfaces for trading on different devices. You can access your accounts anytime to monitor and execute trades.

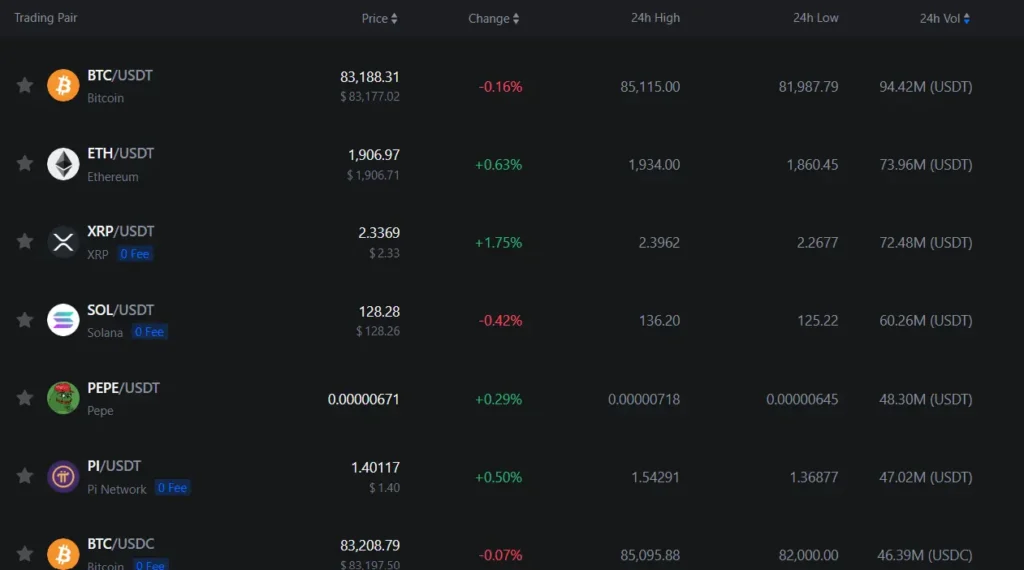

MEXC Vs BitMEX: Supported Cryptocurrencies

When choosing between MEXC and BitMEX, the variety of cryptocurrencies available for trading is an important factor to consider.

MEXC offers a much wider selection of cryptocurrencies. You can trade hundreds of different tokens on MEXC, including major coins and many smaller altcoins. This makes it a good choice if you want to explore emerging crypto projects.

BitMEX focuses on a smaller, more curated selection of cryptocurrencies. It primarily supports major coins like Bitcoin, Ethereum, and other established cryptocurrencies. BitMEX is known for its Bitcoin perpetual contracts.

Here’s a quick comparison of their cryptocurrency offerings:

| Exchange | Number of Cryptocurrencies | New Token Listings | Focus |

|---|---|---|---|

| MEXC | 1,500+ | Frequent new listings | Wide variety including small-cap coins |

| BitMEX | 20+ | Limited new additions | Major cryptocurrencies |

If you’re looking to trade niche altcoins or want access to new token launches, MEXC provides more options. The platform regularly adds new cryptocurrencies to its offerings.

BitMEX takes a more conservative approach, focusing on established cryptocurrencies with higher market caps and liquidity. This might appeal to you if you prefer trading only well-established digital assets.

Both platforms support the most popular cryptocurrencies like Bitcoin and Ethereum, but MEXC’s extensive catalog gives you more flexibility to diversify your trading portfolio.

MEXC Vs BitMEX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and BitMEX, understanding their fee structures is crucial for your trading strategy.

Trading Fees

BitMEX offers a maker-taker fee model where makers typically receive a rebate of 0.01% while takers pay around 0.075%. These rates may vary based on trading volume.

MEXC also uses a maker-taker model with competitive rates. Their maker fees start at 0.02% and taker fees at 0.06%, but these can decrease with higher trading volumes.

Deposit Fees

Both exchanges offer free deposits for cryptocurrencies. Neither platform charges you for adding funds to your account.

Withdrawal Fees

BitMEX charges network fees for withdrawals that vary depending on blockchain congestion. Bitcoin withdrawals typically cost around 0.0005 BTC.

MEXC withdrawal fees differ by cryptocurrency. For example, BTC withdrawals might cost 0.0005 BTC, while ETH withdrawals could be around 0.01 ETH.

Here’s a quick comparison:

| Fee Type | BitMEX | MEXC |

|---|---|---|

| Maker Fee | -0.01% (rebate) | 0.02% |

| Taker Fee | 0.075% | 0.06% |

| Deposit Fee | Free | Free |

| BTC Withdrawal | ~0.0005 BTC | ~0.0005 BTC |

You should consider these fees alongside other factors like available trading pairs and security features when deciding which exchange better suits your needs.

MEXC Vs BitMEX: Order Types

When trading on cryptocurrency exchanges, understanding the available order types can help you execute trades more effectively. Both MEXC and BitMEX offer various order types to meet different trading needs.

BitMEX provides several order types for traders. These include Market Orders for immediate execution and Limit Orders when you want to set specific prices.

BitMEX also offers Take Profit Orders in two forms: Take Profit Market Orders and Take Profit Limit Orders. When the market reaches your trigger price, these orders activate automatically.

MEXC stands out with its high-speed order matching system. It can process up to 1.4 million positions per second, making it highly efficient for fast-paced trading environments.

Both platforms support Stop Loss orders to help manage your risk. These orders execute automatically when prices reach predetermined levels.

Key Order Types Comparison:

| Order Type | BitMEX | MEXC |

|---|---|---|

| Market Orders | ✓ | ✓ |

| Limit Orders | ✓ | ✓ |

| Take Profit | ✓ | ✓ |

| Stop Loss | ✓ | ✓ |

| Trailing Stop | ✓ | ✓ |

BitMEX offers order types designed for various trading strategies. This flexibility makes it suitable for both beginners and advanced traders.

MEXC’s rapid execution speed gives you an advantage when trading in volatile markets where timing is crucial.

MEXC Vs BitMEX: KYC Requirements & KYC Limits

MEXC and BitMEX have different approaches to KYC (Know Your Customer) requirements, which can impact your trading experience.

MEXC offers a more flexible KYC policy. You can trade on MEXC without completing KYC verification, making it one of the best no-KYC crypto exchanges available. This feature is particularly valuable if you value privacy.

However, there are limits. Without KYC, your daily withdrawal limits will be restricted. If you complete MEXC’s Level 1 KYC verification, your withdrawal limits increase significantly.

BitMEX, on the other hand, has stricter KYC policies. You’ll typically need to complete verification before trading with significant amounts or accessing all platform features.

Here’s a quick comparison of KYC requirements:

| Exchange | KYC Required? | Withdrawal Limits |

|---|---|---|

| MEXC | Optional | Limited without KYC; increased limits with Level 1 KYC |

| BitMEX | Mandatory | Full verification typically required for all withdrawals |

Both platforms comply with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. MEXC’s approach simply gives you more flexibility in how you use the platform.

Your choice between these exchanges might depend on how important KYC-free trading is to you. If you prefer not sharing personal information, MEXC offers that option with reasonable withdrawal limits.

MEXC Vs BitMEX: Deposits & Withdrawal Options

When choosing between MEXC and BitMEX exchanges, deposit and withdrawal options are key factors to consider. These features directly affect how easily you can move your money in and out of the platforms.

BitMEX primarily focuses on cryptocurrency deposits and withdrawals. It only accepts Bitcoin for deposits, which limits your options if you prefer using other cryptocurrencies.

MEXC offers more flexibility with deposits. You can fund your account with numerous cryptocurrencies, not just Bitcoin. This gives you more choices based on the digital assets you already hold.

For withdrawal options, BitMEX also centers around Bitcoin. According to search results, some users note that BitMEX charges standard mining fees for withdrawals.

MEXC provides withdrawals in various cryptocurrencies, matching its diverse deposit options. This versatility can be helpful if you trade different digital assets.

Regarding fees, some competitors to BitMEX (like Bybit mentioned in search results) charge no withdrawal fees and have lower mining withdrawal fees. MEXC’s fee structure may differ, so it’s worth checking their current rates.

Processing times can vary between the platforms. BitMEX typically processes withdrawals once per day, while MEXC might offer more frequent processing windows.

Before choosing either platform, you should verify their supported payment methods in your region. Available options may vary based on your location and current regulations.

MEXC Vs BitMEX: Trading & Platform Experience Comparison

When comparing MEXC and BitMEX trading platforms, you’ll notice key differences in fees, user interface, and trading options.

Trading Fees Structure:

| Platform | Maker Fee | Taker Fee | Notes |

|---|---|---|---|

| BitMEX | 0.05% | 0.05% | Same rate for makers and takers |

| MEXC | Lower | 0.02% | Charged when opening and closing positions |

MEXC stands out with its lower fee structure, which can save you money on frequent trades. BitMEX uses a flat fee system that’s straightforward but slightly higher.

Both platforms offer futures trading, but their interfaces differ significantly. BitMEX has a more traditional trading interface that experienced traders might prefer. MEXC provides a more modern, user-friendly design.

Trading tools on BitMEX tend to be more advanced and technical. You’ll find comprehensive charting options and analytical features aimed at serious traders.

MEXC offers a wider variety of altcoins and trading pairs. This gives you more opportunities to diversify your trading portfolio beyond just the major cryptocurrencies.

Security measures are important on both platforms. BitMEX has a longer history in the market, while MEXC has faced some controversy regarding fund freezing in certain situations involving allegedly illegal trading.

The mobile experience differs too. MEXC’s app is more intuitive for beginners, while BitMEX’s mobile platform caters to traders who need advanced features on the go.

MEXC Vs BitMEX: Liquidation Mechanism

When trading on cryptocurrency exchanges like MEXC and BitMEX, understanding liquidation mechanisms is crucial for your risk management.

BitMEX uses a partial liquidation process that gradually reduces maintenance margin before fully liquidating a position. This system aims to help traders avoid complete liquidation of their accounts during market volatility.

One key aspect of BitMEX’s liquidation system is that it relies on index price movements rather than just market price. This provides some protection against market manipulation and flash crashes.

MEXC also employs liquidation mechanisms to protect the platform from excessive losses, though its specific approach differs somewhat from BitMEX.

Both platforms will liquidate your position when your margin falls below the maintenance requirement. However, BitMEX is known for its more sophisticated approach to liquidations.

It’s worth noting that BitMEX only liquidates based on index price movements. This means price spikes on the exchange itself won’t trigger liquidations unless the underlying index price also moves accordingly.

Some traders have reported issues with BitMEX’s liquidation system, claiming profitable positions were liquidated during index discrepancies. These situations appear to occur when one of BitMEX’s two price indexes experiences significant downtime or volatility.

Key Differences:

| Feature | BitMEX | MEXC |

|---|---|---|

| Liquidation Process | Partial, gradual reduction | Standard liquidation |

| Price Reference | Index price based | Market price focused |

| Manipulation Protection | Higher due to index reliance | Standard protections |

MEXC Vs BitMEX: Insurance

When trading crypto on exchanges, insurance funds are crucial for protecting your assets. These funds help manage liquidations and prevent losses during volatile market conditions.

BitMEX has a well-established insurance fund that started operating in 2014. This fund helps avoid auto-deleveraging in traders’ positions by stepping in when liquidation orders aren’t filled at market prices.

The BitMEX insurance fund acts as a buffer between liquidated positions and other traders. When a position is liquidated, the fund can absorb losses that would otherwise affect other users on the platform.

MEXC also offers an insurance mechanism, though with some differences in implementation. Their system aims to protect users during extreme market volatility.

Both exchanges use their insurance funds to maintain market stability and protect traders from cascading liquidations. This is especially important when you’re using leverage.

When choosing between these platforms, you should consider the size and track record of their insurance funds. BitMEX has a longer history, which may provide more data about how effectively their fund works during market crashes.

The insurance protection on both platforms helps you trade with more confidence, knowing there’s a safety net in place for extreme market conditions.

MEXC Vs BitMEX: Customer Support

When choosing a crypto exchange, customer support can make or break your experience. Both MEXC and BitMEX offer support services, but there are key differences.

BitMEX provides 24/7 customer support according to their resources. Their team can assist with both simple and complex questions. They offer support in English and possibly other languages.

MEXC offers 24/5 customer support, which means they’re available five days a week rather than seven. They emphasize quick implementation and onboarding training for new users.

Both platforms likely offer multiple contact methods:

- Email support

- Live chat

- Help center articles

- FAQ sections

Response time can vary between the platforms. BitMEX promotes round-the-clock availability, which might be beneficial if you trade during weekends or encounter urgent issues outside business hours.

MEXC’s dedicated onboarding training could be particularly helpful if you’re new to cryptocurrency trading. This might give you a smoother start on their platform.

When choosing between these exchanges, consider when you’ll most likely need assistance. If weekend support is essential for your trading schedule, BitMEX’s 24/7 availability might be the better option.

Remember to check recent user reviews about support quality, as response times and helpfulness can change over time.

MEXC Vs BitMEX: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both MEXC and BitMEX offer robust security measures to protect your assets.

BitMEX uses multi-signature wallets for all cryptocurrency deposits, adding an extra layer of protection. They also implement two-factor authentication (2FA) to secure your account from unauthorized access.

MEXC similarly offers 2FA but adds additional security through anti-phishing codes and advanced risk control systems. Their security team monitors transactions 24/7 for suspicious activity.

Key Security Features Comparison:

| Feature | MEXC | BitMEX |

|---|---|---|

| Two-Factor Authentication | ✅ | ✅ |

| Cold Storage | ✅ | ✅ |

| Multi-signature Wallets | Partial | ✅ |

| Anti-phishing Protection | ✅ | Limited |

| Insurance Fund | ✅ | ✅ |

BitMEX has faced regulatory scrutiny in the past but has since strengthened their compliance measures. They now perform thorough KYC (Know Your Customer) checks on all users.

MEXC implements strict identity verification procedures and has a clean regulatory record. Their platform includes regular security audits and penetration testing.

Both exchanges offer insurance funds to protect users against losses from system failures or liquidations. However, these funds may not cover all potential losses.

You should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and being cautious of phishing attempts.

Is MEXC A Safe & Legal To Use?

MEXC has been operating since 2018 and has maintained a solid security record with no reported hacks or loss of user funds. This track record is important when considering a cryptocurrency exchange.

The platform is legal to use in many countries, though availability may vary based on your location. Always check if MEXC is permitted in your jurisdiction before signing up.

MEXC offers security features like two-factor authentication (2FA) and withdrawal address management to protect your assets. These basic security measures are standard in the industry.

Be aware that while MEXC advertises as a “no KYC exchange,” they may still require Know Your Customer verification in certain situations. This typically happens when:

- Your account shows unusual activity

- You reach certain withdrawal limits

- Regulatory requirements change

Some users have reported issues with sudden KYC requirements when trying to withdraw funds. This inconsistent approach to verification is something to consider before depositing large amounts.

MEXC is registered in Seychelles, which offers less strict regulations than some other jurisdictions. This gives them flexibility but might provide fewer protections for users.

When using MEXC, it’s recommended to:

- Enable all security features

- Use strong, unique passwords

- Only keep trading amounts on the exchange

- Withdraw larger holdings to private wallets

Is BitMEX A Safe & Legal To Use?

BitMEX operates as a cryptocurrency exchange platform that has been around since 2014. Many traders consider it relatively safe for conducting cryptocurrency trades, though caution is advised.

From a legal standpoint, BitMEX has faced regulatory challenges. The exchange ran into trouble with US regulators for violating derivatives trading laws. As a result, BitMEX is not available to US residents.

For non-US users, BitMEX is generally legal to use, but this depends on your country’s specific regulations regarding cryptocurrency trading.

Safety considerations:

- Use BitMEX primarily as a trading platform

- Avoid storing large amounts of cryptocurrency on the exchange

- Only deposit what you need for active trading

The platform offers security features to protect user accounts, but like any exchange, it’s not immune to potential hacks or security breaches.

When using BitMEX, it’s important to follow proper security practices. Enable two-factor authentication and use strong, unique passwords to protect your account.

BitMEX requires KYC (Know Your Customer) verification for its users, which adds a layer of legitimacy to the platform. This helps prevent fraud and ensures compliance with financial regulations in jurisdictions where it operates.

Frequently Asked Questions

When choosing between MEXC and BitMEX, traders often have specific questions about features, costs, and accessibility. These questions can help determine which platform better suits your trading needs and experience level.

What are the differences in trading fees between the two platforms?

BitMEX typically charges a 0.075% maker fee and a 0.075% taker fee for most contracts. These fees can vary based on trading volume and contract type.

MEXC generally offers slightly lower fees with 0.02% maker and 0.06% taker fees for spot trading. For futures trading, MEXC charges 0.02% maker and 0.05% taker fees.

Both platforms offer fee discounts for high-volume traders, though the specific tier structures differ between the exchanges.

Which exchange offers better customer support for new traders?

MEXC provides 24/7 customer support through multiple channels including live chat, email, and ticket systems. They also offer extensive educational resources designed specifically for new traders.

BitMEX offers email support and an extensive knowledge base but lacks live chat options. Their response times can be longer than MEXC, especially during high-volume trading periods.

Both platforms provide FAQ sections, but MEXC generally receives better reviews for responsiveness and helpful support for beginners.

How do the security features of the two exchanges compare?

BitMEX implements strong security measures including multi-signature wallets, cold storage for most funds, and mandatory two-factor authentication. They have a strong security track record despite being targeted by hackers.

MEXC also uses cold storage solutions and offers two-factor authentication. They provide additional security features like anti-phishing codes and withdrawal address management.

Both platforms conduct regular security audits, but BitMEX is generally considered to have more robust security infrastructure based on its longer history in the market.

What options are available for US traders wanting to trade crypto futures?

Neither BitMEX nor MEXC currently allows US traders to access their platforms due to regulatory constraints. BitMEX explicitly blocks US IP addresses.

US traders seeking crypto futures trading should consider regulated alternatives like CME futures or US-compliant exchanges such as Kraken Futures or FTX.US.

The regulatory landscape continues to evolve, so checking the latest terms of service for both platforms is essential before attempting to create an account.

Which platform offers a more user-friendly interface for beginners?

MEXC provides a cleaner, more intuitive interface that many beginners find easier to navigate. Their mobile app also receives positive reviews for usability and feature accessibility.

BitMEX’s interface is more technical and can be overwhelming for beginners. It’s designed with professional traders in mind, featuring advanced charting tools and trading options.

If you’re new to crypto trading, MEXC’s platform may be easier to learn, while BitMEX might require more time to understand its full functionality.

What are the margin and leverage differences between the two exchanges?

BitMEX offers leverage up to 100x on Bitcoin contracts and generally between 20x-50x on other cryptocurrencies. Their margin system is known for being sophisticated but complex.

MEXC provides similar leverage options with up to 125x on some contracts. Their margin system includes cross margin and isolated margin options for different risk preferences.

Both platforms implement liquidation mechanisms to protect traders, but MEXC’s tiered liquidation system is considered by some traders to be more forgiving for newer users.

MEXC vs BitMEX Conclusion: Why Not Use Both?

When comparing cryptocurrency exchanges like MEXC and BitMEX, you don’t always need to choose just one. Using multiple platforms can actually be a smart strategy for crypto traders.

Both exchanges offer unique features that can complement each other in your trading toolkit. MEXC might excel in certain token offerings, while BitMEX could provide better futures trading options.

Benefits of using multiple exchanges:

- Risk diversification – Spreading assets across platforms reduces vulnerability

- Access to more trading pairs – Different exchanges list different cryptocurrencies

- Fee optimization – Take advantage of lower fees for specific transactions

- Enhanced liquidity options – Find the best prices across multiple markets

Trading cryptocurrency requires attention to detail and accuracy. By using both exchanges, you can capitalize on the strengths of each while minimizing their individual weaknesses.

Remember that each platform has its own security measures, fee structures, and user interfaces. You might find one easier to use for certain types of trades while preferring the other for different transactions.

The crypto market moves quickly. Having accounts on multiple exchanges gives you more flexibility to act when opportunities arise.