Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Both MEXC and Bitget are popular options in 2025, but they have key differences worth understanding before you commit.

Bitget stands out with its superior copy trading features, offering over 110,000 elite traders and at least 540,000 users compared to MEXC’s more limited offering of 1,500 experts. This makes Bitget a stronger choice if you’re interested in following successful traders’ strategies with minimal effort.

However, MEXC has its own advantages, particularly when it comes to trading fees. Many users report that MEXC provides more cost-effective daily trading, which could be important if you plan to make frequent transactions. Both platforms offer various features, so your best choice depends on which aspects of cryptocurrency trading matter most to you.

MEXC Vs Bitget: At A Glance Comparison

Both MEXC and Bitget are popular cryptocurrency exchanges that offer trading services in 2025. Let’s compare their key features to help you decide which platform might work better for your needs.

Trading Fees

| Feature | MEXC | Bitget |

|---|---|---|

| Spot Trading | 0.1-0.2% | 0.1-0.2% |

| Futures Trading | 0.02-0.06% | 0.02-0.05% |

| Withdrawal Fees | Varies by coin | Varies by coin |

Available Features

- Both platforms offer spot trading, futures, and leverage options

- Bitget has a stronger focus on copy trading features

- MEXC typically lists more new tokens and smaller cap coins

Security

Both exchanges employ two-factor authentication, cold storage for funds, and regular security audits. Neither has experienced major security breaches recently.

User Experience

Bitget’s interface is generally considered more beginner-friendly. MEXC offers more advanced trading tools that experienced traders might prefer.

Supported Cryptocurrencies

MEXC supports over 1,500 cryptocurrencies while Bitget offers around 600+ trading pairs. Your choice may depend on which specific coins you want to trade.

Mobile Apps

Both exchanges provide mobile apps for Android and iOS devices with similar functionality to their web platforms.

Customer Support

Both offer 24/7 customer support through chat and email. Response times vary but typically range from minutes to hours depending on issue complexity.

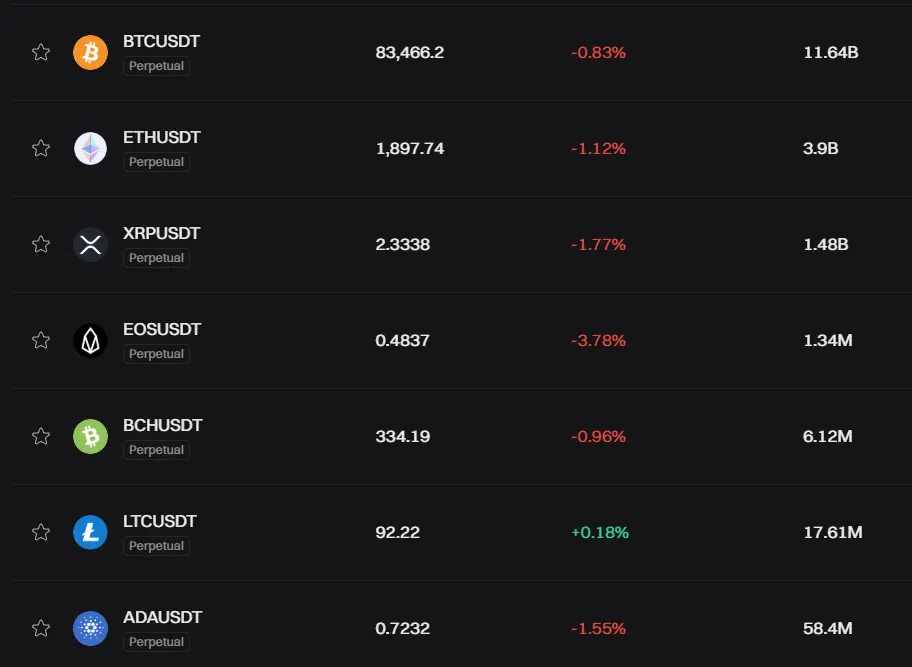

MEXC Vs Bitget: Trading Markets, Products & Leverage Offered

MEXC and Bitget both offer diverse trading options for crypto enthusiasts. Let’s compare what each platform brings to the table.

Leverage Trading

MEXC stands out with impressive leverage options of up to 200x for major cryptocurrencies like Bitcoin and Ethereum. This is significantly higher than most competitors in the market.

Bitget also offers leverage trading but generally with lower maximum levels compared to MEXC.

Trading Fees

MEXC charges approximately 0.02% for futures trading fees, which apply when opening and closing positions. This competitive rate makes it attractive for frequent traders.

Bitget’s fee structure is also competitive, though specific rates may vary by trading pair and volume.

Available Markets

Both exchanges support a wide range of cryptocurrencies and trading pairs. You’ll find spot trading, futures, and various derivatives on both platforms.

Trading Products:

- Spot trading

- Futures contracts

- Margin trading

- Options (availability varies)

- Copy trading features

Bitget has developed a reputation for user-friendly interfaces that cater to both beginners and experienced traders.

MEXC has expanded its service to over 10 million users worldwide, indicating strong market adoption and reliability.

When choosing between these platforms, consider your leverage needs, trading volume, and which specific cryptocurrencies you plan to trade.

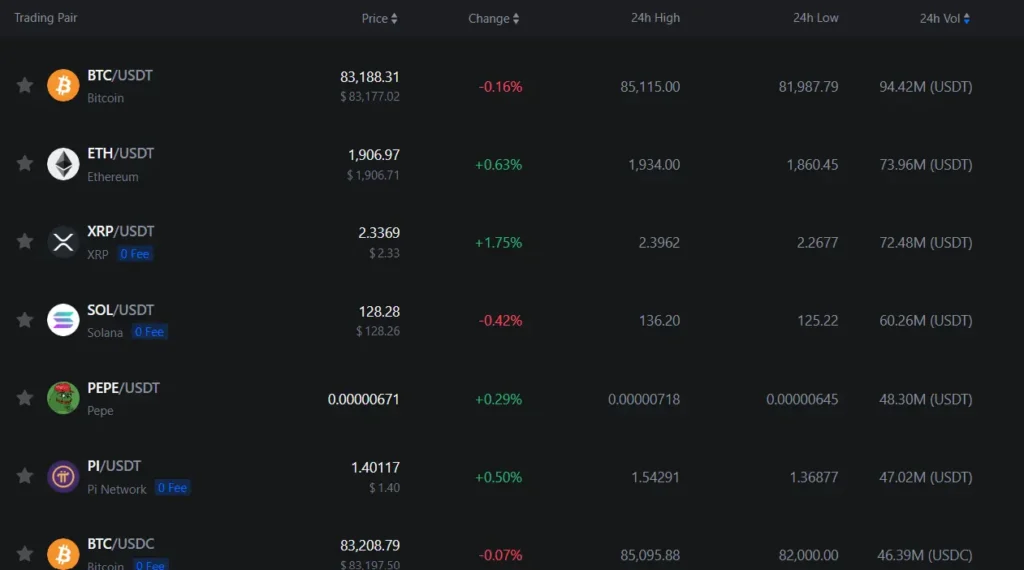

MEXC Vs Bitget: Supported Cryptocurrencies

Both MEXC and Bitget offer a wide range of cryptocurrencies for trading, but there are some differences in their offerings that you should know about.

MEXC generally supports more cryptocurrencies than Bitget. As of March 2025, MEXC lists over 1,500 cryptocurrencies, making it one of the exchanges with the largest selection of altcoins.

Bitget typically offers around 600-700 cryptocurrencies. While this is fewer than MEXC, Bitget still provides access to all major coins and many popular altcoins.

Common cryptocurrencies on both platforms:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Dogecoin (DOGE)

MEXC is known for listing new tokens faster than most exchanges. If you’re interested in trading newly launched projects, MEXC might be your better option.

Bitget has its native token called BGB, which provides benefits like reduced trading fees. According to the search results, BGB is also available for trading on MEXC.

Both exchanges support spot trading and futures markets for most major cryptocurrencies. However, MEXC typically offers more trading pairs overall.

When choosing between these exchanges, consider which specific cryptocurrencies you want to trade. Check both platforms’ current listings if you’re interested in particular altcoins.

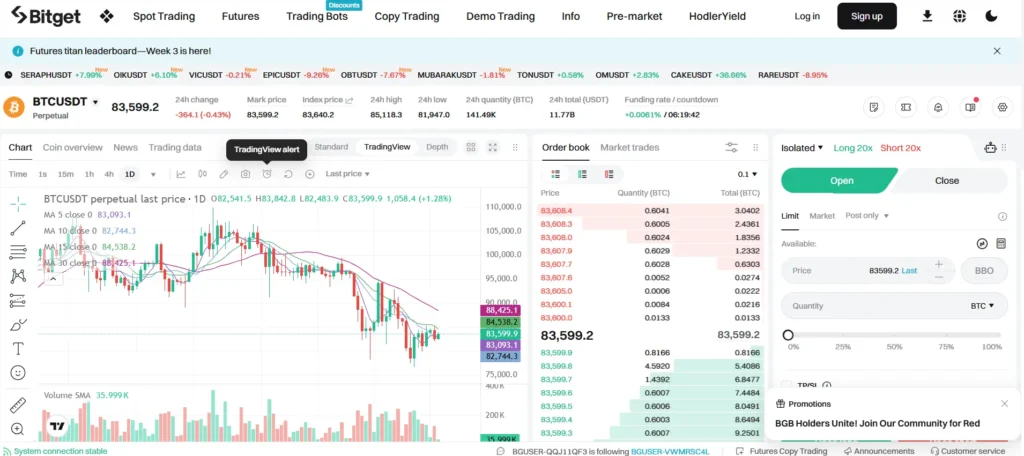

MEXC Vs Bitget: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and Bitget, understanding their fee structures is crucial for your trading strategy.

Spot Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| MEXC | 0% | 0.02% |

| Bitget | 0.1% | 0.1% |

MEXC offers a more competitive spot trading fee structure with zero fees for makers and only 0.02% for takers. Bitget charges 0.1% for both makers and takers in spot trading.

Futures Trading Fees

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Bitget | 0.02% | 0.06% |

| MEXC | Varies | Varies |

For futures trading, Bitget charges 0.02% for makers and 0.06% for takers.

Withdrawal Fees

| Exchange | BTC Withdrawal Fee |

|---|---|

| Bitget | 0.0005 BTC |

| MEXC | 0.0003 BTC |

MEXC has a lower Bitcoin withdrawal fee at 0.0003 BTC compared to Bitget’s 0.0005 BTC. This difference can be significant if you make frequent withdrawals.

You should consider these fee differences when calculating your potential profits. Lower fees directly impact your bottom line, especially if you’re an active trader.

Both exchanges offer sign-up bonuses that may offset initial trading costs. These promotions change regularly, so check their current offers before registering.

MEXC Vs Bitget: Order Types

When trading on cryptocurrency exchanges, the available order types can significantly impact your trading strategy. Both MEXC and Bitget offer various order options to help you execute trades effectively.

MEXC Order Types:

- Market orders

- Limit orders

- Stop-limit orders

- OCO (One-Cancels-the-Other)

- Trailing stop orders

- Post-only orders

MEXC provides a comprehensive range of order types that cater to both beginners and advanced traders. Their platform includes trailing stop orders, which automatically adjust your stop price as the market moves in your favor.

Bitget Order Types:

- Market orders

- Limit orders

- Stop orders

- Iceberg orders

- TWAP (Time-Weighted Average Price)

- Conditional orders

Bitget offers some unique order types like iceberg orders, which help you place large orders without revealing the full size to the market. This can be particularly useful when you want to minimize market impact.

Both exchanges support the essential market and limit orders that most traders regularly use. However, MEXC edges ahead with more advanced order types for futures trading.

If you frequently use complex trading strategies, MEXC’s broader selection might better suit your needs. For those who prioritize copy trading, Bitget’s order system is well-integrated with their social trading features.

Your specific trading style should guide which platform’s order types will work best for your strategy.

MEXC Vs Bitget: KYC Requirements & KYC Limits

Both MEXC and Bitget have different approaches to Know Your Customer (KYC) procedures that affect how you can use their platforms.

MEXC KYC Requirements:

- Generally requires identity verification, especially when using traditional payment methods

- Known as a global crypto exchange with some flexibility in KYC requirements

- Millions of users trade over 1600 cryptocurrencies daily on the platform

Bitget KYC Requirements:

- Has specific KYC processes in place for user verification

- Different KYC levels determine trading and withdrawal limits

- Verification steps typically include personal information and document submission

Trading Without KYC:

| Exchange | No-KYC Trading | Limitations |

|---|---|---|

| MEXC | Possible in some cases | Limited withdrawal amounts |

| Bitget | Limited functionality | Restricted features and lower limits |

Your withdrawal and trading limits on both platforms will increase as you complete higher levels of verification. Basic verification typically allows for smaller transaction amounts.

For maximum account security and full platform access, completing all KYC steps is recommended on either exchange. This helps protect your funds and enables access to all available trading features.

MEXC Vs Bitget: Deposits & Withdrawal Options

Both MEXC and Bitget offer various options for depositing and withdrawing your funds. Understanding these options can help you choose the exchange that better suits your needs.

Deposit Methods:

- MEXC supports cryptocurrency deposits across multiple networks

- Bitget allows crypto deposits and also offers fiat deposit options

- Both platforms support bank transfers for fiat deposits

Bitget provides a more straightforward fiat deposit process with step-by-step tutorials available for new users. This makes it more accessible if you’re just starting your crypto journey.

Withdrawal Options:

| Feature | MEXC | Bitget |

|---|---|---|

| Crypto withdrawals | Yes | Yes |

| Fiat withdrawals | Limited | More options |

| Withdrawal networks | Multiple | Multiple |

MEXC tends to process withdrawals quickly, which is beneficial when you need fast access to your funds. However, Bitget often provides more options for withdrawing to fiat currencies.

Fees:

Both exchanges charge withdrawal fees that vary depending on the cryptocurrency and network you choose. MEXC sometimes offers lower withdrawal fees for certain cryptocurrencies compared to Bitget.

Remember to verify the current withdrawal fees before making transactions, as these can change based on network conditions and exchange policies.

When selecting between these platforms, consider which deposit and withdrawal methods you’ll use most frequently, and check if your preferred options are available.

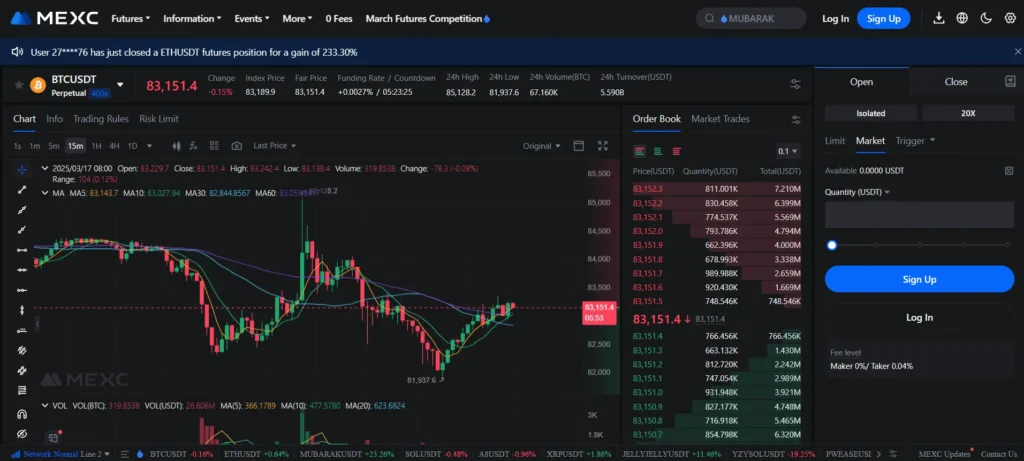

MEXC Vs Bitget: Trading & Platform Experience Comparison

When comparing MEXC and Bitget’s trading platforms, several key differences stand out. Both exchanges offer spot and futures trading, but your experience will vary between them.

MEXC provides a more cost-effective trading environment with lower fees for both spot and futures trading. This can make a significant difference if you’re an active trader who executes multiple trades daily.

Bitget’s interface is generally considered more beginner-friendly, with clearer navigation and helpful tooltips. However, MEXC offers a wider range of trading pairs and cryptocurrencies.

For mobile trading, both exchanges have functional apps, but user reviews suggest Bitget’s mobile experience is slightly more polished and responsive.

Trading Features Comparison:

| Feature | MEXC | Bitget |

|---|---|---|

| Spot Trading Fees | Lower | Higher |

| Futures Trading Fees | Lower | Higher |

| Available Trading Pairs | More | Fewer |

| User Interface | Comprehensive | More intuitive |

| Mobile Experience | Good | Very good |

If you’re focused on advanced trading tools, MEXC offers more technical indicators and charting options. Bitget, meanwhile, stands out with its copy trading feature that lets you follow successful traders.

Execution speed is comparable on both platforms, but MEXC tends to have higher liquidity for altcoins, which can mean less slippage when trading less popular tokens.

MEXC Vs Bitget: Liquidation Mechanism

When trading with leverage on cryptocurrency exchanges, understanding the liquidation mechanism is crucial. Both MEXC and Bitget have systems in place to manage risk, but they operate differently.

MEXC uses a tiered liquidation system that gradually reduces your position size as it approaches the liquidation price. This gives you more chances to avoid complete liquidation during market volatility.

Bitget employs a more standard liquidation model where positions are closed when they reach the liquidation price. Their system can be less forgiving during sudden market movements.

Liquidation Thresholds:

- MEXC: Typically begins partial liquidation at 80-90% of margin usage

- Bitget: Full liquidation occurs when margin ratio falls below maintenance requirement

Both platforms send notifications when your positions approach liquidation levels. MEXC generally provides more advanced warnings through multiple channels.

The liquidation fees also differ between platforms:

| Exchange | Liquidation Fee |

|---|---|

| MEXC | 0.15% – 0.3% |

| Bitget | 0.2% – 0.5% |

MEXC’s insurance fund is more robust based on recent liquidity depth analysis, providing better protection against excessive losses during liquidation events.

You can protect yourself on both platforms by using stop-loss orders and position sizing appropriately. MEXC’s partial liquidation approach tends to be more trader-friendly, especially for beginners still learning risk management.

MEXC Vs Bitget: Insurance

When trading cryptocurrencies, having insurance protection is vital for your funds. Both MEXC and Bitget offer insurance funds to protect users against unexpected losses.

MEXC maintains a sizable insurance fund that covers potential losses from liquidations that exceed a trader’s margin. This helps ensure that winning traders always receive their profits, even if the losing side cannot cover losses.

Bitget also provides an insurance fund, though based on recent comparisons, it may not be as large as MEXC’s fund. The size of an exchange’s insurance fund directly impacts your protection level when trading.

Both exchanges contribute a percentage of their trading fees to their insurance funds. This ongoing contribution helps the funds grow over time and enhances user protection.

Neither exchange offers complete coverage for all types of losses. Typical coverage includes system failures and liquidation issues, but not losses from market volatility or personal trading decisions.

It’s worth noting that both platforms have strong security measures in place alongside their insurance funds. These include cold storage for most assets, two-factor authentication, and regular security audits.

Before choosing either platform, you should review their current insurance fund size and coverage details, as these figures change regularly based on market conditions and platform policies.

MEXC Vs Bitget: Customer Support

When choosing between MEXC and Bitget, customer support can be a deciding factor for your trading experience. Both exchanges offer multiple support channels, but there are some notable differences.

Bitget provides 24/7 customer support through live chat, email, and ticket systems. Their team typically responds within minutes on live chat, making it convenient for urgent issues. Many users praise Bitget’s clear and helpful responses.

MEXC also offers round-the-clock support through similar channels. Their support team handles inquiries in multiple languages, which is beneficial for international traders.

Response times can vary between the platforms. Bitget generally delivers faster initial responses, especially during peak trading hours. MEXC might take longer during busy periods but provides detailed solutions.

Both exchanges maintain help centers with FAQs, tutorials, and guides. Bitget’s resources are more beginner-friendly with step-by-step instructions. MEXC’s knowledge base is comprehensive but sometimes requires more technical understanding.

For complex issues, Bitget offers scheduled callback options where specialists can help with specific problems. MEXC provides community support through social media channels and forums.

Neither exchange currently offers phone support, which might be inconvenient if you prefer direct voice communication.

The quality of customer service may impact your trading confidence, especially during market volatility when quick assistance can be crucial.

MEXC Vs Bitget: Security Features

When choosing between MEXC and Bitget, security should be your top priority. Both exchanges implement industry-standard security measures to protect your crypto assets.

Two-Factor Authentication (2FA) is available on both platforms. This extra layer of security helps prevent unauthorized access to your account.

MEXC offers multi-signature wallets for additional protection of funds. Bitget provides cold storage solutions where most user assets are kept offline, away from potential hackers.

Both exchanges have anti-phishing codes that help you verify emails are legitimate. This protects you from common scam attempts.

Account verification levels on both platforms follow KYC (Know Your Customer) protocols. These help prevent fraud and comply with regulations.

Bitget offers a $300 million protection fund to safeguard user assets in case of security breaches. MEXC has implemented similar protective measures for user funds.

Withdrawal confirmations are required on both exchanges. This prevents unauthorized transfers of your crypto assets.

Risk management systems monitor suspicious activities on both platforms. These systems can automatically freeze accounts if unusual patterns are detected.

Both exchanges conduct regular security audits to identify and fix potential vulnerabilities. This ongoing process helps maintain strong protection of the platforms.

When comparing overall security features, both exchanges provide robust protection. Your choice might depend on which specific security features matter most to your trading needs.

Is MEXC A Safe & Legal To Use?

MEXC is generally considered a safe cryptocurrency exchange for traders. According to Certik, a cybersecurity agency, MEXC has earned a safety score of 81.82 with an A rating, making it the 10th safest crypto exchange as of 2025.

The platform operates legally in many countries, though regulations vary by region. It’s worth noting that MEXC functions as a no-KYC crypto exchange, which means you can trade without completing identity verification in some jurisdictions.

When considering safety features, MEXC implements:

- Two-factor authentication (2FA)

- Anti-phishing codes

- Cold wallet storage for most assets

- Regular security audits

MEXC serves millions of users daily and offers trading for over 1600 cryptocurrencies. This wide selection gives you plenty of options for diversifying your crypto portfolio.

From a fee perspective, MEXC stands out for its cost-effectiveness. Many users choose MEXC specifically because of its lower trading fees compared to competitors like Bitget and KuCoin.

Before using MEXC, you should check if cryptocurrency trading is legal in your country and whether using a no-KYC exchange complies with local regulations. While MEXC provides strong security measures, always use strong passwords and enable all security features to protect your account.

Is Bitget A Safe & Legal To Use?

Bitget is considered safe and legal for cryptocurrency trading. As of March 2025, it has not experienced major security breaches or significant losses of user funds, which is a positive sign for a crypto exchange.

The platform is fully licensed, having completed necessary regulatory processes to ensure security. This licensing provides an extra layer of protection for users concerned about the legitimacy of their trading platform.

Some users have reported positive experiences with Bitget’s operations. Deposits are processed quickly, often within minutes, making it convenient for traders who need fast access to their funds.

However, it’s important to note that some users have expressed concerns about certain aspects of the platform. Like any centralized exchange, Bitget carries inherent risks that come with not having complete control over your crypto assets.

Bitget has taken steps to reassure users that their assets are backed and not misappropriated. They’ve implemented security measures to protect user funds and maintain platform integrity.

When choosing between MEXC and Bitget, consider that both have security measures in place, but you should:

- Enable two-factor authentication

- Use strong, unique passwords

- Be cautious with sharing personal information

- Withdraw large amounts to personal wallets when not actively trading

Frequently Asked Questions

Traders often have specific questions when comparing MEXC and Bitget exchanges. These questions cover important aspects like fees, security, available cryptocurrencies, and user experience that can impact your trading decisions.

What are the key differences in fees between MEXC and Bitget for traders?

MEXC offers lower trading fees compared to Bitget, making it more cost-effective for frequent traders. While specific fee structures change over time, MEXC is typically praised for its competitive fee schedule.

Trading fees on MEXC range from 0.1% to 0.2% for most transactions, with additional discounts available when using the platform’s native token.

Bitget’s fee structure tends to be slightly higher but may offer special promotions for new users or during trading events.

How do the security features of MEXC compare with those offered by Bitget?

Both exchanges implement strong security measures including two-factor authentication and cold storage for funds. Bitget has earned recognition for its comprehensive security protocols and insurance fund to protect user assets.

MEXC also employs multi-signature technology and regular security audits to safeguard user funds. Neither exchange has experienced major security breaches in recent years.

Your account security on both platforms depends partly on following recommended security practices like using unique passwords and enabling all available security features.

Can users expect a difference in liquidity when trading on MEXC versus Bitget?

Liquidity varies between the two exchanges, with some differences in trading pair availability and market depth. Bitget has grown its liquidity pools significantly in recent years, particularly for its futures trading markets.

MEXC offers good liquidity for a wide range of altcoins, including many smaller market cap tokens that may not be available elsewhere.

You might notice tighter spreads on major cryptocurrencies like Bitcoin and Ethereum on Bitget, while MEXC might provide better liquidity for newer or more niche tokens.

What range of cryptocurrencies are available on MEXC and Bitget, and how do they compare?

MEXC typically lists a larger number of cryptocurrencies compared to Bitget, with particular strength in listing new and emerging tokens quickly. MEXC currently supports over 1,500 cryptocurrencies and trading pairs.

Bitget focuses more on established cryptocurrencies but has been expanding its offerings. The exchange is known for its strong selection of futures trading options.

Your choice between the two might depend on whether you’re looking to trade mainstream cryptocurrencies or want access to newly launched tokens and projects.

How do user experiences and platform interfaces on MEXC and Bitget differ for new traders?

Bitget offers a cleaner, more intuitive user interface that new traders find easier to navigate. Its streamlined trading experience receives positive feedback from beginners and experienced traders alike.

MEXC’s interface contains more features and options, which can be overwhelming for newcomers but appreciated by advanced traders who need detailed trading tools.

You’ll find Bitget’s mobile app particularly user-friendly, while MEXC offers more advanced charting capabilities for technical analysis.

What are the customer service and support reputations for MEXC and Bitget?

Both exchanges provide customer support through multiple channels including live chat, email, and help centers. Bitget has invested heavily in improving customer service response times in recent years.

MEXC offers support in more languages, making it accessible to a global user base. Their ticket system typically resolves most issues within 24-48 hours.

You might experience faster response times with Bitget’s live chat feature, while MEXC’s knowledge base provides more comprehensive self-help resources.

Bitget Vs MEXC Conclusion: Why Not Use Both?

When comparing MEXC and Bitget, it’s clear both exchanges have their strengths. MEXC stands out with lower trading fees for both spot and futures trading, which could save you money on frequent trades.

Bitget offers some unique features that might appeal to certain traders. The platforms have different token listings, so you might find some cryptocurrencies on one but not the other.

Fee Comparison:

- MEXC: Lower overall trading fees

- Bitget: Higher fees but potentially different discount structures

You don’t necessarily need to choose just one exchange. Many crypto traders maintain accounts on multiple platforms to take advantage of:

- Different token listings

- Fee promotions and discounts

- Varying liquidity pools

- Platform-specific features

Using both MEXC and Bitget gives you flexibility. You could use MEXC for its lower fees when making regular trades, while keeping Bitget for access to its exclusive offerings or specific features you prefer.

The best approach depends on your trading style and needs. If you’re an active trader focused on minimizing costs, MEXC might be your primary platform. If specific tokens or features matter more, you might prefer Bitget.

Consider starting with the platform that best meets your immediate needs, then explore the other as your trading strategies evolve.