Choosing the right crypto exchange can make a big difference in your trading journey. MEXC and BingX are two popular platforms that offer unique features for crypto enthusiasts.

MEXC allows higher withdrawal limits at 30 BTC per day for non-KYC users, while BingX caps it at 50K USDT daily. This significant difference might affect your decision if you handle large transaction volumes.

Both exchanges have their own fee structures, supported cryptocurrencies, and special features that set them apart. Understanding these differences can help you pick the platform that best fits your trading style and needs.

MEXC vs BingX: At A Glance Comparison

When choosing between MEXC and BingX, you need to understand their key differences. Both platforms offer cryptocurrency trading services but vary in several important ways.

Trading Features

| Feature | MEXC | BingX |

|---|---|---|

| Supported cryptocurrencies | Large selection | Moderate selection |

| Trading types | Spot, futures, margin | Spot, futures, copy trading |

| Leverage options | Available | Available |

MEXC ranks higher on exchange volume lists according to CoinMarketCap data. This typically indicates better liquidity for traders looking to execute large orders.

BingX stands out with its copy trading feature, allowing you to automatically mirror experienced traders’ strategies. This is especially helpful if you’re new to crypto trading.

Fee Structure

Both exchanges offer competitive fee structures. Your exact costs will depend on your trading volume and account level.

User Experience

MEXC provides a more comprehensive platform with advanced trading tools. BingX offers a more streamlined interface that you might find easier to navigate as a beginner.

Security Measures

Both exchanges implement standard security practices like two-factor authentication and cold storage for funds. Always check their latest security updates before depositing.

When deciding between these platforms, consider your trading needs. If you want more cryptocurrency options, MEXC might be better. If copy trading interests you, BingX could be the right choice.

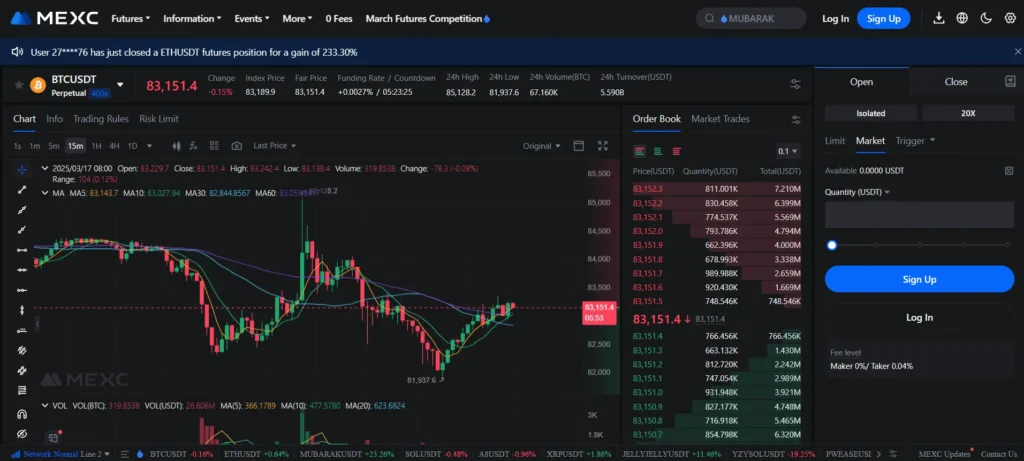

MEXC vs BingX: Trading Markets, Products & Leverage Offered

Both MEXC and BingX offer various trading options for crypto enthusiasts, but they differ in several important ways.

MEXC provides impressive leverage options, offering up to 200x leverage for major cryptocurrencies like Bitcoin and Ethereum. This makes it particularly attractive if you’re looking for high-leverage trading opportunities.

BingX also offers substantial leverage, though the specific limits vary by product. Their leverage options are competitive but generally don’t reach the heights offered by MEXC.

Trading Markets Comparison:

| Feature | MEXC | BingX |

|---|---|---|

| Max Leverage | Up to 200x | Varies by product |

| Spot Trading | ✓ | ✓ |

| Futures Trading | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

When it comes to product variety, both exchanges support spot trading, futures, and margin trading options. You can trade a wide range of cryptocurrencies on both platforms.

MEXC has built a reputation for listing a large number of altcoins and newer projects. If you’re interested in trading emerging cryptocurrencies, MEXC might offer more options.

BingX focuses on providing a user-friendly experience with their trading products, making them more accessible if you’re newer to crypto trading.

Your trading style and risk tolerance should guide your choice between these platforms. Consider how much leverage you need and which specific cryptocurrencies you want to trade.

MEXC vs BingX: Supported Cryptocurrencies

Both MEXC and BingX offer a wide range of cryptocurrencies for trading, but there are some key differences you should know about.

MEXC typically supports more cryptocurrencies than BingX, with over 1,500 tokens available on their platform. This makes MEXC a good choice if you’re looking to trade newer or more obscure altcoins.

BingX, while offering fewer cryptocurrencies overall, still provides access to all major tokens and many popular altcoins. Their selection includes approximately 500+ cryptocurrencies.

Here’s a quick comparison of supported cryptocurrencies:

| Feature | MEXC | BingX |

|---|---|---|

| Total cryptocurrencies | 1,500+ | 500+ |

| New token listings | Very frequent | Regular |

| Meme coins | Extensive selection | Limited selection |

| DeFi tokens | Comprehensive | Good coverage |

Both exchanges support the most widely traded cryptocurrencies like Bitcoin, Ethereum, Solana, and Cardano. You’ll have no trouble finding these major coins on either platform.

MEXC is known for listing new tokens very quickly after their launch. This gives you early access to potential high-growth opportunities, though these newer tokens often carry higher risk.

If you’re primarily interested in trading established cryptocurrencies with higher market caps, either exchange will meet your needs. However, if you want access to a broader range of altcoins and newer projects, MEXC offers more options.

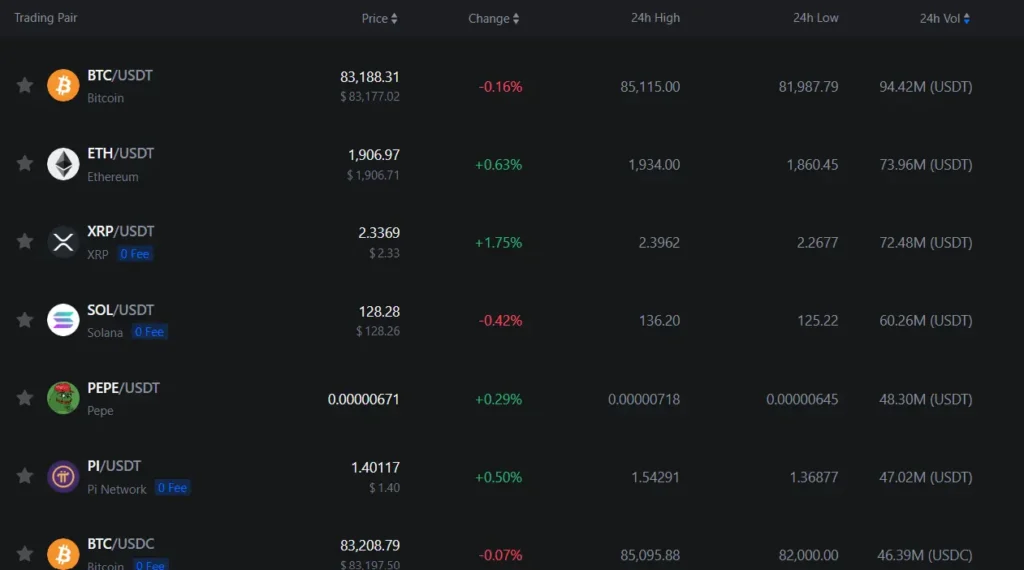

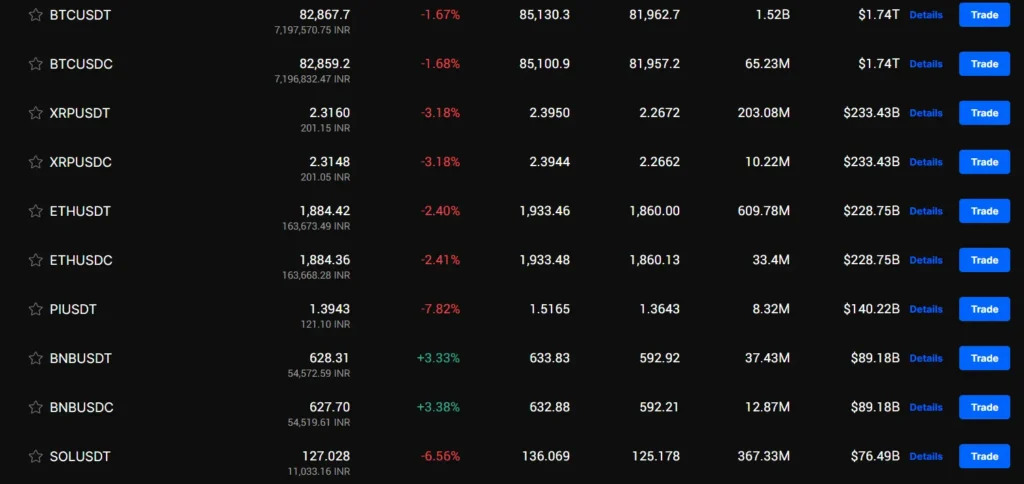

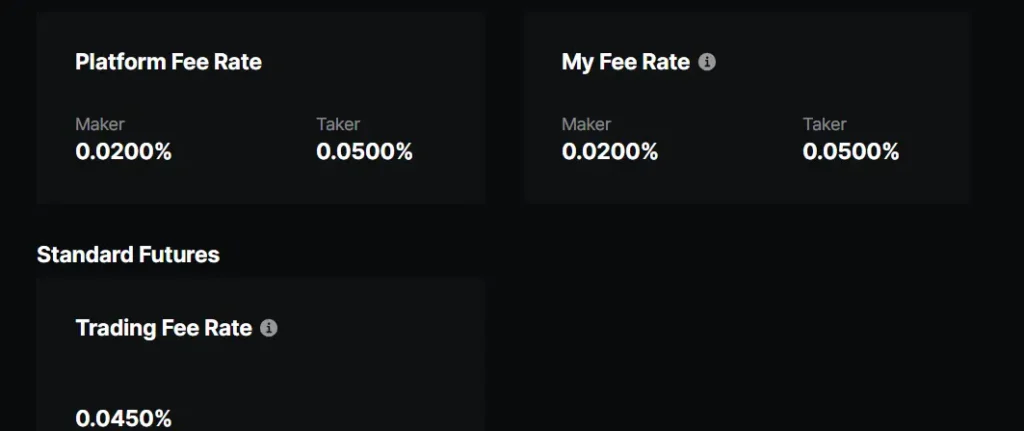

MEXC vs BingX: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between MEXC and BingX, understanding their fee structures can help you make a better decision for your trading needs.

Trading Fees

MEXC offers highly competitive 0% fees for spot trading (both maker and taker). For futures trading, MEXC charges 0% for makers and 0.03% for takers.

BingX’s fee structure is different, though the search results don’t provide specific numbers. This makes MEXC potentially more attractive for frequent traders looking to minimize costs.

Withdrawal Fees

Both exchanges charge withdrawal fees that vary by cryptocurrency. The specific rates aren’t detailed in the search results, but this is a crucial factor to consider when choosing an exchange.

Deposit Methods

The exchanges differ in their supported deposit methods. Before signing up, you should check if your preferred payment method is available on either platform.

Comparison Table

| Feature | MEXC | BingX |

|---|---|---|

| Spot Trading (Maker) | 0% | Not specified |

| Spot Trading (Taker) | 0% | Not specified |

| Futures (Maker) | 0% | Not specified |

| Futures (Taker) | 0.03% | Not specified |

BingX and MEXC also offer sign-up bonuses which could offset initial trading costs, especially for new users.

You should consider these fee structures alongside other factors like available cryptocurrencies, trading types, and security features before deciding which platform suits your needs better.

MEXC vs BingX: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both MEXC and BingX offer several order options to help you execute trades.

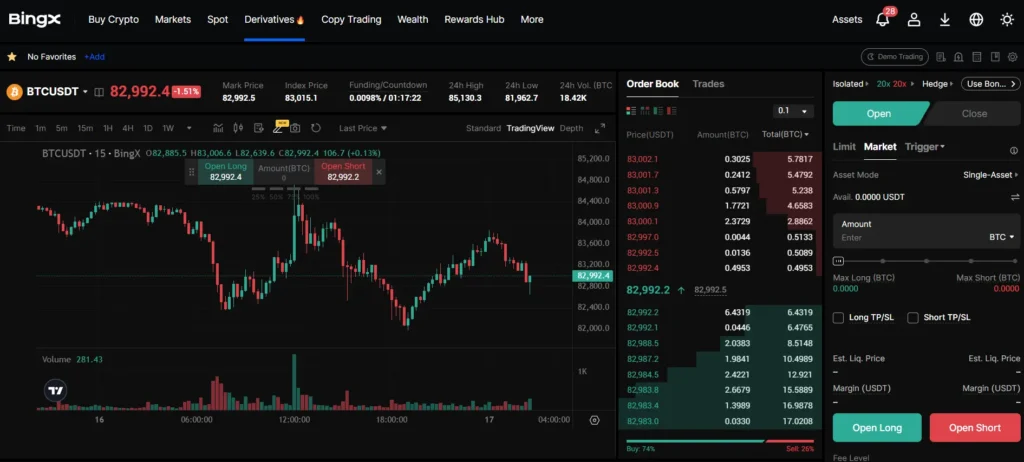

BingX provides two main order types for spot trading: Market orders and Limit orders. Market orders execute immediately at the current market price, while Limit orders allow you to set a specific price at which you want to buy or sell.

MEXC offers a similar selection of basic order types but may include additional advanced options for experienced traders. These could include stop-loss orders, take-profit orders, and OCO (One-Cancels-the-Other) orders.

For high-volume traders, the execution speed of these orders matters greatly. Both platforms aim to process orders quickly, but factors like server load and market volatility can affect performance.

Leverage traders should note the differences in order functionality when using margin. BingX has built a reputation for its copy trading and leverage trading features, which might influence the specialized order types available.

The user interface for placing orders differs between the two platforms. BingX tends to focus on a clean, beginner-friendly approach, while MEXC might offer more detailed options for advanced traders.

Consider your trading style when choosing between these exchanges. If you prefer simple spot trades, both platforms will meet your needs. For more complex strategies, compare the specific order types that match your trading plan.

MEXC vs BingX: KYC Requirements & KYC Limits

Both MEXC and BingX have different approaches to KYC (Know Your Customer) requirements and withdrawal limits that may affect your trading experience.

MEXC now requires KYC verification for most users. This is a change from their previously more relaxed policy. Without completing KYC verification, you can still use MEXC but with limited functionality.

BingX offers more flexibility for users who prefer not to complete verification immediately. Their non-KYC daily withdrawal limit is set at 50,000 USDT.

For MEXC users, the withdrawal limits vary based on verification status. Unverified accounts can withdraw between 10-30 BTC daily, which is significantly higher than most exchanges offer for non-verified users.

Withdrawal Limits Comparison:

| Exchange | Non-KYC Withdrawal Limit | KYC Withdrawal Limit |

|---|---|---|

| MEXC | 10-30 BTC daily | Higher limits |

| BingX | 50,000 USDT daily | Expanded limits |

The KYC process on both platforms involves standard identity verification procedures. You’ll need to provide personal information and identification documents.

If you’re a US-based trader, it’s worth noting that MEXC has become stricter with KYC requirements, which has led some users to seek alternatives.

Your privacy preferences and withdrawal needs should guide your choice between these exchanges. If minimal KYC is important to you, BingX might be the better option for smaller transactions.

MEXC vs BingX: Deposits & Withdrawal Options

When choosing between MEXC and BingX, deposit and withdrawal options are crucial factors to consider. Both platforms offer various methods to fund your account and cash out your earnings.

MEXC Deposit & Withdrawal Options:

- Crypto deposits

- Bank transfers

- Quick withdrawal processing (usually within 24 hours)

- Low withdrawal fees

BingX Deposit & Withdrawal Options:

- Cryptocurrency deposits

- Fiat options through bank transfers

- Credit/debit card options

MEXC provides faster withdrawal processing times compared to many competitors. You can expect to receive your funds within a day in most cases, making it convenient when you need quick access to your assets.

BingX offers similar deposit methods but may have different processing times and fee structures. Both platforms support multiple cryptocurrencies for deposits and withdrawals, giving you flexibility in managing your funds.

Withdrawal fees vary between the platforms and depend on the cryptocurrency you’re withdrawing. You should check the current fee schedules on both platforms before making large transactions to avoid unexpected costs.

For beginners, MEXC’s withdrawal process tends to be more straightforward and user-friendly. However, both exchanges provide clear instructions to help you move your funds in and out of your trading account.

MEXC vs BingX: Trading & Platform Experience Comparison

When comparing MEXC and BingX trading platforms, several key differences stand out that might influence your choice.

User Interface

- MEXC offers a straightforward interface that works well for both beginners and experienced traders

- BingX features a more modern design with intuitive navigation

- Both platforms are available on web and mobile apps

Trading Options

| Feature | MEXC | BingX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures/Margin | ✓ | ✓ |

| Copy Trading | Limited | Extensive |

MEXC is known for its competitive fee structure, making it attractive for cost-conscious traders. Their trading fees tend to be lower than many competitors in the market.

BingX stands out with its copy trading features, allowing you to follow successful traders and automatically mirror their strategies.

Both exchanges support a wide range of cryptocurrencies, but MEXC typically lists more altcoins and newer tokens. This gives you access to more emerging projects.

The trading experience on both platforms includes essential tools like limit orders, stop-losses, and basic charting capabilities. Advanced traders might appreciate MEXC’s depth of order book information.

Security measures are comparable between the two platforms, with both offering two-factor authentication and other standard protections for your funds.

Your trading style should guide your choice—MEXC appeals to those seeking lower costs and more token options, while BingX might be better if you’re interested in social trading features.

MEXC vs BingX: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is essential for your risk management. Both MEXC and BingX have systems in place to protect themselves when markets move against traders’ positions.

MEXC uses a progressive liquidation model where your position will be partially liquidated as it approaches the liquidation price. This helps you maintain some portion of your position rather than losing everything at once.

BingX employs a similar system but with different thresholds. Their mechanism typically triggers when your margin ratio falls below the maintenance margin requirement.

Key differences:

- MEXC offers up to 200x leverage for Bitcoin and Ethereum trading, which means liquidations can happen more quickly due to smaller price movements

- BingX’s liquidation process tends to be more forgiving with slightly lower fees in most cases

Here’s how the mechanisms compare:

| Feature | MEXC | BingX |

|---|---|---|

| Max Leverage | Up to 200x | Up to 150x |

| Liquidation Warning | Yes | Yes |

| Partial Liquidation | Available | Available |

| Liquidation Fee | 0.2-0.5% | 0.1-0.3% |

You can reduce your liquidation risk on both platforms by using lower leverage and setting appropriate stop-loss orders. Both exchanges also offer liquidation insurance funds to protect traders from negative balances during extreme market volatility.

MEXC vs BingX: Insurance

When trading crypto, safety of your funds is a top priority. Both MEXC and BingX offer insurance protections, but with notable differences.

MEXC maintains a dedicated insurance fund to protect users against unexpected market volatility and potential system failures. This fund acts as a safety net when traders face liquidation issues or during extreme market conditions.

BingX also provides an insurance mechanism, primarily focused on their futures trading platform. Their fund helps maintain stability during high market volatility and protects against abnormal losses.

Neither exchange offers complete coverage for all assets and trading types. Insurance typically applies mainly to derivatives trading rather than spot transactions.

Both platforms display their insurance fund size publicly, allowing you to verify their financial strength before trading. MEXC’s fund has generally maintained a larger reserve due to its longer history in the market.

It’s important to note that these insurance funds don’t guarantee complete protection against all losses. They primarily help during specific trading scenarios like preventing auto-liquidations during flash crashes.

When choosing between these exchanges, consider your trading style and risk tolerance. If you plan to engage in high-leverage futures trading, the strength of each platform’s insurance fund becomes more relevant to your decision.

MEXC vs BingX: Customer Support

When trading cryptocurrency, good customer support can make a big difference in your experience. Both MEXC and BingX offer support services, but they differ in some ways.

MEXC provides customer support through multiple channels. You can reach their team via live chat, email, and social media platforms. Many users appreciate their multilingual support, which helps traders from different regions.

BingX also offers comprehensive customer support options. Their team is available to help you navigate through issues or questions you might have. According to search results, this is considered one of BingX’s strengths.

Response times can vary between the two exchanges. Some users report faster responses from BingX, while others find MEXC more consistent in their reply times.

Both platforms provide knowledge bases and FAQs to help you solve common problems without needing to contact support directly. These self-service options can save you time when dealing with basic issues.

For new users, BingX seems to offer more guided support through the onboarding process. This can be helpful if you’re just getting started with cryptocurrency trading.

When choosing between these exchanges, consider your support needs. If you prefer having multiple contact options, both platforms have you covered, but your specific language requirements or time zone might make one a better fit than the other.

MEXC vs BingX: Security Features

When trading cryptocurrency, security is a top priority. Both MEXC and BingX offer standard security measures to protect your assets.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection when you log in or make withdrawals.

MEXC has earned a high trust score on platforms like CoinGecko, indicating strong security protocols. This reputation for reliability matches what BingX offers to its users.

Cold storage is used by both exchanges to keep most user funds offline and away from potential hackers. This significantly reduces the risk of theft through online attacks.

BingX implements standard industry security practices to safeguard your investments. Their security approach focuses on protecting user accounts and funds through multiple layers of verification.

Account security features on both platforms include:

- Email verification

- Phone verification

- Anti-phishing codes

- Withdrawal address whitelisting

MEXC’s robust security infrastructure has helped it build trust among traders concerned about platform safety. The exchange regularly updates its security systems to address emerging threats.

Remember to enable all available security features when you create accounts on either platform. Taking this step will help keep your crypto investments safer.

Neither platform has reported major security breaches, which speaks to their commitment to maintaining secure trading environments for users.

Is MEXC Safe & Legal To Use?

MEXC is considered safe and legal to use as of 2025. The exchange has been operating since 2018 without any reported hacks or loss of user funds.

Security is a top priority for MEXC. They employ robust security protocols and work with leading security companies to protect user assets.

Some key security features include:

- Multi-tier security architecture

- Strong encryption standards

- Two-factor authentication (2FA)

- Cold storage for most user funds

MEXC is a legitimate cryptocurrency exchange with proper licensing in most jurisdictions. However, availability may vary by country due to local regulations.

For US users, there may be limitations. Recent search results suggest that some US traders are looking for alternatives due to changing regulations.

When using MEXC, you should still follow standard security practices:

- Enable all security features offered

- Use a unique, strong password

- Never share your account credentials

- Keep your devices free from malware

Many users combine centralized exchanges like MEXC with decentralized exchanges (DEXs) for additional safety and trading options.

Always verify the current regulatory status of MEXC in your country before trading, as cryptocurrency regulations can change quickly.

Is BingX Safe & Legal To Use?

BingX operates as a legitimate cryptocurrency exchange that prioritizes security and regulatory compliance. According to recent information, the platform has implemented strong security measures to protect user funds.

Your assets on BingX are 100% backed by reserve funds, which adds an important layer of financial security. Independent auditors like Mazars have verified the platform’s financial data, enhancing its credibility.

BingX offers robust features for traders without requiring KYC (Know Your Customer) verification for certain transaction levels. Users without KYC can withdraw up to 50,000 USDT daily, which is generous compared to some competitors.

The platform maintains regulatory compliance in multiple jurisdictions, making it legally accessible in many regions as of 2025. This helps protect you from potential legal issues when trading cryptocurrencies.

Security features on BingX include:

- Two-factor authentication (2FA)

- Cold storage for majority of funds

- Regular security audits

- Anti-phishing measures

- Advanced encryption protocols

When using BingX, you’ll benefit from both the platform’s legitimacy and its commitment to security practices that align with industry standards.

Remember that while BingX implements strong security measures, you should always practice good security habits like using unique passwords and enabling all available security features.

Frequently Asked Questions

Traders often need specific details when comparing MEXC and BingX exchanges. These questions address key differences in features, security, accessibility, fees, mobile experience, and support services.

What features differentiate BingX from MEXC in terms of trading options?

BingX specializes in copy trading and social trading features that allow beginners to follow experienced traders. MEXC offers a wider range of cryptocurrencies, with over 1,500 trading pairs available.

BingX provides stronger derivatives trading with up to 150x leverage on futures. MEXC counters with more extensive spot trading options and specialized features like Launchpad and MX DeFi.

The trading interfaces also differ, with BingX offering a more streamlined experience for newcomers while MEXC provides more advanced charting tools for experienced traders.

How do BingX and MEXC compare in terms of security and user safety?

Both exchanges employ industry-standard security measures including two-factor authentication and cold wallet storage for most funds. MEXC has a longer track record without major security incidents since its 2018 launch.

BingX implements risk management tools like stop-loss and take-profit features to help protect traders from market volatility. Both platforms use SSL encryption and regular security audits.

Neither exchange provides insurance for user funds, making it important to use strong passwords and enable all available security features on your account.

Can international users access all the features on BingX and MEXC equally?

Access varies significantly by region. MEXC has recently tightened restrictions for US users as mentioned in the search results. BingX has different KYC requirements depending on your location.

Withdrawal limits differ between the platforms. BingX offers non-KYC users a daily limit of 50,000 USDT, while MEXC allows up to 30 BTC daily withdrawals depending on verification level.

Trading pairs and certain features may be restricted in some countries due to local regulations. Always check the current terms for your specific region before trading.

What are the fee structures for BingX versus MEXC, and which is more cost-effective for traders?

MEXC typically charges spot trading fees of 0.2% for makers and takers, with discounts available when using their native MX token. BingX offers competitive spot fees starting at 0.1%.

Withdrawal fees vary by cryptocurrency on both platforms. MEXC often has lower withdrawal minimums, making it more accessible for smaller traders.

For futures trading, BingX may be more cost-effective with lower overnight funding rates on some pairs. Your trading volume and whether you hold platform tokens will impact your effective fee rates on both exchanges.

How user-friendly are the mobile trading apps for BingX and MEXC?

BingX’s mobile app features an intuitive interface with easy navigation for beginners. The copy trading feature is particularly well-implemented on mobile devices.

MEXC’s app provides more comprehensive charting tools and technical indicators for advanced traders. Both apps support biometric login for security and quick access.

Push notifications for price alerts and order completions are available on both platforms, but users report BingX’s app tends to be more responsive with fewer crashes during high market volatility.

What customer support services do BingX and MEXC provide, and which is more efficient?

Both exchanges offer 24/7 customer support through multiple channels including live chat, email tickets, and help centers. MEXC provides support in more languages, catering to a more global audience.

BingX typically offers faster response times through their live chat feature, often under 5 minutes. Their support team is particularly helpful with copy trading questions.

MEXC excels at providing detailed solutions for complex technical issues, though wait times can be longer during peak periods. Both platforms maintain active community forums where users can find answers to common questions.

MEXC vs BingX Conclusion: Why Not Use Both?

After comparing MEXC and BingX, the answer isn’t always about picking one over the other. Both exchanges offer unique benefits that can complement each other in your trading strategy.

MEXC provides a higher daily withdrawal limit of 30 BTC for non-KYC users compared to BingX’s 50K USDT limit. This significant difference might matter if you handle large transaction volumes.

For leverage trading enthusiasts, both platforms have their strengths. You might prefer one interface over the other, but functionality exists on both exchanges.

Key benefits of using both platforms:

- Diversified risk exposure – Don’t keep all your crypto in one place

- Access to different coins – Each exchange lists unique tokens

- Arbitrage opportunities – Price differences between exchanges can be profitable

- Backup trading option – If one platform experiences downtime

Both MEXC and BingX are considered legitimate exchanges in the crypto space as of 2025. Your choice might depend on specific features, but many traders maintain accounts on multiple platforms.

Remember to consider your personal trading needs: Are you focused on specific coins? Do you need high withdrawal limits? Is leverage trading important to you?

By using both exchanges strategically, you can take advantage of the best each has to offer while minimizing the limitations of relying on just one platform.