Choosing the right cryptocurrency exchange can be a tough decision. KuCoin and Poloniex are two popular options that many crypto traders consider. When comparing these platforms, you’ll want to look at their features, fees, and user experience.

KuCoin scores higher overall with a 7.8 rating compared to Poloniex, though Poloniex edges ahead in ease of use with a 7.8 versus KuCoin’s 7.3. This suggests that while KuCoin might offer more comprehensive services, Poloniex provides a more intuitive interface for beginners.

Both exchanges offer various trading options and cryptocurrencies, but they differ in important ways. You’ll need to consider factors like available coins, security measures, and trading fees before making your choice. The rest of this article will break down these differences to help you decide which platform better suits your trading needs in 2025.

KuCoin vs Poloniex: At A Glance Comparison

When choosing between KuCoin and Poloniex, several key differences can help you make your decision.

KuCoin holds a higher overall score of 7.8 compared to Poloniex based on recent comparisons. This rating reflects KuCoin’s broader service offerings.

Poloniex, however, scores better in ease of use with a rating of 7.8 versus KuCoin’s 7.3. If you’re newer to cryptocurrency exchanges, Poloniex might feel more intuitive.

Payment Options

| Feature | KuCoin | Poloniex |

|---|---|---|

| Deposit methods | More options | Fewer options |

| Withdrawal options | More options | Fewer options |

KuCoin offers more alternatives for both depositing and withdrawing funds. This flexibility gives you more ways to move your money in and out of the platform.

Both exchanges provide cryptocurrency trading services, but they differ in specific features and available coins. KuCoin typically lists more cryptocurrencies, giving you access to a wider range of trading options.

Fees structure varies between the two platforms, and this can impact your trading costs depending on your trading volume and patterns.

When making your choice, consider what matters most to you: ease of use, variety of payment methods, or the range of available cryptocurrencies.

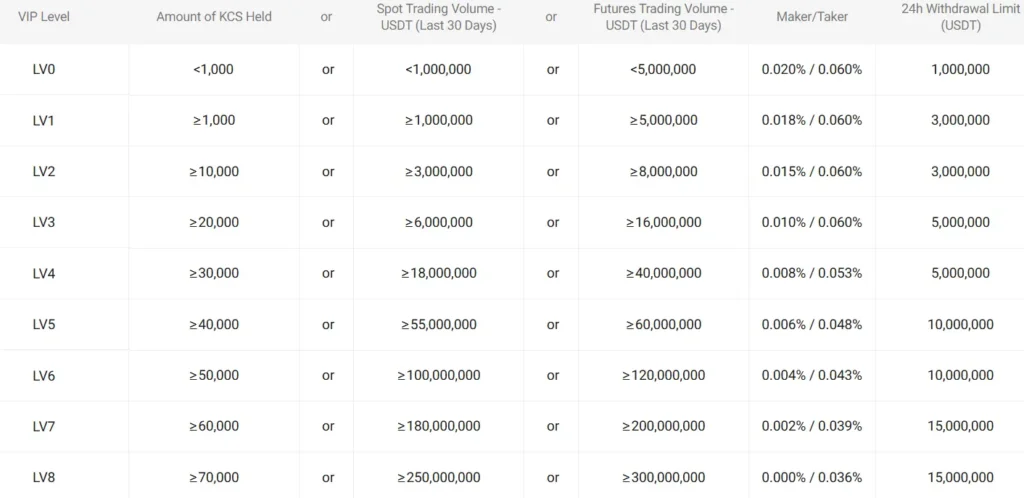

KuCoin vs Poloniex: Trading Markets, Products & Leverage Offered

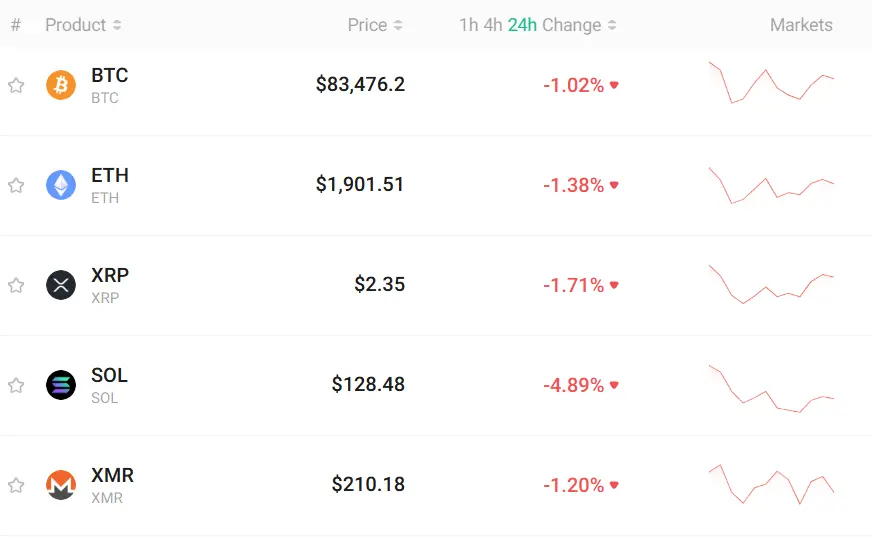

KuCoin offers more trading markets compared to Poloniex. Based on current data, KuCoin supports over 700 cryptocurrencies and thousands of trading pairs, giving you more options for diversifying your portfolio.

Poloniex maintains a smaller but still substantial selection of cryptocurrencies and trading pairs. This focused approach may make it easier for you to navigate if you’re new to crypto trading.

Trading Products Comparison:

| Feature | KuCoin | Poloniex |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | Limited |

| Margin Trading | ✓ | ✓ |

| Lending | ✓ | ✓ |

| Staking | ✓ | ✓ |

KuCoin offers higher leverage options than Poloniex. You can access up to 100x leverage on KuCoin for certain futures contracts, allowing for potentially larger positions with less capital.

Poloniex provides leverage but at lower multiples than KuCoin. This more conservative approach might better suit your needs if you’re cautious about high-risk trading.

Both exchanges offer staking opportunities, allowing you to earn passive income on your crypto holdings. KuCoin’s “Soft Staking” feature is particularly user-friendly.

While Poloniex offers lending and borrowing services, KuCoin provides a wider range of trading tools including trading bots and a more comprehensive futures trading platform.

KuCoin vs Poloniex: Supported Cryptocurrencies

When choosing a crypto exchange, the variety of available cryptocurrencies matters. KuCoin and Poloniex both offer multiple trading options, but there are significant differences in their selection.

KuCoin supports a larger number of cryptocurrencies compared to Poloniex. Based on current information, KuCoin offers traders access to more tokens and trading pairs overall.

This wider selection on KuCoin gives you more options if you’re interested in trading altcoins or newer tokens. You’ll find both major cryptocurrencies and smaller cap projects available.

Cryptocurrency Support Comparison:

| Feature | KuCoin | Poloniex |

|---|---|---|

| Number of cryptocurrencies | Higher | Lower |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoin variety | More extensive | More limited |

| New token listings | Frequent | Less frequent |

Both platforms support the essential cryptocurrencies like Bitcoin and Ethereum. However, if you’re looking to diversify into a broader range of digital assets, KuCoin provides more possibilities.

Keep in mind that available cryptocurrencies can change as exchanges regularly add new tokens. You should check their current listings if you’re looking for specific coins to trade.

Trading pairs also differ between the platforms, which affects how you can exchange between different cryptocurrencies directly.

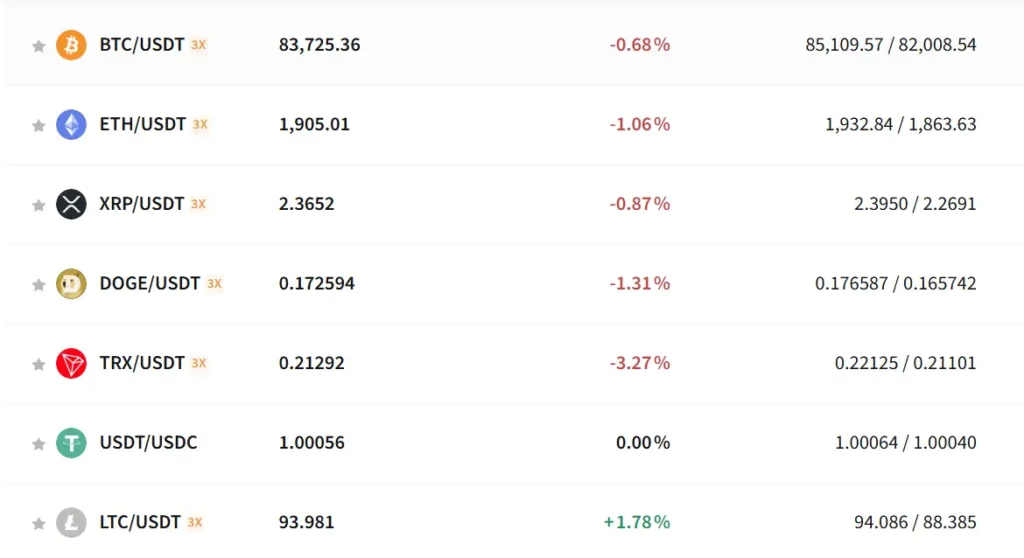

KuCoin vs Poloniex: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between KuCoin and Poloniex, fees play a major role in your decision. Both exchanges offer competitive rates, but there are notable differences.

Poloniex has the edge on trading fees with rates up to 0.145%, which is lower than KuCoin. This difference might seem small, but it adds up when you make multiple trades.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Poloniex | Up to 0.145% | Up to 0.145% |

| KuCoin | Slightly higher | Slightly higher |

For deposits, both platforms offer free options for most cryptocurrencies. This is standard across many crypto exchanges today.

KuCoin wins in the withdrawal and deposit methods category. It provides more alternatives for moving your money in and out of the exchange compared to Poloniex.

Deposit/Withdrawal Options:

- KuCoin: More payment methods

- Poloniex: Fewer options

Withdrawal fees vary by cryptocurrency on both platforms. These fees change based on network conditions and the specific crypto you’re withdrawing.

Remember that fee structures can change over time. It’s always good practice to check the official websites for the most current rates before making your decision.

KuCoin vs Poloniex: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your strategy. Both KuCoin and Poloniex offer several order options to help you trade effectively.

KuCoin provides a robust selection of order types including:

- Market orders: Execute at current market price

- Limit orders: Set your specific buy/sell price

- Stop-limit orders: Trigger at a certain price, then execute as limit order

- OCO (One-Cancels-the-Other): Place two orders where filling one cancels the other

KuCoin also offers advanced order features like post-only and iceberg orders that help with large-volume trading without significantly impacting the market.

Poloniex offers a more streamlined selection:

- Market orders

- Limit orders

- Stop-limit orders

While Poloniex has fewer order types, many traders find its interface more intuitive to use. According to review data, Poloniex scores 7.8 for ease of use compared to KuCoin’s 7.3.

Your trading style should determine which platform might work better for you. If you need complex order types for advanced strategies, KuCoin offers more options. If you prefer simplicity with essential order functions, Poloniex might be sufficient.

Both platforms allow you to set time-in-force parameters for your orders, giving you control over how long your orders remain active in the market.

KuCoin vs Poloniex: KYC Requirements & KYC Limits

Poloniex requires full identity authentication before you can start trading. You must complete their Know Your Customer (KYC) verification process to access the platform’s features.

KuCoin offers more flexibility with its verification requirements. As of March 2025, KuCoin allows limited trading without complete KYC verification, but with significant restrictions on withdrawal amounts.

KuCoin Withdrawal Limits:

- Non-KYC accounts: Up to 5 BTC daily withdrawal limit

- KYC-verified accounts: Higher withdrawal limits

Poloniex Withdrawal Limits:

- All accounts: Require KYC verification

- Verified accounts: Withdrawal limits based on verification level

Starting February 1st, 2025, KuCoin implemented stricter policies, now requiring KYC verification for all trade orders, including selling. This represents a significant change from their previous more relaxed approach.

For US-based traders, it’s important to note that KuCoin is based in Singapore, which may affect verification requirements and available services in your region.

If maintaining privacy is your priority, both exchanges have become more restrictive over time, though KuCoin still offers slightly more flexibility for users seeking limited verification options.

The verification process for both platforms involves submitting personal information and identification documents, with processing times typically ranging from a few hours to several days.

KuCoin vs Poloniex: Deposits & Withdrawal Options

When choosing a crypto exchange, deposit and withdrawal options matter a lot. These features affect how easily you can move your money in and out of the platform.

KuCoin offers more ways to deposit and withdraw funds compared to Poloniex. This gives KuCoin users greater flexibility in managing their crypto assets.

KuCoin Deposit & Withdrawal Options:

- Cryptocurrency deposits

- Bank transfers

- Credit/debit cards

- Third-party payment processors

- P2P trading options

Poloniex Deposit & Withdrawal Options:

- Cryptocurrency deposits

- Limited fiat options

- Fewer third-party integrations

Processing times vary between the two platforms. KuCoin typically processes withdrawals within 2-24 hours depending on the cryptocurrency network congestion.

Poloniex withdrawals can take a similar timeframe, but some users report slightly longer processing times during peak periods.

Fee structures differ as well. Both exchanges charge network fees for crypto withdrawals, but KuCoin often provides more competitive rates for certain cryptocurrencies.

It’s worth noting that verification requirements impact withdrawal limits on both platforms. Higher verification levels unlock larger daily withdrawal amounts.

KuCoin’s more diverse range of deposit and withdrawal methods makes it more accessible to users who prefer different payment options beyond just crypto transfers.

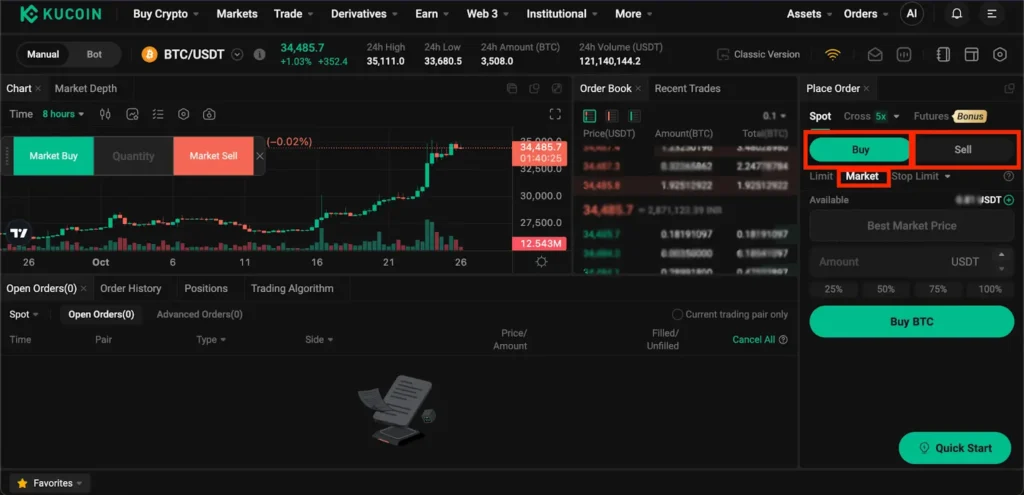

KuCoin vs Poloniex: Trading & Platform Experience Comparison

When choosing between KuCoin and Poloniex, the platform experience can make a big difference in your trading journey.

Users rate Poloniex slightly higher for ease of use, with a score of 7.8 compared to KuCoin’s 7.3. This suggests you might find Poloniex more intuitive when first starting out.

KuCoin earns a higher overall score of 7.8, while Poloniex trails behind. This overall rating reflects KuCoin’s comprehensive feature set and general user satisfaction.

Trading Interface Comparison:

| Feature | KuCoin | Poloniex |

|---|---|---|

| User Interface | Modern, feature-rich | Straightforward, clean |

| Mobile Experience | Full-featured app | Basic but functional |

| Advanced Tools | More charting options | Fewer advanced features |

KuCoin offers a more extensive trading experience with advanced order types and analytical tools. You’ll find spot trading, margin trading, futures, and lending all in one place.

Poloniex provides a cleaner interface that might feel less overwhelming if you’re new to crypto trading. The platform focuses on core functionality without too many distractions.

Both exchanges offer decent mobile apps, but KuCoin’s mobile solution brings more of its desktop features to your phone.

Wait times and platform stability are important factors to consider. During high market activity, both platforms can experience slowdowns, but KuCoin tends to handle traffic spikes slightly better.

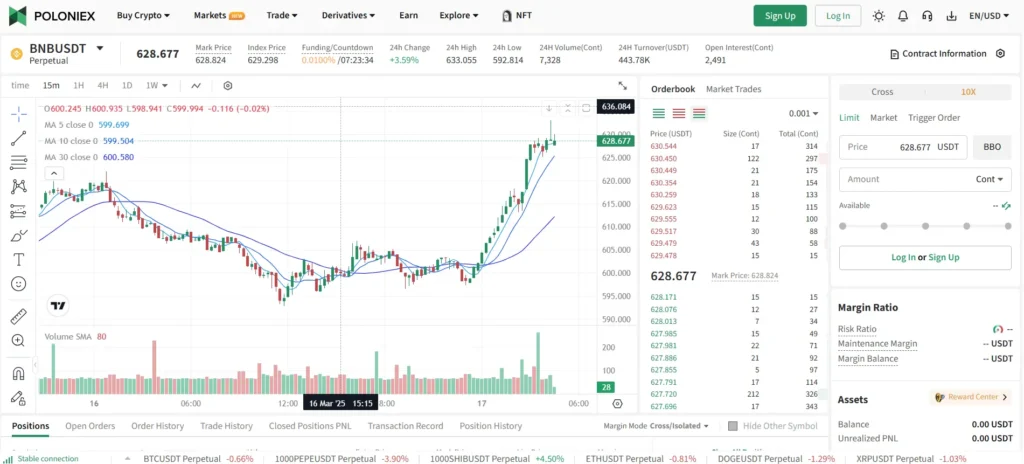

KuCoin vs Poloniex: Liquidation Mechanism

When trading with leverage on KuCoin or Poloniex, understanding liquidation mechanisms is crucial for risk management. Both exchanges implement processes to close positions when they become too risky, but they operate differently.

KuCoin uses a tiered liquidation system with its 100x leverage offerings. The platform sends warnings when your margin ratio approaches dangerous levels (typically around 110%). If your position continues to decline, KuCoin will begin partial liquidation to try preserving some of your capital.

Poloniex employs a more straightforward liquidation approach with its more modest leverage options. The exchange uses a maintenance margin requirement that, when breached, triggers full position liquidation.

KuCoin Liquidation Features:

- Progressive liquidation system

- Early warning notifications

- Insurance fund to prevent negative balances

- Liquidation fees: 0.1-0.3% depending on asset

Poloniex Liquidation Features:

- Single-threshold liquidation model

- Lower maximum leverage (less liquidation risk)

- Simpler to understand for beginners

- Liquidation fees: typically 0.2%

Your liquidation price is more clearly displayed on KuCoin, making it easier to manage risk. Poloniex provides fewer visual cues but generally has lower liquidation risk due to its more conservative leverage options.

Remember to use stop-loss orders on both platforms to prevent liquidation events that can significantly impact your trading capital.

KuCoin vs Poloniex: Insurance

When trading cryptocurrencies, protecting your assets is crucial. Both KuCoin and Poloniex offer different approaches to security and insurance.

KuCoin provides protection through their Safeguard Program. This program aims to protect user funds in case of security breaches or hacks. The exchange has committed to using a portion of its revenues to build this security fund.

Poloniex, on the other hand, has less publicly available information about their insurance or protection funds. This lack of transparency might be concerning for traders who prioritize knowing how their assets are protected.

In 2019, KuCoin also introduced additional protection measures including hot and cold wallets to secure user funds. These systems keep most assets in cold storage away from potential online threats.

Following a 2019 hack, Poloniex compensated affected users, showing their commitment to customer protection despite not having a formal insurance program.

When choosing between these exchanges, you should consider how important formal insurance is to your trading strategy. KuCoin offers more transparent protection policies, making it potentially more suitable if insurance is your priority.

Neither exchange provides FDIC insurance like traditional banks, which is typical for cryptocurrency platforms.

Always remember to use additional security measures like two-factor authentication and strong passwords regardless of which exchange you choose.

KuCoin vs Poloniex: Customer Support

When choosing a crypto exchange, good customer support can make a big difference in your experience. Both KuCoin and Poloniex offer support options, but they differ in availability and methods.

KuCoin provides several ways to get help. They offer 24/7 customer support through live chat, email tickets, and an extensive help center. With about 30 million users, their support team handles a large volume of requests.

Poloniex takes a more self-service approach to customer support. They primarily offer email support and a ticket system for users to submit questions or problems. This might result in slower response times compared to KuCoin.

According to user reviews, both platforms have room for improvement in their support services. Some users report delays in getting responses during high-volume periods.

Support Options Comparison:

| Feature | KuCoin | Poloniex |

|---|---|---|

| Live Chat | Yes (24/7) | Limited |

| Email Support | Yes | Yes |

| Ticket System | Yes | Yes |

| Help Center | Comprehensive | Basic |

| Response Time | Varies | Can be slow |

If you value quick responses and multiple support channels, KuCoin might be the better choice. Their larger user base has pushed them to develop more robust support systems.

However, if you’re comfortable with self-service and don’t anticipate needing much help, Poloniex’s simpler support structure may be sufficient for your needs.

KuCoin vs Poloniex: Security Features

When choosing a cryptocurrency exchange, security should be your top priority. Both KuCoin and Poloniex offer several security features to protect your assets.

KuCoin implements industry-standard security measures including two-factor authentication (2FA) and multi-level encryption. Their platform uses a combination of cold and hot wallets to store funds, with the majority kept in cold storage offline.

Poloniex also provides 2FA options and employs advanced encryption protocols. Their security system includes regular security audits and monitoring for suspicious activities.

Key Security Features Comparison:

| Feature | KuCoin | Poloniex |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| Insurance Fund | ✓ | Limited |

| IP Whitelisting | ✓ | ✓ |

| Anti-Phishing Code | ✓ | ✗ |

| Trading Password | ✓ | ✓ |

KuCoin offers an additional layer of security with their anti-phishing code feature, which helps you verify emails are legitimate before clicking links.

Both exchanges have experienced security breaches in the past. KuCoin suffered a major hack in 2020 but managed to recover most funds. Poloniex experienced a breach in 2014 but has strengthened their security measures since.

You should enable all available security features regardless of which platform you choose. This includes using unique, strong passwords and enabling 2FA with an authenticator app rather than SMS.

Is KuCoin A Safe & Legal To Use?

KuCoin is generally considered safe to use, though it’s important to understand some key facts. The platform experienced a major security breach in 2020, but has since strengthened its security measures to protect user assets.

Most users can legally access KuCoin, but regulations vary by location. If you’re in the United States, you should be particularly careful as KuCoin operates in a regulatory gray area for US residents.

According to user feedback, KuCoin offers better customer support compared to some competitors like Poloniex. Their support quality is rated at 5.6, suggesting users feel satisfied with the assistance they receive.

For maximum security when using KuCoin, you should:

- Enable two-factor authentication

- Use a strong, unique password

- Consider using a hardware wallet for long-term storage

- Only keep trading amounts on the exchange

KuCoin ranks better than some exchanges in terms of trustworthiness, but it’s not without risks. Some crypto communities consider it “less shady” than certain other exchanges, but still advise caution.

Remember that no exchange is completely risk-free. You should always follow security best practices and avoid keeping large amounts of cryptocurrency on any exchange for extended periods.

Is Poloniex A Safe & Legal To Use?

Poloniex is generally considered safe and legal to use, though this depends on your location. The exchange has been operating since 2014, giving it a long history in the crypto space.

From a security standpoint, Poloniex employs standard safety features like two-factor authentication and withdrawal email confirmations. These help protect your account from unauthorized access.

For legal compliance, Poloniex has taken steps to meet regulatory requirements in jurisdictions where it operates. However, it’s not available in all countries due to varying crypto regulations.

Important safety considerations:

- Not insured against hacks

- Has experienced security breaches in the past

- Requires KYC verification for higher withdrawal limits

You should check if Poloniex is legal in your specific location before creating an account. The exchange is not available to US residents as of 2023.

When using Poloniex, it’s best practice to:

- Enable all security features

- Use a unique, strong password

- Never store large amounts of crypto on the exchange long-term

- Withdraw to a personal wallet when not actively trading

Compared to KuCoin, Poloniex offers similar security features but may have different availability depending on your region.

Frequently Asked Questions

Traders looking to choose between KuCoin and Poloniex often have specific questions about these platforms. These FAQs address the most common concerns regarding fees, security, cryptocurrency selection, and user experience.

What are the main differences in transaction fees between KuCoin and Poloniex?

KuCoin and Poloniex have different fee structures that might impact your trading costs. KuCoin generally offers maker/taker fees starting at 0.1%, which can be reduced if you hold their native KCS token.

Poloniex has a similar fee structure but typically starts at 0.125% for takers and 0.095% for makers. Both exchanges offer fee discounts based on trading volume, but KuCoin’s KCS holding program may provide additional benefits for regular traders.

How do KuCoin and Poloniex platforms compare in terms of security measures?

Both exchanges implement strong security protocols, but with different approaches. KuCoin uses multi-factor authentication, encryption, and cold storage for most funds.

Poloniex also employs cold storage and advanced encryption but has experienced security breaches in the past. KuCoin offers additional security features like trading password protection and security questions. Both platforms regularly update their security measures to protect user assets.

Which exchange offers a wider variety of cryptocurrencies, KuCoin or Poloniex?

KuCoin clearly leads in cryptocurrency variety with support for over 700 cryptocurrencies and 1,200+ trading pairs. This makes it particularly attractive if you’re looking for newer or less common tokens.

Poloniex offers fewer options but still maintains a solid selection of established cryptocurrencies. KuCoin is often quicker to list new projects and emerging tokens, giving traders earlier access to potential opportunities.

Can users from the United States trade on both KuCoin and Poloniex?

The situation differs significantly between these exchanges. Poloniex stopped serving U.S. customers in 2019 due to regulatory concerns, and U.S. traders cannot create new accounts.

KuCoin doesn’t explicitly block U.S. users but operates in a regulatory gray area for American traders. Neither platform is fully compliant with U.S. regulations, so you should consider regulated alternatives if you’re a U.S. resident.

How do the user interfaces and trading experiences differ between KuCoin and Poloniex?

Poloniex offers a more straightforward interface that beginners find easier to navigate. According to user reviews, Poloniex scores higher (7.8) than KuCoin (7.3) for ease of use.

KuCoin provides a more feature-rich experience with advanced trading tools, futures trading with up to 100x leverage, and more derivative products. The platform caters well to experienced traders but might feel overwhelming if you’re new to crypto trading.

What is the customer service reputation of KuCoin compared to that of Poloniex?

KuCoin generally receives better customer service ratings with 24/7 support available through multiple channels including live chat, email, and ticket systems. Their response times are typically faster during high-volume periods.

Poloniex has faced criticism for slower customer service responses, especially during periods of high market activity. Both exchanges offer knowledge bases and FAQs, but KuCoin’s more robust support infrastructure tends to resolve issues more efficiently for users needing assistance.

Poloniex vs KuCoin Conclusion: Why Not Use Both?

Both Poloniex and KuCoin offer unique advantages that can benefit crypto traders. KuCoin scores higher overall with a 7.8 rating compared to Poloniex, according to current comparisons.

KuCoin stands out with its extensive selection of over 700 cryptocurrencies and robust futures trading options with up to 100x leverage. It also provides more derivative products for traders looking for advanced trading options.

Poloniex, on the other hand, offers a more user-friendly interface that beginners find easier to navigate. Its futures trading comes with more modest leverage options, which might be safer for less experienced traders.

You don’t need to limit yourself to just one exchange. Using both platforms allows you to take advantage of KuCoin’s wider coin selection and advanced features while benefiting from Poloniex’s user-friendly experience.

This dual-exchange approach gives you:

- More trading pairs to choose from

- Different fee structures to optimize your costs

- Backup options if one exchange experiences downtime

- Diverse features for different trading strategies

Consider your trading needs, experience level, and goals when deciding how to balance your activity between these exchanges. Many experienced traders maintain accounts on multiple platforms to maximize opportunities and minimize risks.