Choosing the right cryptocurrency exchange matters for your trading success. KuCoin and Phemex are two popular platforms that offer different features, fees, and trading options in 2025.

Both KuCoin and Phemex provide competitive bonuses for new users, with Phemex offering up to $8,800 and KuCoin offering around $700 in bonuses. These exchanges differ in their fee structures, available cryptocurrencies, and trading types.

When comparing these platforms, you should consider factors like deposit methods, user experience, and specific features that align with your trading goals. Understanding these differences will help you select the exchange that best suits your cryptocurrency trading needs.

KuCoin Vs Phemex: At A Glance Comparison

KuCoin and Phemex are popular cryptocurrency exchanges with distinct features that may suit different trading needs.

Trading Fees: Both platforms offer competitive fee structures. KuCoin typically charges between 0.1% to 0.3% per trade, while Phemex offers zero-fee spot trading on some pairs.

Available Cryptocurrencies:

- KuCoin: 700+ cryptocurrencies

- Phemex: 100+ cryptocurrencies

KuCoin provides a wider selection of altcoins, making it better if you’re looking for newer or more obscure tokens.

User Interface:

| Feature | KuCoin | Phemex |

|---|---|---|

| Beginner-friendly | Moderate | High |

| Advanced tools | Extensive | Good |

| Mobile app | Available | Available |

Phemex’s interface is generally considered more intuitive for newcomers to crypto trading.

Security Features: Both exchanges utilize two-factor authentication and cold storage. KuCoin experienced a hack in 2020 but has since strengthened its security measures.

Trading Options:

- KuCoin offers spot trading, margin trading (up to 10x), futures (up to 100x), and trading bots

- Phemex specializes in futures trading with leverage up to 100x and offers spot trading

You’ll find more educational resources on Phemex, which can be helpful if you’re still learning about cryptocurrency trading.

For leverage traders, both platforms provide similar options, though their fee structures and liquidation mechanisms differ slightly.

Customer support on both platforms includes live chat and ticket systems, but response times can vary during high-volume periods.

KuCoin Vs Phemex: Trading Markets, Products & Leverage Offered

KuCoin and Phemex offer different advantages when it comes to trading options and leverage capabilities. These differences might impact which platform better suits your trading style.

Phemex stands out with its impressive 100x leverage options, while KuCoin provides up to 50x leverage. This means Phemex gives you more potential trading power if you’re comfortable with higher risk.

Both exchanges support spot trading of cryptocurrencies. Phemex offers zero-fee spot trading, making it attractive if you want to save on transaction costs for regular trades.

For derivatives and futures trading, both platforms provide robust options. You’ll find a wide range of trading pairs on both exchanges, though their specific offerings may differ.

Trading Products Comparison:

| Feature | KuCoin | Phemex |

|---|---|---|

| Max Leverage | 50x | 100x |

| Spot Trading | Yes | Yes (Zero-fee) |

| Futures/Derivatives | Yes | Yes |

| Mobile Trading | Yes | User-friendly app |

Phemex has gained recognition for its fast-growing platform with a user-friendly interface, making it particularly suitable if you prefer trading on mobile devices.

If you’re looking for fiat deposit options, Phemex offers fast processing. This feature proves helpful when you need to quickly move funds into your trading account.

KuCoin Vs Phemex: Supported Cryptocurrencies

When choosing between KuCoin and Phemex, the number of available cryptocurrencies is an important factor to consider.

KuCoin offers a significantly larger selection with over 700 cryptocurrencies available for trading. This extensive range gives you more options for diversifying your crypto portfolio and trading lesser-known altcoins.

Phemex, on the other hand, supports around 150+ cryptocurrencies. While this is fewer than KuCoin, it still covers most major coins and tokens that you might want to trade.

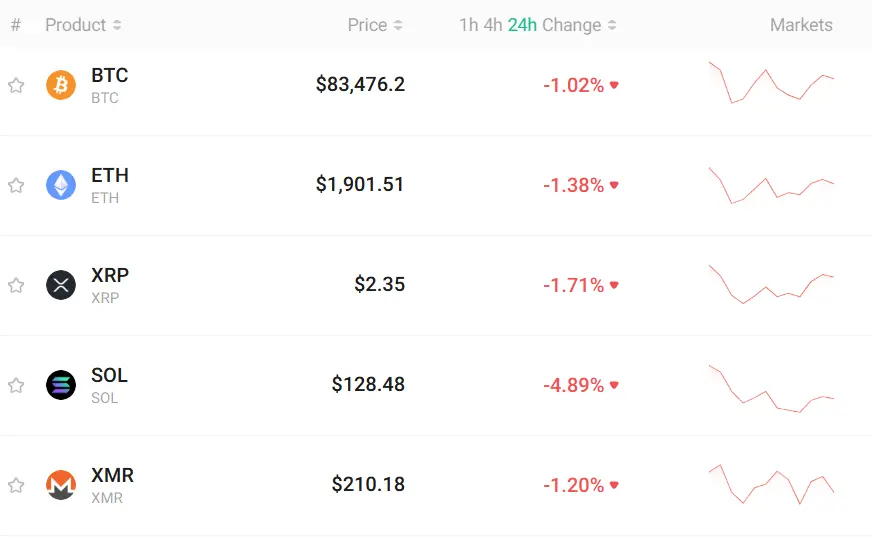

Both exchanges support popular cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Dogecoin (DOGE)

If you’re looking for access to more obscure or newly launched tokens, KuCoin likely has the advantage. Their larger selection makes them a better choice if you want to explore emerging projects.

Phemex’s more focused selection may be sufficient if you primarily trade mainstream cryptocurrencies. Their platform still offers enough variety for most traders’ needs.

It’s worth noting that both exchanges regularly add new cryptocurrencies to their platforms. However, KuCoin typically lists new tokens more quickly than Phemex.

KuCoin Vs Phemex: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing KuCoin and Phemex, their fee structures are important factors to consider for your trading experience.

Trading Fees

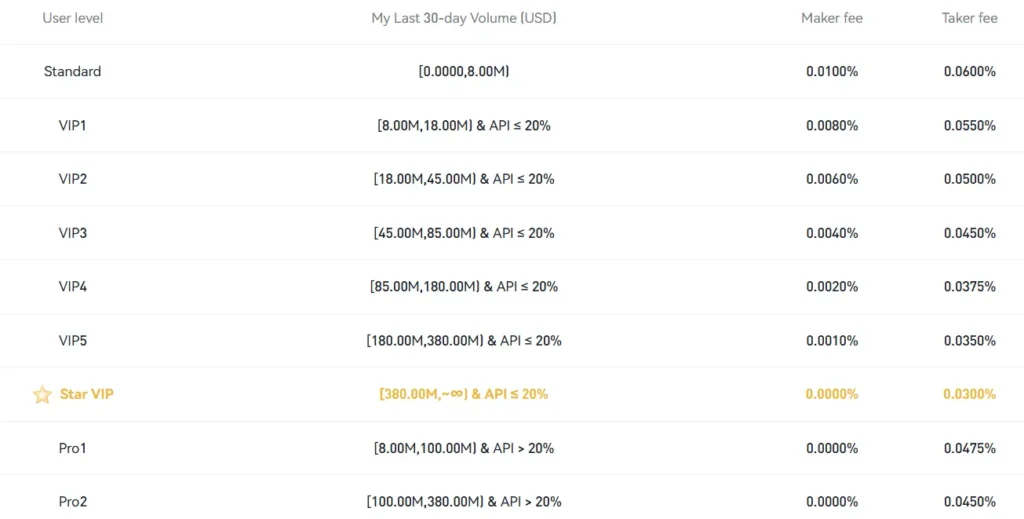

- Phemex offers zero transaction fees on spot trades for premium members

- KuCoin maintains competitive trading fees in the general cryptocurrency exchange market

Withdrawal Fees (Bitcoin)

| Exchange | BTC Withdrawal Fee |

|---|---|

| KuCoin | 0.0005 BTC |

| Phemex | 0.0004 BTC |

Phemex has a slightly lower Bitcoin withdrawal fee than KuCoin, which can save you money when moving funds off the exchange.

Both exchanges rank among the platforms with the lowest fees in 2025. You’ll find them alongside Binance and Kraken when looking for cost-effective trading options.

For deposit methods, both platforms offer similar options. Your specific needs will determine which platform’s fee structure works better for your trading style.

If you’re a high-volume trader, Phemex’s premium membership with zero transaction fees on spot trades might provide significant savings. However, you should consider the cost of this membership against your expected trading volume.

Trading types also affect fees. Both platforms support various trading options, but their fee structures may differ depending on whether you’re doing spot trading or leverage trading.

KuCoin Vs Phemex: Order Types

When trading on KuCoin or Phemex, understanding the available order types is crucial for your trading strategy. Both exchanges offer standard order types, but there are some differences worth noting.

KuCoin Order Types:

- Market Orders: Execute immediately at the best available price

- Limit Orders: Set a specific price for your trade

- Stop Orders: Trigger when the market reaches a certain price

- Stop-Limit Orders: Combine stop and limit features

- OCO (One-Cancels-the-Other): Place two orders with one automatically canceling if the other is filled

Phemex Order Types:

- Market Orders: Quick execution at current market rates

- Limit Orders: Control your entry/exit price

- Conditional Orders: Similar to stop orders

- Post-Only Orders: Ensure you’re always a maker, not a taker

- Immediate-or-Cancel: Partial fills allowed, but unfilled portions are canceled

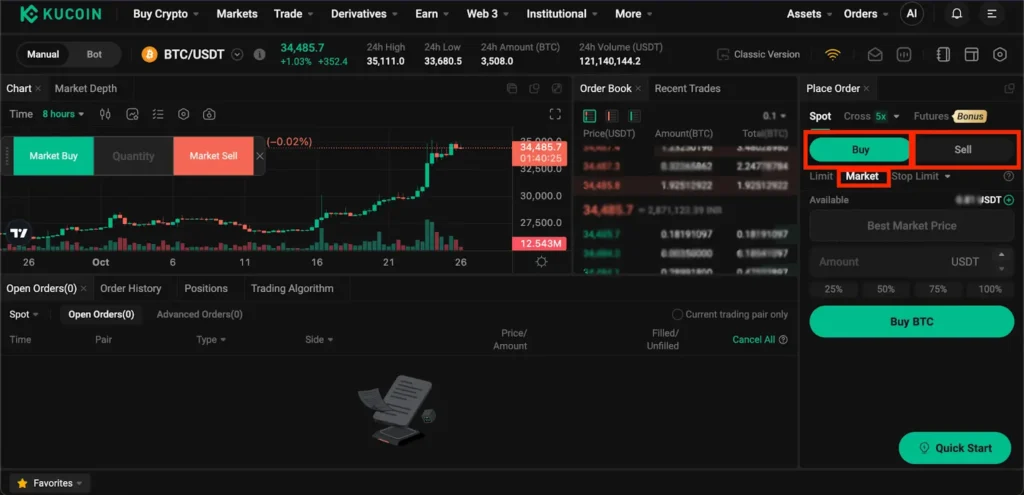

KuCoin offers more advanced trading options on its spot market, which might appeal to experienced traders. Their interface displays clear explanations of each order type.

Phemex focuses on simplicity but still provides essential order types for both beginners and advanced traders. Their platform is known for fast execution speeds.

Both exchanges support futures trading with specialized order types, though recent comparisons suggest KuCoin might have a slight edge in variety of advanced orders.

KuCoin Vs Phemex: KYC Requirements & KYC Limits

KuCoin and Phemex take different approaches to KYC (Know Your Customer) requirements. As of March 2025, KuCoin has updated its policies, now requiring KYC verification for all trade orders, including selling cryptocurrency.

For KuCoin users in the US, this change took effect on February 1st, making KYC mandatory for continued platform use. Without completing verification, your trading activities will be restricted.

Phemex offers more flexibility by not requiring KYC verification for basic account functions. This allows you to start trading with minimal personal information.

KuCoin KYC Limits:

- Non-KYC accounts: Limited withdrawal capabilities

- KYC-verified accounts: Higher withdrawal limits

- Different verification tiers offer progressively higher limits

Phemex KYC Limits:

- Non-KYC accounts: Basic trading available

- Verified accounts: Increased withdrawal limits and platform features

It’s worth noting that using platforms without KYC may carry regulatory risks in certain jurisdictions. Always check your local regulations before choosing a no-KYC option.

For US-based users, KuCoin’s mandatory KYC policy means Phemex might be more attractive if you prefer minimal verification. However, KYC verification provides added security and higher withdrawal limits on both platforms.

KuCoin Vs Phemex: Deposits & Withdrawal Options

When choosing between KuCoin and Phemex, understanding their deposit and withdrawal options is crucial for your trading experience.

KuCoin offers multiple deposit methods including cryptocurrency transfers and some fiat options. You can fund your account using bank transfers and credit/debit cards in certain regions. KuCoin supports a wide range of cryptocurrencies for deposits and withdrawals.

Phemex similarly provides cryptocurrency deposit options but has more limited fiat currency support compared to KuCoin. The platform focuses primarily on crypto-to-crypto transactions.

Both exchanges charge withdrawal fees that vary by cryptocurrency. These fees are typically competitive but can change based on network conditions.

| Feature | KuCoin | Phemex |

|---|---|---|

| Crypto Deposits | Wide range (200+) | Moderate range |

| Fiat Deposits | Bank transfers, cards (varies by region) | Limited options |

| Withdrawal Fees | Varies by crypto | Varies by crypto |

| Processing Time | Generally fast | Generally fast |

Withdrawal limits on both platforms depend on your verification level. Higher verification tiers grant you increased withdrawal amounts, providing more flexibility for larger transactions.

Processing times for deposits and withdrawals are generally quick on both platforms, with cryptocurrency transactions depending on blockchain network congestion.

Remember to verify the current deposit and withdrawal methods available in your region, as both exchanges may update their options periodically.

KuCoin Vs Phemex: Trading & Platform Experience Comparison

KuCoin and Phemex offer different trading experiences that cater to various types of crypto traders. Both platforms process significant daily trading volumes, with KuCoin handling over $1 billion daily.

KuCoin’s interface is feature-rich but might feel overwhelming for beginners. You’ll find a wide range of trading tools, including spot trading, margin trading, futures, and a lending platform. The platform serves over 30 million users across 207 countries.

Phemex provides a cleaner, more streamlined trading experience. You’ll likely appreciate its faster execution speeds and intuitive layout if you’re new to crypto trading.

For mobile trading, both exchanges offer comprehensive apps. KuCoin’s app includes most desktop features, while Phemex’s mobile platform emphasizes simplicity and quick trade execution.

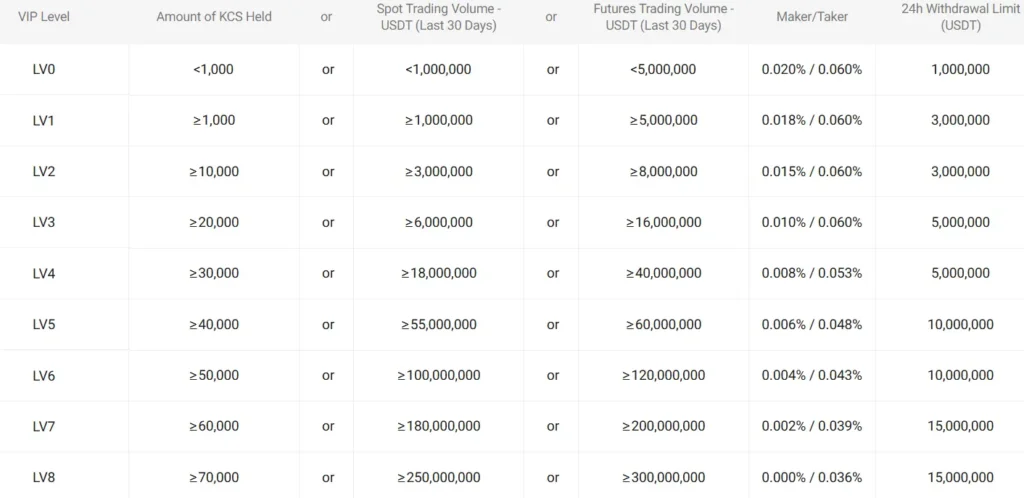

Trading fees differ between the platforms. KuCoin typically offers tiered fee structures based on your trading volume and KCS token holdings. Phemex sometimes provides lower fees for certain trading pairs.

Key Platform Differences:

- KuCoin: More trading pairs and options

- Phemex: Generally faster execution times

- KuCoin: More advanced features for experienced traders

- Phemex: Cleaner user interface

When it comes to leverage trading, both platforms offer options. However, based on search results, some users prefer Phemex specifically for leverage trading functionality.

Your choice between KuCoin and Phemex should depend on your trading style, experience level, and which specific features matter most to your trading strategy.

KuCoin Vs Phemex: Liquidation Mechanism

When trading with leverage on either KuCoin or Phemex, understanding their liquidation mechanisms is crucial for your risk management strategy.

KuCoin’s Liquidation Process:

- Implements a tiered liquidation system

- Sends warnings when your margin ratio approaches the liquidation threshold

- Typically begins partial liquidation at 80% of collateral value

- Allows for auto-deleveraging in volatile market conditions

KuCoin uses a mark price mechanism that takes an average from multiple exchanges to prevent liquidations from sudden price wicks.

Phemex’s Liquidation System:

- Employs a full liquidation model when positions reach the maintenance margin level

- Offers up to 100x leverage with corresponding liquidation risks

- Uses a dual-price mechanism (mark price and last traded price) to determine liquidations

- Provides a liquidation calculator tool to help you estimate potential risks

Phemex generally has a slightly more aggressive liquidation approach, but compensates with better transparency tools.

Your margin requirements on both platforms will vary based on the trading pair and leverage used. For example, BTC positions typically have different liquidation thresholds than altcoin positions.

Neither platform offers negative balance protection by default, meaning you should set stop losses to manage risk properly.

Remember that higher leverage (like Phemex’s 100x option) significantly increases liquidation risk, even with small market movements.

KuCoin Vs Phemex: Insurance

When trading crypto, security should be a top priority. Both KuCoin and Phemex offer insurance options to protect your funds, but they differ in how they implement these protections.

KuCoin maintains an insurance fund specifically designed to cover potential losses during leveraged trading. This fund acts as a safety net if market volatility causes significant issues.

Phemex also offers protection through its own insurance system. Their approach focuses on maintaining platform stability and protecting users from exceptional market conditions.

The search results indicate that KuCoin’s insurance fund is particularly noted for covering potential losses. This can be reassuring if you’re planning to engage in higher-risk trading activities.

Neither platform offers complete protection against all types of risks. It’s worth noting that these insurance funds typically cover system failures or extreme market conditions rather than individual trading losses.

Insurance Comparison:

| Feature | KuCoin | Phemex |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Focus Area | Leverage trading losses | Platform stability |

| Coverage Details | Potential system failures | Exceptional market conditions |

You should review the specific terms of each platform’s insurance policy before making your decision. The extent of coverage can change over time as platforms update their policies.

Both exchanges continue to evolve their security measures as the crypto market matures. Always keep your security best practices in place regardless of platform insurance.

KuCoin Vs Phemex: Customer Support

When choosing between KuCoin and Phemex, customer support is a crucial factor to consider. Both exchanges offer different support options to help you with your trading journey.

KuCoin provides 24/7 customer support, ensuring you can get help whenever you need it. Their support system includes live chat, email tickets, and an extensive help center with guides and FAQs.

Phemex also offers round-the-clock customer support. According to the search results, they provide 24/7 assistance to users, making them comparable to KuCoin in terms of availability.

KuCoin Support Features:

- 24/7 availability

- Live chat support

- Email ticket system

- Comprehensive knowledge base

Phemex Support Features:

- 24/7 customer assistance

- Support ticket system

- Online documentation

Response times may vary between the two platforms. Some users report faster responses from KuCoin, while others have had better experiences with Phemex’s support team.

Language support is another consideration. KuCoin offers support in multiple languages, which can be helpful if English isn’t your first language. Phemex’s language options are more limited.

Both platforms have active community forums where you can find answers to common questions. These community resources can be valuable when you need quick solutions without waiting for official support.

KuCoin Vs Phemex: Security Features

Both KuCoin and Phemex take security seriously, offering several features to protect your crypto assets. Understanding these security measures can help you choose the right platform for your trading needs.

KuCoin uses multi-factor authentication (MFA) to secure user accounts. This includes email verification, SMS authentication, and Google Authenticator options. The platform also employs industry-standard encryption to protect your personal information.

Phemex offers similar security with 2FA protections and advanced encryption. Their cold storage solution keeps most user funds offline, reducing the risk of hacking attempts.

KuCoin Security Features:

- Multi-factor authentication

- Advanced encryption standards

- Anti-phishing security codes

- 24/7 security monitoring

- Majority of assets held in cold storage

Phemex Security Features:

- Two-factor authentication

- Cold storage for most user funds

- Regular security audits

- Real-time monitoring systems

- SSL encryption for data protection

Both exchanges have strong track records for security. KuCoin experienced a hack in 2020 but managed to recover all affected funds. Phemex hasn’t reported any major security breaches since its launch.

When you deposit funds, both platforms offer withdrawal address management. This helps prevent sending crypto to incorrect addresses and protects against potential theft.

You should note that KuCoin offers trading password protection as an additional security layer, which isn’t prominently featured on Phemex.

Is KuCoin A Safe & Legal To Use?

KuCoin is generally considered a reputable exchange in the cryptocurrency space. It implements cutting-edge technologies in web development and site management to protect its website.

When comparing exchanges, KuCoin is often described as the “least shady” among similar platforms like Binance, HTX, OKX, and Poloniex. However, this doesn’t mean it’s completely risk-free.

KuCoin offers bank-level asset security features. When you trade on this platform, your funds benefit from multiple security measures designed to keep your assets safe.

The exchange supports a higher number of cryptocurrencies compared to Phemex. This gives you more trading options and flexibility with your investments.

Regarding legality, KuCoin operates in many countries worldwide. However, regulations vary by location, so you should check if using KuCoin is permitted in your country.

Remember that no exchange is entirely immune to risks. Many users follow the common advice: don’t leave large amounts of cryptocurrency on any exchange for extended periods.

For maximum security, consider using hardware wallets for long-term storage and only keep trading amounts on the exchange.

Is Phemex A Safe & Legal To Use?

Phemex has built a strong reputation for security in the cryptocurrency exchange world. According to the search results, Phemex has never experienced a hack, unlike some other major exchanges such as Binance, Crypto.com, and KuCoin.

Phemex is described as a “secure, regulated exchange” where you can trade cryptocurrencies with leverage options. This regulation helps provide a layer of legitimacy that many users look for when choosing an exchange.

The platform is considered “legitimate, safe, and highly trustworthy” as a centralized exchange. This makes it a viable option if you’re concerned about the security of your digital assets.

Key Security Features:

- Never been hacked (according to provided information)

- Regulated status

- Centralized exchange with security protocols

When using Phemex, you can trade with confidence knowing it prioritizes safeguarding user assets. This security focus is particularly important in the cryptocurrency space where hacks and security breaches can occur.

If you’re in the US, you should verify Phemex’s current legal status in your state, as cryptocurrency regulations vary by location and change frequently.

Frequently Asked Questions

Crypto traders often have specific questions when choosing between KuCoin and Phemex. These exchanges differ in security approaches, user interfaces, fee structures, and cryptocurrency offerings that impact your trading experience.

What are the security features of Phemex compared to KuCoin?

KuCoin implements multi-factor authentication, encryption protocols, and cold storage for most user assets. They also maintain an Insurance Fund to protect users against unexpected losses.

Phemex offers similar security measures with multi-factor authentication and cold wallet storage. They emphasize their server architecture that uses memory matching technology instead of traditional databases to reduce hacking vulnerabilities.

Both exchanges have experienced security incidents in the past, with KuCoin suffering a major hack in 2020. Following this event, KuCoin strengthened its security infrastructure.

How does the user experience differ between KuCoin and Phemex platforms?

KuCoin offers a feature-rich interface with comprehensive trading tools. Their platform includes spot trading, margin trading, futures, and a variety of earning products. The learning curve can be steeper for beginners.

Phemex provides a cleaner, more streamlined interface focused on derivatives trading. Their platform loads faster and experiences fewer downtimes during high volatility periods.

KuCoin’s mobile app offers more features but can feel cluttered. Phemex’s mobile experience prioritizes simplicity and core trading functions.

Which exchange offers better customer service, KuCoin or Phemex?

KuCoin provides 24/7 support through live chat, email, and ticket systems. Response times average 24-48 hours for complex issues. Their knowledge base is extensive but navigating it can be challenging.

Phemex typically offers faster response times, averaging 8-24 hours for most inquiries. Their customer service team receives higher satisfaction ratings in user reviews.

Both exchanges offer multilingual support, but English-speaking users report better experiences with Phemex’s support team.

What are the differences in trading fees between KuCoin and Phemex?

KuCoin has a higher overall fee structure with maker/taker fees starting at 0.1%/0.1% for spot trading. Fees decrease based on trading volume and KCS token holdings.

Phemex offers more competitive fees with contract trading fees at 0.01%/0.06% for maker/taker. Their spot trading fees are comparable to KuCoin’s but with different discount structures.

KuCoin charges withdrawal fees based on the specific cryptocurrency network. Phemex typically has lower withdrawal fees across most popular cryptocurrencies.

How do KuCoin and Phemex compare in terms of supported cryptocurrencies?

KuCoin supports over 700 cryptocurrencies and 1,200+ trading pairs. This makes it an excellent choice for trading altcoins and newer tokens.

Phemex offers fewer cryptocurrencies, focusing on approximately 150 major tokens. Their selection prioritizes established cryptocurrencies with higher market capitalizations.

Both exchanges regularly add new cryptocurrencies, but KuCoin consistently lists new projects earlier than Phemex.

Can users from the United States legally trade on Phemex?

As of March 2025, neither KuCoin nor Phemex officially serves U.S. customers. KuCoin announced in February 2025 that all users must complete KYC verification to make trades.

Phemex previously offered services to U.S. customers but discontinued this in 2023 due to regulatory concerns. U.S. IP addresses are now restricted on both platforms.

Some U.S. users access these platforms through VPNs, but this violates the platforms’ terms of service and carries significant legal and account security risks.

Phemex Vs KuCoin Conclusion: Why Not Use Both?

When comparing Phemex and KuCoin, you might wonder which platform deserves your attention. Based on current information as of March 2025, KuCoin scores higher overall with a 7.8 rating compared to Phemex.

KuCoin offers a robust experience with a wide range of cryptocurrencies and trading options. It’s known for its user-friendly interface and comprehensive features for both beginners and advanced traders.

Phemex, on the other hand, specializes in cryptocurrency derivatives trading. It provides advanced features like futures contracts and perpetual contracts that might appeal to experienced traders looking for specialized tools.

The good news? You don’t have to choose just one. Many crypto traders maintain accounts on multiple exchanges to take advantage of different strengths.

Benefits of using both platforms:

- Access to more trading pairs and opportunities

- Ability to compare fees for the best rates

- Reduced risk through platform diversification

- Use KuCoin for spot trading and Phemex for derivatives

You might consider using KuCoin for its higher overall rating and general trading, while turning to Phemex when you need specialized derivative trading features.

Remember that crypto exchanges evolve quickly. Features, fees, and security measures change regularly, so it’s worth checking both platforms’ current offerings before making your final decision.