Choosing between KuCoin and Kraken can be challenging if you’re looking to buy or trade cryptocurrency. Each exchange offers different features that might match your needs better than the other.

Based on recent comparisons, Kraken appears to have better features and higher evaluation scores than KuCoin, though KuCoin’s overall score of 7.6 edges out Kraken’s 6.5 in some reviews. The right choice depends on what you want from your crypto exchange.

Both platforms have slightly different fee structures and security measures. If you’re an institutional user, you might appreciate Kraken’s offerings, while KuCoin might provide benefits for other types of traders. Remember that regardless of which platform you choose, it’s not recommended to keep your coins on any exchange long-term.

KuCoin Vs Kraken: At A Glance Comparison

When choosing between KuCoin and Kraken, it’s helpful to compare their key features side by side. Based on current data, KuCoin has a higher overall score of 7.6 compared to Kraken’s 6.5.

Scoring Comparison:

| Feature | KuCoin | Kraken |

|---|---|---|

| Overall Score | 7.6 | 6.5 |

| User Satisfaction | Higher | Good |

| Available Cryptocurrencies | More variety | Fewer options |

| Fee Structure | Competitive | Slightly higher |

KuCoin is known for offering a wider variety of cryptocurrencies, making it attractive if you’re looking to trade lesser-known coins or tokens.

Kraken, while scoring lower overall, has built a reputation for stronger security measures. This might be important if security is your top priority when choosing an exchange.

Both platforms offer similar basic functionality for buying, selling, and trading cryptocurrencies. The interfaces differ, with KuCoin often considered more complex but feature-rich.

Remember not to store your coins on either exchange long-term. As noted by users, regardless of which platform you choose, it’s safer to transfer your cryptocurrency to a personal wallet after trading.

Your choice between these exchanges should depend on what you value most—whether that’s variety of coins, security features, or user interface simplicity.

KuCoin Vs Kraken: Trading Markets, Products & Leverage Offered

KuCoin and Kraken offer different trading options for cryptocurrency investors. Let’s compare what each platform provides.

Available Cryptocurrencies:

- KuCoin: Supports 700+ cryptocurrencies

- Kraken: Offers 200+ cryptocurrencies

KuCoin stands out with its wider selection of altcoins and newer tokens. If you’re looking for rare or emerging cryptocurrencies, KuCoin might be your better option.

Trading Products:

| Feature | KuCoin | Kraken |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Staking | ✓ | ✓ |

| NFT Marketplace | ✓ | ✗ |

KuCoin offers KCS token margin trading, allowing you to leverage your KCS holdings. Kraken Pro provides advanced charting tools that active traders might find useful.

Leverage Options:

- KuCoin: Up to 100x leverage on futures

- Kraken: Up to 5x leverage on margin trading

Kraken focuses more on security and regulation, which explains its more conservative leverage limits. You’ll find Kraken’s approach safer if you’re a beginner.

Trading fees are generally lower on Kraken Pro compared to standard Kraken, making it attractive for day traders. KuCoin appeals to those seeking higher risk-reward opportunities through its extensive leverage options.

Both platforms offer staking, but KuCoin provides more ways to earn passive income through lending and other programs.

KuCoin Vs Kraken: Supported Cryptocurrencies

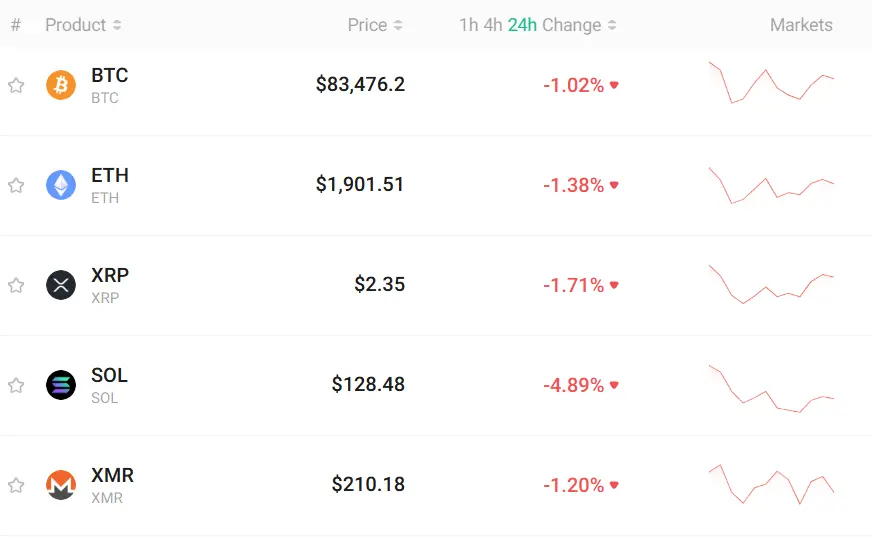

When choosing between KuCoin and Kraken, the variety of cryptocurrencies available is a key factor to consider.

KuCoin takes the lead in this category, offering over 700 cryptocurrencies for trading. This gives you access to both established coins and emerging altcoins.

Kraken, while more limited, still provides a solid selection of approximately 200 cryptocurrencies. The platform focuses on well-established tokens with proven market performance.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | KuCoin | Kraken |

|---|---|---|

| Total cryptocurrencies | 700+ | 200+ |

| Focus | Wide range including newer altcoins | Established cryptocurrencies |

| Token types | Major coins, DeFi tokens, NFT tokens, gaming tokens | Major coins, DeFi tokens, some altcoins |

KuCoin is ideal if you want to invest in newer, emerging projects with growth potential. You’ll find many smaller-cap coins not available on other exchanges.

Kraken takes a more conservative approach. The exchange typically lists cryptocurrencies only after thorough vetting, which might appeal to you if security is a primary concern.

Both platforms support the major cryptocurrencies like Bitcoin, Ethereum, and Solana. Your choice depends on whether you prefer KuCoin’s extensive variety or Kraken’s carefully curated selection.

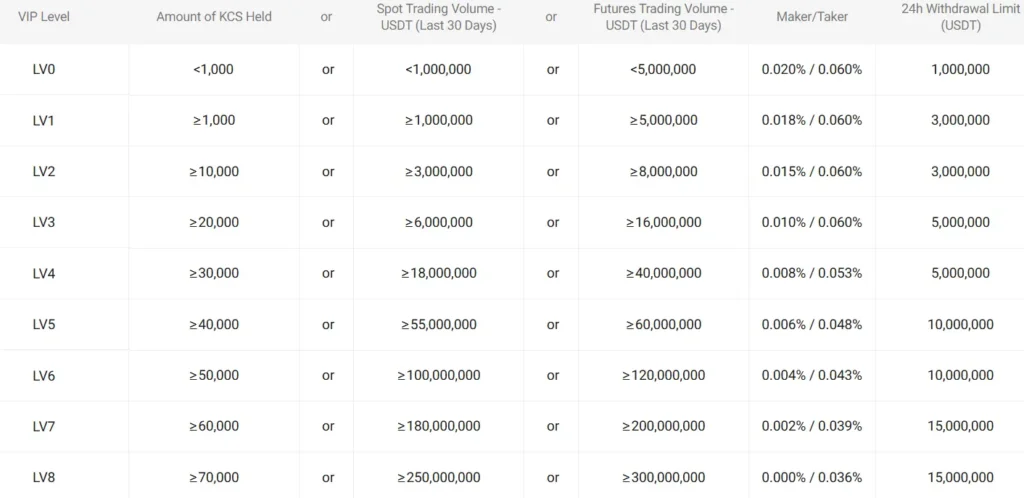

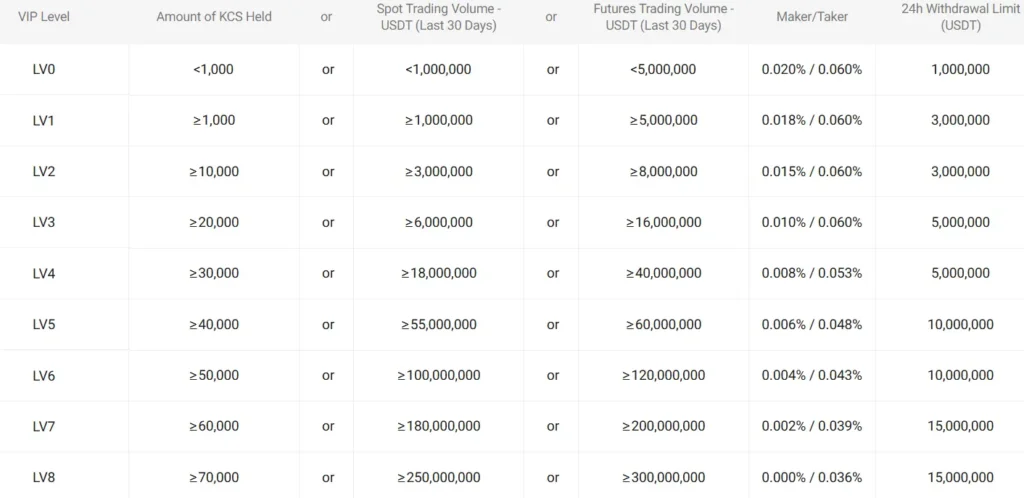

KuCoin Vs Kraken: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between KuCoin and Kraken, fees play a big role in your decision. Based on current information, Kraken offers lower trading fees with rates up to 0.40%.

KuCoin’s trading fees tend to be slightly higher than Kraken’s. Both exchanges use a maker-taker fee structure, where fees decrease as your trading volume increases.

Trading Fee Comparison:

| Exchange | Maker Fee | Taker Fee |

|---|---|---|

| Kraken | 0.16%-0.26% | 0.26%-0.40% |

| KuCoin | 0.1%-0.3% | 0.1%-0.3% |

For deposit fees, both platforms offer free deposits for most cryptocurrencies. However, fiat deposits may have fees depending on your payment method.

Withdrawal fees vary by cryptocurrency on both exchanges. Kraken often has lower withdrawal fees for popular coins like Bitcoin and Ethereum compared to KuCoin.

Your overall costs will depend on your trading volume and the specific cryptocurrencies you’re trading. For high-volume traders, Kraken’s fee structure might save you more money in the long run.

It’s worth checking each platform’s fee page before making your final decision, as fees can change based on market conditions and platform updates.

KuCoin Vs Kraken: Order Types

When trading on cryptocurrency exchanges, order types can make a big difference in your trading strategy. Both KuCoin and Kraken offer several order types, but they differ in variety and functionality.

KuCoin provides a wider range of order types including market, limit, stop, post-only, and iceberg orders. The platform also supports more advanced trading options through its partnership with Arwen.

Kraken, while having fewer order types overall, offers solid options for both beginners and experienced traders. Their platform includes market, limit, stop-loss, and take-profit orders.

Here’s a quick comparison of the main order types available on both platforms:

| Order Type | KuCoin | Kraken |

|---|---|---|

| Market | ✓ | ✓ |

| Limit | ✓ | ✓ |

| Stop | ✓ | ✓ |

| Stop-Loss | ✓ | ✓ |

| Take-Profit | ✓ | ✓ |

| Post-Only | ✓ | ✓ |

| Iceberg | ✓ | ✗ |

If you’re an advanced trader looking for specialized order types, KuCoin might be more suitable for your needs. The iceberg orders allow you to hide the true size of your large orders from the market.

Kraken focuses on reliability and execution rather than variety. Their order system is designed to be straightforward while still providing all essential trading functions.

KuCoin Vs Kraken: KYC Requirements & KYC Limits

KuCoin and Kraken have different approaches to Know Your Customer (KYC) verification. This impacts how you can use these exchanges and what limits you’ll face.

KuCoin technically requires KYC verification, but interestingly, you can still trade crypto without completing it. As of February 2025, KuCoin now requires KYC to make any trade orders, including selling your assets.

However, without verification, you’ll face significant limitations on your account. Completing KYC on KuCoin gives you access to more features and higher trading limits.

Kraken takes a stricter approach to KYC. You must complete verification before you can deposit, trade, or withdraw funds. Their verification process is thorough and mandatory for all users.

KYC Verification Levels:

| Feature | KuCoin | Kraken |

|---|---|---|

| Trading without KYC | Limited | Not possible |

| Basic KYC requirements | Email, phone | Email, full name, address |

| Advanced KYC requirements | ID, facial recognition | ID, proof of address |

| Verification time | 1-3 days | 1-5 days |

Kraken’s KYC process is generally regarded as more rigorous than KuCoin’s. This stricter approach contributes to Kraken’s reputation for better security and regulatory compliance.

For US-based traders, Kraken offers a fully compliant platform, while KuCoin’s services may have limitations depending on your location.

KuCoin Vs Kraken: Deposits & Withdrawal Options

Both KuCoin and Kraken offer multiple options for deposits and withdrawals, but they differ in important ways.

Kraken provides free deposits for most cryptocurrencies and fiat currencies. Withdrawal fees vary based on the cryptocurrency, but they’re generally competitive within the industry.

KuCoin also allows free crypto deposits, but withdrawal fees tend to be slightly higher than Kraken’s for some cryptocurrencies.

For fiat currency options, Kraken has an advantage. You can deposit USD, EUR, GBP, and several other currencies through bank transfers, debit cards, and other methods.

KuCoin has more limited fiat options, though they’ve expanded these features in recent years.

Processing times also differ between the exchanges:

| Feature | Kraken | KuCoin |

|---|---|---|

| Crypto deposits | Quick | Quick |

| Crypto withdrawals | 30 minutes (avg) | 30-60 minutes (avg) |

| Fiat deposits | 1-3 business days | 1-5 business days |

| Fiat withdrawals | 1-3 business days | 3-7 business days |

Kraken typically processes transactions faster, especially for fiat currencies.

Security for withdrawals is stronger on Kraken, with mandatory two-factor authentication and email confirmations. KuCoin offers similar security features but makes some optional.

You’ll find minimum deposit requirements on both platforms, though Kraken’s minimums tend to be higher for some cryptocurrencies.

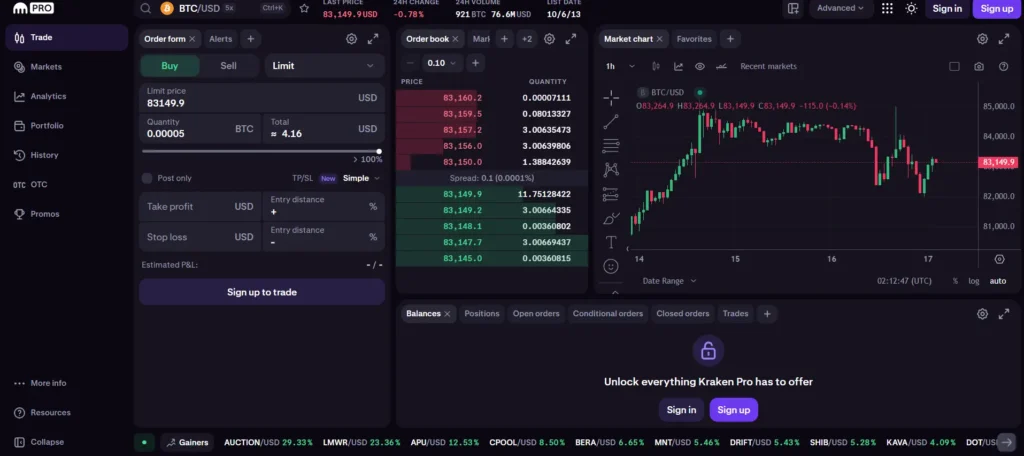

KuCoin Vs Kraken: Trading & Platform Experience Comparison

When comparing KuCoin and Kraken platforms, user experience plays a key role in deciding which exchange better fits your trading style.

KuCoin offers a feature-rich interface with advanced trading tools. You’ll find options like futures trading, margin trading, and a variety of order types. The platform also includes Trading Bot features that can help automate your strategy.

Kraken provides a more streamlined experience that beginners might find easier to navigate. Its interface is clean and professional, focusing on essential functions without overwhelming users.

Mobile Experience:

- KuCoin: Comprehensive mobile app with full trading capabilities

- Kraken: Reliable app focused on core functions

Trading Tools:

| Feature | KuCoin | Kraken |

|---|---|---|

| Trading Bots | ✓ | ✗ |

| Futures Trading | ✓ | ✓ |

| Margin Trading | Up to 10x | Up to 5x |

| Order Types | Multiple advanced options | Standard options |

Kraken tends to excel in platform stability and reliability. You’ll experience fewer outages during high-volume trading periods compared to KuCoin.

KuCoin offers a wider range of altcoins and trading pairs, giving you more diverse trading opportunities. This makes it attractive if you’re interested in newer or more niche cryptocurrencies.

Both platforms provide charting tools, but KuCoin integrates more technical indicators for advanced analysis. Kraken keeps things more straightforward but still offers essential tools for informed trading decisions.

KuCoin Vs Kraken: Liquidation Mechanism

Both KuCoin and Kraken have safeguards in place to protect traders during market volatility. These liquidation mechanisms help prevent excessive losses when trading with leverage.

KuCoin uses a Fair Price Marking system that helps reduce unnecessary liquidations during short-term price fluctuations. This system references prices from multiple sources rather than relying on a single price feed.

The exchange also employs an Auto-Deleveraging (ADL) system. This kicks in when the insurance fund can’t cover liquidated positions, reducing the leverage of profitable traders to balance the books.

Kraken also has a robust liquidation system aimed at protecting both the platform and its users. When positions approach liquidation price, Kraken sends notifications to give you time to add collateral or reduce your position.

Both exchanges try to avoid full liquidations when possible. They implement partial liquidations first, allowing you to maintain a portion of your position.

For new traders, Kraken’s system might be easier to understand. Their clear notifications and straightforward approach make it less intimidating.

KuCoin offers more technical options for experienced traders who want fine-tuned control over their risk management settings.

Neither platform has reported major liquidation cascades or system failures during high volatility periods, which speaks to the reliability of both their mechanisms.

KuCoin Vs Kraken: Insurance

When choosing a crypto exchange, insurance is a crucial factor to consider for your asset protection. Both KuCoin and Kraken offer different approaches to securing your investments.

Kraken maintains a comprehensive insurance policy that covers digital assets held in their custody. They store the majority of funds (95%+) in cold storage wallets that are offline and less vulnerable to hacks.

KuCoin established the “Safeguard Fund” after experiencing a significant hack in 2020. This fund aims to compensate users in case of security breaches or other incidents affecting the platform.

Neither exchange offers FDIC insurance since this only applies to USD deposits in traditional banks, not cryptocurrency holdings.

Kraken’s Insurance Highlights:

- Strong focus on security practices

- Professional custody solutions

- Established track record of security

KuCoin’s Insurance Highlights:

- Dedicated Safeguard Fund

- Demonstrated commitment to making users whole after security incidents

- Regular security audits

You should verify the current insurance policies directly with each exchange before making your decision. Insurance terms may change, and coverage limits might vary based on the type of assets you hold.

Remember that the best protection is following good security practices yourself, such as using two-factor authentication and keeping large holdings in personal wallets.

KuCoin Vs Kraken: Customer Support

When choosing a crypto exchange, customer support is a key factor to consider. Both KuCoin and Kraken offer support services, but there are notable differences between them.

KuCoin provides 24/7 customer support through multiple channels. You can reach their team via live chat, email, and ticket submission. According to search results, KuCoin offers “fast & sincere help” to users.

Kraken also features 24-hour support services. Their customer service team is available around the clock to assist with any issues you might encounter. This constant availability enhances the overall user experience.

For complex problems, Kraken’s support team is often praised for their detailed responses. Their representatives are known for being knowledgeable about both platform features and general crypto topics.

KuCoin’s support is typically more responsive for basic inquiries. Their live chat feature often connects you with an agent in minutes, which can be helpful for quick questions.

Response times may vary depending on inquiry complexity and current platform traffic. During high-volume periods, both exchanges might experience longer wait times.

Language support is another consideration. Kraken offers support in several languages, while KuCoin provides assistance in more languages, making it more accessible to global users.

KuCoin Vs Kraken: Security Features

When choosing a crypto exchange, security should be your top priority. Both KuCoin and Kraken offer robust security measures, but they differ in several key areas.

Kraken is widely recognized for its strong security stance. It has never experienced a major security breach since its founding in 2011. This impressive track record has earned it a reputation as one of the most secure exchanges available.

KuCoin, while generally secure, experienced a significant hack in 2020. However, the exchange handled this well by fully reimbursing affected users.

Both platforms use two-factor authentication (2FA) to protect your account. They also employ cold storage solutions to keep most funds offline and safe from hackers.

Kraken’s Security Features:

- Regular security audits

- Majority of funds in cold storage

- Global Settings Lock (GSL)

- Account timeout feature

- Email confirmation for withdrawals

KuCoin’s Security Features:

- Multi-factor authentication

- Industry-level multilayer encryption

- Micro-withdrawal wallets

- Anti-phishing email security code

- Trading password requirement

Kraken offers an additional layer of security with its Global Settings Lock, which freezes account changes for a set period.

KuCoin counters with its unique anti-phishing system that helps you verify legitimate emails from the exchange.

Based on search results and security history, Kraken appears to have a slight edge in overall security. However, both exchanges provide strong protection for your crypto assets.

Is KuCoin A Safe & Legal To Use?

KuCoin has faced significant regulatory challenges recently. In March 2024, KuCoin and two of its founders were criminally charged with Bank Secrecy Act violations and unlicensed money transmission offenses in the United States.

If you’re a US resident, using KuCoin poses legal risks. The platform is not properly registered with US regulators, making it technically illegal for Americans to use.

Despite these issues, KuCoin continues to operate globally. Some crypto users consider it less problematic than certain other exchanges like Binance, HTX, OKX, and Poloniex.

Security Considerations:

- No major hacks since 2020

- Offers two-factor authentication (2FA)

- Provides trading password protection

- Features anti-phishing security measures

Legal Status By Region:

| Region | Status |

|---|---|

| United States | Illegal/Prohibited |

| Europe | Legal in most countries |

| Asia | Varies by country |

When comparing to Kraken, the difference in regulatory compliance is stark. Kraken maintains proper licensing in multiple jurisdictions and follows strict regulatory requirements.

Your funds on KuCoin may not have the same protections as regulated exchanges. If you decide to use KuCoin, consider keeping minimal assets on the platform and using more secure storage methods for the bulk of your holdings.

Is Kraken A Safe & Legal To Use?

Kraken is widely regarded as one of the most secure cryptocurrency exchanges available today. In fact, independent auditors often rank Kraken #1 in terms of security features and customer service.

The exchange implements robust security measures including API integration with IP whitelisting. This helps protect your funds from unauthorized access.

However, Kraken has faced some regulatory challenges. In 2023, the SEC charged Kraken for operating as an unregistered securities broker, dealer, and clearing agency. This is important to know when considering its legal status.

Despite these challenges, Kraken continues to operate legally in many countries. You should check if it’s authorized in your specific location before signing up.

For your own safety, it’s not recommended to keep large amounts of cryptocurrency on any exchange, including Kraken. Consider using hardware wallets for long-term storage of significant crypto holdings.

When comparing security features to other exchanges like KuCoin, opinions vary. Some sources suggest KuCoin has better security features, while others favor Kraken’s security infrastructure.

The current date (March 2025) indicates that Kraken continues to operate and maintain its reputation for security, suggesting it has addressed regulatory concerns appropriately.

Frequently Asked Questions

Traders comparing KuCoin and Kraken often have specific questions about their features, fees, and security. These key differences can help you decide which platform better suits your trading needs and preferences.

What are the differences in fees between KuCoin and Kraken?

KuCoin typically offers lower trading fees than Kraken for regular users. KuCoin’s standard trading fees start at 0.1% for makers and takers, while Kraken’s begin at 0.16% for makers and 0.26% for takers.

Both exchanges offer fee discounts based on trading volume. KuCoin users can reduce fees by holding KCS tokens, their native cryptocurrency.

Kraken charges higher withdrawal fees for most cryptocurrencies, while KuCoin often has more competitive withdrawal costs.

Which exchange offers better security, KuCoin or Kraken?

Kraken has a stronger security reputation with no major hacks in its operating history. It stores most funds in cold wallets and offers robust security features like two-factor authentication and global settings lock.

KuCoin experienced a significant hack in 2020 but fully reimbursed affected users. The platform has since strengthened its security measures.

Kraken is regulated in more jurisdictions and complies with strict security standards, giving it an edge for security-conscious traders.

How do the trading interfaces of KuCoin and Kraken compare for beginners?

Kraken offers a more straightforward interface for beginners with its clean design and intuitive navigation. The platform also provides Kraken Pro for more advanced trading.

KuCoin’s interface is feature-rich but can overwhelm new users with its numerous options and trading pairs. The learning curve is steeper compared to Kraken.

Both platforms offer mobile apps, but Kraken’s app receives better reviews for stability and ease of use for newcomers to cryptocurrency trading.

Can you explain the variety of cryptocurrencies available on KuCoin versus Kraken?

KuCoin supports over 700 cryptocurrencies and more than 1,100 trading pairs, making it one of the most diverse exchanges for altcoin trading.

Kraken offers around 200 cryptocurrencies, focusing more on established tokens with stronger market caps and liquidity.

If you’re interested in finding newer, less-established projects, KuCoin provides more options. For mainstream cryptocurrencies with better liquidity, both platforms serve well.

What are the customer support experiences like on KuCoin and Kraken?

Kraken consistently receives higher ratings for customer support with 24/7 live chat and ticket-based systems. Response times are generally faster than industry averages.

KuCoin offers support through tickets, chat, and social media but users report longer wait times during peak periods.

Language support is more extensive on Kraken, while KuCoin sometimes struggles with complex issues in non-English languages.

How do the withdrawal processes and times on Kraken compare to those on KuCoin?

Kraken processes withdrawals quickly, typically within 15-30 minutes for most cryptocurrencies after security checks are completed.

KuCoin withdrawal times vary more widely, ranging from 20 minutes to several hours depending on the cryptocurrency and network congestion.

Kraken implements stricter withdrawal security measures, including mandatory email confirmations and potential holds for suspicious activities. KuCoin offers convenient withdrawals but with slightly less rigorous security checks.

Kraken Vs KuCoin Conclusion: Why Not Use Both?

Both Kraken and KuCoin offer unique advantages that might make using both platforms a smart strategy for crypto traders.

Kraken stands out for its strong security features and regulatory compliance. It’s well-established in Western markets and offers a more straightforward interface for beginners.

KuCoin appears to have a higher “Value for Money” score based on recent comparisons. The platform is known for listing a wider variety of altcoins and newer tokens that you might not find on Kraken.

Benefits of using both platforms:

- Diversified access: Use Kraken for major cryptocurrencies and KuCoin for newer, emerging tokens

- Risk management: Split your assets across different exchanges for security

- Feature utilization: Leverage Kraken’s security while benefiting from KuCoin’s broader trading options

One drawback to note is that Kraken reportedly only processes wire transfers, which might take longer to fund your account.

For advanced traders, using multiple exchanges gives you flexibility. You can take advantage of price differences between platforms or access specific features unique to each exchange.

Your trading needs may determine which platform you use more frequently. New traders might prefer Kraken’s clearer interface, while those hunting for emerging coins might favor KuCoin.

Remember to consider the fees, security measures, and available cryptocurrencies on both platforms as you develop your trading strategy.