If you’re looking for a crypto exchange that meets your needs, comparing KuCoin and BloFin can help you make the right choice. KuCoin is a well-established exchange known for its security features, keeping most user funds in offline cold wallets while maintaining hot wallets for daily transactions. They also offer added protection through two-factor authentication and anti-phishing codes.

BloFin has been gaining attention for its exceptional user interface and experience, with many users appreciating the time and effort put into creating a platform that’s actually pleasant to use. This newer platform has connections to KuCoin, having raised $50 million in funding from KuCoin, SIG, and Matrix Partners in 2022.

When selecting between these exchanges, you’ll want to consider factors like security measures, available trading pairs, fees, and user experience. Both platforms have their strengths, with KuCoin offering established security protocols and BloFin providing a more refined user experience.

KuCoin Vs BloFin: At A Glance Comparison

KuCoin and BloFin are both centralized cryptocurrency exchanges offering various trading options for crypto enthusiasts. Here’s how they compare on key features:

Trading Options

| Feature | KuCoin | BloFin |

|---|---|---|

| Spot Trading | Available | Available |

| Futures/Perpetual | Available | 300+ perpetual swap contracts |

| Copy Trading | Limited | Advanced features |

User Experience

BloFin stands out with its top-tier UI/UX design. Users report the platform is intuitive and pleasant to use, showing significant development effort.

KuCoin has been established longer in the market, which may provide more user trust and stability.

Features Comparison

- BloFin appears to focus heavily on advanced trading, particularly futures

- KuCoin offers a wider range of services for different types of traders

- Both platforms compete with major exchanges like Binance

Trading Volume

When choosing between these exchanges, you should consider their trading volume, which affects liquidity and price stability for your trades.

Trust Factor

CoinGecko ranks crypto exchanges based on trust scores, which can help you evaluate platform reliability. Check current scores before making your decision.

Price structures differ between the platforms, so comparing fee schedules is important if you plan to trade frequently or in large volumes.

KuCoin Vs BloFin: Trading Markets, Products & Leverage Offered

When choosing between KuCoin and BloFin, understanding their trading offerings is crucial for your investment strategy.

Trading Markets

Both exchanges offer a wide variety of cryptocurrencies. KuCoin supports over 200 coins while BloFin provides access to more than 230 cryptocurrencies according to recent data.

Futures Trading

BloFin stands out with support for more than 400 crypto futures pairs, making it particularly attractive if you’re interested in derivatives trading. KuCoin also offers futures but with a somewhat smaller selection.

Leverage Options

Both platforms provide leverage trading, allowing you to amplify your potential returns (and risks). BloFin has positioned itself as a platform “where whales are made,” suggesting its leverage options might appeal to larger traders.

Trading Products Comparison:

| Feature | KuCoin | BloFin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ (400+ pairs) |

| Margin Trading | ✓ | ✓ |

| Number of Coins | 200+ | 230+ |

If you’re looking for specialized leverage and futures trading, BloFin might offer more options based on their larger selection of pairs. However, KuCoin has established itself as a reliable general exchange with a good mix of trading products.

Your trading experience on either platform will depend on your specific needs. Consider factors like user interface, fees, and security alongside these product offerings.

KuCoin Vs BloFin: Supported Cryptocurrencies

When choosing between KuCoin and BloFin, the range of cryptocurrencies available on each platform is a key factor to consider.

KuCoin stands out with its extensive selection, supporting over 700 cryptocurrencies. This makes it an excellent choice if you’re looking to trade beyond the most popular coins. KuCoin offers a wide variety of altcoins and tokens that may not be available on other exchanges.

BloFin, being a newer platform, offers fewer cryptocurrencies compared to KuCoin. However, BloFin covers all major cryptocurrencies that most traders typically need.

Comparison of Supported Cryptocurrencies:

| Feature | KuCoin | BloFin |

|---|---|---|

| Total cryptocurrencies | 700+ | 200+ |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| DeFi tokens | Wide selection | Basic selection |

| New coin listings | Frequent | Less frequent |

| Trading pairs | 1,000+ | 400+ |

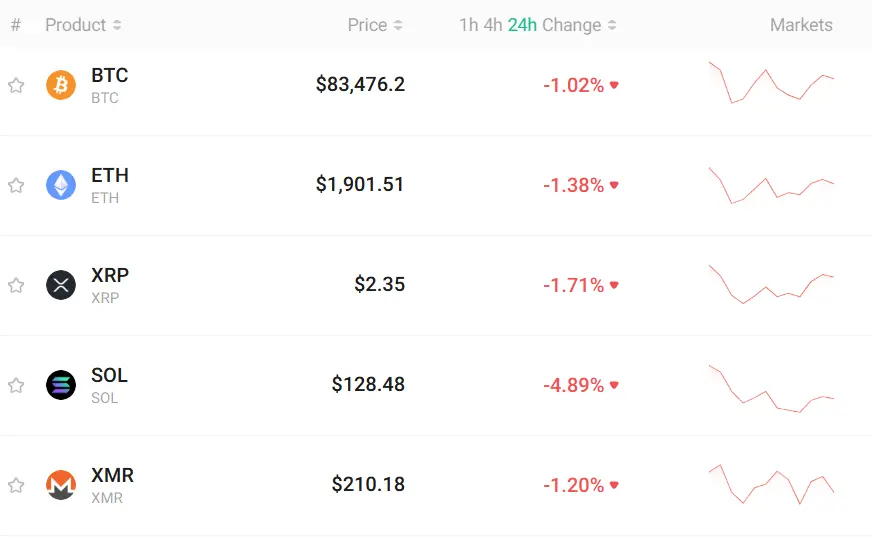

Both platforms support popular cryptocurrencies like:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Dogecoin (DOGE)

If you’re focused on trading mainstream cryptocurrencies, either exchange will meet your needs. However, if you’re interested in lesser-known altcoins or new project tokens, KuCoin provides more options.

BloFin continues to add new cryptocurrencies to its platform as it grows, but currently can’t match KuCoin’s extensive selection.

KuCoin Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing KuCoin and BloFin, fees play a crucial role in determining which platform offers better value for your crypto trading.

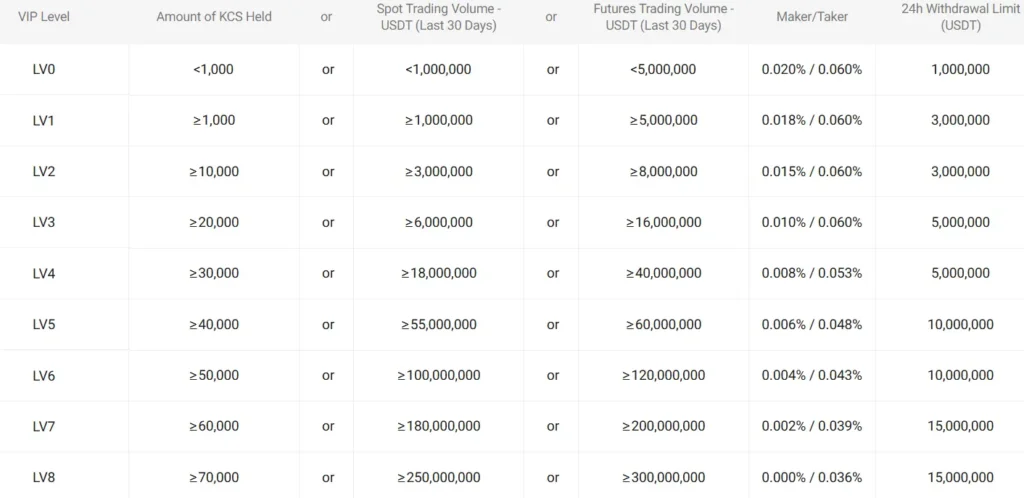

KuCoin Trading Fees:

- Maker fees: 0.02% for futures trading

- Taker fees: 0.06% for futures trading

- Spot trading fees start at 0.1% and can be reduced with KCS holdings

KuCoin’s withdrawal fee for Bitcoin is approximately 0.0002 BTC ($16.66 as of March 16, 2025), while Ethereum withdrawals cost about 0.0027 ETH ($5.15).

BloFin Trading Fees:

- Standard spot trading fees start at 0.1%

- Discount tiers available based on trading volume and platform token holdings

- Futures trading fees vary by market

BloFin’s deposit fees are generally free across most cryptocurrencies, similar to KuCoin. However, their withdrawal structure differs slightly.

Fee Reduction Opportunities:

| Platform | Token Discount | VIP Levels | Referral Benefits |

|---|---|---|---|

| KuCoin | Yes (with KCS) | Yes (6 tiers) | Yes |

| BloFin | Yes | Yes (5 tiers) | Yes |

You can significantly reduce your costs on both platforms by holding their native tokens or maintaining higher trading volumes.

For high-frequency traders, KuCoin’s futures fees may provide an advantage, while BloFin might offer better rates for certain spot trading pairs.

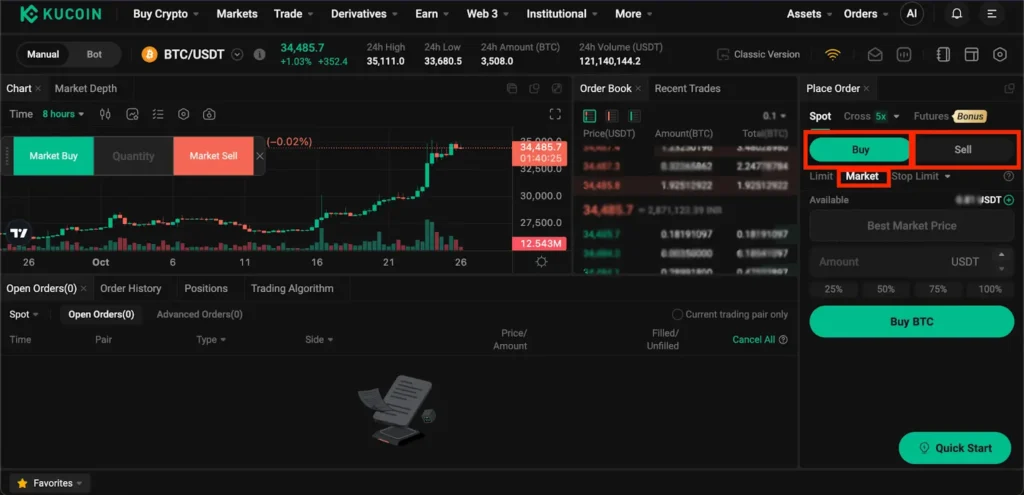

KuCoin Vs BloFin: Order Types

When trading on cryptocurrency exchanges, understanding the available order types is essential for executing your strategy effectively.

KuCoin offers two primary order types on its Spot Market: market orders and limit orders. Market orders execute immediately at the current market price, while limit orders allow you to set a specific price at which you want to buy or sell.

KuCoin also provides advanced order options like Stop Limit Orders. These orders automatically trigger when the market reaches your predetermined price, then execute as a limit order at your specified price.

BloFin, as an advanced centralized exchange, focuses on futures trading with over 300 perpetual swap contracts. This suggests they likely support standard order types plus specialized orders for derivatives trading.

Both platforms support the fundamental order types needed for most trading strategies. However, BloFin appears to emphasize more complex trading with its focus on futures.

For beginners, KuCoin’s straightforward market and limit orders provide an accessible entry point. More experienced traders might appreciate BloFin’s advanced trading features for derivatives.

Consider your trading goals when choosing between these platforms. If you primarily make simple spot trades, KuCoin’s order types will cover your needs. For advanced derivatives trading strategies, BloFin’s specialized order types may offer more flexibility.

KuCoin Vs BloFin: KYC Requirements & KYC Limits

KuCoin and BloFin have different approaches to Know Your Customer (KYC) requirements, which directly affect trading limits and user experience.

KuCoin offers a tiered verification system. Without KYC verification, your daily withdrawal limit is restricted. Once you complete their identity verification process, these limits increase significantly.

BloFin is gaining popularity as a no-KYC or minimal-KYC alternative. Many users can trade on BloFin without extensive identity verification, making it more accessible for those valuing privacy.

However, if you want to maximize your trading potential on BloFin, completing KYC verification is recommended. This verification can increase your 24-hour withdrawal limit to 1,000,000 USDT, a substantial upgrade from the basic limit.

Key Differences:

| Feature | KuCoin | BloFin |

|---|---|---|

| Basic Account | Requires some KYC | Minimal or no KYC for basic trading |

| Withdrawal Limits | Lower without KYC | Up to 1,000,000 USDT with KYC |

| Verification Process | Multi-tiered system | Simpler verification |

| Regional Restrictions | Some restrictions | May require VPN for certain regions including USA |

It’s worth noting that regulatory requirements are constantly changing. As of March 2025, BloFin offers a more KYC-light experience, but this could change based on new regulations.

For users prioritizing privacy and simpler onboarding, BloFin currently provides advantages over KuCoin’s more structured KYC approach.

KuCoin Vs BloFin: Deposits & Withdrawal Options

When choosing between KuCoin and BloFin exchanges, deposit and withdrawal options significantly impact your trading experience.

KuCoin offers multiple ways to move your funds. You can transfer between internal KuCoin accounts using email, mobile phone, or user ID. This makes sending crypto to friends or family on the same platform quite simple.

However, KuCoin has some withdrawal limitations to be aware of. The platform charges a $25 fee for USDT withdrawals via the ERC20 network, with a minimum withdrawal amount of $40. These fees can be substantial for smaller transactions.

BloFin, as a newer exchange, typically offers competitive deposit options but may have a more limited selection of withdrawal methods compared to established platforms like KuCoin.

Comparison Table: Deposit & Withdrawal Features

| Feature | KuCoin | BloFin |

|---|---|---|

| Internal transfers | Email/Phone/UID | Limited options |

| USDT withdrawal fee (ERC20) | $25 | Varies |

| Minimum withdrawal | $40 for USDT | Depends on cryptocurrency |

| Fiat options | Multiple | Limited |

Both exchanges support cryptocurrency deposits, but KuCoin generally provides more extensive fiat-to-crypto options as one of the established exchanges in the market.

Before choosing either platform, check their current fee structures as these can change frequently in the crypto space.

KuCoin Vs BloFin: Trading & Platform Experience Comparison

When trading on KuCoin, you’ll find a comprehensive platform with many trading pairs and options. The interface is well-designed but can be overwhelming for beginners due to its numerous features.

BloFin offers a more streamlined experience that caters to both new and experienced traders. Based on search results, BloFin positions itself as “the next Binance” and creates an environment “where whales are made.”

Trading Features Comparison:

| Feature | KuCoin | BloFin |

|---|---|---|

| User Interface | Feature-rich, complex | Streamlined, accessible |

| Target Users | All levels, more complex | Both new and experienced traders |

| Derivatives | Available | Strong focus on derivatives |

| Mobile App | Full-featured | Modern, responsive |

KuCoin’s strength lies in its established reputation and wide range of available cryptocurrencies. The platform has built trust over years of operation.

BloFin appears to be positioning itself as an up-and-coming alternative with particular strength in derivatives trading. This might appeal to you if you’re interested in futures and options.

For day-to-day trading, both platforms offer the essential tools you need. KuCoin provides more advanced charting options, while BloFin seems to focus on creating a more accessible experience.

Trading fees vary between the platforms, so it’s worth comparing their fee structures based on your typical trading volume and patterns.

KuCoin Vs BloFin: Liquidation Mechanism

When trading with leverage, understanding the liquidation mechanism is crucial to protect your investments. Both KuCoin and BloFin have systems in place to manage risk, but they operate differently.

KuCoin triggers forced liquidation when your debt ratio reaches 97%. This happens when the mark price of your holdings and debt assets changes unfavorably. KuCoin also uses an Auto-deleveraging (ADL) mechanism to protect users from severe margin call losses.

BloFin’s approach has faced some criticism. According to user reports, BloFin has been known to adjust margin requirements and liquidation thresholds without proper notice. Some traders have even reported being liquidated unexpectedly.

KuCoin offers tracked leveraged tokens that come with no risk of liquidation. This option is ideal for traders wanting to avoid liquidity risks while still benefiting from leveraged positions.

Key Differences:

| Feature | KuCoin | BloFin |

|---|---|---|

| Liquidation Threshold | 97% debt ratio | Variable, reported to change without notice |

| Transparency | Clear liquidation policies | Users report lack of transparency |

| Liquidation Alternatives | Tracked leveraged tokens with no liquidation risk | Over 300 perpetual swap contracts |

You should regularly monitor your positions on both platforms to avoid unwanted liquidations. Setting stop-loss orders can help protect your capital when market conditions change rapidly.

Remember that higher leverage increases your liquidation risk. Using more conservative leverage ratios can give you more room before liquidation is triggered.

KuCoin Vs BloFin: Insurance

When choosing a crypto exchange, insurance policies can protect your funds from unexpected events like hacks or technical failures.

KuCoin offers users protection through an insurance fund specifically designed to cover potential losses. This safety net helps traders feel more secure, especially when engaging in leverage trading.

BloFin takes security seriously with its customer funds insurance policy. They also maintain a 1:1 proof of reserve policy, which means they keep 100% of user assets in reserve.

Both exchanges understand the importance of protecting user assets in the volatile crypto market. However, there are some differences in their approaches.

Insurance Comparison:

| Feature | KuCoin | BloFin |

|---|---|---|

| Insurance Fund | Yes | Yes |

| Proof of Reserve | Not specified in results | 1:1 ratio |

| Additional Security | 2FA, anti-phishing codes | Wallet-as-a-service system, KYT process |

You should review the specific insurance terms on both platforms before trading. Coverage limits, conditions, and claim processes may vary significantly.

Remember that while insurance provides an extra layer of protection, it’s still important to follow good security practices when using any exchange.

KuCoin Vs BloFin: Customer Support

When choosing between cryptocurrency exchanges, customer support can make a huge difference in your experience. Both KuCoin and BloFin offer support systems, but they differ in several ways.

KuCoin provides 24/7 customer support throughout the year, as confirmed by their help center. This around-the-clock availability means you can get assistance regardless of your time zone or when issues arise.

The platform offers multiple support channels including:

- Live chat

- Ticket system

- Help center with FAQs

- Social media support

BloFin’s customer support system is less widely documented in the search results. Their approach appears to be more focused on regulatory compliance than on the breadth of support options.

KuCoin has faced some regulatory challenges in the US, which might affect support availability for American users. Some users report being required to verify their identity to access certain features.

Response times can vary for both platforms during high-volume periods. You might experience longer waits during market volatility or after major announcements.

For complex issues, KuCoin’s extensive support infrastructure may provide an advantage. Their longer presence in the market has allowed them to build more comprehensive support documentation.

Consider your own priorities when evaluating support options. If 24/7 availability is crucial, KuCoin’s documented round-the-clock service could be appealing.

KuCoin Vs BloFin: Security Features

When choosing a crypto exchange, security should be your top priority. Both KuCoin and BloFin have implemented several measures to protect your assets.

KuCoin uses industry-standard security protocols including two-factor authentication (2FA), SSL encryption, and cold storage for most user funds. Their security system also includes anti-phishing features and regular security audits.

BloFin matches these core security features with their own robust 2FA system, SSL encryption, and cold storage solutions for user assets. Based on search results, BloFin has specifically emphasized security as a priority in their platform design.

Common Security Features:

- Two-factor authentication (2FA)

- SSL encryption

- Cold storage for majority of assets

- Anti-phishing protection

KuCoin has been operating longer, which has allowed it to establish a track record for security. However, this also means it has faced and resolved security challenges in the past.

BloFin, as a newer exchange, has the advantage of implementing more modern security protocols from its inception. They’ve made security a central focus of their platform development.

When considering which exchange to use, you should also enable all available security features on your account. Set up strong passwords, enable 2FA, and be cautious of phishing attempts regardless of which platform you choose.

Is KuCoin A Safe & Legal To Use?

KuCoin’s safety and legality have come under scrutiny recently. In March 2024, KuCoin and two of its founders were criminally charged with Bank Secrecy Act violations and unlicensed money transmission offenses.

The exchange experienced a major hack in 2020, where significant assets were compromised. Since then, KuCoin has reportedly enhanced its security measures to better protect user assets.

While many users consider KuCoin a reputable exchange in the cryptocurrency space, no platform is completely risk-free. Some crypto traders prefer to diversify across multiple exchanges to minimize potential risks.

Legal Status Concerns:

- Criminal charges filed against the company (March 2024)

- Regulatory compliance issues in some jurisdictions

- Operating without proper licenses in certain regions

Safety Considerations:

- Prior security breach history (2020 hack)

- Improved security protocols since the incident

- Mixed user reviews regarding account safety

If you’re considering using KuCoin, you might want to research the latest developments regarding its legal status in your jurisdiction. The current charges against the company make its long-term stability uncertain.

You should weigh the potential risks against your trading needs. Some users are withdrawing funds while monitoring the situation, planning to potentially return if the exchange stabilizes in the coming months.

Is BloFin A Safe & Legal To Use?

BloFin has established itself as a secure cryptocurrency exchange in 2025. According to recent reviews, the platform employs robust security measures to protect user funds and create a safe trading environment.

The exchange uses industry-standard security protocols to safeguard your assets. This includes two-factor authentication (2FA), cold storage for the majority of funds, and regular security audits.

BloFin is designed to accommodate all types of traders with an easy-to-use, secure, and reliable trading experience.

Regarding legality, BloFin operates as a legitimate cryptocurrency exchange. However, its availability may vary depending on your location and local regulations governing cryptocurrency exchanges.

If you’re concerned about KYC (Know Your Customer) requirements, BloFin appears to be among exchanges that offer services with limited identity verification. This contrasts with platforms like KuCoin, where users report being unable to trade without verification.

Key security features include:

- Advanced encryption technology

- Cold storage for most assets

- Regular security audits

- Secure API connections

Always verify the legal status of any cryptocurrency exchange in your specific jurisdiction before trading. Regulations around crypto trading change frequently, and what’s permitted varies significantly between countries.

Frequently Asked Questions

When comparing KuCoin and BloFin exchanges, users often have specific questions about features, security, fees, and overall user experience. These questions help traders make informed decisions based on their specific needs.

What are the primary differences in features between KuCoin and BloFin?

KuCoin offers a comprehensive trading platform with features like spot trading, margin trading, futures, and a lending platform. Their KuCoin Shares (KCS) token provides holders with trading fee discounts.

BloFin positions itself as a professional-level trading platform with advanced charting tools and trading features. Based on recent reviews, BloFin caters to more experienced traders with sophisticated trading requirements.

KuCoin offers more social features like Trading Bot and Pool-X staking, while BloFin focuses on providing a streamlined professional trading experience.

How do KuCoin and BloFin compare in terms of security measures?

KuCoin implements industry-standard security protocols including two-factor authentication, cold storage for most assets, and regular security audits. The platform did experience a hack in 2020 but managed to recover most funds.

BloFin, being newer to the market, emphasizes security as a priority. They utilize multi-signature wallets and cold storage techniques similar to other major exchanges.

Both platforms require identity verification for higher transaction limits, though KuCoin has faced issues with US users regarding verification requirements as noted in the search results.

Which platform offers more competitive trading fees, KuCoin or BloFin?

KuCoin’s fee structure starts at 0.1% for makers and takers, with discounts available for KCS token holders and higher trading volumes. This positions them competitively in the market.

BloFin’s fee structure is designed to attract professional traders. Their fees are tiered based on trading volume, similar to other exchanges in the space.

For high-volume traders, both platforms offer incentives, though specific rates should be checked on their respective websites as they can change with market conditions.

Can users expect a wider variety of cryptocurrencies on KuCoin or BloFin?

KuCoin has earned the nickname “People’s Exchange” partly due to its extensive selection of cryptocurrencies. They typically list new tokens earlier than many competitors, offering over 700 different coins and tokens.

BloFin, as a newer platform, offers a growing but more selective range of cryptocurrencies. They focus on established coins and projects with strong fundamentals rather than every new token.

For traders seeking rare altcoins or newly launched projects, KuCoin typically provides more options.

How do user reviews rate KuCoin and BloFin in terms of customer service?

KuCoin receives mixed reviews for customer service. Some users praise their 24/7 support and multiple channels, while others report slow response times during high-volume periods.

BloFin, according to 2025 reviews mentioned in the search results, seems to maintain a dedicated support system, though specifics about response times and user satisfaction aren’t detailed in the provided information.

Both exchanges offer knowledge bases and FAQs, with BloFin specifically mentioned as having a comprehensive Help Center.

What are the key factors to consider when choosing between KuCoin and other leading exchanges?

Consider regulatory compliance if you’re in the United States. The search results indicate KuCoin has verification issues for US users, which might limit functionality.

Evaluate your trading needs – KuCoin suits both beginners and advanced traders with various features, while BloFin appears positioned for more professional traders.

Look at asset selection based on your portfolio plans. KuCoin typically offers more cryptocurrencies, especially newer altcoins.

Trading fees should factor into your decision, especially if you’re a high-volume trader who can benefit from tiered discounts on either platform.

Security history and measures are crucial – research each platform’s track record and current security implementations before depositing significant funds.

BloFin Vs KuCoin Conclusion: Why Not Use Both?

When comparing BloFin and KuCoin, you don’t necessarily need to choose just one. Each platform offers distinct advantages that might benefit your trading strategy.

BloFin stands out with its competitive futures trading fees, especially for high-volume traders. The platform provides an easy-to-use, secure trading experience suitable for various types of traders.

KuCoin, while popular, has faced some user complaints about fund seizures and customer service issues. This doesn’t mean all users have negative experiences, but it’s something to be aware of.

Here’s a quick comparison of key features:

| Feature | BloFin | KuCoin |

|---|---|---|

| Futures Trading Fees | Very competitive, especially for high volumes | Standard industry rates |

| User Experience | Easy-to-use, secure | Feature-rich but potentially complex |

| Reliability | Generally positive reviews | Mixed reports |

You might consider using BloFin for futures trading where its fee structure gives you an advantage. Meanwhile, KuCoin could serve as a secondary platform for accessing its wide range of altcoins.

Remember to start with small amounts when trying new exchanges. This approach lets you test the platforms’ features and security without significant risk.

Consider your specific trading needs when deciding how to distribute your activities between these exchanges.