Choosing the right crypto exchange can make a big difference in your trading journey. KuCoin and Bybit are two popular platforms that many traders consider in 2025, each with distinct advantages.

KuCoin offers lower trading fees compared to Bybit, especially for high-volume traders, while Bybit provides zero-fee deposit and withdrawal options. This fee structure is just one of many factors to consider when selecting between these exchanges.

Both exchanges have different overall ratings according to comparison sites, with Bybit scoring slightly higher at 8.0 compared to KuCoin’s 7.9. The platforms differ in their futures trading fee structures, available cryptocurrencies, and user interfaces, making each better suited for different types of traders.

KuCoin Vs Aibit: At A Glance Comparison

When choosing between KuCoin and Aibit, several key factors can help you make your decision. Let’s compare these two cryptocurrency exchanges side by side.

Trading Fees:

| Exchange | Maker Fee | Taker Fee | Withdrawal Fees |

|---|---|---|---|

| KuCoin | 0.1% | 0.1% | Varies by coin |

| Aibit | 0.1% | 0.1% | Varies by coin |

Available Features:

- KuCoin: Spot trading, futures, margin trading, lending, staking, and Trading Bot

- Aibit: Spot trading, futures trading, and basic staking options

KuCoin has a more established reputation in the market, operating since 2017. It offers a wider range of cryptocurrencies with over 700 available tokens.

Aibit is newer to the scene and provides a more streamlined experience with fewer coins but a user-friendly interface that beginners might appreciate.

Security Measures:

- Both exchanges offer two-factor authentication (2FA)

- KuCoin provides additional security with anti-phishing codes

- Aibit focuses on basic security protocols suitable for newer traders

The user interface of KuCoin can be overwhelming for beginners but offers more advanced tools for experienced traders. Aibit presents a cleaner, simpler design that’s easier to navigate when you’re just starting out.

For mobile trading, both exchanges offer apps for iOS and Android, though KuCoin’s app tends to have more features and functionality.

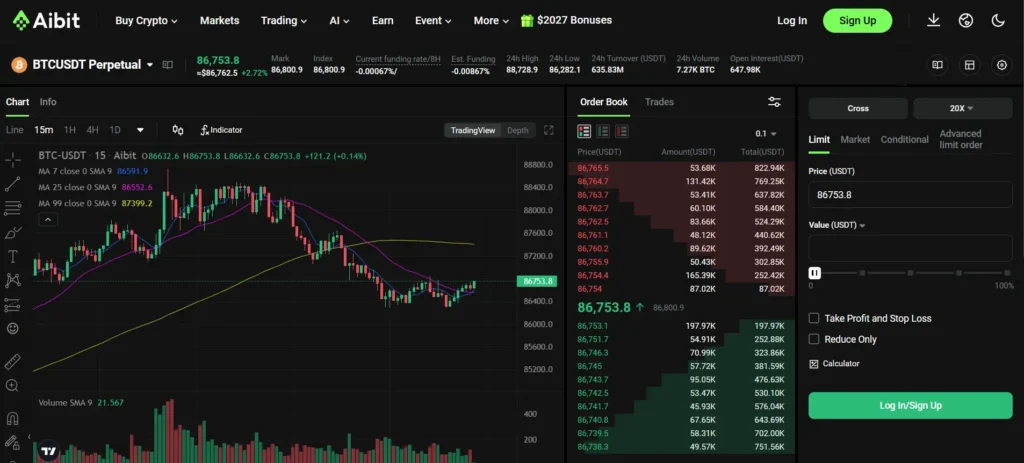

KuCoin Vs Aibit: Trading Markets, Products & Leverage Offered

KuCoin offers over 700 cryptocurrencies for trading, making it one of the most diverse exchanges available. You can access spot trading, futures, margin trading, and even trading bots on their platform.

For leverage options, KuCoin provides up to 10x leverage for margin trading in both cross-margin and isolated-margin modes. This gives you flexibility based on your risk tolerance.

Aibit (formerly Bybit) features a smaller selection of cryptocurrencies but excels in derivatives trading. Their platform is known for its user-friendly futures trading interface.

Fee Comparison:

| Exchange | Spot Trading Fee | Futures Fee |

|---|---|---|

| KuCoin | 0.1% | Variable |

| Aibit | 0.1% | Tiered |

Both exchanges offer competitive spot trading fees at 0.1%, but their futures fee structures differ. KuCoin tends to provide more gamified trading competitions, which might appeal if you enjoy trading events.

KuCoin’s trading bot feature stands out, allowing you to automate your trading strategies without coding knowledge. This is especially useful if you’re looking for passive trading options.

For advanced traders, both platforms offer technical analysis tools, but KuCoin provides more variety in tradeable markets. If you’re seeking exotic altcoins, KuCoin will likely have more options for you.

Leverage traders should note that both platforms enforce liquidation policies to manage risk. Always use stop-loss orders when trading with leverage to protect your investments.

KuCoin Vs Aibit: Supported Cryptocurrencies

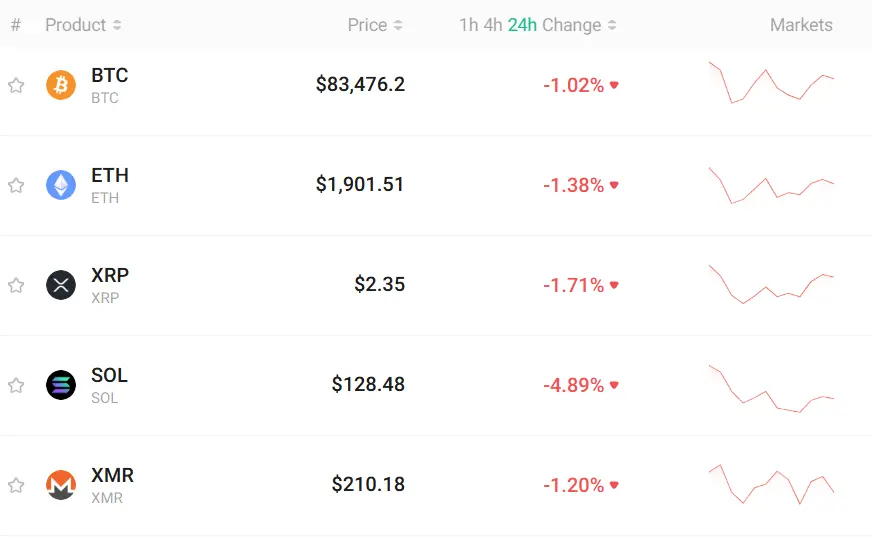

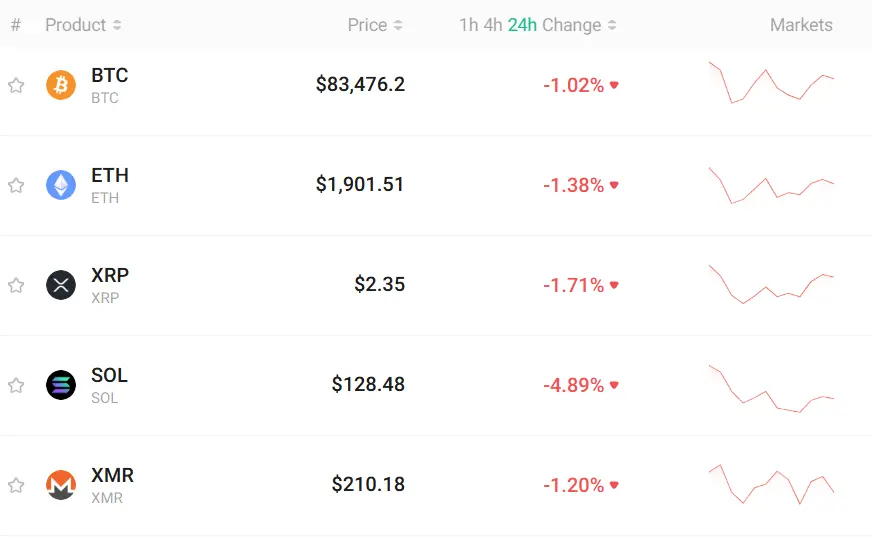

KuCoin offers an impressive range of over 700 cryptocurrencies for trading. This includes popular coins like Bitcoin, Ethereum, Ripple, Cardano, and Litecoin, as well as numerous altcoins and tokens.

Aibit has a more limited selection compared to KuCoin. While Aibit supports major cryptocurrencies, its overall offering is smaller, focusing primarily on established coins rather than newer altcoins.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | KuCoin | Aibit |

|---|---|---|

| Total cryptocurrencies | 700+ | ~200 |

| Bitcoin (BTC) | ✓ | ✓ |

| Ethereum (ETH) | ✓ | ✓ |

| Altcoins | Extensive selection | Limited selection |

| New/emerging tokens | Many available | Few available |

If you’re looking to trade popular cryptocurrencies, both exchanges will meet your needs. However, KuCoin is clearly the better choice if you want access to a wider variety of altcoins and newer tokens.

KuCoin also tends to list new cryptocurrencies faster than Aibit. This can be advantageous if you want to invest in projects early.

For beginners, Aibit’s more focused selection might actually be beneficial. You won’t feel overwhelmed by too many choices when starting your cryptocurrency journey.

Advanced traders will likely prefer KuCoin’s extensive cryptocurrency support, giving you more opportunities to diversify your portfolio across different blockchain projects.

KuCoin Vs Aibit: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between KuCoin and Aibit, fees play a major role in your decision. KuCoin stands out with competitive trading fees ranging from 0.1% to 0.3% for spot trading.

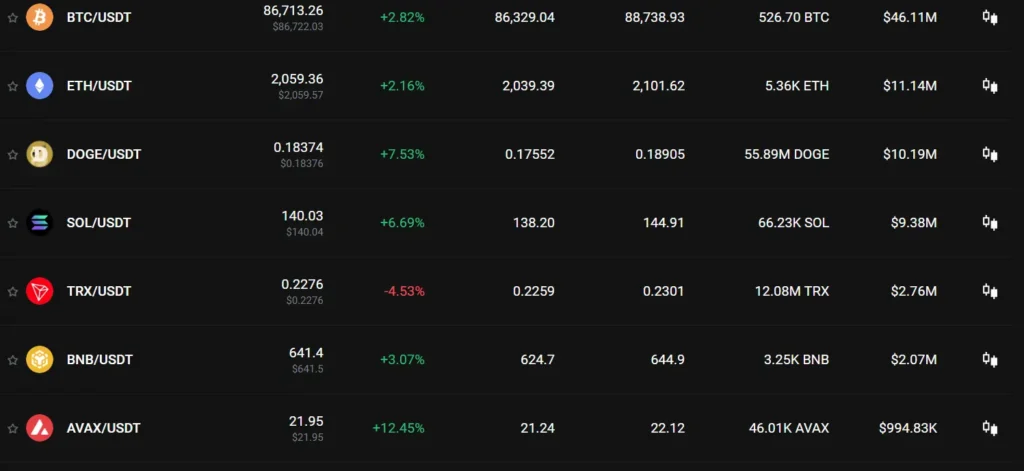

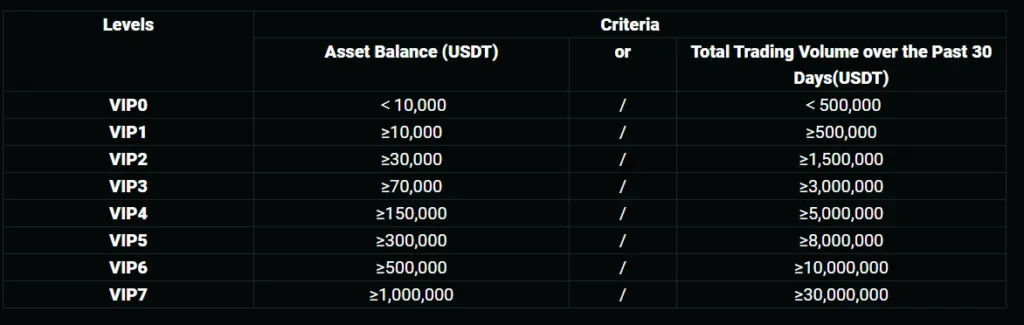

For high-volume traders, KuCoin offers even better rates through their VIP level system. The more you trade, the less you pay.

Aibit, on the other hand, has slightly different fee structures. While specific Aibit fees aren’t mentioned in the search results, cryptocurrency exchanges typically charge between 0.1% and 0.5% per trade.

KuCoin Fee Highlights:

- Spot trading fees: 0.1% – 0.3%

- Lower fees for high-volume traders

- Withdrawal fees can go up to $60 depending on the cryptocurrency

Deposit and Withdrawal Comparison:

| Exchange | Deposit Fees | Withdrawal Fees |

|---|---|---|

| KuCoin | Varies by cryptocurrency | Up to $60 |

| Aibit | Information not provided | Information not provided |

KuCoin’s withdrawal fees vary depending on which cryptocurrency you’re moving. Some coins have higher network fees than others.

You should check both platforms’ current fee schedules before making your final decision, as cryptocurrency exchange fees can change frequently.

Remember that lower fees directly impact your trading profits, especially if you plan to trade actively or move funds often.

KuCoin Vs Aibit: Order Types

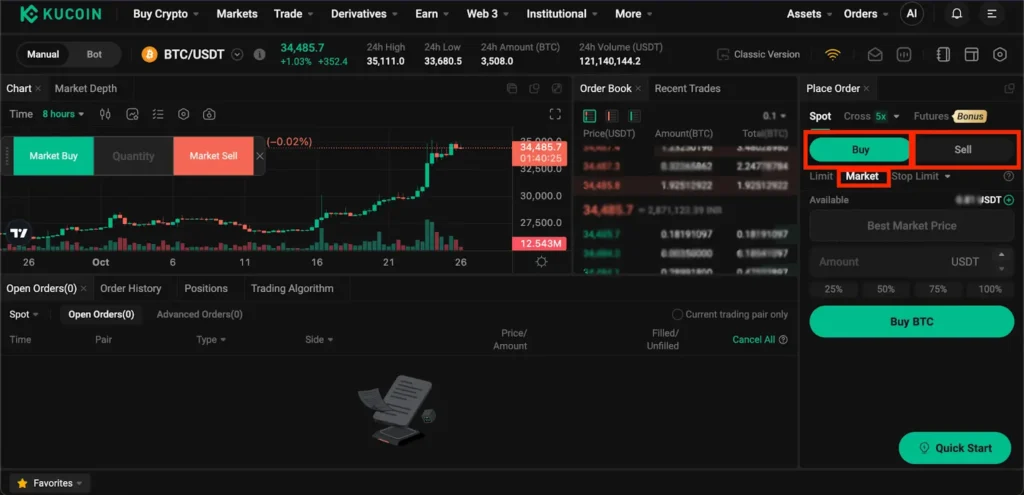

When trading on cryptocurrency exchanges, understanding order types is essential for your success. KuCoin offers a comprehensive range of order options to help you execute trades effectively.

KuCoin provides two primary order types: market orders and limit orders. Market orders execute immediately at the current market price, while limit orders allow you to set a specific price for your trade.

For more advanced trading, KuCoin offers stop limit orders. These orders trigger when the market reaches your specified price point and then execute at your set limit price or better.

Aibit also provides basic order types including market and limit orders. However, their selection of advanced order types is more limited compared to KuCoin.

KuCoin Order Types:

- Market Orders

- Limit Orders

- Stop Limit Orders

- Stop Market Orders

- Post-Only Orders

- Fill or Kill Orders

Aibit Order Types:

- Market Orders

- Limit Orders

- Some basic conditional orders

KuCoin’s stop market orders automatically become market orders when your trigger price is reached. This feature helps you limit losses or secure profits during volatile market conditions.

Price execution on KuCoin can sometimes experience slippage with market orders during high volatility. Many traders prefer limit orders for more reliable and consistent results when aiming for profits.

The diversity of order types on KuCoin gives you more flexibility to implement complex trading strategies compared to Aibit’s more streamlined offerings.

KuCoin Vs Aibit: KYC Requirements & KYC Limits

KuCoin has tightened its KYC (Know Your Customer) requirements. Starting August 31, 2023, new users must complete identity verification to use KuCoin’s products and services.

To pass KYC on KuCoin, you need to submit ID documents and complete face verification. This process is mandatory despite previous claims on social media that KYC wasn’t required.

KuCoin’s identity verification is crucial for compliance with financial regulations. The exchange faced charges for allegedly operating illegally as a money service business, partly due to issues with their KYC enforcement.

Aibit, on the other hand, maintains simpler KYC procedures while ensuring regulatory compliance. Their verification process is streamlined and typically less intrusive than KuCoin’s.

KYC Limits Comparison:

| Exchange | Unverified Limits | Basic KYC | Full KYC |

|---|---|---|---|

| KuCoin | Very limited access | Basic features, withdrawal limits | Full access, higher limits |

| Aibit | Limited trading | Most features accessible | Complete access, highest limits |

You should consider which platform offers the level of privacy and convenience that meets your needs. Aibit generally provides more flexibility for users who prefer minimal identity verification.

Remember that KYC requirements may change as regulations evolve. Always check the current policies on both platforms before making your decision.

KuCoin Vs Aibit: Deposits & Withdrawal Options

KuCoin has limited options for fiat deposits and withdrawals. According to recent information, KuCoin does not natively support fiat deposits or purchases, and it also lacks fiat withdrawal support.

This can be challenging if you want to move traditional currency in or out of the platform directly.

Aibit offers more flexibility with fiat transactions. Unlike KuCoin, Aibit provides support for both depositing and withdrawing fiat currencies, making it easier to convert between crypto and traditional money.

Crypto Transactions:

| Feature | KuCoin | Aibit |

|---|---|---|

| Crypto deposits | Supported | Supported |

| Crypto withdrawals | Supported* | Supported |

| Fiat deposits | Limited | Supported |

| Fiat withdrawals | Not supported | Supported |

*Note: Some KuCoin users have reported issues with withdrawals. One high-volume trader mentioned being unable to withdraw funds without explanation.

KuCoin does offer alternative services like lending and borrowing, where you can earn interest by lending crypto to other traders.

For new users, the deposit and withdrawal process on Aibit tends to be more straightforward and accessible. This is especially important if you’re just starting with cryptocurrency trading.

If you primarily trade between cryptocurrencies, KuCoin’s limitations with fiat may not be a major concern. However, if you frequently move between traditional currency and crypto, Aibit’s more comprehensive options might better suit your needs.

KuCoin Vs Aibit: Trading & Platform Experience Comparison

When comparing KuCoin and Aibit’s trading platforms, you’ll notice several key differences that might impact your trading experience.

KuCoin offers a more extensive selection with over 700 cryptocurrencies and more than 1,200 trading pairs. This exchange is known for listing new coins early, giving you access to emerging projects before they hit larger exchanges.

Aibit provides a cleaner, more streamlined interface that many beginners find easier to navigate. Their platform focuses on simplicity without sacrificing essential trading tools.

Trading Features Comparison:

| Feature | KuCoin | Aibit |

|---|---|---|

| Number of cryptocurrencies | 700+ | 400+ |

| Trading pairs | 1,200+ | 800+ |

| Mobile app | Yes | Yes |

| Trading bots | Yes | Limited |

| Margin trading | Yes | Yes |

| Futures trading | Yes | Yes |

KuCoin’s trading interface includes more advanced charting tools and indicators, which experienced traders might prefer. Their platform also includes built-in trading bots to help automate your strategy.

Both exchanges offer similar fee structures, but KuCoin edges out slightly with lower trading fees for most transaction types.

Aibit shines with faster transaction processing times and a more responsive customer support system. You’ll typically receive assistance within minutes rather than hours.

The KuCoin mobile app provides more functionality, allowing you to access all desktop features on the go. Aibit’s app is more basic but extremely stable.

KuCoin Vs Aibit: Liquidation Mechanism

When trading with leverage, understanding the liquidation process is crucial. Both KuCoin and Aibit have systems in place to protect themselves when trades go against you.

On KuCoin, forced liquidation happens when your debt ratio reaches 97%. This occurs when the market price of your assets changes unfavorably compared to your borrowed funds. KuCoin’s leveraged tokens offer high liquidity, making it easier to enter and exit positions.

Aibit also implements liquidation protocols, though with slightly different parameters than KuCoin. Their system monitors your positions continuously and may liquidate when certain thresholds are crossed.

For margin traders, liquidation can happen in both profit and loss scenarios. For example, if you open a $1000 short position with 10x leverage on a $5 coin, and that coin crashes dramatically, your position will remain open until you close it or the exchange intervenes.

Both platforms provide liquidation warnings, but they arrive differently. KuCoin tends to notify users through the platform and email, while Aibit focuses on in-app notifications.

To avoid liquidation on either platform:

- Monitor your positions regularly

- Use stop-loss orders

- Avoid using maximum leverage

- Maintain additional funds as buffer

The main difference between these exchanges is the threshold at which liquidation occurs and how the process is communicated to you as a trader.

KuCoin Vs Aibit: Insurance

When choosing between crypto exchanges, insurance protection is a key factor to consider. Both KuCoin and Aibit offer different insurance options to protect your investments.

KuCoin provides insurance coverage for its customers in case of security breaches or hacks. They maintain a special fund designed to compensate users if the platform experiences significant losses.

Aibit (often confused with Bybit) offers insurance specifically for liquidation events. This means you receive protection if market volatility causes unexpected liquidations on your trading positions.

The insurance models differ in what they cover:

| Exchange | Insurance Type | Coverage Focus |

|---|---|---|

| KuCoin | General Insurance | Platform security breaches, hacks |

| Aibit | Liquidation Insurance | Trading losses from forced liquidations |

KuCoin’s approach focuses more on platform-level security, giving you peace of mind about the safety of your stored assets.

Aibit’s insurance is particularly valuable if you engage in margin trading or futures contracts, as it provides a safety net against sudden market movements.

You should consider your trading style when evaluating these insurance options. If you primarily hold assets, KuCoin’s protection might be more relevant. If you actively trade with leverage, Aibit’s liquidation insurance could save you from significant losses.

Neither exchange offers complete coverage for all possible scenarios, so understanding the specific terms and limitations is essential.

KuCoin Vs Aibit: Customer Support

Customer support is a crucial factor when choosing a crypto exchange. Both KuCoin and Aibit offer support options, but they differ in quality and accessibility.

KuCoin’s customer support has received mixed reviews. According to search results, many users find KuCoin’s support “disappointing to say the least.” Some tickets remain unresolved for extended periods, creating frustration for users needing quick assistance.

KuCoin Support Options:

- 24/7 live chat

- Email ticket system

- FAQ knowledge base

- Community forum

Aibit (sometimes confused with IBIT or InfinityBit Token) has limited information available about their customer support quality. The search results don’t provide specific details about Aibit’s support structure.

When comparing similar exchanges, responsive customer service becomes especially important during market volatility or when addressing account issues. You should consider how quickly you might need assistance with your trading activities.

Response time is another key difference. While both exchanges claim to offer timely support, actual user experiences suggest KuCoin often has delays in responding to tickets.

Language support varies between platforms as well. KuCoin offers multi-language support, which may be beneficial if English isn’t your primary language.

If customer support is a priority for you, research recent user experiences before making your decision between these two exchanges.

KuCoin Vs Aibit: Security Features

When choosing a crypto exchange, security should be your top priority. Both KuCoin and Aibit offer strong security measures, but there are some important differences to consider.

KuCoin implements multiple security layers including two-factor authentication (2FA) and advanced encryption. Their risk control system includes account verification, risk identification, and secure login protocols for withdrawals.

Despite these measures, it’s worth noting that KuCoin experienced a security breach in 2020 that resulted in millions of dollars being stolen from user wallets.

Aibit (formerly known as Bybit) uses multisignature authorization and offers similar security features to KuCoin. According to recent comparisons, Aibit has a slightly better security rating in 2025 evaluations.

Both platforms require KYC (Know Your Customer) verification for higher trading limits and enhanced account security. This helps prevent unauthorized access and protects your assets.

Here’s a quick comparison of key security features:

| Feature | KuCoin | Aibit |

|---|---|---|

| Two-factor authentication | ✓ | ✓ |

| Advanced encryption | ✓ | ✓ |

| Multisignature wallets | Partial | ✓ |

| Cold storage | ✓ | ✓ |

| Security breach history | Yes (2020) | None reported |

For additional protection, both exchanges offer withdrawal confirmations and IP address monitoring to detect suspicious activities.

Is KuCoin A Safe & Legal To Use?

KuCoin is generally considered a legitimate cryptocurrency exchange. The platform uses standard encryption technology and offers two-factor authentication (2FA) to protect your account.

However, safety concerns exist due to a major security breach in 2020. During this incident, KuCoin experienced a large-scale hack but has since strengthened its security measures to protect user assets.

KuCoin operates in a legal gray area in some countries. While not explicitly banned in most regions, it lacks regulatory licenses in certain jurisdictions. This means you should check your local laws before using the platform.

Security Features:

- Two-factor authentication

- Advanced encryption

- Trading password protection

- Anti-phishing email security

Some users choose to use KuCoin only for trading, not for long-term storage of assets. The “not your keys, not your coins” principle suggests moving crypto to personal wallets for increased security.

If you’re concerned about safety, consider using the platform for shorter periods. Some community members recommend withdrawing funds when not actively trading, especially during uncertain market conditions.

KuCoin has worked to rebuild trust since the 2020 incident by improving security protocols and promising complete reimbursement to affected users.

Is Aibit A Safe & Legal To Use?

Aibit’s safety and legality are important factors to consider before trading on the platform. The exchange implements standard security protocols to protect user assets.

Aibit uses two-factor authentication (2FA) to add an extra layer of security to your account. This helps prevent unauthorized access even if your password is compromised.

The platform complies with regulatory requirements in most jurisdictions where it operates. However, you should verify if Aibit is licensed to operate in your specific country before signing up.

Security Features:

- Cold wallet storage for majority of funds

- Regular security audits

- SSL encryption for data protection

- Anti-phishing measures

Aibit has not experienced any major security breaches as of March 2025, which speaks to its security infrastructure. They maintain an insurance fund to protect users against potential losses from security incidents.

You should still practice good security habits when using Aibit. This includes using unique passwords, enabling all available security features, and not keeping large amounts of crypto on the exchange long-term.

For maximum safety, consider using hardware wallets for storing cryptocurrency you don’t actively trade. Only keep what you need for trading on the exchange platform.

Frequently Asked Questions

Traders looking at KuCoin and Aibit often have specific concerns about fees, security, and platform features. These common questions address the key differences between these two cryptocurrency exchanges.

What are the main differences in trading fees between KuCoin and Aibit?

KuCoin offers competitive spot trading fees starting at 0.1%, which can be reduced through higher trading volumes or by holding KCS tokens.

Aibit typically charges slightly higher base fees but provides more discount tiers based on 30-day trading volume.

For futures trading, KuCoin uses a maker-taker model while Aibit implements a flat fee structure that may benefit high-frequency traders.

How do the security features of KuCoin compare to those offered by Aibit?

KuCoin employs industry-standard security including two-factor authentication, encryption, and cold storage for most assets. Their Safeguard Program protects users against certain types of hacks.

Aibit features similar core security but adds additional verification steps for large withdrawals.

Both exchanges maintain insurance funds, though KuCoin’s has demonstrated real protection during their 2020 security incident when they reimbursed affected users.

Which platform offers a broader range of cryptocurrencies, KuCoin or Aibit?

KuCoin clearly leads with support for over 700 cryptocurrencies and 1,200+ trading pairs. This includes many small-cap altcoins not available elsewhere.

Aibit offers approximately 400 cryptocurrencies and focuses more on established tokens with higher market capitalizations.

If you’re looking for emerging tokens or niche projects, KuCoin typically lists these assets earlier than Aibit.

What advantages does KuCoin provide over Aibit for new cryptocurrency traders?

KuCoin’s interface is often considered more beginner-friendly with clear navigation and detailed help guides. Their Trading Bot feature allows automated strategies without coding knowledge.

The Learning Center on KuCoin provides educational resources specifically designed for newcomers to cryptocurrency trading.

KuCoin also has lower minimum deposit requirements, making it easier for new traders to start with smaller amounts.

How do user experiences differ between trading on KuCoin and Aibit?

KuCoin’s mobile app receives higher ratings for reliability and ease of use, with simpler navigation between different account features.

Aibit offers a more technical trading interface that appeals to experienced traders but may overwhelm beginners.

KuCoin’s social trading features let you follow successful traders’ strategies, while Aibit emphasizes advanced charting tools and technical analysis capabilities.

Which exchange provides better customer service and user support, KuCoin or Aibit?

KuCoin offers 24/7 support through live chat, email, and ticket systems with typical response times under 24 hours for most issues.

Aibit has more limited customer service hours and relies heavily on their knowledge base, with live support primarily available for account security issues.

User feedback indicates KuCoin typically resolves complex trading problems more efficiently, while Aibit excels at addressing basic account questions.

Aibit Vs KuCoin Conclusion: Why Not Use Both?

After comparing KuCoin and Aibit, you might wonder which platform is better. The truth is that each exchange has its own strengths.

KuCoin offers a user-friendly experience with robust API support and numerous altcoin markets. It’s considered a leading competitor to Binance and features helpful tools like the DualFutures AI Bot for high-frequency trading.

Aibit has its own set of advantages that might appeal to different types of traders and investors.

Why choose between them when you can use both?

Using multiple exchanges gives you:

- Better risk management

- Access to more trading pairs

- Opportunity to take advantage of price differences

- Backup options if one platform experiences downtime

Consider this strategy:

- Use KuCoin for its wide selection of altcoins

- Try Aibit for its unique features

- Compare fees on both platforms for each trade

You don’t need to limit yourself to a single exchange. Many experienced traders maintain accounts on several platforms to maximize their opportunities.

The crypto world changes quickly. Having access to different exchanges keeps your options open and helps you adapt to market shifts.