Choosing the right cryptocurrency exchange can make a big difference in your trading experience. Kraken and OKX stand as two popular options in 2025, each with distinct features that might suit different types of traders.

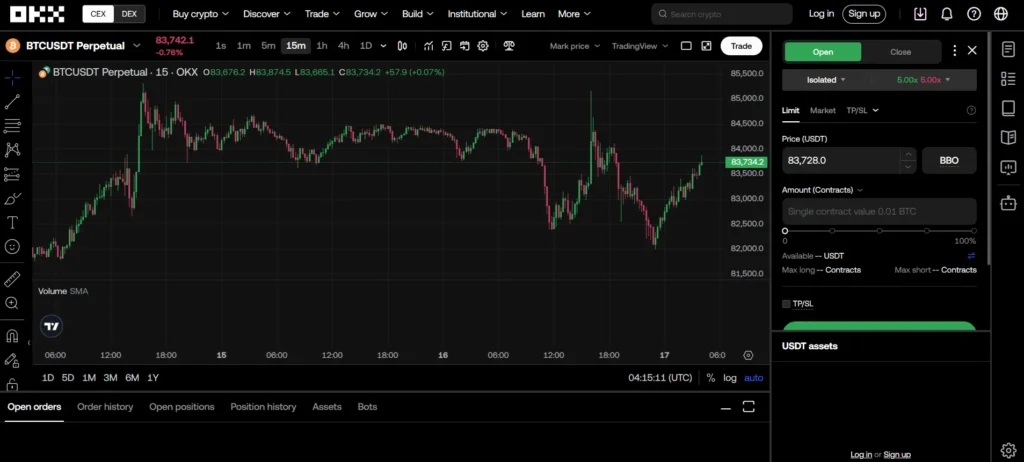

OKX offers lower trading fees and advanced options, making it the overall better choice for many traders, while Kraken stands out for its security track record and user-friendly platform. If you’re looking for ultra-low latency, OKX provides 5ms REST and WebSocket API connectivity, which can be crucial for active traders.

When comparing these exchanges, consider what matters most to you. Kraken might be your best option if security and a diverse selection of cryptocurrencies including Bitcoin are priorities. However, if you want lower fees and advanced trading features, OKX could be the better fit for your needs.

Kraken Vs OKX: At A Glance Comparison

When choosing between Kraken and OKX, several key differences can help you make the right decision for your crypto trading needs.

Trading Fees

OKX generally offers lower trading fees than Kraken, especially for market makers who place limit orders. This can save you money if you trade frequently.

Products and Services

OKX stands out as an “all-in-one” crypto exchange with more products and services than Kraken. If you want a platform with extensive offerings beyond basic trading, OKX might be your better choice.

User Requirements

According to reviewer ratings, OKX scores higher (9.2) than Kraken (8.6) in meeting user requirements. This suggests OKX may better fulfill your expectations as a crypto trader.

| Feature | Kraken | OKX |

|---|---|---|

| Trading Fees | Higher | Lower |

| Product Variety | More limited | More extensive |

| User Satisfaction | 8.6/10 | 9.2/10 |

| Best For | Traditional traders, security-focused users | All-in-one crypto services, lower fees |

OKX (formerly known as OKeX) provides a broader range of crypto products for users looking for more than just basic exchange services.

Kraken may be preferable if you value a more established reputation in certain markets or have specific security concerns.

Your choice ultimately depends on what features matter most to you – lower fees, product variety, or specific trading tools.

Kraken Vs OKX: Trading Markets, Products & Leverage Offered

Kraken and OKX both offer a wide range of cryptocurrency trading options, but they differ in key areas.

Available Cryptocurrencies:

- Kraken: Supports 200+ cryptocurrencies including Bitcoin, Ethereum, and many altcoins

- OKX: Features a larger selection with 350+ cryptocurrencies

Trading Products:

| Feature | Kraken | OKX |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ (Not in US) | ✓ |

| Options | Limited | Extensive |

| Margin Trading | ✓ | ✓ |

| Staking | ✓ | ✓ |

- Leverage Options: Kraken offers 3x leverage on spot trading and up to 50x on futures trading. This is good if you want moderate risk exposure. OKX provides more aggressive leverage options with up to 5x on spot and 125x on futures trading. This higher leverage gives you more trading power but comes with increased risk.

- Trading Pairs: OKX has more trading pairs, giving you more flexibility for direct crypto-to-crypto exchanges without converting to fiat first.

- Regional Restrictions: Kraken’s futures trading isn’t available to US customers. OKX has more global availability but faces some regional restrictions too.

For advanced trading, OKX offers more tools and higher leverage. Kraken provides a more balanced approach with strong security and moderate leverage options.

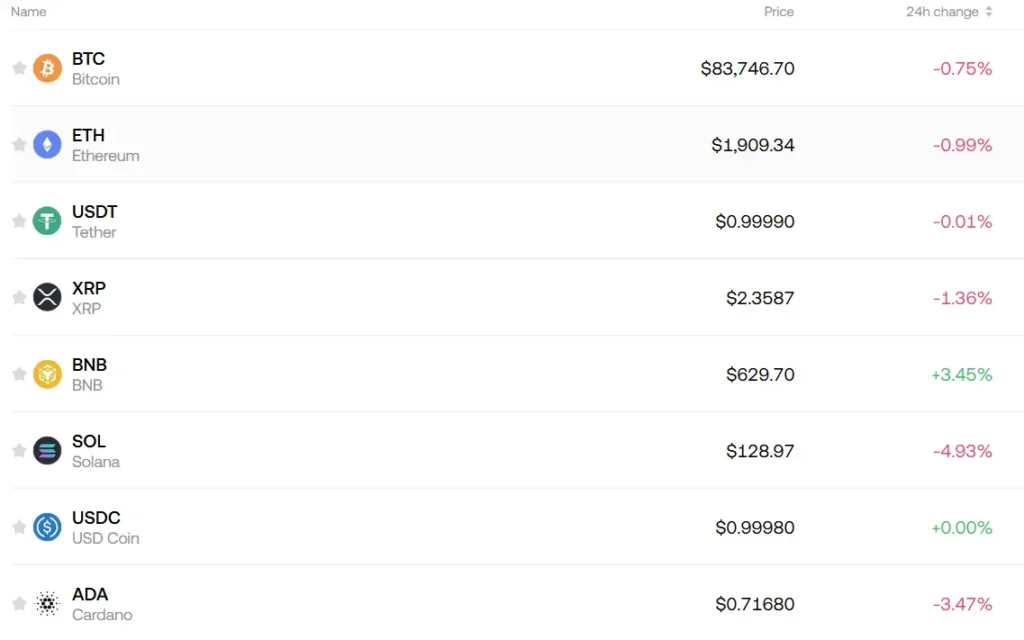

Kraken Vs OKX: Supported Cryptocurrencies

When choosing between Kraken and OKX, the variety of cryptocurrencies available is an important factor to consider.

Kraken supports over 220 cryptocurrencies for trading. This extensive selection includes major coins like Bitcoin and Ethereum, as well as numerous altcoins and tokens.

OKX also offers a wide range of cryptocurrencies, though the exact number may vary as they regularly update their offerings. They support most major coins and many emerging tokens.

The key difference lies in the availability of certain coins. Kraken typically focuses on well-established cryptocurrencies with stronger regulatory compliance, making it a good choice if you want to trade mainstream coins.

OKX often lists newer tokens more quickly, which can be appealing if you’re interested in emerging projects. This can provide more opportunities for trading lesser-known cryptocurrencies.

Both exchanges allow you to:

- Buy popular cryptocurrencies (Bitcoin, Ethereum, etc.)

- Trade various altcoins

- Access stablecoins like USDT and USDC

Here’s a quick comparison:

| Feature | Kraken | OKX |

|---|---|---|

| Total cryptocurrencies | 220+ | Comparable range |

| New token listings | More conservative | Faster to list new tokens |

| Stablecoin options | Multiple options | Multiple options |

| Regional restrictions | May vary by region | May vary by region |

You should check both platforms for specific coins you want to trade, as availability can change and may differ based on your location.

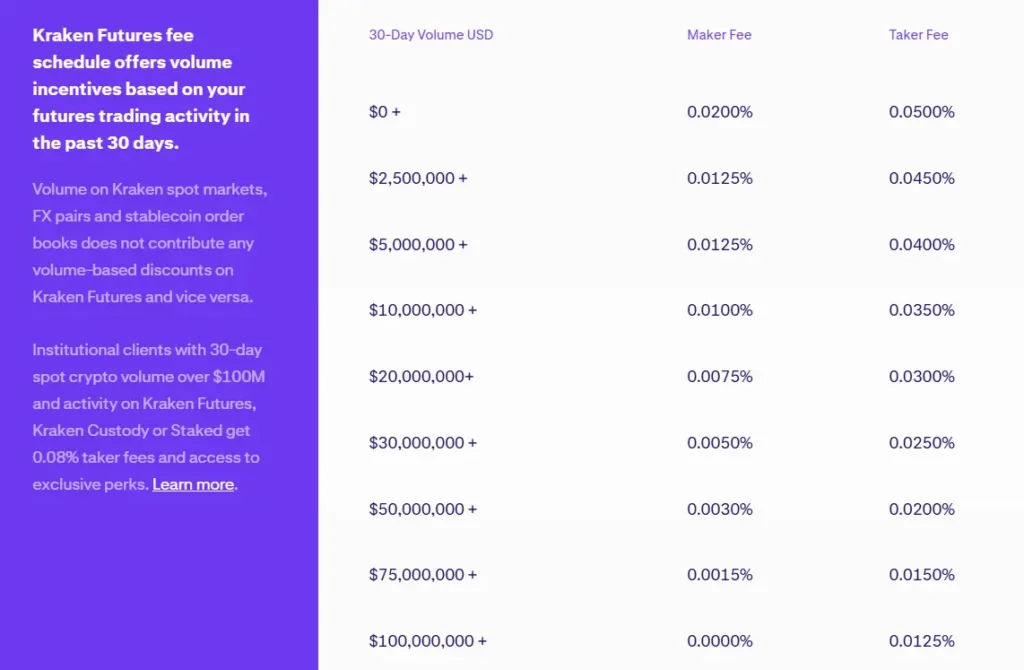

Kraken Vs OKX: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Kraken and OKX, fees play a big role in choosing the right exchange for your crypto trading needs.

Trading Fees

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| OKX | From 0.08% | From 0.10% |

| Kraken | From 0.16% | From 0.26% |

OKX offers some of the lowest trading fees among major exchanges. Their maker fees start at just 0.08%, while taker fees begin at 0.10%.

Kraken’s trading fees are slightly higher, with maker fees starting at 0.16% and taker fees at 0.26%.

Deposit Fees

Kraken stands out with free crypto deposits and no fees for most fiat deposits. You can deposit USD via ACH or EUR via SEPA without any charges.

OKX also offers free crypto deposits, but some fiat deposit methods may include fees depending on your region and payment method.

Withdrawal Fees

Both exchanges charge network fees for crypto withdrawals, which vary by cryptocurrency. These fees change based on network congestion.

Kraken’s withdrawal fees are typically competitive, though they vary by crypto. Some coins have fixed fees while others use dynamic pricing.

OKX withdrawal fees also differ by crypto, with the exact amount displayed before you confirm your withdrawal.

For frequent traders, OKX’s lower trading fees might save you more money in the long run. However, if you mainly make fiat deposits, Kraken’s free options could be more beneficial.

Kraken Vs OKX: Order Types

When trading on crypto exchanges, order types can make a big difference in your trading strategy. Both Kraken and OKX offer various order options, but there are some notable differences.

Kraken provides a solid selection of basic and advanced order types. You can place market orders for immediate execution at the best available price, and limit orders to buy or sell at a specific price point.

For risk management, Kraken offers Stop Loss orders and Take Profit orders. These can be combined as bracket orders to protect your positions from significant market movements.

OKX (formerly OKEx) generally offers a more extensive range of order types. As an “all-in-one” platform, OKX includes all the standard orders that Kraken has, plus additional advanced trading options.

Some traders prefer OKX for its variety of conditional orders and more sophisticated trading tools. These features can be helpful if you engage in complex trading strategies.

Common Order Types on Both Platforms:

- Market orders

- Limit orders

- Stop loss orders

- Take profit orders

Kraken’s order interface is known for being straightforward and user-friendly. You might find it easier to navigate if you’re new to crypto trading.

OKX tends to appeal more to experienced traders who need diverse order types for their trading techniques. The platform offers more products overall, which reflects in its order type variety.

Kraken Vs OKX: KYC Requirements & KYC Limits

Both Kraken and OKX require KYC (Know Your Customer) verification to comply with regulations, but they differ in their approach and requirements.

Kraken has strict KYC procedures as it’s highly regulated and works closely with authorities. You’ll need to verify your identity before trading on their platform. This typically includes providing personal identification documents.

OKX (formerly OKEx) also requires KYC verification. Their process is similar to other exchanges, requiring personal identification to confirm your identity before you can access full trading capabilities.

The KYC process on both platforms typically involves:

- Providing your full name

- Submitting a valid ID

- Proof of address

- Selfie or photo verification

Account Tiers and Limits:

| Exchange | Basic Verification | Full Verification |

|---|---|---|

| Kraken | Limited trading | Higher withdrawal limits |

| OKX | Basic features | Access to all products and services |

While both exchanges require KYC, some users report that OKX’s verification process can be less stringent in certain regions.

It’s worth noting that KYC requirements have become more comprehensive over time across all platforms. This helps exchanges comply with anti-money laundering regulations.

If you value privacy, remember that both exchanges must collect your personal information to operate legally in most jurisdictions.

Kraken Vs OKX: Deposits & Withdrawal Options

Both Kraken and OKX offer various deposit and withdrawal options, but they differ in fees and processing times.

Kraken provides several funding methods including bank transfers, credit/debit cards, and cryptocurrency deposits. You need to sign in to your Kraken account to see the most current information about fees and minimums.

OKX also supports multiple deposit options including crypto transfers and fiat methods. Their interface makes it easy to move funds in and out of your account.

When it comes to withdrawal fees, both exchanges charge varying rates depending on the cryptocurrency and method chosen. Kraken’s withdrawal fees tend to be competitive but slightly higher than OKX in some cases.

For processing times, both platforms process crypto withdrawals relatively quickly. Fiat withdrawals typically take 1-5 business days depending on your bank and location.

Minimum withdrawal amounts exist on both platforms to prevent dust accounts and cover network fees. These minimums vary by cryptocurrency.

| Feature | Kraken | OKX |

|---|---|---|

| Fiat Deposit Methods | Bank transfers, cards | Bank transfers, cards, third-party |

| Crypto Deposits | All listed coins | All listed coins |

| Withdrawal Speed | 0-5 days (method dependent) | 0-5 days (method dependent) |

| Fee Structure | Higher withdrawal fees | Lower withdrawal fees |

You should check both platforms directly for the most up-to-date information on specific cryptocurrencies you plan to use.

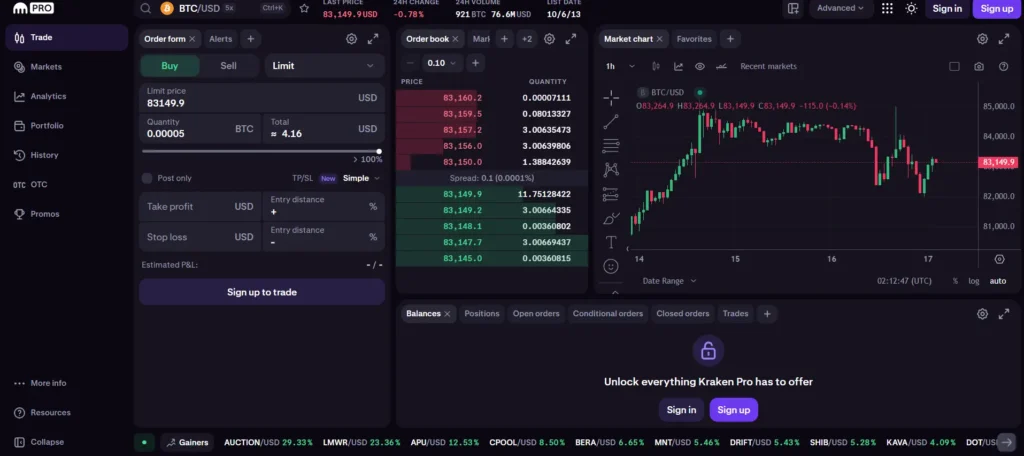

Kraken Vs OKX: Trading & Platform Experience Comparison

When choosing between Kraken and OKX, the trading experience differs in several key areas. Both platforms offer desktop and mobile trading options, but with distinct interfaces.

Kraken provides a more intuitive and user-friendly design. Many users find its layout easier to navigate, especially if you’re new to crypto trading. The platform is known for its clean interface and reliable performance.

OKX offers a more feature-rich experience that advanced traders might prefer. Their platform includes more complex trading tools and chart options for technical analysis.

Trading Fees Comparison

| Platform | Maker Fees | Taker Fees | Special Features |

|---|---|---|---|

| Kraken | Slightly higher | Slightly higher | Better security track record |

| OKX | Lower | Lower | More advanced trading tools |

OKX generally offers lower trading fees compared to Kraken. This makes OKX more cost-effective for high-volume traders.

However, Kraken may be cheaper for buying crypto directly, as their purchasing fees are competitive.

For mobile users, both exchanges offer comprehensive apps. Kraken’s app focuses on simplicity while OKX’s app includes most of the advanced features found on their desktop platform.

Trading speed and execution are reliable on both platforms, but OKX tends to have more trading pairs and options for derivatives trading if that’s important to you.

Kraken Vs OKX: Liquidation Mechanism

When trading on margin or futures platforms, understanding how exchanges handle liquidations is crucial for your risk management strategy. Liquidations happen when your position can’t meet margin requirements.

Kraken’s Liquidation Process:

- Uses a robust liquidation mechanism specifically designed for derivatives trading

- Gradually liquidates positions to minimize market impact

- Provides warning notifications as your margin ratio approaches critical levels

- Offers a tiered liquidation system that helps protect traders from complete loss

OKX’s Liquidation Process:

- Employs an automated system to manage risk

- May liquidate positions more aggressively during high volatility

- Features a partial liquidation option in some cases

- Uses third-party custodians for handling assets during liquidation events

Both platforms prioritize market stability during liquidations, but their approaches differ. OKX typically acts more swiftly to protect the exchange, while Kraken tends to provide more buffer time for traders.

You should pay attention to the liquidation prices displayed on both platforms. These show exactly when your position might be at risk.

The differences in liquidation mechanisms may impact your trading experience, especially if you use high leverage or trade during volatile market conditions.

Kraken Vs OKX: Insurance

When comparing Kraken and OKX, insurance is a crucial factor for protecting your crypto assets. Both exchanges offer some form of protection, but their approaches differ significantly.

Kraken maintains a comprehensive insurance policy that covers digital assets held in their custody. They store most user funds (about 95%) in cold storage, which adds an extra layer of security against hacks.

OKX also offers insurance protection through their Investor Protection Fund. This fund is designed to compensate users in case of security breaches or exchange insolvency.

Kraken’s Insurance Features:

- Clear documentation about insurance coverage

- Majority of funds kept in cold storage

- Regular proof-of-reserves audits

- Strong track record with no major security breaches

OKX’s Insurance Features:

- Investor Protection Fund

- SAFU-style insurance mechanism

- Less transparent about specific coverage details

- Has experienced security incidents in the past

You should note that neither exchange guarantees 100% protection of all assets. Insurance policies typically have limitations and specific conditions.

For maximum security, consider keeping only trading funds on either exchange and moving long-term holdings to personal wallets where you control the private keys.

The insurance aspect alone might not be decisive, but combined with each platform’s overall security measures, it forms an important part of your exchange selection process.

Kraken Vs OKX: Customer Support

When choosing a cryptocurrency exchange, customer support can make or break your experience. Both Kraken and OKX offer support options, but they differ in quality and accessibility.

Kraken’s customer support was once highly regarded in the crypto space. However, recent user experiences suggest their service quality has declined over time. Some users report longer response times than in previous years.

OKX, on the other hand, has been working to improve their customer service. They offer 24/7 support through multiple channels including live chat, email, and a help center with detailed guides.

Both platforms provide:

- Live chat support

- Email ticketing systems

- Knowledge bases with FAQs

- Community forums

Response Times:

| Exchange | Average Response Time |

|---|---|

| Kraken | 24-48 hours (email) |

| OKX | 1-24 hours (varies) |

Kraken does offer phone support for certain account issues, which is uncommon among crypto exchanges. This can be valuable when you face urgent account or security problems.

OKX’s multilingual support gives them an edge for international users. They serve a global audience with support in several languages, making them more accessible if English isn’t your first language.

Remember that support quality can vary based on your specific issue and current platform traffic. During market volatility periods, both exchanges typically experience longer wait times.

Kraken Vs OKX: Security Features

When choosing a crypto exchange, security is a top priority. Both Kraken and OKX have strong security measures, but they differ in several key areas.

Kraken has built a reputation as one of the most secure exchanges in the industry. It offers advanced security features that many competitors lack. Kraken has never experienced a major security breach since its launch.

OKX also takes security seriously but has had some security incidents in its history. Still, the platform has significantly improved its security protocols in recent years.

Key Security Features Comparison:

| Feature | Kraken | OKX |

|---|---|---|

| Two-factor authentication (2FA) | ✓ | ✓ |

| Cold storage for majority of funds | ✓ | ✓ |

| Insurance fund | ✓ | ✓ |

| Proof of reserves | ✓ | ✓ |

| Security breach history | None reported | Some incidents |

Kraken stores most user funds in offline cold wallets, making them less vulnerable to online attacks. You’ll also benefit from their regular security audits and strict compliance with regulations.

OKX implements similar cold storage solutions but adds additional security layers like multi-signature technology. Their security team actively monitors for suspicious activities on your account.

Both exchanges require verification of your identity to comply with regulations and prevent fraud. This adds an extra layer of protection for your account.

For maximum security on either platform, you should enable all available security features including strong passwords, 2FA, and email confirmations for withdrawals.

Is Kraken Safe & Legal To Use?

Kraken is widely recognized as one of the safest cryptocurrency exchanges available today. In fact, many independent auditors rank it #1 in terms of security practices in the crypto industry.

The exchange implements advanced security features that many competitors lack. This includes robust two-factor authentication, encrypted data storage, and regular security audits.

Kraken maintains a strong security record with no major hacks since its founding in 2011. This is impressive in an industry where security breaches are unfortunately common.

From a legal standpoint, Kraken operates as a fully regulated exchange in many jurisdictions. They’ve obtained proper licensing in countries where they offer services.

For US users, Kraken is registered as a Money Services Business with FinCEN. They also comply with AML and KYC requirements, making it a legally sound option for most traders.

Key security features include:

- Air-gapped cold storage for the majority of funds

- 24/7 armed guards at physical locations

- Mandatory 2FA for all accounts

- Global settings lock for account changes

- PGP encryption for sensitive communications

When you use Kraken, you gain access to an exchange that prioritizes your security without compromising on functionality or ease of use.

Is OKX Safe & Legal To Use?

OKX is generally considered a safe cryptocurrency exchange with strong security measures. As of 2025, OKX uses cold storage for most user funds and implements two-factor authentication to protect accounts.

The exchange has improved its security record over the years. While no exchange is completely immune to risks, OKX has invested in security infrastructure to protect user assets.

Regarding legality, OKX’s status varies by country. If you’re in the United States, you should know that OKX has limited services for U.S. residents due to regulatory restrictions.

For users outside the U.S., OKX operates legally in many countries. The platform complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements in jurisdictions where it operates.

OKX has obtained licenses in several countries to ensure legal operation. However, regulations change frequently, so it’s wise to check the current status for your specific location.

Key safety features of OKX include:

- Cold storage for majority of assets

- Two-factor authentication

- Anti-phishing security codes

- Regular security audits

The platform ranks among major exchanges for security practices, comparable to Kraken, though each has different strengths. Before using OKX, verify it’s permitted in your country and follow security best practices like using strong passwords.

Frequently Asked Questions

Choosing between Kraken and OKX requires understanding several key aspects of these popular crypto exchanges. These questions address the most common concerns traders have when comparing these platforms.

What are the security measures implemented by Kraken and OKX?

Kraken employs industry-leading security protocols including 95% cold storage of assets, air-gapped cold wallets, and mandatory two-factor authentication. Their security team runs 24/7 monitoring with real-time alerts.

OKX provides multiple security layers including cold storage solutions, regular security audits, and advanced encryption for user data. They also offer anti-phishing codes and withdrawal whitelists.

Kraken has earned a reputation for security excellence, with many experts considering it one of the most secure exchanges in the crypto market.

How do the transaction fees compare between Kraken and OKX for trading?

OKX generally offers lower trading fees than Kraken, with maker fees starting at 0.08% and taker fees at 0.10%. Their fee structure rewards higher trading volumes with further discounts.

Kraken’s fees start slightly higher at 0.16% for makers and 0.26% for takers. However, Kraken offers lower fees for direct crypto purchases compared to OKX.

For high-volume traders, OKX provides better value, while occasional buyers might find Kraken’s purchase fees more attractive overall.

What are the user reviews saying about the trading experience on Kraken Pro?

Users consistently praise Kraken Pro for its reliable performance during high market volatility. Many traders highlight the platform’s minimal downtime compared to competitors.

The advanced charting tools and order options on Kraken Pro receive positive feedback, especially from experienced traders who appreciate the detailed technical analysis features.

Some users mention the learning curve can be steep for beginners, but most agree the professional trading environment justifies this complexity.

Has there been any history of security breaches with Kraken or OKX?

Kraken maintains an impressive security record with no major breaches affecting customer funds since its founding in 2011. This clean security history is often cited as a key advantage.

OKX (formerly OKEx) experienced a temporary suspension of withdrawals in 2020 when one of their private key holders became unavailable during a government investigation. No customer funds were lost.

Neither exchange has suffered from the catastrophic hacks that have affected other platforms, demonstrating their commitment to security practices.

Which platform, Kraken or OKX, offers a more user-friendly interface for beginners?

Kraken offers a straightforward main interface that beginners find accessible, with clear buy/sell options and a simple account setup process. Their educational resources help newcomers understand crypto basics.

OKX presents a more feature-rich interface that can overwhelm new users. Their dashboard contains numerous trading options, charts, and features that cater more to experienced traders.

If you’re new to cryptocurrency trading, Kraken’s interface provides an easier starting point, while OKX offers more advanced features you can grow into.

What are the different cryptocurrencies available for trading on Kraken and OKX?

OKX offers over 350 cryptocurrencies for trading, giving you access to many emerging tokens and altcoins. This extensive selection appeals to traders seeking exposure to newer projects.

Kraken supports approximately 200 cryptocurrencies, focusing on established tokens with higher market capitalizations. Their listing process is known to be more selective.

Both exchanges offer the major cryptocurrencies like Bitcoin, Ethereum, and Solana, but OKX provides more options if you’re interested in trading a wider variety of altcoins.

OKX Vs Kraken Conclusion: Why Not Use Both?

Choosing between OKX and Kraken doesn’t have to be an either/or decision. Each platform has distinct advantages that might suit different aspects of your trading needs.

Kraken stands out for its top-tier security features. Many users consider it one of the most secure exchanges available, which is crucial for protecting your investments.

OKX, on the other hand, offers remarkably low fees compared to most major exchanges. It also scores higher in user-friendliness with a 9.4 rating versus Kraken’s 7.9.

For beginners, OKX’s intuitive interface might be more approachable. The platform is designed with ease of use in mind, making the cryptocurrency trading experience less intimidating.

Advanced traders might appreciate Kraken’s robust features and security-first approach. Its reliability during market volatility has earned it a strong reputation among serious investors.

Why consider using both:

- Use Kraken for long-term holdings where security is paramount

- Use OKX for frequent trading to take advantage of lower fees

- Test both interfaces to see which one matches your personal preferences

- Diversify your exchange risk by splitting your assets

Many experienced traders maintain accounts on multiple exchanges to capitalize on different fee structures, trading pairs, and features. This approach also provides a backup option if one exchange faces technical issues.