Choosing between Kraken and Gemini for your crypto exchange needs can be tricky. These platforms offer different advantages that might suit your specific trading goals and preferences.

Kraken has a larger user base with approximately 10 million users compared to Gemini’s 1.8 million, but Gemini tends to offer lower trading fees overall. This difference in size and cost structure reflects their distinct approaches to the crypto market.

While Gemini provides a broader range of products and features for different types of investors, Kraken gives you access to more than twice the number of cryptocurrencies. Both exchanges prioritize security, but they differ in their availability of features like staking options, with Kraken offering “off-chain staking” that isn’t available everywhere.

Kraken Vs Gemini: At A Glance Comparison

Kraken and Gemini are leading cryptocurrency exchanges in 2025, each with distinct features that might suit different types of traders.

User Base: Kraken has a significantly larger community with approximately 10 million users compared to Gemini’s 1.8 million users.

Cryptocurrency Selection: Kraken offers a wider variety with 361 cryptocurrencies available for trading. Gemini supports a more limited selection of 81 cryptocurrencies.

Fee Structure: Gemini generally has lower trading fees overall compared to Kraken. Both exchanges position themselves between budget options and premium services.

| Feature | Kraken | Gemini |

|---|---|---|

| User Base | ~10 million | ~1.8 million |

| Cryptocurrencies | 361 | 81 |

| Fee Level | Moderate to High | Moderate |

| Interface | Advanced | User-friendly |

When choosing between these platforms, you should consider your trading goals. Kraken might be better if you want access to a wider range of cryptocurrencies and don’t mind slightly higher fees.

Gemini could be your preferred choice if you prioritize lower trading costs and don’t need as many cryptocurrency options. Their more streamlined selection might also be less overwhelming if you’re newer to crypto trading.

Both exchanges offer secure platforms with different strengths that appeal to various types of crypto investors in 2025.

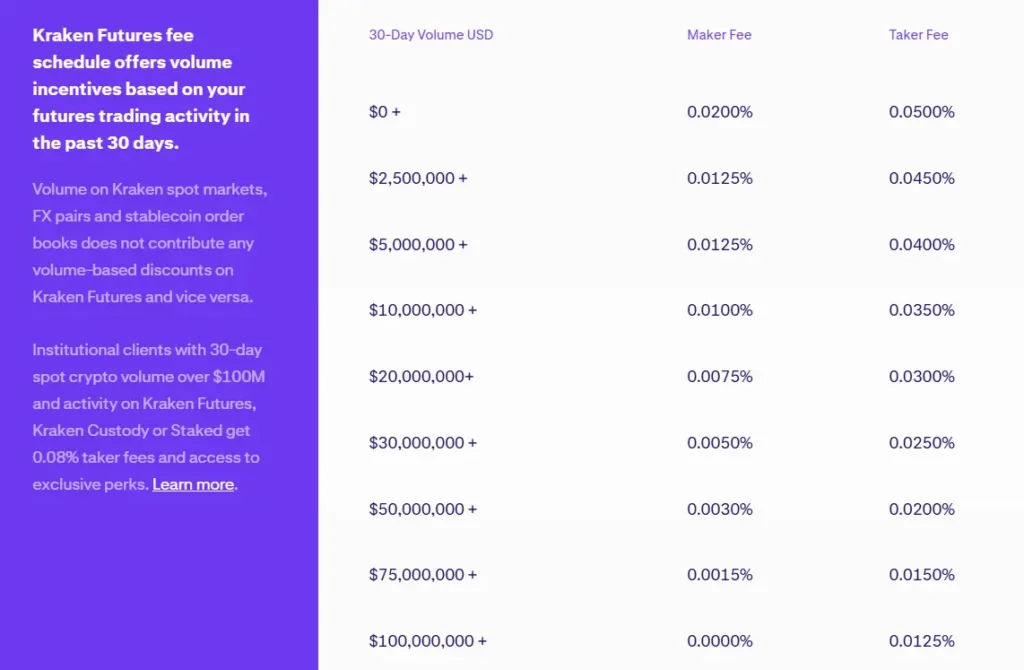

Kraken Vs Gemini: Trading Markets, Products & Leverage Offered

Kraken and Gemini offer different trading options that might affect your choice between them.

Kraken supports 361 cryptocurrencies while Gemini offers a more focused selection of 81. If you want access to a wider range of digital assets, Kraken has the advantage.

Leverage and Derivatives:

- Gemini: Offers derivative trading with up to 100x leverage

- Kraken: Provides both margin and futures trading for specific cryptocurrency pairs

Gemini stands out for some of its leverage and derivative products. These tools let you amplify potential returns, though they also increase risk.

Kraken excels with its more comprehensive derivatives trading options, leverage choices, and staking features. This makes it attractive if you’re looking to diversify your crypto investment strategies.

Both exchanges support the major high-market-cap cryptocurrencies that most traders focus on. Your decision might depend on whether you need specific altcoins that are only available on one platform.

When considering trading markets, evaluate your needs carefully. If you’re primarily trading mainstream cryptocurrencies, either exchange will serve you well. For more specialized trading needs, compare their specific offerings.

The trading interfaces differ between the platforms. You may find one more intuitive based on your experience level and trading style.

Kraken Vs Gemini: Supported Cryptocurrencies

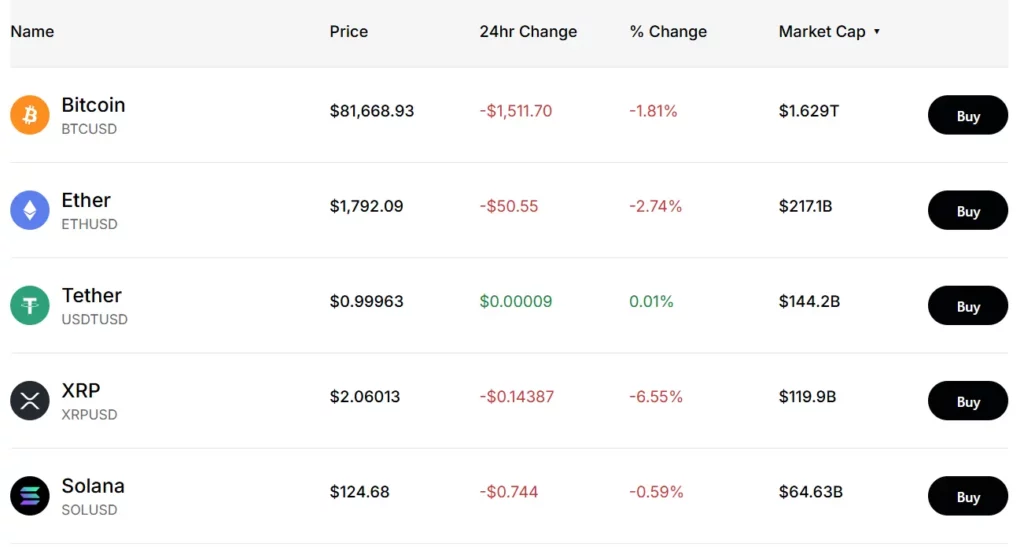

When choosing between Kraken and Gemini, the range of available cryptocurrencies is a key factor to consider for your investment strategy.

Kraken clearly takes the lead in this category, offering a significantly larger selection of cryptocurrencies compared to Gemini. Based on recent data, Kraken supports over 200 different digital assets.

Gemini, while trusted and reliable, provides a more limited selection with approximately 100 cryptocurrencies available for trading. This more curated approach might appeal to you if you prefer quality over quantity.

Here’s a quick comparison of their cryptocurrency offerings:

| Feature | Kraken | Gemini |

|---|---|---|

| Number of cryptocurrencies | 200+ | ~100 |

| Major coins (BTC, ETH, etc.) | ✓ | ✓ |

| Altcoin variety | Extensive | Moderate |

| New coin additions | Frequent | Selective |

Kraken regularly adds new tokens and coins to its platform, making it a good choice if you’re interested in emerging cryptocurrencies or want to diversify your portfolio widely.

Gemini is more selective about which cryptocurrencies it lists, focusing on established coins that meet strict security and compliance standards. This cautious approach may give you more confidence in the assets available on their platform.

Your choice depends on your trading goals. If you want access to a wide variety of cryptocurrencies, Kraken might be your better option. If you prefer trading only well-established cryptocurrencies with strong security measures, Gemini could be the right fit.

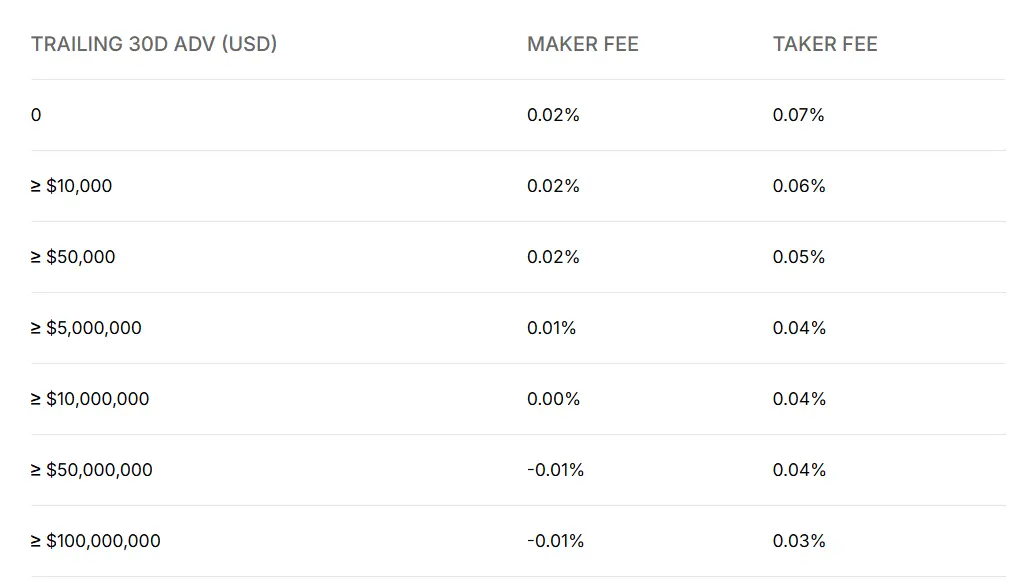

Kraken Vs Gemini: Trading Fee & Deposit/Withdrawal Fee Compared

When comparing Kraken and Gemini’s fee structures, there are notable differences that can impact your trading costs.

Gemini offers lower overall trading fees, with rates of up to 1% per transaction. This gives Gemini a slight edge for traders who make frequent transactions.

Kraken’s trading fees range from 0.10% to 0.26% for crypto spot trades. These rates vary based on your 30-day trading volume and whether you’re a maker or taker in the transaction.

Deposit Fees:

- Kraken: $0 – $5 USD for bank transfers

- Gemini: 0% for bank transfers

Credit/Debit Card Deposits:

- Gemini: 3.49%

- Kraken: Not clearly listed in available information

For smaller transactions, Gemini charges a flat fee between $0.99 to $2.99 depending on size. For transactions above $200, they apply a 1.49% fee.

Both platforms offer competitive fee structures, but your best choice depends on your trading habits. High-volume traders might benefit from Kraken’s volume-based discounts.

Remember that fees can change over time, so it’s worth checking each platform’s current fee schedule before making your decision.

The difference in fee structures could significantly impact your returns, especially if you plan to trade frequently or in large volumes.

Kraken Vs Gemini: Order Types

When trading cryptocurrencies, the types of orders available can significantly impact your trading strategy. Both Kraken and Gemini offer various order types, but they differ in their offerings.

Kraken provides a more comprehensive selection of order types, especially on its advanced trading interface. You can place market orders, limit orders, and stop orders on the platform.

The advanced trading interface on Kraken also allows for more sophisticated order types like stop-limit orders, take-profit orders, and conditional close orders. These options give experienced traders more control over their positions.

Gemini, while more limited, still offers the essential order types most traders need. You can place market orders for immediate execution at the current market price.

Limit orders are also available on Gemini, allowing you to set a specific price at which you want to buy or sell a cryptocurrency.

Both exchanges let you switch between basic and advanced trading interfaces. This flexibility makes them suitable for both beginners and experienced traders.

If you need complex order types for advanced trading strategies, Kraken might be the better choice for you. Its wider range of order options gives you more precise control over entries and exits.

Gemini’s simpler approach works well if you prefer a more straightforward trading experience with just the essential order types.

Kraken Vs Gemini: KYC Requirements & KYC Limits

Both Kraken and Gemini require Know Your Customer (KYC) verification, but they differ in their approaches and limits.

Kraken offers tiered KYC levels including starter, express, intermediate, and pro. Only intermediate and pro levels unlock full platform features.

Gemini has a stricter KYC policy that requires verification before you can begin trading. You’ll need to provide proof of address documents and other personal information.

For deposit limits, Kraken offers higher maximums. With proper verification and proof of funds, you can deposit up to $25,000 daily on Kraken.

Gemini’s deposit limits are lower than Kraken’s, which might be a consideration if you plan to move larger amounts of cryptocurrency.

Kraken KYC Highlights:

- Multiple verification tiers

- Higher deposit limits

- Requires proof of source of funds for maximum limits

Gemini KYC Highlights:

- Front-loaded verification process

- Stricter initial requirements

- Lower maximum deposit limits

The verification process on both platforms is designed to comply with financial regulations, but Kraken provides more flexibility in how you progress through their verification levels.

Kraken Vs Gemini: Deposits & Withdrawal Options

When choosing between Kraken and Gemini, deposit and withdrawal options play a key role in your decision. Both exchanges offer several methods to fund your account and access your funds.

Deposit Methods:

- Kraken: Bank account, wire transfer, and debit card

- Gemini: Bank account, wire transfer, debit card, and PayPal

Deposit Fees:

| Method | Kraken | Gemini |

|---|---|---|

| Bank Transfer | $0-$5 | 0% |

| Credit/Debit Card | Not clearly listed | 3.49% |

Deposit Limits:

Kraken offers higher deposit limits, with a daily maximum of $25,000 when you provide proof of your funds’ source. This makes Kraken more suitable if you plan to trade larger amounts.

Withdrawals:

Gemini stands out by offering 10 free withdrawals per month, which can save you money if you frequently move crypto off the exchange. This is especially valuable since withdrawal fees can add up quickly.

Kraken offers more cryptocurrency options for withdrawal, giving you greater flexibility with your assets. Their customer service also receives positive feedback regarding deposit and withdrawal issues.

Both platforms process fiat withdrawals to bank accounts, though processing times may vary depending on your location and banking system.

You should consider which deposit methods you prefer and how often you plan to withdraw funds when making your choice between these exchanges.

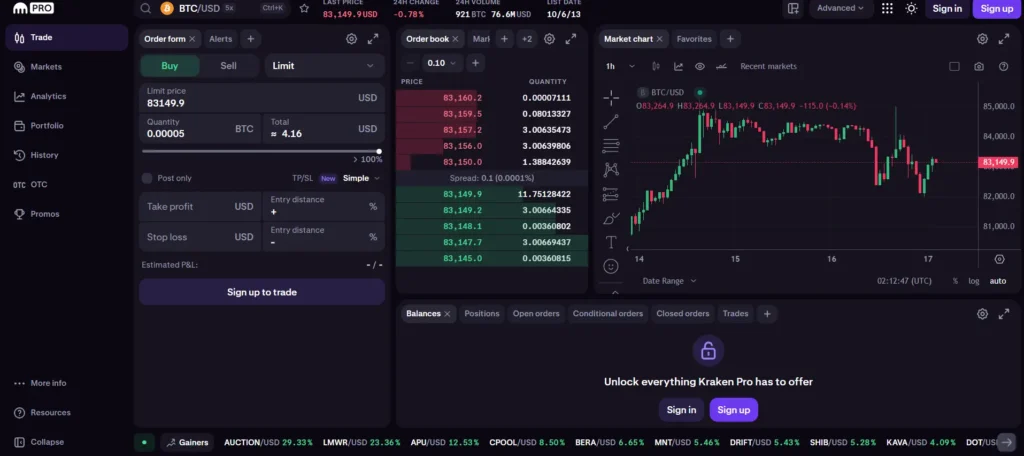

Kraken Vs Gemini: Trading & Platform Experience Comparison

Kraken and Gemini offer distinct trading experiences that cater to different types of crypto investors. Kraken’s platform is designed with advanced traders in mind, featuring a robust interface with detailed trading tools.

Gemini provides a cleaner, more straightforward design that beginners find easier to navigate. Its intuitive layout helps new users make trades without feeling overwhelmed.

Trading Tools Comparison:

- Kraken: Advanced charting, multiple order types, margin trading

- Gemini: Simpler charts, basic order types, ActiveTrader platform for more experienced users

When you use Kraken, you’ll find more cryptocurrency options available. This gives you greater flexibility in diversifying your portfolio compared to Gemini’s more limited selection.

Mobile experience differs between the exchanges. Gemini’s mobile app receives better user ratings for reliability and ease of use, while Kraken’s app provides more features but can be more complex to navigate.

Platform Reliability:

| Feature | Kraken | Gemini |

|---|---|---|

| Uptime | High | Very High |

| Trading during high volume | Some slowdowns | More stable |

| Customer support | 24/7 support | Limited hours |

Kraken offers margin trading for those seeking leverage in their trades, which Gemini doesn’t provide. This makes Kraken better suited if you’re looking to take more advanced positions in the market.

Gemini’s ActiveTrader platform bridges the gap for intermediate users by offering more advanced features without Kraken’s complexity.

Kraken Vs Gemini: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial for managing risk. Both Kraken and Gemini have systems to protect themselves when your positions approach dangerous territory.

Kraken uses a tiered liquidation system that starts with warnings as your margin ratio decreases. If your position continues to decline, Kraken will automatically begin closing positions to prevent complete loss.

Gemini’s ActiveTrader platform employs a similar but somewhat more conservative approach to liquidations. They monitor positions closely and may liquidate at slightly higher margin ratios than Kraken.

Key differences in liquidation approaches:

| Feature | Kraken | Gemini |

|---|---|---|

| Warning system | Multiple alerts | Limited warnings |

| Liquidation threshold | Lower (more flexible) | Higher (more conservative) |

| Partial liquidations | Yes | Limited |

| Liquidation fees | 0.1-0.3% | 0.1-0.25% |

You’ll receive notifications from both platforms before liquidation occurs, but Kraken typically gives you more time to add funds or adjust positions.

Kraken offers more granular control with partial liquidations, allowing you to maintain some positions while others are closed. Gemini tends to take a more all-or-nothing approach in many cases.

For beginners, Gemini’s conservative approach may provide better protection against significant losses. For experienced traders, Kraken’s flexibility might be preferable.

Kraken Vs Gemini: Insurance

When comparing Kraken and Gemini’s insurance offerings, there are notable differences that might impact your decision.

Gemini provides more robust insurance protection for your digital assets. They offer FDIC insurance for USD deposits up to $250,000 and have secured insurance for cryptocurrencies held in their hot wallet system.

Kraken, on the other hand, does not provide FDIC insurance for USD deposits. They do maintain a reserve fund and keep the majority of user assets in cold storage to minimize risk.

Both exchanges employ cold storage security measures. Gemini stores most user funds offline in cold storage, with only a small percentage kept in hot wallets for daily operations.

Insurance Comparison at a Glance:

| Feature | Kraken | Gemini |

|---|---|---|

| FDIC Insurance | No | Yes (up to $250,000 for USD) |

| Crypto Insurance | Limited | Yes (for hot wallet holdings) |

| Cold Storage | Yes (95%+ of assets) | Yes (majority of assets) |

If insurance coverage is your primary concern, Gemini may be the better choice. Their additional layer of protection can provide peace of mind, especially if you plan to keep significant funds on the exchange.

Neither exchange has a perfect insurance solution for all cryptocurrency holdings, so consider your specific needs and risk tolerance when making your decision.

Kraken Vs Gemini: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your experience. Both Kraken and Gemini offer support options, but there are key differences.

Kraken provides a more robust customer support system. They offer multiple ways to get help, including live chat, email, and an extensive knowledge base. Users can typically expect faster response times compared to many competitors.

Gemini focuses on 24/7 customer support availability. This round-the-clock service is especially valuable for institutional clients who may need assistance outside regular business hours.

Response Time Comparison:

| Exchange | Average Response Time | Support Channels |

|---|---|---|

| Kraken | Faster overall | Live chat, email, knowledge base |

| Gemini | Variable | 24/7 support, email, help center |

Kraken’s larger user base (approximately 10 million users) means they’ve had to develop a more scalable support system to handle customer inquiries efficiently.

Gemini’s support team is particularly helpful during the onboarding process. Their expedited verification and setup assistance make getting started easier for new users.

You might prefer Kraken if quick response times are your priority. Their support team is known for resolving technical issues promptly and providing clear explanations.

Gemini could be your better choice if you value having support available at any hour, especially if you’re an institutional trader who operates across different time zones.

Kraken Vs Gemini: Security Features

When choosing between Kraken and Gemini, security should be a top priority for your crypto investments. Both exchanges have strong security measures, but they differ in specific features.

Kraken stands out with its comprehensive security approach. It uses two-factor authentication (2FA) and stores most user funds in cold storage, away from potential online threats. Kraken also has a strong reputation for security, having operated since 2011 without major breaches.

Gemini, founded by the Winklevoss twins, is known for its regulatory compliance. It was one of the first exchanges to receive a BitLicense from New York State. Gemini offers insurance coverage for digital assets held in their hot wallet.

Key Security Features Comparison:

| Feature | Kraken | Gemini |

|---|---|---|

| 2FA Authentication | ✓ | ✓ |

| Cold Storage | Majority of funds | Most assets |

| Insurance | Limited | Yes, for hot wallet |

| Regulatory Compliance | Strong | Excellent |

| Security History | No major breaches | Clean record |

Both platforms offer email confirmations for withdrawals and air-gapped cold storage systems. Gemini adds an extra layer with its “Gemini Custody” feature for institutional clients.

For personal security, you should enable all available security features regardless of which platform you choose. This includes using strong passwords, enabling 2FA, and considering a hardware wallet for long-term storage.

Is Kraken A Safe & Legal To Use?

Kraken is considered one of the oldest and most trusted cryptocurrency exchanges in the industry. Founded in 2011, it has built a strong reputation for security over the years.

The exchange uses strong security measures like 2-factor authentication and encrypted data storage. Most of Kraken’s assets are kept in cold storage offline, which helps protect against hacking attempts.

However, Kraken has faced some regulatory challenges. In 2023, the SEC charged Kraken for operating as an unregistered securities broker, dealer, and clearing agency.

Despite these challenges, Kraken continues to operate legally in many countries. It follows Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures to maintain compliance with regulations.

When comparing security features with Gemini, both exchanges maintain high standards. Gemini is often recognized for its exceptional security protocols and is sometimes described as “one of the most secure crypto exchanges on the planet.”

Kraken has a larger user base with approximately 10 million users compared to Gemini’s 1.8 million. This larger community suggests significant trust in Kraken’s platform.

Before using Kraken, you should check if it’s available and regulated in your location. The legality of using Kraken depends on your country’s cryptocurrency regulations.

Is Gemini A Safe & Legal To Use?

Gemini is a fully regulated cryptocurrency exchange that operates legally in the United States and other countries where it has received proper authorization. The exchange complies with all relevant financial regulations, making it a legal platform for buying and selling digital assets.

When it comes to security, Gemini has built its platform with safety as a top priority. The exchange has a security rating of CC with a 48% security score based on search results. While this isn’t perfect, Gemini maintains strong security measures.

Key Security Features:

- Cold storage for majority of assets

- Two-factor authentication (2FA)

- Address whitelisting

- Insurance coverage for digital assets

Gemini is known as one of the most secure crypto exchanges available today. The platform was founded by the Winklevoss twins, who have emphasized security and regulatory compliance from day one.

The exchange employs industry-standard encryption to protect your data and funds. You can enhance your account security by enabling additional features like hardware security keys.

Gemini hasn’t experienced any major security breaches, which speaks to its strong security practices. However, like any financial platform, it’s not immune to all risks.

For maximum safety when using Gemini, you should:

- Use a strong, unique password

- Enable all security features

- Consider a hardware wallet for long-term storage

- Keep your authentication methods secure

Frequently Asked Questions

Choosing between Kraken and Gemini involves understanding several key differences across fees, security, and features. These questions address the most common comparisons potential users need to consider.

What are the differences in fees between Kraken and Gemini?

Kraken typically offers lower trading fees than Gemini for most users. Kraken’s fee structure starts at 0.26% for makers and 0.16% for takers, decreasing as your trading volume increases.

Gemini charges slightly higher fees with their ActiveTrader platform starting at 0.35% for makers and 0.40% for takers. Their mobile app and basic interface have even higher fees at approximately 1.49% per transaction.

Both exchanges charge network fees for withdrawals, but Kraken often has lower withdrawal fees for most cryptocurrencies.

How do Kraken and Gemini compare in terms of security measures?

Both exchanges prioritize security but implement different approaches. Kraken stores 95% of assets in cold storage and offers two-factor authentication, global settings lock, and SSL encryption.

Gemini is SOC 2 Type 2 compliant and insures digital assets through Aon. They also keep the majority of assets in cold storage with hardware security keys and whitelisted withdrawal addresses.

Gemini’s regulatory compliance in the US is more robust, operating with licenses in more states. Kraken has a strong global security reputation with no major hacks since its founding.

Which offers a wider range of cryptocurrencies, Kraken or Gemini?

Kraken offers a significantly larger selection with support for over 200 cryptocurrencies. This includes major coins and many altcoins with various trading pairs.

Gemini supports approximately 100 cryptocurrencies, focusing on established tokens with strong fundamentals. Their selection process is more conservative due to their regulatory approach.

If you’re looking for less common altcoins or a wider variety of trading pairs, Kraken provides more options.

Can users expect higher liquidity on Kraken or Gemini?

Kraken generally provides higher liquidity across most trading pairs. With daily trading volumes often exceeding $1 billion, Kraken serves a larger global user base.

Gemini has good liquidity for major cryptocurrencies like Bitcoin and Ethereum but may have thinner order books for less common assets. Their US-focused approach means peak trading hours align with American markets.

For large trades, Kraken’s deeper liquidity typically results in less price slippage and better execution.

What are the advantages of using Kraken Pro over the standard Kraken platform?

Kraken Pro offers significantly lower fees than the standard Kraken interface. Trading fees on Pro start at 0.16% maker and 0.26% taker versus higher fees on the basic platform.

The Pro interface provides advanced charting tools, multiple order types, and customizable layouts for serious traders. You’ll have access to depth charts, order book visualization, and trade history.

Kraken Pro also enables margin trading with up to 5x leverage for eligible users, a feature not available on the standard platform.

How do the user experiences differ between Kraken and Gemini’s trading interfaces?

Gemini offers a cleaner, more intuitive interface that beginners find easier to navigate. Their mobile app is particularly user-friendly with simplified buying and selling processes.

Kraken’s standard interface is reasonably straightforward, but Kraken Pro has a steeper learning curve with multiple panels and technical options. The trade-off is greater functionality for experienced traders.

Both platforms offer mobile apps, but Gemini’s is generally rated higher for ease of use while Kraken’s provides more advanced features.

Gemini Vs Kraken Conclusion: Why Not Use Both?

Both Kraken and Gemini offer strong security measures and reliable cryptocurrency services. Choosing between them depends on your specific needs.

Kraken stands out with lower fees and advanced trading features. It offers over twice as many cryptocurrencies as Gemini, making it appealing if you want variety. However, its fiat on-ramp is limited without ACH transfers.

Gemini boasts a broader product range and higher customer satisfaction ratings on Trustpilot. It provides a more user-friendly experience for beginners but comes with slightly higher fees.

You might consider using both platforms strategically. Use Gemini for its smooth user experience and ACH transfers when depositing funds. Then use Kraken for its lower trading fees and wider selection of cryptocurrencies.

Many experienced traders maintain accounts on multiple exchanges. This approach gives you access to more trading pairs and creates redundancy in case one platform experiences issues.

Your decision should ultimately reflect your trading volume, cryptocurrency interests, and security preferences. Both exchanges are reputable options in the 2025 crypto landscape.

Remember to consider the withdrawal fees, verification process, and available customer support when making your final choice.