Choosing between Kraken and Coinbase is a significant decision for your crypto journey. These two major exchanges offer different advantages that might suit your specific needs.

Kraken offers lower fees and higher trading limits, while Coinbase provides easier funding options like PayPal and debit cards. When it comes to security, both exchanges maintain high standards, though Kraken stands out with insurance for funds kept on their platform – a rare feature in the crypto exchange world.

Your decision should ultimately depend on your trading preferences. If you’re looking for more complex trading strategies and lower costs, Kraken might be your better option. If user-friendly interfaces and convenient payment methods matter more to you, Coinbase could be the right choice. Let’s explore these differences in detail to help you make an informed decision.

Kraken vs Coinbase: At A Glance Comparison

When choosing between Kraken and Coinbase, several key differences stand out that might influence your decision.

Trading Fees

| Exchange | Spot Trading Fees | Instant Buy/Sell |

|---|---|---|

| Kraken | Lower | More competitive |

| Coinbase | Higher | Premium pricing |

Kraken offers more favorable fee structures, especially beneficial if you’re a high-volume trader.

Security Features

Kraken provides a more robust security model with multiple 2FA options, including separate keys for login, funding, and trading activities.

Coinbase has strong security but offers fewer customization options for account protection.

Market Size

Coinbase is the larger exchange with a market cap exceeding $78 billion, giving it more visibility and often higher liquidity for popular coins.

Available Cryptocurrencies

Both exchanges support major cryptocurrencies, but their selection of altcoins differs. Your specific coin interests might determine which platform works better for you.

User Experience

Coinbase is known for its beginner-friendly interface, making it accessible if you’re new to crypto trading.

Kraken offers more advanced trading tools that you might find valuable as you gain experience.

Mobile Experience

Both offer mobile apps, but they differ in features and user satisfaction. Consider testing both if mobile trading is important to your strategy.

Kraken vs Coinbase: Trading Markets, Products & Leverage Offered

Kraken and Coinbase both offer spot trading for cryptocurrencies, but their available markets and products differ significantly.

Available Cryptocurrencies

Coinbase has a slight edge with more listed tokens overall, making it better if you’re looking for variety in altcoins. Kraken offers fewer cryptocurrencies but compensates by providing more crypto pairs for futures trading.

Staking and Earn Products

When it comes to earning passive income:

- Kraken typically offers higher yields on staking

- Kraken charges lower fees for these services

- Coinbase makes staking more accessible but at lower returns

Advanced Trading Features

Kraken shines with its advanced trading options:

- Margin trading with leverage

- Futures contracts

- More order types for sophisticated strategies

Coinbase focuses more on simplicity for beginners but has expanded its advanced trading platform recently.

Fee Structure

Kraken’s trading fees are notably lower:

- Spot trades: 0.10% – 0.26% per trade

- Coinbase’s fees are generally higher, especially on the standard platform

You’ll find both exchanges useful for basic buying and selling, but Kraken provides more tools if you’re interested in advanced trading strategies or futures.

Kraken vs Coinbase: Supported Cryptocurrencies

When choosing between Kraken and Coinbase, the variety of cryptocurrencies available for trading is an important factor to consider.

Coinbase offers around 200+ cryptocurrencies for trading. This selection includes all major coins like Bitcoin, Ethereum, and Solana, plus many altcoins and some newer tokens.

Kraken supports approximately 185+ cryptocurrencies. While slightly fewer than Coinbase, Kraken offers a solid range of established coins and some more specialized tokens that Coinbase doesn’t carry.

Coinbase Exclusive Coins:

- Several DeFi tokens

- More newly launched cryptocurrencies

- More NFT-related tokens

Kraken Exclusive Coins:

- Certain privacy coins

- Some international tokens

- Select specialized altcoins

Both exchanges regularly add new cryptocurrencies to their platforms as the market evolves. The difference in total number isn’t significant enough to be a deciding factor for most traders.

For beginners, both platforms offer all the popular cryptocurrencies you’re likely to want. Advanced traders might need to compare specific coin availability based on your trading strategy.

You can easily check each platform’s current coin listings on their websites before signing up, as these offerings change frequently as new tokens are added.

Kraken vs Coinbase: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Kraken and Coinbase, fees play a big role in your decision. Both platforms have different fee structures that impact your overall costs.

Kraken typically offers lower trading fees than Coinbase. Kraken’s trading fees go up to 0.40%, while Coinbase charges up to 0.60% per transaction. This difference can add up if you trade frequently.

For withdrawal fees, Kraken can charge up to $60 depending on the cryptocurrency. Coinbase withdrawal fees can reach up to 3% of the transaction amount.

Payment Methods & Deposit Fees:

| Platform | Payment Methods | Deposit Fees |

|---|---|---|

| Kraken | Bank transfers, crypto deposits | Varies by method |

| Coinbase | Bank transfers, PayPal, debit cards | Varies by method |

Coinbase offers more convenient funding options like PayPal and debit cards. However, these conveniences often come with higher fees.

If you’re sending money from Switzerland, Kraken allows direct CHF deposits without conversion fees. This can save you money compared to having to convert currencies first.

For wire transfers specifically, Coinbase has less expensive options than Kraken. This makes Coinbase potentially better for those who frequently move fiat currency in and out of their account.

Kraken’s NFT marketplace charges a flat 2% fee, while Coinbase’s NFT fees vary by collection. This is worth considering if you plan to trade NFTs.

Kraken vs Coinbase: Order Types

Both Kraken and Coinbase offer various order types for crypto trading, but they differ in complexity and options available.

Coinbase Advanced provides standard order types like market, limit, and stop orders. These basic options are perfect if you’re new to crypto trading or prefer simplicity.

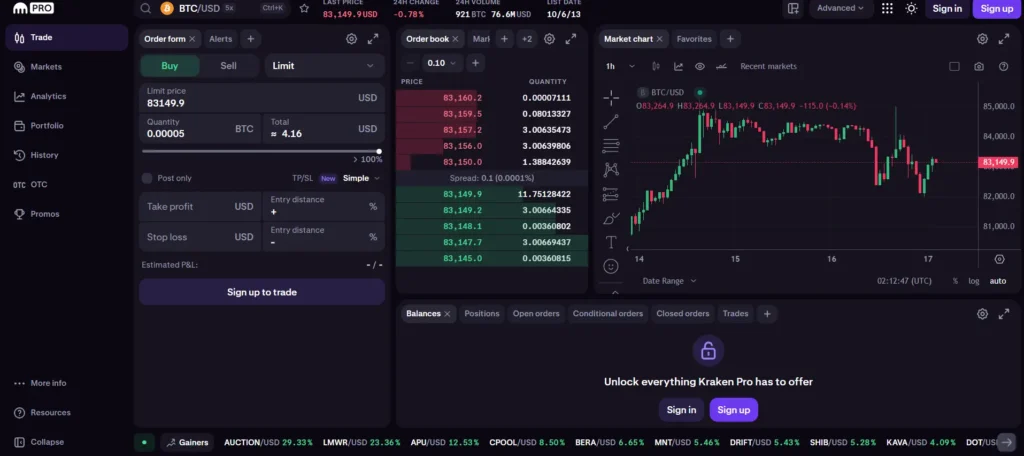

Kraken takes order flexibility to another level with more advanced options. Beyond the basics, Kraken Pro includes:

- Market orders: Buy or sell immediately at current market price

- Limit orders: Set specific buy/sell prices

- Stop-loss orders: Automatically sell when price drops to a certain point

- Take-profit orders: Automatically sell when price reaches your target

- Conditional orders: Execute based on market conditions

Kraken also offers settlement orders and conditional close features for futures trading, making it more suitable for advanced traders.

Coinbase’s interface is more user-friendly, making basic orders easy to place even for beginners. Their simplified approach works well if you don’t need complex trading strategies.

If you’re looking to implement more sophisticated trading techniques, Kraken’s extensive order options give you greater control over your trading strategy.

Both platforms allow order customization, but Kraken provides more parameters to adjust, including time-in-force options that determine how long your order remains active.

Kraken vs Coinbase: KYC Requirements & KYC Limits

Both Kraken and Coinbase require users to complete Know Your Customer (KYC) verification to use their platforms. This process helps prevent fraud and meet regulatory requirements.

Coinbase KYC Requirements:

- Basic tier: Name, email, phone number, and photo ID

- Higher tiers require additional personal information

- Most users can complete verification in minutes

Coinbase makes verification straightforward with a user-friendly interface. You can upload documents directly through their app or website.

Kraken KYC Requirements:

- Starter tier: Name, date of birth, address, and phone number

- Intermediate and Pro tiers require photo ID and proof of residence

- Multiple 2FA options (login key, funding key, trading key)

Kraken’s verification can take longer but offers more security features. Their tiered approach lets you access different features as you verify more information.

Trading Limits:

| Exchange | Unverified | Basic Verification | Full Verification |

|---|---|---|---|

| Coinbase | Not allowed | $7,500-$25,000/week | Higher custom limits |

| Kraken | Not allowed | $2,000-$10,000/day | Up to millions/month |

For privacy-conscious users, Kraken provides better account security with multiple 2FA keys. However, Coinbase offers faster verification and might be more beginner-friendly.

Your trading needs will determine which platform’s KYC process works better for you. Higher volume traders may prefer Kraken’s larger limits after full verification.

Kraken vs Coinbase: Deposits & Withdrawal Options

Both Kraken and Coinbase offer several ways to fund your account and withdraw your money. Your options will depend on where you live and what you prefer.

Coinbase Deposit Options:

- Bank transfers (ACH in the US)

- Wire transfers

- Debit/credit cards

- PayPal (a unique advantage over Kraken)

- Apple Pay/Google Pay

Coinbase makes it easy to deposit funds directly from your bank account or card. You don’t need to upgrade your account level to use credit or debit cards.

Kraken Deposit Options:

- Bank transfers

- Wire transfers

- Debit/credit cards (requires higher account verification)

- Cash (via certain retail locations)

Kraken typically has higher limits for deposits and withdrawals, which benefits high-volume traders. However, you might need to complete additional verification steps.

Withdrawal Methods:

Both platforms allow withdrawals to bank accounts and crypto wallets. Coinbase offers PayPal withdrawals while Kraken does not.

Processing Times and Fees:

Kraken often has lower deposit and withdrawal fees than Coinbase. However, Coinbase may offer faster processing for certain methods.

Coinbase charges higher fees for card deposits (around 3.99%) while Kraken’s fees vary by region but are generally lower for most methods.

Consider your preferred funding method and fee sensitivity when choosing between these exchanges.

Kraken vs Coinbase: Trading & Platform Experience Comparison

Kraken and Coinbase offer different trading experiences that might suit various types of crypto investors.

Coinbase provides a more beginner-friendly interface. You’ll find its clean design easy to navigate with straightforward buy and sell options. The platform shows real-time prices and offers a mobile app that mirrors the desktop experience.

Kraken delivers a more advanced trading platform with detailed charts and order options. You get access to more order types including limit, market, stop-loss, and take-profit orders. This makes it better suited if you want more control over your trades.

When comparing trading tools:

| Feature | Kraken | Coinbase |

|---|---|---|

| Order types | More advanced options | Basic buy/sell |

| Charts | Detailed technical analysis | Simple price charts |

| Mobile experience | Comprehensive but complex | Streamlined and simple |

Kraken’s platform includes dark pool trading and an OTC desk for large transactions, features that advanced traders might appreciate.

Coinbase stands out with its integration of PayPal and debit card funding options, making it easier to start trading quickly.

Trading limits also differ between platforms. Kraken offers higher withdrawal limits, which might matter if you plan to move large amounts of crypto.

The platforms have different fee structures too. Kraken generally charges lower trading fees, which can save you money if you trade frequently or in large volumes.

Kraken vs Coinbase: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation process is crucial for your financial safety. Both Kraken and Coinbase have established mechanisms to handle liquidations, but they operate differently.

Kraken uses a tiered liquidation system that begins with warnings as your position approaches the liquidation price. You’ll receive notifications when your margin ratio falls below certain thresholds. This gives you time to add funds or reduce your position.

Coinbase’s liquidation process tends to be more straightforward but potentially less forgiving. When your collateral falls below maintenance requirements, the system automatically begins closing positions with less warning time compared to Kraken.

Liquidation Thresholds Comparison:

| Feature | Kraken | Coinbase |

|---|---|---|

| Warning Alerts | Multiple stages | Limited |

| Liquidation Buffer | More gradual | More immediate |

| Partial Liquidation | Yes | Yes |

| Liquidation Fee | 0.5% typically | Varies by asset |

Kraken offers more control during the liquidation process. You can often choose which positions to close first if you act quickly enough after receiving warnings.

Coinbase’s system prioritizes platform stability, sometimes at the expense of trader flexibility. The exchange typically liquidates positions more rapidly when thresholds are crossed.

Both platforms use automated systems to protect themselves from negative balances. However, Kraken’s approach generally provides more opportunity for you to take corrective action before full liquidation occurs.

Kraken vs Coinbase: Insurance

When choosing a crypto exchange, insurance protection is a key factor to consider for your funds’ safety.

Coinbase offers more comprehensive insurance options. They provide pass-through FDIC insurance up to $250,000 through their banking partners for USD balances. This means your cash (not cryptocurrency) is protected if something happens to the exchange.

Coinbase also maintains crime insurance to protect against certain types of theft and cybersecurity breaches. This adds an extra layer of protection for your digital assets.

Kraken, while strong on security measures, doesn’t currently offer FDIC insurance for USD deposits. Their security focuses more on prevention through advanced account protection features.

Kraken does keep most assets in cold storage (offline) to prevent hacking, which is a different approach to security rather than insurance.

Here’s a quick comparison:

| Feature | Coinbase | Kraken |

|---|---|---|

| FDIC Insurance | ✅ (up to $250,000) | ❌ |

| Crime Insurance | ✅ | ❌ |

| Cold Storage Security | ✅ | ✅ |

You should note that neither exchange fully insures cryptocurrency assets against all risks. Most insurance only covers specific scenarios like theft through security breaches.

When deciding between these platforms, consider how important insurance coverage is for your investment strategy and risk tolerance.

Kraken vs Coinbase: Customer Support

When choosing between Kraken and Coinbase, customer support can be a deciding factor for your crypto journey.

Kraken offers 24/7 customer service globally, giving you round-the-clock access to help when you need it. Their support system includes live chat options, allowing for quick responses to your questions.

Coinbase also provides comprehensive support through an online knowledge base, live chat, and phone support. They additionally offer peer assistance to help solve your issues.

One key difference is Kraken’s reputation for excellent support quality. According to user feedback, Kraken’s customer service is highly regarded compared to other exchanges.

Both platforms make it easy to get help, but Kraken appears to put extra emphasis on customer service quality.

It’s worth noting that availability varies by location. Kraken isn’t available in New York, Washington, and Maine, which might affect your ability to access their customer support if you live in these areas.

If quick and reliable customer service is important to you, Kraken’s 24/7 support and positive reputation might give it an edge over Coinbase in this category.

Kraken vs Coinbase: Security Features

Both Kraken and Coinbase take security seriously, but they offer different approaches to keeping your crypto safe.

Kraken stands out by providing insurance for funds held on their platform. This is uncommon among crypto exchanges and gives users an extra layer of protection.

Coinbase also maintains strong security protocols with encryption and two-factor authentication (2FA). Like Kraken, they use cold storage solutions to keep most customer assets offline and safe from hackers.

Key Security Features Comparison:

| Feature | Kraken | Coinbase |

|---|---|---|

| Two-Factor Authentication | ✓ | ✓ |

| Cold Storage | ✓ | ✓ |

| 24/7 Surveillance | ✓ | ✓ |

| Fund Insurance | ✓ | Limited |

| Customer Support | Excellent | Good |

Kraken’s customer support has a reputation for excellence, which is important when you need help with security issues. You can reach their team quickly when problems arise.

Both platforms encrypt your data to protect it from unauthorized access. Your personal information and transaction history remain private through these measures.

When choosing between these exchanges, consider which security features matter most to you. If insurance coverage is a priority, Kraken has the edge in this area.

Remember to always enable all available security features on whichever platform you choose. This includes using strong passwords and keeping your authentication methods secure.

Is Kraken A Safe & Legal To Use?

Kraken is considered a safe cryptocurrency exchange with a strong focus on security. Based on our research and the search results, Kraken offers multiple layers of protection for your digital assets.

The exchange provides insurance for funds kept on their platform, which is uncommon among crypto exchanges. This adds an extra layer of security for your investments.

Kraken operates legally in many countries and regions. It follows regulatory requirements and implements Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to stay compliant with financial laws.

Security Features Include:

- Two-factor authentication (2FA)

- Global Settings Lock

- SSL encryption

- Cold storage for most funds

- Email confirmation for withdrawals

Their customer support is also praised as excellent, which is important when you need help with security issues or account access.

Kraken has a good track record when it comes to security. Unlike many exchanges that have suffered major hacks, Kraken has maintained a relatively clean security history since its founding in 2011.

You should still follow best practices when using Kraken. This includes using strong passwords, enabling all security features, and considering moving large amounts to private wallets for long-term storage.

For most users looking for a reputable, secure exchange, Kraken meets high safety standards while remaining legally compliant in supported jurisdictions.

Is Coinbase A Safe & Legal To Use?

Coinbase is a legal cryptocurrency exchange that operates in compliance with regulations in the countries where it’s available. It’s licensed and registered with appropriate financial authorities, making it a legitimate platform for buying, selling, and storing cryptocurrencies.

In terms of safety, Coinbase has maintained a strong security record. According to search results, the platform hasn’t experienced any significant security breaches. This speaks to their investment in security measures to protect user funds and information.

Coinbase employs several security features to protect your account:

- Two-factor authentication (2FA)

- Biometric login options

- Insurance coverage for digital assets

- Cold storage for 98% of customer funds

- AES-256 encryption for digital wallets

The platform is also a publicly-traded company on the NASDAQ, which adds a layer of transparency and oversight not found with many crypto exchanges.

You should be aware that while Coinbase takes extensive security measures, no platform is 100% immune to risks. It’s always good practice to enable all security features and consider using a hardware wallet for large amounts of cryptocurrency.

Coinbase follows KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This means you’ll need to verify your identity when creating an account, which adds to the platform’s legitimacy and security.

Frequently Asked Questions

Many crypto investors wonder about specific differences between Kraken and Coinbase that affect daily trading activities. These questions address key aspects that impact your choice of platform.

What are the differences in trading fees between Kraken and Coinbase?

Kraken generally offers lower trading fees compared to Coinbase. For standard transactions, Kraken charges 0.16% to 0.26% for makers and takers, while Coinbase charges higher fees starting at 0.40%.

Coinbase also adds additional fees for smaller transactions, which can significantly increase costs for casual traders. These convenience fees can make small purchases much more expensive.

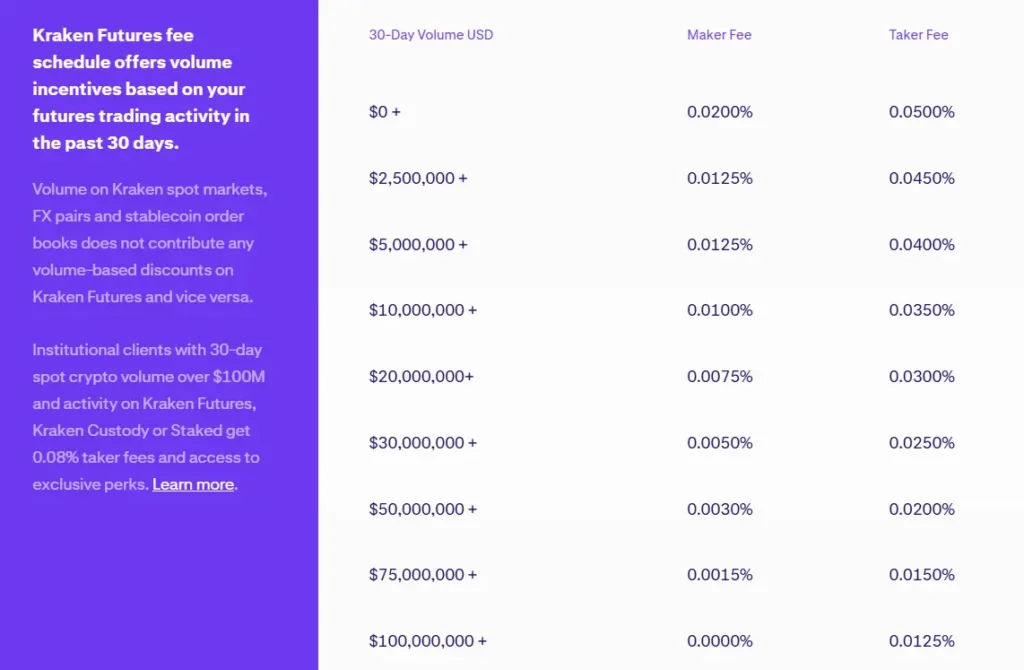

Kraken’s volume-based discount structure rewards frequent traders more generously. The more you trade on Kraken, the lower your fee percentage becomes.

How does withdrawal fee comparison between Kraken and Coinbase affect users?

Withdrawal fees vary by cryptocurrency on both platforms, but Kraken typically offers lower withdrawal fees for most tokens. This difference becomes significant when making frequent withdrawals.

Coinbase charges network fees plus their own service fee for withdrawals. During high network congestion, these combined fees can become quite expensive.

Kraken’s withdrawal structure is more transparent and often more economical for regular withdrawals. This can result in substantial savings for users who frequently move assets off-exchange.

Which platform offers better security features, Kraken or Coinbase?

Kraken’s security model is considered more robust, with support for multiple 2FA keys (separate keys for login, funding, and trading). This layered approach provides stronger protection against unauthorized access.

Coinbase offers solid security basics including 2FA, but lacks the advanced security customization options that Kraken provides. Both platforms maintain cold storage for the majority of assets.

Kraken has never experienced a major security breach, which speaks to their security practices. Coinbase has implemented significant security measures but has had some account security complaints.

How do user experiences compare when trading on Kraken versus Coinbase?

Coinbase offers a more intuitive interface that beginners find easier to navigate. The platform prioritizes simplicity and supports convenient funding options like PayPal and debit cards.

Kraken’s interface has more advanced trading features that experienced traders appreciate. The platform provides more detailed charting tools and trading options but has a steeper learning curve.

Trading limits also differ, with Kraken offering higher maximums for withdrawals and deposits. This makes Kraken more suitable for high-volume traders.

In terms of international support, how do Kraken and Coinbase differ?

Kraken supports more countries globally than Coinbase. The platform is available in over 190 countries, making it more accessible to international users.

Coinbase focuses more on established markets, particularly North America and Europe. Its limited global reach can be a disadvantage for users in less-supported regions.

Kraken also supports more fiat currencies for direct deposits and withdrawals. This reduces the need for currency conversion and associated fees for international users.

What are the advantages of using Kraken over Coinbase for professional traders?

Kraken offers more advanced order types including stop-loss, take-profit, and OCO (one-cancels-other) orders. These tools give professional traders greater control over their positions.

The platform provides margin trading with up to 5x leverage, which Coinbase doesn’t offer to retail customers. This allows for more sophisticated trading strategies.

Kraken’s API is more robust and developer-friendly, making it preferred for algorithmic trading. Professional traders also benefit from Kraken’s lower fees on high-volume trades.

Coinbase vs Kraken Conclusion: Why Not Use Both?

Many crypto traders wonder if they should choose either Coinbase or Kraken. The truth is, you can benefit from using both exchanges instead of picking just one.

Coinbase offers user-friendly features and easy funding options like PayPal and debit cards. Its interface works well for beginners who want a simple way to buy crypto.

Kraken stands out with lower fees and higher trading limits. For active traders, these savings add up significantly over time.

Both exchanges provide strong security measures and comply with regulations. This means your funds are generally safe on either platform.

Consider using Coinbase for:

- Quick and easy purchases

- User-friendly mobile experience

- PayPal funding options

- Learning resources for beginners

Try Kraken for:

- Lower trading fees

- Advanced trading features

- Higher trading limits

- More cryptocurrency options

Using both exchanges gives you flexibility. You might start with Coinbase as a beginner, then branch out to Kraken as you gain experience and want to save on fees.

The best strategy depends on your personal trading needs and preferences. By maintaining accounts on both platforms, you can take advantage of the unique benefits each one offers.