When it comes to crypto trading platforms, Kraken and BloFin offer distinct experiences for different types of traders. Each platform has built its reputation on specific strengths that might align with your particular trading needs and goals.

Kraken stands out for its strong security measures and established reputation, while BloFin offers competitive fee structures with maker fees as low as 0.0060% depending on VIP level. The choice between these two platforms ultimately depends on what you value most as a trader – whether that’s Kraken’s security-first approach or BloFin’s focus on competitive fees and specialized derivatives trading.

You’ll want to consider factors like fee structures, available cryptocurrencies, security features, and user interface when making your decision. Both platforms serve different segments of the crypto market, with Kraken generally appealing to those who prioritize platform stability and BloFin potentially offering advantages for traders focused on derivatives and competitive fee structures.

Kraken Vs BloFin: At A Glance Comparison

When choosing between Kraken and BloFin for your crypto trading needs, several key differences stand out. Here’s how these two platforms compare:

Security Measures

- Kraken: Known for strong security with cold storage and regular audits

- BloFin: Features rigorous security protocols and VIP-level protection

Trading Fees

| Exchange | Maker Fees | Taker Fees |

|---|---|---|

| Kraken | 0.16% – 0% | 0.26% – 0.10% |

| BloFin | 0.10% – 0% | 0.20% – 0.05% |

User Experience

Kraken offers a more established platform with a longer history in the crypto space. It’s known for reliability and a straightforward interface.

BloFin provides a newer trading experience with some innovative features that might appeal to both beginners and advanced traders.

Available Assets

Kraken supports 200+ cryptocurrencies, making it suitable for diverse portfolio building.

BloFin has a growing selection of tokens but may not match Kraken’s extensive offerings yet.

Special Features

Kraken provides staking, futures trading, and margin options with strong regulatory compliance.

BloFin stands out with its VIP services and may offer more competitive fee structures for high-volume traders.

Mobile Experience

Both exchanges offer mobile apps, but Kraken’s app tends to have more comprehensive functionality and higher ratings.

Kraken Vs BloFin: Trading Markets, Products & Leverage Offered

Kraken and BloFin offer different trading options that may suit your specific needs. Let’s compare what each platform provides.

Available Markets

- Kraken: 200+ cryptocurrencies

- BloFin: 230+ coins and 400+ crypto futures pairs

Trading Products

| Feature | Kraken | BloFin |

|---|---|---|

| Spot Trading | ✓ | ✓ |

| Futures | ✓ | ✓ |

| Margin Trading | ✓ | ✓ |

| Options | Limited | Extensive |

Kraken focuses on providing a reliable platform for both beginners and advanced traders. You’ll find strong security features and a straightforward interface.

BloFin excels in offering a wider range of trading pairs and derivatives. If you’re looking for variety in futures trading, BloFin’s 400+ pairs give you more options.

Leverage Options

Kraken offers margin trading with up to 5x leverage. This is suitable if you prefer moderate risk levels and want built-in limits.

BloFin provides higher leverage options, making it attractive for experienced traders seeking greater potential returns. However, remember that higher leverage also means increased risk.

When choosing between these platforms, consider your trading style. If you value institutional-grade security with moderate leverage, Kraken might be your better option. For more variety in trading pairs and higher leverage potential, BloFin could be more suitable.

Kraken Vs BloFin: Supported Cryptocurrencies

Kraken offers a solid selection of over 60 cryptocurrencies for trading and investing. This gives you plenty of options whether you’re looking for established coins or emerging altcoins.

BloFin’s cryptocurrency selection is less documented in the search results, but it appears to target traders interested in a variety of crypto assets. The platform likely offers both major cryptocurrencies and some alternative options.

When choosing between these exchanges, consider which specific coins you want to trade. Here’s a quick comparison:

| Feature | Kraken | BloFin |

|---|---|---|

| Number of cryptocurrencies | 60+ | Not specified in results |

| Major coins (Bitcoin, Ethereum) | ✓ | ✓ |

| Focus | Wide range for different investor types | Appears to target crypto traders |

Your trading needs should guide your decision. If you need access to many different cryptocurrencies, Kraken’s extensive selection might be more suitable for your needs.

Both platforms offer the most popular cryptocurrencies like Bitcoin and Ethereum. However, if you’re interested in trading specific altcoins, you’ll want to check each platform’s current listings before making your decision.

Remember that cryptocurrency availability can change as exchanges add or remove supported assets over time.

Kraken Vs BloFin: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Kraken and BloFin, fees play a crucial role in your decision. Let’s break down what you can expect to pay on both platforms.

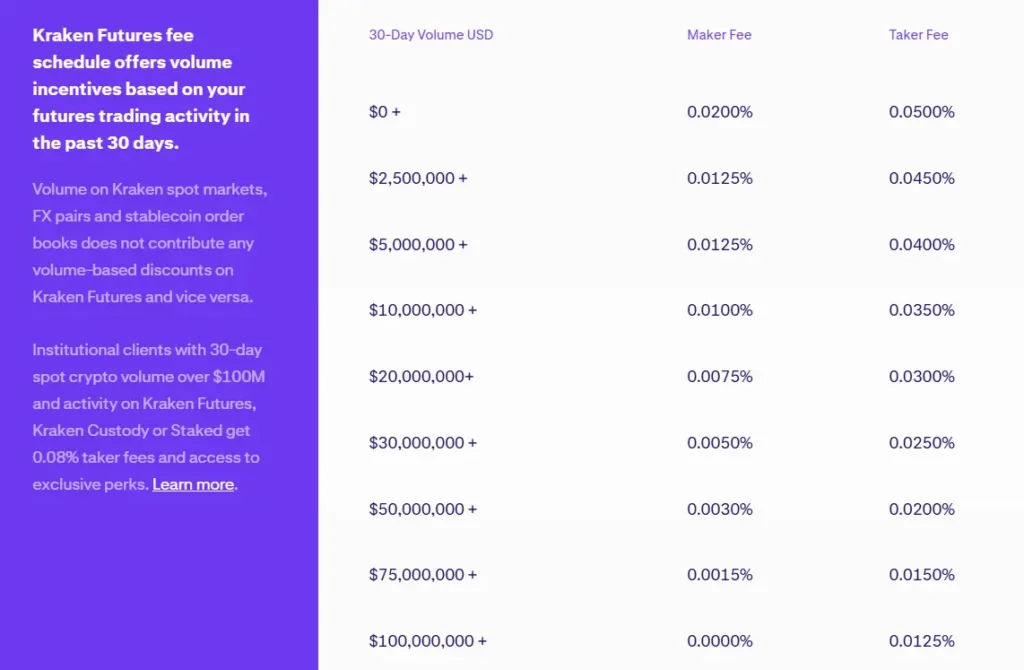

Kraken offers a tiered fee structure based on your monthly trading volume. For most beginners trading less than $50,000 monthly, you’ll pay 0.16% as a maker fee and 0.26% as a taker fee. These fees decrease as your trading volume increases.

BloFin also uses a volume-based fee structure, though their exact rates differ from Kraken’s. Their competitive fee schedule aims to attract both new and experienced traders.

For deposits, Kraken stands out by offering free crypto deposits and no fees for most fiat deposits using ACH (for USD) or SEPA (for EUR). BloFin also supports various deposit methods, but fee structures may vary.

Withdrawal Fee Comparison:

| Platform | Crypto Withdrawal | Fiat Withdrawal |

|---|---|---|

| Kraken | Varies by cryptocurrency | Depends on method |

| BloFin | Varies by cryptocurrency | Depends on method |

Kraken has built a reputation for security, being one of the few major exchanges never to have been hacked. This security might justify slightly higher withdrawal fees for some users.

You should consider both the immediate fee impact and long-term costs when choosing between these platforms. Your trading volume and preferred currencies will significantly affect which platform offers better value for your specific needs.

Kraken Vs BloFin: Order Types

When trading cryptocurrency, the types of orders available can make a big difference in your trading strategy. Both Kraken and BloFin offer various order options, but they have some key differences.

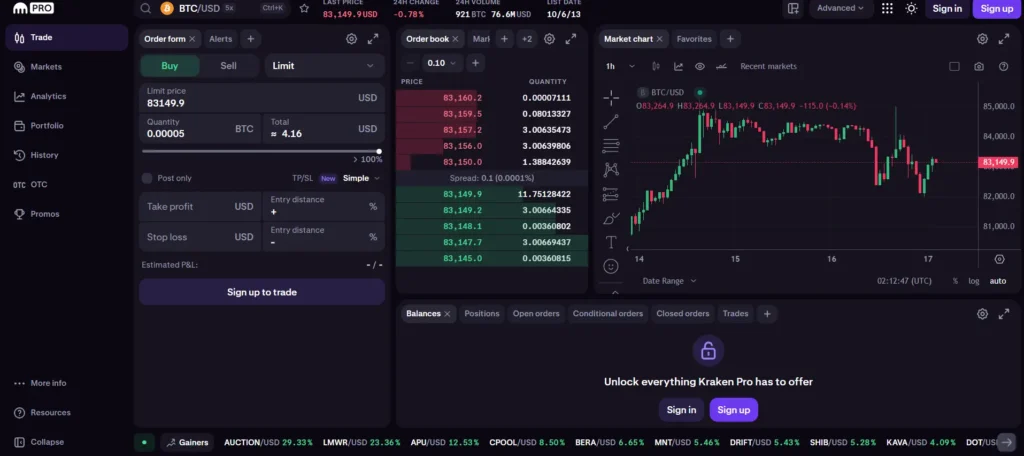

Kraken provides two order interfaces: a Simple order form and a more advanced Order form. The Simple form only allows Market and Limit orders, while the advanced form gives you access to all order types.

Some of Kraken’s notable order options include:

- Market and Limit orders: Basic buy/sell orders

- Take Profit / Stop Loss (bracket) orders: Help manage risk

- Advanced charting tools: For technical analysis

BloFin also offers a range of trading features that help you manage your trades effectively. These include:

- Advanced charting tools: Similar to Kraken

- Various order types: Including advanced options

- Tools that make trade management easier

If you’re looking for platform-specific features, Kraken is known for its strong security measures alongside its order options. This makes it appealing if safety is your top priority.

BloFin might be more suitable if you want a platform with user-friendly trading tools and order types designed for active traders.

Your choice between these platforms should depend on which order types and trading features best match your trading style and experience level.

Kraken Vs BloFin: KYC Requirements & KYC Limits

Kraken and BloFin take different approaches to Know Your Customer (KYC) requirements. These differences might influence which platform you choose based on your privacy preferences and withdrawal needs.

Kraken offers two verification levels for personal accounts: Intermediate and Pro Personal. Most users find the Intermediate level sufficient for their trading needs. Kraken requires KYC verification for all users, which involves providing personal information and identity documents.

BloFin operates with more flexible KYC policies. You can trade on BloFin without completing KYC verification initially. However, there’s a withdrawal limit of 20,000 USDT for unverified accounts. If you want to withdraw larger amounts, you’ll need to complete personal verification.

This key difference makes BloFin appealing if you value privacy or prefer minimal verification processes. BloFin is often categorized among “NO KYC” crypto exchanges, though this label is somewhat misleading since verification is required for larger withdrawals.

KYC Requirements Comparison:

| Platform | Initial KYC Required | Withdrawal Limits Without KYC |

|---|---|---|

| Kraken | Yes (all accounts) | Not available |

| BloFin | No | Up to 20,000 USDT |

Your location may also impact which exchange is more suitable. Some regions have restricted access to BloFin, making Kraken a more accessible option for traders in those areas.

Kraken Vs BloFin: Deposits & Withdrawal Options

When choosing between Kraken and BloFin, understanding their deposit and withdrawal systems is essential for managing your crypto efficiently.

Kraken offers multiple networks and methods for deposits and withdrawals. This flexibility allows you to execute transactions on the same blockchain in different ways. For assets like USDC, Kraken provides alternative transaction methods.

For withdrawals, Kraken supports various currencies including CHF (Swiss Franc). Be aware that fees may vary based on your registered location or country of residence.

BloFin caters to a different segment of crypto traders compared to Kraken. While specific withdrawal details aren’t fully outlined in the search results, BloFin is positioned as an alternative to Kraken.

Fee Comparison:

| Exchange | Fee Structure | Notes |

|---|---|---|

| Kraken | Variable | Depends on currency and location |

| BloFin | Competitive | Positioned as an alternative option |

Both platforms offer crypto deposit and withdrawal options, but they differ in their target users. Kraken is known for strong security features, which might influence how withdrawals are processed.

When deciding between these exchanges, you should consider not just the available currencies but also processing times and minimum withdrawal amounts. These factors can significantly impact your trading experience.

Kraken Vs BloFin: Trading & Platform Experience Comparison

Kraken offers a robust trading platform with a clean interface that balances functionality and ease of use. You’ll find the classic Kraken platform suitable for beginners, while Kraken Pro caters to more advanced traders.

BloFin presents a modern trading experience with an intuitive design. The platform focuses on accessibility while still offering advanced features that experienced crypto traders appreciate.

User Interface Comparison:

| Feature | Kraken | BloFin |

|---|---|---|

| Beginner-friendly | Yes (Basic interface) | Yes |

| Advanced trading tools | Yes (Pro version) | Yes |

| Mobile app experience | Well-developed | Streamlined |

| Dashboard customization | Limited | More flexible |

Trading tools vary between the platforms. Kraken provides comprehensive order types, detailed charting, and solid technical analysis features. BloFin offers similar capabilities with some unique tools for risk management.

Both exchanges support spot and derivative trading, though their fee structures differ. Kraken typically uses a maker-taker model with volume-based discounts. BloFin’s fee structure is competitive, especially for higher-volume traders.

The platforms differ in execution speed. Kraken has established a reputation for reliable order execution even during high volatility. BloFin performs well but doesn’t have as extensive a track record yet.

For beginners, both platforms offer educational resources. Kraken provides more comprehensive learning materials, while BloFin focuses on practical tutorials and guides.

Your trading style will largely determine which platform feels more comfortable. Kraken suits methodical traders who value stability and proven reliability. BloFin appeals to those looking for a fresh approach with innovative features.

Kraken Vs BloFin: Liquidation Mechanism

When trading with leverage, understanding how exchanges handle liquidations is crucial for your risk management. Both Kraken and BloFin have specific liquidation processes to protect themselves when markets move against traders.

Kraken’s Liquidation Approach

- Uses a graduated liquidation system

- Sends warnings as your position approaches liquidation levels

- Typically begins partial liquidation at 80% of margin used

- Offers some time to add funds or reduce position size

- Uses a relatively conservative liquidation threshold compared to some exchanges

BloFin’s Liquidation System

- Employs a more aggressive liquidation mechanism

- Can adjust margin requirements and liquidation thresholds

- Has faced user complaints about liquidations without proper notice

- Offers higher leverage which can lead to faster liquidations

- Uses a complex risk management system for determining liquidation prices

Kraken tends to be more transparent about its liquidation process, with clear documentation and warnings. BloFin’s system, while potentially more flexible, has been criticized for making unexpected adjustments.

Your liquidation risk is directly tied to your leverage level. Kraken’s more conservative approach may protect newer traders, while BloFin’s system might require more active monitoring of your positions.

Both platforms use automatic liquidation engines, but their triggers and execution methods differ significantly in practice.

Kraken Vs BloFin: Insurance

When choosing a crypto exchange, insurance is a key factor in protecting your investments. Both Kraken and BloFin offer different approaches to security and insurance.

Kraken maintains a substantial insurance fund to protect users against potential losses. They keep most assets in cold storage and have insurance coverage for digital assets held in their custody.

BloFin is known for its rigorous security measures. They also maintain an insurance fund specifically designed to protect traders against unexpected market movements and system failures.

Kraken’s Insurance Features:

- Majority of assets kept in cold storage (95%+)

- Regular security audits

- Insurance coverage for assets in custody

- Proof of reserves auditing

BloFin’s Insurance Features:

- Comprehensive security protocols

- Insurance fund for market volatility protection

- VIP-level security measures

- Protection against system failures

Neither exchange guarantees complete protection against all potential losses. You should always consider keeping large amounts in personal wallets.

The insurance policies of both platforms focus primarily on protecting against internal failures or breaches rather than covering individual trading losses.

Before depositing significant funds, you might want to review the most current insurance terms on both platforms, as these policies can change over time.

Kraken Vs BloFin: Customer Support

When choosing a crypto exchange, customer support can make a big difference in your trading experience. Both Kraken and BloFin offer customer support options, but there are some differences worth noting.

Kraken provides 24/7 customer support. This means you can get help at any time, day or night. Their support team is available through multiple channels to address your questions or concerns.

BloFin also offers 24/7 customer support through live chat and email. According to search results, they provide support in multiple languages, which can be helpful if English isn’t your first language.

Response times can vary between the two platforms. Some users report faster response times with Kraken, while others say BloFin’s support team is quick to address issues.

Support Channels Comparison:

| Platform | Live Chat | Phone | Languages | |

|---|---|---|---|---|

| Kraken | ✓ | ✓ | ✓ | Multiple |

| BloFin | ✓ | ✓ | – | Multiple |

User reviews suggest that both platforms have knowledgeable support staff. However, during high-volume trading periods, you might experience longer wait times on either platform.

If you’re new to crypto trading, you’ll find that both exchanges offer helpful resources like FAQs and guides. These can often answer your questions without needing to contact support directly.

Kraken Vs BloFin: Security Features

When choosing between Kraken and BloFin for your crypto trading needs, security should be a top priority. Both exchanges offer robust security measures, but they differ in several important ways.

Kraken is known for its strong security track record. It uses cold storage for most user funds, keeping them offline and away from potential hackers. Kraken also offers two-factor authentication (2FA) and has never experienced a major security breach.

BloFin implements “rigorous security measures” according to search results. The platform emphasizes protection of user assets as a key selling point.

Kraken Security Features:

- Cold storage for majority of funds

- 2FA authentication

- Global Settings Lock

- Email confirmations for withdrawals

- Strong history with no major breaches

BloFin Security Features:

- Robust protection systems

- Security-focused approach

- VIP-based structure that may offer additional security for higher-tier accounts

You should consider how each platform handles regulatory compliance. Kraken operates in many countries and follows strict regulatory guidelines. BloFin is newer to the market, but also prioritizes security protocols.

For added security on either platform, you should always:

- Enable all available security features

- Use strong, unique passwords

- Keep your authentication apps updated

- Be cautious of phishing attempts

Both exchanges understand that security is crucial for crypto traders, but your specific needs might make one a better fit than the other.

Is Kraken A Safe & Legal To Use?

Kraken has built a solid reputation as a secure cryptocurrency exchange. Founded in 2011, it has maintained a strong security record with no major hacks of its main platform.

The exchange operates with proper licensing in several regions. In the UK, Kraken is registered with the Financial Conduct Authority (FCA) as a Cryptoasset Firm under Payward Ltd. This provides a level of regulatory oversight for users in that region.

However, Kraken has faced some regulatory challenges. In 2023, the SEC charged Kraken for allegedly operating as an unregistered securities broker, dealer, and clearing agency in the United States.

Despite these challenges, Kraken is often ranked highly for security and customer service by independent auditors. The platform implements robust security features including:

- Two-factor authentication (2FA)

- PGP encryption for email communications

- Global settings lock

- Air-gapped cold storage for the majority of funds

You should know that while Kraken is generally considered trustworthy, experts still recommend not keeping large amounts of cryptocurrency on any exchange long-term. The safer practice is to transfer significant holdings to personal wallets.

For day-to-day trading, Kraken provides a secure environment with a strong focus on security protocols and regulatory compliance in the jurisdictions where it operates.

Is BloFin A Safe & Legal To Use?

BloFin is generally considered a safe cryptocurrency exchange with several security measures in place. The platform operates with a 1:1 asset reserve policy, ensuring your deposited funds are fully backed.

BloFin partners with leading custody firms like Fireblocks to enhance security. This adds an extra layer of protection for your digital assets.

The exchange also offers third-party insurance on customer deposits, providing additional security for your investments.

Regarding privacy, BloFin balances user privacy with regulatory compliance. Your personal data is protected, though not completely anonymous due to compliance requirements.

For legal status, BloFin appears to operate within regulatory frameworks, though specific licensing details vary by region. You should verify if BloFin is legally permitted to operate in your country before creating an account.

The platform focuses on providing a secure and reliable environment for managing cryptocurrency investments. Their emphasis on security measures suggests they take user protection seriously.

When considering any exchange, you should:

- Verify regional availability

- Check current security certifications

- Use additional security features (2FA, etc.)

- Store large amounts in personal wallets when not trading

BloFin’s security features make it a reasonable choice for both long-term holders and active traders looking for a secure trading environment.

Frequently Asked Questions

Traders considering these platforms often have specific questions about their features, costs, and reliability. These key differences can significantly impact your trading experience and investment results.

How do fee structures compare between Kraken and BloFin?

Kraken offers a transparent fee structure with spot trading fees starting at 0.25% for makers and 0.40% for takers. These rates may decrease based on your 30-day trading volume.

BloFin’s fee structure is also competitive in the crypto exchange market. They offer different rates for various trading pairs and account levels.

When comparing the two, Kraken is often praised for its clear and straightforward fee presentation, making it easier for you to calculate potential costs before trading.

What are the key differences in user experience when using Kraken versus BloFin?

Kraken provides a more established user interface with both basic and advanced trading views. The platform has been refined over many years, resulting in a generally smooth navigation experience.

BloFin offers a modern interface that some users find intuitive, particularly for those focused on derivatives trading. Their mobile experience has received positive feedback from users.

You might find BloFin’s layout more appealing if you prefer newer design elements, while Kraken’s interface might feel more familiar if you’ve used other established exchanges.

Which platform between Kraken and BloFin offers a wider range of cryptocurrencies?

Kraken supports over 200 cryptocurrencies and continues to add new listings regularly. Their selection includes most major coins and many emerging assets.

BloFin has a smaller but growing selection of cryptocurrencies. They focus on providing quality trading pairs rather than quantity.

You’ll likely find more niche or newer cryptocurrencies on Kraken, making it potentially better suited if you’re looking to diversify into less common assets.

Can users trust BloFin’s security measures compared to those of Kraken?

Kraken has built a strong reputation for security, with no major hacks in its operating history. They employ cold storage for most funds and offer robust two-factor authentication options.

BloFin stands out with rigorous security measures and VIP-level protection protocols. They emphasize their security infrastructure as a key selling point.

Both platforms prioritize user security, but Kraken’s longer track record may provide additional peace of mind for you if established history is a primary concern.

How do Kraken’s trading tools and features stack up against those provided by BloFin?

Kraken offers comprehensive trading tools including advanced charting, margin trading, futures, and staking services. Their tools cater to both beginners and experienced traders.

BloFin specializes in derivatives trading tools with features designed for more sophisticated trading strategies. Their platform includes advanced risk management features.

You might prefer BloFin if derivatives trading is your focus, while Kraken provides a more balanced toolset across various trading styles.

In terms of liquidity, how does BloFin fare in comparison to Kraken?

Kraken maintains high liquidity across major trading pairs, resulting in tighter spreads and less slippage for large orders. Their established position in the market attracts substantial trading volume.

BloFin has decent liquidity for a newer exchange but cannot match Kraken’s depth in most markets. They continue to work on attracting more traders to improve their order books.

You’ll typically experience better execution on Kraken for larger trades, especially with mainstream cryptocurrencies, while BloFin may still be building liquidity in some markets.

BloFin Vs Kraken Conclusion: Why Not Use Both?

Both BloFin and Kraken offer unique advantages that might suit different parts of your crypto journey.

BloFin stands out with its futures trading options, featuring over 300 perpetual swap contracts. It also offers copy trading functionality, which can be valuable if you’re looking to learn from experienced traders.

Kraken, on the other hand, has built a strong reputation for security and reliability since its founding. Its user interface tends to be more beginner-friendly while still offering advanced trading features.

You don’t necessarily have to choose just one platform. Many crypto traders use multiple exchanges to take advantage of different strengths.

For example, you might use Kraken for its security when holding long-term investments and basic trading. Meanwhile, BloFin could be your go-to for futures trading or trying copy trading features.

Consider your specific needs when deciding:

- Trading experience level

- Types of trades you want to make

- Security priorities

- Fee structures that work best for you

Both platforms offer solid options for crypto trading in 2025. The best approach may be using each platform for what it does best rather than limiting yourself to just one exchange.

Remember to always use strong security practices regardless of which platform you choose, including two-factor authentication and secure passwords.