Choosing between Kraken and Bitpanda for your crypto trading needs can be challenging. Both exchanges offer distinct features that might appeal to different types of traders and investors.

Based on current 2025 comparisons, Kraken appears to have better overall features and higher evaluation scores than Bitpanda. When looking at these platforms side-by-side, you’ll notice differences in their fee structures, available cryptocurrencies, trading options, and user experiences.

Whether you’re a beginner or experienced trader, understanding these differences will help you select the platform that best fits your needs. The right choice depends on what matters most to you—lower fees, more crypto options, better user interface, or specific payment methods.

Kraken Vs Bitpanda: At A Glance Comparison

When choosing between Kraken and Bitpanda, several key differences stand out. This quick comparison will help you understand which exchange might better suit your needs.

Features Overview:

| Feature | Kraken | Bitpanda |

|---|---|---|

| Founded | 2011 | 2014 |

| Available Cryptocurrencies | 200+ | 150+ |

| Trading Fees | Lower overall | Higher compared to Kraken |

| Security Rating | Very High | High |

| Beginner-Friendly | Moderate | Very High |

| Fiat Currencies Supported | 7+ | 25+ |

| Mobile App | Yes | Yes |

Kraken offers more advanced trading features and better suits experienced traders. The platform provides lower fees and more cryptocurrency options.

Bitpanda stands out with its user-friendly interface, making it perfect if you’re just starting your crypto journey. It supports more fiat currencies, which can be helpful depending on where you live.

Security is strong on both platforms, but Kraken has built a reputation for its robust security measures over its longer history in the market.

Trading options differ significantly between the two. Kraken provides more advanced trading tools like margin trading and futures. Bitpanda focuses on simplicity with its easy-to-use platform.

Customer support quality varies between the exchanges. Bitpanda typically offers faster response times, while Kraken provides more in-depth technical assistance.

Kraken Vs Bitpanda: Trading Markets, Products & Leverage Offered

Kraken and Bitpanda offer different ranges of trading assets and products for crypto investors. Your options vary significantly between these platforms.

Kraken provides access to approximately 185 cryptocurrencies for spot trading. This exchange also offers futures trading and margin trading with leverage up to 5x for eligible users.

Bitpanda has a much larger selection with over 2,700 assets available for trading. These include not just cryptocurrencies but also commodities, making it a more diverse platform for different types of investments.

Product Comparison:

| Feature | Kraken | Bitpanda |

|---|---|---|

| Cryptocurrencies | ~185 | 2,700+ assets |

| Commodities | Limited | Yes |

| Margin Trading | Yes (up to 5x) | Limited |

| Futures | Yes | No |

| Staking | Yes | Yes |

Kraken appeals more to advanced traders who want access to futures and leverage trading options. The platform’s trading tools are comprehensive and designed for serious crypto investors.

Bitpanda might be better for you if you want a wider variety of assets beyond just cryptocurrencies. Its large selection gives you more diversification options.

Both platforms offer staking capabilities, allowing you to earn passive income on certain cryptocurrencies you hold. However, the supported coins and rewards rates differ between the exchanges.

Your trading needs should determine which platform is right for you. Consider the specific assets you want to trade and whether advanced trading features like leverage matter to you.

Kraken Vs Bitpanda: Supported Cryptocurrencies

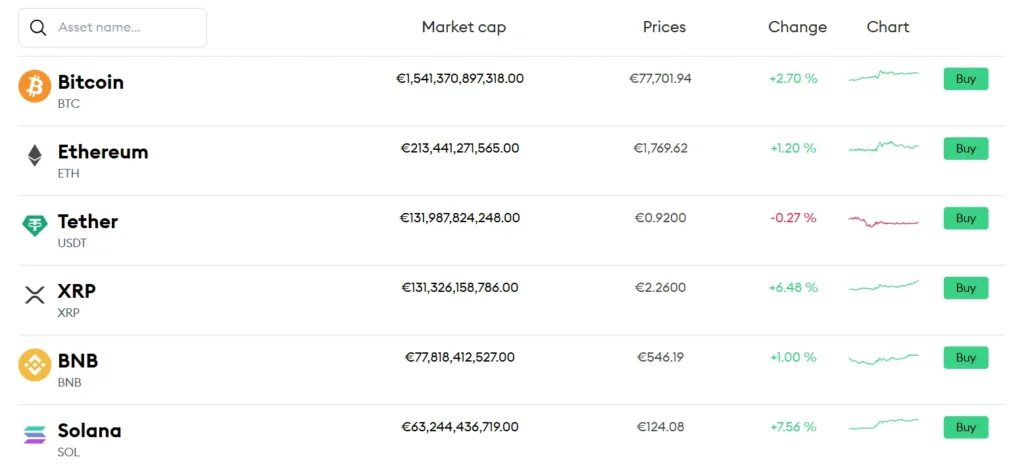

When choosing between Kraken and Bitpanda, the variety of cryptocurrencies available on each platform is an important factor to consider.

Kraken offers a robust selection of cryptocurrencies for trading. You can access popular coins like Bitcoin, Ethereum, and Litecoin, along with many altcoins and emerging tokens.

Bitpanda also provides access to major cryptocurrencies, but typically offers a smaller selection compared to Kraken.

Kraken’s Cryptocurrency Support:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Cardano (ADA)

- Solana (SOL)

- Plus many more altcoins and tokens

Kraken supports fiat deposits in multiple currencies including USD, EUR, CAD, JPY, GBP, CHF, and AUD. This gives you flexibility when moving between crypto and traditional currencies.

Bitpanda’s Cryptocurrency Support:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Several popular altcoins

One advantage of both platforms is their regulatory compliance in Europe, ensuring safer trading experiences. You’ll find both exchanges list new cryptocurrencies periodically, though Kraken tends to add new tokens more frequently.

The choice between these exchanges may depend on whether you want to trade specific cryptocurrencies. If you’re looking for more exotic or newer coins, Kraken might be the better option based on their wider selection.

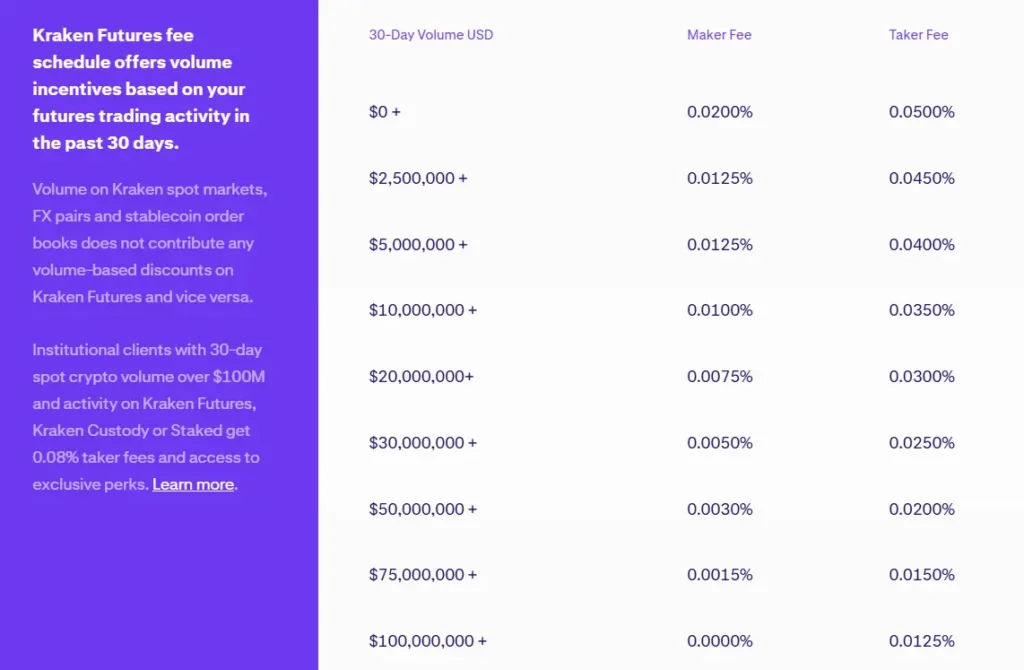

Kraken Vs Bitpanda: Trading Fee & Deposit/Withdrawal Fee Compared

When choosing between Kraken and Bitpanda, understanding their fee structures is essential for maximizing your investment returns.

Trading Fees

Bitpanda offers more competitive trading fees with rates up to 1.49% for crypto purchases. This makes it slightly more affordable for regular traders.

Kraken typically charges higher trading fees than Bitpanda, especially for casual users. However, Kraken’s fee structure may offer better rates for high-volume traders.

Deposit Methods & Fees

Both platforms support various deposit methods including bank transfers and credit cards. Bitpanda offers more localized European payment options.

Kraken generally has lower deposit fees for bank transfers, making it cost-effective for larger deposits.

Withdrawal Fees

| Platform | Crypto Withdrawal | Fiat Withdrawal |

|---|---|---|

| Bitpanda | Varies by crypto | Low for SEPA |

| Kraken | Competitive rates | Standard fees |

Crypto withdrawal fees vary based on the specific cryptocurrency on both platforms. Bitpanda tends to have lower withdrawal fees for European users using SEPA transfers.

Remember that fee structures may change over time, so it’s worth checking both platforms’ current rates before making your decision.

For European traders making smaller, frequent transactions, Bitpanda’s fee structure might be more economical overall.

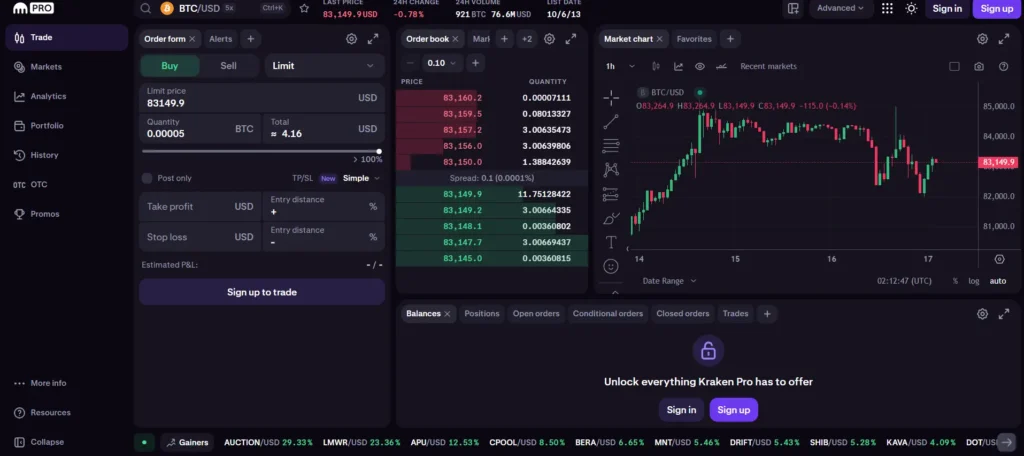

Kraken Vs Bitpanda: Order Types

When choosing between Kraken and Bitpanda, understanding the different order types each platform offers is essential for your trading strategy.

Kraken provides a comprehensive range of order types that gives you more flexibility. You can place basic market and limit orders, but also more advanced options like stop limit orders. These advanced features help you manage risk and automate your trading decisions.

Bitpanda offers a more simplified approach to order types. Their platform focuses on basic market and limit orders, making it easier for beginners to navigate without feeling overwhelmed by complex options.

Kraken Order Types:

- Market orders

- Limit orders

- Stop limit orders

- Take profit orders

- Conditional close orders

Bitpanda Order Types:

- Market orders

- Limit orders

The difference in available order types reflects each platform’s target audience. Kraken caters to more experienced traders who need advanced tools for sophisticated strategies.

If you’re new to crypto trading, Bitpanda’s streamlined order options might be less intimidating. However, as you grow more confident, you might find these basic options limiting.

For active traders who want to set specific entry and exit points or use risk management strategies, Kraken’s variety of order types provides valuable tools for your trading arsenal.

Kraken Vs Bitpanda: KYC Requirements & KYC Limits

Both Kraken and Bitpanda require KYC (Know Your Customer) verification to comply with financial regulations. These checks help prevent money laundering and fraud.

Kraken operates globally in over 190 countries and has a tiered verification system. Basic verification typically requires your name, date of birth, address, and phone number. Higher tiers may require additional documentation like ID and proof of residence.

Bitpanda focuses primarily on European users, serving 40+ countries. Their verification process includes identity verification with government-issued ID and proof of address.

Trading Limits Based on Verification Level:

| Platform | Basic Verification | Full Verification |

|---|---|---|

| Kraken | Limited deposit/withdrawal | Unlimited trading |

| Bitpanda | Small transaction limits | Higher limits |

It’s worth noting that Kraken reports transactions to tax authorities when your total volume exceeds $1,000. This reporting requirement may impact your choice if privacy is a concern.

The verification process for both platforms is straightforward but can take anywhere from minutes to a few days depending on verification queue and document quality.

You’ll need to decide which platform better suits your needs based on your location and trading volume requirements. European users might find Bitpanda’s regional focus beneficial, while global traders might prefer Kraken’s broader reach.

Kraken Vs Bitpanda: Deposits & Withdrawal Options

When choosing between Kraken and Bitpanda, understanding their deposit and withdrawal options is crucial for your trading experience.

Kraken supports fiat deposits in multiple currencies including USD, EUR, CAD, JPY, GBP, CHF, and AUD. This gives you flexibility if you’re trading across different regions.

Bitpanda primarily focuses on EUR deposits but also supports some other currencies. Their platform is more Europe-centered in its payment options.

For deposit methods, both exchanges offer:

- Bank transfers (SEPA for European users)

- Credit/debit card options

- Digital wallet integrations

Kraken typically has lower fees for deposits and withdrawals compared to Bitpanda. While Bitpanda may charge up to 1.49% for some transactions, Kraken keeps fees below 0.40% in most cases.

Withdrawal speeds vary between the platforms. Kraken processes cryptocurrency withdrawals quickly, but fiat withdrawals might take 1-5 business days depending on your location and banking system.

Bitpanda offers a slightly more user-friendly withdrawal process that appeals to beginners, though it may come with higher fees.

Both exchanges implement security measures for withdrawals, including two-factor authentication and withdrawal address whitelisting to protect your funds.

Your choice should depend on your location, preferred currency, and how often you plan to move funds in and out of the exchange.

Kraken Vs Bitpanda: Trading & Platform Experience Comparison

Kraken and Bitpanda offer different trading experiences that might affect your choice between the two platforms.

Fee Structure:

- Kraken: Lower trading fees up to 0.40%

- Bitpanda: Higher trading fees up to 1.49%

Availability:

Bitpanda is not available in the USA, while Kraken offers more global coverage. This is important if you plan to travel or relocate.

User Interface:

Kraken provides a more technical experience geared toward experienced traders. You’ll find advanced charting tools and trading options.

Bitpanda offers a simpler, more intuitive platform that beginners find easier to navigate. You can quickly buy crypto with just a few clicks.

Trading Options:

Kraken gives you access to margin trading, futures, and more advanced trading types. This platform works well if you want to use complex strategies.

Bitpanda functions more as a broker platform, making it straightforward to buy and sell assets but with fewer advanced features.

Mobile Experience:

Both platforms offer mobile apps, but Bitpanda’s app is often praised for its user-friendly design. You can manage your investments on the go with either option.

Customer Support:

Kraken typically offers more comprehensive customer service options, including live chat and phone support in some regions.

Remember that your trading style and experience level should guide your choice between these platforms.

Kraken Vs Bitpanda: Liquidation Mechanism

When trading with leverage on crypto exchanges, understanding the liquidation mechanism is crucial for your risk management. Both Kraken and Bitpanda have different approaches to handling liquidations.

Kraken uses a multi-tier liquidation process. When your position approaches the liquidation price, Kraken first issues a margin call. If you don’t add funds, your position gets liquidated gradually to minimize market impact.

Bitpanda, focusing primarily on European users, employs a simpler liquidation mechanism. Their system automatically closes positions when they reach predetermined liquidation thresholds.

Liquidation Triggers:

- Kraken: 80% maintenance margin requirement

- Bitpanda: Varies by asset but typically around 80-85%

Kraken offers more advanced liquidation controls for experienced traders. You can set stop-loss orders to exit positions before forced liquidation occurs.

Bitpanda provides a more straightforward approach with fewer customization options. This makes it potentially better for beginners who prefer simplicity.

Both platforms send notifications before liquidation, but Kraken’s notification system is more robust with multiple alert options including email, SMS, and in-app messages.

The fee structure during liquidation also differs. Kraken charges a liquidation fee of 0.35%, while Bitpanda’s fees range between 0.5-1% depending on the asset being traded.

Kraken Vs Bitpanda: Insurance

When choosing a crypto exchange, insurance protection is a key factor to consider for your assets’ safety.

Kraken offers limited insurance coverage. They maintain only enough online funds to facilitate daily operations, with the majority of cryptocurrencies held in secure offline cold storage. This approach reduces risk, but doesn’t provide comprehensive insurance against all potential losses.

Bitpanda also prioritizes security through cold storage systems. However, like Kraken, they don’t offer full insurance coverage for all customer deposits against every possible risk scenario.

Both platforms implement:

- Cold storage for most assets

- Two-factor authentication (2FA)

- Regular security audits

- Encryption protocols

Neither exchange provides the same level of insurance protection as traditional financial institutions. This is important to understand when trading on these platforms.

Your funds on both exchanges may be vulnerable in case of major security breaches. This is different from traditional banks where deposits are typically insured by government programs.

For maximum security, consider using hardware wallets for long-term storage of significant cryptocurrency holdings rather than keeping everything on either exchange.

Kraken Vs Bitpanda: Customer Support

When choosing between Kraken and Bitpanda, customer support can be a deciding factor for your cryptocurrency trading experience.

Kraken offers 24/7 customer support through live chat and email. Their support team is known for quick response times, typically answering queries within 30 minutes to an hour.

Bitpanda provides customer support through email tickets and a help center. They don’t offer 24/7 support, but generally respond within 1-2 business days.

Response Time Comparison:

| Exchange | Average Response Time | 24/7 Support |

|---|---|---|

| Kraken | 30 min – 1 hour | Yes |

| Bitpanda | 1-2 business days | No |

Both platforms offer extensive knowledge bases and FAQs. Kraken’s help center is more comprehensive with detailed guides for beginners and advanced users alike.

Kraken supports more languages for customer service, making it accessible to a global audience. Bitpanda’s support is mainly focused on European languages, reflecting their market focus.

User reviews indicate Kraken’s support team has more technical expertise for solving complex issues. This can be particularly valuable if you’re dealing with transaction problems or security concerns.

Bitpanda’s support is rated well for friendliness, but some users report inconsistent response quality depending on the issue complexity.

Kraken Vs Bitpanda: Security Features

When choosing between Kraken and Bitpanda, security should be a top priority for your crypto investments. Both platforms offer solid protection, but with notable differences.

Kraken stands out with its impressive security track record. The exchange has maintained a hack-free history since its 2011 launch, which is rare in the crypto world. Kraken stores most user funds in cold wallets, keeping them offline and away from potential online threats.

Bitpanda also employs cold storage solutions but doesn’t have quite the same long-standing security reputation as Kraken.

Two-Factor Authentication (2FA) is available on both platforms. This adds an extra layer of protection when you log in or make transactions.

Kraken offers more advanced security features including:

- Global Settings Lock (GSL)

- API key management

- Email verification for withdrawals

- Customizable account timeout settings

Bitpanda provides:

- Biometric authentication options

- Regular security audits

- HTTPS encryption

Regulation Status:

| Exchange | Regulatory Compliance |

|---|---|

| Kraken | Multiple licenses across global jurisdictions |

| Bitpanda | EU-regulated, based in Austria |

Both platforms follow KYC (Know Your Customer) protocols, requiring identity verification before you can trade significant amounts.

For maximum account protection, you should enable all available security features regardless of which platform you choose.

Is Kraken Safe & Legal To Use?

Kraken is considered one of the safest cryptocurrency exchanges in the industry. According to search results, it has maintained a strong security record with no major hacks reported throughout its operation.

The exchange follows strict security protocols to protect user funds and personal information. This includes two-factor authentication, encrypted data, and cold storage for most cryptocurrencies.

Kraken is fully regulated and operates legally in most countries. However, availability varies by region, with full services accessible in most European countries and the United States.

For safety rankings, Kraken scores “Very Good” compared to self-custody options which rate as “Great.” This makes it a reliable option if you prefer not to manage your own crypto wallets.

The platform is particularly known for its:

- Strong security measures

- Regulatory compliance

- Transparent operations

- Reputation stability

Kraken is often recommended for experienced traders who need advanced features without compromising on security. The exchange undergoes regular security audits and maintains insurance policies for additional protection.

When comparing safety features to Bitpanda, Kraken typically receives higher evaluation scores from security experts. Your funds on Kraken are generally well-protected, though as with any exchange, it’s always wise to enable all available security features on your account.

Is Bitpanda Safe & Legal To Use?

Bitpanda is a legal cryptocurrency exchange that operates under European regulations. The platform is based in Austria and complies with EU financial laws, making it a legitimate option for European users.

Security is a strong point for Bitpanda. According to search results, the platform has never experienced a hack, which is impressive in the cryptocurrency industry. They maintain strong security measures to protect user funds and data.

Bitpanda implements several security features including:

- SOC 2 Type 1 certification

- Multi-factor authentication (MFA)

- Secure password requirements

- Cold storage for majority of assets

The platform is regulated and follows KYC (Know Your Customer) procedures. This means you’ll need to verify your identity before trading, which adds an extra layer of legitimacy and security.

European users can feel confident that Bitpanda operates within legal frameworks. The company has established itself as one of the top regulated crypto exchanges in Europe.

While no exchange is 100% risk-free, Bitpanda has built a solid reputation for security. Their track record of no hacks puts them above many competitors in the safety department.

For Austrian bank account holders specifically, Bitpanda offers a convenient and secure option for cryptocurrency trading.

Frequently Asked Questions

Traders often ask important questions when comparing Kraken and Bitpanda for their cryptocurrency needs. These platforms differ in key aspects that might affect your trading experience.

What are the key differences in fees between Kraken and Bitpanda?

Kraken typically offers lower trading fees compared to Bitpanda. While Kraken functions as a traditional exchange with transparent fee structures, Bitpanda includes surcharges within their displayed prices.

On Kraken, trading fees usually range from 0.16% to 0.26% depending on your trading volume. Higher volume traders enjoy lower fees.

Bitpanda’s fee structure is less transparent because fees are built into the crypto prices you see. This makes actual costs higher than what you might initially recognize.

How do user experiences compare when using Bitpanda versus Kraken platforms?

Bitpanda offers a more user-friendly interface designed for beginners. The platform focuses on simplicity and ease of navigation with a clean design.

Kraken provides a more advanced trading experience with detailed charts and multiple order types. This complexity can be overwhelming for new users but valuable for experienced traders.

Both platforms offer mobile apps, but Bitpanda’s app receives higher marks for intuitive design and accessibility for everyday use.

What are the security measures implemented by Kraken and Bitpanda to protect users’ assets?

Kraken has established a strong security reputation with features like two-factor authentication, SSL encryption, and cold storage for most user funds. They also conduct regular security audits.

Bitpanda implements similar security standards with two-factor authentication and cold storage solutions. Both platforms are regulated in Europe, providing an additional layer of security.

Neither exchange has experienced major security breaches, though Kraken’s longer history in the industry gives some users more confidence in their security protocols.

Which platform, Kraken or Bitpanda, offers a wider range of cryptocurrencies for trading?

Kraken supports more cryptocurrencies overall, with access to over 100 different tokens and trading pairs. This includes both major cryptocurrencies and smaller altcoins.

Bitpanda offers fewer cryptocurrency options but covers all major coins like Bitcoin, Ethereum, and Litecoin. Their selection focuses on established cryptocurrencies rather than newer tokens.

For traders seeking niche or emerging cryptocurrencies, Kraken provides more options and greater diversity.

How do the withdrawal and deposit processes of Kraken compare to those of Bitpanda?

Bitpanda offers more payment methods for deposits, including credit cards, bank transfers, and services like Skrill. Their process is streamlined for European users particularly.

Kraken focuses primarily on bank transfers and wire transfers. While this means fewer options, their fees for these methods tend to be lower.

Both platforms implement verification procedures before allowing withdrawals, but Bitpanda generally processes withdrawals faster for verified users.

What are the customer support options available for Kraken and Bitpanda users?

Kraken provides 24/7 live chat support, an extensive knowledge base, and ticket-based email support. Their response times are generally faster during standard business hours.

Bitpanda offers email support and a detailed help center, but lacks 24/7 live assistance. Many users report satisfaction with their comprehensive guides and FAQ sections.

Both platforms provide better customer service than many cryptocurrency exchanges, though Kraken’s live chat gives them an advantage for urgent issues.

Bitpanda Vs Kraken Conclusion: Why Not Use Both?

Kraken and Bitpanda both offer solid options for cryptocurrency trading, but they serve different needs. Using both platforms might give you the best of both worlds.

Kraken shines with lower trading fees (up to 0.40%) compared to Bitpanda’s higher fees (up to 1.49%). If you’re making frequent trades or dealing with larger amounts, these savings add up quickly.

For variety, Kraken offers over 200 cryptocurrencies while Bitpanda has fewer options. Serious traders might prefer Kraken’s extensive selection.

However, Bitpanda operates more like a broker than an exchange. This makes it more beginner-friendly with a simpler interface and easier buying process.

Consider using Kraken for:

- Lower fee trading

- Access to more cryptocurrencies

- Advanced trading features

Consider using Bitpanda for:

- Beginner-friendly experience

- Simpler buying process

- European-based services

Your trading style and needs should guide your choice. New users might start with Bitpanda to learn the basics, then migrate to Kraken for lower fees as their trading volume increases.

Remember that cryptocurrency investing involves risks. You can lose part or all of your deposit regardless of which platform you choose.